Why Has August Been Feeling So Low?

Much like death and taxes, producers have always been able to anticipate that the seasonal low for corn would likely happen during harvest. After all, farmers without storage have needed to sell their grain at harvest, thus infusing a huge supply of grain into the market and driving down prices. And although seasonal lows can occur any time around harvest, on average over the past 30 years, the seasonal low has favored a later seasonal low of October 2.

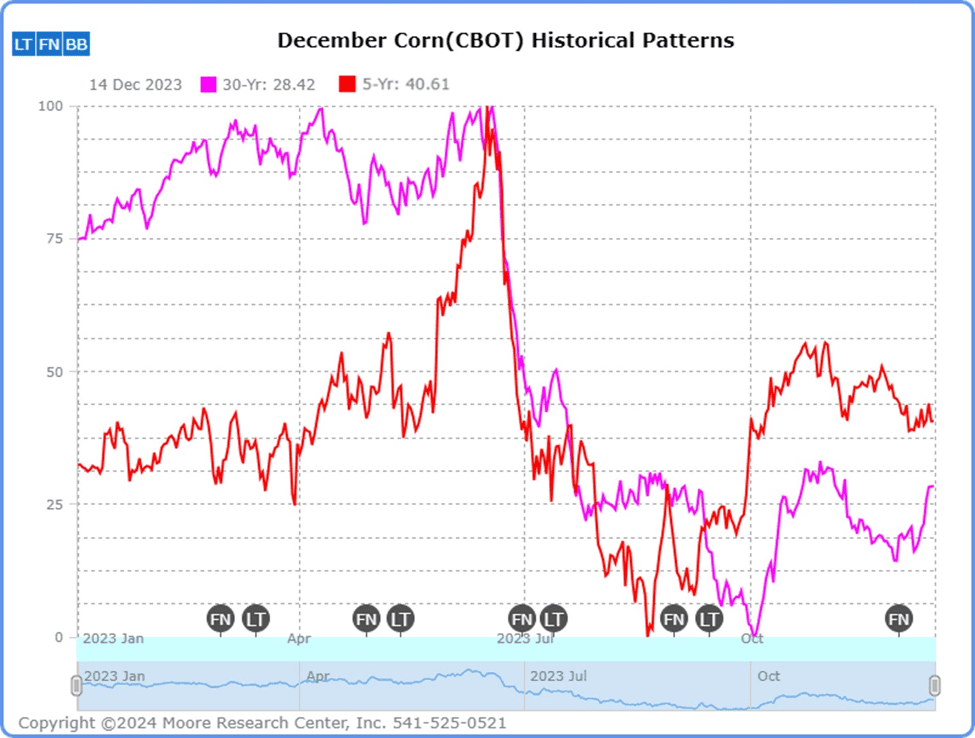

Yet, as you can see in the historical chart below, over the last five years the seasonal low for December corn has shifted quite early to the 20th of August. This implies that the bulk of corn sold based on December futures has been occurring closer to the very end of the summer.

This begs the question – what has systemically changed? And how does this impact how you market your grain?

What Could Account for the Shift in Seasonal Lows?

If you’re thinking back over the past five years on events that could have shifted the average seasonal low date so significantly, you’re likely thinking of big weather events like the Midwest Derecho of August 2020. This storm and its major damage to corn and corn storage sent futures on a multi-month rally that plays a significant role in the last five years of price action for corn. Clearly, these sorts of major events affect averages. Nonetheless, weather events occur regularly, and their impacts have always been represented in the averages. Thus, weather events play some role, but perhaps not the entire role in the change to the 5-year harvest low average.

Nonetheless, weather events occur regularly, and their impacts have always been represented in the averages. Thus, weather events play some role, but perhaps not the entire role in the change to the 5-year harvest low average.

The next consideration is a consistent decrease in the demand for corn late in summer. While demand always fluctuates, we could not identify any permanent change in demand affecting the timing of a seasonal low.

Finally, the last consideration is a consistent increase in supply. While actual supply hasn’t changed, we realize a change in how farmers choose to release their supplies, and significantly. More specifically, over the last twenty years, many farmers have made the strategic decision to invest in grain storage infrastructure. This allows them the flexibility to improve harvest logistics and better time marketing decisions.

How much have storage capabilities grown? Between 2003 and 2023, U.S. farmers expanded on-farm storage nearly 20% from about 11 billion (page 27, 2003 NASS Grain Stocks) to 13.6 billion bushels (page 30, 2003 NASS Grain Stocks), primarily in the Corn Belt states of the U.S. In 2023, Iowa was estimated to have 2.05 billion bushels of on-farm grain storage, a 400 million bushel jump from 2003. Illinois added an estimated 300 million bushels of grain storage capacity over the last two decades while Minnesota added 350 million of storage during this same time period.

Still, could this increase in storage really shift the seasonal low window forward? This undoubtedly could have an effect if farmers are selling a majority of their newly stored grain in August in anticipation of filling their storage again with new crop at harvest. This “tin can marketing” essentially floods the market in August vs. at harvest, contributing to a new timeframe for seasonal lows.

Strategic Marketing Is Even More Important If You’re Storing Grain

Storing grain offers you advantages as a marketer and comes with additional costs and resulting risk. To be sure, on-site storage offers you the ability to sell on-hand grain throughout the year at hopefully advantageous times. However, you need to make a financial investment upfront to build the infrastructure. Don’t lose sight of the fact that storing grain adds incremental costs annually to your business in the form of drying and managing your stored grain. While maintenance costs might seem insignificant, the costs to maintain the quality of your grain can really add up over time. With this in mind, the very last thing you want to do is to keep holding your grain in storage and then selling the bulk of it at the seasonal low in order to empty the bin. You need to be prepared to act and to sell your grain throughout the year with the goal of building the best possible average price.

At Grain Market Insider, we take a strategic approach to farm marketing. We have helped farmers market their grain for almost forty years focusing on both cash and futures decisions for grain already harvested, grain yet to be harvested, and grain not yet planted. We can help you set up a plan that prepares you for whatever the market does rather than on what you hope it will do, and to do it before the seasonal low comes around again.