Grain Market Insider: September 5, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| DEC ’23 | 486 | 4.5 |

| MAR ’24 | 501 | 4.5 |

| DEC ’24 | 512.25 | 2.75 |

| Soybeans | ||

| NOV ’23 | 1365 | -4.25 |

| JAN ’24 | 1379 | -3.75 |

| NOV ’24 | 1298.75 | 5.75 |

| Chicago Wheat | ||

| DEC ’23 | 599.25 | 3.75 |

| MAR ’24 | 625 | 3 |

| JUL ’24 | 647.75 | 0.5 |

| K.C. Wheat | ||

| DEC ’23 | 724.5 | 1.75 |

| MAR ’24 | 728.75 | 0.75 |

| JUL ’24 | 717.75 | -0.25 |

| Mpls Wheat | ||

| DEC ’23 | 762.25 | 2.5 |

| MAR ’24 | 780 | 1.5 |

| SEP ’24 | 793.5 | 6.5 |

| S&P 500 | ||

| DEC ’23 | 4561.75 | -9.25 |

| Crude Oil | ||

| NOV ’23 | 85.92 | 1.17 |

| Gold | ||

| DEC ’23 | 1952 | -15.1 |

Grain Market Highlights

- A potential quickening of the corn crop’s maturity due to the recent hot and dry weather helped support corn prices today as traders anticipate lower crop condition ratings.

- Weaker soybean oil and meal likely added to the negativity in the soybean complex that was unable to end the day on the positive side, despite another 251k metric ton flash sale of soybeans to unknown destinations.

- Even though crude oil rallied over 1%, soybean oil likely followed palm oil lower on increasing Malaysian stocks that are now reportedly at a six-month high.

- Despite mediocre export inspections, additional attacks on Danube River ports and a shrinking Australian wheat crop lent support to the wheat market where all three wheat classes settled mostly higher except the deferred K.C. contracts which closed lower on the day.

- Disappointing economic data from Europe and Asia lent support to the U.S. dollar today which reached a 6-month high, and likely added some resistance to commodities.

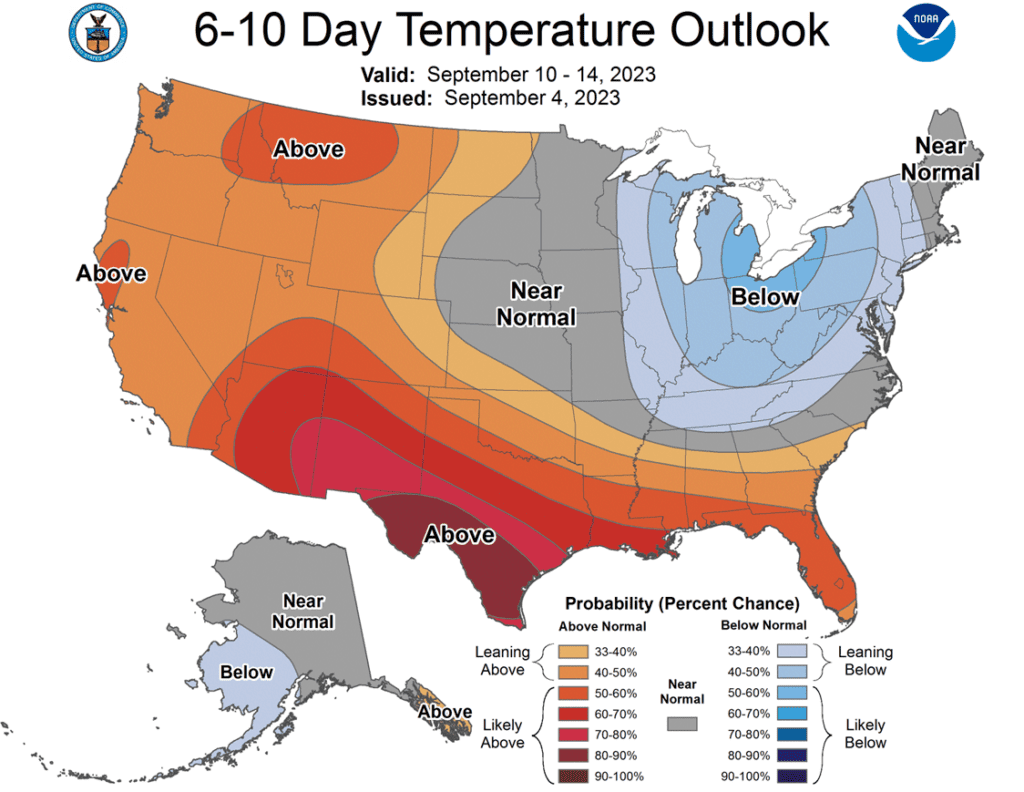

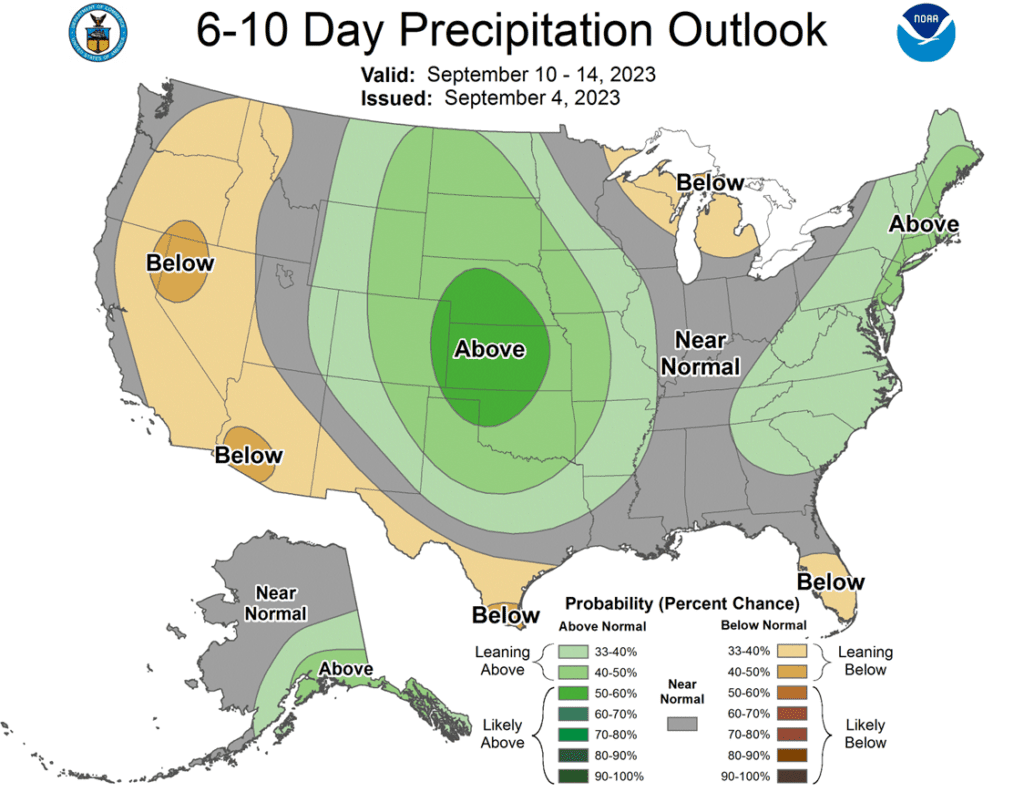

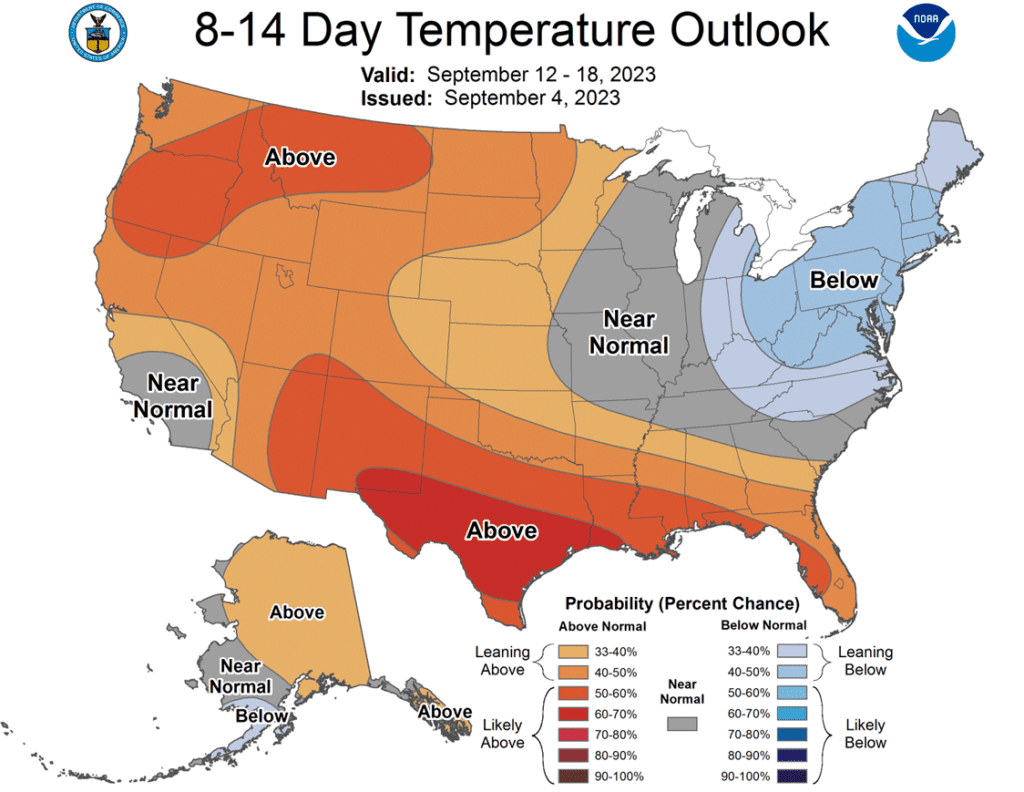

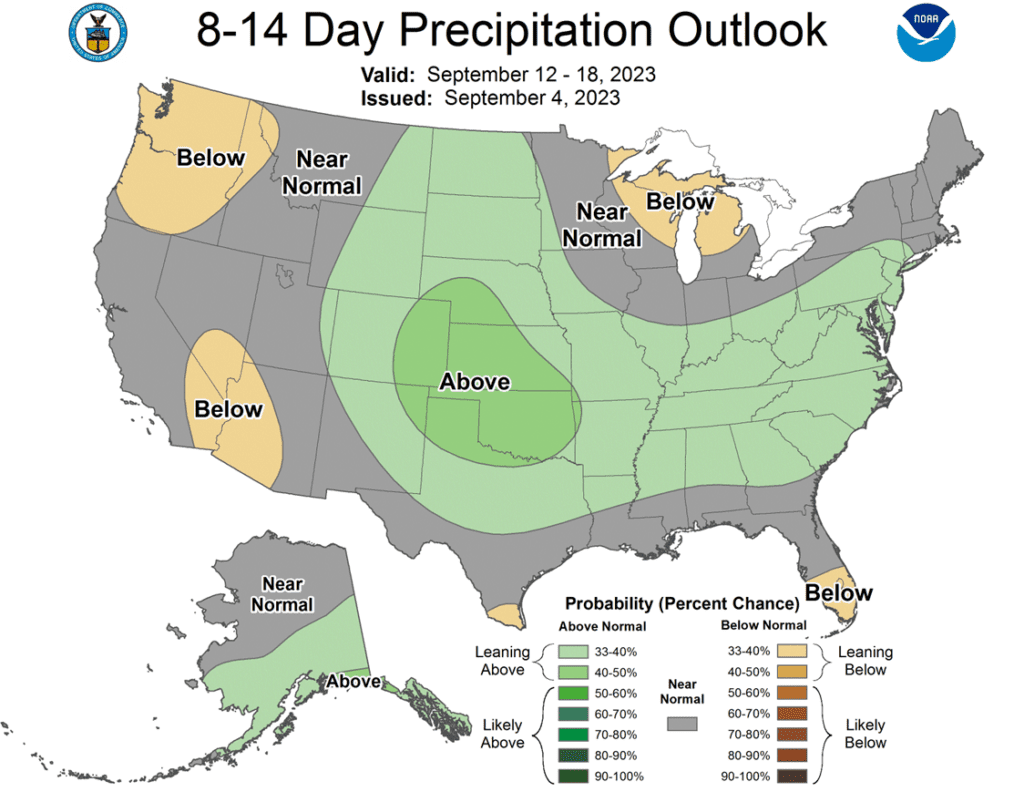

- To see the current U.S. 6 – 10 day and the 8 – 14 day Temperature and Precipitation Outlooks courtesy of the NWS and NOAA, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

Active

Sell DEC ’24 Cash

2025

No Action

Puts

2023

Active

Exit All DEC ’23 580 Puts ~ 100c

2024

No Action

2025

No Action

Corn Action Plan Summary

- Grain Market Insider sees an active opportunity to sell the remaining, previously recommended, DEC ‘23 580 puts to lock in gains. At the end of June, Insider recommended buying DEC ’23 580 puts for approximately 30 cents in premium plus fees and commission. At the time, the U.S. Drought Monitor was showing dryness across the Midwest and weather forecasts were calling for hot and dry conditions. Since then, conditions have improved and DEC ’23 corn has dropped over 100 cents with the recommended 580 puts gaining over 200% in value. With much of the growing season behind us, we are at the time of year when market lows are often made, and while the market may continue to recede into harvest, it is still subject to unforeseen weather like the 2020 derecho, or headlines from the Black Sea that could shock prices higher.

- Grain Market Insider sees an active opportunity to sell a portion of your 2024 corn crop today. The 2023 growing season has been marked by hot and dry conditions, changing weather forecasts, and geopolitical volatility that has moved prices dramatically in both directions for both the 2023 and 2024 crops. We recognize that $5 is not the $6 or $7 that we have seen in recent memory, but much like the runup in 2012, some of the best prices for the 2013 crop were made in the summer of 2012 before they retreated that fall and into the next calendar year. Now that the 2023 growing season is winding down, 2024 prices continue to be historically favorable to get another early sale on the books, and Grain Market Insider suggests selling another portion of your 2024 production on a DEC 24 HTA contract, or DEC 24 Futures contract, so basis can be set at a later more advantageous time.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- Corn prices pushed higher with December closing up 4 ½ cents on the session. The talk of hot weather pushing the crop to maturity and possibly limiting final production, along with technical buying and short covering helped support the market.

- Excessive heat across the middle of the country over the weekend likely pushed the crop close to maturity and limited any additional potential the corn crop could have in most areas. The temperature looks to moderate later in the week with improved rain chances in the northern plains.

- Weekly crop ratings are likely to reflect the impact of high temperature across the Midwest this past weekend. The percentage of Good/Excellent is expected to drop to 54%, down 2% from last week. Crop maturity may be a bigger focus, which last week saw 9% of the corn crop classified as mature, up 5% on the week and 1% over the 5-year average of 8%.

- Grain markets are becoming concerned about the water levels on the Mississippi River for the fall harvest window. Barge restrictions have been put in place, limiting grain movement, and will have the potential to impact cash basis levels going into the fall months. This may be more tied to the pressure in the soybean markets but is likely limiting buying strength in corn.

- The last weekly export inspection report for the marketing year saw 481,000 MT of shipments last week. This is still down 32% year over year with the new marketing year beginning on September 1.

Above: After trading mostly sideways since the end of July, December corn posted a bearish reversal on 8/21 after testing the 495 – 516 resistance level. While the reversal is a bearish development, prices could turn higher if the market receives additional bullish input. Should that happen, resistance above the market remains between 495 – 516. If not and prices turn lower, support may be found near 460 and again near 415.

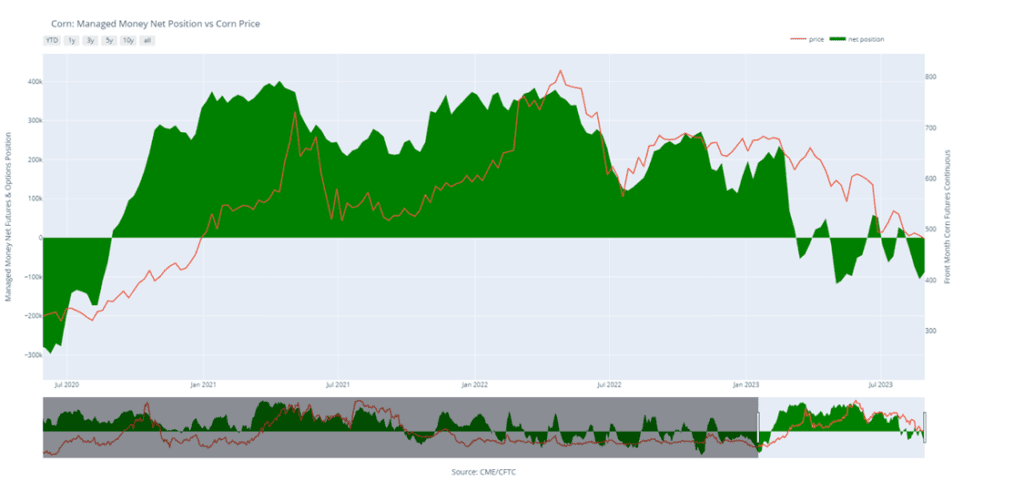

Money Corn Managed Money Funds net position as of Tuesday, Aug. 29. Net position in Green versus price in Red. Managers net bought 18,787 contracts between Aug. 22 – 29, bringing their total position to a net short 87,348 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from the changing weather forecasts, crop conditions, and export sales. We ended the month of July experiencing hot conditions with little rainfall and weak export sales. Since then, conditions have become more favorable, and export sales have picked up. While much of the crop remains in drought conditions, which can maintain upside potential, timely rains may come and push prices lower. Much like in 2012, when July was dry, and the pattern changed in August, when decent rain fell in parts of the western Corn Belt and IL, sending Nov ’12 soybeans down 20%. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Soybeans ended the day mostly lower along with both soybean meal and oil despite the hot and dry weather, decent export sales, and the possibility of deteriorating yields. The U.S. Dollar hit a 6-month high today which may have pressured the soy complex.

- Although it did not provide any support today, crude oil rallied sharply which could be beneficial to soybean oil down the road. The rally came after Saudi Arabia said that it would extend its voluntary cut of 1 million barrels per day until the end of the year.

- There was a sale reported this morning of 251,000 metric tons of soybeans for delivery to unknown destinations for the 23/24 marketing year, and export inspections totaled 13.9 mb for the week ending Thursday, August 31 which was a bit light.

- July soybean crush was reported to be a new record for July at 184.8 million bushels which was up 2% from July last year. Crush margins have been very profitable and have incentivized processors. Malaysian palm oil was down 2.13% today which likely pressured soybean oil.

Above: After filling in the chart gap that was left between 1390-1/2 and 1394-3/4, the market has drifted lower in conjunction with stochastic indicators crossing over in overbought conditions indicating a possible downward market reversal. For now, if prices continue to slide lower, the market may find support near 1330 and again around 1300. If prices regain upward momentum, initial resistance will be in the 1400 – 1410 area.

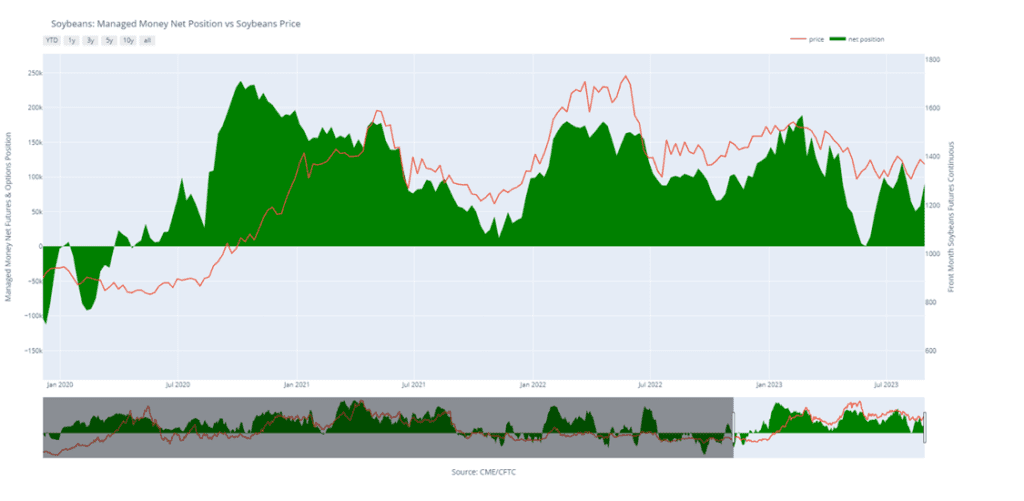

Soybeans Managed Money Funds net position as of Tuesday, Aug. 29. Net position in Green versus price in Red. Money Managers net bought 32,779 contracts between Aug. 22 – 29, bringing their total position to a net long 90,985 contracts.

Wheat

Market Notes: Wheat

- For the week ending August 31, the USDA reported that 300,000 mt of wheat were inspected for export, toward the low end of expectations and versus 390,000 inspected the week prior, and down 24% from last year versus the USDA’s forecast of down only 8%.

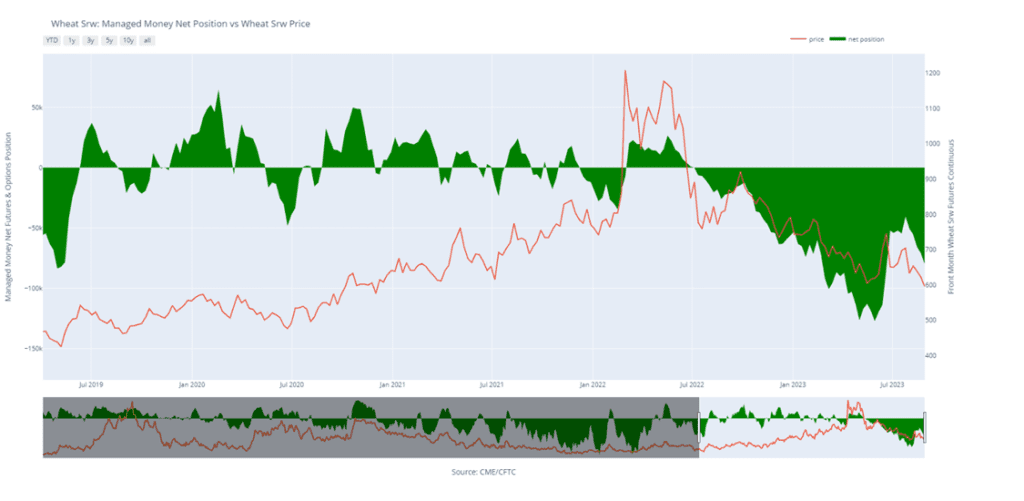

- In Friday’s Commitment of Traders report, Managed Money sold nearly 9k contracts of Chicago wheat, bringing their short position to just under 80,000 contracts.

- Monday’s talks between Russia and Turkey ended without reviving a Black Sea export corridor deal. Putin stated that he wasn’t interested in renewing a deal unless obstacles to Russian ag exports were removed. Additionally, Russia would like to reopen an ammonia pipeline and be admitted back into the SWIFT banking system.

- Prior to Russia’s and Turkey’s talks, Russia attacked another Ukrainian port on the Danube River, and despite the attacks, Ukraine is looking to boost its exports via the river. To that end, the Ukrainian grain industry is lobbying Ukraine and Romania to add anchorage points in the Danube off the coasts of both countries.

- According to ABARE, the Australian government shaved 3% off its June estimate of the Australian wheat crop to 25.4 mmt, representing a 36% decline from last year’s record crop and 4.6 mmt below the USDA’s current 29 mmt estimate. The decline in production may have China, who is a major importer of Australian wheat, looking for other sources for its supply needs.

- The Rosario Grains Exchange stated that Argentina recently received between 1.18 and 3.94 inches of rain in some key growing areas and may have been enough to relieve the wheat crop that has been struggling with dry conditions.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

Active

Enter(Buy) JUL ’24 590 Puts ~ 30c

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 crop. Since the end of May, the wheat market has been largely rangebound, influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the rearview mirror, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward the 800 level before considering any additional sales.

- Grain Market Insider sees an active opportunity to buy July ’24 590 Chicago Wheat Puts on a portion of your 2024 SRW Wheat crop. While weather has been a dominant feature of the market this year with dry growing conditions and harvest delays, slow export demand and cheap Russian exports remain major headwinds to prices. The market has turned lower in recent weeks and July Chicago wheat broke through a major support area around 657. Closing below 657 support signals that the major trend may be turning down and poses the risk that prices could erode further in the weeks ahead, possibly to the next level of support, the May low of 573. If the 573 level fails, the next support could be the 468 – 514 level. Buying July ’24 590 Chicago wheat puts on a portion of our SRW production should help protect future sales from further downside erosion, while still allowing for upside appreciation should the market turn higher.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The Chicago wheat market appears to be consolidating between 650 and 596. If the market breaks out to the upside, the next level of resistance may be found near 665, if not, and the market drifts lower, the next level of support below the market may be found near 573.

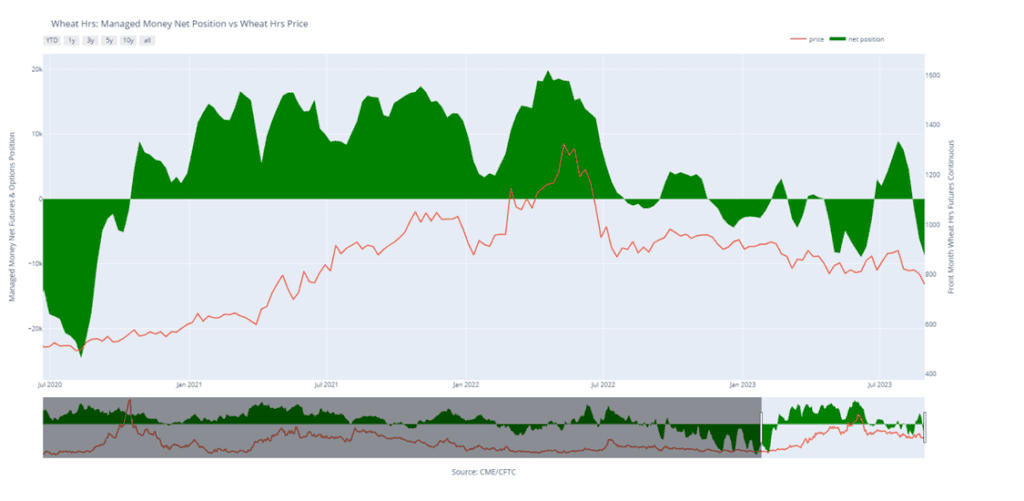

Chicago Wheat Managed Money Funds net position as of Tuesday, Aug. 29. Net position in Green versus price in Red. Money Managers net sold 8,960 contracts between Aug. 22 – 29, bringing their total position to a net short 79,881 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. As more becomes known about this year’s crop with some reports of better-than-expected yields, questions remain about the world wheat supply. War continues in the Black Sea region, Ukraine’s export capabilities remain uncertain, and dryness continues in key production areas of the world. With a world stock-to-use ratio at its lowest level in 8 years, we continue to target 950 – 1000 in the December futures as a potential level to suggest the next round of sales. At the same time, we continue to watch the bottom end of the range that prices have traded in since late 2022. A close below the bottom end would reduce the probability of getting to 950 – 1000 and would increase the risk of prices falling into the 600 – 650 range.

- No action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks-to-use ratio remains at an 8-year low, there are still many uncertainties that could shock prices higher. Plenty of time remains to market the 2024 crop, and after recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 850.

- No Action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: December KC wheat broke through the bottom end of its trading range and may be poised to test the September ’21 low of 670 unless bullish input enters the market to turn prices higher. If so, initial resistance above the market may rest near 772 – 780.

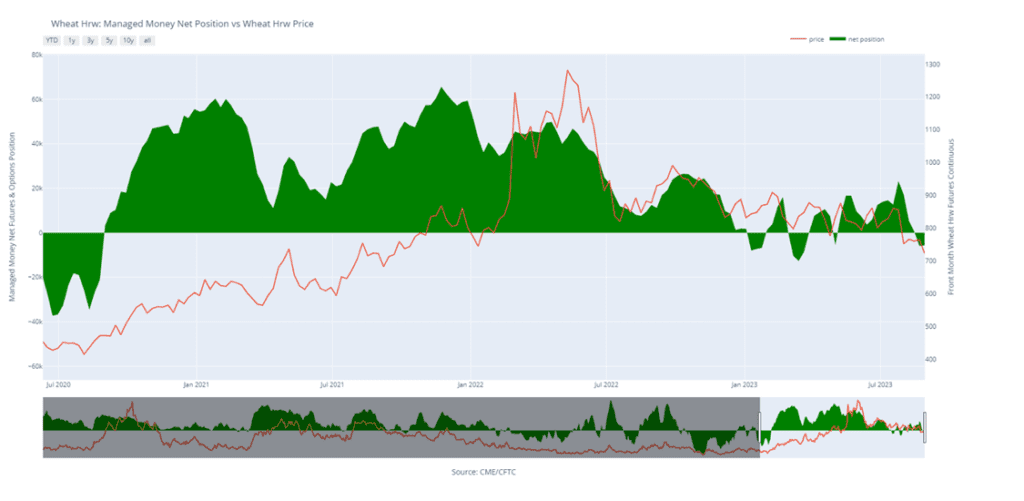

K.C. Wheat Managed Money Funds net position as of Tuesday, Aug. 22. Net position in Green versus price in Red. Money Managers net sold 6,552 contracts between Aug. 15 – 22, bringing their total position to a net short 5,965 contracts.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature to price volatility this growing season, with continued dryness concerns in not only the US, but also Canada and Australia. While there typically isn’t a strong likelihood of higher prices until after harvest is complete, both weather and geopolitical events can change suddenly to move prices higher. Insider will consider making sales suggestions if prices improve, while also continuing to watch the downside for any further violations of support.

- No action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks-to-use ratio remains at an 8-year low, there are still many uncertainties that could shock prices higher. For now, plenty of time remains to market the 2024 crop and Insider is content to see how the market develops before suggesting making any additional sales. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales.

- No Action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The December contract resumed its downward slide and traded through the May low of 769, and is now showing signs of being oversold, which can be supportive if prices turn higher. If prices do turn higher, nearby resistance could be found near 785 – 795 and again around 810 – 820. Otherwise, the next support level below the market could come in near the June ’21 low of 730.

Minneapolis Wheat Managed Money Funds net position as of Tuesday, Aug. 22. Net position in Green versus price in Red. Money Managers net sold 4,723 contracts between Aug. 15 – 22, bringing their total position to a net short 6,234 contracts.

Other Charts / Weather