Grain Market Insider: September 7, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| DEC ’23 | 486.25 | 0.5 |

| MAR ’24 | 500 | 0 |

| DEC ’24 | 510 | -1 |

| Soybeans | ||

| NOV ’23 | 1359.5 | -16.75 |

| JAN ’24 | 1373.75 | -15.5 |

| NOV ’24 | 1289.75 | -7.75 |

| Chicago Wheat | ||

| DEC ’23 | 599.75 | -9.25 |

| MAR ’24 | 625.75 | -8.75 |

| JUL ’24 | 652 | -7 |

| K.C. Wheat | ||

| DEC ’23 | 737 | -12.5 |

| MAR ’24 | 741 | -11 |

| JUL ’24 | 727.75 | -9.25 |

| Mpls Wheat | ||

| DEC ’23 | 774.75 | -7.75 |

| MAR ’24 | 792 | -8.5 |

| SEP ’24 | 801.75 | -8.25 |

| S&P 500 | ||

| DEC ’23 | 4498 | -22.5 |

| Crude Oil | ||

| NOV ’23 | 86.21 | -0.58 |

| Gold | ||

| DEC ’23 | 1943.9 | -0.3 |

Grain Market Highlights

- In a relatively quiet session corn held onto fractional gains as the market waited in anticipation of next week’s USDA supply and demand update.

- Soybeans traded lower erasing gains from yesterday as prices gravitated toward the middle of the recent trading range.

- Soybean meal and oil both traded lower with December soybean oil futures shedding over 2.5% following weakness in crude and palm oil.

- All three wheat classes ended lower as traders squared positions ahead of next week’s USDA WASDE report.

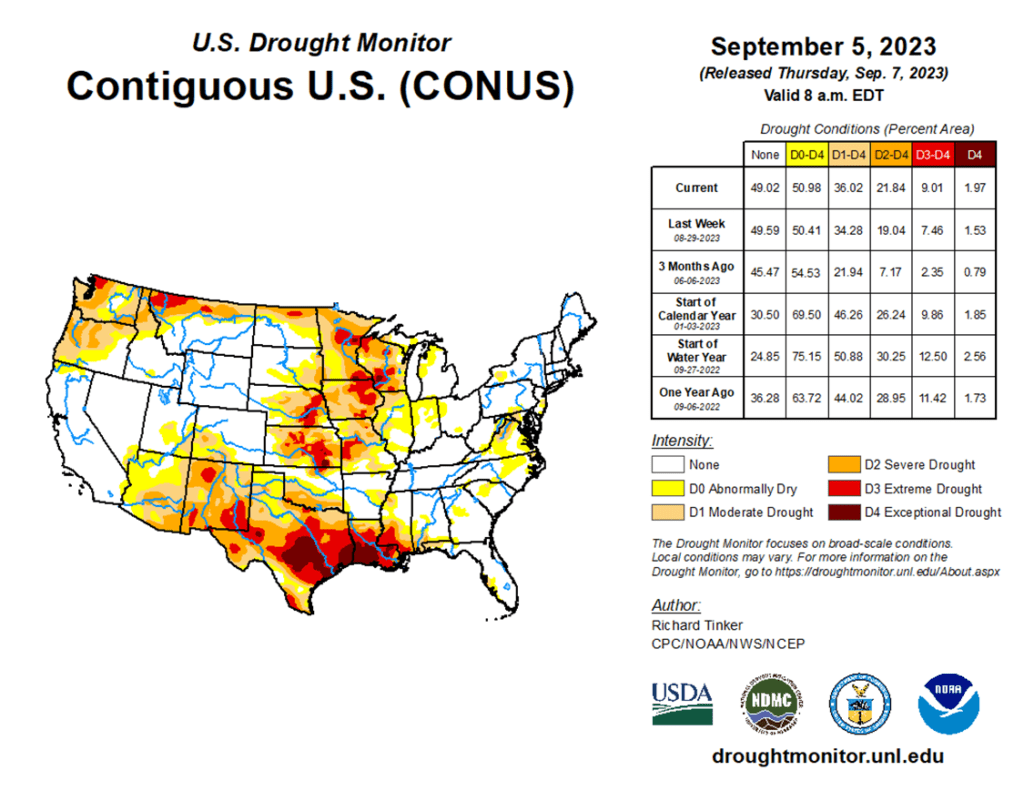

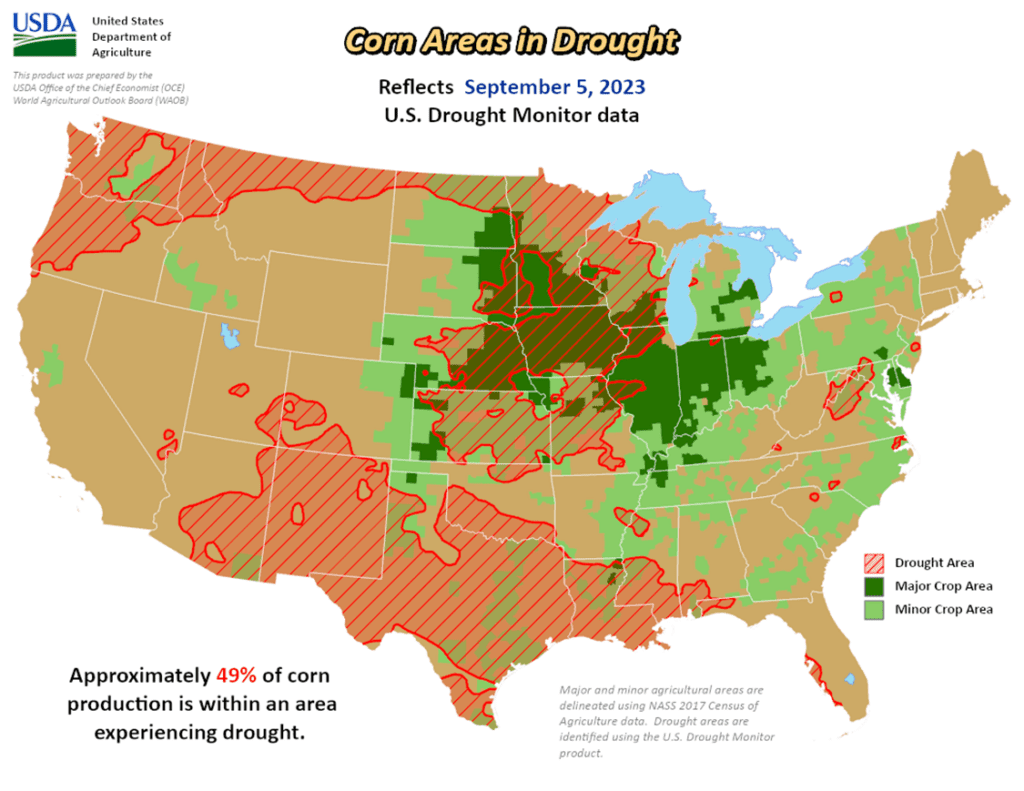

- To see the current U.S. Drought Monitor and the U.S. Corn Areas in Drought as of September 5th map, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

Active

Sell DEC ’24 Cash

2025

No Action

Puts

2023

Active

Exit(Sell) All DEC ’23 580 Puts ~ 100c

2024

No Action

2025

No Action

Corn Action Plan Summary

- Grain Market Insider sees an active opportunity to sell the remaining, previously recommended, DEC ‘23 580 puts to lock in gains. At the end of June, Insider recommended buying DEC ’23 580 puts for approximately 30 cents in premium plus fees and commission. At the time, the U.S. Drought Monitor was showing dryness across the Midwest and weather forecasts were calling for hot and dry conditions. Since then, conditions have improved and DEC ’23 corn has dropped over 100 cents with the recommended 580 puts gaining over 200% in value. With much of the growing season behind us, we are at the time of year when market lows are often made, and while the market may continue to recede into harvest, it is still subject to unforeseen weather like the 2020 derecho, or headlines from the Black Sea that could shock prices higher.

- Grain Market Insider sees an active opportunity to sell a portion of your 2024 corn crop today. The 2023 growing season has been marked by hot and dry conditions, changing weather forecasts, and geopolitical volatility that has moved prices dramatically in both directions for both the 2023 and 2024 crops. We recognize that $5 is not the $6 or $7 that we have seen in recent memory, but much like the runup in 2012, some of the best prices for the 2013 crop were made in the summer of 2012 before they retreated that fall and into the next calendar year. Now that the 2023 growing season is winding down, 2024 prices continue to be historically favorable to get another early sale on the books, and Grain Market Insider suggests selling another portion of your 2024 production on a DEC 24 HTA contract, or DEC 24 Futures contract, so basis can be set at a later more advantageous time.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- It was a very quiet session in the corn market on Thursday as prices traded on both sides of a narrow trading range to close just fractionally higher in the Dec corn futures. The market is looking for news and squaring positions going into next week’s USDA report on Tuesday.

- Next week’s USDA report will be looking at crop production and likely making demand adjustments. Expectations are for yield to be lowered to 173.5 bushels/acre from 175.1 last month. The movement of demand may be the key to prices as reduced demand will likely keep the carryout projection for the marketing year relatively large, limiting price rallies. The market is concerned about a possible acre adjustment that could also increase the potential corn supply.

- The USDA will release the last export sales report for the 2022-23 marketing year on Friday morning. The expectations for corn or old crop sales of -200,000 to 100,000 MT and new crop sales of 400,000 to 1,000,000 MMT. Export demand remains lackluster and has limited price.

- Corn prices have been trading in a sideways, consolidative pattern since mid-August. The narrowing, choppy pattern may be setting the market up for a break in either direction, likely triggered by the reaction to the report on Tuesday next week.

Above: After trading mostly sideways since the end of July, December corn posted a bearish reversal on 8/21 after testing the 495 – 516 resistance level. While the reversal is a bearish development, prices could turn higher if the market receives additional bullish input. Should that happen, resistance above the market remains between 495 – 516. If not and prices turn lower, support may be found near 460 and again near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from changing weather patterns, crop conditions and export sales. While export sales have improved, growing conditions have continued to be variable and questions remain regarding what final yields will be, keeping prices supported. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Soybeans ended the day lower, erasing all gains made yesterday as trade remains rangebound. Soybean oil was down over 2.5% in the December contract with soybean meal lower but not by as much. Soybean oil has been pressured by lower palm oil.

- Analysts are anticipating yields between 49 and 50 bpa, but the planting estimate of just 83.5 million acres could lead to an even tighter carryout unless the USDA finds more soybean acres on Tuesday.

- Soybean export demand has remained active with another sale yesterday announced of 9.2 mb to unknown destinations. This brings new crop total sales to 526 mb, which is decent but still 370 mb lower than a year ago.

- Soybeans on the Dalian exchange are trading at the equivalent of $18.80 a bushel, which is near the yearly highs and has spurred imports. China’s soybean imports for August were seen rising to 9.36 mmt which is up 31% from a year ago.

Above: After filling in the chart gap that was left between 1390-1/2 and 1394-3/4, the market has drifted lower in conjunction with stochastic indicators crossing over in overbought conditions indicating a possible downward market reversal. For now, if prices continue to slide lower, the market may find support near 1330 and again around 1300. If prices regain upward momentum, initial resistance will be in the 1400 – 1410 area.

Wheat

Market Notes: Wheat

- All three wheat classes ended the day lower, as traders began consolidating positions and taking profits from Wednesday’s gains ahead of Tuesday’s USDA September WASDE update.

- Adding to the negative tone to the wheat markets, Matif wheat futures were lower again on slow EU and U.S. exports record setting Russian export pace. Although, the U.S. recently sold South Korea 88k mt of milling wheat for their flour mills for November/December shipment.

- Russia continued its drone attacks on both the Black Sea and Danube River ports, damaging port and grain facility infrastructure, and injuring one person. This recent attack was the fourth such strike in five days.

- Not many changes are expected in Tuesday’s WASDE update. The average trade guess for U.S. carryout is 614 mb, down 1 mb from last month, and the average guess for 23/24 world carryout is 265 mmt, 600k lower than last month.

- Statistics Canada is also expected to release its July-23 stocks estimate tomorrow, with all wheat stocks expected to be near 4 mmt, up from last year’s 3.663 mmt.

- While some of Wednesday’s strength could be attributed to the market adding war premium, concerns regarding dry conditions contributing to smaller Australian and Argentinian crops and too much rain affecting the quality of Brazil’s wheat also likely contributed.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 crop. Since the end of May the wheat market has been largely rangebound, influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the rearview mirror, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward the 800 level before considering any additional sales.

- No action is recommended for 2024 Chicago wheat. Considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. Plenty of time remains to market the 2024 crop with many uncertainties that could shock prices higher, like the world stocks to use ratio at an 8-year low, war in the Black Sea and production concerns in the southern hemisphere. If prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 825, if not, and prices make new lows, unsold bushels will be protected by the recommended July ’24 590 puts.

- No action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The Chicago wheat market continues to be rangebound with initial support at the low end coming in near 590 – 595, with resistance at the upper end near 650. If the market breaks out to the upside, the next level of resistance may be found near 665; if not and the market drifts lower, the next level of support below the market may be found near 573.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. As more becomes known about this year’s crop with some reports of better-than-expected yields, questions remain about the world wheat supply. War continues in the Black Sea region, Ukraine’s export capabilities remain uncertain, and dryness continues in key production areas of the world. With a world stock-to-use ratio at its lowest level in 8 years, we continue to target 950 – 1000 in the December futures as a potential level to suggest the next round of sales. At the same time, we continue to watch the bottom end of the range that prices have traded in since late 2022. A close below the bottom end would reduce the probability of getting to 950 – 1000 and would increase the risk of prices falling into the 600 – 650 range.

- No action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks-to-use ratio remains at an 8-year low, there are still many uncertainties that could shock prices higher. Plenty of time remains to market the 2024 crop, and after recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 850.

- No action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: December K.C. wheat posted a bullish reversal on September 5 from oversold conditions and followed through into the previous trading range. If prices continue higher, resistance above the market remains near 772 – 780. Otherwise, support below the market rests near the September 5 low of 724-1/2, and again near the September ’21 low of 670.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature to price volatility this growing season, with continued dryness concerns in not only the US, but also Canada and Australia. While there typically isn’t a strong likelihood of higher prices until after harvest is complete, both weather and geopolitical events can change suddenly to move prices higher. Insider will consider making sales suggestions if prices improve, while also continuing to watch the downside for any further violations of support.

- No action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks-to-use ratio remains at an 8-year low, there are still many uncertainties that could shock prices higher. For now, plenty of time remains to market the 2024 crop and Insider is content to see how the market develops before suggesting making any additional sales. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales.

- No action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: On September 5, the December contract posted a bullish reversal from oversold conditions with some follow-through. If prices continue to the upside, nearby resistance could be found near 785 – 795 and again around 810 – 820. Otherwise, the next support level below the market is near the Sept. 5 low of 756-3/4, and then near the June ’21 low of 730.

Other Charts / Weather