Grain Market Insider: May 26, 2023

The CME and Total Farm Marketing offices will be closed

Monday, May 29, 2023, in observance of Memorial Day

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 604 | 13.25 |

| DEC ’23 | 534.5 | 18.5 |

| DEC ’24 | 513.25 | 11.25 |

| Soybeans | ||

| JUL ’23 | 1337.25 | 13.25 |

| NOV ’23 | 1189.5 | 17.25 |

| NOV ’24 | 1160.75 | 11.75 |

| Chicago Wheat | ||

| JUL ’23 | 604.25 | -2 |

| SEP ’23 | 629.5 | 12.25 |

| JUL ’24 | 673 | 11.75 |

| K.C. Wheat | ||

| JUL ’23 | 819.25 | 1.25 |

| SEP ’23 | 814.25 | 2.5 |

| JUL ’24 | 766.5 | 13.25 |

| Mpls Wheat | ||

| JUL ’23 | 818 | 12.5 |

| SEP ’23 | 819.25 | 11.25 |

| SEP ’24 | 783.5 | 9.25 |

| S&P 500 | ||

| JUN ’23 | 4212.75 | 53 |

| Crude Oil | ||

| JUL ’23 | 72.64 | 0.81 |

| Gold | ||

| AUG ’23 | 1965.4 | 3.1 |

Grain Market Highlights

- Fund short covering and the building of weather premium on a warm and dry outlook ahead of a long weekend pushed the corn market higher with December leading the way.

- The addition of weather premium on the warm and dry outlooks had November leading the Old Crop contracts higher, with further support coming from both soybean meal and oil.

- Led by strength in the corn market and a short fund position in the Chicago, all three wheat classes ended the day on the positive side of unchanged, with K.C. being the laggard, likely on ideas of increased crop ratings with the recent moisture in the southern Plains.

- With debt ceiling talks in Washington D.C. appearing to progress, there has been a sense of optimism that has permeated the markets and likely added a broad level of support to the commodities.

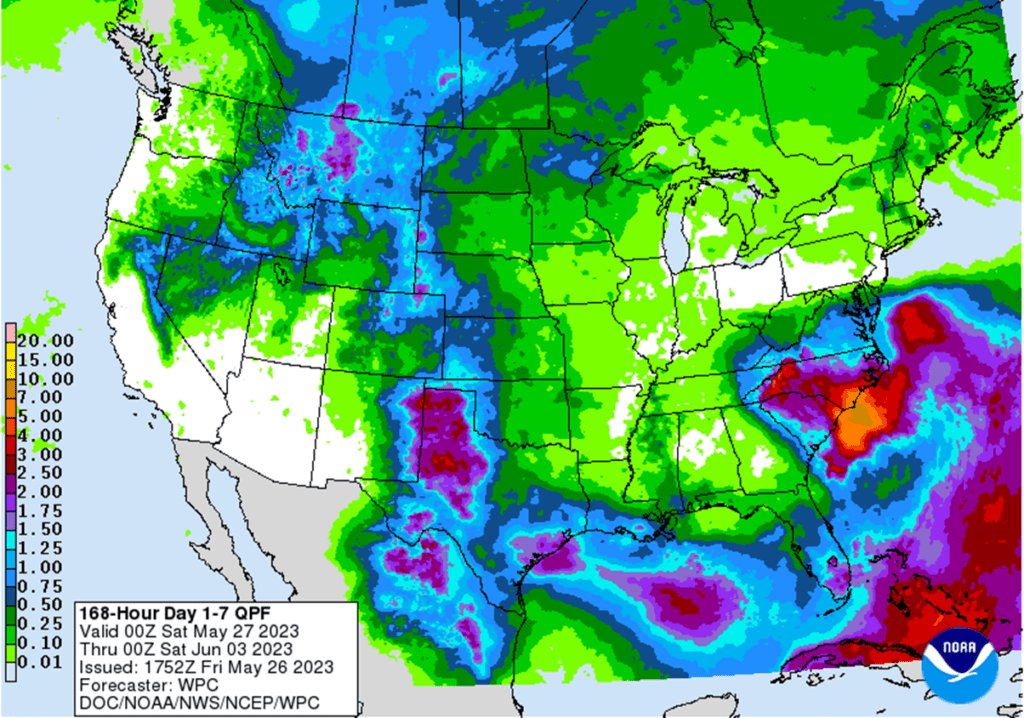

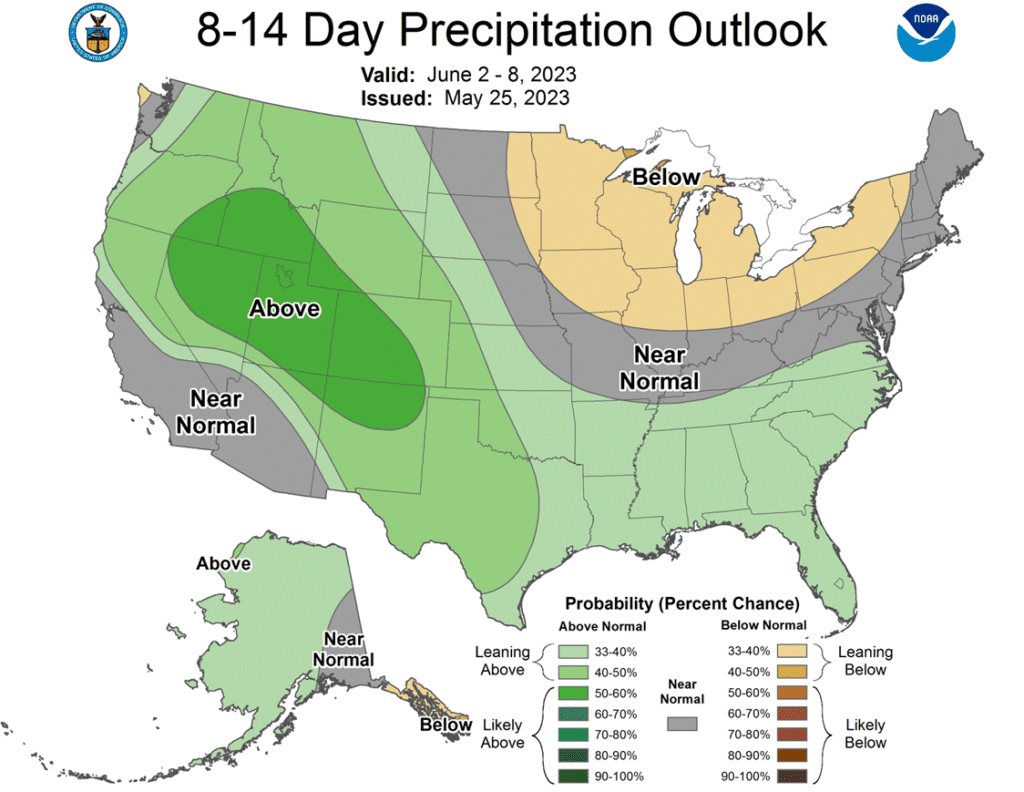

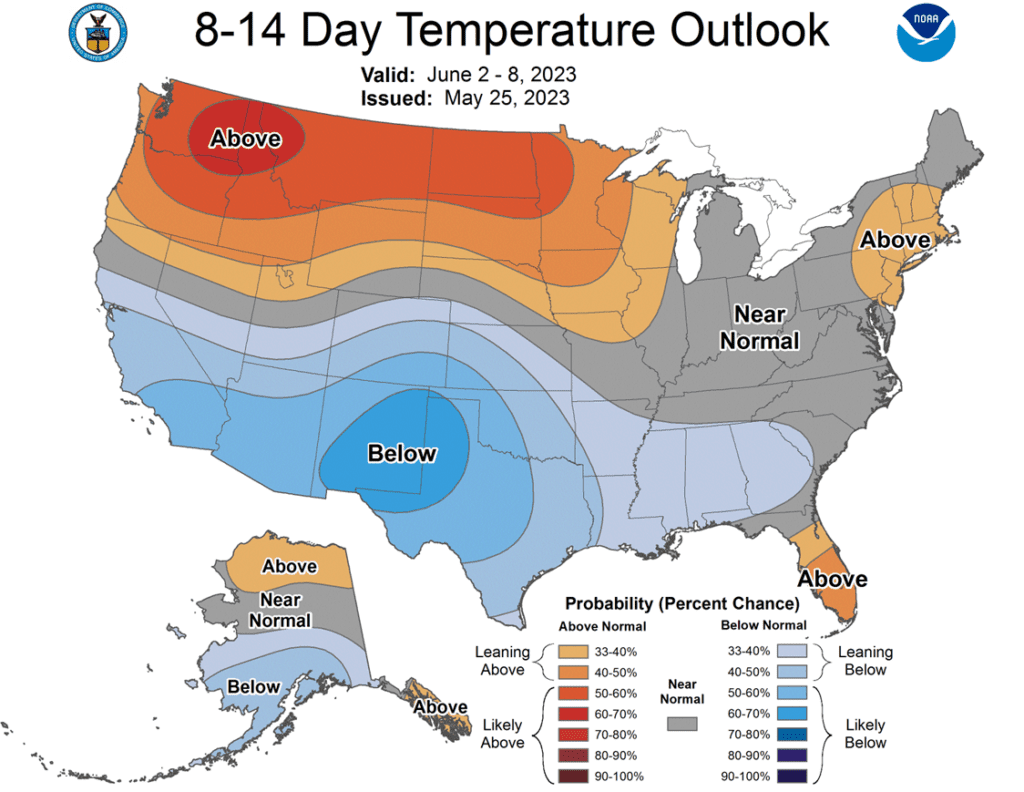

- To see updated US 7 day precipitation forecast and US 8-10 day Temperature and Precipitation Outlooks from the Climate Prediction Center, scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn touched the lower end of the target range of 575 – 600 with a high of 575-1/2, which put it 30 cents off last week’s low. If you still have Old Crop bushels to sell, consider using this rally to begin pricing some of those remaining bushels and adding incremental sales up to 600. Another thing to consider is that there is about a 65-cent inversion from the July contract to the September contract, which may be lost when bids roll from one contract to the other in the next month or so.

- No action is currently recommended for the 2023 new crop. Planting is nearly complete and the volatile weather months still ahead. December corn has dropped nearly 120 cents from its January high, and with that drop, much of the weather risk premium has eroded away. With drought still looming in the WCB and the funds carrying a 92k contract short position, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you happen to not have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Fund short covering pushed corn prices strongly higher to end the week as weather forecasts for the heart of the Corn Belt are a concern into the first week of June.

- Weather models are showing above normal temperatures and limited rainfall over the core of the Corn Belt into early June as a high-pressure ridge has developed over this region. Evaporation rates will stay high next week, which has the potential to damage the early-stage corn crop.

- Weather forecasts after Memorial Day will be key for potential precipitation to develop around the June 5-7 window. The grain markets could have a high amount of volatility based off those forecasts given the recent rally and the positioning of the Managed money funds in the corn market.

- The cash corn market stays supportive as end-users are pursuing supplies given a potential weather issue. The National Corn Index closed Friday at $6.25 with July Futures at $6.04, a discount to the index, reflecting the cash market strength.

- Demand will likely be a limiting factor as weekly exports remain poor, and the recent price rally will only add more premium to U.S. corn price versus the cheaper Brazil supplies coming online.

Above: The July contract traded through the recent high of 600 and continues to show positive momentum. If current prices can hold and close above the 50-day moving average near 613, the market would be poised to test April’s high of 647-1/2. Support below the market rests between 550 and 530, and again near the 2021 September low of 497-1/2.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- July soybeans found support last week just above the 1300 level. While the month of May has been a rough one for the soy complex, the market remains in a seasonal window conducive for upside volatility and opportunity. Given the oversold nature of the market, combined with a still tight Old Crop domestic balance, continue to hold on progressing any Old Crop sales for now.

- We recommend not adding to current sales levels for the new 2023 crop at this time. As we continue through planting season, favorable weather conditions and South American competition have pressed US prices down nearly 17% from the beginning of the year. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1350 to 1400 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans ended the week on a strong note along with higher soybean meal and oil. July beans posted a 30-cent gain on the week, while November gained 14 cents. Higher crude oil and palm oil prices were supportive as well.

- The entire grain complex got a boost today from talk of dry weather that may continue into the beginning of July, but the European weather models are calling for moderate showers in some of the Corn Belt. We will get a clearer weather picture within the next two weeks.

- While soybean meal found some much-needed technical support, soybean oil got a boost from palm oil, which had its third consecutively higher close.There is concern for drought in Malaysia and Indonesia this coming year, which may impact their production.

- Argentina will be exporting approximately 5.4 mmt less soybean meal in the coming year due to their drought ravaged crop, and there is still hope that the US will pick up some of that export business.

Above: Soybean prices have fallen to near 1300 and have found some support near 1304. The market continues to show signs of being oversold and appears to be consolidating. Stochastic indicators have crossed to the upside, which is considered positive, and could be supportive if reversal action occurs. Should the 1304 support level fail, the next area of support may be found near the July 2022 and November 2021 lows of 1288 and 1181 respectively.

Wheat

Market Notes: Wheat

- The poor US HRW crop, as well as dryness in Russian spring wheat areas, are supportive factors. However, the wheat market was likely pulled higher today, mostly by spillover from corn and soybeans; the US Midwest weather forecast looks warm and dry for the next two weeks or so and the market may be putting in some weather premium ahead of the 3 day weekend.

- Nearby contracts were weaker relative to the deferred in K.C. wheat futures today. This may be indicative of the recent rains in the panhandle areas versus supply concerns down the road, given the overall poor conditions in the southern Plains.

- There are reports that Russa may not extend the Black Sea export deal on July 17th unless demands are met regarding their grain and fertilizer exports.This may have been reflected in higher Matif wheat futures today, even though French wheat is rated 93% good to excellent.

- Taiwan flour millers are reported to have purchased 56,000 mt of US milling wheat overnight.

- The US Dollar Index continues to trend higher, and though wheat posted gains today, the rising Dollar Index may limit upside potential going forward.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. The July contract may also post its 8th consecutive down month in a row at prices not seen since early 2021, even though wheat inventories of major exporting countries are anticipated to fall to 16 year lows. With the market being this oversold and a fund net position short nearly 113k contracts, we continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No action is currently recommended for the 2024 crop. While we are looking for stronger markets to present themselves in this currently weak environment, there are factors that could be supportive, should they occur. Such as any escalation of the Ukraine war or disruption of grain movement in the Black Sea, or a significant devaluation of the US Dollar back to 2021 levels, as that market is showing characteristics of a potential drop.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: Following the recent break, the July contract posted a bullish reversal on 5/22, indicating short-term support near 807. The break below Tuesday’s (5/23) low puts the 807 support level in jeopardy, with the next major support level between 736 and 716 if it does not hold. If 807 can hold, follow-through buying may put the market in position to rally and test resistance between 885 and 917.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

- No action is recommended on the 2023 crop at this time. Wet conditions have delayed some planting and raised some prevent planting concerns which could continue to influence the market and generate better selling opportunities in the coming months. We are in no hurry to sell right now with everything going on.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract posted a bullish reversal on 5/22, indicating the market has found short-term support near 793. Technical follow-through buying could put the market in position to test resistance between 830 and 855 and then the recent high of 888-1/2. If not, support below 793 may be found between 770 and 760.

Other Charts / Weather