Grain Market Insider: September 18, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| DEC ’23 | 471.5 | -4.75 |

| MAR ’24 | 485.75 | -4.75 |

| DEC ’24 | 504.25 | -4.25 |

| Soybeans | ||

| NOV ’23 | 1316.75 | -23.5 |

| JAN ’24 | 1332.75 | -23 |

| NOV ’24 | 1264.25 | -18.25 |

| Chicago Wheat | ||

| DEC ’23 | 591.25 | -13 |

| MAR ’24 | 616.75 | -12.75 |

| JUL ’24 | 640.5 | -11.5 |

| K.C. Wheat | ||

| DEC ’23 | 735 | -11.5 |

| MAR ’24 | 739.75 | -11.75 |

| JUL ’24 | 723.75 | -12.5 |

| Mpls Wheat | ||

| DEC ’23 | 774 | -15 |

| MAR ’24 | 790 | -14 |

| SEP ’24 | 797.5 | -10.75 |

| S&P 500 | ||

| DEC ’23 | 4507.25 | 9.25 |

| Crude Oil | ||

| NOV ’23 | 90.53 | 0.51 |

| Gold | ||

| DEC ’23 | 1952.8 | 6.6 |

Grain Market Highlights

- Despite strong ethanol margins that support domestic demand, harvest pressure and weekly exports that remain behind the pace needed to reach the USDA’s goal weighed on corn prices.

- Although the USDA announced a 123k mt flash sale of soybeans to China this morning, export inspections that were 16% behind year ago levels added pressure to the soybean market, which saw follow through selling following Friday’s bearish reversal.

- Soybean oil followed a weaker palm oil, which was sharply lower on demand concerns and possibly too much nearby supply, while technical selling in the meal weighed on prices following Friday’s weakness.

- Export inspections for wheat were within expectations, though cumulatively they remain 29% behind last year’s numbers, versus the USDA’s forecast of an 8% decline, and weighed heavily on all three classes of wheat.

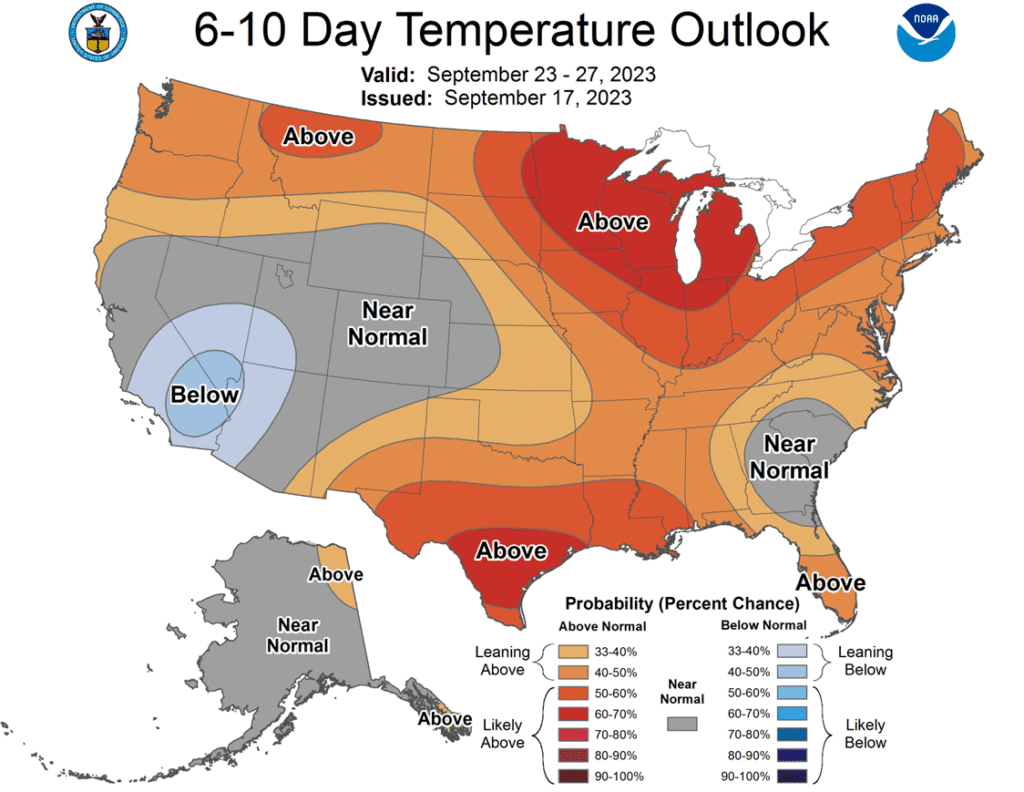

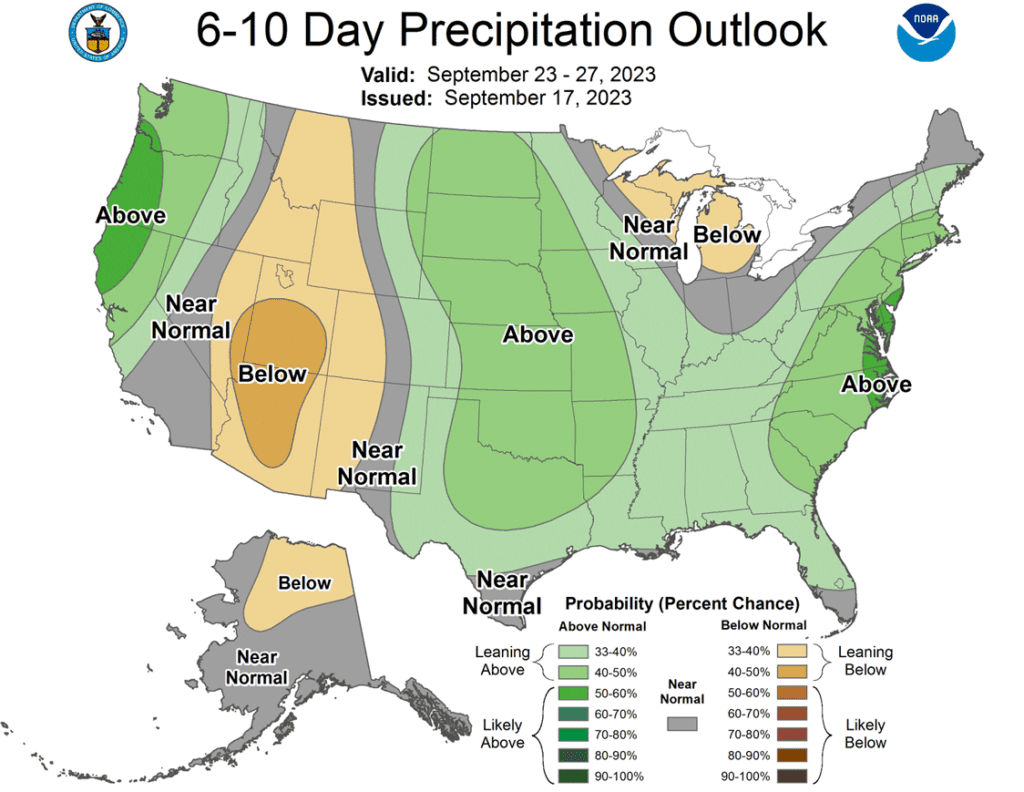

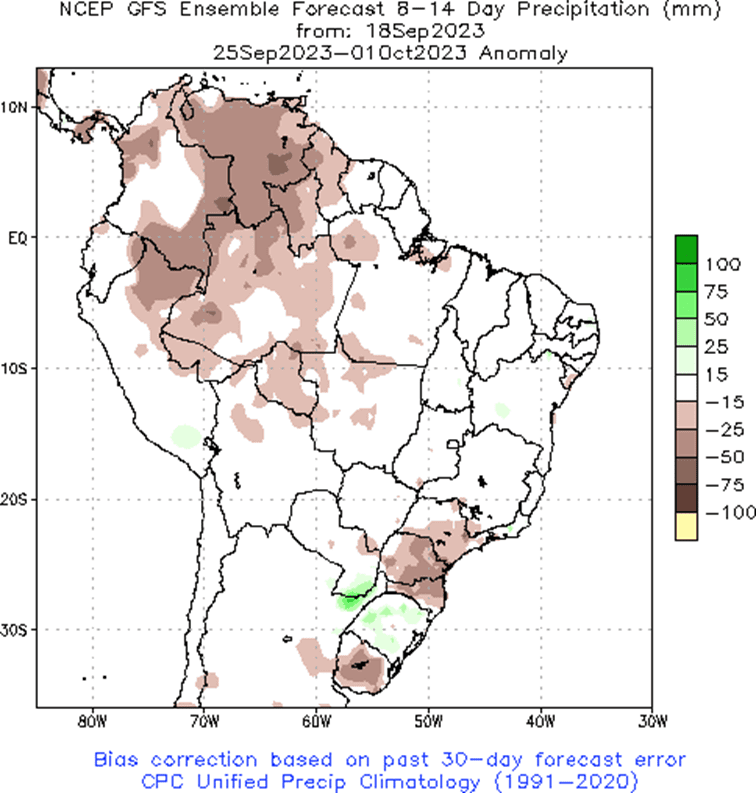

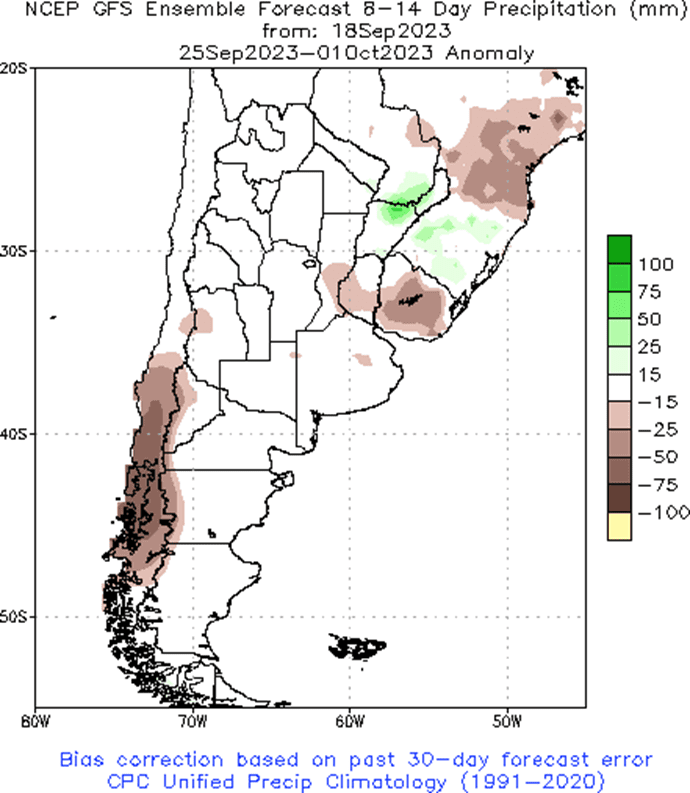

- To see the current U.S. 6 – 10 day Temperature and Precipitation Outlooks, and the Two week South American Precipitation Forecasts, courtesy of the NWS and NOAA, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No action is recommended for 2023 corn. Volatility has been a dominant feature this growing season with slow demand and increased planted acres, followed by hot and dry growing conditions that rallied prices nearly 140 cents and back down again. With the growing season mostly behind us, we are at the time of year when market lows are often made, and while the market may continue to recede into harvest, it is still subject to unforeseen influences that could move prices higher. For now, after locking in gains from the previously recommended purchased 580 puts, Insider is content to wait until after harvest when markets tend to strengthen before considering suggesting any additional sales.

- No action is recommended for 2024 corn. Like the 2023 corn market, prices for the 2024 crop have been dominated by volatility from slow exports and adverse growing conditions which led to a near 80 cent trading range during the summer months. Plenty of time remains to market the crop, and while demand continues to be slow, many uncertainties remain that can move prices higher. After recommending an additional sale for the 2024 crop, Insider may not consider suggesting any further sales until later this winter or possibly even spring. We will continue to monitor the market for any upside opportunities in the coming weeks.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- Weak price action and harvest pressure keep the sellers in control in the corn market to start the week. Dec corn established a new contract low, losing 4 ¾ cents on the session. The overall trend continues to be sideways to lower in the corn market.

- Harvest pressure will likely push on cash basis. Corn harvest was 5% complete last week and is expected to push to 10% complete on this week’s Crop Progress report. Weather forecasts overall are likely to support any ongoing harvest.

- Ethanol margins have remained strong, with softening corn prices. A strong crude oil market, challenging $92 a barrel on the session, will help support those margins. Ethanol production will likely stay supportive in the market.

- Weekly corn export inspections were at 642,000 mt (25.3 mb), which was within analyst expectations. Year-to-date export inspections have totaled 1.267 mmt (50 mb), up 10% from last year, but still behind the required pace to reach USDA targets. The USDA is targeting total exports to 2.050 billion bushels, up 23% from last year.

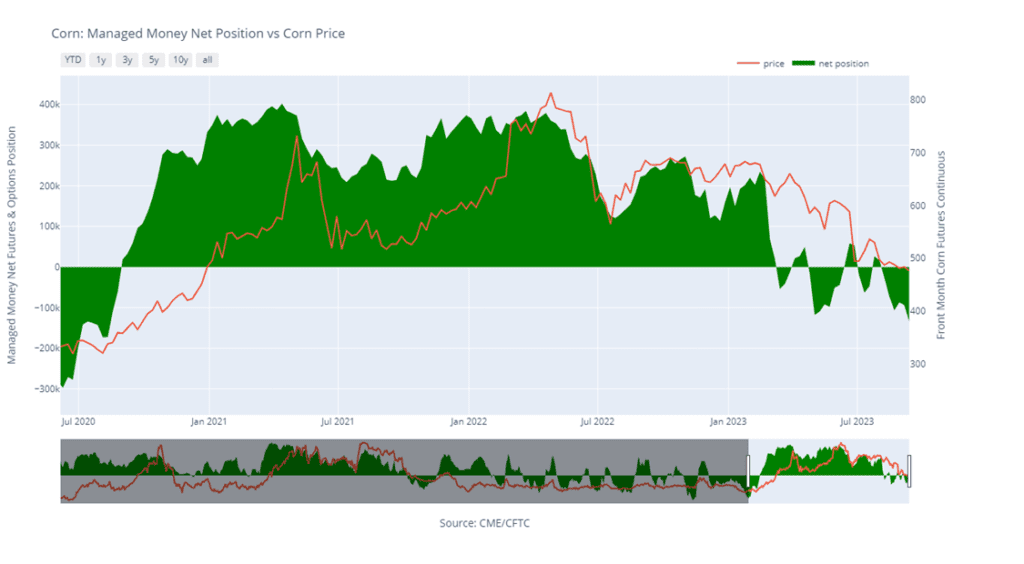

- Manage Money funds have grown their net short position in the corn market to 134,909 contracts as of 9/12. Funds added nearly 41,000 combined short contracts last week, growing the position to one of the largest for this time of year in the last 5 years.

Above: The corn market has largely been rangebound since the beginning of August. Two bearish reversals have been posted, one on 8/21 and another on 8/29, and the market continues to be under their influence, though trade has primarily been sideways. Above the market, resistance remains between 495 – 516, and below the market, support may be found near 460 and again near 415.

Corn Managed Money Funds net position as of Tuesday, Sept. 12. Net position in Green versus price in Red. Managers net sold 41,996 contracts between Sept. 6 – 12, bringing their total position to a net short 134,909 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from changing weather patterns, crop conditions and export sales. While export sales have improved, growing conditions have continued to be variable and questions remain regarding what final yields will be, keeping prices supported. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Despite a tight carryout and a flash sale today, harvest pressure, along with lower soybean oil and meal, pressed the soybean market, which ended significantly lower.

- Private exporters reported to the U.S. Department of Agriculture export sales totaling 123,000 metric tons of soybeans for delivery to China during the 2023/2024 marketing year, which began September 1.

- Crop progress will be released later this evening, and trade is expecting good to excellent ratings to fall 1 – 2 percentage points from last week on hot and dry weather. Some analysts are expecting ending soybean yields to come out below 49 bpa, which is below the USDA’s estimate of 50.1 bpa and could offer support to the market.

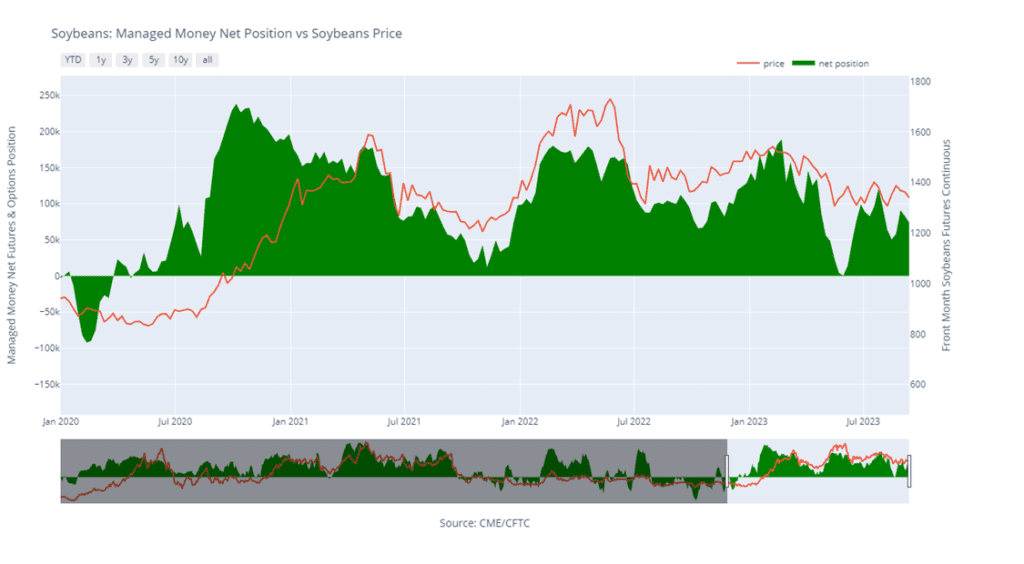

- Last week, November soybeans lost 22-3/4 cents and today, the contract fell below the 200-day moving average. Between September 5 – 12, non-commercials were sellers of 8,995 contracts, which reduced their net short position to 73,815 contracts.

Above: After posting a bullish reversal on September 13, the market has since retreated and traded through the low of that day, negating the bullish signal. Below the market, support may be found near 1330 and again around 1300. If prices turn higher, initial resistance now sits between 1368 and the 50-day moving average, about 1387.

Soybean Managed Money Funds net position as of Tuesday, Sept. 12. Net position in Green versus price in Red. Money Managers net sold 8,995 contracts between Sept. 6 – 12, bringing their total position to a net long 73,815 contracts.

Wheat

Market Notes: Wheat

- Weekly inspections of 13.5 mb brought 23/24 total wheat inspections for export to 188 mb, down 29% from last year and below the pace needed to meet the USDA’s 700 mb export projection.

- Also pressuring wheat is news that two cargo ships made their way to Ukraine this weekend. Apparently, they will transport wheat out of Ukraine along the western coast of the Black Sea. News outlets are reporting that these are the first civilian vessels to make their way to a Ukrainian port since the end of the Black Sea export corridor.

- As El Nino strengthens, drought is expected to expand in Australia. According to the Australian Bureau of Meteorology, they are anticipating record breaking temperatures. Additionally, some private estimates of the Australian wheat crop are below 24 mmt versus the USDA’s 26 mmt figure.

- The roughly 1.6% drop in Matif wheat futures today did not lend any support to the U.S. markets. From a technical standpoint, the 20-day moving average, currently around 608, is acting as resistance, and the market has not traded above that average since the beginning of August.

- While it is highly anticipated that the Federal Reserve will issue a pause on Wednesday, there is a small chance that they could also raise interest rates another 25 basis points due to inflation still being above their target level.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

Active

Sell DEC ’23 Cash

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- Grain Market Insider sees an active opportunity to sell a portion of your 2023 Soft Red Winter wheat crop. The wheat market has been very volatile in recent weeks following corn on weather and headlines regarding Russia and Ukraine. Harvest is now behind us, and while war continues in the Black Sea, and weather continues to be variable, demand remains weak with cheap Black Sea supplies continuing to undercut U.S. offers. Of course, changing headlines can still jolt the market higher, prices have retraced into nearby resistance, and Insider recommends taking advantage of this rally to make an additional sale on your 2023 crop.

- No action is recommended for 2024 Chicago wheat. Considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. Plenty of time remains to market the 2024 crop with many uncertainties that could shock prices higher, like the world stocks to use ratio at an 8-year low, war in the Black Sea and production concerns in the southern hemisphere. If prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800, if not, and prices make new lows, unsold bushels will be protected by the recommended July ’24 590 puts.

- No action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the USDA’s 9/12 update, the market posted a bullish reversal and traded into the 590 – 615 resistance area. If the market breaks through to the upside, further resistance could be found between 645 – 665. Otherwise, if the market turns lower, the next level of support lies between 570 and the December 2020 low of 565.

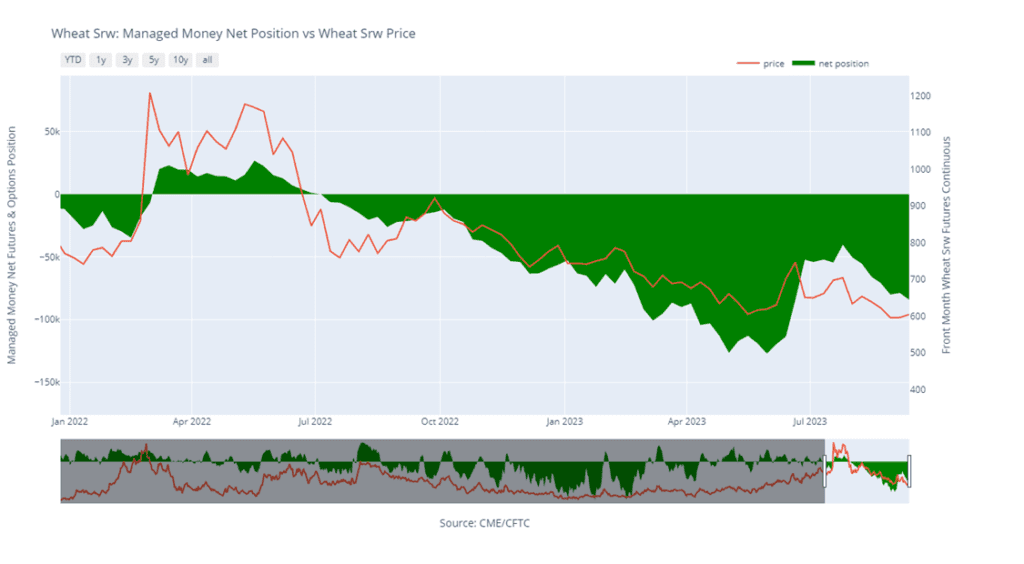

Chicago Wheat Managed Money Funds net position as of Tuesday, Sept. 12. Net position in Green versus price in Red. Money Managers net sold 5,458 contracts between Sept. 6 – 12, bringing their total position to a net short 84,139 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No action is recommended for 2023 K.C wheat crop. Since the end of May, the wheat market has been influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the bin, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region and the southern hemisphere, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward 750 – 800 before considering any additional sales.

- No action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the USDA update on September 12, the December contract posted a bullish key reversal, where the market made a new low for the move, yet closed higher. If prices continue higher, resistance above the market remains near 770 – 780. Otherwise, support below the market rests near the September 12 low of 709, and again near the September ’21 low of 670.

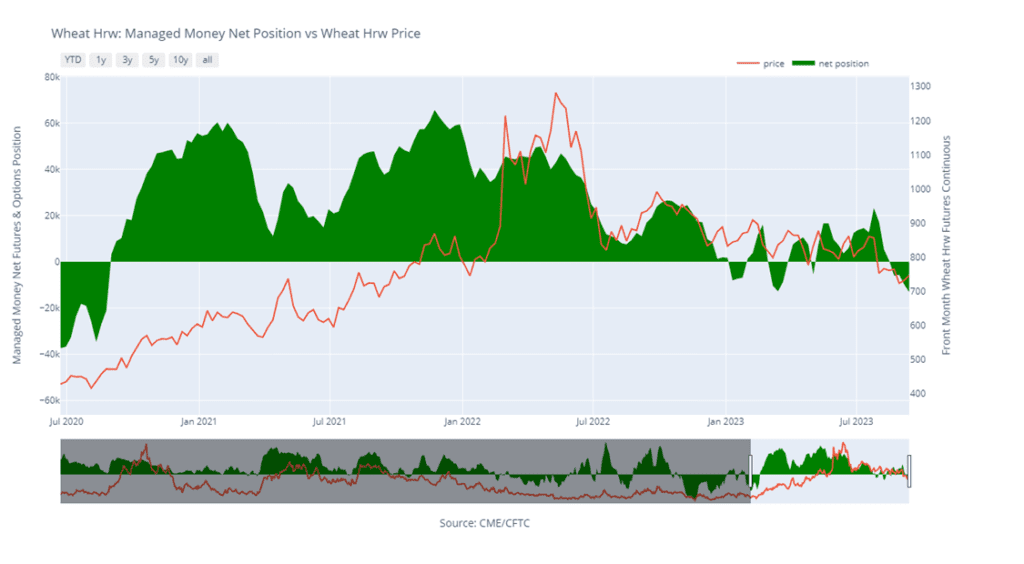

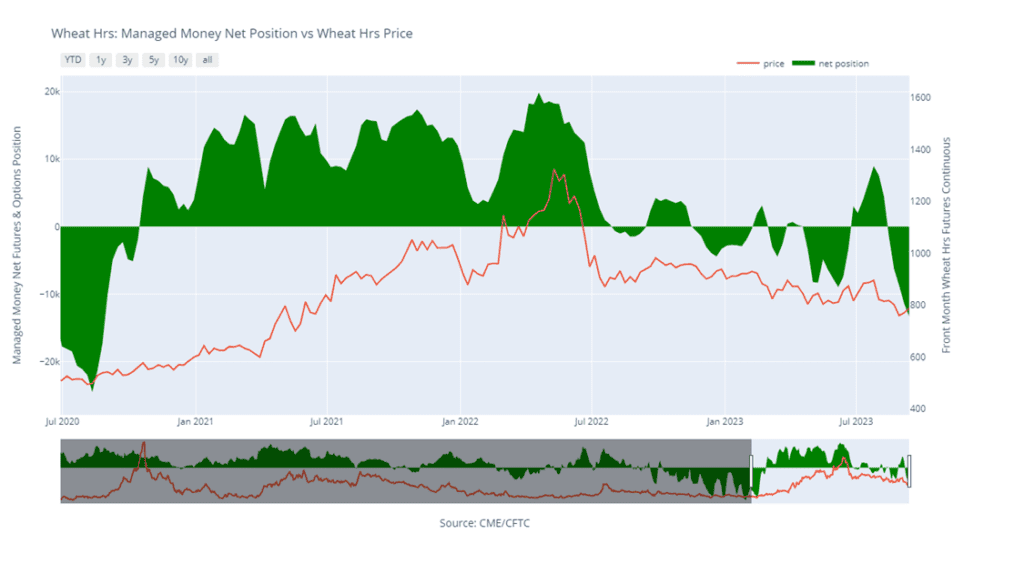

K.C. Wheat Managed Money Funds net position as of Tuesday, Sept. 12. Net position in Green versus price in Red. Money Managers net sold 3,310 contracts between Sept. 6 – 12, bringing their total position to a net short 13,148 contracts.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature this season with production concerns not only in the U.S., but also Canada and Australia. While prices have been weak due to low export demand, weather and geopolitical events can change suddenly to move prices higher. If prices begin to improve, Insider will consider making sales suggestions, while also continuing to watch the downside for any further violations of support.

- No action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices. Insider recently recommended buying July ’24 K.C. wheat puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: On September 5, the December contract posted a bullish reversal from oversold conditions, and while the market initially retreated, the reversal was not negated. Currently, nearby resistance remains near 785 – 795 and again around 810 – 820. Otherwise, the next support level below the market is near the Sept. 5 low of 756-3/4, and then near the June ’21 low of 730.

Minneapolis Wheat Managed Money Funds net position as of Tuesday, Sept. 12. Net position in Green versus price in Red. Money Managers net sold 1,948 contracts between Sept. 6 – 12, bringing their total position to a net short 13,361 contracts.

Other Charts / Weather