Grain Market Insider: May 2, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 580 | -4.5 |

| DEC ’23 | 519.75 | -5.5 |

| DEC ’24 | 515.25 | -5.25 |

| Soybeans | ||

| JUL ’23 | 1410.75 | -16.75 |

| NOV ’23 | 1267.25 | -7.75 |

| NOV ’24 | 1231 | -1.5 |

| Chicago Wheat | ||

| JUL ’23 | 609.25 | -9 |

| SEP ’23 | 620.5 | -9.5 |

| JUL ’24 | 659.25 | -8 |

| K.C. Wheat | ||

| JUL ’23 | 740.25 | -17 |

| SEP ’23 | 735.75 | -19.5 |

| JUL ’24 | 726.75 | -13 |

| Mpls Wheat | ||

| JUL ’23 | 773.5 | -17.5 |

| SEP ’23 | 776.5 | -17.25 |

| SEP ’24 | 760 | -7.75 |

| S&P 500 | ||

| JUN ’23 | 4129.5 | -56.25 |

| Crude Oil | ||

| JUL ’23 | 71.55 | -3.96 |

| Gold | ||

| AUG ’23 | 2043.8 | 32.4 |

Grain Market Highlights

- The lack of threatening weather and a risk off mentality in outside markets, especially crude oil, led the corn market lower.

- Soybeans traded lower today as planting gets off to a swift start. The USDA is estimating plantings at 19% complete.

- Soybean meal traded lower on record production from the March census crush report, while soybean oil found support, despite record production, from lower-than-expected stocks.

- All three wheat classes closed lower on improved winter wheat ratings.

- Concerns regarding the US banking sector, debt ceiling and higher interest rates weighed on outside markets in a risk off type of trade, which likely bled over and added pressure to the grain markets.

Note – For the best viewing experience, some Grain Market Insider content may be best viewed in horizontal mode.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

New Alert

Enter(Buy) DEC ’23 Calls:

560 @ ~ 22c & 610 @ ~ 12c

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. At this point in the crop marketing year most, if not all, of your Old Crop 2022 corn should be sold out. With the substantial inverse between old and new crop contract months, large rallies for Old Crop corn may be difficult to come by as we move forward. Consider using 40 to 50-cent rallies to sell any remaining inventory.

- For 2023 New Crop corn, Grain Market Insider recommends buying December ‘23 560 and December ‘23 610 calls in equal quantities. The December corn contract is extremely oversold and has left tails on the daily pricing chart indicating that it is finding support near the 520 area. Additionally, with the market approximately 50 cents off the recent high and 115 cents off the fall high, it has eroded enough risk premium ahead of the long growing season that call valuations look attractive here.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Risk off trade across many markets weighed on corn prices. The market saw money flow out of corn as fear of the looming debt ceiling and fed interest rate announce on Wednesday led to broad based selling.

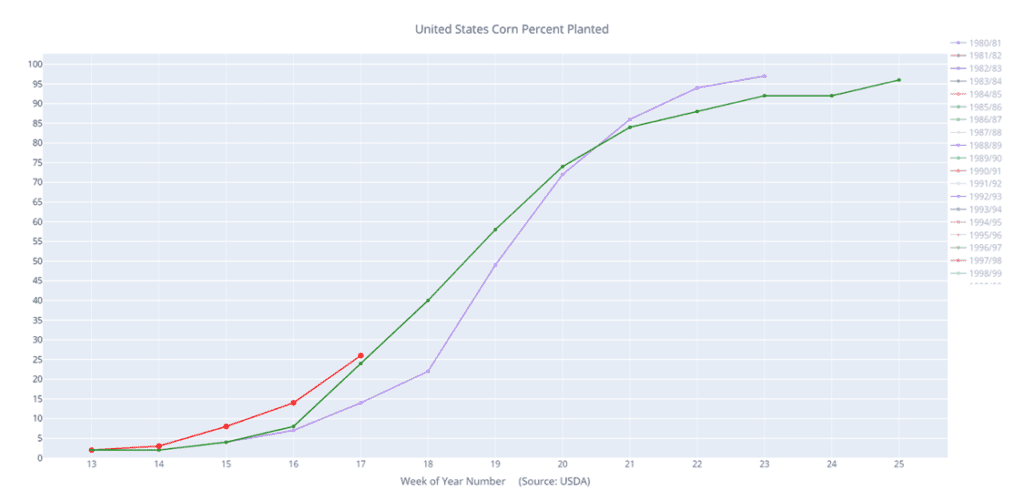

- USDA Crop Progress report showed corn planting at 26% completed, even with the 5-year average, and slightly below market expectations. Cold temperatures continue to limit planting pace in the Northern and Western Corn Belt states, but Southern planting progress has been strong.

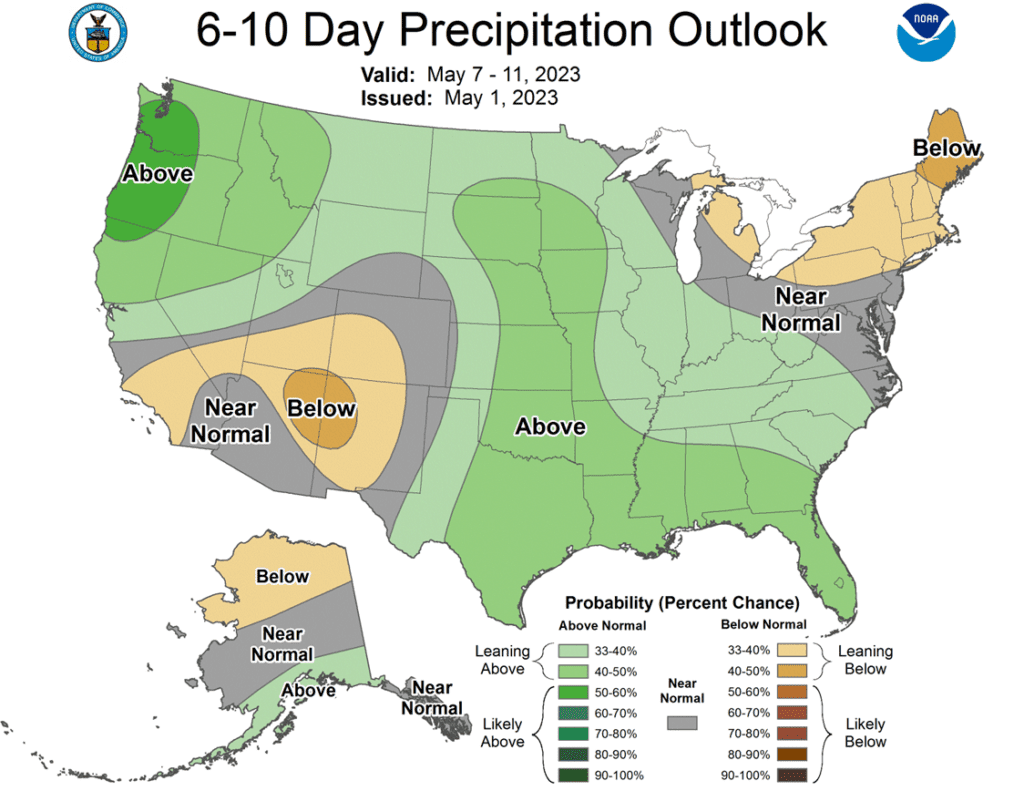

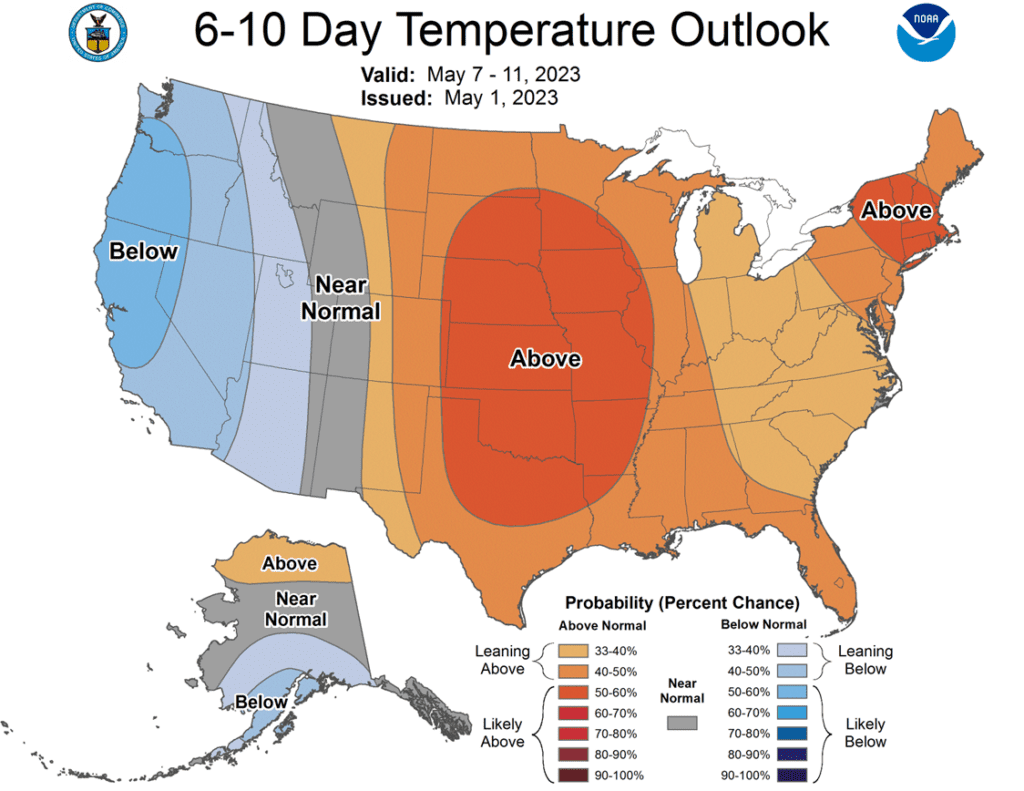

- Planting should start to pick up more in some areas as forecasts are calling for warmer and drier weather into the second week of May for the Northern and Eastern Corn Belt.

- Demand concerns remain an overall concerning theme for the corn market as export activity and corn bushels used for weekly ethanol production are running behind USDA forecasts. This brings fear that the USDA will make further demand adjustments on the May 12 WASDE report, potentially increasing corn carry out projections.

Above: The market is severely oversold and has exhibited a reversal after making a new low for the move, indicating short-term selling may be exhausted, which could be seen as supportive. Nearby resistance sits near 612 and again near the 50-day moving average, while support for the July contract rests near the recent low of 572.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- We recommend holding current sales levels for Old Crop. We are beginning to push into the May-June seasonal window of opportunity, where prices could bounce as processors begin to push to keep supplies flowing.

- We recommend not adding to current sales levels for the new 2023 crop at this time. Our research indicates there is about a 74% likelihood of improved prices moving into the June time frame. Also, weather conditions will begin to dominate the market as we begin to move through planting and into the growing season, and we may consider recommending sales in the 1400 to 1450 area if any significant concerns arise.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans were higher for most of the day but ultimately turned sharply lower, as crude oil declined suddenly to a loss of nearly 4 dollars a barrel.

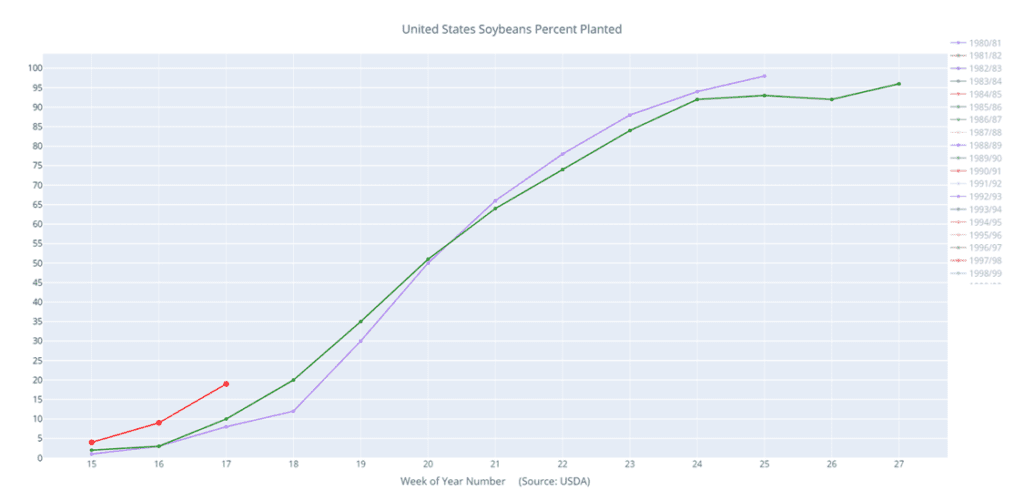

- Soybean plantings in the US are ahead of pace at 19%, while the 5-year average is 11%. Illinois and Iowa are leading the way with the benefit of better planting conditions.

- Tomorrow’s Federal Reserve announcement for interest rate changes likely put pressure on crude oil today and therefore soybeans. The Fed is expected to increase rates by 25 basis points, but there is a small chance of no change due to the most recent banking failure.

- While export demand remains sluggish, domestic demand is still firm thanks to the still profitable crushing margins. There have been no deliveries so far against May soybeans or soybean meal, which is a testament to the tight supplies.

Above: July soybeans have reversed and closed lower after making a new high for the move, which could lead to profit taking and possibly lower prices. Support lies near the recent low of 1396 with further support near 1350. Should support hold and buyers enter the market, resistance may be found between 1450 and 1460, and again near 1500.

Wheat

Market Notes: Wheat

- After strength earlier in the session, wheat closed lower in all three US futures classes. Paris milling wheat futures were also sharply lower at the close.

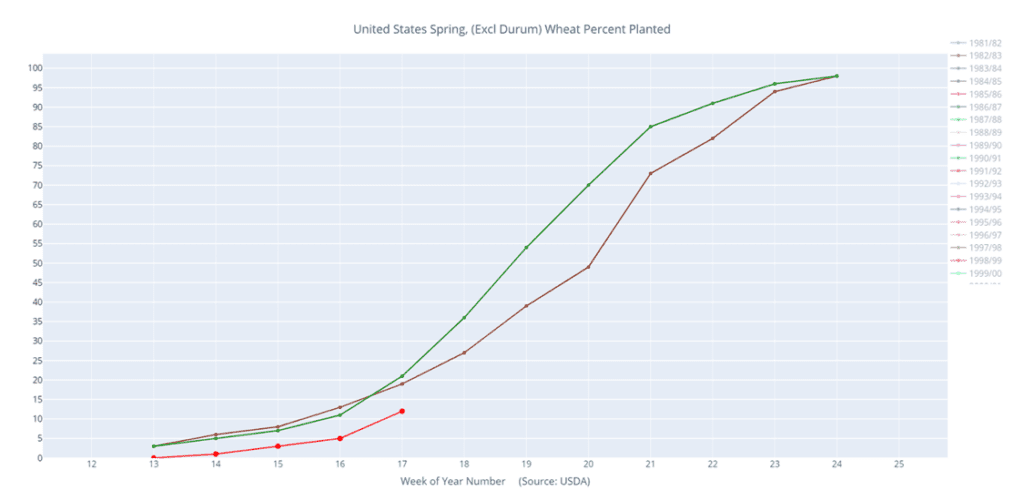

- The USDA’s Crop Progress report showed spring wheat was 12% planted vs 22% average. Additionally, winter wheat condition was rated 28% good to excellent (up 2% from last week).

- As of this writing, crude oil is down roughly $4 per barrel, and the Dow is down about 450 points. This outside market pressure may have spilled over into the grains today.

- The Fed is expected to raise interest rates by one quarter percent at the FOMC meeting this week. This could, in part, be offering weakness to financial and commodity markets.

- Further rains are needed in the US Southern Plains. In Kansas the winter wheat poor to very poor crop rating is at 64% (2% worse than last week).

- Egypt’s GASC is tendering for wheat. With the recent drop in price, they could look to source it from the US. However, the freight costs may be the deciding factor.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. At this point in the crop marketing year most, if not all, of your Old Crop 2022 wheat should be sold out. With large rallies difficult to come by at this time of year, consider using 40 to 50-cent rallies to sell any remaining inventory.

- We recommend not taking any action on the 2023 crop at this time. Corn and K.C. wheat are near historic premiums to Chicago wheat, which could lend support to the Chicago contracts if HRW production concerns persist, or if any production concerns develop for corn.

- No action is currently recommended for the 2024 crop. While we are looking for stronger markets to present themselves in this currently weak environment, there are factors that could be supportive, should they occur. Such as any escalation of the Ukraine war or disruption of grain movement in the Black Sea, or a significant devaluation of the US Dollar back to 2021 levels, as that market is showing characteristics of a potential drop.

Above: The market broke below the March low of 654 and is oversold. Initial resistance could be found near 668 and again between 718 and 724, while key support may be found near 592.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist despite recent the recent rain. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: The short-term trend is down, and the July contract is oversold, which could be supportive should buyers enter the market. Support may be found near 742 with further chart support near 690. Initial resistance lies between 835 and 850 and then near 886.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. We look for better pricing opportunities for the 2022 crop with potential planting concerns and a seasonal tendency for better prices as we move through springtime.

- No action is recommended on the 2023 crop at this time. The snowy and cold winter has given rise to wet conditions and planting concerns which may present good selling opportunities in the coming weeks.

- We continue to be patient to market any of the 2024 crop. Due to the lack of liquidity for the 2024 crop, there may not be any recommendations until late spring or early summer. This is the time for patience, not action.

Above: The short-term trend is down, though the July contract is oversold, which can be supportive should buying return to the market. Nearby support may be found near 778 and again near 760, while resistance may be found near 870 and 895.

Other Charts / Weather