Grain Market Insider: June 8, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 610.25 | 6 |

| DEC ’23 | 533 | 2.25 |

| DEC ’24 | 509.25 | 5.25 |

| Soybeans | ||

| JUL ’23 | 1363.25 | 2.5 |

| NOV ’23 | 1189 | 10.5 |

| NOV ’24 | 1146.75 | 12.25 |

| Chicago Wheat | ||

| JUL ’23 | 626.25 | 9.5 |

| SEP ’23 | 639 | 11.25 |

| JUL ’24 | 685 | 11 |

| K.C. Wheat | ||

| JUL ’23 | 804.75 | 16.75 |

| SEP ’23 | 803.75 | 17.75 |

| JUL ’24 | 767.5 | 15.25 |

| Mpls Wheat | ||

| JUL ’23 | 813.75 | 19.75 |

| SEP ’23 | 817 | 20.5 |

| SEP ’24 | 770 | -15 |

| S&P 500 | ||

| SEP ’23 | 4339.25 | 22 |

| Crude Oil | ||

| AUG ’23 | 71.38 | -1.26 |

| Gold | ||

| AUG ’23 | 1978.6 | 20.2 |

Grain Market Highlights

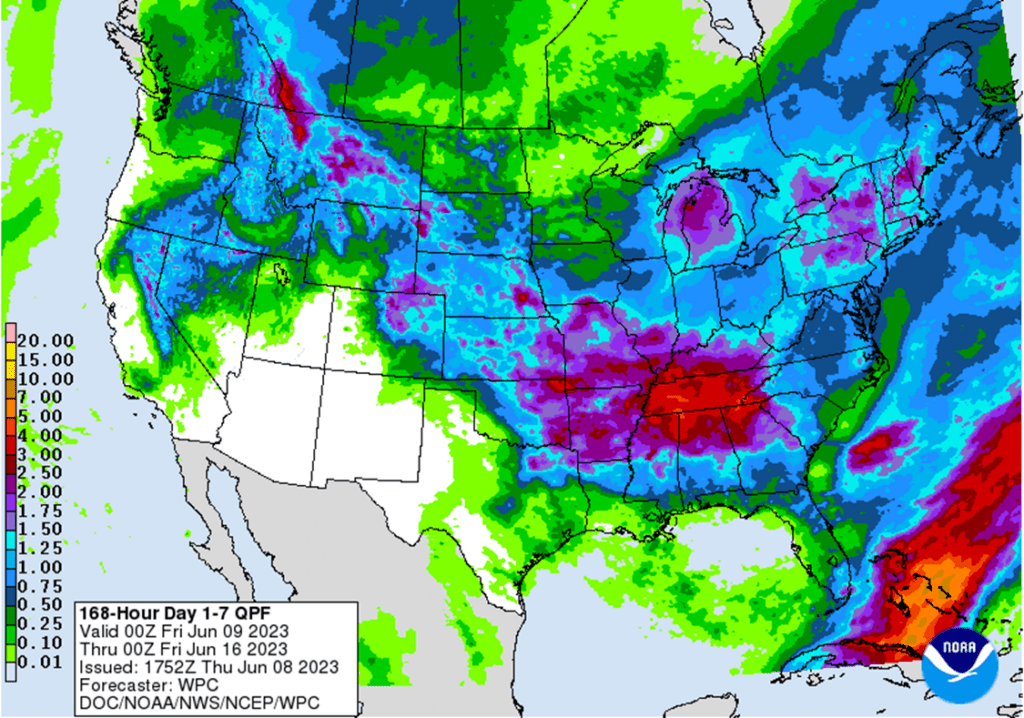

- Corn closed higher as forecasted weekend rainfall totals continue to fluctuate for areas of desperate need in the eastern Corn Belt. Spillover strength from the wheat market also helped add to higher momentum.

- Soybeans ended higher, driven mostly by another daily surge in soybean oil futures. Soybean meal futures were fractionally lower on continued demand concerns.

- Wheat ended higher despite weak export sales and a continued drop in Russian wheat export values.

- The US Dollar Index moved sharply lower, closing below the 20-day moving average for the first time since early May, this helped support commodities throughout the session.

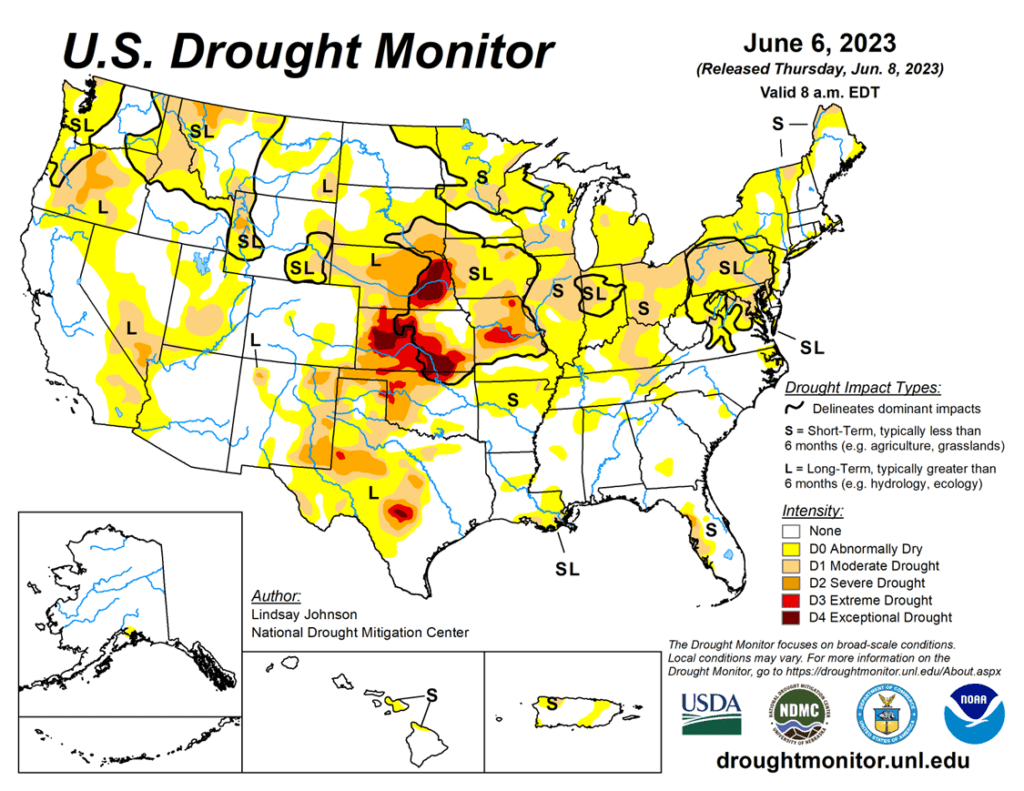

- To see the updated US Drought Monitor Map and 7-day NOAA Precipitation Outlook scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

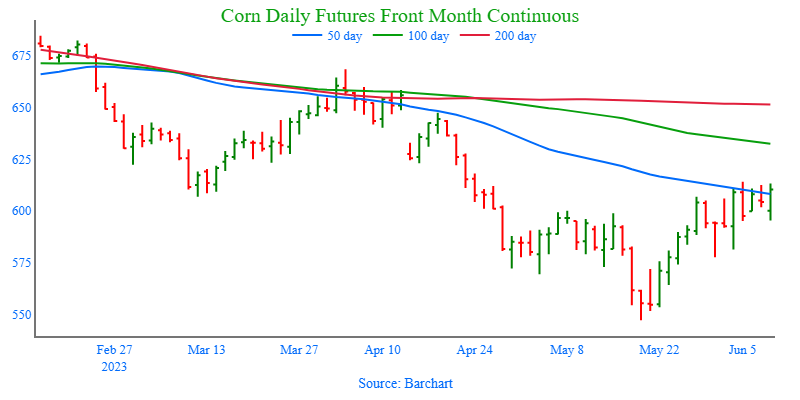

- Corn prices finished higher on the session, fighting off overnight lows in some position squaring before Friday’s USDA report. The corn market was also supported by fluctuating weather models for weekend rains, and strength in the wheat market on increasing Ukrainian-Russian war tensions.

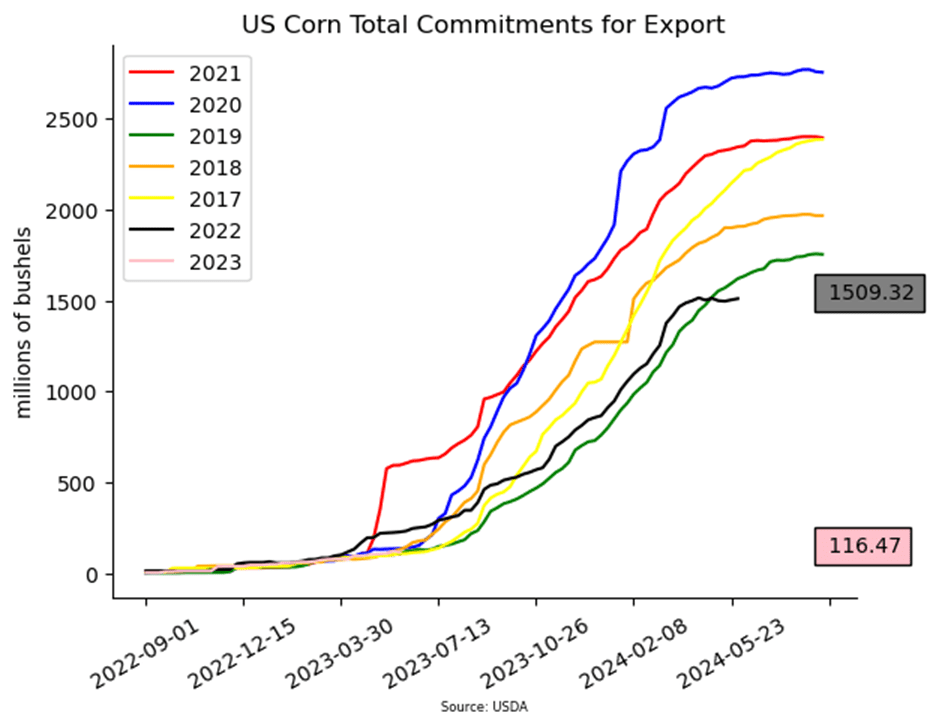

- The USDA released weekly exports sales this morning for corn, and old crop sales were 173,000 MT and new crop sales saw cancelations of 107,000 MT. Overall sales were at the low end of expectations as export demand remains weak.

- The wheat market was supported by the talk of a Ukrainian counter offensive, escalating activity in the Russia-Ukraine war. The strong wheat market spilled over to support corn prices at the end of the session.

- Tomorrow morning at 11:00 CST, the USDA will release the June WASDE report. The June WASDE is expected to show a weaker demand tone and overall increasing corn supplies. The trade is looking for old-crop carryout at 1.449 billion bushels (bb), up slightly from last month; new crop at 2.254 bb, also up slightly.

Market Notes: Corn

- Corn prices finished higher on the session, fighting off overnight lows in some position squaring before Friday’s USDA report. The corn market was also supported by fluctuating weather models for weekend rains, and strength in the wheat market on increasing Ukrainian-Russian war tensions.

- The USDA released weekly exports sales this morning for corn, and old crop sales were 173,000 MT and new crop sales saw cancelations of 107,000 MT. Overall sales were at the low end of expectations as export demand remains weak.

- The wheat market was supported by the talk of a Ukrainian counter offensive, escalating activity in the Russia-Ukraine war. The strong wheat market spilled over to support corn prices at the end of the session.

- Tomorrow morning at 11:00 CST, the USDA will release the June WASDE report. The June WASDE is expected to show a weaker demand tone and overall increasing corn supplies. The trade is looking for old-crop carryout at 1.449 billion bushels (bb), up slightly from last month; new crop at 2.254 bb, also up slightly.

Above: Prices have continued to run into resistance at the 610 area. If current prices can hold and close above the 50-day moving average near 604, the market would be poised to test April’s high of 647-1/2. Support below the market rests between 550 and 530, and again near the 2021 September low of 497-1/2.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

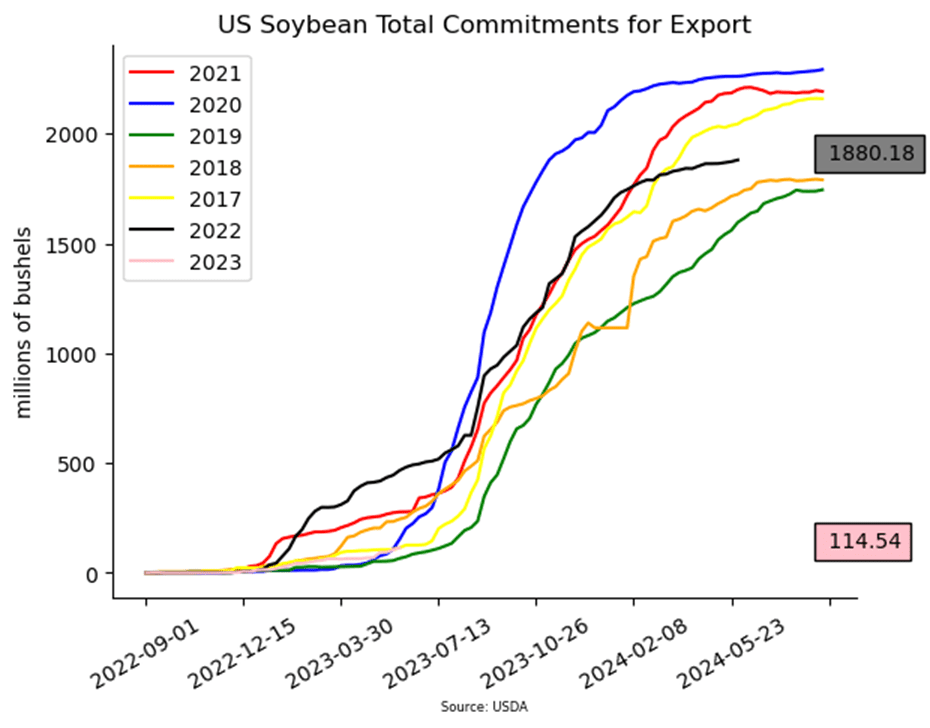

- May was a rough month for soybeans with a 175-cent range, but the market is consolidating, and found support just above 1270. July soybeans continue to be oversold with a tight Old Crop balance sheet, and with dryness concerns building and a seasonal window that is conducive for upside volatility and opportunity, continue to hold on progressing any Old Crop sales for now.

- We recommend not adding to current sales levels for the new 2023 crop at this time. A quick planting pace with favorable conditions and South American competition have pressed US prices down nearly 17% from the beginning of the year. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1300 to 1350 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans ended the day higher, driven by large gains in soybean oil, which saw the July contract 4% higher, while soybean meal moved lower.

- Export sales were decent, all things considered, the USDA reported an increase of 7.6 mb for the 22/23 year, which was up 68% from the previous week, 9.7 mb were reported for 23/24. Export shipments of 9.1 mb were below the 12.1 mb needed each week to meet the USDA’s expectations.

- US biodiesel exports for April were up 110% from last year at over 147,000 mt, which is the highest on record. The first four months of the year were 52% higher than that of a year ago.

- Tomorrow’s WASDE report will be released at 11:00 CST, and traders will be watching for a change in the carryout number. Trade expectations are for 223 mb of old crop beans and 345 mb of new crop, which would be slightly up from last month. Argentinian production will most likely be revised lower.

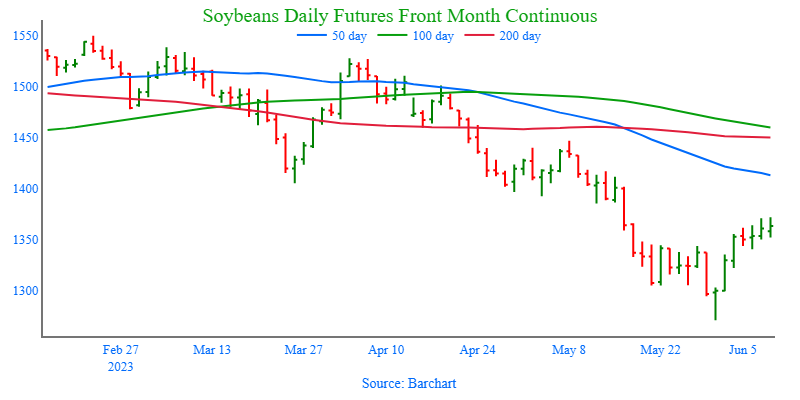

Above: After a strong close last week, July soybeans will look for follow-through momentum to turn around a down-trend that has been in place since April. Support should be found near the recent lows of 1300 with nearby resistance near the 1420 area.

Wheat

Market Notes: Wheat

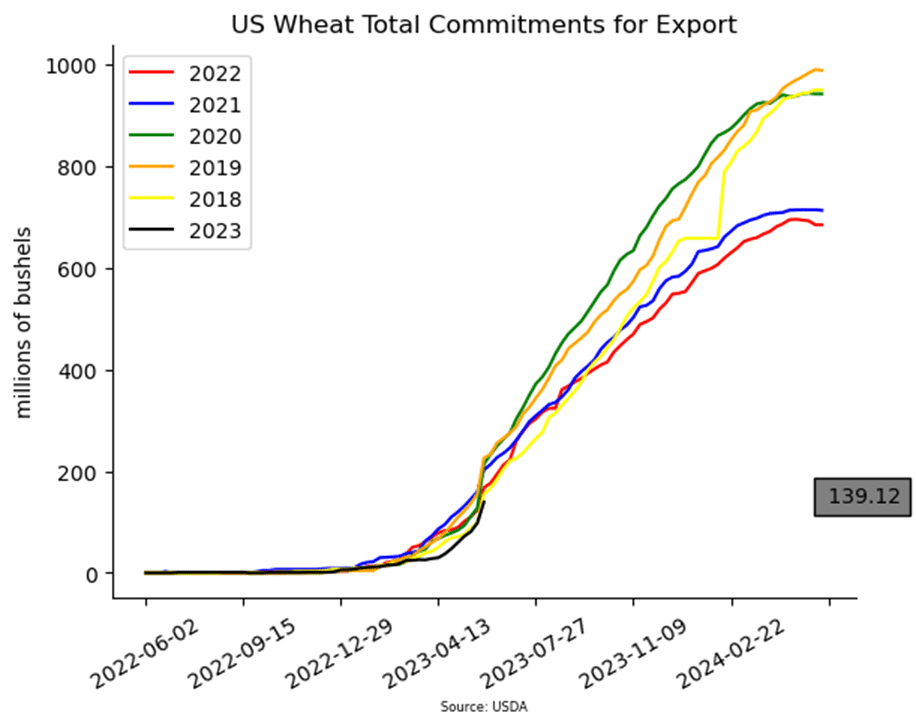

- Weekly export sales for wheat were reported at 8.6 mb. Shipments last week of just 7.0 mb are well below the needed 34.5 mb per week to reach the 775 mb export estimate.

- Russian wheat export values continue to fall, with reports of August offers as low as $226 per metric ton. With Russia cutting into US exports, it is possible that in tomorrow’s USDA report there may be an increase to US carryout.

- Most Ukrainian wheat areas and spring wheat areas of Russia remain dry. Australia is wet, however. This is contrary to the typical El Nino pattern, which should bring dryness to Australia’s wheat growing areas.

- The average pre-report estimate for US 23/24 all wheat production is 1.666 bb (vs 1.659 in May, and 1.650 for 22/23)

- The average pre-report estimate for US 22/23 wheat carryout is 606 mb (vs 598 in May), estimates for 23/24 carryout come in at 568 mb (vs 556 in May).

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

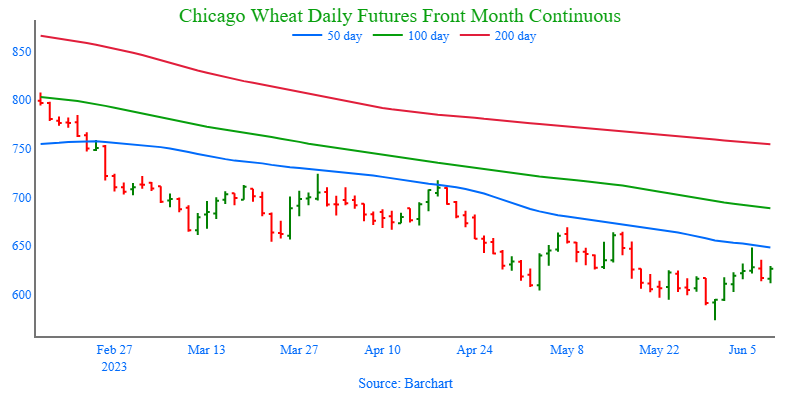

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. The July contract may also post its 8th consecutive down month in a row at prices not seen since early 2021, even though wheat inventories of major exporting countries are anticipated to fall to 16-year lows. With the market being this oversold and a fund net position short nearly 113k contracts, we continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No new action is recommended for the 2024 crop at this time. Prices have rallied nicely off of lows to start the month of June. With continued Black Sea tensions July of 2024 futures prices should be able to build off of the recent lows. We are currently targeting the 750-775 area to advance further on sales.

Above: The market appears to have put in short-term lows to end the month of May near the 575 level. A close above the 660 area would be a supportive sign of a trend change to higher. The next area of possible support, if the late May lows do not hold, would be below the market near the September ’20 low of 533-1/4. Resistance above the market could be found between 670 and 724.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

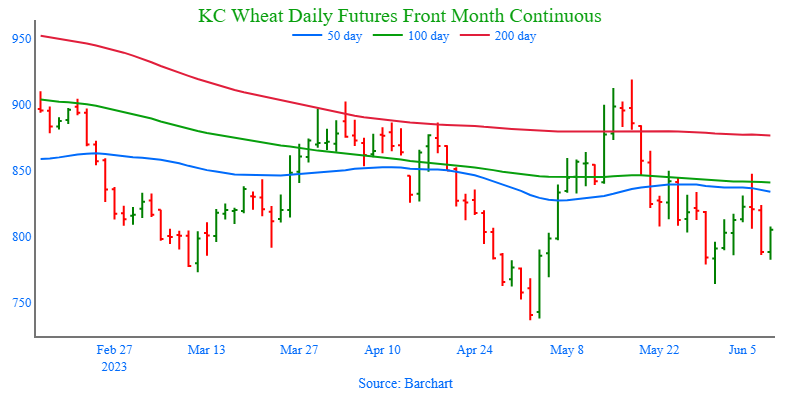

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: Last week Wednesday’s bullish reversal indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting pace has largely caught up to the 5-year average, dryness in some areas is increasing. With the market still largely oversold and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

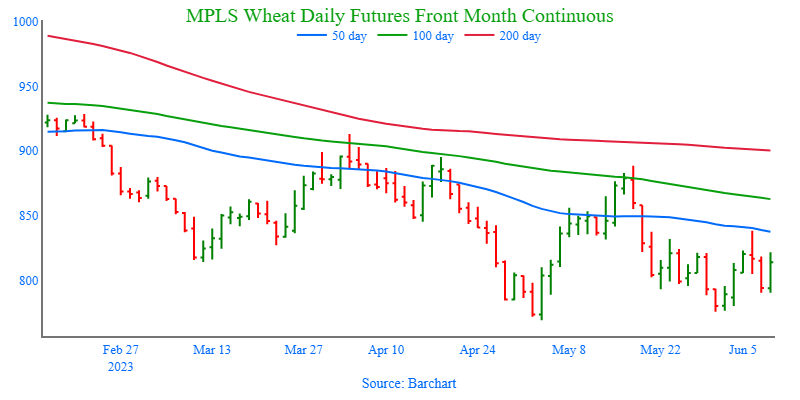

Above: The July contract continues to be weak and showing signs of being oversold after breaking back below the 800 level this week. With winter wheat harvest on the horizon, spill over selling pressure could plague the spring wheat market in the weeks to come. Resistance currently sits between 820 and 855 and then the recent high of 888-1/2. Support below the market may be found between 770 and 760.

Other Charts / Weather