Grain Market Insider: October 11, 2023

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 488 | 2.5 |

| MAR ’24 | 503.75 | 2.5 |

| DEC ’24 | 517.25 | 3 |

| Soybeans | ||

| NOV ’23 | 1252.5 | -19 |

| JAN ’24 | 1272.25 | -17 |

| NOV ’24 | 1239.5 | -9.75 |

| Chicago Wheat | ||

| DEC ’23 | 556 | -2.5 |

| MAR ’24 | 587.25 | -2.75 |

| JUL ’24 | 625.25 | -3.5 |

| K.C. Wheat | ||

| DEC ’23 | 667.25 | -4 |

| MAR ’24 | 676.25 | -4 |

| JUL ’24 | 686 | -4.25 |

| Mpls Wheat | ||

| DEC ’23 | 718.25 | -5.25 |

| MAR ’24 | 742.25 | -4.75 |

| SEP ’24 | 777.5 | -5 |

| S&P 500 | ||

| DEC ’23 | 4395.75 | 4.25 |

| Crude Oil | ||

| DEC ’23 | 82.4 | -1.73 |

| Gold | ||

| DEC ’23 | 1885.5 | 10.2 |

Grain Market Highlights

- Positioning ahead of tomorrow’s USDA WASDE report lent support to the corn market as traders anticipate a slightly lower carryout, while a swift harvest pace, and weakness in wheat, soybeans, and crude oil added upward resistance to corn prices, as the market settled just off the day’s highs.

- After trading higher in the overnight session, and despite two flash sales totaling 12 mb, November soybeans traded lower throughout the day to close near the bottom of the range on harvest pressure, and as traders set positions in anticipation of potentially bearish USDA numbers in tomorrow’s report.

- After trading on both sides of unchanged, soybean meal closed lower on the day, though just a mere 40 cents/ton. While further contributing to a weaker soybean trade, soybean oil continued its slide lower on weaker world veg oils and lower biofuel RIN values.

- Position squaring led the day with two-sided trade that had all three wheat classes closing in the red as traders anticipate higher ending stocks in tomorrow’s USDA report.

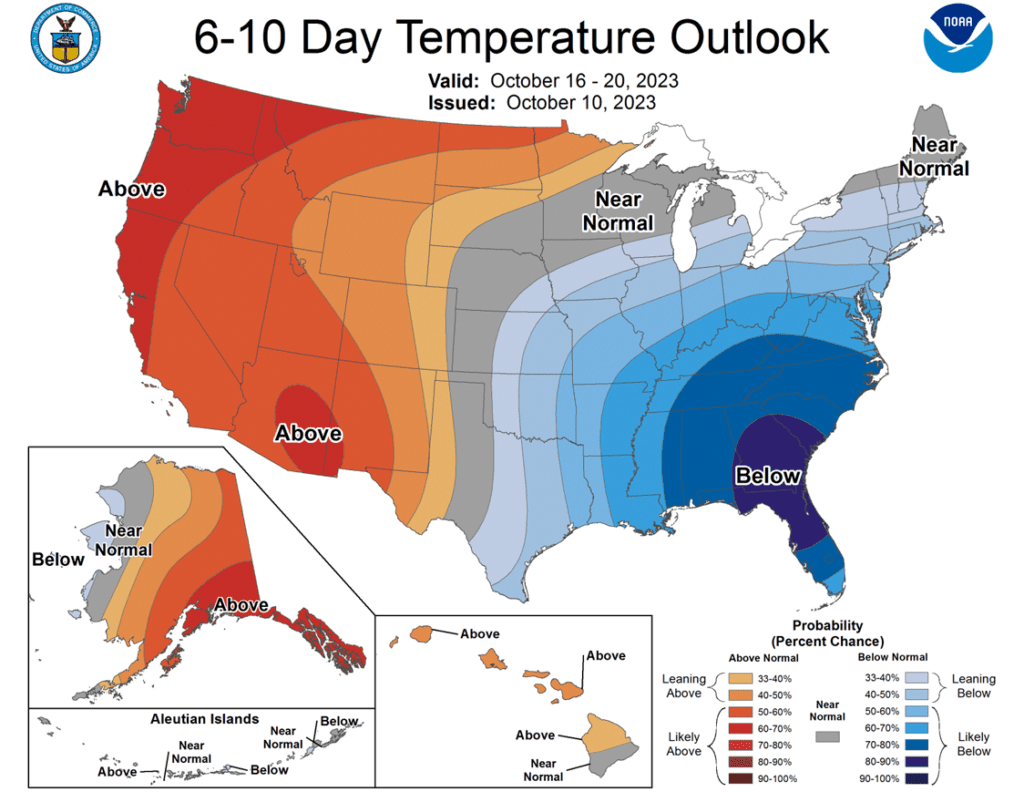

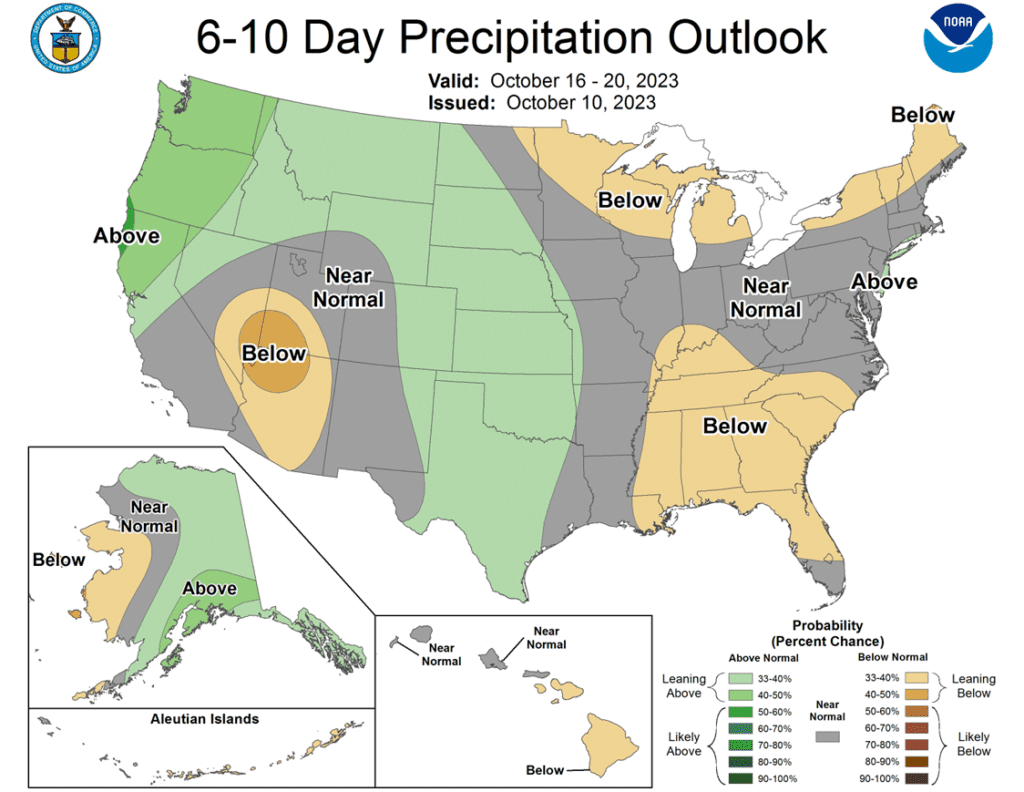

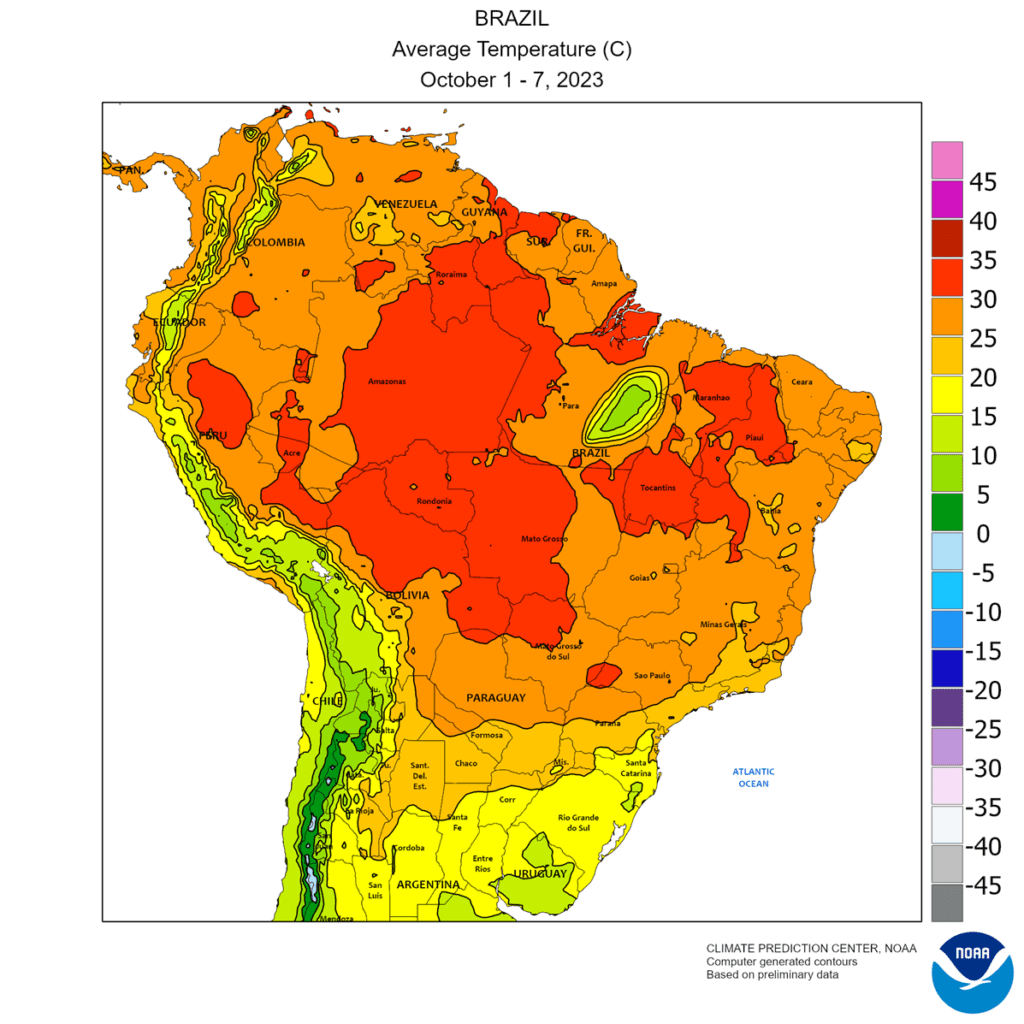

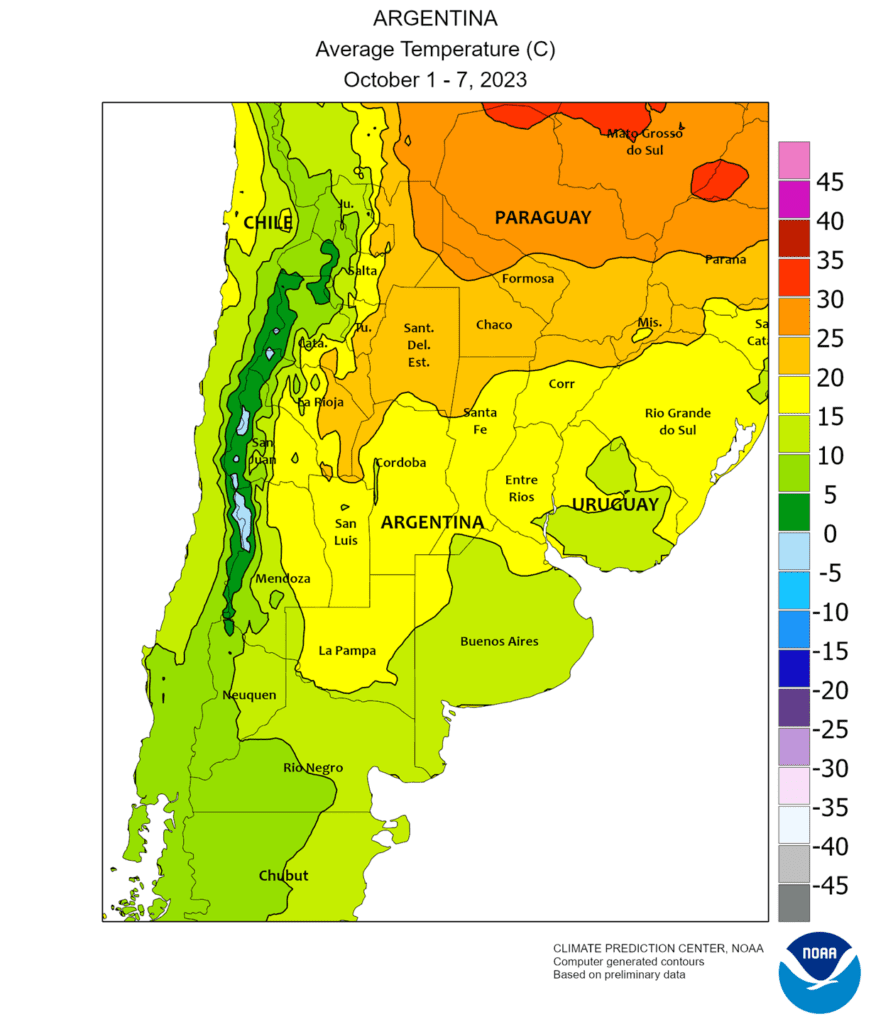

- To see the current U.S. 6 – 10 day Temperature and Precipitation Outlooks, and South American average temperatures from the NWS and NOAA, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. The last couple weeks Dec ’23 corn has seen a bump from a low of 467.75 to a high last week of 499.00. Since mid-August, the psychological 500.00 level has served as market resistance on the front month. Without any bullish catalyst from the coming USDA Supply and Demand report this Thursday, the market remains at risk of sideways to lower price action. In years without bullish fundamental tailwinds at this time of year, the worst case scenarios have seen prices trend slowly lower into anywhere from late November to early January. If you’re new to Insider and were not a subscriber during this summer’s rally, Insider did recommend making sales into that summer rally when Dec ’23 was around 624.00, so for now the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Insider may sit tight on the next sales recommendations until next spring. If you end up harvesting more bushels than you can store this fall and must move them, consider re-owning those bushels with either July or September ’24 call options.

- No new action is recommended for 2024 corn. The Dec ’24 contract has held up better than Dec ’23 as bear spreading over the last several months has brought increased buying interest into Dec ’24 and other further out contract months. Back in late July, the Dec ’23 contract traded up to a 25-cent premium over Dec ’24. Now Dec ’24 holds a 28-cent premium over Dec ’23. This bear spreading has the Dec ’24 price up about 28 cents from its year-to-date low. The risk for 2024 prices is the same as 2023 prices, which is a continuation of a lower trend without a bullish catalyst on this Thursday’s Supply and Demand report. Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally, and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700.00 or 800.00 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Insider starts considering the first sales targets.

Grain Market Insider has issued the following number of corn recommendations:

• 2023: 1 Cash/2 Call/2 Put

• 2024: 2 Cash/0 Call/0 Put

• 2025: 0 Cash/0 Call/0 Put

Market Notes: Corn

- In pre-USDA report trade, corn futures saw prices trade higher as funds were likely squaring positions for tomorrow’s report. December corn added 2 ½ cents as weakness in wheat, soybeans, and crude oil markets limited gains on the session.

- The USDA will release the latest crop production and supply/demand numbers on Thursday morning. Expectations are for corn yield to be trimmed slightly to 173.5 bushels/acre. The lower possible production, plus the tighter than expected grain stocks should lower corn carryout slightly to an expected 2.138 billion bushels.

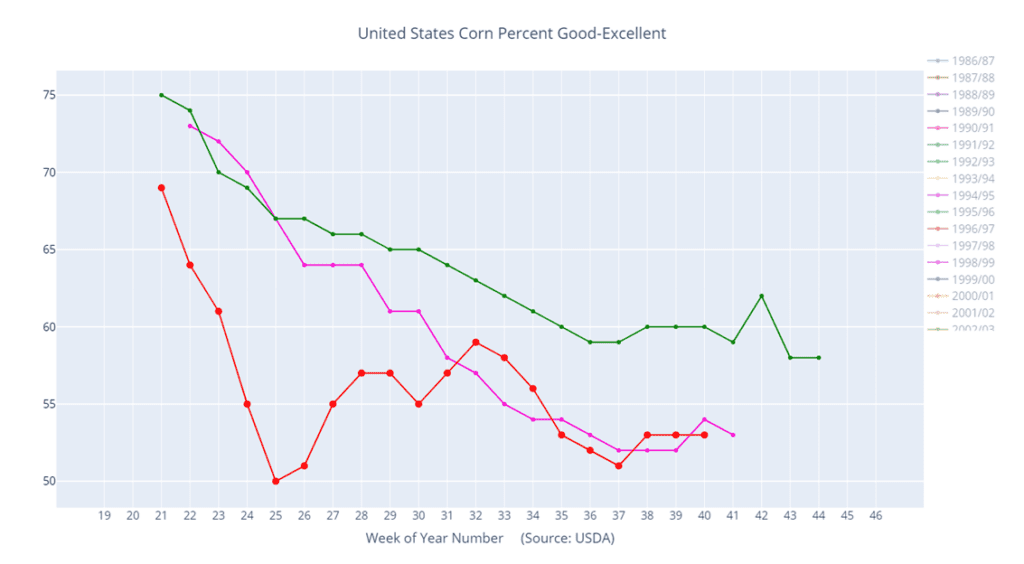

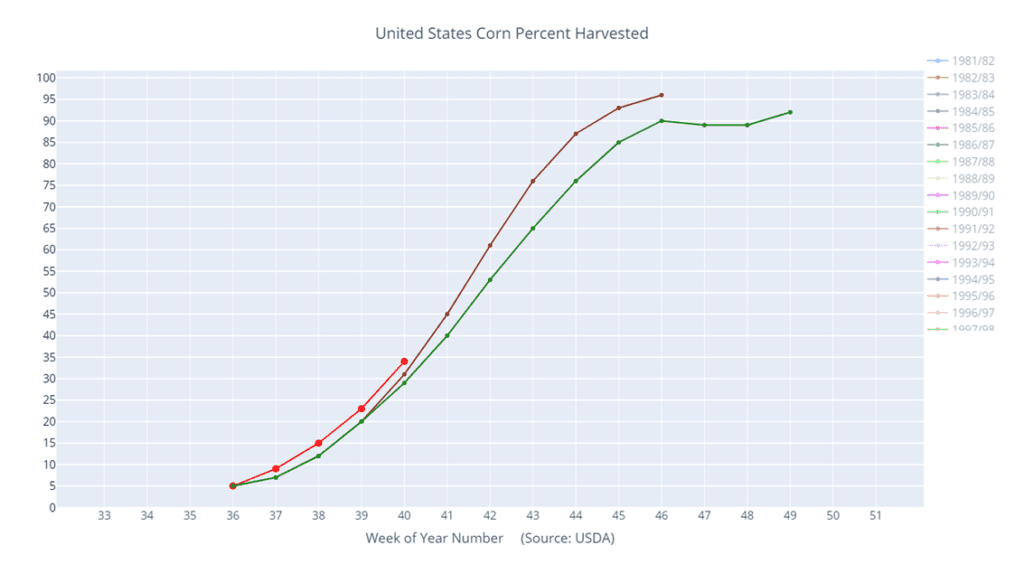

- Corn harvest pace moved to 34% complete on the weekly crop progress numbers. This was slightly below market expectations, but ahead of the 5-year average of 31%. The ongoing harvest pressure added resistance to the market’s upside potential.

- The weather forecasts have kept the harvest pace strong for the first half of the week, but projected moisture in the 2nd half of the week, and into the weekend, may slow harvest progress going into next week for north and central areas of the Corn Belt.

- South American weather will become a potential factor after Thursday’s USDA report. Dry weather in the north and excessive moisture in the south regions may slow soybean planting, which could push back the 2nd crop corn planting. The weather concerns are extremely early in the crop year but could be more important as the market moves closer to the end of the year.

Above: The corn market has largely been rangebound since the beginning of August, with some minor short covering lifting prices in recent days. Resistance remains above the market between 490 – 516, and support below the market may be found near 460 and again near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. The Nov ’23 contract has been finding buying interest around the June 2023 low of 1256.75 on the front month. Over the last seven trading days, Nov ’23 has traded largely between 1260.00 and 1280.00. If there were to be a bullish catalyst from this Thursday’s USDA Supply and Demand report and Nov ’23 subsequently closed over 1287.25, that could signal the possibility that a harvest/fall low is in. Bigger picture, since May 2023, the front month contract has traded in a range from 1256.75 on the downside to 1435.00 on the topside. If you are a newer subscriber to Insider and were not with us back in the summer, Insider did make two sales recommendations in the 1310-1360 price window versus Nov ’23. Given those sales recommendations were already made and given that now is not the time of year to be making many if any sales, Insider is content to hold tight on next sales recommendations until later this fall or early winter. The focus for strategy right now is to be on the lookout for any call option buying opportunities. If you end up harvesting more bushels than you can store this fall, consider buying those sold bushels back with July or August ’24 call options.

- No action is recommended for the 2024 crop. Nov ’24 continues to trade at a discount to Nov ’23. That discount was over 90 cents in late summer yet has stabilized lately around the 10-20 cent range. Since July, the Nov ’24 contract has largely traded between 1250 and 1320, so this contract is currently testing the bottom end of that range. To date, Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Grain Market Insider has issued the following number of soybean recommendations:

• 2023: 2 Cash/0 Call/0 Put

• 2024: 0 Cash/0 Call/0 Put

• 2025: 0 Cash/0 Call/0 Put

Market Notes: Soybeans

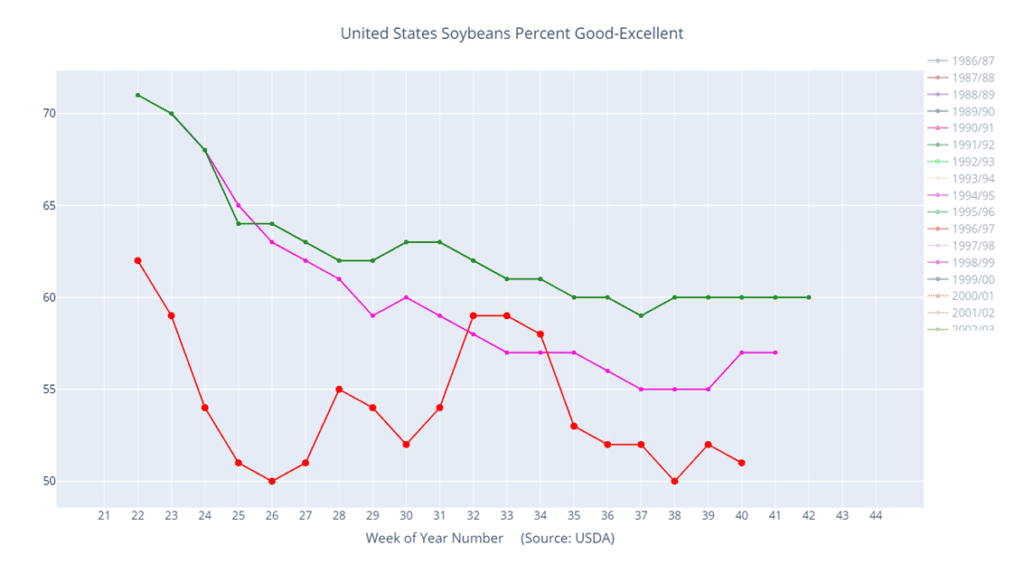

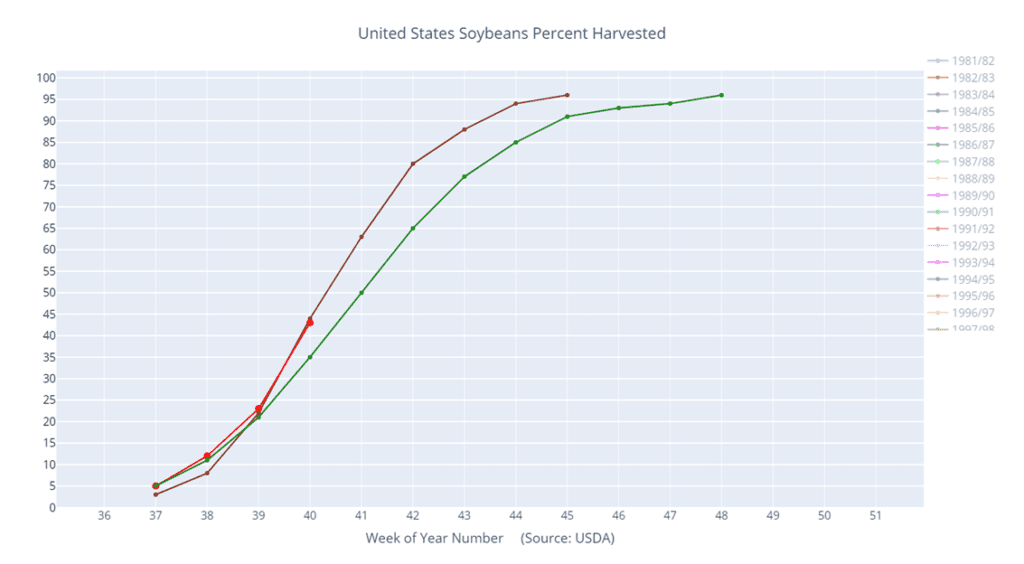

- Soybeans ended the day lower and were below the previous low of 12-56-3/4 from June as they are under pressure from harvest and in anticipation of tomorrow’s WASDE report. Both soybean meal and oil were lower with pressure from crude oil and world veg oils.

- Estimates for Thursday’s WASDE report call for soybean yields to fall slightly to 49.9 bpa from 50.1 bpa in last month’s estimate. Production is expected to be lowered slightly to 4.134 bb. It is unknown if the USDA will make adjustments to demand in this report.

- World veg oil prices continue to be weak as Ukrainian sunflower oil’s premium to palm oil fell to just $45/mt from $400 in recent days. Additionally, here in the U.S., lower biofuel RIN values continue to weigh on bean oil prices.

- Brazil is currently in the middle of planting and early estimates are calling for a record 23/24 production of 162 mmt, but the country continues to deal with weather issues. In the northern region, light showers are expected but it is likely not enough, and in the southern region conditions remain far too wet.

- On the heels of yesterday’s impressive export inspections number of 1.036 mmt, sales were reported today of 121,000 mt of soybeans for delivery to China for the 23/24 period, and 213,000 mt for delivery to unknown destinations for the 23/24 marketing year. U.S. exports have picked up recently out of the PNW as Brazil runs tight on supplies.

Above: Since the end of August, the soybean market has been in a downtrend, and though it has been consolidating, it remains oversold, which can be supportive if prices turn higher. Initial support to the downside lies near the recent low of 1254, with further support between 1238 – 1214, while resistance above the market lies between 1285 – 1323.

Wheat

Market Notes: Wheat

- Tomorrow traders will receive the latest USDA data on the WASDE report. Pre-report estimates of U.S. 23/24 wheat carryout come out to an average of 646 mb, compared to 615 mb in September. The world 23/24 average carryout estimate is projected at 258.8 mmt, up just slightly from 258.6 mmt last month.

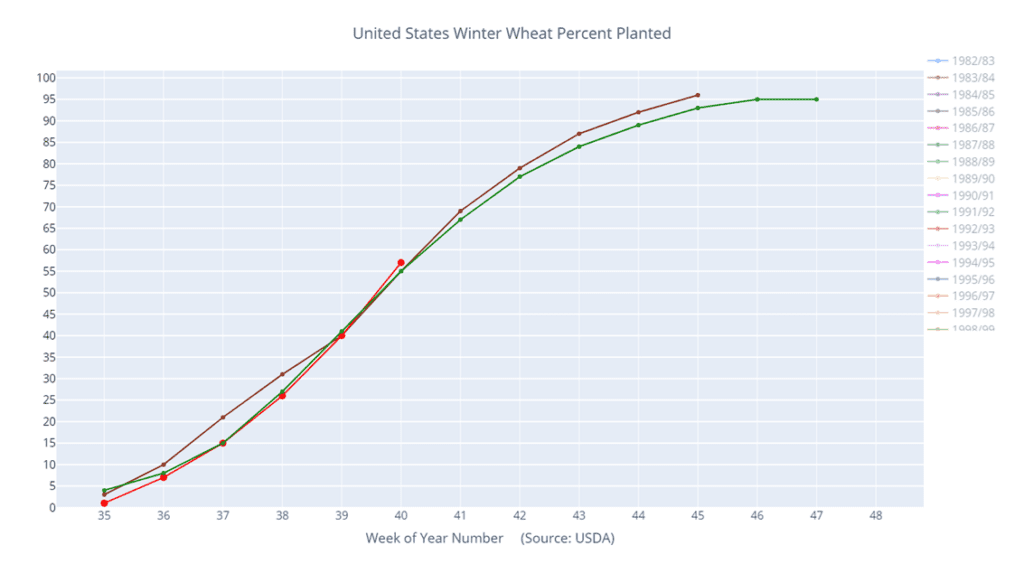

- According to the USDA, winter wheat planting is 57% complete with 29% of the crop emerged. With most of the Midwest dry, there is some concern about emergence. However, some rain across the upper Midwest and northern Plains is expected over the coming days.

- Even though western Australia is too dry, and it is affecting their wheat production, Australian wheat futures are actually trading lower as yields are coming in better than expected.

- With low global prices in general, it will be a tough road ahead to see U.S. futures rally. Russia continues to dominate exports, with talk of a sale to Egypt for 480,000 mt at $265 per ton FOB. In response to this sale, EU wheat is said to have dropped to just $250 per ton.

- In contrast to the above point, SovEcon believes Russia’s wheat exports are expected to decline due to slowing demand. This could be tied to their Ministry of Agriculture trying to prevent sales below the $270 per ton price floor. Russia’s October wheat exports may be 3.9-4.4 mmt, down from 4.5 mmt last year.

- For the 23/24 season, French soft wheat exports are expected to rise to 17.25 mmt, versus a projected 17.16 mmt in September. This is according to the French crop office, FranceAgriMer. In addition, stocks were reduced to 2.77 mmt vs 2.92 mmt previously.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The Dec ’23 contract has been in a downtrend since making highs in late July but has found support near 541 following the September 29 production report and has since been rangebound between 541 and 581 ½. With weak U.S. export demand driven by cheap Russian exports being the dominant headwind, it appears that prices may be finding value in the current trading range. If a bullish catalyst were to enter the market and push prices over 616, it may signal that a fall low is in place, which would line up with the historical tendency for prices to appreciate into the winter months. If you are a newer subscriber, Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 600 – 650 range. If at that point the market remains strong and continues to rally, Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. Considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. There is plenty of time to market the 2024 crop and with the world stocks to use ratio at an 8-year low, many uncertainties remain that could shock prices higher, like geopolitical instability and dryness in the southern hemisphere. If prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 750, if not, and prices make new lows, unsold bushels will be protected by the recommended July ’24 590 puts.

- No action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Grain Market Insider has issued the following number of Chicago wheat recommendations:

• 2023: 1 Cash/0 Call/0 Put

• 2024: 2 Cash/0 Call/1 Put

• 2025: 0 Cash/0 Call/0 Put

Above: December wheat has been consolidating since the break on September 29. The market’s previous range of 570 – 618 is an area of resistance which will need more bullish input to rally through. If the market breaks further, support below the market resides between 533 – 524.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 K.C wheat crop. Since the end of May the wheat market has been influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the bin, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region and the southern hemisphere, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward 700 – 750 before considering any additional sales.

- No new action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian exports continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further, while war persists in the Black Sea region, and production concerns continue in the southern hemisphere due to El Nino. With the world stocks to use ratio at an 8-year low, there are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and Insider will also be looking for opportunities to consider recommending additional sales if prices turn around and rally north of 775.

- No action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Grain Market Insider has issued the following number of K.C. wheat recommendations:

• 2023: 0 Cash/0 Call/0 Put

• 2024: 1 Cash/0 Call/1 Put

• 2025: 0 Cash/0 Call/0 Put

Above: Since the end of September, K.C. wheat has been consolidating after finding initial support just below the market near 660. If the market resumes its downtrend, the next levels of support below 660 come in around 630 and then 575, while resistance to the upside may be found between 710 – 722.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. Weather has been a dominant feature this season with production concerns not only in the U.S., but also Canada, and Australia. While prices have been weak due to low export demand, weather and geopolitical events can change suddenly to move prices higher. If prices move towards 750 – 800, Insider will consider making sales suggestions, while also continuing to watch the downside for any further violations of support.

- No new action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices, Insider recently recommended buying July ’24 K.C. wheat puts to protect unsold grain if prices continue to retreat further, while war persists in the Black Sea region, and production concerns continue in the southern hemisphere due to El Nino. With the world stocks to use ratio at an 8-year low, there are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally towards 800, Insider will be looking for opportunities to consider recommending additional sales.

- No action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Grain Market Insider has issued the following number of Minneapolis wheat recommendations:

• 2023: 1 Cash/0 Call/0 Put

• 2024: 1 Cash/0 Call/1 Put

• 2025: 0 Cash/0 Call/0 Put

Above: Since early September, Dec Minneapolis wheat has been largely rangebound, and the recent breakout to the downside on September 29 has the market poised to test support near the May ’21 low of 665. If prices turn higher, initial resistance may be found between 745 – 760.

Other Charts / Weather