Grain Market Insider: June 5, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 597.5 | -11.5 |

| DEC ’23 | 537 | -4.25 |

| DEC ’24 | 511.75 | -4.25 |

| Soybeans | ||

| JUL ’23 | 1350 | -2.5 |

| NOV ’23 | 1179.75 | -4 |

| NOV ’24 | 1142.25 | -6 |

| Chicago Wheat | ||

| JUL ’23 | 624 | 5 |

| SEP ’23 | 636.25 | 4 |

| JUL ’24 | 686.5 | 4 |

| K.C. Wheat | ||

| JUL ’23 | 822.25 | 10 |

| SEP ’23 | 816.5 | 9.25 |

| JUL ’24 | 782.75 | 4 |

| Mpls Wheat | ||

| JUL ’23 | 807.75 | 18.75 |

| SEP ’23 | 805.75 | 15 |

| SEP ’24 | 780.5 | 13.25 |

| S&P 500 | ||

| SEP ’23 | 4318.5 | -12.5 |

| Crude Oil | ||

| AUG ’23 | 72.23 | 0.39 |

| Gold | ||

| AUG ’23 | 1978.4 | 8.8 |

Grain Market Highlights

- Corn futures closed lower after trading sharply higher in the Sunday night open. Weather models trended slightly wetter in their mid-day run for areas of desperate need in the eastern Corn Belt.

- Soybeans and soybean oil closed lower despite crude oil moving higher on news of a Saudi Arabian production cut. Soybean meal managed to hold onto gains and close back above the $400/ton level.

- All three wheats closed higher bucking the lower trend in the row crops. Spring wheat was the biggest winner adding double-digits as forecast models continue to point towards dryness into mid to late June for key producing regions.

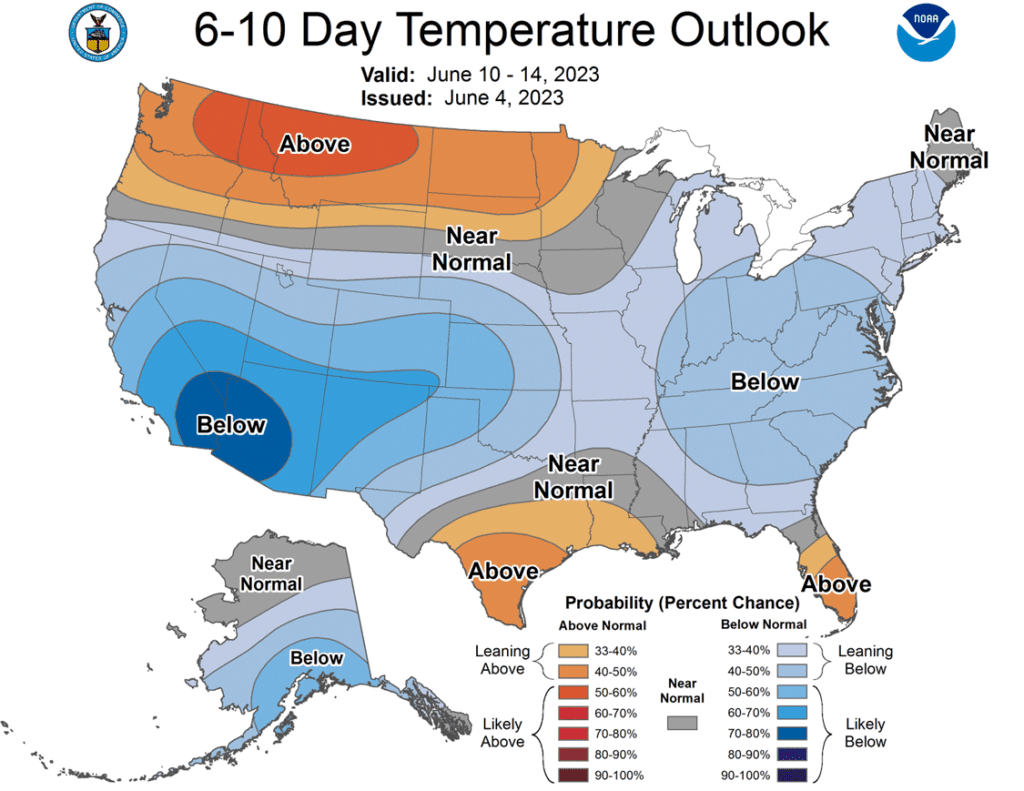

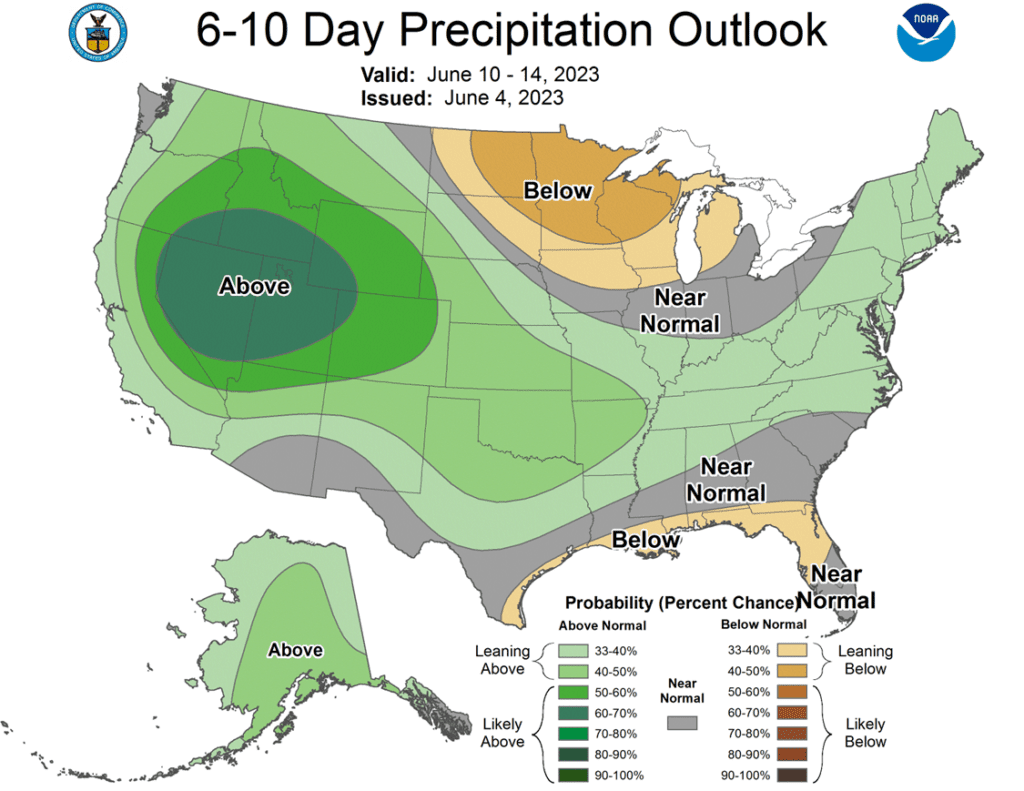

- To see updated US 6-10 Day Temperature and Precipitation Outlooks from the Climate Prediction Center, scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

Continued Opportunity

Exit (Sell) All DEC ’23 560 Calls ~ 37c

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn has had nearly a 60-cent rally in the last couple of weeks. Expect volatility to remain in the market, a changing weather forecast can push the market significantly in either direction. If you still have Old Crop to sell, consider using this rally to begin pricing some of those bushels. Don’t forget, there is about a 70-cent inverse between the July and September futures contracts, which could be lost when bids get rolled from one contract to the next in the next few weeks.

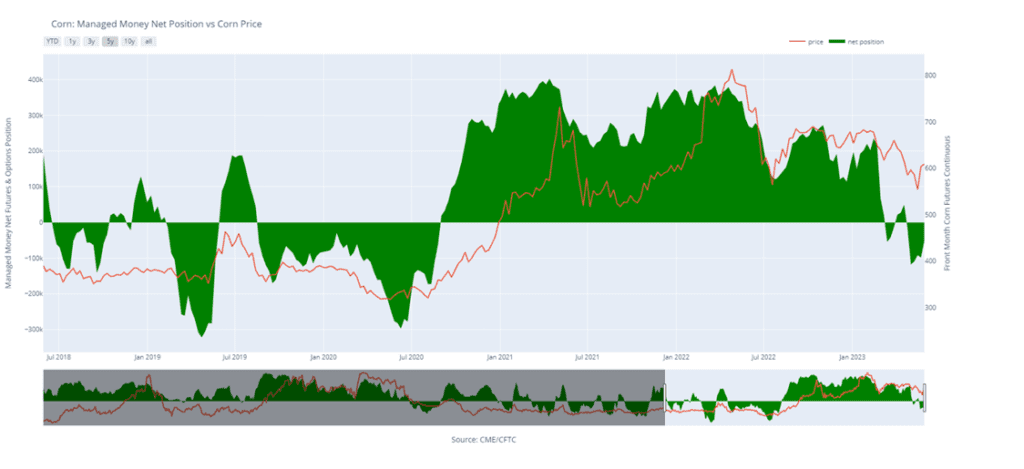

- For 2023 New Crop corn, Grain Market Insider recommends liquidating December ‘23 560 calls. Since our previous recommendation to purchase December ‘23 560 and 610 calls, the December ‘23 corn contract has rallied enough that you should be able to liquidate your 560 call position with enough equity to pay for the December 610 call position. With dryness building in the Midwest, and an estimated fund short position in excess of 45k contracts, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you don’t happen to have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Corn futures reversed off overnight highs as weather models are still forecasting rainfall chances to increase around June 12, with a potential pattern shift coming in the back half of the month. The weak price action could lead to additional selling pressure on the Monday night open.

- Demand keeps the market cautious as weekly corn export inspections were at 46.5 mb for the week ending June 1. This number was within expectations, but overall export inspections are running 32% behind last year versus a predicted drop in exports of 28% for the marketing year by the USDA. Total inspections are still behind the pace needed to reach USDA targets.

- The USDA will release weekly crop ratings on Monday afternoon, and the market is expecting a 2% drop to 67% good/excellent, reflecting the current dry weather across the Corn Belt. Corn planting should be nearly complete, analyst estimate US corn at 97% planted as of Sunday.

- The corn market will likely stay volatile and choppy this week, focusing on daily weather forecasts and preparing for the June WASDE report to be released on Friday, June 9. The June WASDE is expected to show a weaker demand tone and overall increasing corn supplies.

Above: The July contract is beginning to show signs of exhaustion, but Friday’s bullish surge higher is a positive sign that there is support near 575. If current prices can hold and close above the 50-day moving average near 610, the market would be poised to test April’s high of 647-1/2. Support below the market rests between 550 and 530, and again near the 2021 September low of 497-1/2.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

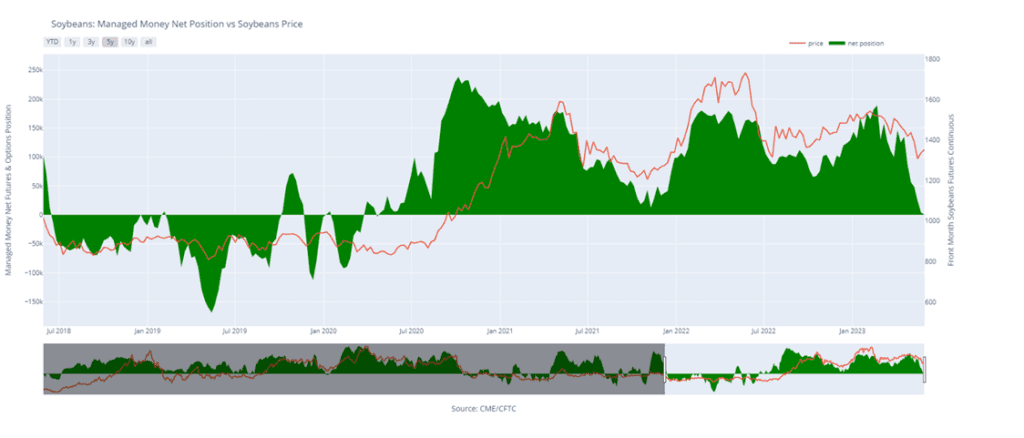

- May was a rough month for soybeans with a 175-cent range, but the market is consolidating, and found support just above 1270. July soybeans continue to be oversold with a tight Old Crop balance sheet, and with dryness concerns building and a seasonal window that is conducive for upside volatility and opportunity, continue to hold on progressing any Old Crop sales for now.

- We recommend not adding to current sales levels for the new 2023 crop at this time. A quick planting pace with favorable conditions and South American competition have pressed US prices down nearly 17% from the beginning of the year. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1300 to 1350 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans ended the day lower after trading either side of unchanged, while soybean meal ended higher but soybean oil was lower despite higher crude oil prices. Weather forecasts changed around midday causing prices to turn negative.

- Weather has been the focus for the price movement in corn and soybeans, and up until around noon, forecasts were calling for dryness until mid-June. Forecasts have changed slightly now calling for more rain within the next 7 days in the heart of the Corn Belt where it is sorely needed.

- Soybean inspections totaled just 7.9 mb for the week ending Thursday, June 1, bringing total inspections to 1.788 bb and down 3% from the previous year. The USDA is estimating soybean exports at 2.015 bb for 22/23 which is down 7% from the previous year, but those numbers could change on Friday’s WASDE report.

- Crop progress will be released this afternoon and planting progress is being estimated at 92% complete from 83% last week, and we will get our first glimpse of the soybean ratings for which analysts are estimating at 65% good to excellent.

Above: After a strong close last week, July soybeans will look for follow-through momentum to turn around a down-trend that has been in place since April. Support should be found near the recent lows of 1300 with nearby resistance near the 1420 area.

Wheat

Market Notes: Wheat

- Weekly wheat inspections of 8.6 mb bring the total 22/23 inspections to 728 mb. The USDA is estimating exports at 775 mb, and with only a few weeks left in the marketing year, they may need to revise that estimate on Friday’s USDA report.

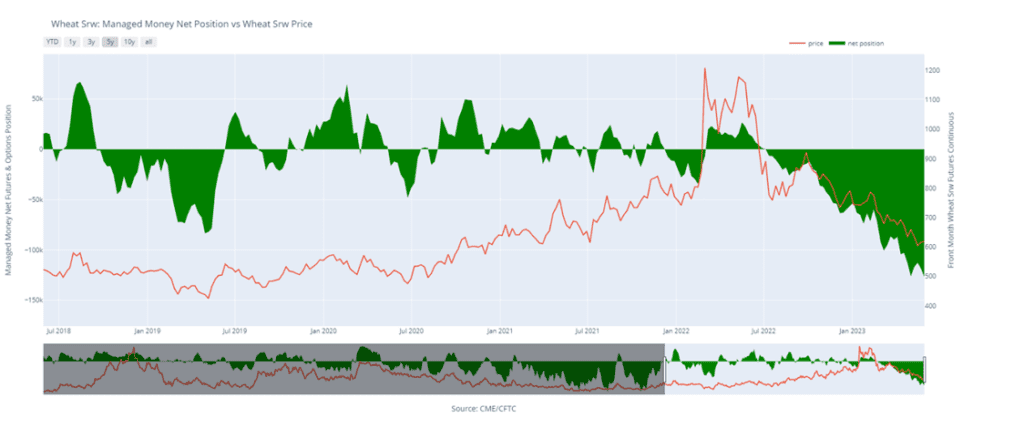

- As of May 30th, funds have increased their net short position of Chicago wheat to 127,034 contracts (equivalent to about 635 mb).

- News outlets are reporting that Russia stated they will not extend the Black Sea grain corridor again in July. However, time will tell. They have made similar statements in the past before the deal was renewed. Russia does appear to still be delaying vessel inspections though.

- Weather is improving in China’s wheat-growing regions, where recent heavy rains may have caused some crop damage. From a bigger-picture perspective, there is some concern that global wheat supply could be lower than anticipated, especially if there is adverse weather.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. The July contract may also post its 8th consecutive down month in a row at prices not seen since early 2021, even though wheat inventories of major exporting countries are anticipated to fall to 16-year lows. With the market being this oversold and a fund net position short nearly 113k contracts, we continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No action is currently recommended for the 2024 crop. Although the market is down nearly 17% from the beginning of the year, the July ’24 contract is finding support near 2021 lows. With major exporting countries’ stocks expected to fall to 16-year lows, and the great amount of economic and geopolitical uncertainty in the world, it wouldn’t take much to trigger a 23% retracement of the 2022 highs, toward the 700-750 level, which we are targeting to suggest adding coverage on next year’s crop.

Above: The market is currently oversold and testing support between 593 and 565, with the next area of possible support below the market near the September ’20 low of 533-1/4. Resistance above the market could be found between 670 and 724.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: Last week Wednesday’s bullish reversal indicates that there is support near 760, and any follow-through buying could be supportive with the market still showing signs of being oversold. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting pace has largely caught up to the 5-year average, dryness in some areas is increasing. With the market still largely oversold and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract continues to be weak and showing signs of being oversold. Additionally, open interest is falling, indicating liquidation. The market is showing signs of being oversold, which could be supportive if buying returns. Resistance currently sits between 820 and 855 and then the recent high of 888-1/2. Support below the market may be found between 770 and 760.

Other Charts / Weather