Grain Market Insider: June 23, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 630.75 | -29.75 |

| DEC ’23 | 588 | -32.75 |

| DEC ’24 | 533.25 | -22.5 |

| Soybeans | ||

| JUL ’23 | 1494.5 | -6 |

| NOV ’23 | 1310 | -29.5 |

| NOV ’24 | 1241 | -8 |

| Chicago Wheat | ||

| JUL ’23 | 733.25 | -5.75 |

| SEP ’23 | 746.5 | -6.25 |

| JUL ’24 | 770.5 | -9.75 |

| K.C. Wheat | ||

| JUL ’23 | 859 | -12 |

| SEP ’23 | 861.75 | -10.75 |

| JUL ’24 | 824.5 | -16.75 |

| Mpls Wheat | ||

| JUL ’23 | 863.5 | -16.5 |

| SEP ’23 | 871.75 | -12.75 |

| SEP ’24 | 813 | -8 |

| S&P 500 | ||

| SEP ’23 | 4397 | -26.75 |

| Crude Oil | ||

| AUG ’23 | 69.14 | -0.37 |

| Gold | ||

| AUG ’23 | 1929.6 | 5.9 |

Grain Market Highlights

- Follow through selling and long liquidation with disappointing export sales weighed heavily on the corn market as traders took profits ahead of the weekend.

- A shift in the weather forecast for the better across the “I” states of the Midwest, along with a 4% drop in soybean meal, added pressure to the soybean market as traders liquidated long positions from this week’s rally ahead of the weekend.

- Soybean oil was the strong leg of the bean complex as it found follow through buying from yesterday’s bullish reversal and a stronger palm oil market.

- All three wheat markets trade lower as spillover weakness from corn and soybeans weigh on prices and traders take profits from the recent rally.

- To fight inflation, European central banks are raising interest rates, and there are growing concerns that this could put us into a global recession, reducing demand for food and energy.

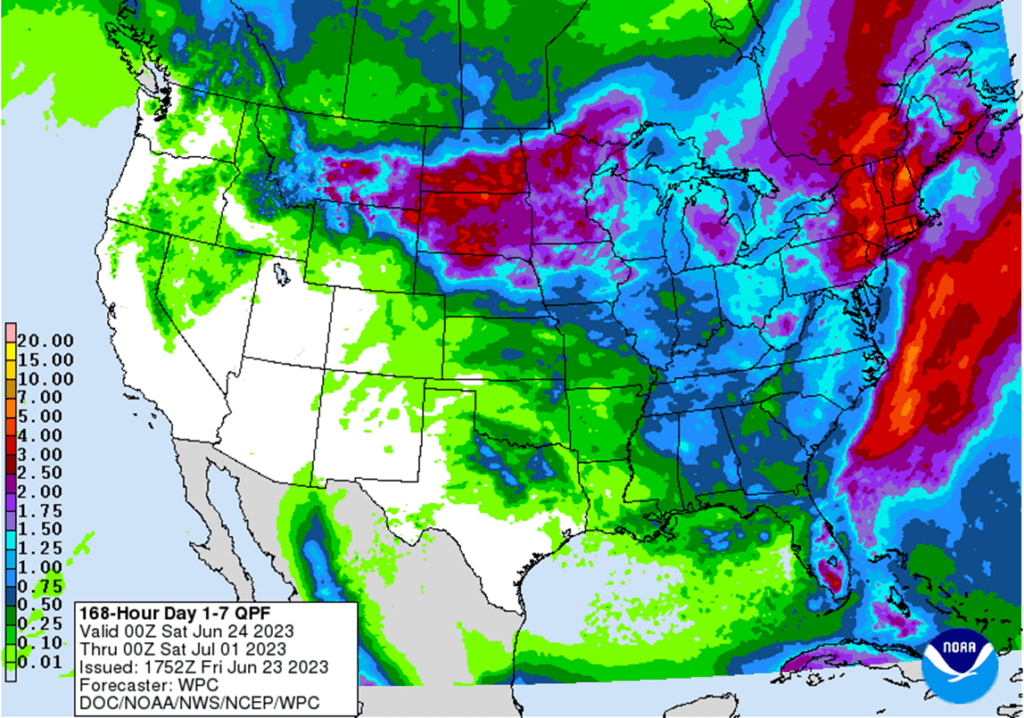

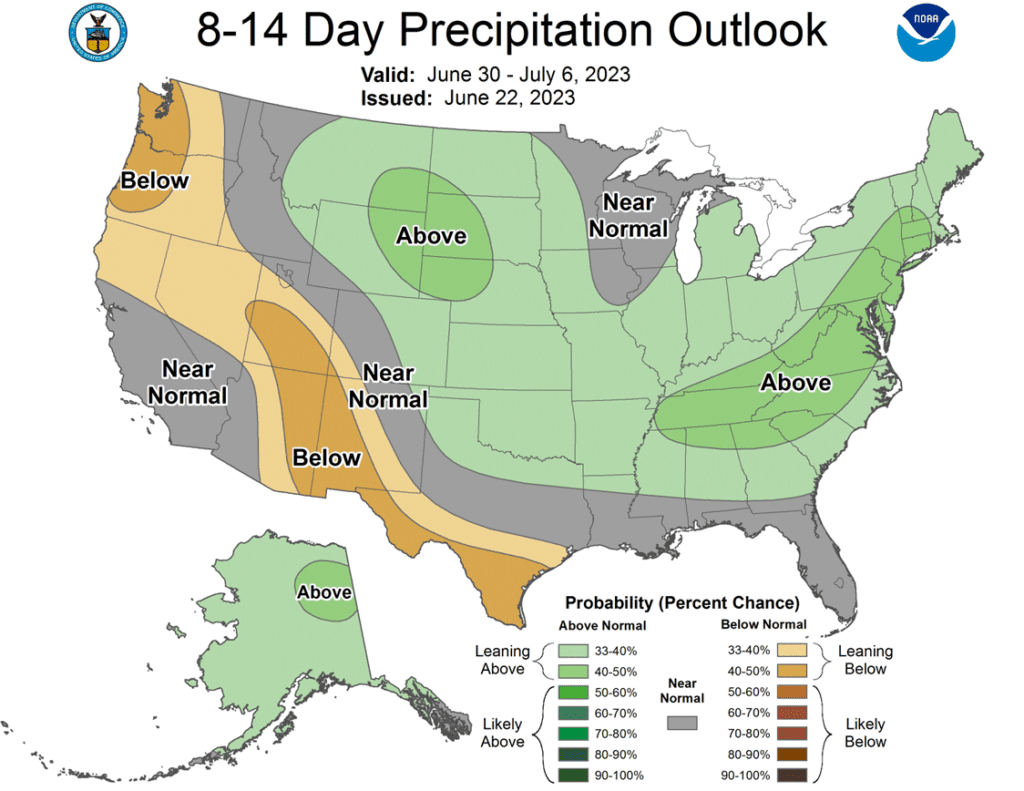

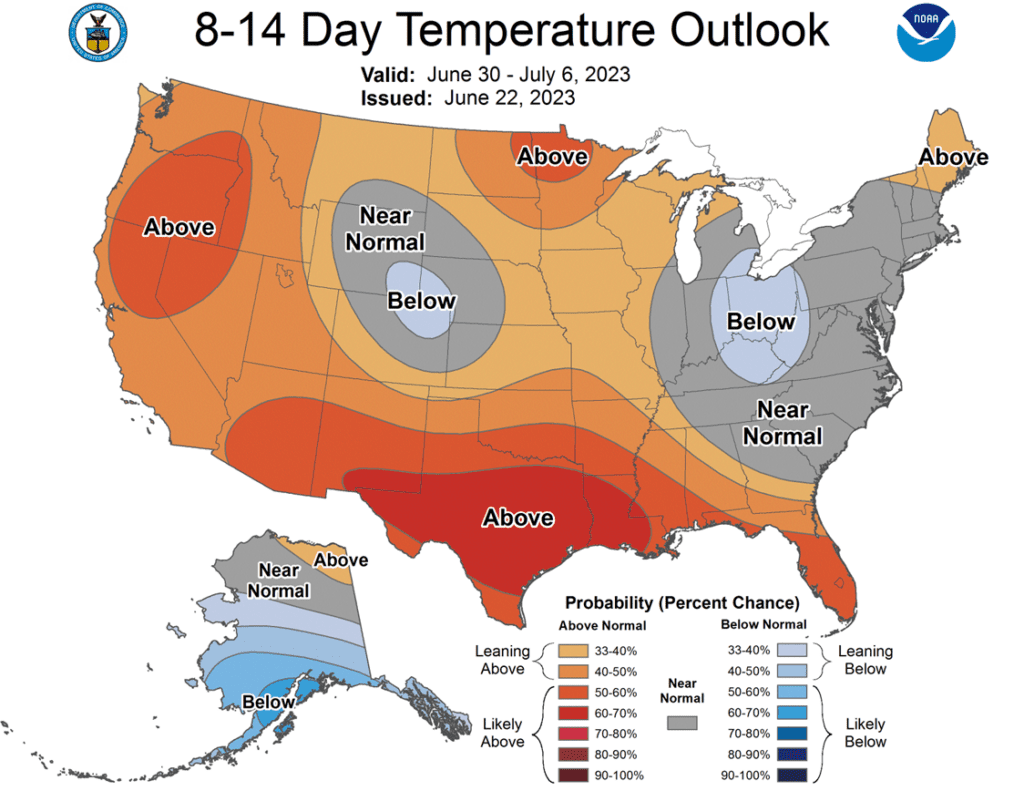

- To see the current US NOAA 7 – day US Precipitation Outlook and the US NOAA 8 – 14 day Precipitation and Temperature Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. Any remaining old crop bushels that you may have should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Corn — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

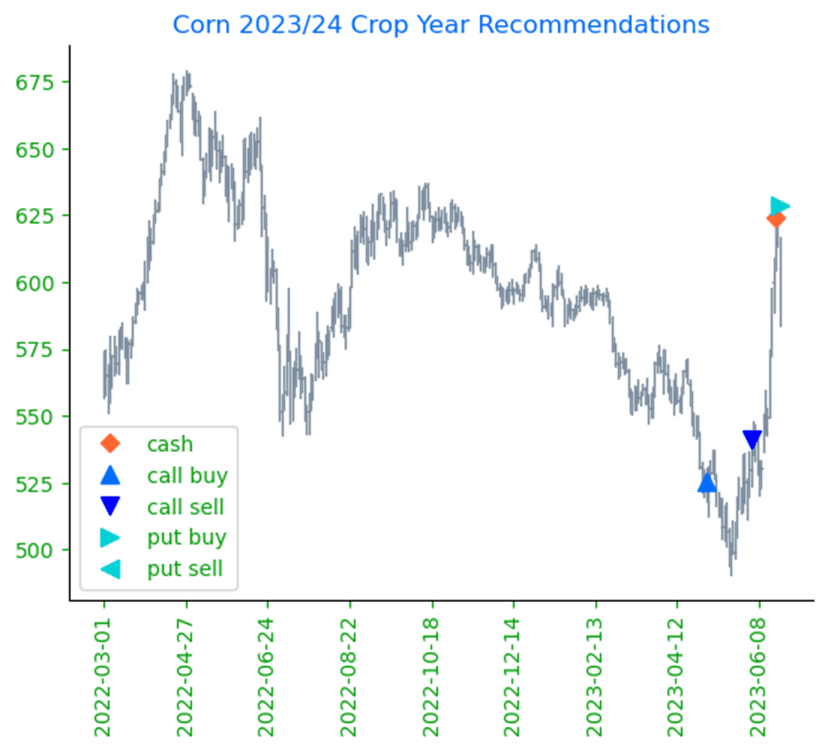

- Grain Market Insider recommends buying Dec 23 580 corn puts today for about 30 cents in premium plus commission and fees. Additionally, Grain Market Insider sees an active opportunity to sell New Crop 2023 corn. With the Dec 23 contract trading at the upper end of our 590 – 630 target range, Insider recommends buying December puts today to add downside coverage on New Crop in case prices move significantly lower. Despite the ongoing drought concerns, we still have confidence to continue to recommend selling into this rally as the Dec 23 610 Call options have been in place since May 2nd. On May 2nd, Insider recommended buying 560 and 610 Dec calls, and then recommended exiting the 560s on June 2nd once the 560 calls had gained enough in value to offset the cost of the 610 calls. Owning both calls and puts can be very beneficial in a market as volatile as this. If it doesn’t rain, and Dec corn continues to rally, the 610 calls will continue to gain in value and protect your new sale. Meanwhile, buying puts will allow you to protect the downside on more bushels without committing to a sale when your production may be uncertain. For now, the market is strong, though demand remains sluggish, and with Brazil beginning to harvest another possible record crop, both domestic and world carryout figures could potentially rise further. Any change to a more favorable weather forecast could easily turn the market lower and erase much, if not all, of the 125 cent rally from the May 19th low.

- Continue to hold current sales levels for the 2024 crop year. Much like the Dec 23 contract, the Dec 24 contract has rallied significantly from the May 18 lows as the market prices in possible crop reductions that could carry over into the 2024 crop year. Be watchful, as we are, entering into the time frame where we would consider suggesting making additional sales recommendations for the 2024 crop year.

Market Notes: Corn

- The corn market traded down in excess of 5% with traders booking profits ahead of the weekend on disappointing export sales and forecasts call for rain next week across the “I” states.

- Forecasts for rain across the Midwest dominated the trade with the longer range 6 – 10 and 8 – 14 day outlooks shifting to more normal to above normal precipitation patterns, while the 7-day forecast has rain favoring the northern Midwest with less in MO, central IL and IN.

- US export sales came in at a disappointing 36k tons for Old Crop versus 272k last week, well below the 470k tons in sales needed each week to reach the USDA’s goal. As for New Crop sales, the USDA reported 47k tons sold.

- Further hampering US export sales, Brazilian offers continue to be $30 – $40 per ton cheaper than the US as they continue to harvest their large second (safrinha) corn crop.

- It’s estimated with the latest run of the US Drought Monitor, that 64% of the corn crop is in areas with some level of drought, which includes 82% of Illinois and 83% of Iowa.

Above: Weather is the dominant force for the corn market at this time. If the market can push through the 100-day moving average and the recent 625 high, it may be able to make a run for the March highs between 650 – 670. If not, support may be found between 580 and 540.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell NOV ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

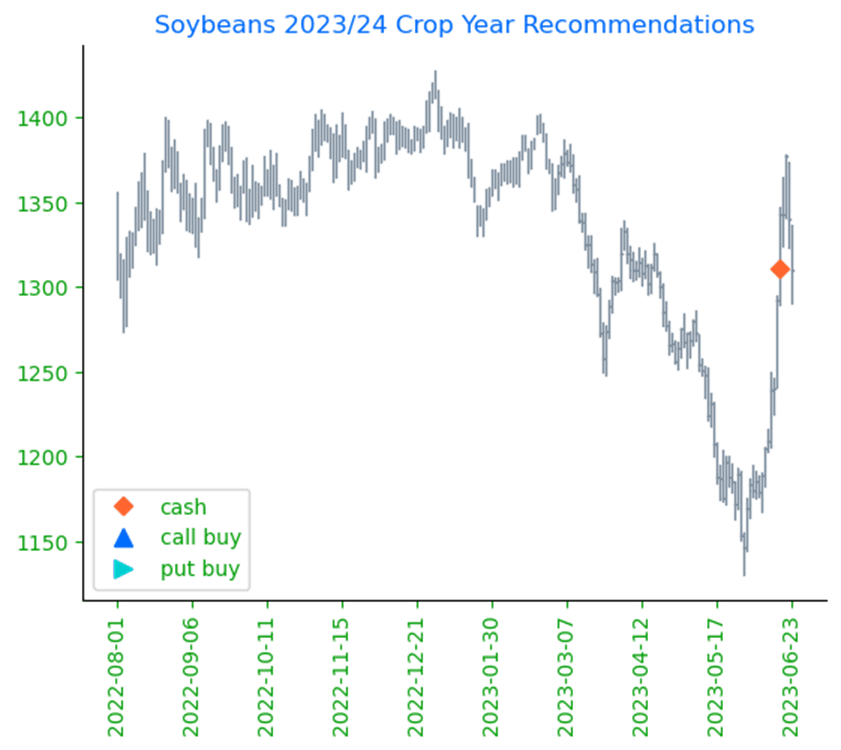

- Grain Market Insider sees an active opportunity to sell New Crop 2023 soybeans. Grain Market Insider sees an active opportunity to sell New Crop 2023 soybeans. November soybeans have rallied over 200 cents from the May 31st low and hit the upper end of our 1300 to 1350 target range. With the November contract a little bit over the upper end of this range, an Active sales opportunity continues to get some New Crop priced. KC Wheat has demonstrated that domestic drought conditions do not necessarily guarantee higher domestic prices if global supplies are ample. US wheat country has been extremely dry for many months, yet prices are about even with where prices were in late 2021, before Russia invaded Ukraine. Global soybean supplies could be record large, and this could be a rally risk factor.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans closed lower today with New Crop leading the way lower and July only down slightly.Soybean meal closed sharply lower, while soybean oil moved higher thanks to a jump in palm oil of 1.7% today.

- Changes in the weather forecast have pressured both corn and soybeans with the 7-day forecast from NOAA showing an accumulated 0.5 to 1.5 inches of rain over the next week in the very dry areas of Iowa, Illinois, and Indiana.

- Export sales were better this week at 16.8 mb for 22/23 and increases of 6.2 mb for 23/24. Last week’s export shipments of 14.2 mb were better than expected and above the 11.7 mb needed each week to meet the USDA’s expectations.

- Next week, crop progress will be released, and conditions could decline after this week’s dryness. If weekend rains come through, conditions could remain steady with last week.

Above: The market’s eye is squarely on the weather at this time. The August contract rallied through the 50-day moving average and hit resistance near 1450 and the 100-day moving average. If the market can rally beyond this point, the resistance area between 1500 and 1550 could be its next target. If the market drops back, support could be found between 1340 and 1300 with further support near 1270.

Wheat

Market Notes: Wheat

- The USDA reported an increase of 4.0 mb of wheat export sales for 23/24, and an increase of 0.5 mb for 24/25. The figures for corn and soybeans were not much better and may have contributed to today’s weakness.

- Several other factors are likely weighing on markets today – weather being number one. With both the American and European models putting rain in the forecast mid to late next week for the Midwest, wheat followed corn and soybeans lower today. Other factors may be profit taking, as well as the recent interest rate increases by European banks, which are causing renewed concern about recession.

- US futures received no support from Matif wheat, which traded lower today. Matif wheat is also overbought on daily stochastics and is showing potential sell signals, painting a weak technical picture despite the fact that French wheat conditions have declined for four weeks in a row.

- Position squaring before month end could be playing into the grain complex trade as well. With the recent strong rally and the June 30 Stocks and Acreage reports due for release next week, traders may be taking profit ahead of uncertain results.

- Russia has essentially said they are unwilling to extend the Black Sea grain deal beyond the July 18th deadline. This does not seem to be impacting the market much, however, perhaps because traders have heard this story before.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell SEP ’23 Cash

2024

Active

Sell JUL ’24 Cash

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Grain Market Insider is done with the 2022 crop, and there will be no New Alerts posted for the 2022 crop going forward.

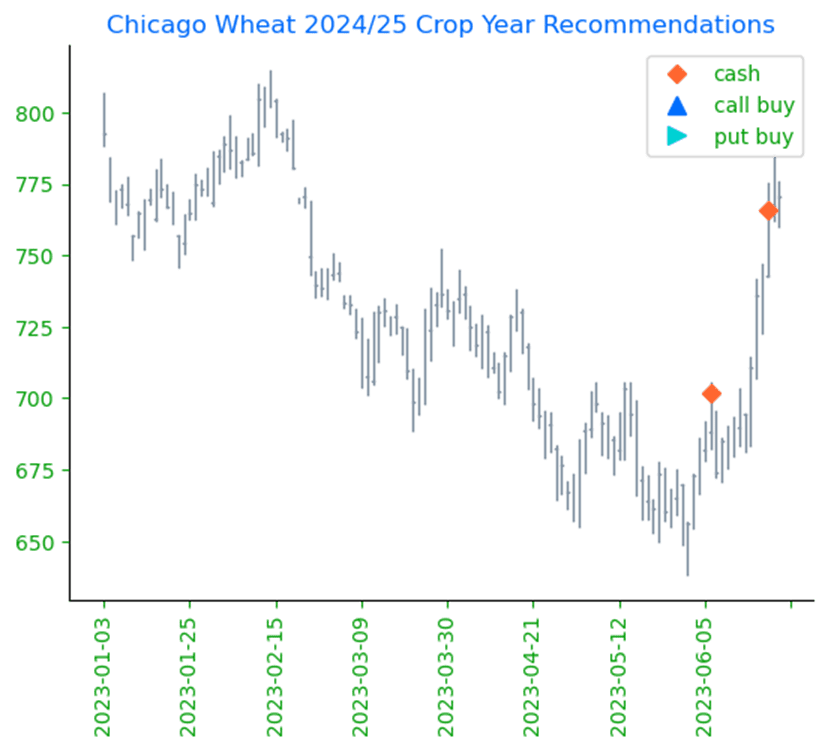

- Grain Market Insider sees an active opportunity to sell 2023 New Crop. We are in a weather market and with the US Drought Monitor showing dryness across the Midwest, September Chicago Wheat has now rallied about 22% from its May 31 low into the March – April resistance area and is overbought. As of late, the wheat market has largely been a follower of the corn market, and this rally has been fueled in part by the Funds exiting their short positions. While there are production concerns in parts of the country, demand has been weak, and the potential remains for a rising carryout. Any change to a more favorable weather forecast could easily erase much, if not all, of the weather premium that has been added to prices. With the dry conditions and great uncertainty that many of you are experiencing, about how much you will have to harvest, we understand there’s hesitancy to sell anything here. If you are concerned about committing physical bushels with a cash sale, consider selling futures or buying put options.

- Grain Market Insider sees an active opportunity to sell 2024 Chicago wheat. Prices for the 2024 crop have largely followed prices for the 2023 crop and are currently about 20% above the low set on May 31. Weather and production concerns have been the primary driver of prices lately, and the funds have likely been covering short positions, further feeding the rally. As we all know, weather markets can be fickle beasts, and any change in the forecast or crop conditions can quickly turn traders from buyers to sellers, quickly erasing much, if not all, of the premium priced into the market. Grain Market Insider recommends making a sale on next year’s 2024 Chicago wheat crop and using either a July ’24 futures contract or a July 24 HTA contract so basis can be set at a later date, as it should improve in time.

Above: September wheat has had a strong run and is near the 200-day moving average around 750, which it hasn’t seen since last October. Above there, resistance may be found between the psychological resistance point of 800 and 865. With further resistance coming in between 900 – 950. Should prices turn lower, initial support may be found near 670 and then again near 611.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The market has been able to trade out of the recent congestion area to near the 200-day moving average and into the 870 – 920 resistance area. If the market can push through, 970 – 1000 is the next major point of resistance. If it falls back, initial support could be near 825 with further support between 778 and 764.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks, and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract, and there is currently no carry offered.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting has largely been completed, dryness in some areas is increasing. With a full growing season ahead of us, we are not looking to make any sales right now. (Updated 6/22)

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

Above: The September contract has rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average. Resistance may be found above the market between 889 and 940, the April and December highs respectively. While the upside breakout is a positive sign, the market will need additional bullish news to keep it moving. Should the market reverse course and turn lower, support below the market may be found between 770 and 760.

Other Charts / Weather