Grain Market Insider: May 23, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 577.5 | 6.5 |

| DEC ’23 | 516.75 | 7.75 |

| DEC ’24 | 504.5 | 4 |

| Soybeans | ||

| JUL ’23 | 1322.5 | -18.75 |

| NOV ’23 | 1187.75 | -9.25 |

| NOV ’24 | 1163.75 | -7 |

| Chicago Wheat | ||

| JUL ’23 | 622.25 | 16 |

| SEP ’23 | 634.5 | 15.75 |

| JUL ’24 | 673.75 | 12.25 |

| K.C. Wheat | ||

| JUL ’23 | 841.5 | 15.75 |

| SEP ’23 | 833.75 | 16 |

| JUL ’24 | 766 | 13.75 |

| Mpls Wheat | ||

| JUL ’23 | 820.75 | 11.25 |

| SEP ’23 | 824.25 | 11.75 |

| SEP ’24 | 774.25 | 11.25 |

| S&P 500 | ||

| JUN ’23 | 4162.75 | -42.25 |

| Crude Oil | ||

| JUL ’23 | 72.9 | 0.85 |

| Gold | ||

| AUG ’23 | 1996.9 | 1.2 |

Grain Market Highlights

- Technical buying and carryover support from a strong wheat market helped carry corn higher on the day.

- A quick planting pace and low weekly export numbers from Monday added resistance to the market with little fresh bullish news to report.

- Soybean meal and oil finished the day in the red, which dragged on soybeans and Board crush margins in the process. Soybean oil was pressured by lower palm and rapeseed oil.

- After Monday’s bullish reversals in K.C. and Minneapolis wheat, follow-through buying in the two markets helped support oversold Chicago wheat contracts as they posted a bullish reversal in today’s trade.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn touched the lower end of the target range of 575 – 600 with a high of 575-1/2 which put it 30 cents off last week’s low. If you still have Old Crop bushels to sell, consider using this rally to begin pricing some of those remaining bushels and adding incremental sales up to 600. Another thing to consider is that there is about a 65-cent inversion from the July contract to the September contract, which may be lost when bids roll from one contract to the other in the next month or so.

- No action is currently recommended for the 2023 new crop. Planting is nearly complete and the volatile weather months still ahead. December corn has dropped nearly 120 cents from its January high, and with that drop, much of the weather risk premium has eroded away. With drought still looming in the WCB and the funds carrying a 92k contract short position, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you happen to not have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Following through on Monday’s rally, corn and wheat found technical buying strength on Tuesday, as prices finished higher with moderate gains. The corn market is still lacking overall bullish news, but prices are oversold and ready for a technical bounce.

- Corn market may be adding some weather premium as forecasts show above average temperatures and below average moisture across the Corn Belt going into early June. Rain chances are limited in the near-term forecast, but a potential storm system for the week of June 5 may be a key potential rainfall for the Corn Belt.

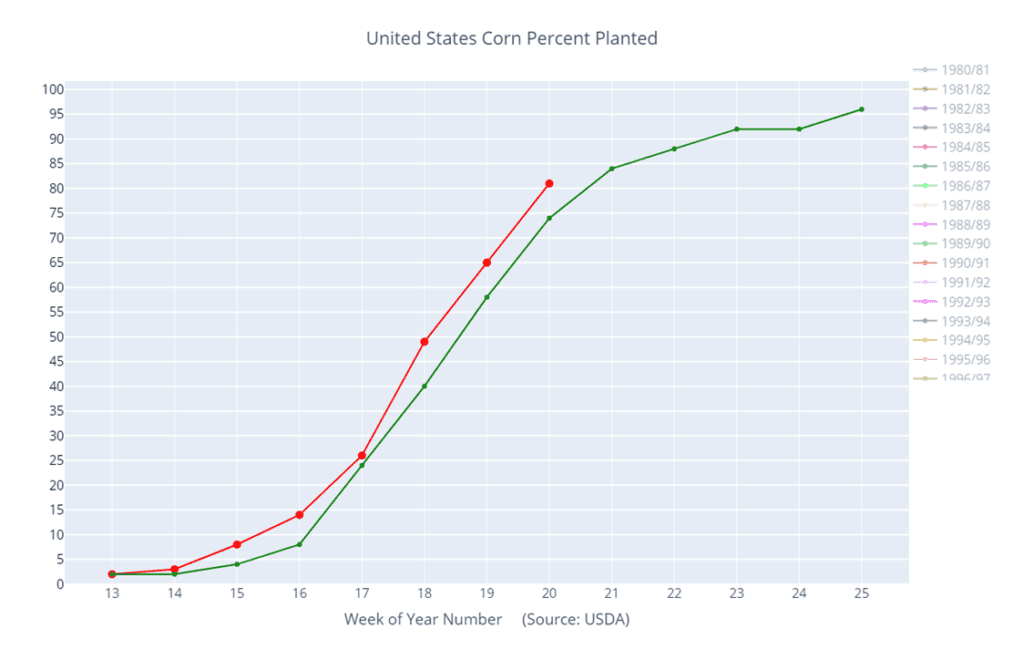

- The USDA reported that corn planting was 81% complete as of May 21, up from 65% last week. North Dakota remains a laggard at 36% complete versus the 5-year average of 50%. It is estimated approximately 2.6 million corn acres are unplanted as of May 21 with prevent plant date on May 25.

- Demand news is still a concern. Weekly ethanol statistics will be released on Wednesday, and the market will be looking for an uptick in the usage of corn used to produce ethanol. This usage category is also trailing the pace needed to reach the USDA’s market year target.

Above: The corn market has recovered somewhat from being oversold, and stochastic indicators have crossed back over to the upside which can be supportive. The July contract has found support between 550 and 530, with further support near the 2021 September low of 497-1/2. Nearby resistance sits near 600 and again near the 50-day moving average.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- July soybeans found support last week just above the 1300 level. While the month of May has been a rough one for the soy complex, the market remains in a seasonal window conducive for upside volatility and opportunity. Given the oversold nature of the market, combined with a still tight Old Crop domestic balance, continue to hold on progressing any Old Crop sales for now.

- We recommend not adding to current sales levels for the new 2023 crop at this time. As we continue through planting season, favorable weather conditions and South American competition have pressed US prices down nearly 17% from the beginning of the year. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1350 to 1400 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans closed lower along with both soybean meal and oil. The move comes due to lower palm oil futures and planting pace that is ahead of schedule, despite higher crude oil prices.

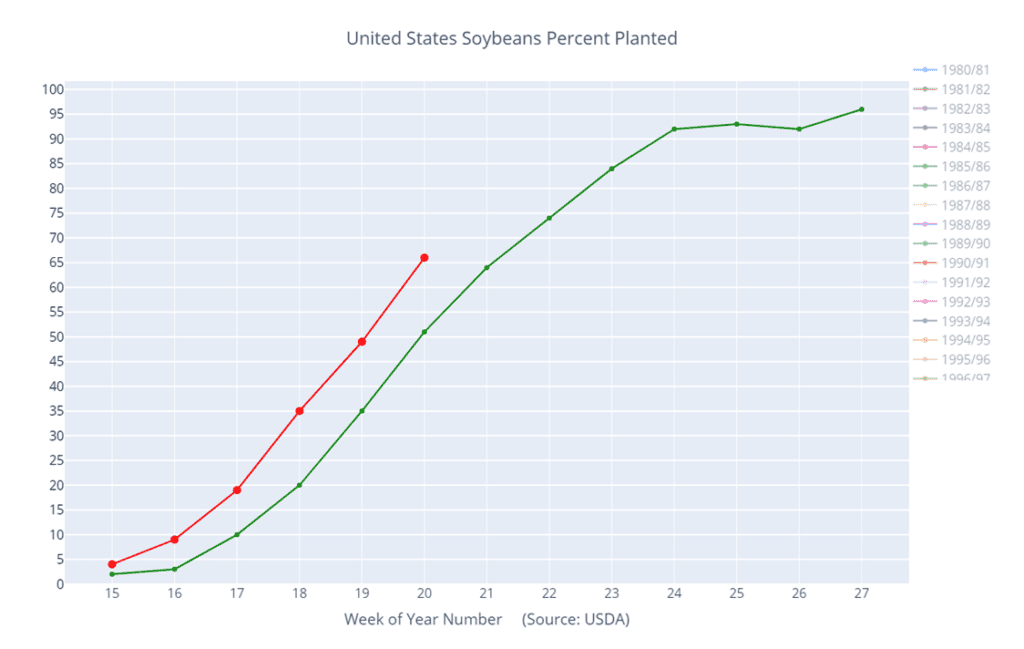

- The USDA reported that 66% of the soybean crop has been planted as of May 21, and 36% has emerged. Planting is 10 percentage points ahead of where it was in 2016, which was the year the US recorded the highest soybean yield.

- The planting delays in North Dakota may provide the market with some support as they are only 20% planted due to wet fields. Apart from North Dakota, the US is on track for a large crop.

- Reports of Chinese cancellations of palm oil purchases and a large EU rapeseed crop added resistance to soybean oil, and soybeans.

- Non-commercials sold an estimated 4,000 contracts of soybeans and 5,000 contracts of soybean products, and at this point they may have taken a net short position in soybeans.

Above: While July soybeans posted a bearish reversal on 5/08 and have continued to follow through to the downside, the market is showing signs of being oversold, which could be supportive if reversal action occurs. The next area of support may be found near 1288 and 1181, the July 2022 and November 2021 lows respectively. Nearby resistance may be found between 1420 and 1450, and again near 1500.

Wheat

Market Notes: Wheat

- Leading the way in the grain complex, all three wheat classes posted double digit gains despite reports of an additional 210k mt of EU wheat being imported into the US.

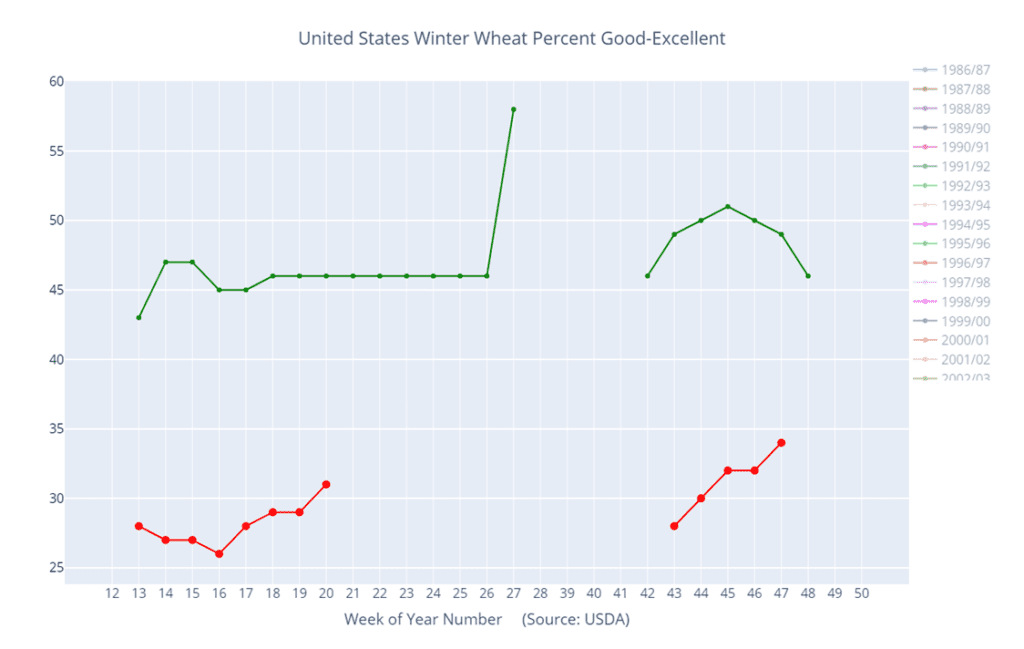

- The USDA reported that 31% of the winter wheat crop was rated good to excellent, up 2% from last week, and 61% of the crop is headed, versus 49% last week, in line with the 5-year average.

- Winter wheat condition is rated only 10% good to excellent in both Kansas and Oklahoma, reiterating the fact that the crop is struggling in the southwestern Plains.

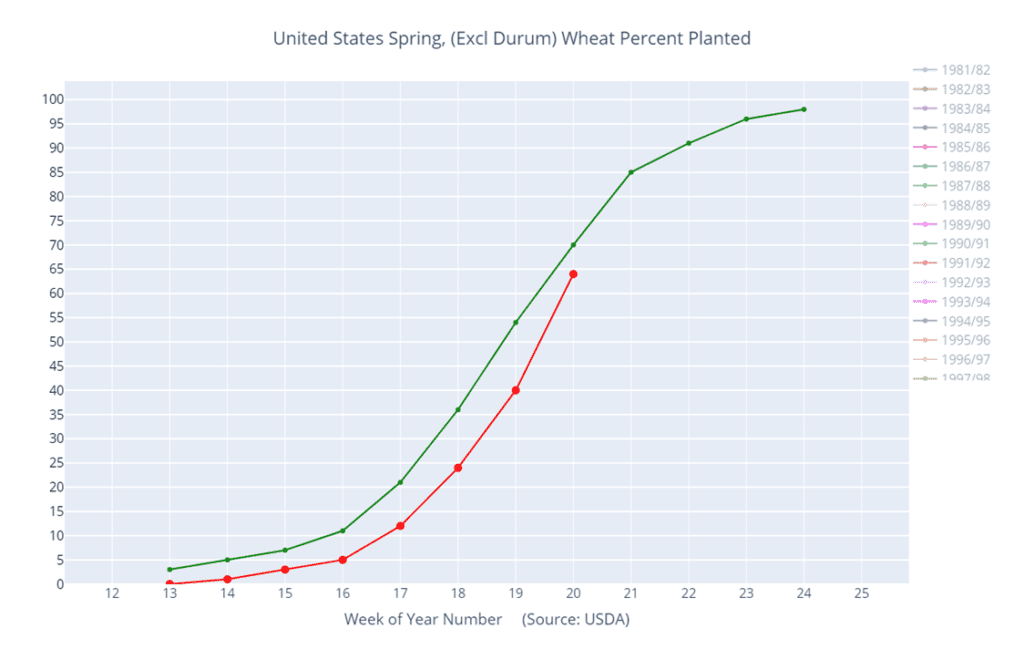

- The USDA reported that 64% of the spring wheat crop was planted as of May 21, versus 40% last week, down from the average of 73%.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. The July contract may also post its 8th consecutive down month in a row at prices not seen since early 2021, even though wheat inventories of major exporting countries are anticipated to fall to 16 year lows. With the market being this oversold and a fund net position short nearly 113k contracts, we continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No action is currently recommended for the 2024 crop. While we are looking for stronger markets to present themselves in this currently weak environment, there are factors that could be supportive, should they occur. Such as any escalation of the Ukraine war or disruption of grain movement in the Black Sea, or a significant devaluation of the US Dollar back to 2021 levels, as that market is showing characteristics of a potential drop.

Above: The July contract posted a bullish reversal on 5/23 indicating support between 593 and 565 has held so far. Any follow through buying from this reversal could trigger fund short covering and fuel a bigger bounce to test nearby resistance between 655 and 669, with further resistance near the April high of 718.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: Following the recent break, the July contract posted a bullish reversal on 5/22, indicating short-term support near 807. With follow-through buying, the market may be in a position to test resistance between 885 and 917. Below the market, further support may be found between 736 and 716.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

- No action is recommended on the 2023 crop at this time. Wet conditions have delayed some planting and raised some prevent planting concerns which could continue to influence the market and generate better selling opportunities in the coming months. We are in no hurry to sell right now with everything going on.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract posted a bullish reversal on 5/22, indicating the market has found short-term support near 793. Technical follow-through buying could put the market in position to test resistance between 830 and 855 and then the recent high of 888-1/2. If not, support below 793 may be found between 770 and 760.