Grain Market Insider: May 1, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 584.5 | -0.5 |

| DEC ’23 | 525.25 | -2.5 |

| DEC ’24 | 520.5 | -2.75 |

| Soybeans | ||

| JUL ’23 | 1427.5 | 8.25 |

| NOV ’23 | 1275 | 11.5 |

| NOV ’24 | 1232.5 | 13.25 |

| Chicago Wheat | ||

| JUL ’23 | 618.25 | -15.5 |

| SEP ’23 | 630 | -15 |

| JUL ’24 | 667.25 | -9.25 |

| K.C. Wheat | ||

| JUL ’23 | 757.25 | -19 |

| SEP ’23 | 755.25 | -18.5 |

| JUL ’24 | 739.75 | -11.25 |

| Mpls Wheat | ||

| JUL ’23 | 791 | -12.75 |

| SEP ’23 | 793.75 | -13 |

| SEP ’24 | 767.75 | -11.25 |

| S&P 500 | ||

| JUN ’23 | 4187.25 | -1.25 |

| Crude Oil | ||

| JUL ’23 | 75.61 | -1 |

| Gold | ||

| AUG ’23 | 2010.2 | -8.1 |

Grain Market Highlights

- Corn traded lower to begin the week with pressure coming from good planting weather ahead and a lower wheat market, while tight on-hand supplies supported the nearby contracts.

- Soybeans found strength following Friday’s reversal higher as last week’s short sellers continued to cover their positions.

- Despite weaker palm and crude oil markets, and less expensive South American meal offers, soybean oil and meal closed mid-range and on the positive side of unchanged, while adding support to soybeans.

- All three wheat classes closed lower today from follow through selling on expected crop improvements from last week’s rain and that more is forecasted for this week.

- Likely adding some pressure to the corn and wheat markets, the US Dollar traded higher today in anticipation of another 0.25% rate hike by the Federal Reserve on Wednesday.

Note – For the best viewing experience, some Grain Market Insider content may be best viewed in horizontal mode.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. At this point in the crop marketing year most, if not all, of your Old Crop 2022 corn should be sold out. With the substantial inverse between old and new crop contract months, large rallies for Old Crop corn may be difficult to come by as we move forward. Consider using 40 to 50-cent rallies to sell any remaining inventory.

- Be patient to take further action for New Crop. We are moving into a time of year when we may be looking for option buying opportunities given the market is very oversold and weather-related issues could pop up at any time to move the market significantly. Additionally, owning both calls and puts could be warranted depending on market conditions and volatility.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- The corn market saw choppy, pressured trade overall to start the week, with support staying in the old crop due to potential tighter supplies helping support the front end of the market. The lack of deliveries against the May futures reflects this tighter old crop corn supply picture.

- Strong selling pressure in the wheat markets limited the potential gains in the corn futures market as wheat futures broke to new nearby lows to start the week.

- Weather forecasts are turning more favorable for improved planting pace, as recent cold temperatures likely limited planting in the north and northwestern corn belt this past week.

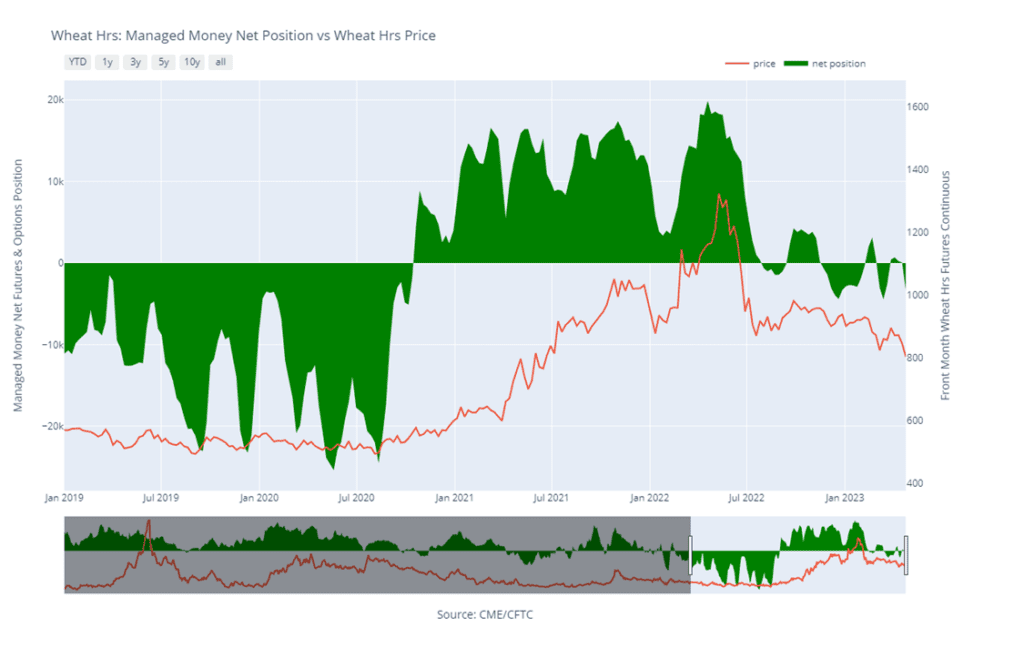

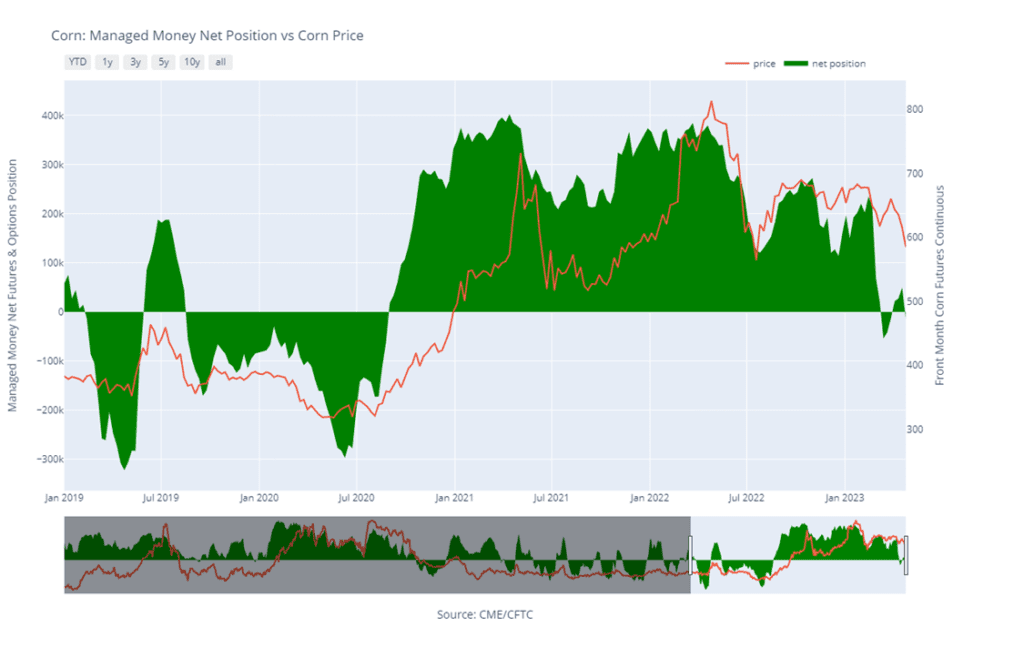

- Money flow is a concern in the corn markets as managed money funds moved back to a net short position in the corn markets of 15,297 short contracts, selling over 64,000 net corn positions last week.

- Weekly export inspections for corn were strong this week at 1.518 MMT, which was a market year high. Despite the strong shipment week, export inspections are still down 35% year-over-year.

Above: The market is severely oversold and has exhibited a reversal after making a new low for the move, indicating short-term selling may be exhausted, which could be seen as supportive. Nearby resistance sits near 612 and again near the 50-day moving average, while support for the July contract rests near the recent low of 572.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

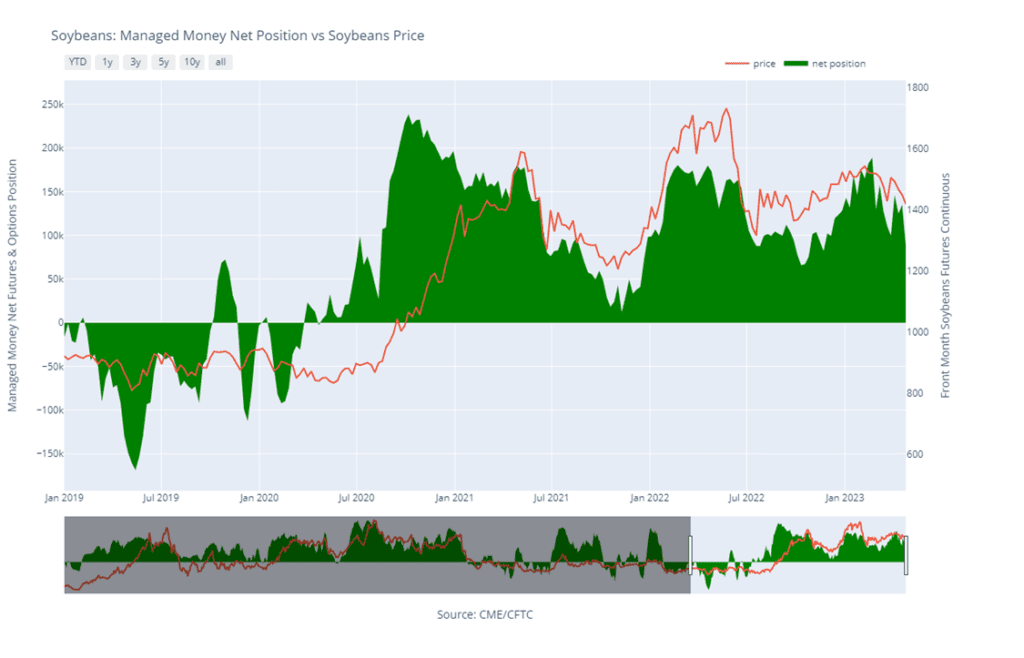

- We recommend holding current sales levels for Old Crop. We are beginning to push into the May-June seasonal window of opportunity, where prices could bounce as processors begin to push to keep supplies flowing.

- We recommend not adding to current sales levels for the new 2023 crop at this time. Our research indicates there is about a 74% likelihood of improved prices moving into the June time frame. Also, weather conditions will begin to dominate the market as we begin to move through planting and into the growing season, and we may consider recommending sales in the 1400 to 1450 area if any significant concerns arise.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans kept their momentum from Friday and moved higher again today with support from both soybean meal and oil.

- While lower crude oil pressured soybean oil earlier in the day, bean oil recovered to close on the positive side of unchanged.

- Basis for Brazilian soybeans appears to have put in a bottom and has rallied between 30 and 50 cents in the last week. Farmers initially sold everything they could not store but are now holding onto what they can to avoid making sales below their cost of production.

- Argentina’s soy-dollar incentive to get farmers to make cash sales has not worked nearly as well as it did the two previous times and has resulted in sales of just 2 mmt. Argentinian farmers are keen to hold on to their old crop due to the drought which significantly cut into production.

- Soybean inspections were on the lighter side last week with 14.8 mb inspected for export. Total inspections are now at 1,744 mb and are even with the previous year. The USDA is estimating soybean exports at 1.990 bb for 22/23, which is down 8% from the previous year.

Above: The market has retraced itself back to the March lows and has exhibited a reversal after making a new low for the move. This reversal indicates short-term selling may be exhausted and could be seen as supportive. Support lies near the recent low of 1396 with further support near 1350. Should support hold and buyers enter the market, resistance may be found between 1450 and 1460, and again near 1500.

Wheat

Market Notes: Wheat

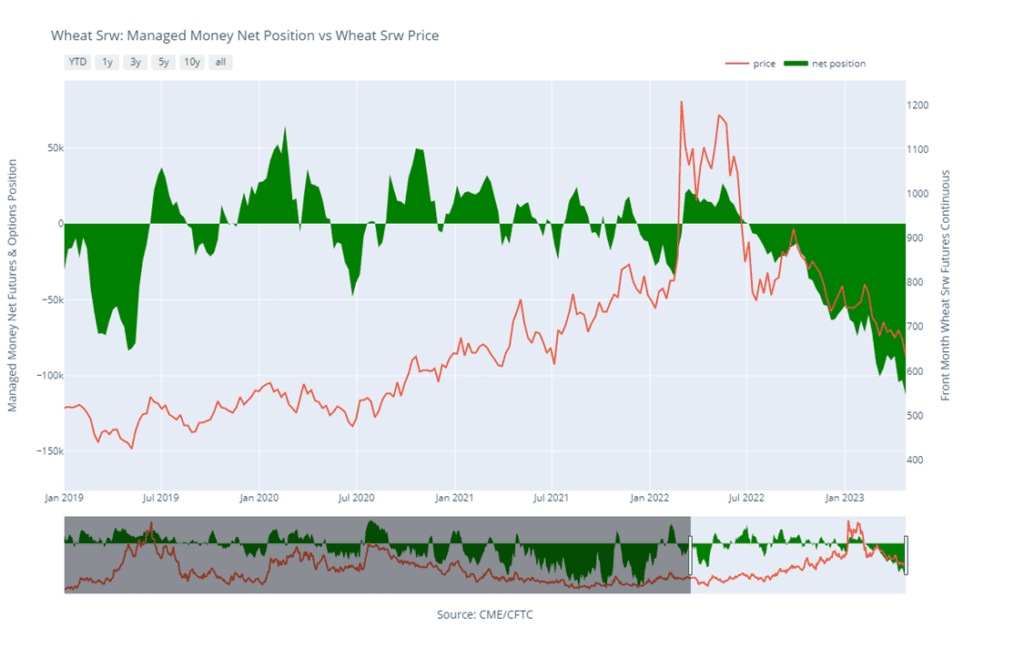

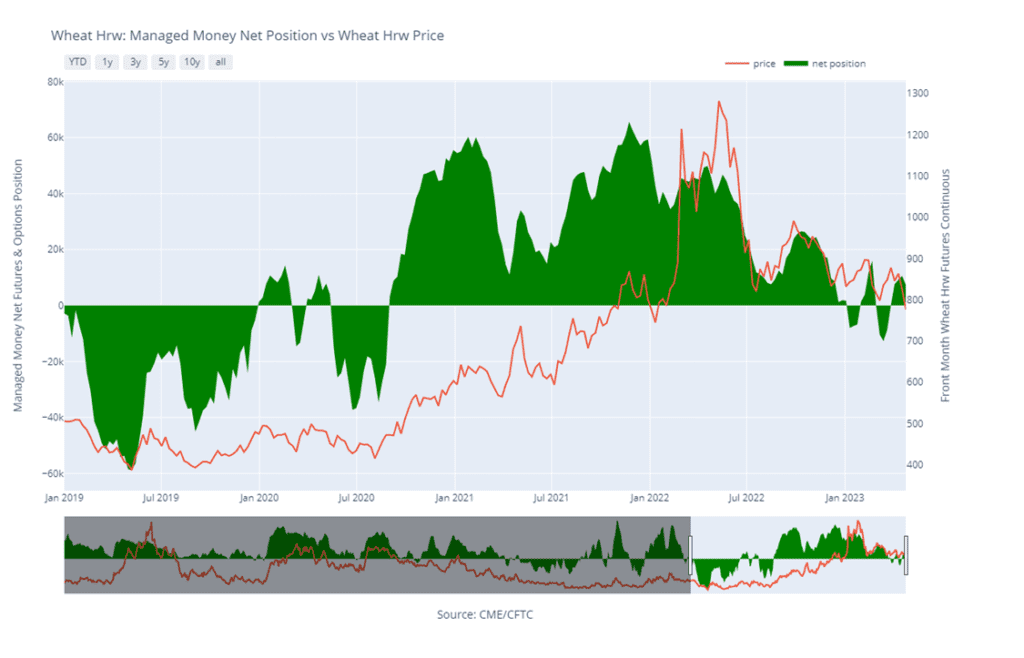

- The managed funds are said to have sold 146,000 grain contracts in total last week. With all three US wheat classes posting double-digit losses, it is likely that they continued to add to shorts today.

- Spring wheat planting conditions should improve mid to late week, with temperatures in the Dakotas expected to reach the 70s.

- The EU struck a deal with several eastern European countries: Five nations will ban imports of Ukrainian grain to maintain profitability for their farmers, but they will allow the grain to be transported westward to other countries through their regions.

- At this point in time, it does not seem like Russia intends to renew the Black Sea Grain Initiative. The current deal is set to expire on May 18.

- Wheat inspections of 13.2 mb for the week bring total 22/23 inspections to 671 mb. That is down 3% from last year.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. At this point in the crop marketing year most, if not all, of your Old Crop 2022 wheat should be sold out. With large rallies difficult to come by at this time of year, consider using 40 to 50-cent rallies to sell any remaining inventory.

- We recommend not taking any action on the 2023 crop at this time. Corn and K.C. wheat are near historic premiums to Chicago wheat, which could lend support to the Chicago contracts if HRW production concerns persist, or if any production concerns develop for corn.

- No action is currently recommended for the 2024 crop. While we are looking for stronger markets to present themselves in this currently weak environment, there are factors that could be supportive, should they occur. Such as any escalation of the Ukraine war or disruption of grain movement in the Black Sea, or a significant devaluation of the US Dollar back to 2021 levels, as that market is showing characteristics of a potential drop.

Above: The market broke below the March low of 654 and is oversold. Initial resistance could be found near 668 and again between 718 and 724, while key support may be found near 592.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist despite recent the recent rain. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: The short-term trend is down, and the July contract is oversold, which could be supportive. Support may be found near 753 and again near 742, while initial resistance lies between 835 and 850 and then near 886.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. We look for better pricing opportunities for the 2022 crop with potential planting concerns and a seasonal tendency for better prices as we move through springtime.

- No action is recommended on the 2023 crop at this time. The snowy and cold winter has given rise to wet conditions and planting concerns which may present good selling opportunities in the coming weeks.

- We continue to be patient to market any of the 2024 crop. Due to the lack of liquidity for the 2024 crop, there may not be any recommendations until late spring or early summer. This is the time for patience, not action.

Above: The short-term trend is down, though the July contract is oversold, which can be supportive should buying return to the market. Nearby support may be found near 778 and again near 760, while resistance may be found near 870 and 895.