Grain Market Insider: June 20, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 643.75 | 3.5 |

| DEC ’23 | 597.5 | 0 |

| DEC ’24 | 546.5 | 5 |

| Soybeans | ||

| JUL ’23 | 1477.25 | 10.75 |

| NOV ’23 | 1342.75 | 0.5 |

| NOV ’24 | 1240.5 | 1.75 |

| Chicago Wheat | ||

| JUL ’23 | 695.75 | 7.75 |

| SEP ’23 | 708.75 | 7.25 |

| JUL ’24 | 742.5 | 6.5 |

| K.C. Wheat | ||

| JUL ’23 | 836 | -6 |

| SEP ’23 | 834.5 | -4.5 |

| JUL ’24 | 804.25 | -2 |

| Mpls Wheat | ||

| JUL ’23 | 849 | -4.5 |

| SEP ’23 | 852 | -4.5 |

| SEP ’24 | 800 | 1.5 |

| S&P 500 | ||

| SEP ’23 | 4439.5 | -14.25 |

| Crude Oil | ||

| AUG ’23 | 71.22 | -0.71 |

| Gold | ||

| AUG ’23 | 1948.4 | -22.8 |

Grain Market Highlights

- Hopes of improved relations with China following Secretary of State Blinken’s visit to China and continued dryness over large areas of the Midwest gave strength to the markets overnight, but forecasts for rain next week led to some profit taking and the corn market closing mixed.

- Like the corn market, anticipation of better relations with China and the lack of significant rainfall in much of the Midwest drove soybean futures higher in the overnight session, but profit taking and weaker soybean meal and oil added resistance in the day session.

- Harvest pressure and Canadian rains added pressure to the K.C. and Minneapolis wheat contracts respectively, while continued short covering on dry conditions helped to rally Chicago contracts.

- While the US Dollar is down almost 2% from its recent high at the end of May, it looks to be consolidating. It appears to have traded into resistance and may trade lower, which would add support to commodities.

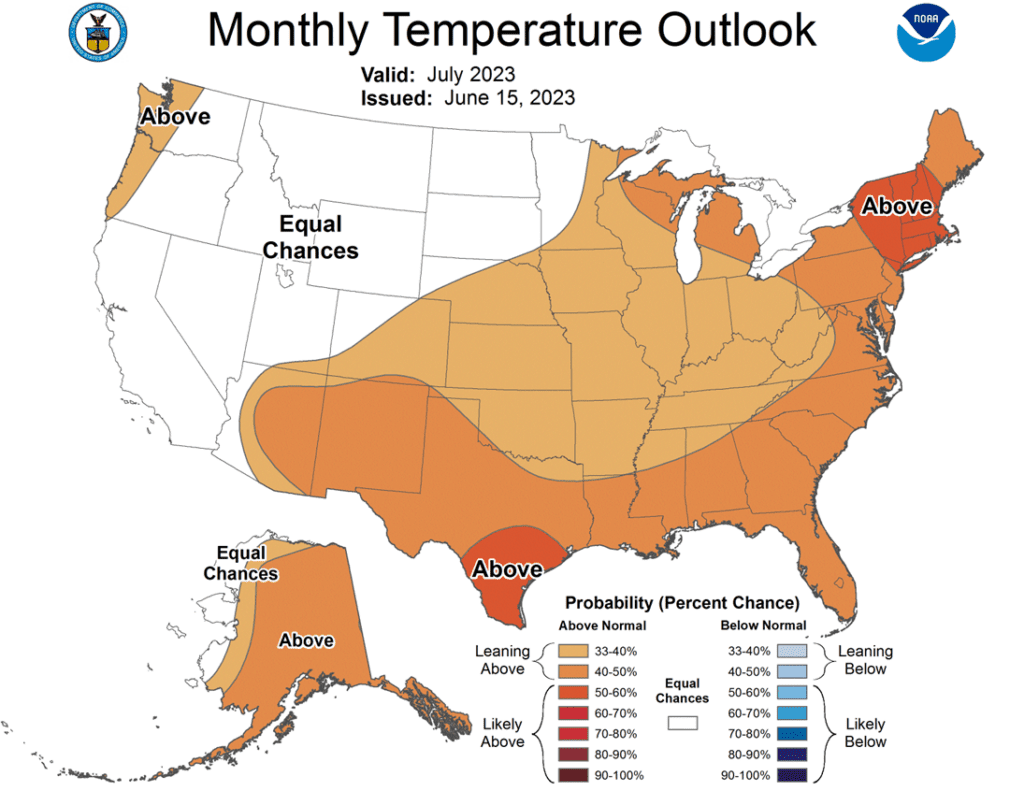

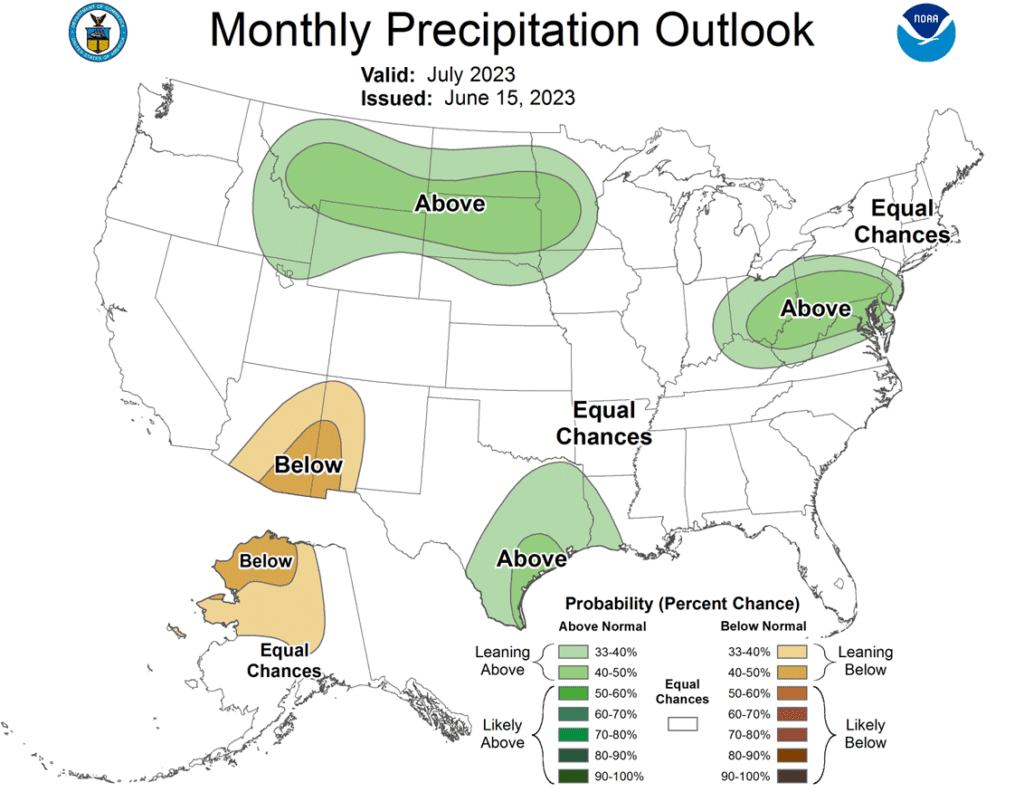

- To see the current US NOAA 30-day US Temperature and Precipitation Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn is up over 90 cents from the May 18th low. Elevators are already rolling their bids from the July contract to September. While the price inverse between the two has been nearly cut in half in just six trading days, September is still trading at a 46-cent discount to July. The risk remains the loss of this premium as elevators roll from pricing off July to pricing off September. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Corn — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is recommended at this time for New Crop. Continued dryness has pushed the Dec 23 contract into the lower end of the price window we’ve been targeting for a number of weeks now: 590 – 630. No official recommendation yet as we are leaning toward the upper end of this target price range for the moment.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- The corn market traded both sides of unchanged on the spotty nature of the weekend’s precipitation but closed mixed on technically driven profit taking in the spreads and increased chances for moisture across the Midwest next week.

- Recent forecasts with both the European and the US models are calling for additional rain in the Northern Midwest and Eastern Corn Belt early next week. Rain this week is expected to favor western Nebraska and the Northern Plains. Outside of that, it will remain dry, and if the forecast does not verify, the market may be in for another leg up.

- Secretary of State Anthony Blinken visited to China to meet with President Xi Jinping and helped to smooth the US’ relationship with China, though concerns remain about the stability of China’s economy and its commitment to become more self-reliant.

- Brazil’s second corn crop (safrinha) harvest is underway and with a lack of storage for both soybeans and corn, nearby basis is getting hit hard with farmers selling, adding further resistance to US prices.

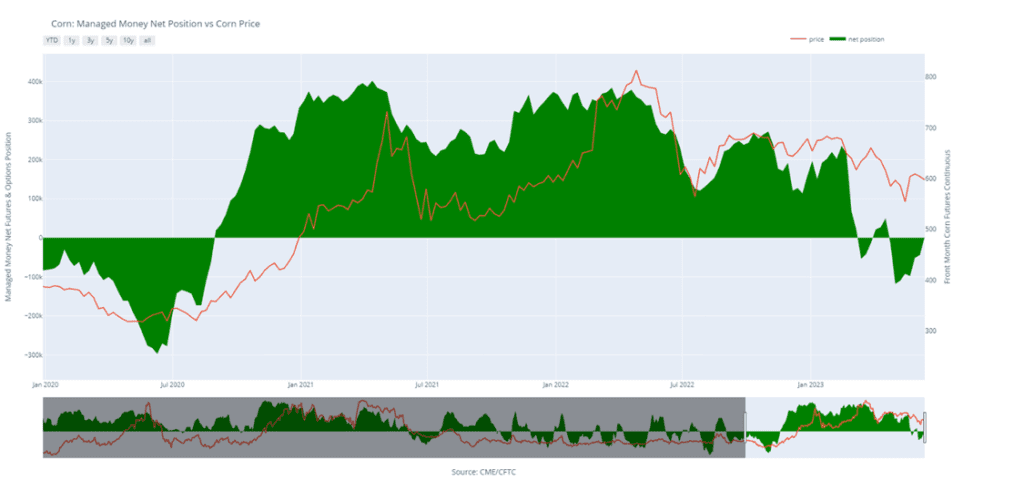

- Last week it was reported by the Commodity Futures Trading Commission that Managed Money funds bought a large 47k contracts between June 6 and June 13, thereby flipping their net position from net short 44.5k contracts to net long 2,145 contracts.

- The USDA will release its weekly Crop Progress report this afternoon with many looking for lower ratings than last week’s 61% good to excellent rating with the relatively dry conditions last week and the relatively spotty rainfall over the weekend.

Above: The corn market has had quite a run recently on weather concerns. The September contract has pushed into the 50-day moving average, and the psychological resistance area is around 600 on the continuous chart. With a bearish reversal showing, the market will need more bad news to overcome the reversal and further resistance near 625 and the 100-day moving average. Otherwise, the market could turn lower where support may be found between 550 and 535.

Corn Managed Money Funds net position as of Tuesday, June 13. Net position in Green versus price in Red. Money Managers net bought 46,637 contracts between June 7 – June 13, bringing their total position to a net long 2,145 contracts.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

Active

Sell JUL ’23 Cash

2023

Active

Sell NOV ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- Grain Market Insider sees an active opportunity to sell 2022 Old Crop soybeans. Grain Market Insider continues to recommend using this rally to clear out the last of the bushels in the bin. July beans are up nearly 200 cents from the May 31st low. If the weather pattern stays dry, prices could continue to push higher; yet the first significant moisture added to the forecast poses the risk of erasing this added weather premium just as fast (or faster) given the size of South American supplies and their discounted price. This will be the last Grain Market Insider recommendation for 2022 soybeans as we’re emptying the bins on this rally and moving fully on to 2023 and 2024 crops.

- Grain Market Insider sees an active opportunity to sell New Crop 2023 soybeans. November soybeans have rallied over 200 cents from the May 31st low and today entered the target range we’ve been looking for: 1300 to 1350. The upper end of this range was nearly tagged with an intraday high of 1347, so we are recommending pricing some new crop. KC Wheat has demonstrated that domestic drought conditions do not necessarily guarantee higher domestic prices if global supplies are ample. US Wheat country has been extremely dry for many months, yet prices are about even with where prices were in late 2021, before Russia invaded Ukraine. Global soybean supplies could be record large, and this could be a rally risk factor.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans were mixed today trading both sides of unchanged and ultimately closed higher in July and November but lower in September. Both soybean oil and meal ended lower, and crude oil closed lower as well.

- Crop progress will be released at 3pm today, and trade is estimating that the good to excellent rating will fall by 2% to 57% after disappointing and spotty rains over the past week.

- Some support came from Secretary of State Anthony Blinken’s visit to China where he met with President Xi Jinping. The meeting apparently went well and soothed tensions. On the other hand, there have been some concerns that China’s GDP is lagging.

- The EPA is slated to make their announcement regarding renewable diesel mandates tomorrow which could have a big impact on profitability.

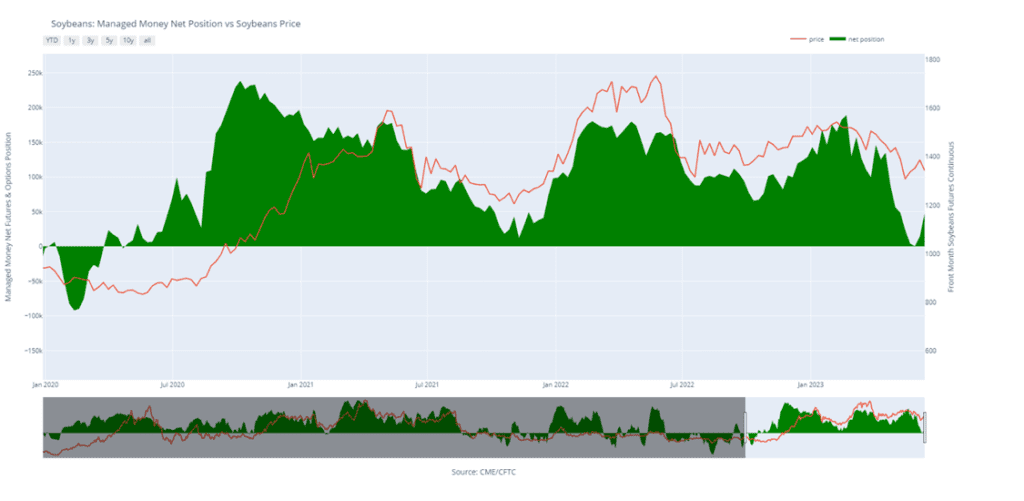

- Funds were buyers of soybeans by 33,901 contracts last week increasing their net long position to 47,882 contracts.

Above: With traders continuing to eye the weather maps, the August contract has pierced above the psychological level of 1400 and is presenting a bearish reversal. The market is in need of continued weather/crop concerns to fuel the current rally with resistance above the market near 1450. If the market drops back, support could be found between 1340 and 1300 with further support near 1270.

Soybeans Managed Money Funds net position as of Tuesday, June 13. Net position in Green versus price in Red. Money Managers net bought 33,901 contracts between June 6 – June 13, bringing their total position to a net long 47,882 contracts.

Wheat

Market Notes: Wheat

- After a two-sided trade, wheat finished with decent gains in the Chicago contract. Kansas city futures posted losses, with the nearby contracts down more than the deferred. This spread action may be related to the 7-day forecast for HRW areas, which is mostly dry, and may lead to increased harvest pressure.

- Parts of Canada received heavy rains this weekend, which may account for the decline in spring wheat futures prices today.

- Russian spring wheat areas remain in need of moisture. The longer range forecasts suggest these areas will get some rain. Northern Europe is also dry but looks like it will get some rain too.

- Contrary to what normally happens in an El Nino year, Australia is getting rain. This could help their wheat crop, but it is possible that drought conditions could still develop over time.

- Algeria is said to have purchased between 580,000 and 620,000 mt of milling wheat, likely sourced from Russia.

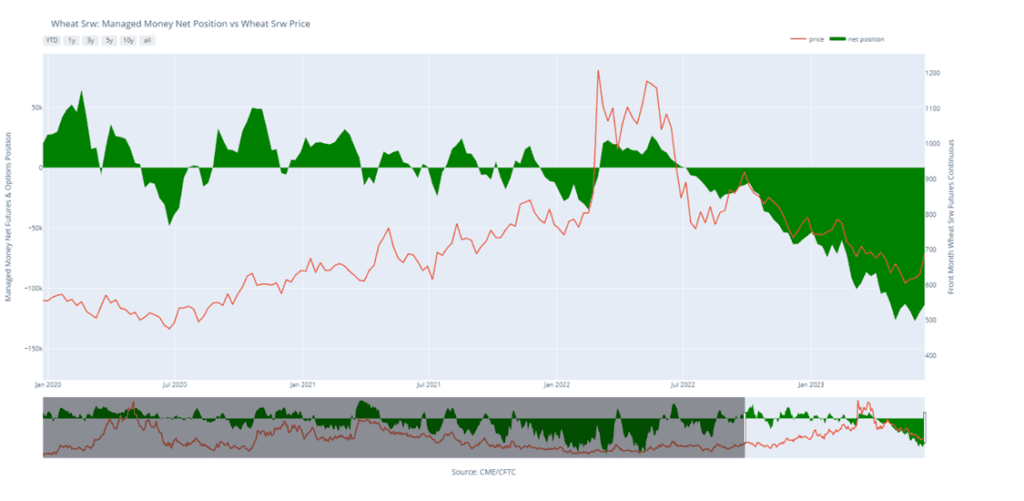

- Managed funds reduced their net short position in Chicago wheat last week but are estimated to still be short more than 113k contracts as of last Tuesday.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. July pushed through the upper end of the 640 – 670 range we’ve been targeting. With harvest coming upon us, any remaining old crop bushels should be moved to make room for new crop. There will be no New Alerts posted for the 2022 crop going forward.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No new action is recommended for the 2024 crop at this time. Prices have rallied nicely off of lows to start the month of June. With continued Black Sea tensions July of 2024 futures prices should be able to build off of the recent lows. We are currently targeting the 750-775 area to advance further on sales.

Above: September wheat was able to break out and close above the 50-day moving average and the May highs, which is supportive and could portend a change in trend. Resistance for the market could still be found between 670 and 724 with the 100-day moving average resting near 684. Initial support below the market (should prices turn lower) may be found between 625 and 610 and again near 573.

Chicago Wheat Managed Money Funds net position as of Tuesday, June 13. Net position in Green versus price in Red. Money Managers net bought 6,044 contracts between June 6 – June 13, bringing their total position to a net short 113,430 contracts.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The bullish reversal from May 31 indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

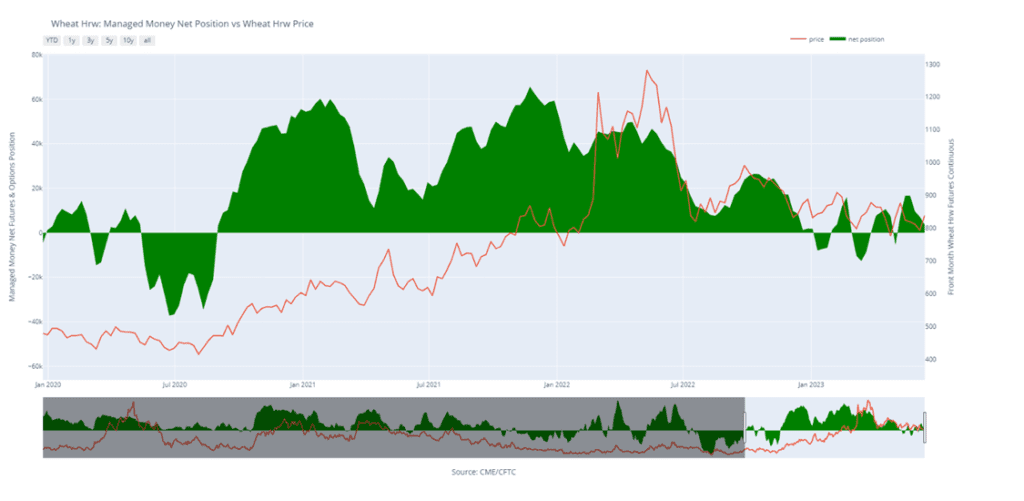

K.C. Wheat Managed Money Funds net position as of Tuesday, June 13. Net position in Green versus price in Red. Money Managers net sold 3,419 contracts between June 6 – June 13, bringing their total position to a net long 3,616 contracts.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks, and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract, and there is currently no carry offered.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting has largely been completed, dryness in some areas is increasing. With the market still largely oversold on the weekly charts and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The market has rolled from the July to the September contract and has rallied out of its congestion area on the Front Month Continuous chart into resistance at the 100-day moving average near 860, with further resistance above the market between 889 and 940 the April and December highs respectively. While the upside breakout is a positive sign, the market will need additional bullish news to keep it moving. Should the market reverse course and turn lower, support below the market may be found between 770 and 760.

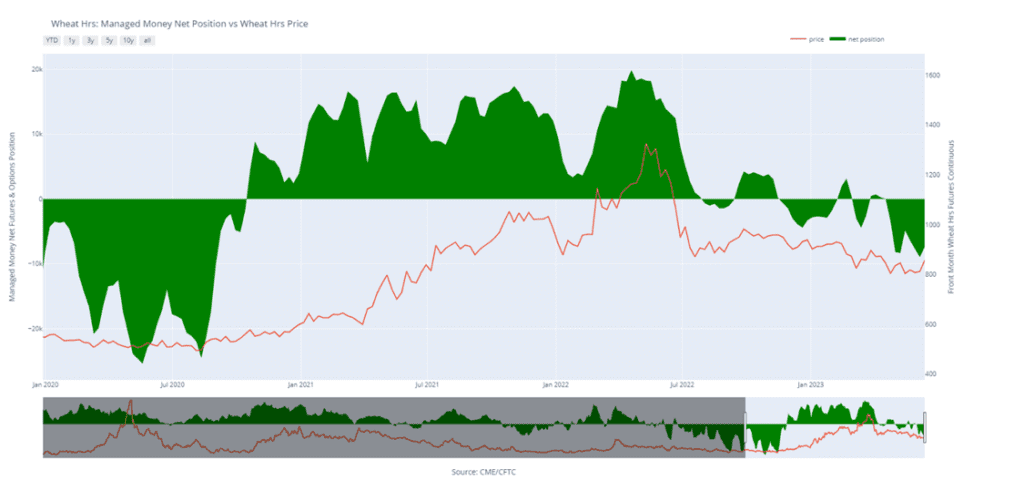

Minneapolis Wheat Managed Money Funds net position as of Tuesday, June 13. Net position in Green versus price in Red. Money Managers net bought 1,552 contracts between May 31 – June 6 – June 13, bringing their total position to a net short 7,422 contracts.

Other Charts / Weather