Grain Market Insider: October 16, 2023

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 490 | -3.25 |

| MAR ’24 | 505 | -3.5 |

| DEC ’24 | 517.75 | -3.5 |

| Soybeans | ||

| NOV ’23 | 1286.25 | 6 |

| JAN ’24 | 1305.75 | 5.75 |

| NOV ’24 | 1255 | 3.25 |

| Chicago Wheat | ||

| DEC ’23 | 577.25 | -2.5 |

| MAR ’24 | 604.5 | -1.75 |

| JUL ’24 | 634.75 | -2 |

| K.C. Wheat | ||

| DEC ’23 | 668.75 | -0.25 |

| MAR ’24 | 678 | -0.5 |

| JUL ’24 | 687.5 | -0.75 |

| Mpls Wheat | ||

| DEC ’23 | 728.75 | 6.75 |

| MAR ’24 | 751.25 | 5.25 |

| SEP ’24 | 781.75 | 3 |

| S&P 500 | ||

| DEC ’23 | 4402.25 | 45 |

| Crude Oil | ||

| DEC ’23 | 85.18 | -1.17 |

| Gold | ||

| DEC ’23 | 1932.1 | -9.4 |

Grain Market Highlights

- The corn market followed through on Friday’s small losses and sold off in the day session after trading higher early on Sunday evening. Low export inspections, that came in well below expectations and at a marketing year low, added to the pall of the market.

- Record September crush from today’s NOPA crush report and a marketing year high for export inspections kept the soybean market supported through the day, though neighboring corn and wheat likely added resistance.

- Today’s sharp gains in soybean oil are likely due to the record crush numbers and lower than expected bean oil stocks that imply that much of the crushing activity is for oil, and that demand from the biofuel sector remains strong. While on the flip side, the resulting excess meal production weighed on meal prices, producing only modest gains near unchanged.

- While export inspections were in line with expectations, they still fell below the pace required to meet the USDA’s estimates, and are 28% behind year ago levels, versus the USDA’s forecast of an 8% decline. This in addition to higher Russian wheat production estimates dragging on the wheat complex, which had a strong start overnight trade but finished on the weak side. Minneapolis contracts settled in the green, with Chicago and K.C. lower.

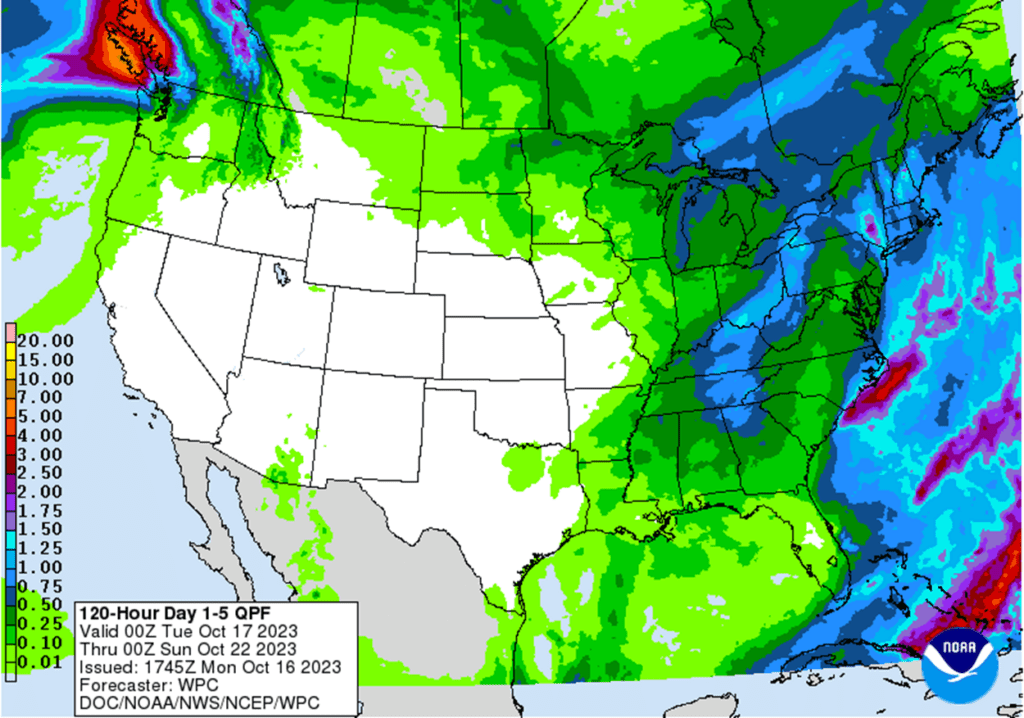

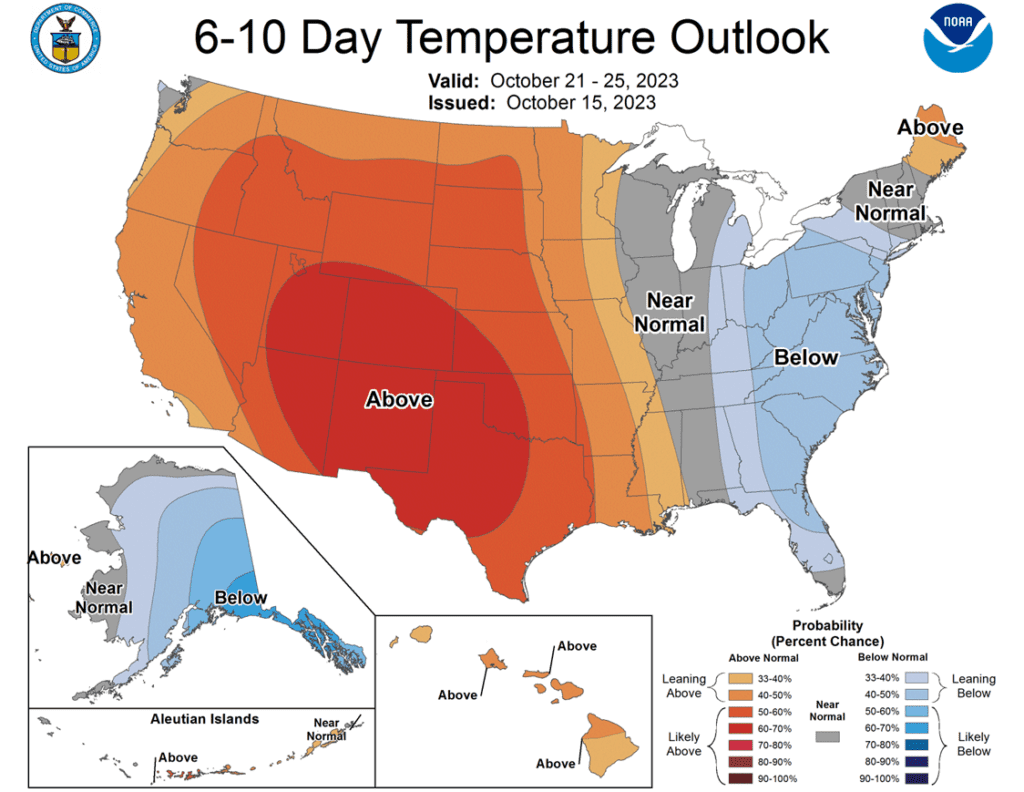

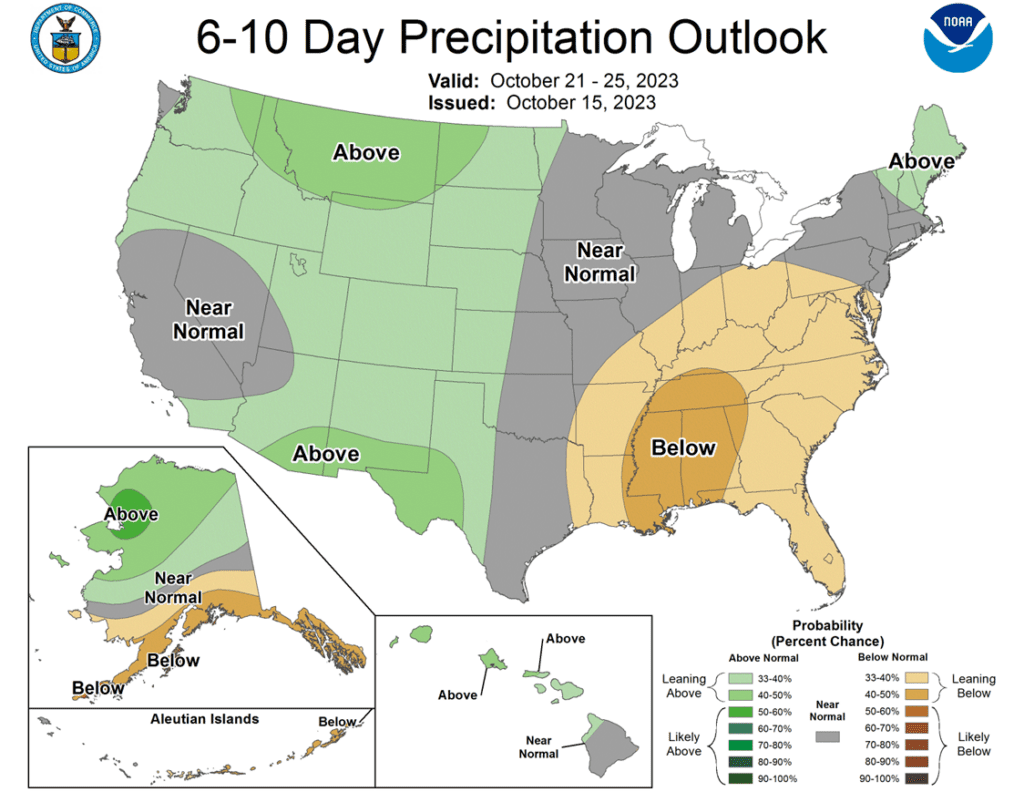

- To see the current U.S. 5-day precipitation forecast, the 6 – 10 day Temperature and Precipitation Outlooks, and the 1 week precipitation forecasts for South America from the NWS and NOAA, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. Last week’s supportive USDA Supply and Demand report had Dec ’23 corn testing that 500 psychological price level, yet so far Dec has been unable to close over that resistance. That 500 level remains an important resistance for the trend, and without a close over it, the market remains at risk of continuing to trend sideways-to-lower. The worst-case scenarios from a timing perspective, could entail sideways-to-lower into the late November to early January window. If Dec ’23 can reverse the slide of the last two days and close over 500, the next resistance would be 547. First support on the downside is the August low of 461. If you’re new to Grain Market Insider and were not a subscriber during this summer’s rally, Grain Market Insider did recommend making sales into that rally when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until next spring. If you end up harvesting more bushels than you can store this fall and must move them, consider protecting those sold bushels with either July or September ’24 call options.

- No new action is recommended for 2024 corn. The Dec ’24 contract has held up better than Dec ’23 as bear spreading over the last several months has brought increased buying interest into Dec ’24 and other further out contract months. Back in late July, the Dec ’23 contract traded up to a 25-cent premium over Dec ’24. Now, Dec ’24 holds a 28-cent premium over Dec ’23. This bear spreading has the Dec ’24 price up about 28 cents from its year-to-date low. The risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally, and having those in place, helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

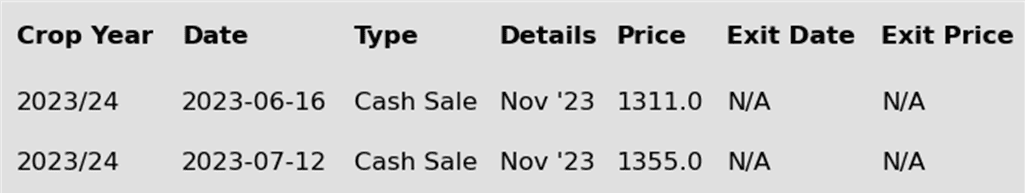

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures failed to find any traction to start the week as prices consolidated at the top of last week’s trading range. Dec corm lost 3 ¼ cents to $4.90 on the session. The grain market lacked any true momentum to start the week.

- Weekly export inspections released by the USDA on Monday morning saw soft action last week at 435,000 mt (17.1 mb), which was below market expectations. Total inspections for the marketing year are at 155 mb, up 19% year-over-year, but still behind pace to reach the USDA target for the marketing year at 2.025 billion bushels.

- Demand news overall has helped support prices with an uptick in activity. USDA announced a flash sale of 200,000 mt (7.87 mb) to Mexico on the overnight, as Mexico has remained active in the corn export market with routine purchases.

- Despite end of week rainfall, US corn harvest is expected to move to 46% complete on the weekly USDA crop progress report. Weather forecasts give a window for some progress again early this week, but good rainfall over the weekend may limit some field activity.

- Harvest pressure still limits the corn market with less than 50% of the harvest completed. Potential rallies in the corn market are limited by producer selling.

Above: The corn market has largely been rangebound since the beginning of August, with some minor short covering lifting prices in recent days. Resistance remains between 490 – 516, with initial support between 475 – 480 and then near 460.

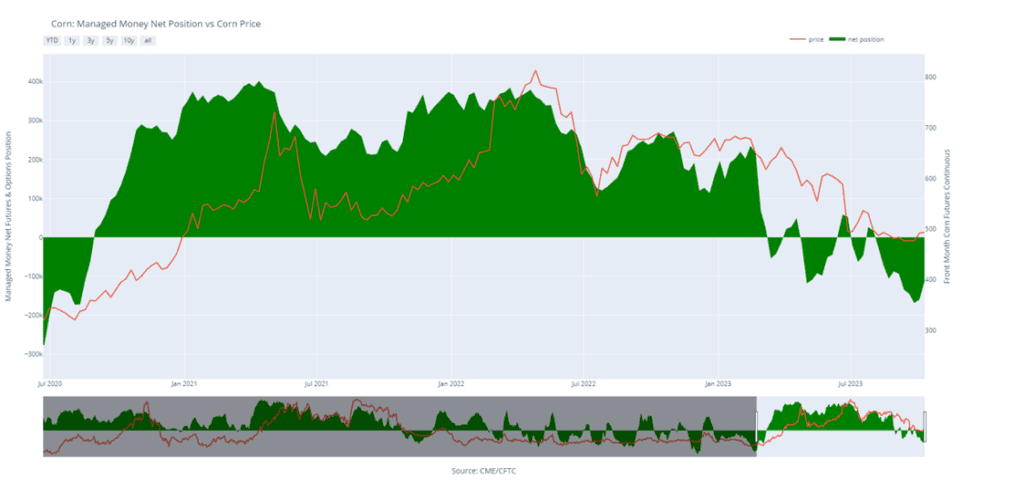

Corn Managed Money Funds net position as of Tuesday, Oct.10. Net position in Green versus price in Red. Managers net bought 46,742 contracts between Oct. 4 – 10, bringing their total position to a net short 112,691 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. The Nov ’23 contract has been finding buying interest around the June 2023 low of 1256 ¾, and since the beginning of October, it has also traded largely between 1260 and 1280. The close over 1287 ¼ on October 12 could be a signal that a harvest/fall low is in. The bigger picture, since May 2023, Nov ’23 has traded in a range from 1256 ¾ on the downside to 1435 on the topside. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Given that those sales recommendations were made and given that now is not the time of year to be making many sales, if any, Grain Market Insider is content to hold tight on any further sales recommendations until later this fall or early winter. The focus for strategy right now is to be on the lookout for any call option buying opportunities. If you end up harvesting more bushels than you can store this fall, consider protecting any sold bushels with July or Aug ’24 call options.

- No action is recommended for the 2024 crop. Nov ’24 continues to trade at a discount to Nov ’23. That discount was over 90 cents in late summer yet has stabilized lately to around the 10-20 cent range. Since July, the Nov ’24 contract has largely traded between 1250 and 1320, so this contract is currently testing the bottom end of that range. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

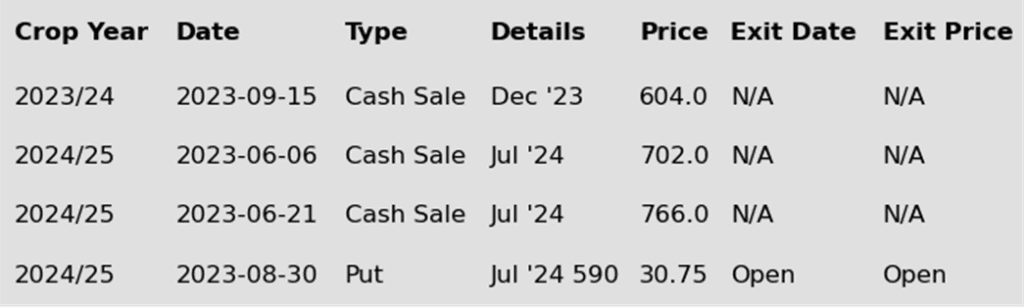

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher today after trading lower earlier in the day. Support came from the NOPA crush report which saw soybean oil stocks lower than expected. Export inspections today were supportive as well. Both soybean meal and oil finished the day higher.

- Weekly soybean inspections came in at an impressive 2,011,589 tons which was well above the high end of the trade guesses. This comes as a larger number of soybeans are getting shipped out of the PNW to China and other countries with Brazilian soybean supplies tight.

- Today’s NOPA crush report saw 165.456 million bushels of soybeans crushed in September, above the average trade guess of 161.683 mb and a new record for September. Soybean oil stocks came in at 1.108 billion pounds which is the lowest soybean oil stocks number since December 2014 and below the average trade guess.

- For the week ending October 10, non-commercial traders were sellers of 2,831 contracts of soybeans reducing their net long position to 2,170 contracts. In the wake of the bullish WASDE report last Thursday, it is more likely that those funds began buying and increased their net long position since the report which showed soybean yields at just 49.6 bpa and ending stocks at 220 mb.

Above: October 12 soybeans were shocked higher and traded into the resistance area of 1285 – 1323. If the market can maintain upward momentum, it would be poised to make a run to test mid-September prices around 1370. Otherwise, initial support below the market remains near 1250, with key support coming in between 1180 – 1200.

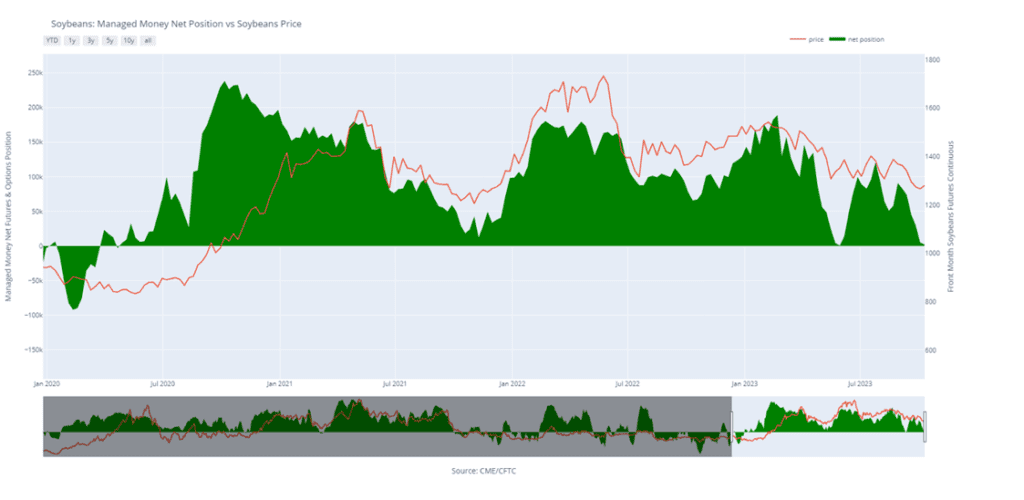

Soybean Managed Money Funds net position as of Tuesday, Oct. 10. Net position in Green versus price in Red. Money Managers net sold 2,835 contracts between Oct. 4 – 10, bringing their total position to a net long 2,166 contracts.

Wheat

Market Notes: Wheat

- Although it was a relatively quiet session, wheat closed mostly negative. This may be due in part to IKAR increasing their estimate of Russian grain production to 141.6 mmt. Despite this increase that should keep Russia competitive on exports, there are rumors that China is looking to potentially buy more US wheat after last week’s 181,000 mt purchase. China is expecting heavy rains over the next week or so in their grain regions, and this has the potential to affect their corn and wheat crops.

- Weekly wheat inspections of 13 mb bring the total 23/24 inspections to 248 mb. That is down 28% from last year, and so far, inspections are running behind the pace needed to meet the USDA’s export estimate of 700 mb.

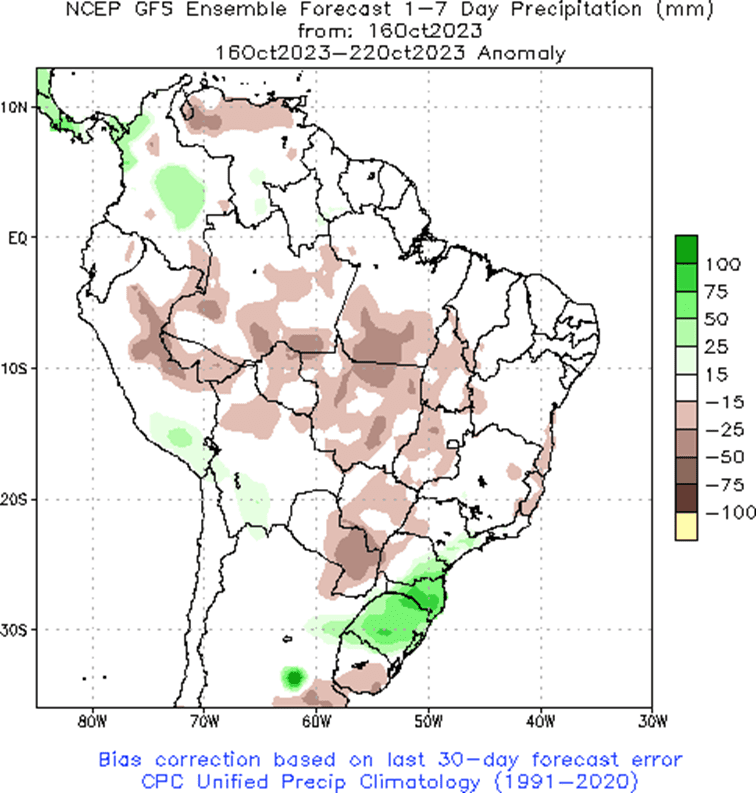

- Argentina is already struggling with drought that will affect their crops, and as long as the Amazon basin stays dry, central Brazil should remain dry as well. While central and northern Brazil are experiencing dry conditions, southern Brazil remains too wet. Additionally, with Australia having their own drought problems, there is talk that in 2024, wheat stocks of the major exporting countries will be the lowest in 16 years, which should be bullish for the market.

- From a technical standpoint, even though December Chicago wheat has closed over the 21-day moving average for the second day since the end of July, significant resistance remains at the six dollar level. Aside from the negative influence of last week’s report, the uncertainty in the Middle East could also affect the wheat market as the conflict ramps up given that wheat is more of a staple in that part of the world.

- According to the Ukrainian government, since July, Russia has destroyed about 300,000 mt of grain during their attacks on port infrastructure and vessels.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The Dec ’23 contract has been in a downtrend since making highs in late July but has found support near 541 following the September 29 Production report and has since been rangebound between 541 and 581 ½. With weak U.S. export demand driven by cheap Russian exports being the dominant headwind, it appears that prices may be finding value in the current trading range. If a bullish catalyst were to enter the market and push prices over 616, it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into the winter months. If you are a newer subscriber, Grain Market Insider made sales recommendations in the late June rally around 720, and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 600 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. Currently, July ’24 is trading at a 68-cent premium to the Dec ’23 contract as bear spreading, due to fund positioning and weak fundamentals, has driven the Dec ’23 contract closer to 550, while the July ’24 contract remains near 625. The risk for the July ’24 contract remains the same as for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward June’s highs, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: December wheat has been consolidating since the break on September 29. The market’s previous range of 570 – 618 is an area of resistance which will need more bullish input to rally through. If the market retreats lower, support below the market resides between 540 – 533.

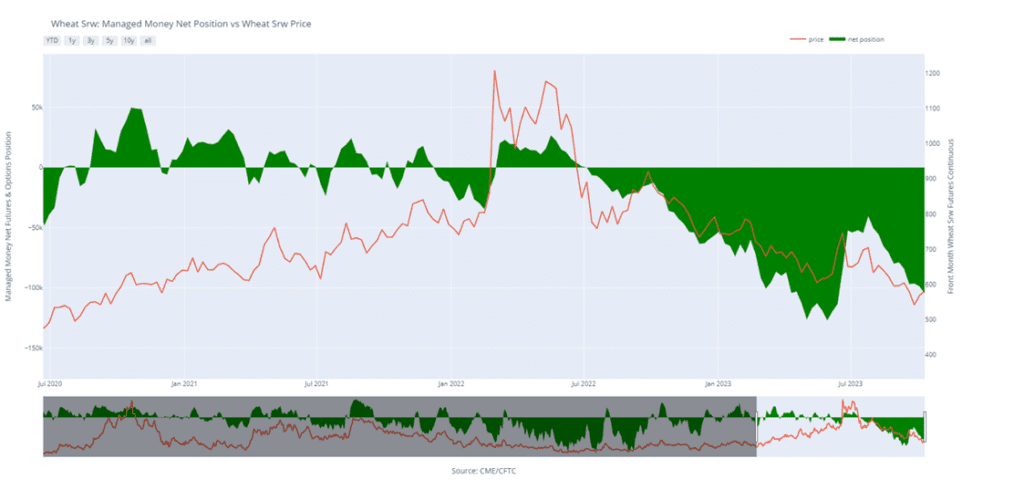

Chicago Wheat Managed Money Funds net position as of Tuesday, Oct. 10. Net position in Green versus price in Red. Money Managers net sold 5,547 contracts between Oct. 4 – 10, bringing their total position to a net short 104,335 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 K.C. wheat crop. The Dec ’23 contract has been in a downtrend since making highs in late July and continues to search for support while trading about 40 cents off the contract lows from July ’21. With weak U.S. export demand, driven by cheap Russian exports, being the dominant headwind, the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst were to enter the market and push prices towards 750 it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into winter and early spring. Earlier this year, Grain Market Insider made a sales recommendation in the late May rally around 1170. With that sale, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales north of 700, and again around 750 – 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 K.C. wheat. Currently, July ’24 is trading at an 18-cent premium to the Dec ’23 contract, up from a 60-cent discount last July, as bear spreading due to weak fundamentals has driven the Dec ’23 contract closer to its contract lows, while the July ’24 contract remains more elevated as it tests Feb ’22 lows. The risk for the July ’24 contract is much like that for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode, and in mid-August, Grain Market Insider recommended purchasing July 660 puts to prepare for this possibility. Also, back in July, Grain Market Insider recommended a sale near 800 to take advantage of elevated prices before they eroded further. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 K.C. Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Insider starts considering the first sales targets.

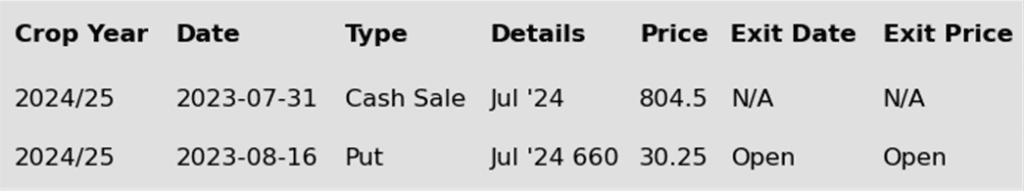

To date, Grain Market Insider has issued the following K.C. recommendations:

Above: Since the end of September, K.C. wheat has been consolidating with initial support just below the market near the September 12 low of 655. If the market retreats lower and breaks through 655, the next levels of support come in around 630 and 575. Initial resistance to the upside may be found around 700 and again near 722.

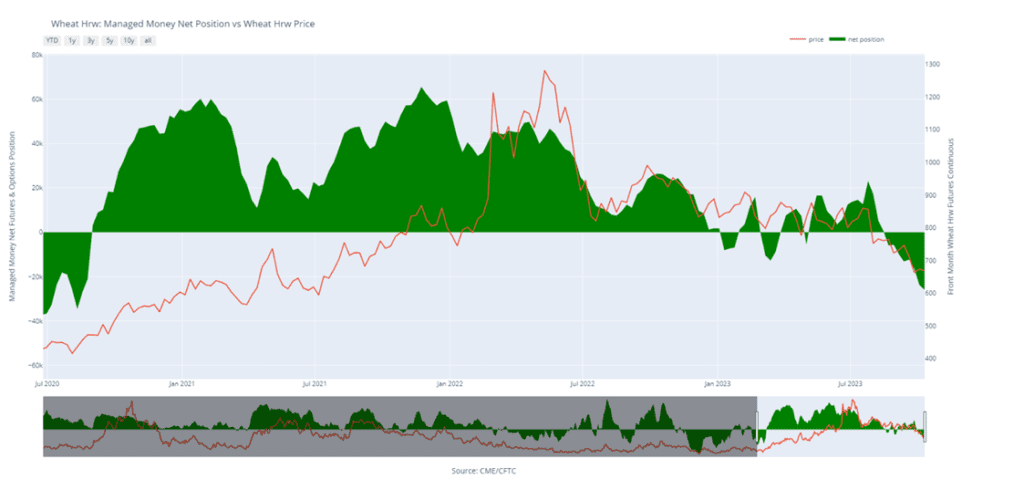

K.C. Wheat Managed Money Funds net position as of Tuesday, Oct. 10. Net position in Green versus price in Red. Money Managers net sold 2,043 contracts between Oct. 4 – 10, bringing their total position to a net short 25,870 contracts.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. The Dec ’23 contract has been in a downtrend since making highs in late July and continues to search for support while showing signs of being oversold. With weak U.S. export demand driven by cheap Russian exports being the dominant headwind, the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst were to enter the market and push prices towards 800, it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into winter. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820. With that sale, Grain Market Insider’s strategy is to look for price appreciation going into this winter with an eye on considering additional sales around 750 – 800, and again north of 825. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is currently recommended for 2024 Minneapolis wheat. In the last three months, the Sep ’24 contract has gone from a 60 – 80 discount to Dec ’23, to a nearly 60-cent premium. Weak fundamentals led bear spreading to drive Dec ’23 in search of new contract lows, while Sep ’24 remains nearly 30 cents off its low from last June. The risk for the Sep ’24 contract is much like that of Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. In mid-August, Grain Market Insider recommended purchasing July K.C. 660 puts (for their greater liquidity, and correlation to Minneapolis pricing) to prepare for this possibility, and back in July, Grain Market Insider recommended a sale near 815 to take advantage of elevated prices. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further. Grain Market Insider will then be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: For much of September, December Minneapolis wheat was rangebound, and the breakout to the downside on September 29 set the market up to test support near 665, the May ’21 low. Since then, the market has been consolidating, and while support below the market remains near 665, initial support may also be found near 700. If prices turn higher, initial resistance remains between 745 – 760.

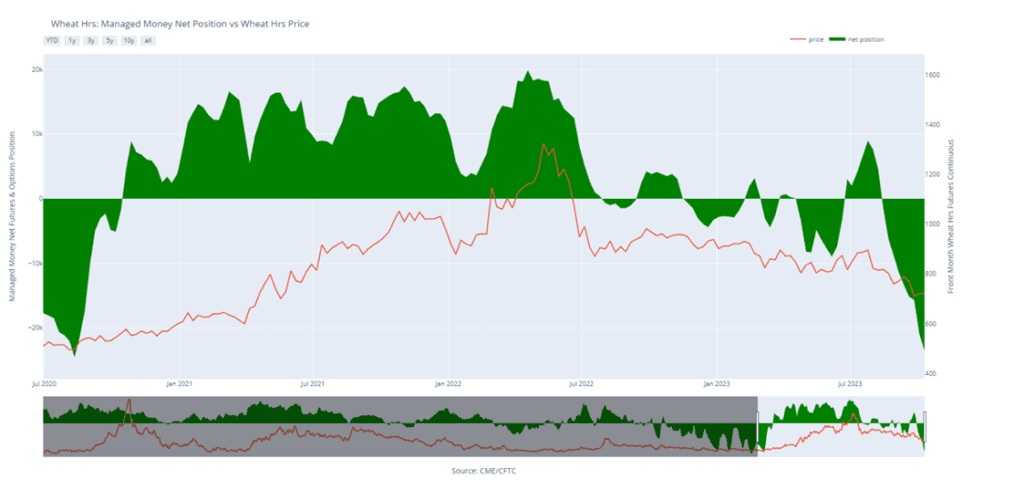

Minneapolis Wheat Managed Money Funds net position as of Tuesday, Oct. 10. Net position in Green versus price in Red. Money Managers net sold 2,520 contracts between Oct. 4 – 10, bringing their total position to a net short 23,506 contracts.

Other Charts / Weather

Brazil 1 week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.

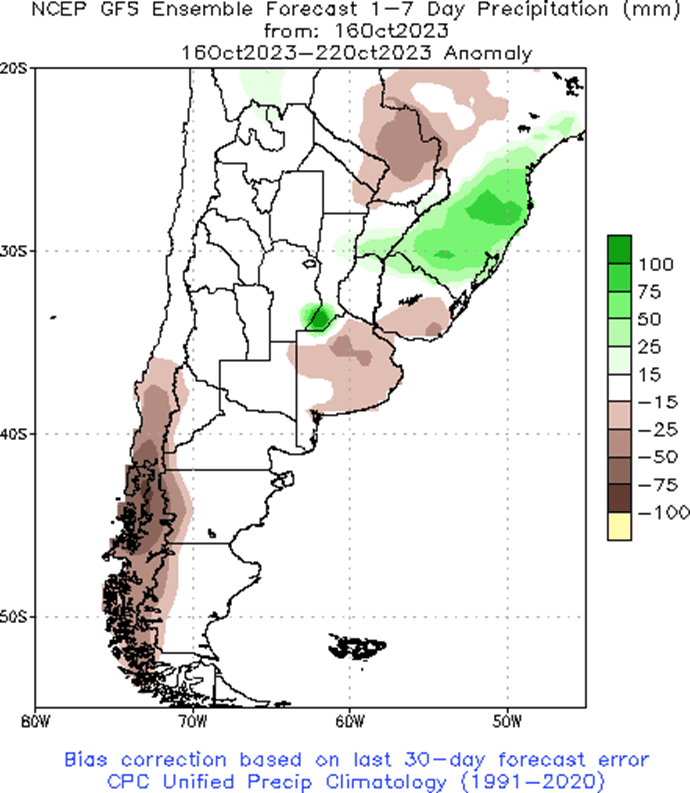

Argentina 1 week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.