Grain Market Insider: June 27, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 623 | -14.25 |

| DEC ’23 | 561 | -27.25 |

| DEC ’24 | 522.5 | -15.75 |

| Soybeans | ||

| JUL ’23 | 1495 | -26 |

| NOV ’23 | 1294.25 | -28.75 |

| NOV ’24 | 1232.25 | -18 |

| Chicago Wheat | ||

| JUL ’23 | 685 | -39.25 |

| SEP ’23 | 699 | -39.25 |

| JUL ’24 | 736.75 | -35.75 |

| K.C. Wheat | ||

| JUL ’23 | 837.75 | -28.75 |

| SEP ’23 | 839.5 | -28.75 |

| JUL ’24 | 805.5 | -24.25 |

| Mpls Wheat | ||

| JUL ’23 | 833.25 | -29 |

| SEP ’23 | 845.25 | -27.25 |

| SEP ’24 | 810 | -15.5 |

| S&P 500 | ||

| SEP ’23 | 4422.5 | 52.25 |

| Crude Oil | ||

| AUG ’23 | 67.58 | -1.79 |

| Gold | ||

| AUG ’23 | 1922.4 | -11.4 |

Grain Market Highlights

- Lower than expected crop ratings led the corn market to gap open 5 cents higher at the start of the evening session, only to uncover the sellers in the market as weather forecasts showed more rain chances across the Midwest.

- Soybeans opened steady to better at the opening of the overnight session, and like corn, sellers emerged to liquidate long positions on improved weather forecasts.

- Soybean meal and oil settled in opposite directions, while December meal added to the woes in soybeans and succumbed to more long liquidation to close down 3.38%, December bean oil found support midday to rally nearly 2.00 cents and close up 1.67%.

- Led by the Chicago contracts, all three wheat classes fell victim to the sellers’ wrath as spillover pressure from corn and soybeans weighed heavily on the wheat market.

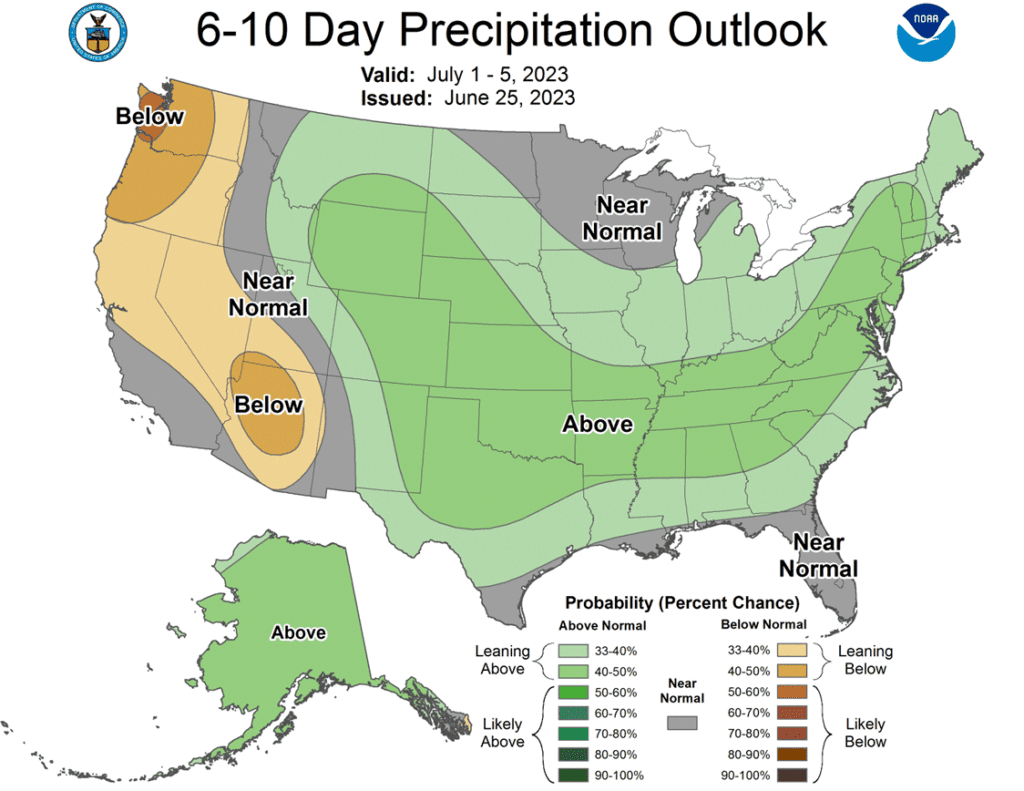

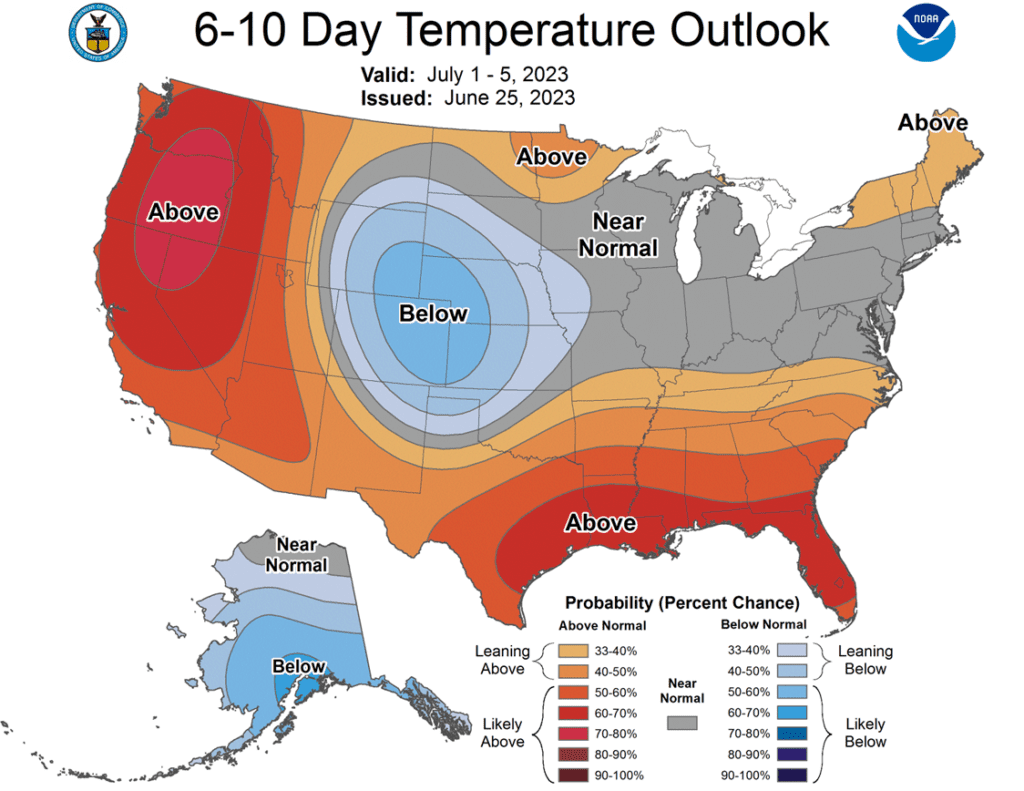

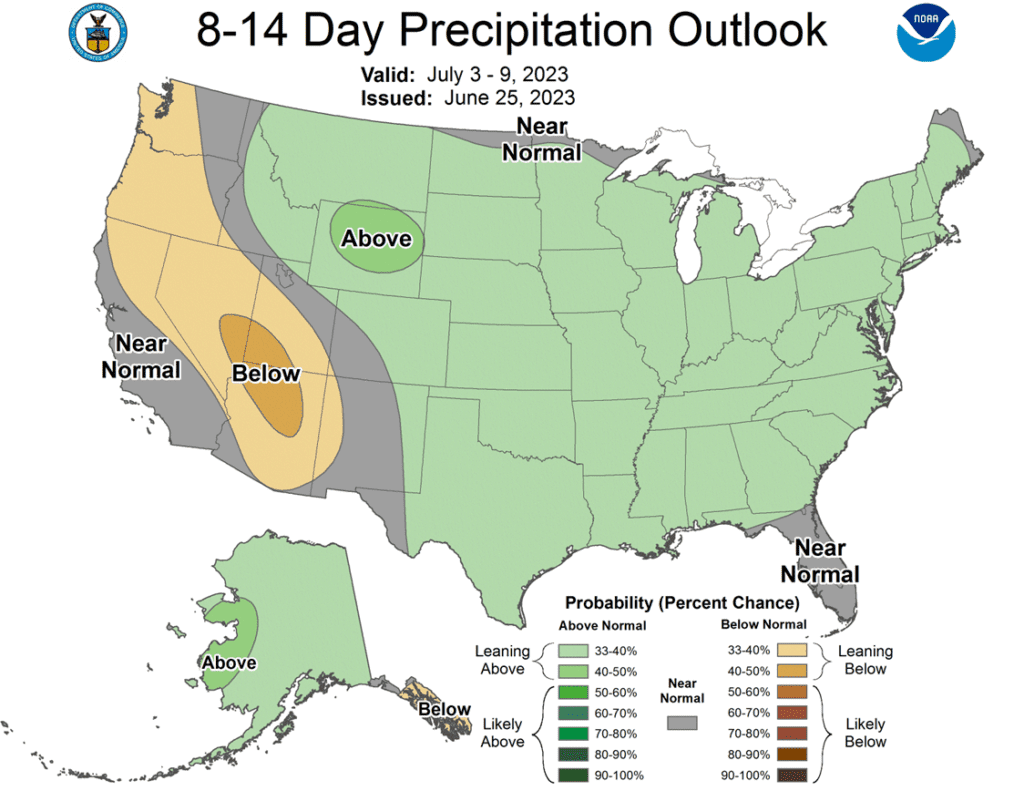

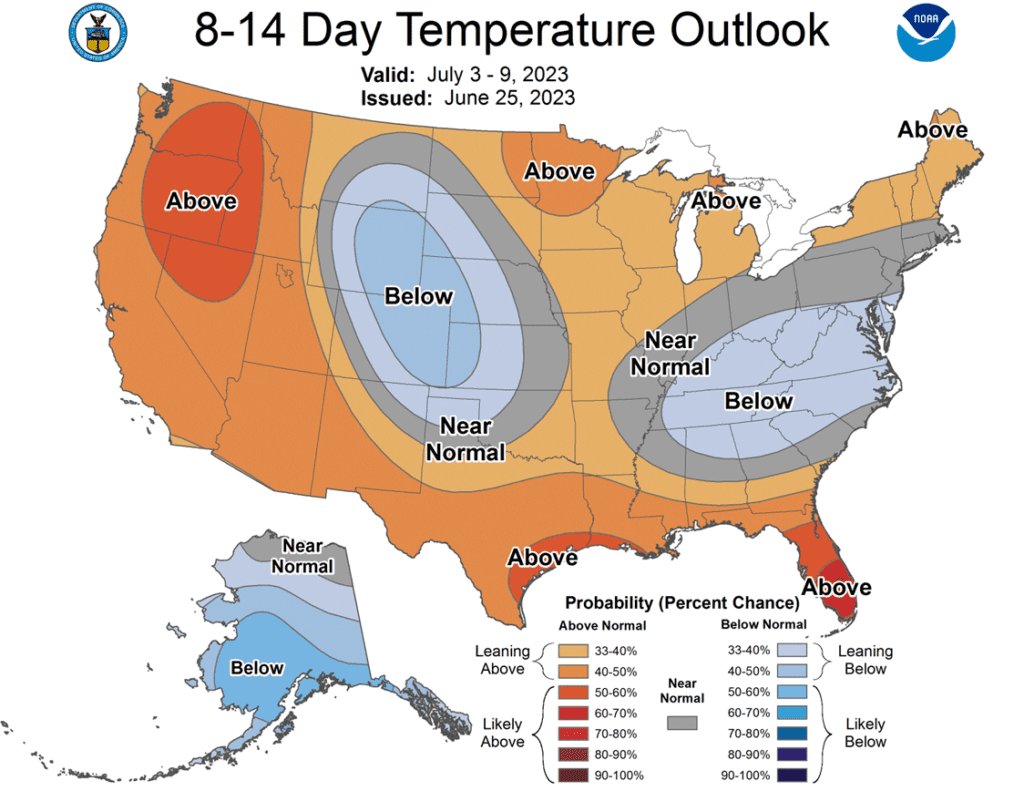

- To see the current US NOAA 6 – 10 and 8 – 14 day Precipitation and Temperature Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. Any remaining old crop bushels that you may have should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Corn — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is recommended for New Crop 2023 corn. December corn rallied 139 cents from its May 18 low to its high on June 21 on weather and production concerns. The market is currently off that high as traders book profits and liquidate long positions on poor export sales figures and a forecast that shows increased chances of rain in the next two weeks. The US Drought Monitor still shows drought conditions across much of the Midwest and it is estimated that 64% of the corn crop is experiencing some level of drought and is in desperate need of rain. If you missed getting any sales made or adding Dec 23 580 puts before this sharp break, for now, we are looking at a level north of 610 as a catchup opportunity.

- Continue to hold current sales levels for the 2024 crop year. The Dec 24 contract is trading weather much like the rest of the market and posted nearly an eighty-cent range between 5/18 and 6/21 as dry conditions affect the ’23 crop and the potential carryout for the 2024 crop year. For now, continue to be patient as Grain Market Insider would like to see prices in the 570 – 600 level before considering making additional sales recommendations for the 2024 crop.

Market Notes: Corn

- Strong selling pressure gripped the corn market on Tuesday as New Crop prices closed down over 4% lower as improved weather forecasts outweighed the USDA crop ratings from Monday afternoon.

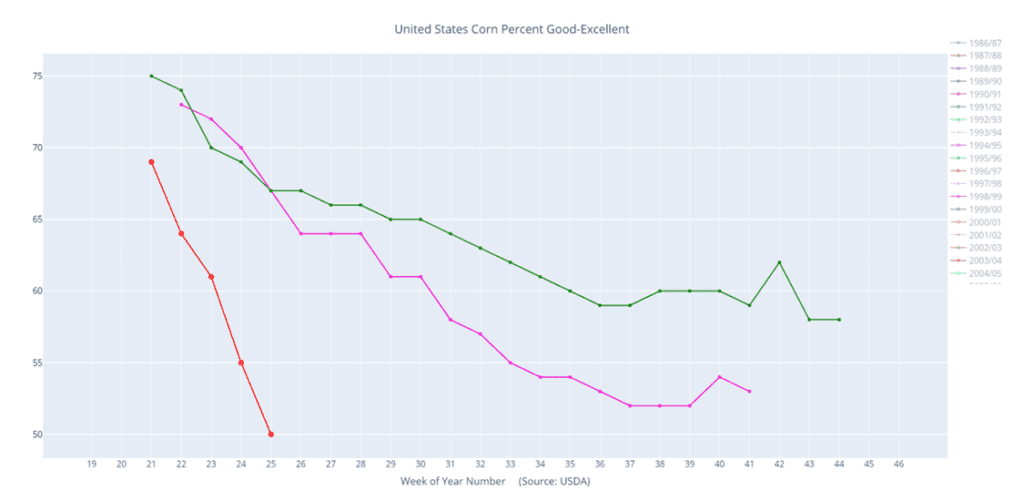

- The USDA released weekly corn crop ratings on Monday afternoon. The corn conditions dropped an additional 5% to 50% good/excellent. The state of Illinois is still the focus of the market as rainfall missed many areas of the state over the weekend and ratings were at 26% good/excellent last week, down 10% from the prior week. These are the worst ratings since 2012.

- Sellers took control of the market as weather forecasts for the next two weeks look to bring plenty of chances for rainfall to most of the Midwest. If realized, this could help stabilize the crop as pollination is right around the corner.

- AgRural estimates that Brazil’s safrinha corn, or second crop corn, is 9.3% harvested. They estimate the safrinha crop at 97.9 MMT and the total corn crop estimate at 127.4 MMT. The influence of fresh supplies to the market is a wet blanket on rallies.

- The market may likely remain choppy as traders look to this Friday’s USDA Planted Acreage and Grain Stocks report. Expectations are for corn acres to be at 91.8 million acres, down slightly from the March planting estimates. Grain stocks for the quarter are expected to be near 4.25 billion bushels, down 2.3% from last year.

Above: Weather continues to dominate price discovery with every change in the weather forecast. Corn rallied into the 625 resistance area and reversed lower to test 580 – 540 support level. Further support may be found below the market between 505 and 490, with resistance above 625 coming in near the March highs between 650 – 670.

Above: 2023/24 Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is being recommended for New Crop 2023 soybeans. Changes in weather forecasts and crop conditions will continue to dominate the market. With having just recommended making a cash sale, and with one of the most volatile USDA report days of the year coming this Friday, we would need to see the market rally to 1400 – 1450 area before we would consider recommending any additional sales for the 2023 crop. Otherwise, in light of current crop conditions, we will suggest holding tight on further cash sales for now.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans closed lower today along with soybean meal, while soybean oil closed higher. A wetter forecast for the Corn Belt over the next week has put pressure on corn and beans while rising world veg oil prices have given soybean oil support.

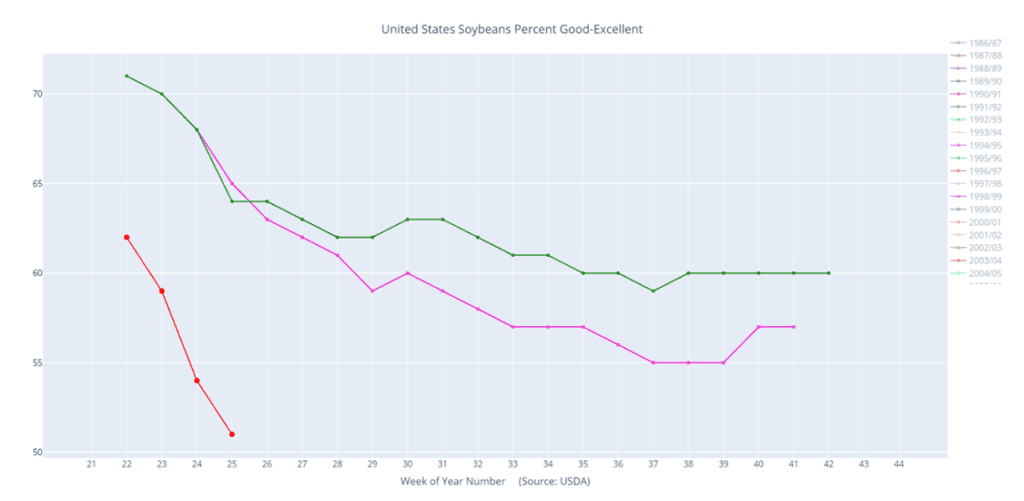

- At the moment, traders are clearly fixated on weather forecasts, because yesterday’s Crop Progress report showed the worst good to excellent ratings since 1988 at just 51%, down 3% from the previous week, but the selloff today was due to increased chances for widespread rain.

- The next report to watch will be Friday’s Quarterly Stocks and Acreage report, where analysts are expecting soybean acres to increase slightly to 87.67 million acres from 87.45 million acres in the previous report.

- Yesterday’s soybean inspections were poor as Brazil keeps control of the export market with their cheaper soybean offerings. Due to slow US sales, exports may be lowered in the next WASDE report.

Above: The market’s eye is squarely on the weather at this time. The August contract rallied through the 50-day moving average and hit resistance near 1450 and the 100-day moving average. If the market can rally beyond this point, the resistance area between 1500 and 1550 could be its next target. If the market drops back, support could be found between 1340 and 1300 with further support near 1270.

Above: 2023/24 Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- All three US wheat futures classes posted double-digit losses. No support was received from Paris milling wheat futures, which gapped lower and also saw a sharp decline. Spillover pressure from lower corn and soybeans did not help.

- The increased chances of rain for some parts of the central Midwest likely has funds jumping back into the market. While the actual weather impact to the wheat crop at this point should be minimal, pressure from lower row crop prices is expected to weigh on wheat as well.

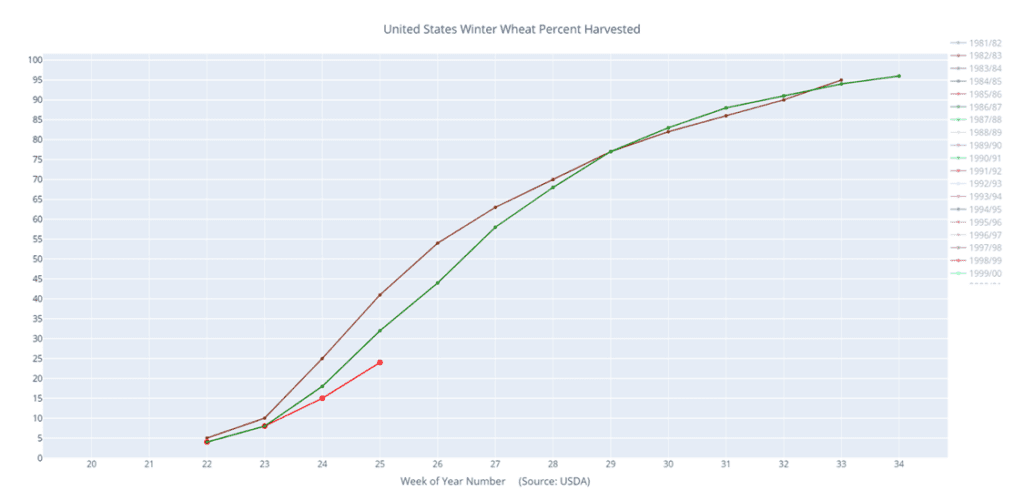

- US winter wheat harvest is well behind the average pace of 33% complete for this time of year, with only 24% of the crop collected. And while at this point the impact is minimal, the USDA did say winter wheat conditions improved 2% from last week to 40% good to excellent. Spring wheat conditions did decrease by 1% from last week to 50% GTE.

- Russia continues to rule the wheat export front, with FOB offers said to range between $230 and $240 per ton. This is well below US or European offers and is keeping pressure on futures prices.

- The 100-day moving average for Chicago wheat is around 713. This may act as an area of support, especially if traders catch wind of some friendly news. If there is a bright spot, it is the fact that Russia is said to already be blocking grain shipments in the Black Sea and may not renew the corridor deal on July 18th.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Grain Market Insider is done with the 2022 crop, and there will be no New Alerts posted for the 2022 crop going forward.

- No new action is recommended for 2023 New Crop. In the month of June, the September Chicago wheat contract posted a 163 cent range and has largely been a follower of the corn market which has been mostly driven by weather. While demand remains weak, production concerns in parts of the country remain, as does uncertainty surrounding the Black Sea region and the potential for major exporting countries’ inventory to hit 16-year lows. While Grain Market Insider will continue to monitor the downside for any violation of major support, following the recent sales recommendation it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Price volatility has risen in the last couple of weeks due to the changing weather forecasts and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market next year’s crop. War continues in the Black Sea region, major exporting countries’ stocks expected to fall to 16-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recently recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. This technical formation on the price chart is considered bearish and momentum may be adding to the bearish tone. Support below the market may be found near 670 with further support coming in between 650 – 610. While resistance above the market rests between 770 – 810.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The market has been able to trade out of the recent congestion area to near the 200-day moving average and into the 870 – 920 resistance area. If the market can push through, 970 – 1000 is the next major point of resistance. If it falls back, initial support could be near 825 with further support between 778 and 764.

Above: 2023/24 Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks, and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract, and there is currently no carry offered.

- K.C. Wheat Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 2,328 contracts between June 13 – 20, bringing their total position to a net long 5,944 contracts.

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

Above: The September contract rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. With the market trading lower, it will need additional bullish news to turn it back around. Should the market continue to fall, support may be found between 770 and 760.

Other Charts / Weather