Grain Market Insider: September 25, 2023

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 481.25 | 4 |

| MAR ’24 | 495.75 | 3.5 |

| DEC ’24 | 509.5 | 2.5 |

| Soybeans | ||

| NOV ’23 | 1297.75 | 1.5 |

| JAN ’24 | 1315.5 | 2 |

| NOV ’24 | 1261.75 | 5 |

| Chicago Wheat | ||

| DEC ’23 | 589 | 9.5 |

| MAR ’24 | 615.5 | 9 |

| JUL ’24 | 642.75 | 9.25 |

| K.C. Wheat | ||

| DEC ’23 | 714.5 | 3.25 |

| MAR ’24 | 721.25 | 2.75 |

| JUL ’24 | 714.5 | 3.25 |

| Mpls Wheat | ||

| DEC ’23 | 769 | -1.5 |

| MAR ’24 | 785.75 | -1.5 |

| SEP ’24 | 795.75 | 0.25 |

| S&P 500 | ||

| DEC ’23 | 4368.5 | 7.5 |

| Crude Oil | ||

| NOV ’23 | 89.66 | -0.37 |

| Gold | ||

| DEC ’23 | 1934.6 | -11 |

Grain Market Highlights

- Short covering and a flash sale to Mexico for 1.661 mmt (65.5 mb) of corn, helped get the ball rolling in the right direction for the corn market, which settled near the day’s highs after trading 3 ½ cents lower in the overnight session.

- After opening the evening session in the red and trading 12 cents lower. Soybeans rallied back to close near the highs of the day, in part from higher meal and neighboring grain prices, despite sharply lower soybean oil.

- While soybean meal finished the day higher, soybean oil lost over 3% on the day and closed below the Aug. ’23 low as losses in heating oil (diesel fuel) added pressure to the market. Today’s weakness in bean oil also weighed heavily on Board crush margins which settled 16-1/4 cents lower in the December contracts.

- A managed fund short position of nearly 125k contracts in wheat likely spurred short covering and position squaring ahead of Friday’s quarterly Grain Stocks report and led the Chicago and K.C. contracts to a higher close while Minneapolis finished mixed.

- The grain complex largely shook off the negative influence of the US dollar, as it traded to its highest level since last November, primarily influenced by the Fed’s hawkish comments that interest rates will stay higher for a longer period of time than anticipated.

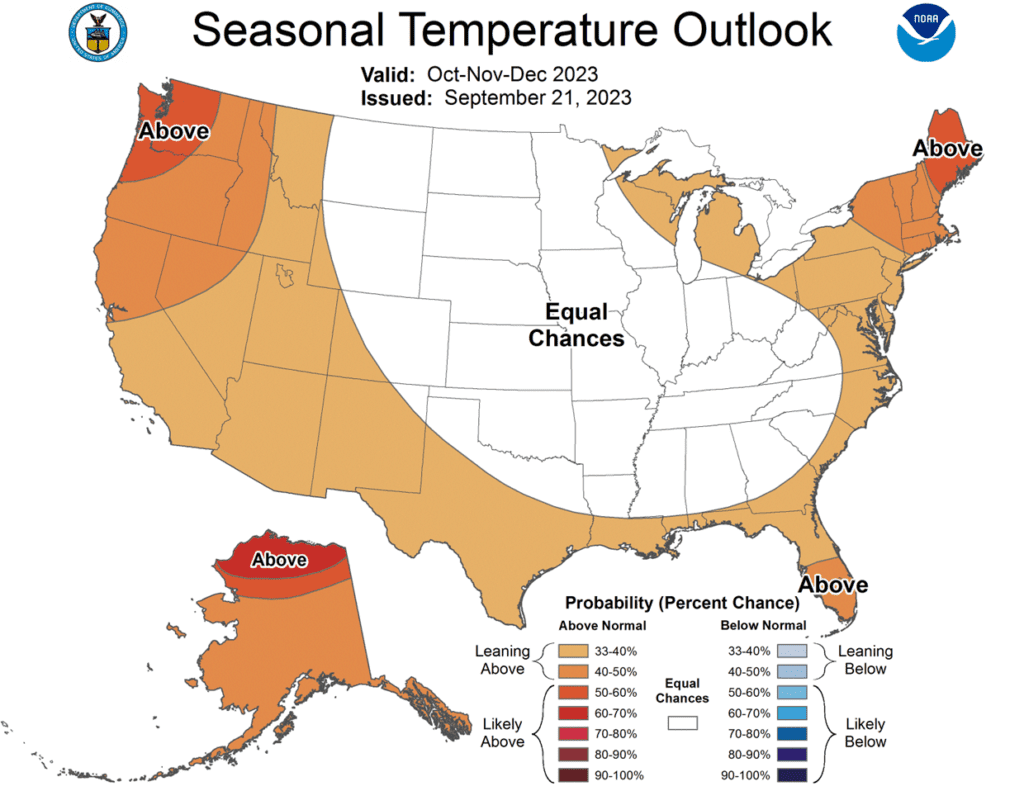

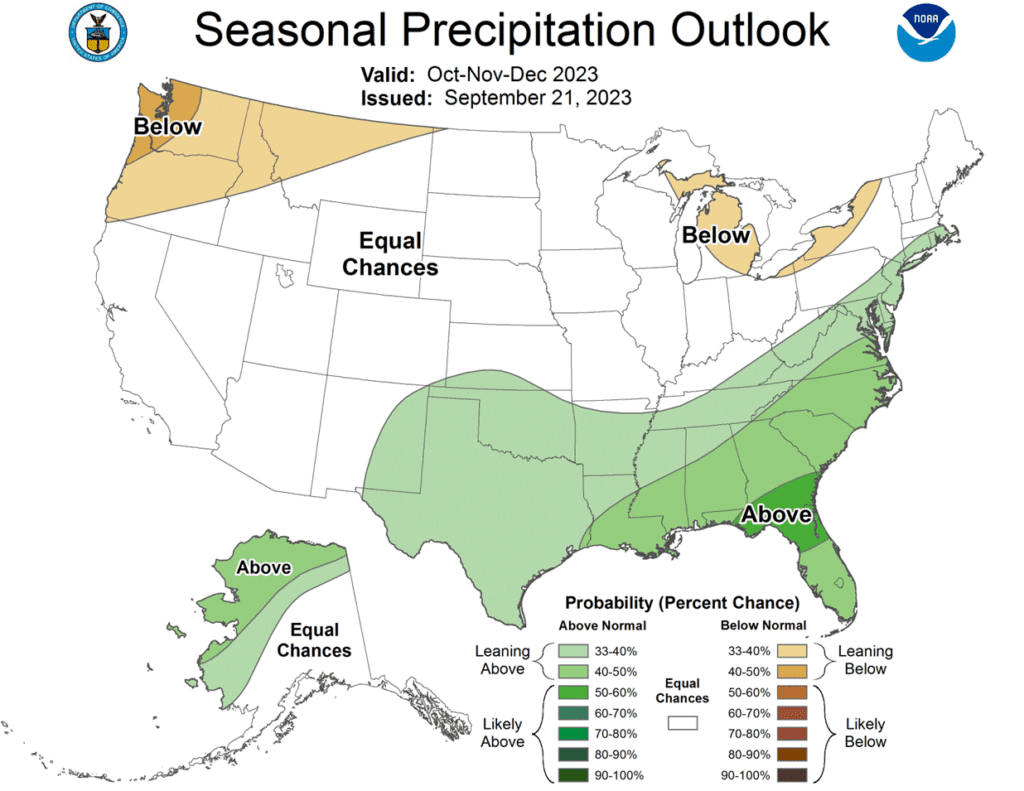

- To see the current US, Seasonal Temperature and Precipitation Outlooks courtesy of the NWS and NOAA, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No action is recommended for 2023 corn. Volatility has been a dominant feature this growing season with slow demand and increased planted acres, followed by hot and dry growing conditions that rallied prices nearly 140 cents and back down again. With the growing season mostly behind us, we are at the time of year when market lows are often made, and while the market may continue to recede into harvest, it is still subject to unforeseen influences that could move prices higher. For now, after locking in gains from the previously recommended purchased 580 puts, Insider is content to wait until after harvest when markets tend to strengthen before considering suggesting any additional sales.

- No action is recommended for 2024 corn. Like the 2023 corn market, prices for the 2024 crop have been dominated by volatility from slow exports and adverse growing conditions which led to a near 80 cent trading range during the summer months. Plenty of time remains to market the crop, and while demand continues to be slow, many uncertainties remain that can move prices higher. After recommending an additional sale for the 2024 crop, Insider may not consider suggesting any further sales until later this winter or possibly even spring. We will continue to monitor the market for any upside opportunities in the coming weeks.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- Corn futures battle off session lows to close higher on the day. December corn gained 4 cents on the session as bull spreading (buying the front month versus selling the deferred) and short covering supported the market.

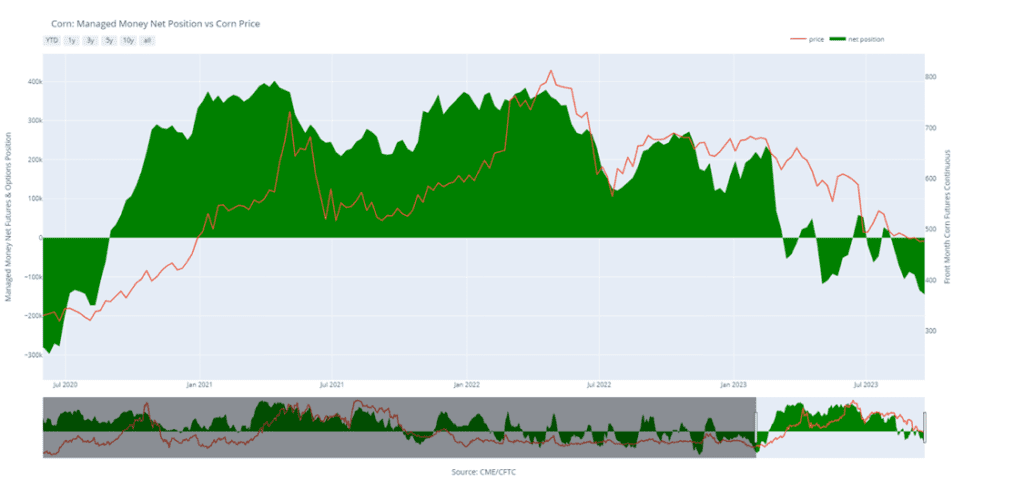

- On Friday’s Commitment of Traders Report, managed money was holding a net short position of nearly 145,000 contracts. This was one of the largest short positions in the last handful of years.

- Export demand is a concern, but Mexico stepped into the market with an announcement of a large flash sale. USDA announced that Mexico bought 1.661 mmt (65.4 mb) of US corn. Of that total, 1.049 mmt (41.3 MB) was for the current marketing year with the rest for 2024-25.

- Corn harvest continues to ramp up with early yield results being extremely variable based on the weather for the past growing season. Harvest pressure will likely affect the cash basis. Corn harvest was 9% complete last week. Analysts are looking for the crop to be 17% harvested in this week’s crop progress report.

- Weekly Corn Exports inspections are improving, totaling 26 mb for the week ending Thursday, September 21, 2023. Total inspections in 2023-24 are now at 77 mb, up 16% from last year at this time frame. USDA is estimating corn exports at 2.050 bb in 2023-24, up 23% from the previous year. The total overall pace of corn exports is still lacking the pace for USDA targets.

Above: The corn market has largely been rangebound since the beginning of August, and it continues to be under the influence of two bearish reversals, one posted on 8/21 and the other on 8/29. Above the market, resistance remains between 495 – 516, and below the market, support may be found near 460 and again near 415.

Corn Managed Money Funds net position as of Tuesday, Sept. 19. Net position in Green versus price in Red. Managers net sold 9,906 contracts between Sept. 13 – 19, bringing their total position to a net short 144,815 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from changing weather patterns, crop conditions, and export sales. While export demand currently lags last year’s numbers, ending stocks are also currently estimated at a tight 220 million bushels. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Soybeans ended the day higher after rebounding from lows earlier in the day. Soybean meal ended higher, while soybean oil traded lower near support at the 200-day moving average. Soybeans are under pressure from the start of US harvest and the new Brazilian supplies.

- The Crop Progress report will be released later this afternoon, and expectations are that 10 to 12% of the crop will be reported as harvested with conditions expected to remain unchanged at 52% good to excellent. Weather is expected to be mostly dry apart from the eastern Corn Belt, which should speed up harvest.

- In Brazil, conditions remain very dry in central and northern Brazil with above average temperatures where soybeans were recently planted, but there have been indications that the country’s wet season could begin by the end of the week. In the US, dry conditions have some analysts convinced that yields could come in closer to 49 bpa.

- Crude oil has rallied by 30% since the end of June which has made biodiesel production more profitable. Crush margins have been significantly more attractive to processors lately as soybeans have lost more value than soy products.

Above: While the soybean market recently broke through the 1300 level of support, it continues to show signs of being oversold, which can be supportive. Currently, the next level of support lies near the May 31 low of 1270, with initial resistance above the market may be found near 1325 and again near the 50-day moving average.

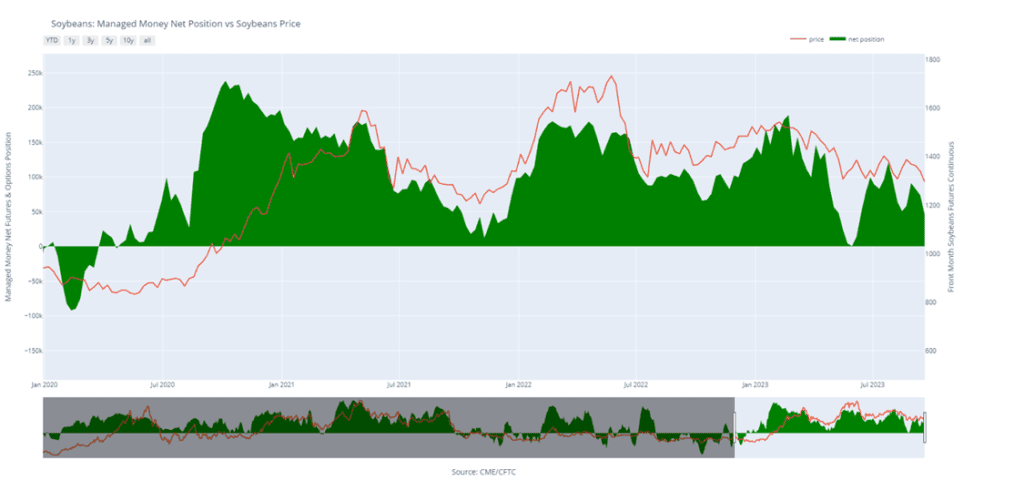

Soybean Managed Money Funds net position as of Tuesday, Sept. 19. Net position in Green versus price in Red. Money Managers net sold 27,983 contracts between Sept. 13 – 19, bringing their total position to a net long 45,832 contracts.

Wheat

Market Notes: Wheat

- Weekly wheat inspections at 16.6 mb were decent and brought the total 23/24 inspections to 207 mb. However, inspections are still running behind the pace needed to meet the 700 mb export goal.

- According to the CFTC’s Commitments of Traders report on Friday, funds were net short about 97,000 contracts of Chicago wheat as of September 19. Factoring in all three futures classes brings that short position to about 125,000 contracts.

- This Friday traders will receive the quarterly Grain Stocks report, as well as the small grains summary report. With funds holding such a large short position, the wheat market could be primed for a short covering rally if those reports are friendly.

- Globally, weather is a concern for the wheat market, especially in Australia. With their drought expected to get worse, some analysts are forecasting their wheat exports to drop as low as 17 mmt as compared to the record 32.5 mmt last year.

- Ukraine’s agriculture ministry said that grain exports between September 1 and 24 totaled just 1.57 mmt. That corresponds to a 51% decrease from a year’s 3.21 mmt. While they gave no official explanation, many believe that blocked or damaged ports, and Russian attacks on the Danube River terminals are to blame.

- According to India’s food secretary, their nation does not have a shortage of wheat, but may sell from their reserves to control domestic prices. This is despite curbing exports and the fact that as of September 24, India’s monsoon rains are 6% below normal.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No action is currently recommended for 2023 Chicago wheat. The wheat market in recent weeks has been sensitive to slow export demand, weather, and headlines regarding the Black Sea region. Now with harvest behind us, and new crop planting upon us, markets can still change suddenly due to El Nino and unforeseen geopolitical events, even though export demand remains weak. Following the recent recommendation to make an additional sale for the 2023 crop, Insider will continue to watch for any violations of support while also looking for prices to reach 650 – 700 before suggesting any further sales.

- No action is recommended for 2024 Chicago wheat. Considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. Plenty of time remains to market the 2024 crop with many uncertainties that could shock prices higher, like the world stocks to use ratio at an 8-year low, war in the Black Sea and production concerns in the southern hemisphere. If prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800, if not, and prices make new lows, unsold bushels will be protected by the recommended July ’24 590 puts.

- No action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the USDA’s 9/12 update, the market posted a bullish reversal and traded into the 590 – 615 resistance area. If the market breaks through to the upside, further resistance could be found between 645 – 665. Otherwise, if the market turns lower, the next level of support lies between 570 and the December 2020 low of 565.

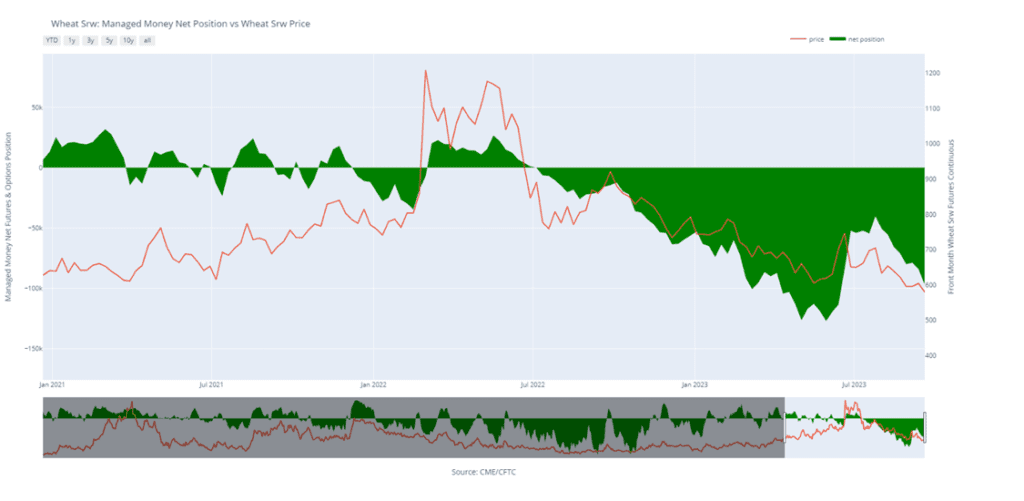

Chicago Wheat Managed Money Funds net position as of Tuesday, Sept. 19. Net position in Green versus price in Red. Money Managers net sold 12,666 contracts between Sept. 13 – 19, bringing their total position to a net short 96,805 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No action is recommended for 2023 K.C wheat crop. Since the end of May, the wheat market has been influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the bin, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region and the southern hemisphere, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward 750 – 800 before considering any additional sales.

- No action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the USDA update on September 12, the December contract posted a bullish key reversal, where the market made a new low for the move, yet closed higher. If prices continue higher, resistance above the market remains near 770 – 780. Otherwise, support below the market rests near the September 12 low of 709, and again near the September ’21 low of 670.

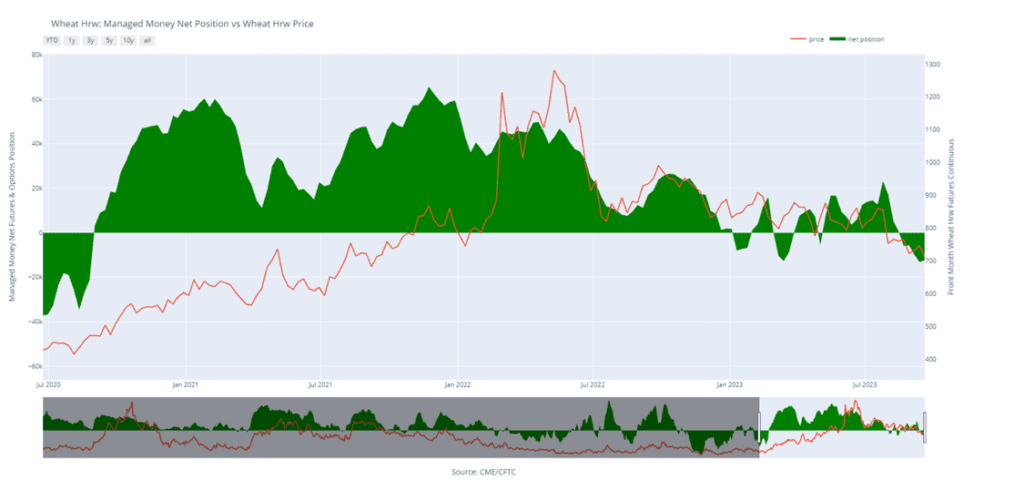

K.C. Wheat Managed Money Funds net position as of Tuesday, Sept. 19. Net position in Green versus price in Red. Money Managers net bought 818 contracts between Sept. 13 – 19, bringing their total position to a net short 12,330 contracts.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature this season with production concerns not only in the U.S., but also Canada and Australia. While prices have been weak due to low export demand, weather and geopolitical events can change suddenly to move prices higher. If prices begin to improve, Insider will consider making sales suggestions, while also continuing to watch the downside for any further violations of support.

- No action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices. Insider recently recommended buying July ’24 K.C. wheat puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: On September 5, the December contract posted a bullish reversal from oversold conditions, and while the market initially retreated, the reversal was not negated. Currently, nearby resistance remains near 785 – 795 and again around 810 – 820. The next support level below the market remains near the September 5 low of 756-3/4, and then near the June ’21 low of 730.

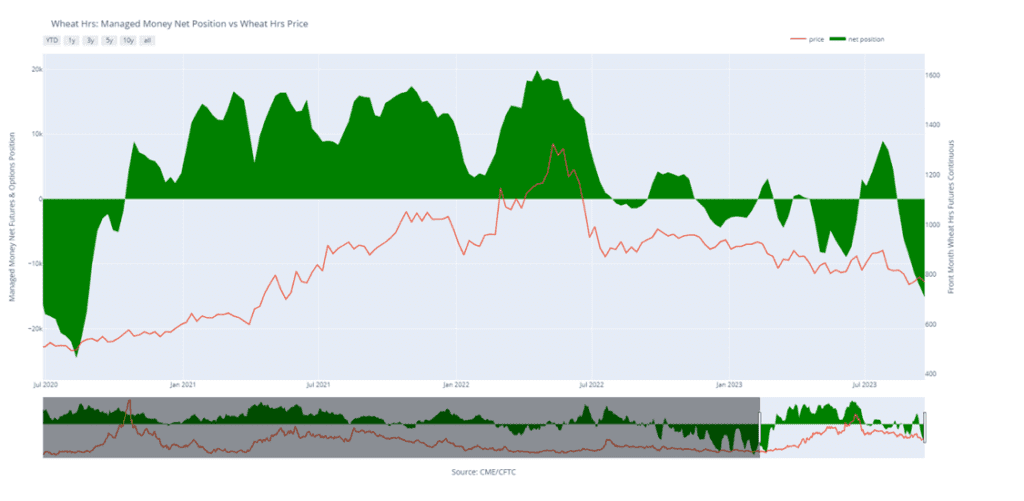

Minneapolis Wheat Managed Money Funds net position as of Tuesday, Sept. 19. Net position in Green versus price in Red. Money Managers net sold 1,816 contracts between Sept. 13 – 19, bringing their total position to a net short 15,177 contracts.

Other Charts / Weather