Grain Market Insider: September 28, 2023

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 488.5 | 5.25 |

| MAR ’24 | 503.25 | 5 |

| DEC ’24 | 514.5 | 2.25 |

| Soybeans | ||

| NOV ’23 | 1300.5 | -2.75 |

| JAN ’24 | 1319.25 | -3.75 |

| NOV ’24 | 1269.75 | -3.25 |

| Chicago Wheat | ||

| DEC ’23 | 578.75 | -0.75 |

| MAR ’24 | 606.5 | -0.75 |

| JUL ’24 | 636.25 | -1.5 |

| K.C. Wheat | ||

| DEC ’23 | 685 | -9.5 |

| MAR ’24 | 693 | -9 |

| JUL ’24 | 694.25 | -7.25 |

| Mpls Wheat | ||

| DEC ’23 | 747 | -3.75 |

| MAR ’24 | 766.25 | -2.5 |

| SEP ’24 | 789.5 | 7 |

| S&P 500 | ||

| DEC ’23 | 4333.5 | 20 |

| Crude Oil | ||

| NOV ’23 | 91.7 | -1.98 |

| Gold | ||

| DEC ’23 | 1882.5 | -8.4 |

Grain Market Highlights

- The funds continue to hold a short position estimated to be north of 140k contracts, likely leading to additional short covering as traders even up positions ahead of month end and Friday’s USDA quarterly Grain Stocks report, supporting prices.

- Weekly export sales that came in at the low end of expectations, along with sharply lower soybean oil, weighed on soybean prices, which continues to consolidate into Friday’s USDA report.

- Soybean oil traded lower with meal higher, as reports of a supply glut for green diesel and plummeting biofuel credits continue to weigh on soybean oil prices, and its share of soybean crush value.

- Strong export sales, that exceeded expectations and were the highest in 7 weeks, did not lend enough support to the wheat complex to keep it from sliding into the red. While December K.C. made a fresh 2-year low, and Minneapolis a new contract low, Dec. Chicago held support.

- After making fresh 10-month highs yesterday, the U.S. dollar reversed course to trade lower today, which could be friendly to commodities as it continues to show signs of being overbought, and today’s trade took out yesterday’s low.

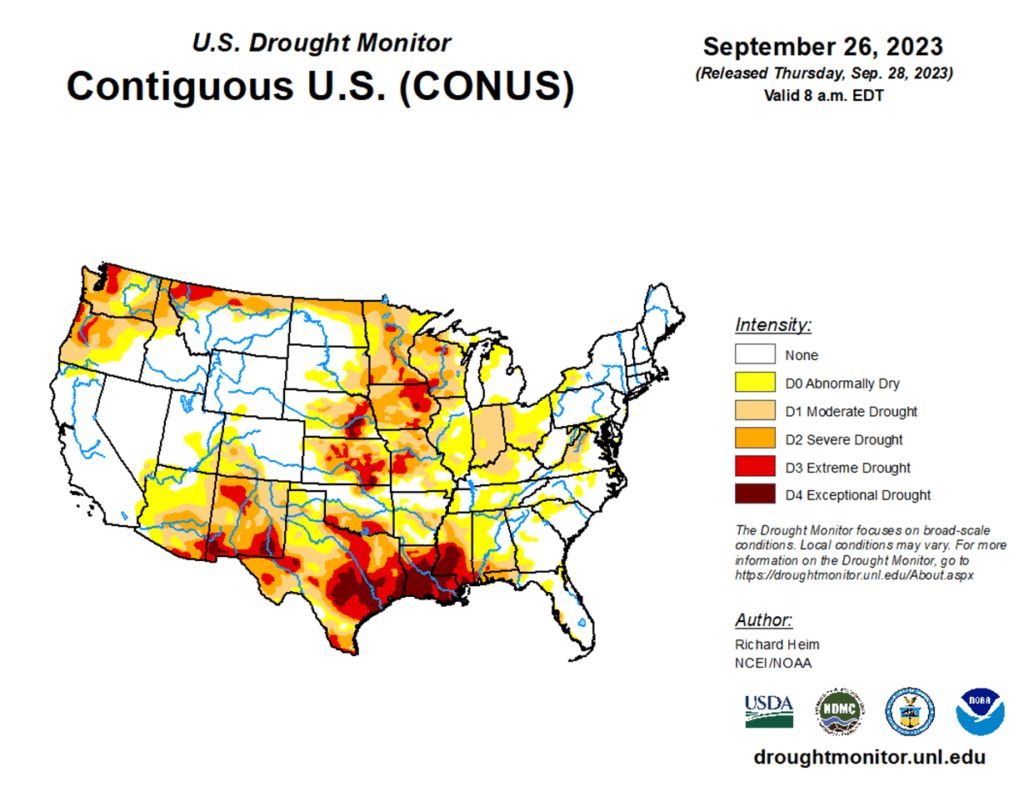

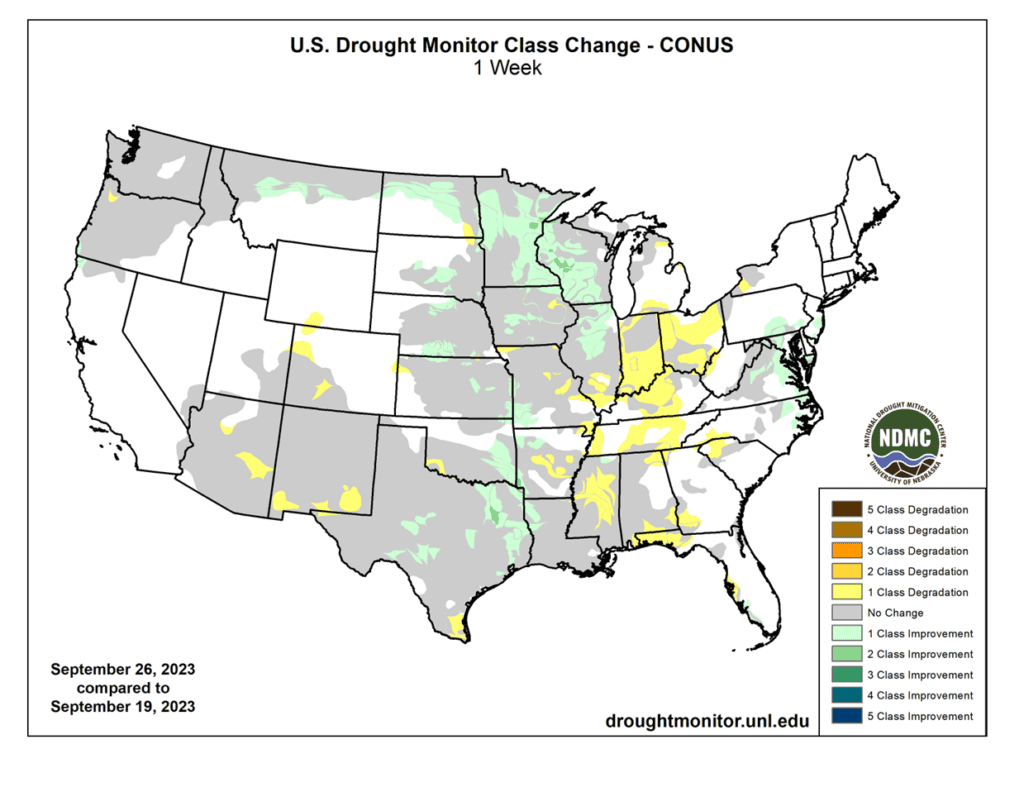

- To see the current U.S. Drought Monitor, and the drought classification change map courtesy of the USDA, NOAA, and NDMC, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. The 2023 growing season has been marked with many challenges that whipsawed the market up and down in a 140-cent range. And while we are at the time of year when lows are often made, the market is still subject to many unforeseen influences that can move prices higher, like in 2020 when the market went on to test contract highs and beyond after hitting market lows before harvest. For now, after locking in gains from previously recommended purchased 580 puts, Insider is content to wait until later in the year (when markets tend to strengthen) before considering suggesting any additional sales. Insider is also monitoring the market for any re-ownership opportunities, should it experience an extended rally.

- No new action is recommended for 2024 corn. Like the 2023 corn market, prices for the 2024 crop have been dominated by volatility from slow exports and adverse growing conditions which led to a near 80 cent trading range during the summer months. Plenty of time remains to market the crop, and while demand continues to be slow, many uncertainties remain that can move prices higher. After recommending an additional sale for the 2024 crop, Insider may not consider suggesting any further sales until later this winter or possibly even spring. We will continue to monitor the market for any upside opportunities in the coming weeks.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- Corn futures traded to a fourth consecutive higher high on the daily trade, as December corn futures gained 3 ½ cents for the session. In this recent move, Dec corn has now added 21 cents of value off the contract low. The market is seeing short cover and technical buying leading into the end of the month and tomorrow’s USDA Grain Stocks report.

- The USDA will release the quarterly Grain Stocks report tomorrow. Expectations are for September 1 grain stocks to be at 1.429 billion bushels. This would be the highest September total in 3 years, and approximately 50 mb above last year’s report.

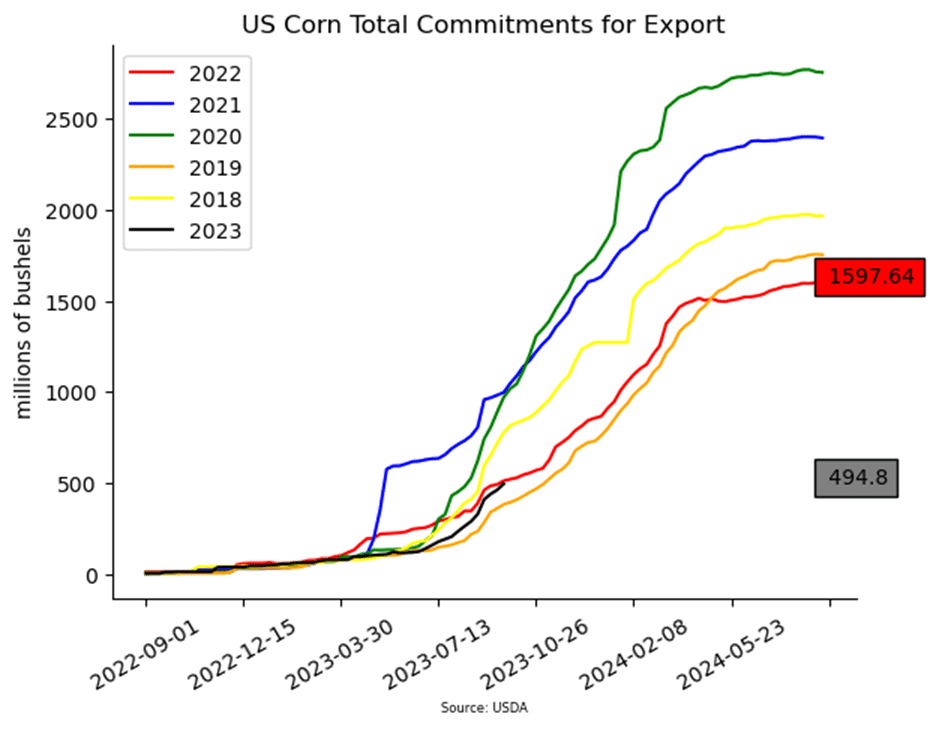

- Export sales last week totaled 842,000 mt (33.1 MB) in the weekly Export Sales report released on Thursday morning. Corn sales commitments now total 495 mb for 23/24 and are down 3% from a year ago. Last week’s shipments were 28.7 mb, which is below the pace needed to reach the USDA export target.

- Ethanol margins remain strong, supported by strong crude oil prices, and corn usage so far this year has increased over last year. Though early, corn used for ethanol is running 10.5 mb, or 3.6% above last year, to start the marketing year.

- Short-term weather patterns look drier, which should keep harvest moving forward. The fresh supply of corn into the pipeline should keep basis and the market under pressure.

Above: The corn market has largely been rangebound since the beginning of August, with some minor short covering lifting prices in recent days. Resistance remains above the market between 495 – 516, and support below the market may be found near 460 and again near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from changing weather patterns, crop conditions, and export sales. While export demand currently lags last year’s numbers, ending stocks are also currently estimated at a tight 220 million bushels. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Soybeans ended the day slightly lower, but came back significantly from their early morning lows. November soybeans are struggling to get back above the 100-day moving average and settled just below it today. Soybean meal ended higher, while soybean oil was lower.

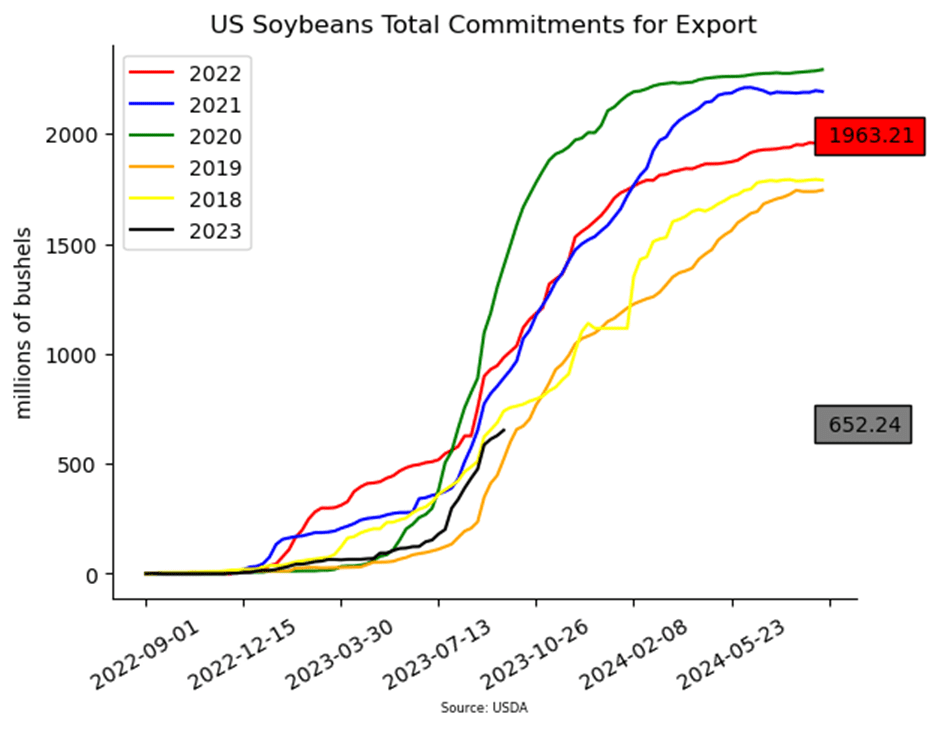

- For the week ending September 21, the USDA reported an increase of 24.7 mb in soybean export sales for 23/24, which was in line with expectations. Last week’s export shipments of 20.0 mb were below the 35.1 mb needed each week to meet the USDA’s export estimates.

- Tomorrow, the USDA U.S. quarterly Grain Stocks report will be released, and average expectations are for ending stocks to come in at 244 mb, which would be down from the USDA’s September estimate of 250 mb. This report will give a better indication to the yields that can be expected, and analysts have been seeing yields closer to 49 bpa rather than the USDA’s last guess of 50.1 bpa.

- The U.S. soybean harvest should pick up speed in the coming days, with little rain expected over the next week. Drought conditions are still prevalent in the Midwest, and heavy rains would be needed to improve soil moisture levels.

Above: Since the end of August, November soybeans have been in a downtrend and are showing signs of being oversold, which is supportive if prices do reverse higher. Above the market, initial resistance lies between 1317 – 1323, with further resistance near 1368. To the downside, support remains near the May 31 low of 1270.

Wheat

Market Notes: Wheat

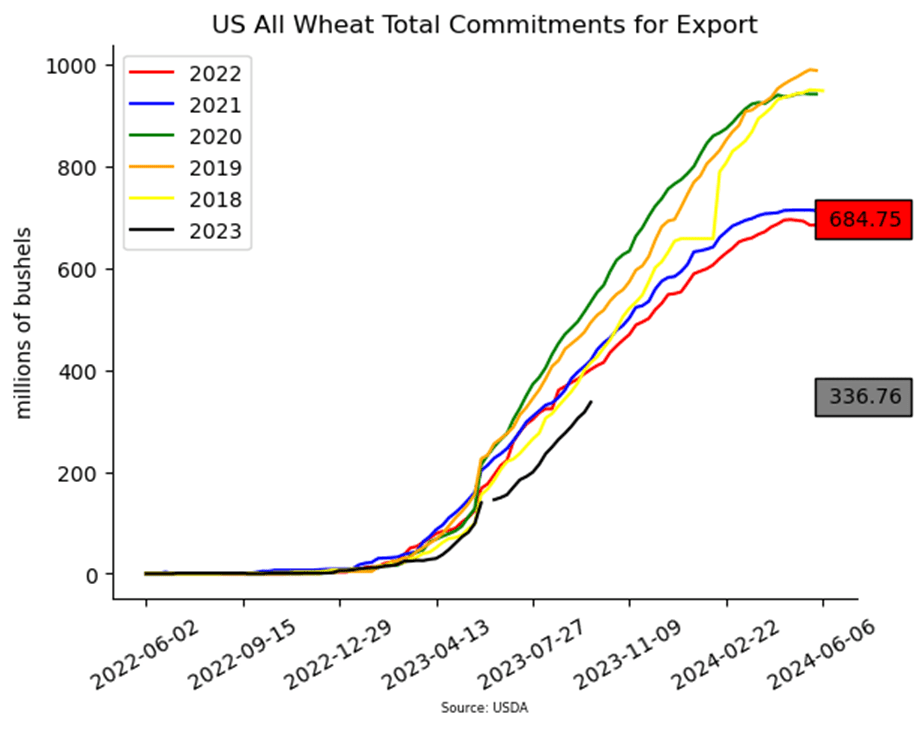

- The USDA reported an increase of 20.0 mb of wheat export sales for 23/24. Shipments last week of 21.5 mb, were above the 14.1 mb per week pace needed to meet the USDA’s export estimate of 700 mb for 23/24.

- Tomorrow, traders will receive the quarterly grain stocks and small grains summary reports. Pre-report estimates peg September 1st wheat stocks at 1.774 bb, compared with 1.778 bb last year. Additionally, the final production pre-report estimate for all U.S. wheat comes in at 1.731 bb, versus 1.734 bb in August, and 1.650 bb in 2022.

- Egypt purchased 180,000 mt of wheat, but it was not sourced from Russia. Reportedly, 120,000 mt came from Romania, while the remaining 60,000 mt came from Bulgaria. Despite their dominance, these offers were said to have beaten out Russia’s FOB values by $10-15 per mt.

- Outside influences are still pressuring wheat. Despite today’s drop in the U.S. Dollar Index, it remains at a very high level that is sure to keep weighing on U.S. exports, wheat in particular, and a lower close for Paris milling wheat futures today did not help the situation.

- The Ukrainian agriculture ministry kept their 2023 grain crop estimate unchanged at 57 mmt. According to officials, their grain harvest this year is better than expected so far.

- Brazil and Argentina have both issued complaints against a new EU policy, which is requiring certification that Argentine and Brazilian soybean meal is not from deforested areas. This may be difficult to regulate, but in any case, the policy starts October 1st. While this does not have a large impact on wheat, it could have a broader impact on the agricultural trade out of South America overall.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The wheat market in recent weeks has been sensitive to slow export demand, weather, and headlines regarding the Black Sea region. Now with harvest behind us, and new crop planting upon us, markets can still change suddenly due to El Nino and unforeseen geopolitical events, even though export demand remains weak. Following the recent recommendation to make an additional sale for the 2023 crop, Insider will continue to watch for any violations of support while also looking for prices to reach 650 – 700 before suggesting any further sales.

- No new action is recommended for 2024 Chicago wheat. Considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. Plenty of time remains to market the 2024 crop with many uncertainties that could shock prices higher, like the world stocks to use ratio at an 8-year low, war in the Black Sea and production concerns in the southern hemisphere. If prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800, if not, and prices make new lows, unsold bushels will be protected by the recommended July ’24 590 puts.

- No action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Since the beginning of September, December wheat has been mostly sideways and looking for direction. Initial upside resistance remains between 590 – 615, with resistance further up at 645 – 665 if the market breaks out to the upside. To the downside, support continues to reside just below the current range between 570 – 565, the December 2020 low.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 K.C wheat crop. Since the end of May, the wheat market has been influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the bin, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region and the southern hemisphere, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward 750 – 800 before considering any additional sales.

- No new action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Since the beginning of September, the market has drifted sideways to lower. The recent breakout to the downside has Dec. K.C. wheat looking toward 670 for the next level of support. While to the upside, nearby resistance rests near 722 and up further near 750.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. Weather has been a dominant feature this season with production concerns not only in the U.S., but also Canada and Australia. While prices have been weak due to low export demand, weather and geopolitical events can change suddenly to move prices higher. If prices begin to improve, Insider will consider making sales suggestions, while also continuing to watch the downside for any further violations of support.

- No new action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices. Insider recently recommended buying July ’24 K.C. wheat puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Since early September, Dec. Minneapolis wheat has been largely rangebound, and the recent breakout to the downside has the market poised to test support near the June ’21 low of 730. If prices turn higher, initial resistance may be found between 778 – 791.

Other Charts / Weather