Grain Market Insider: June 21, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 671 | 27.25 |

| DEC ’23 | 628.75 | 31.25 |

| DEC ’24 | 564.5 | 18 |

| Soybeans | ||

| JUL ’23 | 1514.75 | 37.5 |

| NOV ’23 | 1377 | 34.25 |

| NOV ’24 | 1256 | 15.5 |

| Chicago Wheat | ||

| JUL ’23 | 734.5 | 38.75 |

| SEP ’23 | 748.25 | 39.5 |

| JUL ’24 | 774.5 | 32 |

| K.C. Wheat | ||

| JUL ’23 | 873.75 | 37.75 |

| SEP ’23 | 872 | 37.5 |

| JUL ’24 | 835.75 | 31.5 |

| Mpls Wheat | ||

| JUL ’23 | 878.75 | 29.75 |

| SEP ’23 | 881.75 | 29.75 |

| SEP ’24 | 816.25 | 16.25 |

| S&P 500 | ||

| SEP ’23 | 4427.5 | -7.25 |

| Crude Oil | ||

| AUG ’23 | 72.54 | 1.35 |

| Gold | ||

| AUG ’23 | 1947.7 | 0 |

Grain Market Highlights

- Lower than anticipated crop ratings helped to rally the corn market to 7 – month highs.

- Like the corn market, soybeans rallied on lower crop ratings and crop concerns, with added support coming from a 7.5% rally in soybean meal.

- Soybean oil traded limit down in reaction to much lower than expected EPA biofuel targets for both 2024 and 2025. The negative reaction in bean oil likely weighed on the enthusiasm in soybeans, keeping the market from trading higher.

- Spillover strength from the corn and soybean markets, along with likely short covering in the Chicago wheat carried all three wheat classes to sharply higher closes in today’s trade.

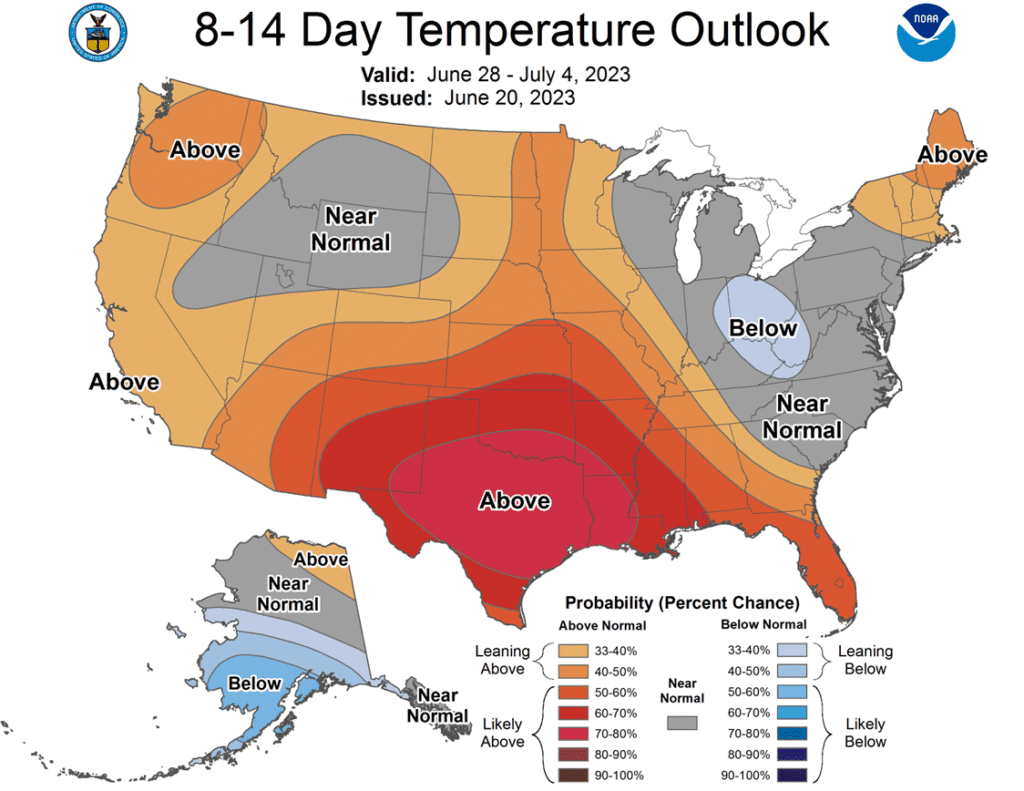

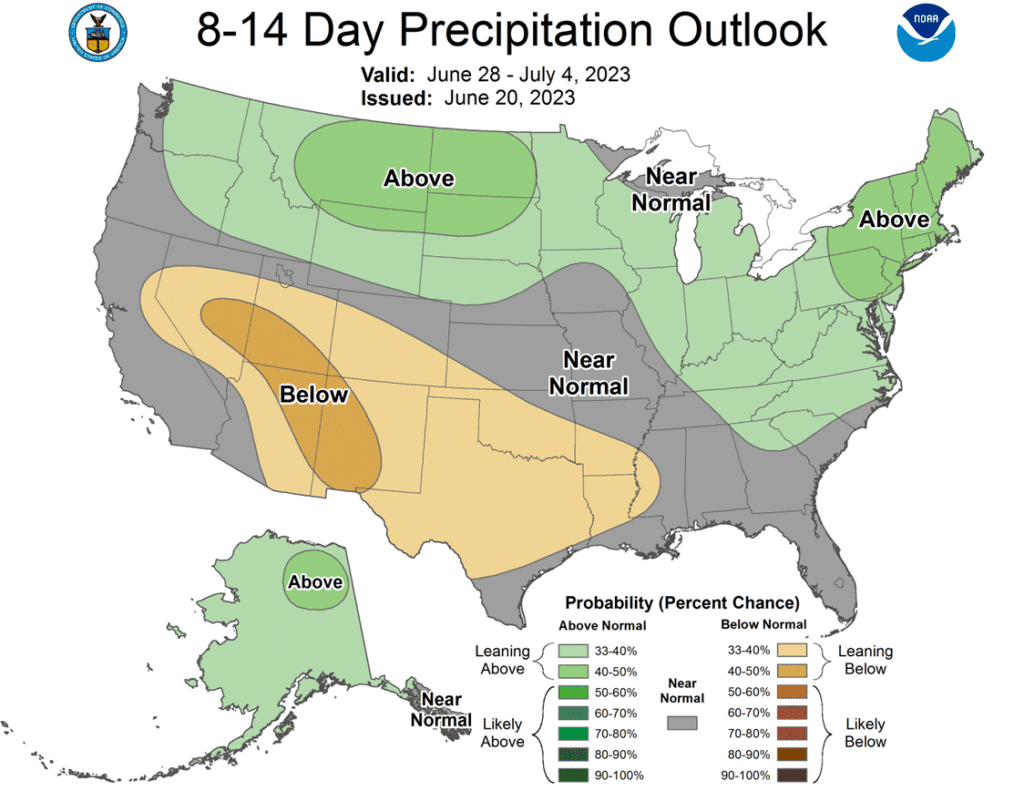

- To see the current US NOAA 8 – 14 day US Temperature and Precipitation Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

New Alert

Sell DEC ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. Any remaining old crop bushels that you may have should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Corn — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- Grain Market Insider recommends selling New Crop 2023 corn today. Insider recommends selling New Crop as the Dec 23 contract has pushed towards the upper end of our 590 – 630 target range. Despite the ongoing drought concerns, we have confidence to recommend selling into this rally as the Dec 23 610 Call options have been in place since May 2nd. On May 2, Insider recommended buying 560 and 610 Dec calls, and recommended exiting the 560s on June 2, once the 560 calls had gained enough in value to offset the cost of the 610 calls. If the skies never open up with rain, and Dec corn continues to rally, the 610 calls will continue to gain in value and protect today’s sale. Meanwhile, demand remains sluggish, and with Brazil beginning to harvest another possible record crop, both domestic and world carryout figures could potentially rise further. Any change to a more favorable weather forecast could easily turn the market lower and erase much, if not all, of the 125 cent rally from the May 19th low.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

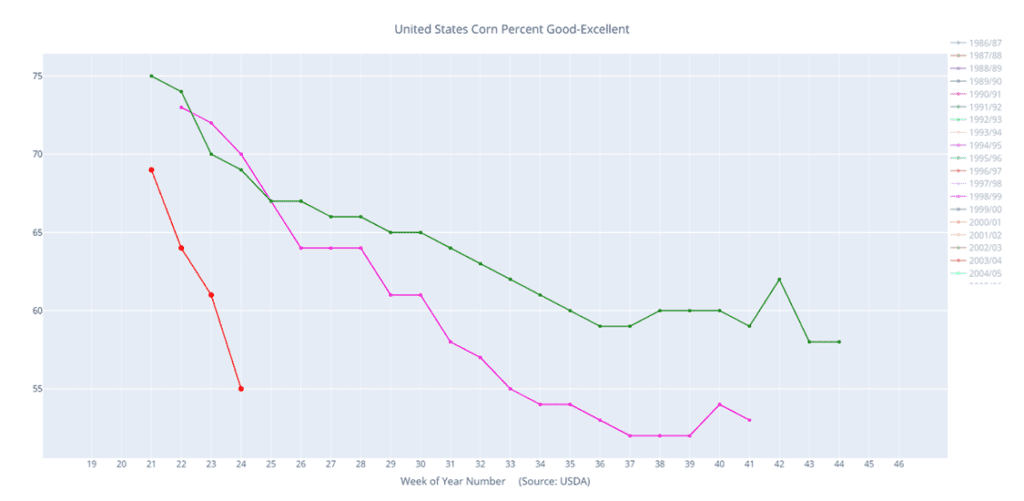

- The corn market rallied sharply, trading to within 9 cents of last October’s high, following the USDA’s release of yesterday’s Crop Progress report. The report showed a 6% drop in the good to excellent rating to just 55%, a steeper decline than expected and lower than 2012 ratings at this time.

- Some feel the current ratings suggest a yield much closer to 174 bpa versus the USDA’s current estimate of 181.5 bpa.

- The USDA reported that 877k tons of corn were inspected for export, much lower than the 1,170k tons inspected last week.

- The current 7-day forecast continues to look dry for much of the central Midwest, with conditions reportedly the worst since 1988.

- In Illinois, subsoil moisture is reported to be 85% short to very short, 9% higher than in the drought of 2012. Looking toward Nebraska, the NOAA indicated that between 6 and 15 inches of rain would be needed to reduce drought conditions in the region.

- Today’s rally will likely make US export offerings even more expensive on the world market, further hampering new export sales, especially with Brazil in the midst of harvesting their safrinha corn crop, which continues to weigh on the country’s domestic basis and export prices.

Above: The corn market continues to run on weather concerns, and the September contract is above the 50-day moving average and knocking on the door of 100-day moving average and the recent 625 high. If the market can push through that level, it may be able to make a run for the 650 – 670 resistance level around the March highs. If not, support may be found between 580 and 540.

2023/24 Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell NOV ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- Grain Market Insider sees an active opportunity to sell New Crop 2023 soybeans. Grain Market Insider sees an active opportunity to sell New Crop 2023 soybeans. November soybeans have rallied over 200 cents from the May 31st low and hit the upper end of our 1300 to 1350 target range. With the November contract a little bit over the upper end of this range, an Active sales opportunity continues to get some New Crop priced. KC Wheat has demonstrated that domestic drought conditions do not necessarily guarantee higher domestic prices if global supplies are ample. US wheat country has been extremely dry for many months, yet prices are about even with where prices were in late 2021, before Russia invaded Ukraine. Global soybean supplies could be record large, and this could be a rally risk factor.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans closed sharply higher today, but soy products were a mixed bag as soybean meal rocketed over 6% higher, but soybean oil closed limit down after the EPA biofuel mandate.

- The EPA made their announcement regarding biofuel targets and the 2024 and 2025 blending mandates are lower than had been previously hoped for, which caused the limit down move today in soybean oil.

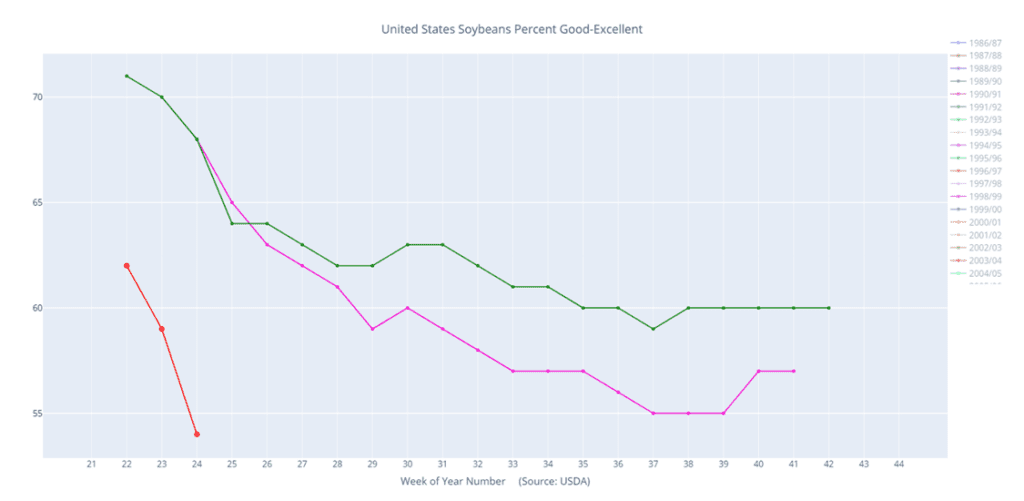

- Yesterday’s crop progress was a big catalyst for the gains in corn and soybeans today after it was revealed that the good to excellent rating for soybeans fell by 6% to 54%, far below analysts’ expectations. These ratings may continue to decline as the 10-day forecast remains dry.

- Soybean export inspections were poor last week at 6.8 mb, which puts total inspections for 22/23 down 4% from the previous year. The US is struggling to compete with Brazil’s significantly cheaper corn exports.

Above: The market’s eye is squarely on the weather at this time. The August contract has rallied through the 50-day moving average and is approaching the 1450 resistance area and the 100-day ma. If the market can rally beyond this point, the resistance area between 1500 and 1550 could be its next target. If the market drops back, support could be found between 1340 and 1300 with further support near 1270.

2023/24 Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- All three US wheat futures classes closed sharply higher alongside Paris milling wheat futures, which gained as much as 8.25 Euros per metric ton.

- The weather market is still impacting the grain complex, with spillover support from corn and soybeans. Both of those crops saw a decline in condition beyond what the trade was expecting. Compared with last week, corn was down 6% and soybeans were down 5%.

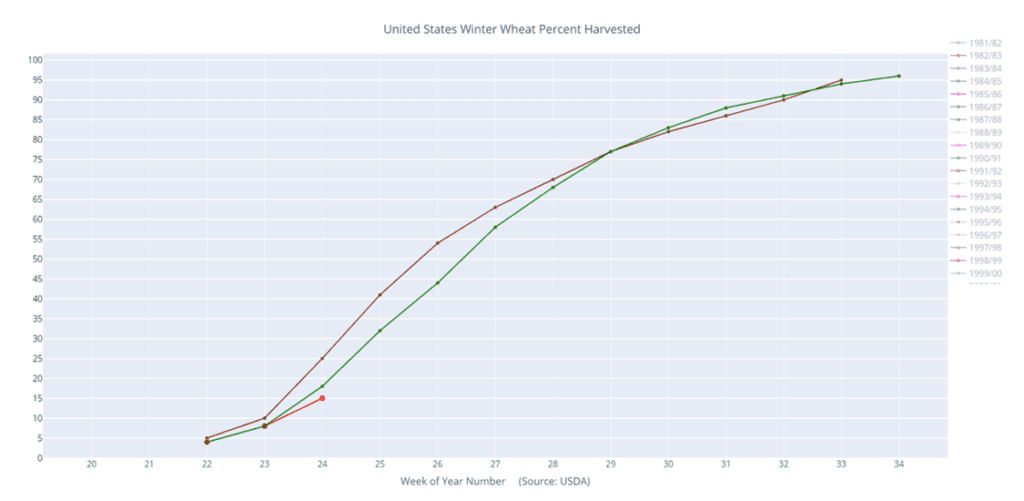

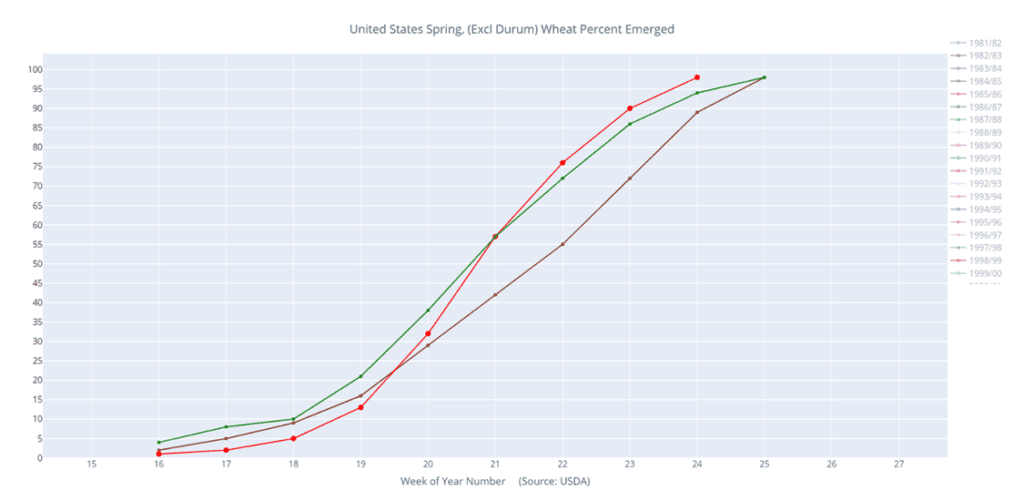

- The most recent Crop Progress report showed what winter wheat harvest is 15% complete vs 20% average. The lag appears to be in the southern plains area where rainfall is causing delays. Spring wheat condition declined (perhaps more than expected) to 51% good to excellent vs 60% last week and 59% at this time last year. The winter wheat good to excellent condition was left unchanged at 38% good to excellent.

- The US Dollar Index trended lower today, offering a boost to the wheat market. Traders did not seem to mind the soft export sales figure of 8.7 mmt.

- According to IKAR, a Russian consultancy, Russian wheat exports are now as cheap as $228 per metric ton FOB. Russia has also said they are unlikely to extend the Black Sea export corridor again.

- Given the weather forecast and recent rally in the grain complex, funds are likely short covering, especially in the wheat market. July Chicago wheat closed higher for the fourth day in a row.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

New Alert

Sell SEP ’23 Cash

2024

New Alert

Sell JUL ’24 Cash

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Grain Market Insider is done with the 2022 crop, and there will be no New Alerts posted for the 2022 crop going forward.

- Grain Market Insider recommends selling 2023 New Crop. We are in a weather market and with the US Drought Monitor showing dryness across the Midwest, September Chicago Wheat has now rallied about 22% from its May 31 low into the March – April resistance area and is overbought. As of late, the wheat market has largely been a follower of the corn market, and this rally has been fueled in part by the Funds exiting their short positions. While there are production concerns in parts of the country, demand has been weak, and the potential remains for a rising carryout. Any change to a more favorable weather forecast could easily erase much, if not all, of the weather premium that has been added to prices. With the dry conditions and great uncertainty that many of you are experiencing, about how much you will have to harvest, we understand there’s hesitancy to sell anything here. If you are concerned about committing physical bushels with a cash sale, consider selling futures or buying put options.

- Grain Market Insider recommends selling 2024 Chicago wheat. Prices for the 2024 crop have largely followed prices for the 2023 crop and are currently about 20% above the low set on May 31. Weather and production concerns have been the primary driver of prices lately, and the funds have likely been covering short positions, further feeding the rally. As we all know, weather markets can be fickle beasts, and any change in the forecast or crop conditions can quickly turn traders from buyers to sellers, quickly erasing much, if not all, of the premium priced into the market. Grain Market Insider recommends making a sale on next year’s 2024 Chicago wheat crop and using either a July ’24 futures contract or a July 24 HTA contract, so basis can be set at a later date, as it should improve in time.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The market has been able to trade above the recent resistance area and is near the 200-day moving average and 870 resistance. If the market can push through, 920 is the next major point of resistance. If it falls back, initial support could be near 825 with further support between 778 and 764.

2023/24 Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks, and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract, and there is currently no carry offered.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting has largely been completed, dryness in some areas is increasing. With the market still largely oversold on the weekly charts and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The market has rolled from the July to the September contract and has rallied out of its congestion area on the Front Month Continuous chart into the May highs. Further resistance above the market may be between 889 and 940, the April and December highs respectively. While the upside breakout is a positive sign, the market will need additional bullish news to keep it moving. Should the market reverse course and turn lower, support below the market may be found between 770 and 760.

2023/24 Spring wheat percent emerged (red) versus the 5-year average (green) and last year (purple).

Other Charts / Weather