Grain Market Insider: May 24, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 587.25 | 9.75 |

| DEC ’23 | 520 | 3.25 |

| DEC ’24 | 505.25 | 0.75 |

| Soybeans | ||

| JUL ’23 | 1324.5 | 2 |

| NOV ’23 | 1185 | -2.75 |

| NOV ’24 | 1159.5 | -4.25 |

| Chicago Wheat | ||

| JUL ’23 | 606.25 | -16 |

| SEP ’23 | 619 | -15.5 |

| JUL ’24 | 660.25 | -13.5 |

| K.C. Wheat | ||

| JUL ’23 | 812.25 | -29.25 |

| SEP ’23 | 807.75 | -26 |

| JUL ’24 | 753.25 | -12.75 |

| Mpls Wheat | ||

| JUL ’23 | 799 | -21.75 |

| SEP ’23 | 801.5 | -22.75 |

| SEP ’24 | 764.75 | -9.5 |

| S&P 500 | ||

| JUN ’23 | 4120 | -38.75 |

| Crude Oil | ||

| JUL ’23 | 74.27 | 1.36 |

| Gold | ||

| AUG ’23 | 1985.1 | -7.7 |

Grain Market Highlights

- Corn traded both sides of unchanged in volatile trade. A dry forecast and firmer cash basis helped to support, but weakness in the wheat market dragged on prices.

- There was little supportive news for soybeans in today’s trade as continued weakness from abundant and less expensive South American supplies hung over the market, with current offers $35 – $45 per ton cheaper than the US.

- Soybean oil was the bright spot in the soybean complex as it gained support from higher crude oil, and while crush margins were weaker today, they remain profitable and supportive with Board Crush margins in the July contracts near 93 cents/bu.

- Record Illinois SRW yields estimated by the Illinois Wheat Association’s crop tour and the threat of more imports of European wheat into the US weighed heavily on the wheat complex.

- The US dollar broke out of its range to make new recent highs, which likely added resistance to commodities.

- Hawkish comments from Federal Reserve officials Bullard and Kashkari have raised expectations for a protracted period of higher interest rates, which could be supportive of the US Dollar.

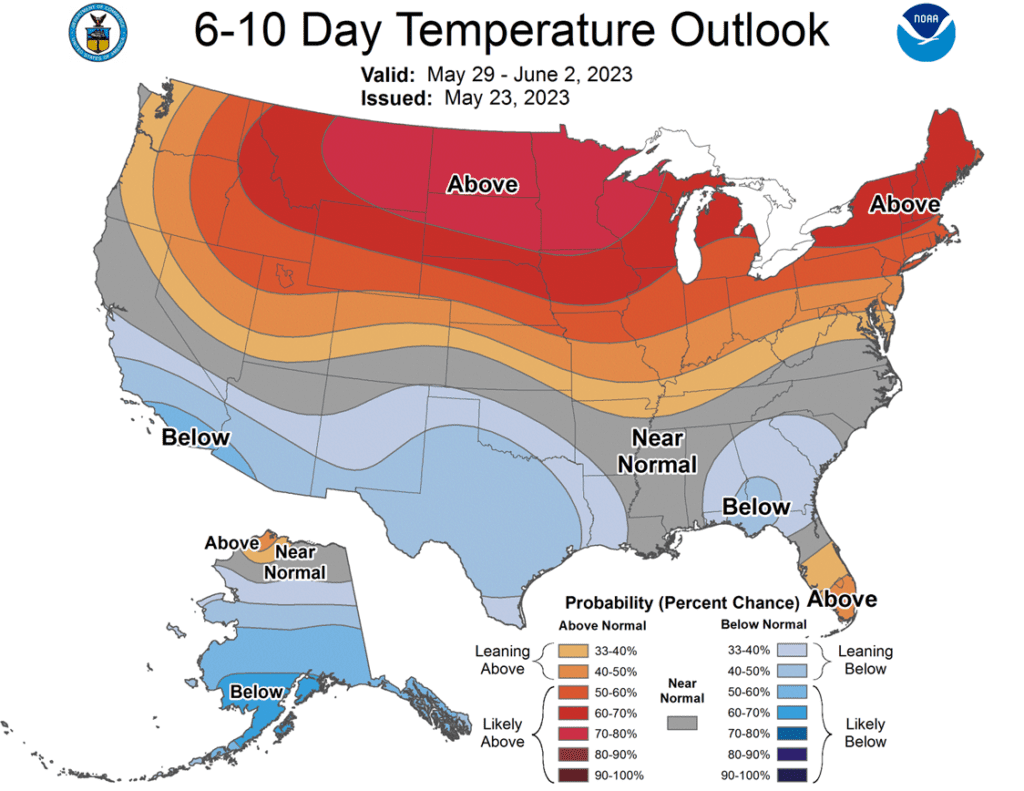

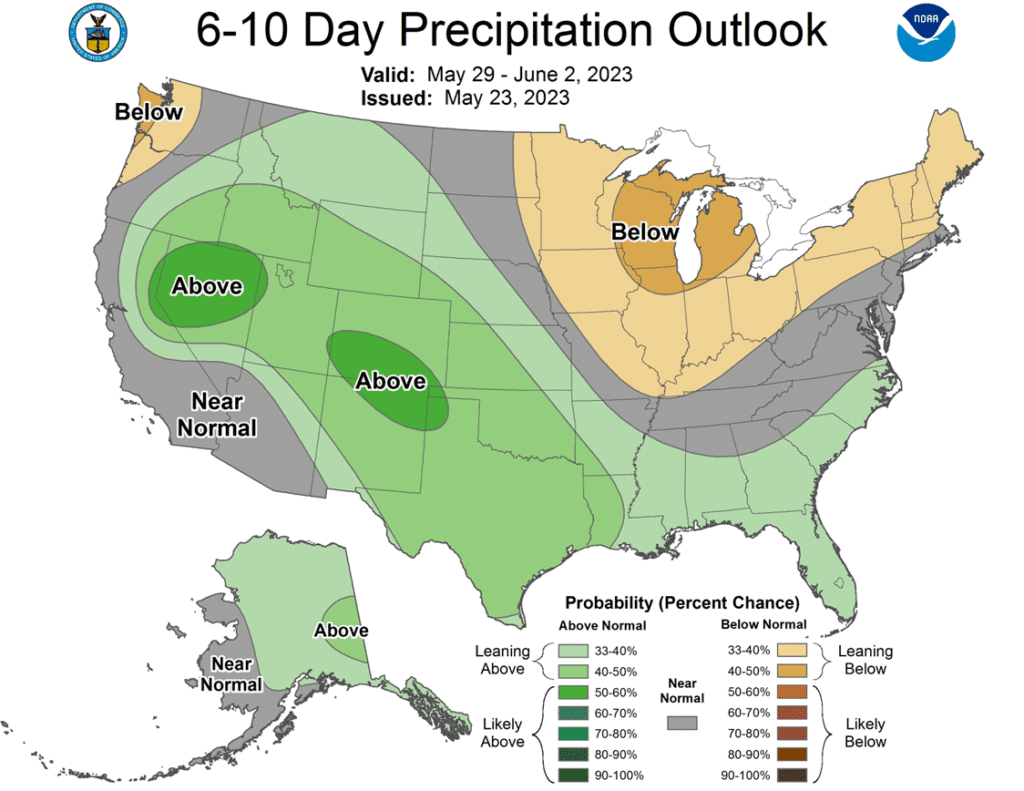

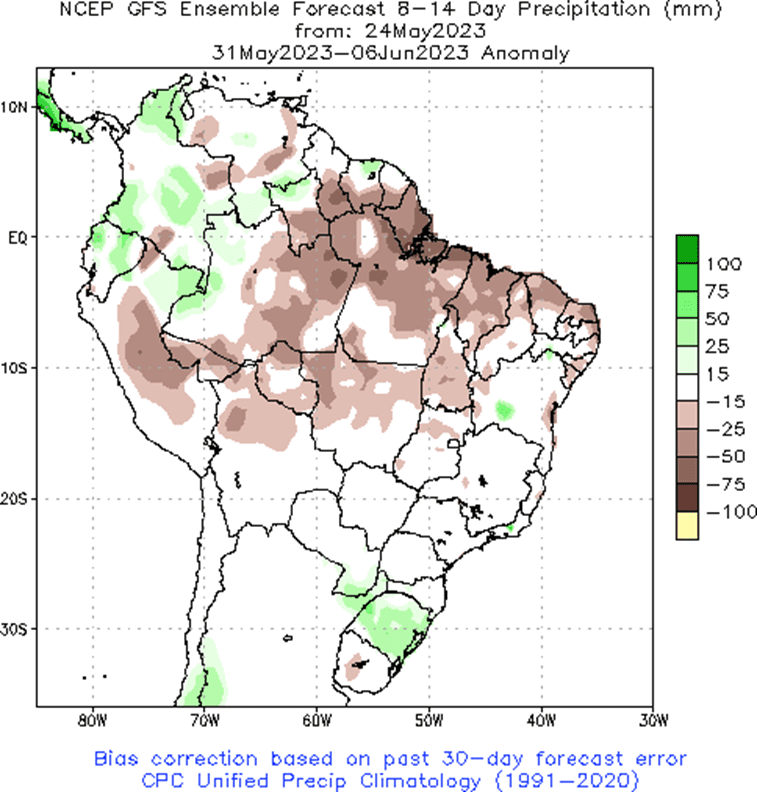

- To see the updated US 6-10 day Temperature and Precipitation Outlooks from the Climate Prediction Center, and the updated Brazil 2 week precipitation forecast, scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn touched the lower end of the target range of 575 – 600 with a high of 575-1/2, which put it 30 cents off last week’s low. If you still have Old Crop bushels to sell, consider using this rally to begin pricing some of those remaining bushels and adding incremental sales up to 600. Another thing to consider is that there is about a 65-cent inversion from the July contract to the September contract, which may be lost when bids roll from one contract to the other in the next month or so.

- No action is currently recommended for the 2023 new crop. Planting is nearly complete and the volatile weather months still ahead. December corn has dropped nearly 120 cents from its January high, and with that drop, much of the weather risk premium has eroded away. With drought still looming in the WCB and the funds carrying a 92k contract short position, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you happen to not have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Corn market fought the trend in other grains, and finished the day with moderate gains, led by the July contract. July futures were pushed higher by short covering and buying into the bull spreads, with the market watching the weather forecast for the Midwest over the next couple weeks.

- Strong selling in the wheat market and a fading soybean market throughout the session limited the corn market’s upside on the day as prices slipped off session highs.

- Weather models are showing predicted warmer temperatures and limited rainfall over the core of the Corn Belt into early June as a high-pressure ridge is developing over this region. Weather forecasts after Memorial Day will be keys for a potential precipitation to develop around the June 5-6 window.

- Ethanol margins remain strong, but corn usage for ethanol production is still behind the required pace to reach USDA target. The weekly ethanol report saw production slip to 983,000 barrels/day, down from last week and last year’s levels. A total of 96.8 mb of corn was used last week for the ethanol grind, down from 99.9 mb from last year.

- Private Brazil Crop Analyst, Agroconsult, raised their projection for the second crop Brazil corn harvest to 102.4 MMT, which is up 11% from their last projection and well above both USDA and CONAB current projections, as the overall condition of the Brazil 2nd crop corn remains strong.

Above: The corn market has recovered somewhat from being oversold, and stochastic indicators have crossed back over to the upside, which can be supportive. The July contract has found support between 550 and 530, with further support near the 2021 September low of 497-1/2. Nearby resistance sits near 600 and again near the 50-day moving average.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- July soybeans found support last week just above the 1300 level. While the month of May has been a rough one for the soy complex, the market remains in a seasonal window conducive for upside volatility and opportunity. Given the oversold nature of the market, combined with a still tight Old Crop domestic balance, continue to hold on progressing any Old Crop sales for now.

- We recommend not adding to current sales levels for the new 2023 crop at this time. As we continue through planting season, favorable weather conditions and South American competition have pressed US prices down nearly 17% from the beginning of the year. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1350 to 1400 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans ended the day mixed with the front month July higher, but all deferred contracts lower, with additional pressure coming from the decline in soybean meal.

- Soybean meal led soybeans lower today, but soybean oil moved higher despite another decline in palm oil. Higher crude oil has been supportive as Saudi Arabia hints at production cuts.

- Tomorrow’s export sales report is not expected to be very friendly for soybeans, as Brazil’s cheaper offers get scooped up on the global market. If this trend continues, the USDA will likely decrease US exports and increase the carryout.

- China is attempting to use fewer soy products and corn in favor of wheat for feed needs, which is weighing on soybean meal, but Brazil’s recent shipments of soybeans to Argentina to be crushed has hurt prices as well. The bullish thought was that the US would pick up some meal export business from Argentina due to their poor crop.

Above: Soybean prices have fallen to near 1300 and have found some support near 1304. The market continues to show signs of being oversold and appears to be consolidating. Stochastic indicators have crossed to the upside, which is considered positive, and could be supportive if reversal action occurs. Should the 1304 support level fail, the next area of support may be found near the July 2022 and November 2021 lows of 1288 and 1181 respectively.

Wheat

Market Notes: Wheat

- KC futures led the wheat complex lower today. While most of the Midwest looks drier for the next 10 days or so, parts of Oklahoma and Texas are getting good moisture. Though this moisture is perceived largely as negative, it may be too little too late to help the crop, and there is some concern that it may cause some quality issues.

- The Illinois Wheat Association crop tour came out with a record breaking 97 bushel per acre yield for Illinois’ SRW crop, versus the USDA’s estimate of 78 bpa.

- The US Dollar Index continues to trend higher, nearly reaching the 104 level today, and because it tends to have an inverse relationship with the wheat market, it may have contributed to today’s weakness.

- China has imported 6 mmt of wheat during the first four months of the year. This is up 61% from last year as they want to use more feed wheat versus corn and soybeans, with most of it sourced from Australia.

- Russia continues to dominate world wheat exports, with FOB offers cheaper than the US that are reportedly as low as $245 per ton.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. The July contract may also post its 8th consecutive down month in a row at prices not seen since early 2021, even though wheat inventories of major exporting countries are anticipated to fall to 16 year lows. With the market being this oversold and a fund net position short nearly 113k contracts, we continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No action is currently recommended for the 2024 crop. While we are looking for stronger markets to present themselves in this currently weak environment, there are factors that could be supportive, should they occur. Such as any escalation of the Ukraine war or disruption of grain movement in the Black Sea, or a significant devaluation of the US Dollar back to 2021 levels, as that market is showing characteristics of a potential drop.

Above: The July contract posted a bullish reversal on 5/23 indicating support between 593 and 565 has held so far. Any follow through buying from this reversal could trigger fund short covering and fuel a bigger bounce to test nearby resistance between 655 and 669, with further resistance near the April high of 718.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: Following the recent break, the July contract posted a bullish reversal on 5/22, indicating short-term support near 807. The break below Tuesday’s (5/23) low puts the 807 support level in jeopardy, with the next major support level between 736 and 716 if it does not hold. If 807 can hold, follow-through buying may put the market in position to rally and test resistance between 885 and 917.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

- No action is recommended on the 2023 crop at this time. Wet conditions have delayed some planting and raised some prevent planting concerns which could continue to influence the market and generate better selling opportunities in the coming months. We are in no hurry to sell right now with everything going on.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract posted a bullish reversal on 5/22, indicating the market has found short-term support near 793. Technical follow-through buying could put the market in position to test resistance between 830 and 855 and then the recent high of 888-1/2. If not, support below 793 may be found between 770 and 760.

Other Charts / Weather