Grain Market Insider: October 19, 2023

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 505 | 13 |

| MAR ’24 | 517 | 10.5 |

| DEC ’24 | 525 | 6.75 |

| Soybeans | ||

| NOV ’23 | 1315.5 | 4.5 |

| JAN ’24 | 1331.75 | 2.5 |

| NOV ’24 | 1269 | 2.5 |

| Chicago Wheat | ||

| DEC ’23 | 594 | 13.75 |

| MAR ’24 | 619.75 | 11.75 |

| JUL ’24 | 647.75 | 9.25 |

| K.C. Wheat | ||

| DEC ’23 | 676.25 | 5.75 |

| MAR ’24 | 684.5 | 5.5 |

| JUL ’24 | 692.5 | 5.25 |

| Mpls Wheat | ||

| DEC ’23 | 739 | 5.5 |

| MAR ’24 | 761.5 | 6.75 |

| SEP ’24 | 788.25 | 5.25 |

| S&P 500 | ||

| DEC ’23 | 4306.25 | -36 |

| Crude Oil | ||

| DEC ’23 | 89.06 | 1.79 |

| Gold | ||

| DEC ’23 | 1986.3 | 18 |

Grain Market Highlights

- Decent export sales, strong domestic demand, and light farmer selling lent support to December corn as it pushed above the 500 mark for the first time in nearly 3 months, which likely spurred short covering into the close.

- Like corn, good export sales, solid domestic demand and light farmer selling pushed November beans to gain on the deferred months, and close higher on the day for the fourth day in a row.

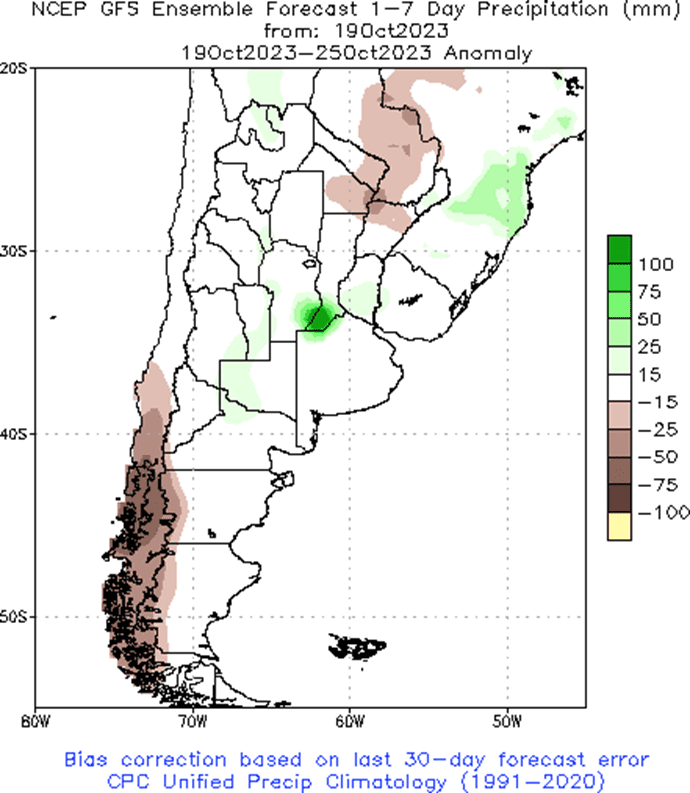

- Soybean meal continued its rally to levels not seen since last July. Technical buying, strong export sales, and dryness in Argentina, the world’s largest soy product exporter, all lent support to the market. Bean oil, on the other hand, saw sharply lower price action on more long liquidation, with lower palm oil adding to the weakness.

- Carryover strength from the corn market and higher than expected export sales lent support to all three wheat classes, and likely triggered short covering in the Chicago contracts, which had an estimated fund short position just over 100k contracts going into today.

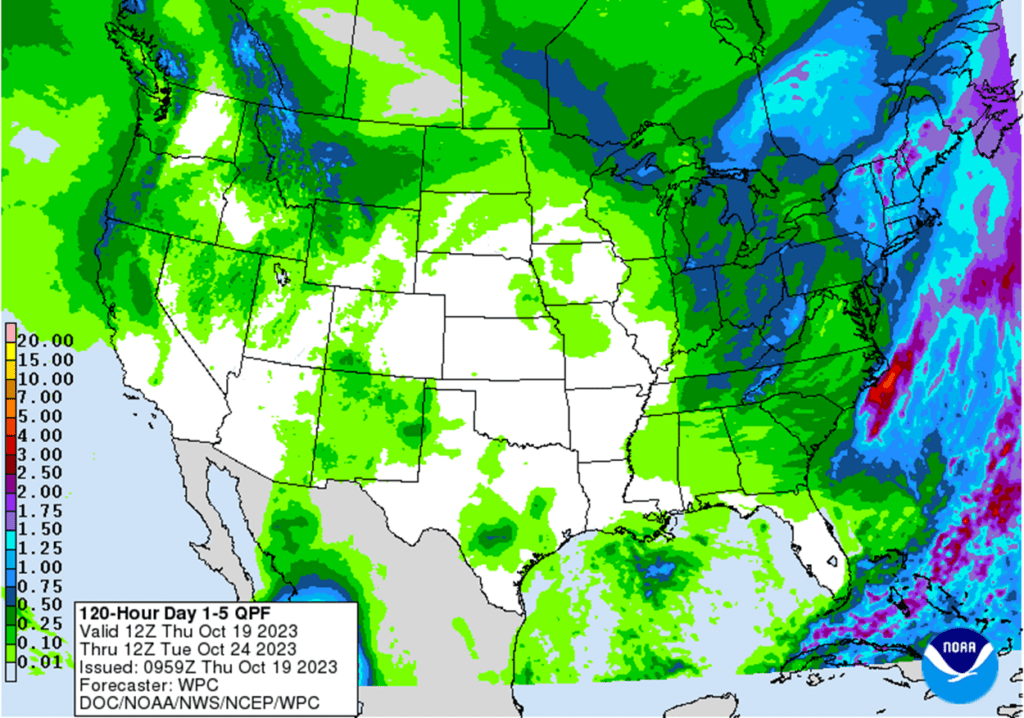

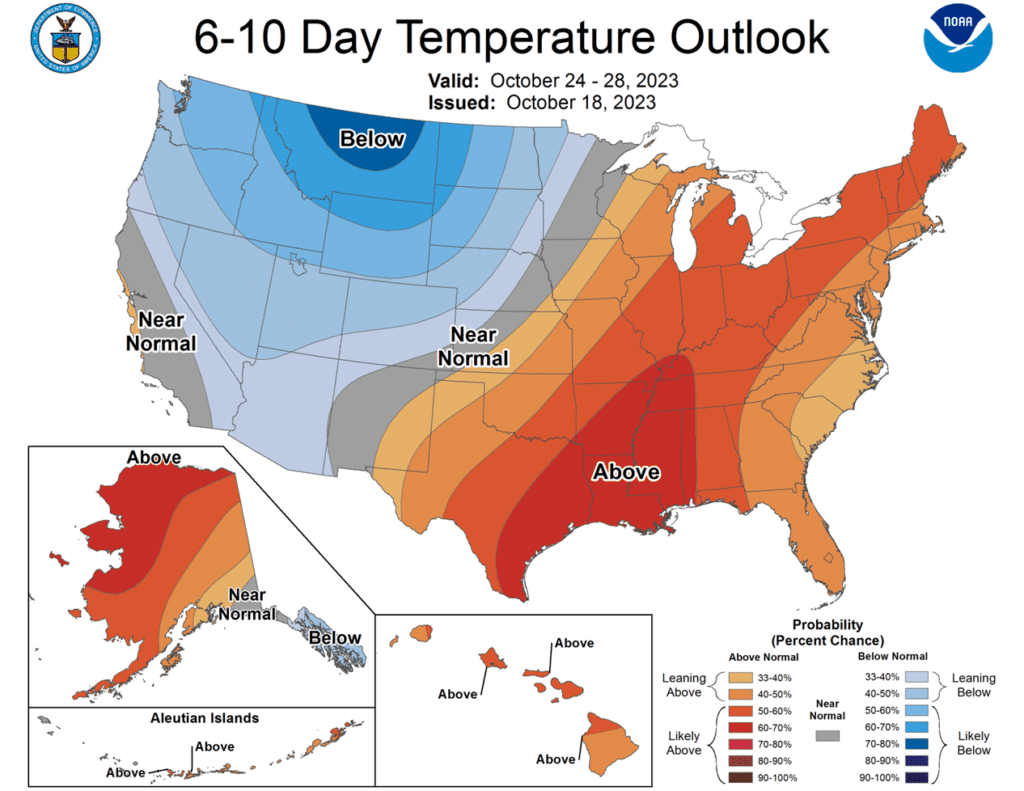

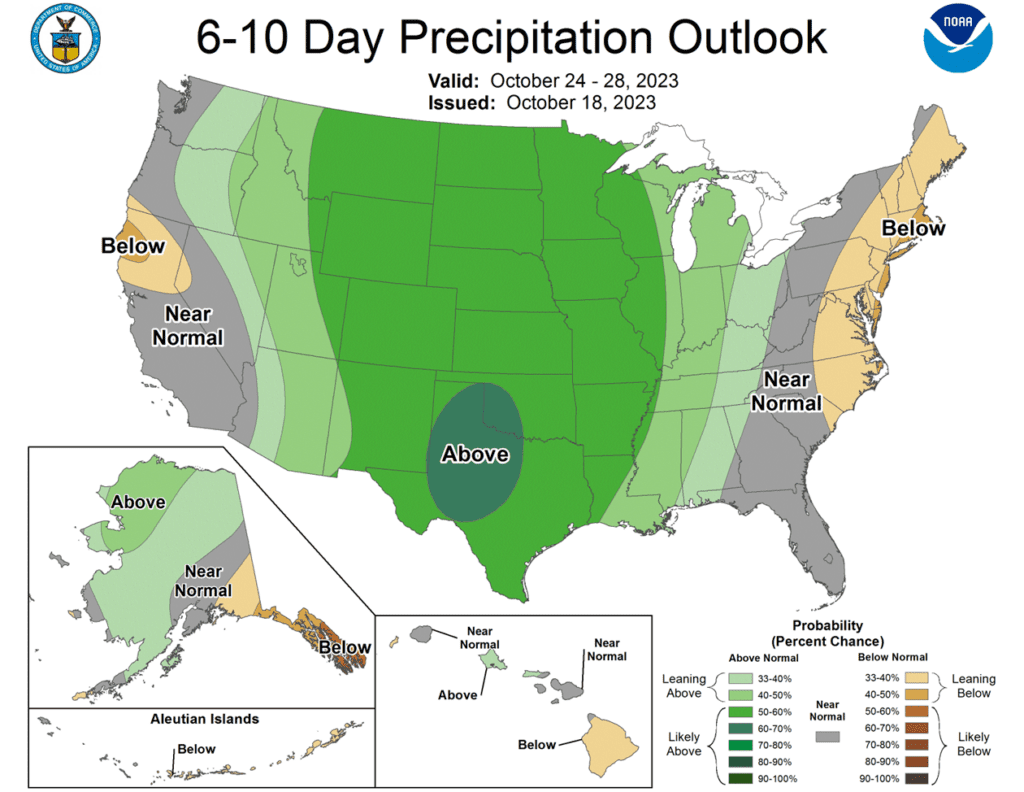

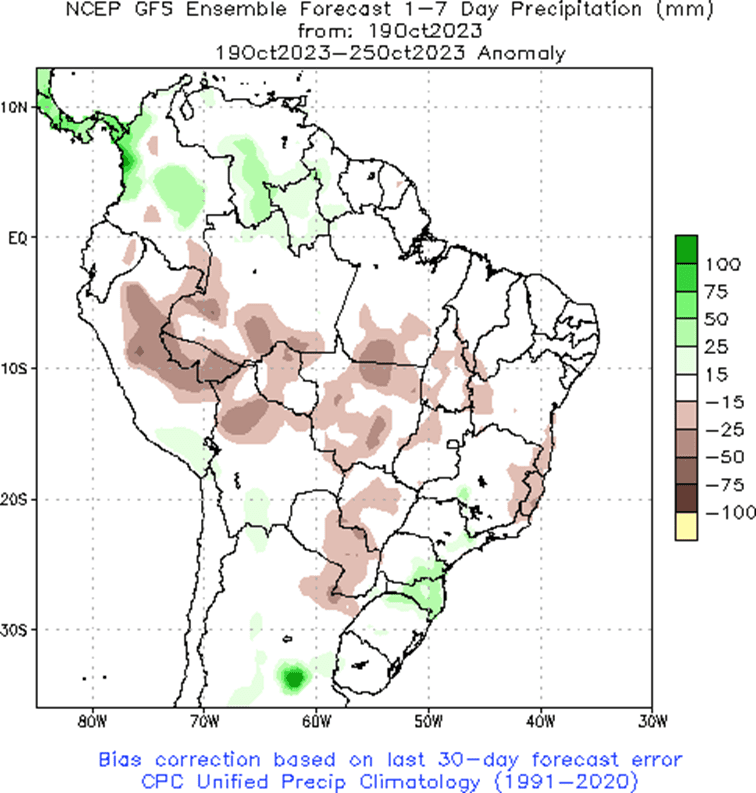

- To see the current U.S. 5-day precipitation forecast, the 6 – 10 day Temperature and Precipitation Outlooks, and the 1 week percent of normal precipitation for South America from the NWS and NOAA, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

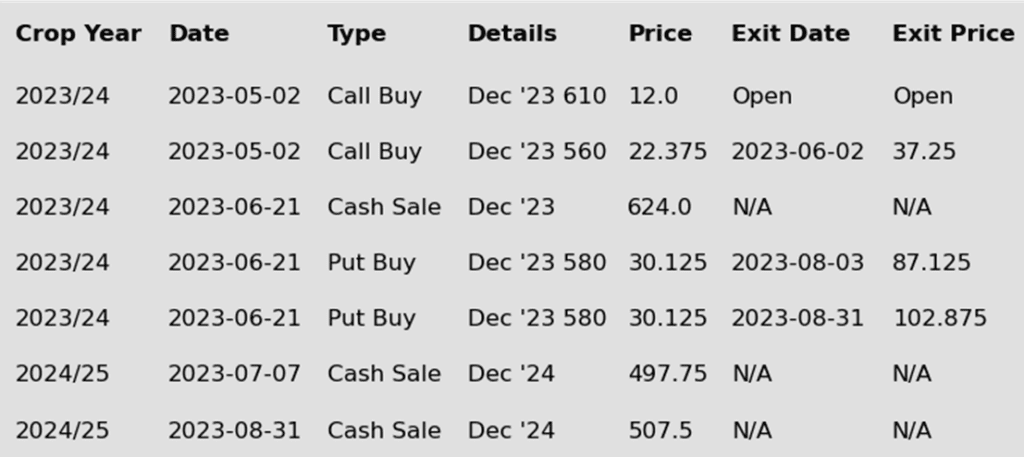

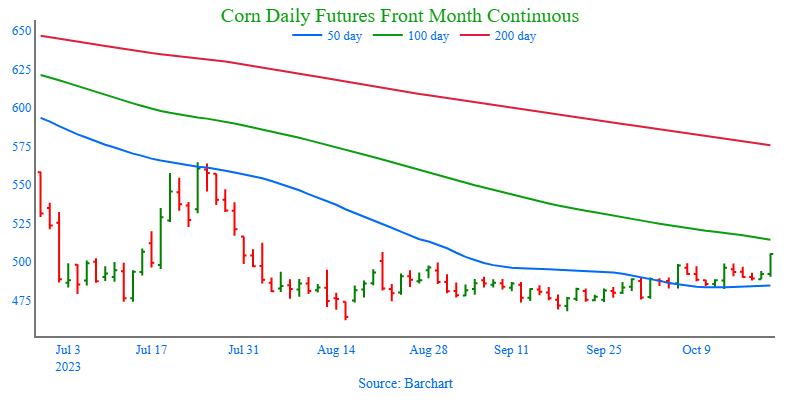

- No new action is recommended for 2023 corn. The supportive USDA Supply and Demand report from October 12 had Dec ’23 corn testing that 500 psychological price level, yet so far Dec ’23 has been unable to close above it. That 500 level remains an important resistance area for the trend, and without a close over it, the market remains at risk of continuing to trend sideways to lower, and worst-case scenarios could entail sideways-to-lower trends into the late November to early January window. If Dec ’23 can close above 500, it may aim to test the next resistance near 547. Otherwise, the first support on the downside is the August low of 461. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until spring. If you end up harvesting more bushels than you can store this fall and must move them, consider protecting those sold bushels with either July or September ’24 call options.

- No new action is recommended for 2024 corn. The Dec ’24 contract has held up better than Dec ’23 as bear spreading over the last several months has brought increased buying interest into Dec ’24 and other further out contract months. Back in late July, the Dec ’23 contract traded up to a 25-cent premium over Dec ’24. Now, Dec ’24 holds a 28-cent premium over Dec ’23. This bear spreading has the Dec ’24 price up about 28 cents from its year-to-date low. The risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally, and having those in place, helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn prices pushed through technical resistance at the $5.00 level, which triggered additional short covering as the December futures gained 13 cents and closed at its highest price point since July 31.

- An improved demand tone and cash market basis helped support the front month contract as bull spreading pulled the entire market higher.

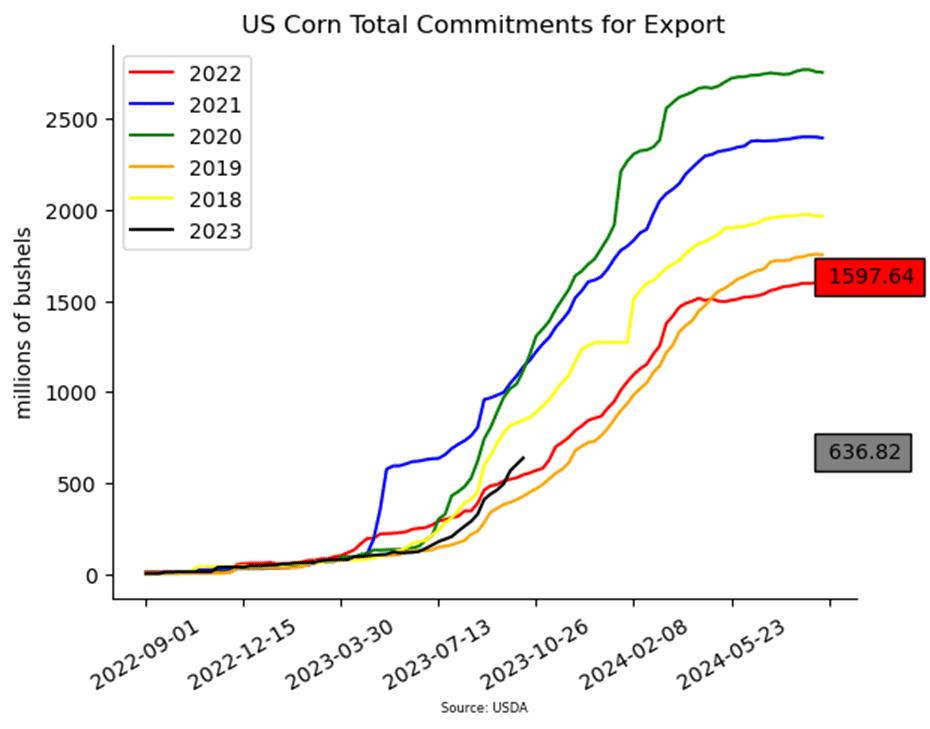

- The USDA released weekly export sales Thursday morning. Sales for the 2023-24 marketing year were 881,300 mt (34.7 mb). Corn sales commitments now total 637 mb for 23/24 and are up 17% from a year ago, but still lag the overall demand pace needed to reach USDA export targets.

- Ethanol margins remain strong, and processors are looking for corn, supporting the cash market. Strong gasoline demand and tight energy supplies have helped support the ethanol market.

- Some weather concerns in South America are adding weather premium into prices. Key northern and central areas of Brazil are experiencing hot and dry weather, which is slowing the soybean planting pace. A slow soybean planting pace narrows the window for the second crop of Brazil corn, which could tighten longer-term global supplies.

Above: The corn market has largely been rangebound since the beginning of August, with only minor short covering moving the market higher until recently. With the market moving above 490, and now 500, the next resistance level in the range is near the 20-day moving average and the July 31 high of 516 ¼. If the market retreats, initial support below the market remains between 475 – 480 and then near 460.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. Front month soybeans have been finding buying interest around the June 2023 low of 1256 ¾, and since the beginning of October, they have also traded largely between 1260 and 1280. The close over 1287 ¼ on October 12 could be a signal that a harvest/fall low is in. In the big picture since May 2023, Nov ’23 has traded in a range from 1256 ¾ on the downside to 1435 on the topside. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Given that those sales recommendations were made and given that now is not the time of year to be making many sales, if any, Grain Market Insider is content to hold tight on any further sales recommendations until later this fall or early winter. The focus for strategy right now is to be on the lookout for any call option buying opportunities. If you end up harvesting more bushels than you can store this fall, consider protecting any sold bushels with July or Aug ’24 call options.

- No action is recommended for the 2024 crop. Nov ’24 continues to trade at a discount to Nov ’23. That discount was over 90 cents in late summer yet has stabilized lately to around the 10-20 cent range. Since July, the Nov ’24 contract has largely traded between 1250 and 1320, so this contract is currently testing the bottom end of that range. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

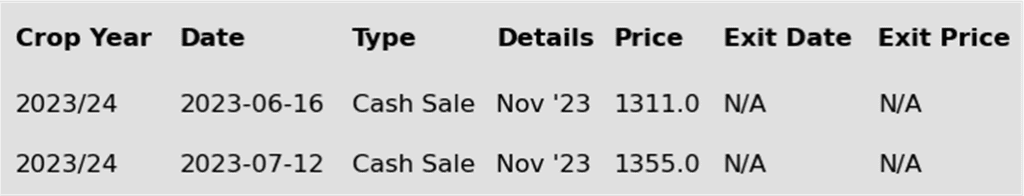

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher and were bull spread, with the majority of gains landing in the front month, which was supported by higher front month soybean meal. Soybean oil closed lower despite higher crude oil and the lowest soybean oil stocks since 2014.

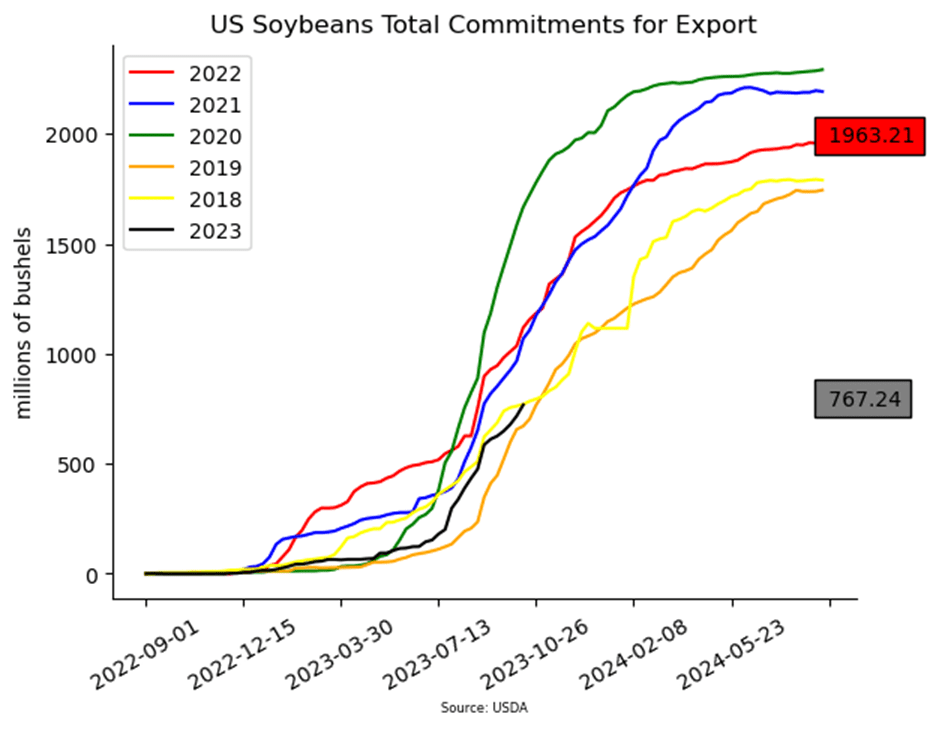

- Today’s export sales report was friendly and showed increases of 50.4 mb for 23/24, which was up 30% from the previous week and 92% from the prior 4-week average. Last week’s export shipments of 73.1 mb were well above the 34.6 mb needed each week to meet the USDA’s estimates. Primary destinations were to China, Mexico, and Spain.

- Weather in South America remains a concern as Argentina and northern Brazil deal with very hot and dry conditions over the next 10 days during planting, and only light rain chances next week. Brazil’s main growing area, Mato Grosso, hit temperatures of 105 degrees yesterday. Due to the heat and drought, only 19% of the crop has been planted, rather than the average of 22%.

- In the US, this week has been mostly dry giving producers an opportunity to get a good chunk of harvest complete before more rains fall again in the coming week. Despite some reports of “better than expected” yields, a prominent crop scout has called the final bean yield at just 49.3 bpa, below the USDA’s last estimate of 49.6 bpa.

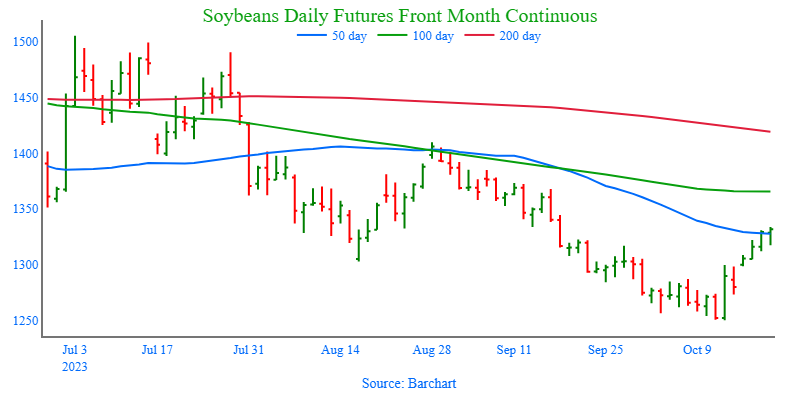

Above: Front month soybeans have pierced the upper end of the 1285 – 1323 resistance area and are testing close in resistance at the 50-day moving average. If the market can maintain upward momentum, it would be poised to make a run to test mid-September prices around 1370. Otherwise, to the downside initial support may be found near 1300 and again near 1273. Key support for the move remains down near 1250.

Wheat

Market Notes: Wheat

- After trading both sides of unchanged throughout the session, US wheat futures had a strong close, with double digit gains in the Chicago front months. This is in the face of a lower close for Paris milling wheat futures, but may have been helped by today’s dip in the US Dollar Index below the 106 level.

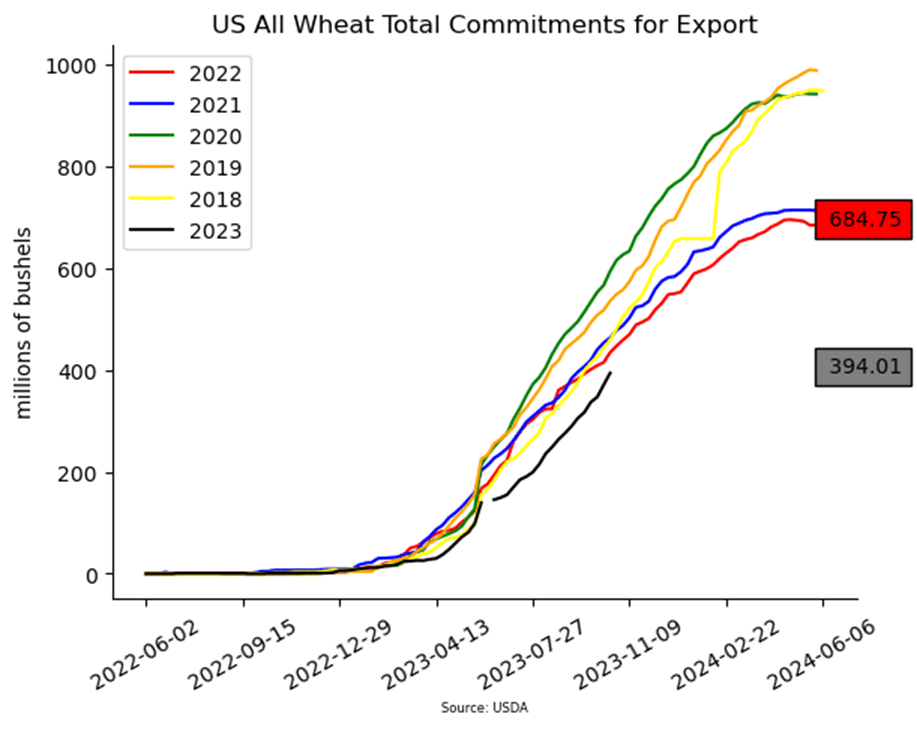

- The USDA reported an increase of 23.3 mb of wheat export sales for 23/24 and an increase of 1.1 mb for 24/25. Additionally, shipments last week at 14.1 mb were above the 13.9 mb pace per week necessary to hit the USDA’s 700 mb export estimate.

- The rally in the grain markets was a pleasant surprise, given today’s lack of fresh news. However, it may be reflective of new volatility being added back into the market and uncertainty with several global factors. First and foremost, the potential for the war in Israel to develop into a more significant conflict is on the minds of many traders. Tonight, President Biden will give an address in which he is expected to make the case for providing monetary aid for military assistance in both Israel and Ukraine.

- The International Grains Council increased the world wheat supply by 2 mmt to 785 mmt, though still below 803 mmt last year. This is apparently a result of higher output in the US, Russia, and Ukraine; Australia was lower.

- There are continued rumors that China has interest in purchasing more US SRW wheat, though none have been reported over the 100,000 mt minimum required for the USDA to report. Apparently, China may also be looking for US corn. Both things are interesting, considering that according to China’s National Bureau of Statistics, they are looking at record grain production this year. It is possible that their economy is on the mend, which could mean more commodity imports are needed.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

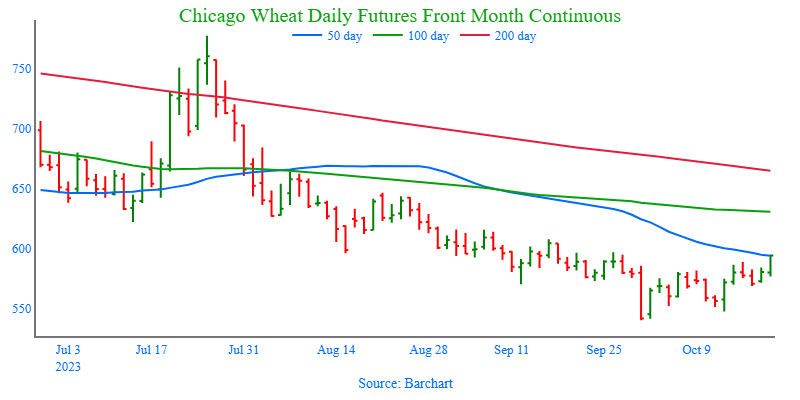

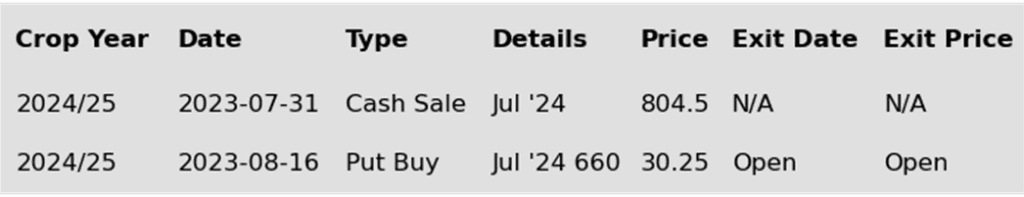

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The Dec ’23 contract has been in a downtrend since making highs in late July but has found support near 541 following the September 29 Production report and has since been rangebound between 541 and 581 ½. With weak U.S. export demand driven by cheap Russian exports being the dominant headwind, it appears that prices may be finding value in the current trading range. If a bullish catalyst were to enter the market and push prices over 616, it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into the winter months. If you are a newer subscriber, Grain Market Insider made sales recommendations in the late June rally around 720, and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 600 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

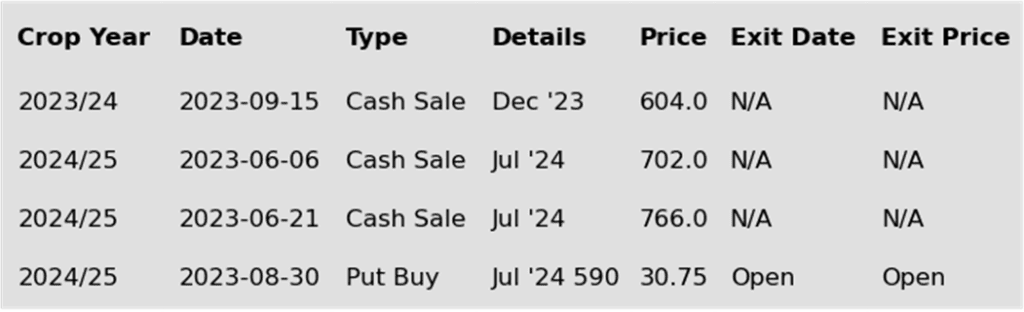

- No new action is recommended for 2024 Chicago wheat. Currently, July ’24 is trading at a 68-cent premium to the Dec ’23 contract as bear spreading, due to fund positioning and weak fundamentals, has driven the Dec ’23 contract closer to 550, while the July ’24 contract remains near 625. The risk for the July ’24 contract remains the same as for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward June’s highs, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: After its push lower on Sept. 29, December wheat has slowly regained its value and is trading in the same 570 – 618 range it did prior to its break lower. For the market to push through the top side of the range, more bullish input will be needed. If so, the market would be poised to test the 645 – 664 area. If not and the market retreats, initial support could be found near 568 and then down between 547 and 540.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

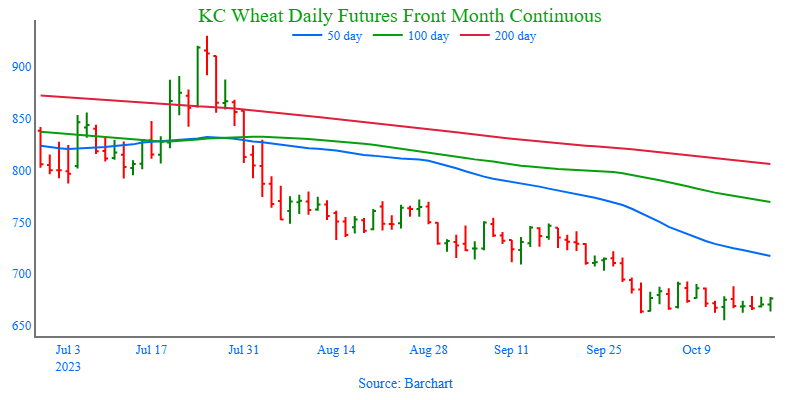

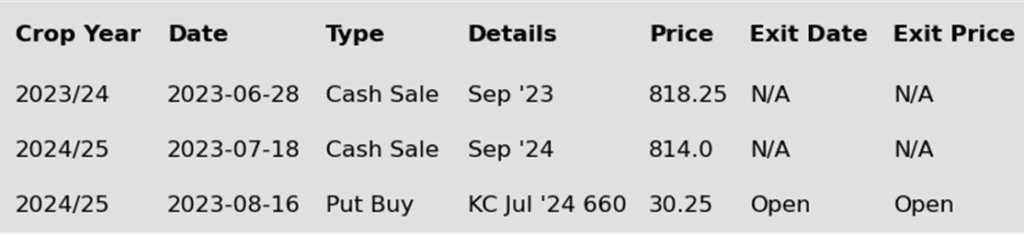

KC Wheat Action Plan Summary

- No new action is recommended for 2023 K.C. wheat crop. The Dec ’23 contract has been in a downtrend since making highs in late July and continues to search for support while trading about 40 cents off the contract lows from July ’21. With weak U.S. export demand, driven by cheap Russian exports, being the dominant headwind, the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst were to enter the market and push prices towards 750 it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into winter and early spring. Earlier this year, Grain Market Insider made a sales recommendation in the late May rally around 1170. With that sale, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales north of 700, and again around 750 – 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 K.C. wheat. Currently, July ’24 is trading at an 18-cent premium to the Dec ’23 contract, up from a 60-cent discount last July, as bear spreading due to weak fundamentals has driven the Dec ’23 contract closer to its contract lows, while the July ’24 contract remains more elevated as it tests Feb ’22 lows. The risk for the July ’24 contract is much like that for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode, and in mid-August, Grain Market Insider recommended purchasing July 660 puts to prepare for this possibility. Also, back in July, Grain Market Insider recommended a sale near 800 to take advantage of elevated prices before they eroded further. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 K.C. Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following K.C. recommendations:

Above: Since the end of September, K.C. wheat has been consolidating with initial support just below the market near the September 12 low of 655. If the market retreats lower and breaks through 655, the next levels of support come in around 630 and 575. Initial resistance to the upside may be found around 700 and again near 722.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

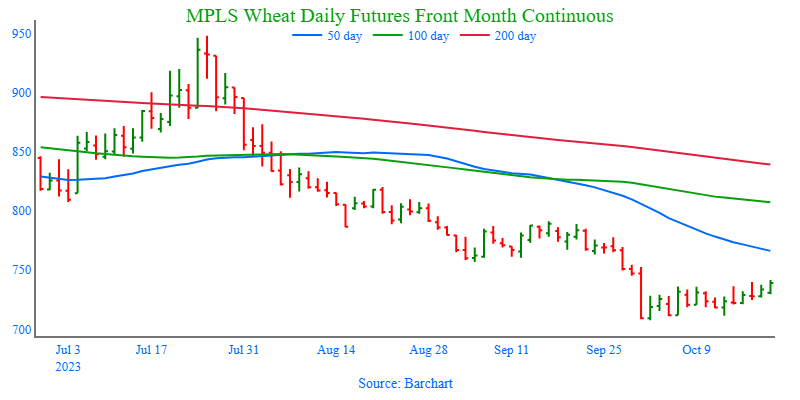

- No new action is currently recommended for the 2023 New Crop. The Dec ’23 contract has been in a downtrend since making highs in late July and continues to search for support while showing signs of being oversold. With weak U.S. export demand driven by cheap Russian exports being the dominant headwind, the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst were to enter the market and push prices towards 800, it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into winter. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820. With that sale, Grain Market Insider’s strategy is to look for price appreciation going into this winter with an eye on considering additional sales around 750 – 800, and again north of 825. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is currently recommended for 2024 Minneapolis wheat. In the last three months, the Sep ’24 contract has gone from a 60 – 80 discount to Dec ’23, to a nearly 60-cent premium. Weak fundamentals led bear spreading to drive Dec ’23 in search of new contract lows, while Sep ’24 remains nearly 30 cents off its low from last June. The risk for the Sep ’24 contract is much like that of Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. In mid-August, Grain Market Insider recommended purchasing July K.C. 660 puts (for their greater liquidity, and correlation to Minneapolis pricing) to prepare for this possibility, and back in July, Grain Market Insider recommended a sale near 815 to take advantage of elevated prices. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further. Grain Market Insider will then be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: For much of September, December Minneapolis wheat was rangebound, and the breakout to the downside on September 29 set the market up to test support near 665, the May ’21 low. Since then, the market has been consolidating upward, with initial support between 711 and 708. If prices continue higher, initial resistance remains between 745 – 760.

Other Charts / Weather