Grain Market Insider: October 27, 2023

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 480.75 | 1.5 |

| MAR ’24 | 495.25 | 2 |

| DEC ’24 | 511.75 | 2.25 |

| Soybeans | ||

| NOV ’23 | 1297.25 | 17.75 |

| JAN ’24 | 1319.5 | 19.25 |

| NOV ’24 | 1274.25 | 16.75 |

| Chicago Wheat | ||

| DEC ’23 | 575.5 | -4 |

| MAR ’24 | 602.5 | -3.5 |

| JUL ’24 | 633.75 | -2.75 |

| K.C. Wheat | ||

| DEC ’23 | 643 | -11.75 |

| MAR ’24 | 655.75 | -9.5 |

| JUL ’24 | 670.25 | -6 |

| Mpls Wheat | ||

| DEC ’23 | 719.75 | -4.5 |

| MAR ’24 | 738 | -4.75 |

| SEP ’24 | 769.25 | -3.5 |

| S&P 500 | ||

| DEC ’23 | 4130.75 | -25.75 |

| Crude Oil | ||

| DEC ’23 | 84.92 | 1.71 |

| Gold | ||

| DEC ’23 | 2016.7 | 19.3 |

Grain Market Highlights

- As weather concerns in South America may be getting priced into the market, corn could only muster mediocre gains as it appeared caught between a weaker wheat complex and a strong bean complex.

- Led by sharply higher soybean meal and Brazilian weather concerns, January soybeans traded to their highest level in over a month and pierced the 50-day moving average before closing 5 ¾ cents of the day’s high.

- The prospect of increased US exports due to extremely low Argentine supplies continues to support the meal market, which closed 12.90 higher. While soybean oil didn’t rally sharply, it also posted respectable gains, and added 16 ½ cents to December Board crush margins, which also lent further support to the soybean market.

- Reports out of Ukraine that their “Humanitarian Corridor” isn’t closed weighed on the wheat complex, and while the recent rainfall in the southern Plains hasn’t eliminated the drought conditions, they may have added pressure to the KC contracts, which led the complex lower on the day.

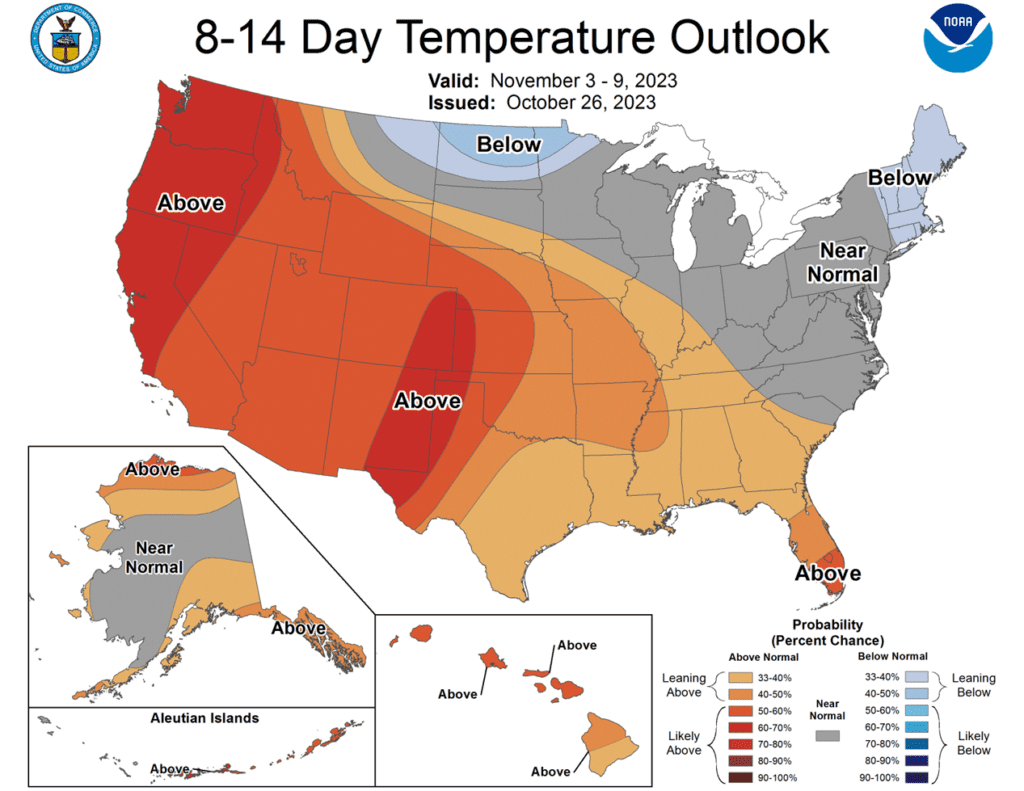

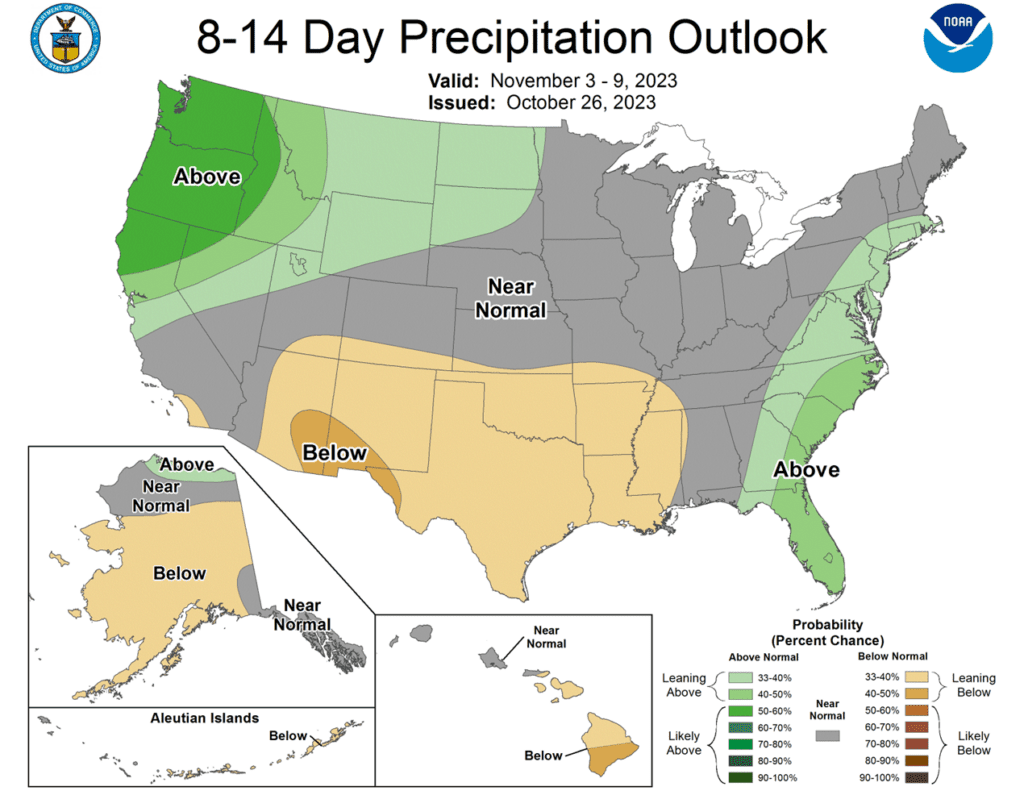

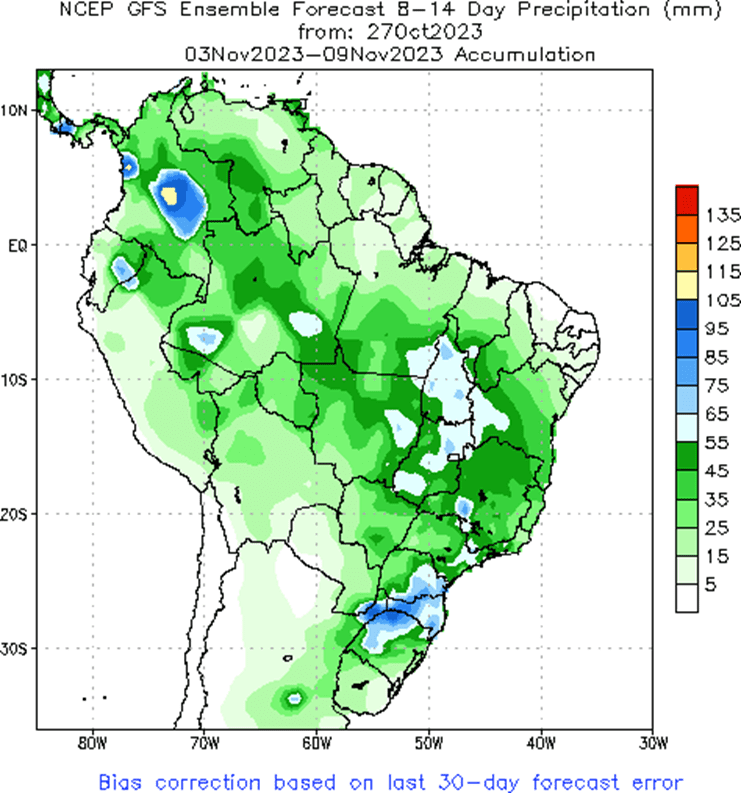

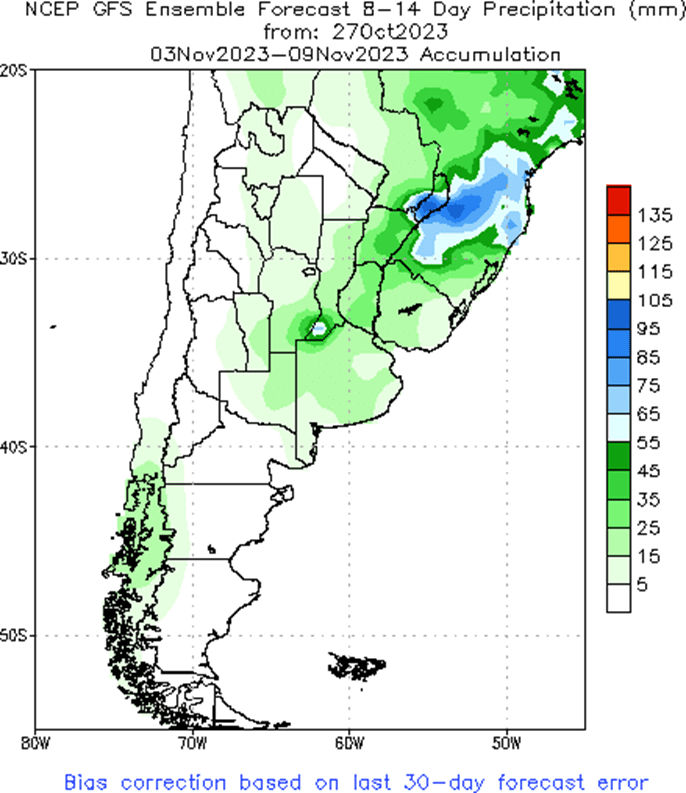

- To see the updated US 8-14 day Temperature and Precipitation Outlooks, and the South American 2 week precipitation forecast courtesy of the National Weather Service, Climate Prediction Center, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. On October 19, December corn closed above 500 for the first time since the end of July. While the market was unable to follow through to the upside, the overall trend remains positive with successively higher lows, from mid-August. If the market can maintain a close above 500 and the 100-day moving average, it may aim to test resistance near 547. Otherwise, if the market closes below the 50-day moving average near 485, it may run the risk of continuing to trend sideways to lower, with a worst-case scenario being a sideways to lower trend into late November, or even early January. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until spring. If you end up harvesting more bushels than you can store this fall and must move them, consider protecting those sold bushels with either July or September ’24 call options.

- No new action is recommended for 2024 corn. The Dec ’24 contract has held up better than Dec ’23 as bear spreading over the last several months has brought increased buying interest into Dec ’24 and other further out contract months. Back in late July, the Dec ’23 contract traded up to a 25-cent premium over Dec ’24. Now, Dec ’24 holds about a 30 cent premium over Dec ’23. This bear spreading has held the Dec ’24 price up about 28 cents from its year-to-date low. The risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market traded higher to end the week, supported by strength in the soybean market. Friday’s higher trade ended a 5-session selling streak in the corn market as December corn closed 1 ½ cents higher. Despite being higher on Friday, Dec corn lost 14 ¾ cents for the week and posted its lowest weekly close in a month.

- Overall, a quiet news day for the corn market. Prices were supported by strong soybean and soybean meal prices, a higher crude oil market, which helped trigger some end of week profit taking of short positions. Nearby resistance over the December contract is at $4.85, and trading below leaves open the greater possibility of lower trade.

- Corn has seen an uptick in demand, which can support the market. Cash basis has firmed as the US moves into the second half of harvest, ethanol margins remain supportive, and export sales this week were above expectations at 53.2 mb. The market will be watching to see if an improving demand will be a trend.

- South American weather is forecasted to stay dry and hot for areas of Brazil, and areas of Argentina are seeing signs of last year’s drought persist. While South American weather is still in its early stages, weather will grow more in importance in the weeks ahead.

- Last week, anaged money funds were reported as net short 108,000 corn contracts, and that position likely grew this week. Global and US corn supplies are still heavy, and funds will still need a reason to want to exit those short positions.

Above: The corn market has largely been rangebound since the beginning of August, with only minor short covering moving the market higher until recently. With the market trading up to 509 ½ and failing, the next major resistance level now sits at that recent high, with further resistance near the July 31 high of 516 ¼. If the market retreats, the next major support level remains near 460.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

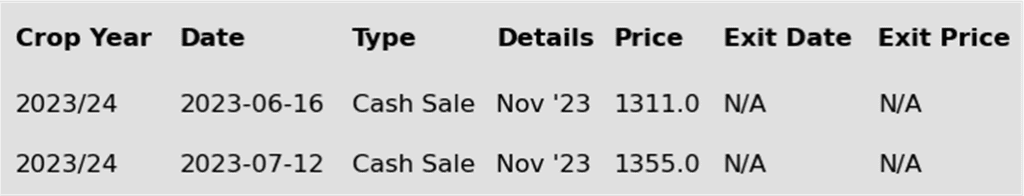

- No new action is recommended for 2023 soybeans. Front month soybeans have been finding buying interest around the June 2023 low of 1256 ¾ in the Nov ’23 contract, and since the beginning of October, they have also traded largely between 1260 and 1280. The close over 1287 ¼ on October 12 could be a signal that a harvest/fall low is in. In the big picture, since May 2023, Nov ’23 has traded in a range from 1251 on the downside to 1435 on the topside. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Given that those sales recommendations were made and given that now is not the time of year to be making many sales, if any, Grain Market Insider is content to hold tight on any further sales recommendations until later this fall or early winter. The focus for strategy right now is to be on the lookout for any call option buying opportunities. If you end up harvesting more bushels than you can store this fall, consider protecting any sold bushels with July or Aug ’24 call options.

- No action is recommended for the 2024 crop. Nov ’24 has traded at a discount to the 2023 crop for nearly its entire contract life and that discount extended out to 142 versus the Jan ’24 contract in late July, with it recently trading between 17 ¾ and 66 cents. Since July, the Nov ’24 contract has mostly traded between 1250 and 1320 and is currently testing the bottom end of that range. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher following significant gains from soybean meal and oil. The bulk of the bullish news came earlier in the week, but soybeans had not been able to break out of this week’s tight range. For the week, November soybeans lost 5 cents, December meal gained $18.50, making new contract highs, and December soybean oil lost 1.12 cents.

- Soy products were behind today’s rally in soybeans, with soybean meal posting contract highs. Soybean meal exports have climbed as the US has been able to pick up Argentinian business. Soybean oil moved higher along with crude oil, and the gains in both products have greatly improved crush margins, helping demand.

- Yesterday, export sales were announced with increases of 50.6 mb for 23/24, and export shipments far above expectations at 87.6 mb. Along with that positive news, two sales of soybeans were reported to China for a total of 232,000 for 23/24. The renewed interest from China in US soybean purchases has been encouraging, and the purchasing agreement signed earlier in the week instilled more confidence.

- Weather in South America has not improved much with only slight showers in Argentina that helped some key wheat areas. Northern Brazil is dry and is forecast to remain that way, while southern Brazil is too wet with parts of it flooding. Producers in both regions are beginning to replant soybeans as a result.

Above: In the middle of October, the market traded up to 1334 and pierced the upper end of resistance, and the 50-day moving average, before retreating lower. If the market can maintain a close above resistance at 1334, it would be poised to make a run to test 1370. Otherwise, initial support to the downside may be found near 1300 and again near 1273. Key support for the move remains down near 1250.

Wheat

Market Notes: Wheat

- Despite corn and soybeans finishing the session on a positive note, wheat could not do the same and posted losses in all three US futures classes. Yesterday’s reports that Ukraine temporarily suspended their humanitarian corridor later were denied, and the shipping lanes are still open. In fact, four vessels were reported to have left today with an additional 23 loading. This is likely the main culprit that pressured wheat today.

- In addition to the above point, recent rains in the US southern Plains may have also burdened wheat futures. With the first winter wheat crop ratings due for release on Monday, the trade is looking for conditions to come in around 50% good to excellent. If that is accurate, it would be the highest rating for this time of year since 2019.

- On a bullish note, there is still talk that India may eventually need to import wheat due to rising prices and inflation. Reportedly, their government has plans to sell more wheat from their reserves to help alleviate rising costs. They are said to be ready to sell 300,000 mt, which is up from 200,000 mt previously.

- Argentina’s wheat crop is reported to be 6.8% harvested, according to the Buenos Aires Grain Exchange. Recent rains there were significant and have helped to stabilize the crop. The BAGE also said that 54% of the planted area now has sufficient, or even optimal moisture, versus only 8% the previous week.

- The EU slightly increased their estimate of the soft wheat harvest to 125.5 mmt, up from the 125.3 mmt estimate in September. However, exports were reduced by 1 mmt to 31 mmt. The European Commission also increased their carryout estimate to 19.1 mmt vs 17.8 mmt last month.

- The EU slightly increased their estimate of the soft wheat harvest to 125.5 mmt, up from the 125.3 mmt estimate in September. However, exports were reduced by 1 mmt to 31 mmt. The European Commission also increased their carryout estimate to 19.1 mmt vs 17.8 mmt last month.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

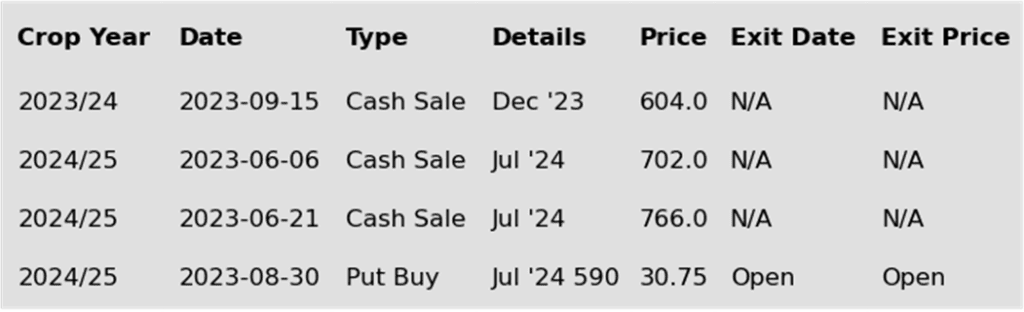

- No new action is currently recommended for 2023 Chicago wheat. Since making a mid-summer high in late July, the Dec ’23 contract has been in a downtrend, but after finding support at 540 on September 29, the market has steadily rallied, briefly piercing 600 and the 50-day moving average. With weak US export demand driven by cheap Russian exports being the dominant headwind, it appears that prices may be finding value in the 540 – 616 range established since early September. Grain Market Insider made sales recommendations in the late June rally around 720, and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. The July ’24 contract has been trading at a premium to the Dec ’23 contract since late April, which has steadily increased to about 55 cents, September 29, it traded as far out as 71 ¾ cents. Fund positioning and weak fundamentals have driven Dec ’23 closer to the mid to upper 500 range, and July ’24 to the low to mid 600’s. The market risk for July ’24 remains the same as for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward June’s highs, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: On October 20, the December contract posted a bearish reversal after making a new recent high of 604 ½. The market has retreated and solidified resistance above the market that now stands between 604 ½ and 618. Without bullish input, the market is likely to trend sideways to lower with the next major support level between 547 and 540.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

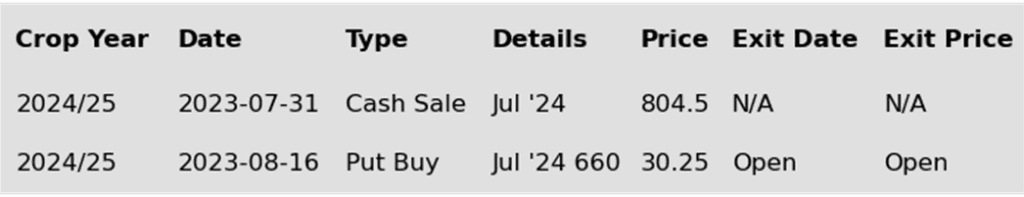

- No new action is recommended for 2023 KC wheat crop. With prices falling below the Oct. 12 low of 655 ¼, the Dec ’23 contract continues to search for support as it resumes the downtrend that has been in place since late July. Currently, weak US export demand, driven by cheap Russian exports, remains the dominant headwind, and the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst enters the market to push prices towards 750, it may signal that a fall low is in place and would line up with the historical tendency for prices to appreciate into winter and early spring. Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales north of 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 KC wheat. Currently, July ’24 is trading near a 25-cent premium to the Dec ’23 contract, up from a 60-cent discount last July, as bear spreading due to weak fundamentals has driven the Dec ’23 contract closer to its contract lows, while the July ’24 contract remains more elevated as it tests Feb ’22 lows. The risk for the July ’24 contract is much like that for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. In mid-August, Grain Market Insider recommended purchasing July 660 puts to prepare for this possibility, and back in July, Grain Market Insider recommended a sale near 800 to take advantage of elevated prices before they eroded further. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following K.C. recommendations:

Above: Since the end of September, KC wheat has been consolidating and recently broke through the bottom of the range at 655. The market is now poised to test minor support near 630, with the next level of major support remaining near 575. Resistance above the market remains around 690 – 700.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. The Dec ’23 contract has been in a downtrend since making highs in late July and continues to search for support while showing signs of being oversold. With weak U.S. export demand driven by cheap Russian exports being the dominant headwind, the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst were to enter the market and push prices towards 800, it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into winter. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820. With that sale, Grain Market Insider’s strategy is to look for price appreciation going into this winter with an eye on considering additional sales around 750 – 800, and again north of 825. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is currently recommended for 2024 Minneapolis wheat. In the last three months, the Sep ’24 contract has gone from a 60 – 80 discount to Dec ’23, to a nearly 50-cent premium. Weak fundamentals led bear spreading to drive Dec ’23 in search of new contract lows, while Sep ’24 remains off its low from last June. The risk for the Sep ’24 contract is much like that of Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. In mid-August, Grain Market Insider recommended purchasing July KC 660 puts (for their greater liquidity, and correlation to Minneapolis pricing) to prepare for this possibility, and back in July, Grain Market Insider recommended a sale near 815 to take advantage of elevated prices. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further. Grain Market Insider will then be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Since the beginning of October, the market has been consolidating, with the upper end of the range acting as resistance. Initial support below the market lies near the October 2 low, between 711 and 707, with major support remaining near 665. If prices turn higher, initial resistance remains between 745 – 760.

Other Charts / Weather

Brazil 2 week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Argentina 2 week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.