Grain Market Insider: June 15, 2023

The CME and Total Farm Marketing offices will be closed

Monday, June 19, in observance of Juneteenth

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 623.25 | 15.5 |

| DEC ’23 | 574.5 | 25.25 |

| DEC ’24 | 530.25 | 13 |

| Soybeans | ||

| JUL ’23 | 1428.25 | 40 |

| NOV ’23 | 1292.25 | 52.25 |

| NOV ’24 | 1218.75 | 27.25 |

| Chicago Wheat | ||

| JUL ’23 | 661.5 | 31.25 |

| SEP ’23 | 672.75 | 31.5 |

| JUL ’24 | 710.5 | 26.25 |

| K.C. Wheat | ||

| JUL ’23 | 812.75 | 27 |

| SEP ’23 | 808.75 | 26.5 |

| JUL ’24 | 778.5 | 22.5 |

| Mpls Wheat | ||

| JUL ’23 | 832.75 | 23.5 |

| SEP ’23 | 833.5 | 25.75 |

| SEP ’24 | 790.25 | 8.5 |

| S&P 500 | ||

| SEP ’23 | 4468.25 | 49.75 |

| Crude Oil | ||

| AUG ’23 | 70.92 | 2.46 |

| Gold | ||

| AUG ’23 | 1970.6 | 1.7 |

Grain Market Highlights

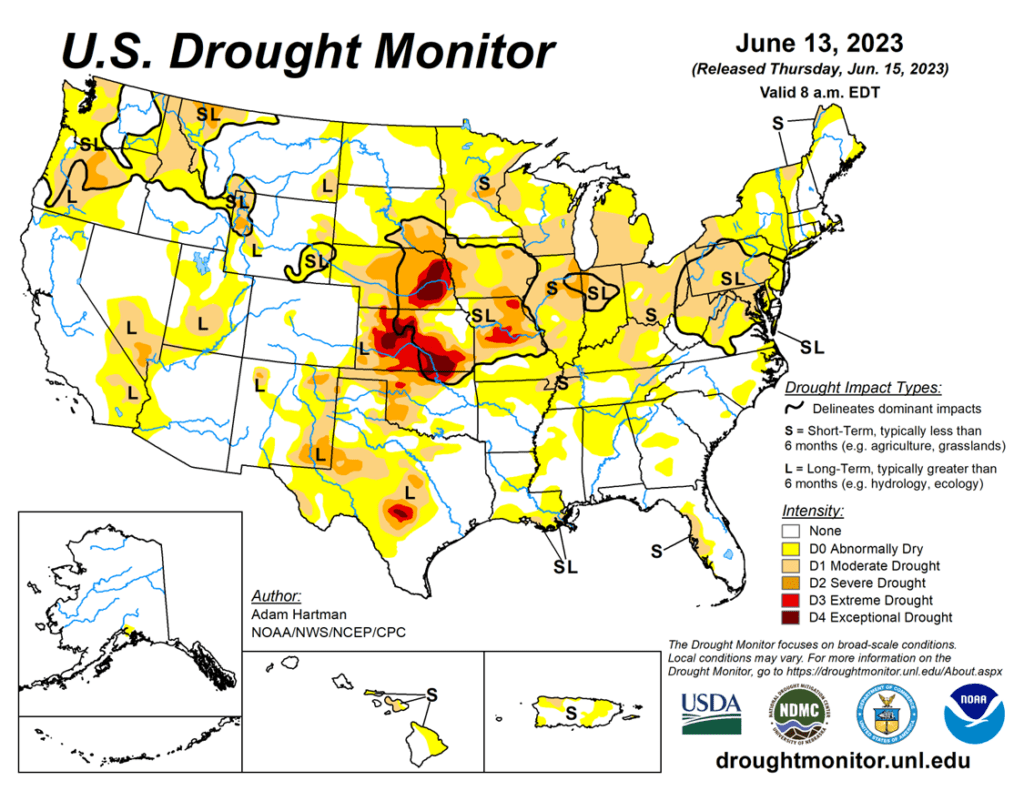

- Corn was sharply higher on a drier outlook for much of the corn belt over the next seven days and a continued expansion of drought in key corn producing areas according to the weekly updated drought monitor map.

- Strong May NOPA soybean crush, strong weekly export sales and a continued surge higher in soybean oil all helped send soybean futures sharply higher.

- Soybean oil continued its impressive June rally, closing over 4.4% higher, while soybean meal also traded higher on the day.

- Spillover strength from corn and soybeans as well as a lower US Dollar Index helped propel all three wheat classes higher.

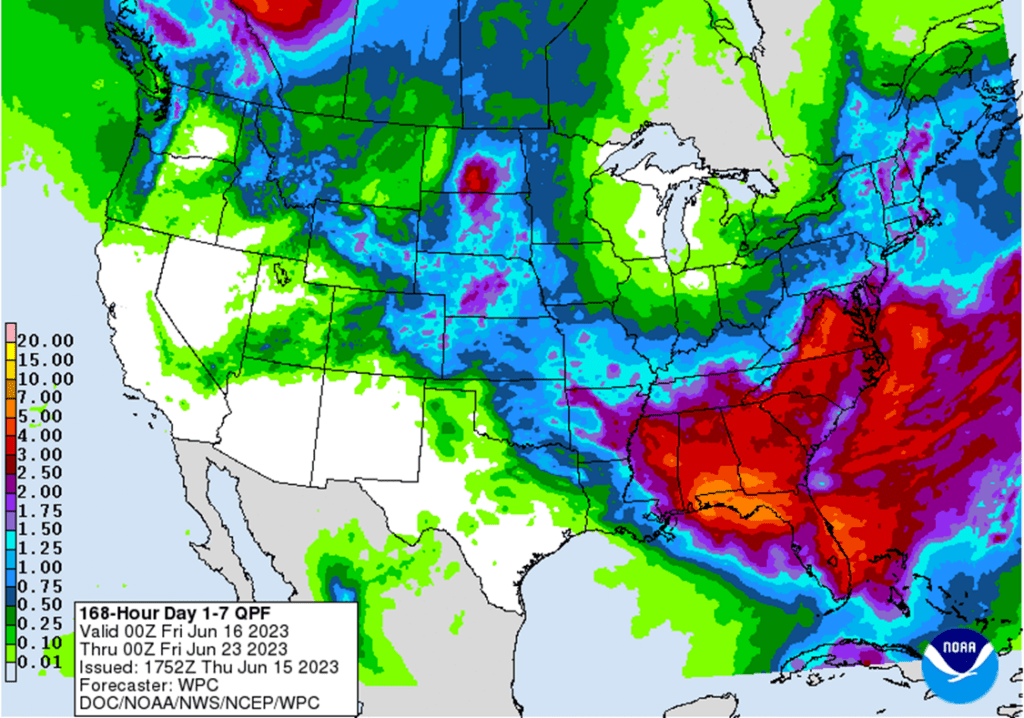

- To see the updated US Drought Monitor as well as the 7-day NOAA Precipitation Outlook scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn has had nearly a 60-cent rally in the last couple of weeks. Expect volatility to remain in the market; a changing weather forecast can push the market significantly in either direction. If you still have Old Crop to sell, consider using this rally to begin pricing some of those bushels. Don’t forget, there is a significant inverse between the July and September futures contracts, which could be lost when bids get rolled from one contract to the next.

- No action is recommended at this time for New Crop. With dryness building in the Midwest and an estimated fund short position near 40k contracts, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you don’t happen to have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Corn prices surged higher on Thursday, fueled by concerns regarding weather forecasts remaining dry across large portions of the corn belt. Strong technical buying pushed prices through levels of resistance. December corn closed at its highest price level since February 27 and is trading 44 cents higher on the week.

- Current drought monitor maps reflect the impacts of dry conditions across the corn belt as overall drought area expanded last week. With today’s weekly update, an estimated 57% of corn production areas in the US are experiencing some form of drought.

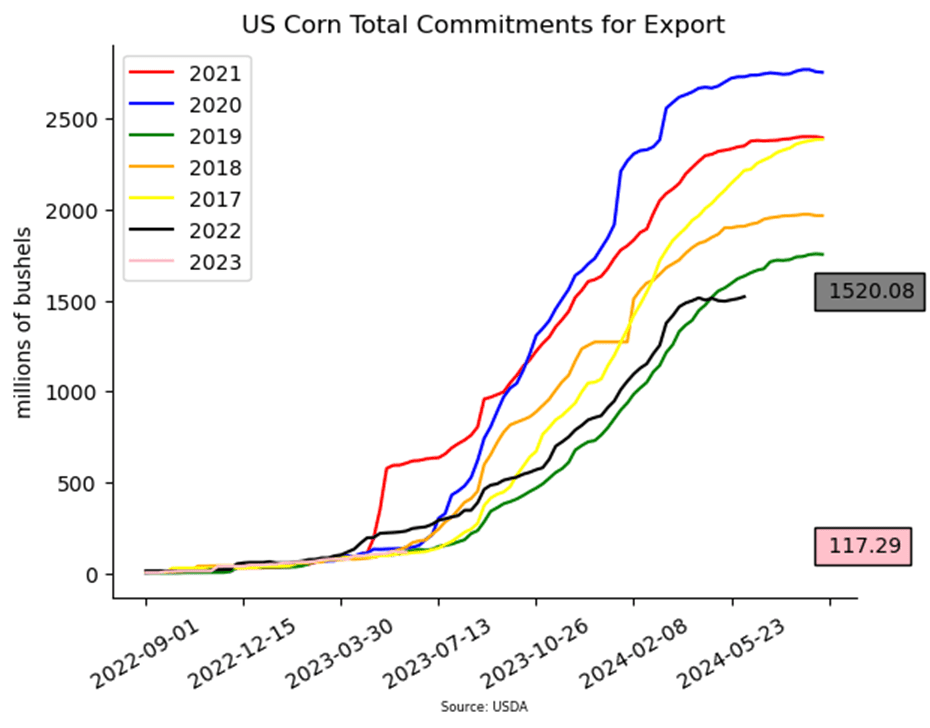

- Weekly export sales were still disappointing last week, but the U.S. did sell 273,300 MT of old crop corn. This was the largest weekly total for old crop corn sales in the last five weeks.

- Outside markets were supportive of the grain markets on Thursday as equity and energy futures saw buying support, helping build a “risk-on” trade during the day.

- The weather forecast overall remains spotty as rainfall coverage is expected to be hit-or-miss for the next seven days. Temperatures are forecasted to warm over the corn belt, which will likely increase crop stress.

Above: The corn market has had quite a run recently on weather concerns, and the September contract has pushed into a resistance area between 560 and 585. Should the market break through the 585 level, it may be poised to test the congestion area between 595 and 625. If not, initial support below the market may be found near 535 and again between 505 and 515.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

Continued Opportunity

Sell JUL ’23 Cash

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- Grain Market Insider sees a continuing opportunity to sell 2022 Old Crop soybeans and take advantage of the recent rally. July soybeans have rallied nearly 160 cents from the May low and are approaching the 100-day moving average which should pose some resistance. Additionally, with a 60+ cent inverse to the August contract, much of that value may be lost as end users roll bids from the July contract.

- We recommend not adding to current sales levels for the new 2023 crop at this time. A quick planting pace with favorable conditions and South American competition greatly pressured soybeans in April and May. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1300 to 1350 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans skyrocketed higher today along with both soybean meal and soybean oil, which gained nearly 4.50%. NOPA crush was released and was supportive, and weather forecasts have trended slightly drier into next week.

- NOPA US crush for May 2023 was pegged at 177.915 mb of soybeans, which was a record for the month and 4% above May of 2022. Soybean oil stocks came in at 1.872 billion bushels, which was below all trade guesses, and the average guess was 1.942. Stocks were up 5.5% from May 2022.

- The dry weather has added support to the soy complex as well as the corn market, although soybeans have a wider window for beneficial rain to fall. Soil moisture has been extremely short in the eastern Corn Belt, and good rains will be needed to offset the coming high temperatures.

- Argentina’s Rosario grain exchange cut their soybean production estimate again today by 5% to 20.5 mmt. The previous estimate was 21.5 mmt, both way below the USDA’s 25 mmt estimate.

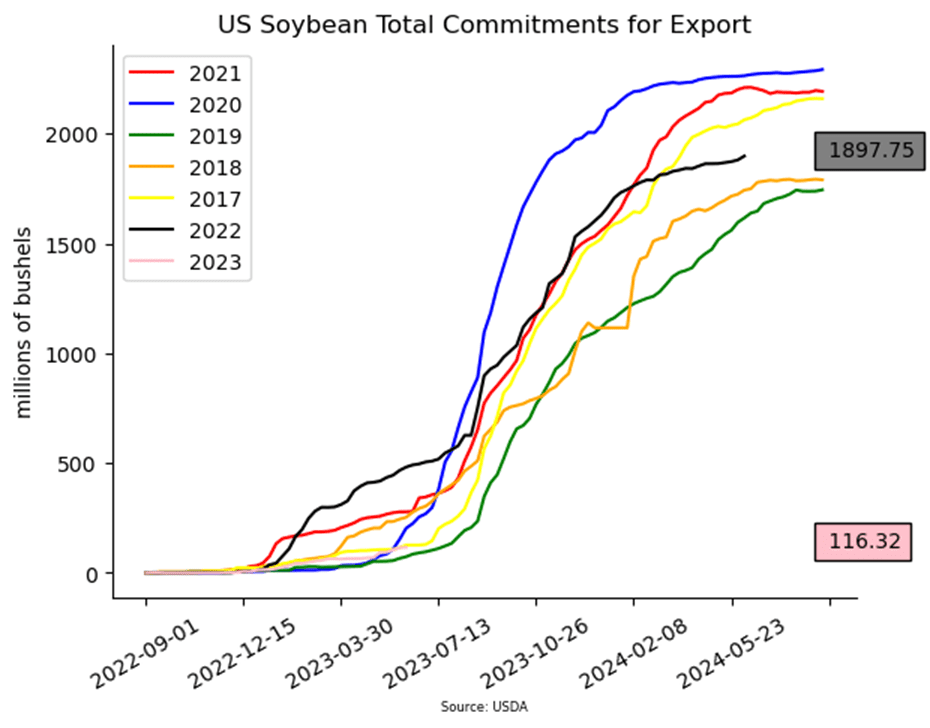

- Export sales for soybeans showed an increase of 17.6 mb for 22/23, which was up from the prior week and the 4-week average. There was an increase of 1.8 mb for 23/24, and last week’s export shipments were 5.2 mb, down 43% from the previous week and 41% from the prior 4-week average.

Above: The market continues to be strong with traders eyeing the weather maps. The August contract is nearing its April highs in the neighborhood of 1383, and if the market can penetrate those levels, it may be poised to test the psychological level of 1400. If prices were to set back, initial support could be found between 1290 and 1250.

Wheat

Market Notes: Wheat

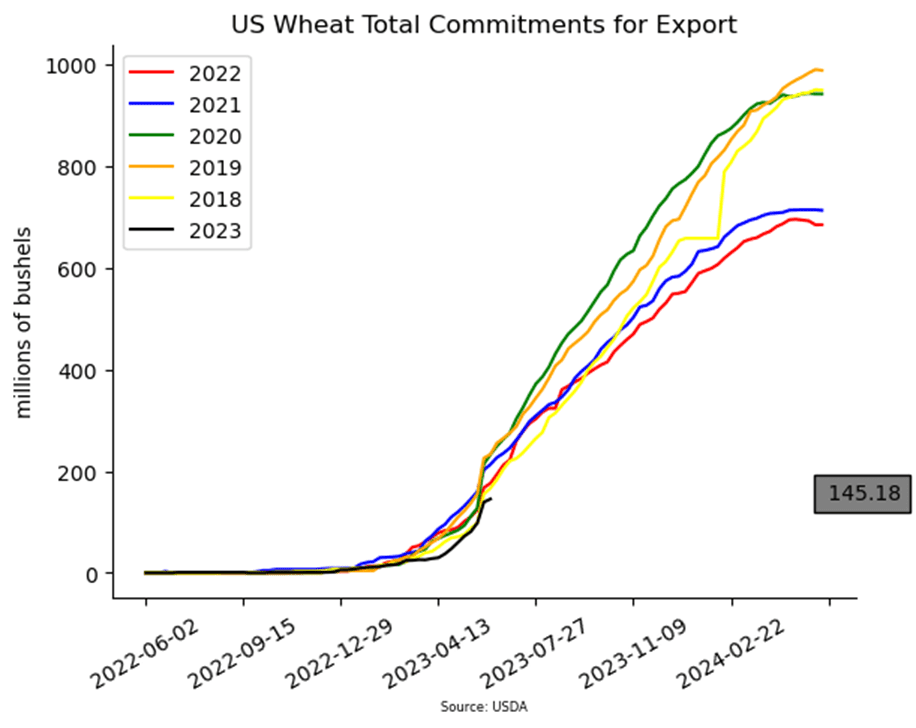

- The USDA reported an increase of 6.1 mb of wheat export sales for 23/24.

- Spillover support from corn and soybeans certainly helped the wheat market rally today. The current weather market environment is sure to remain volatile, especially with markets closed Monday for the Juneteenth holiday.

- Both the American and European weather models are aligning to show a dry forecast for the next 10 days across most of the corn belt, and this likely led to today’s rally. Short covering may have also played a part, especially in wheat, where the funds are said to still hold a net short of about 115,000 contracts.

- The US Dollar Index was sharply lower today, which eased pressure on the wheat market, allowing it to run. In general, wheat and the US Dollar have an inverted relationship, meaning that when the dollar trades lower, wheat tends to trade higher (and vice versa).

- The Russian government is said to have established a $240 per ton price floor on wheat exports for July and August. It remains to be seen if exporters will adhere to this, but these export values are far below US prices and may limit upside potential.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. With good price action to start June, the market may be positioned for a short covering rally as new crop harvest quickly approaches. We continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No new action is recommended for the 2024 crop at this time. Prices have rallied nicely off of lows to start the month of June. With continued Black Sea tensions July of 2024 futures prices should be able to build off of the recent lows. We are currently targeting the 750-775 area to advance further on sales.

Above: September wheat was able to break out and close above the 50-day moving average and the May highs, which is supportive and could portend a change in trend. Resistance for the market could still be found between 670 and 724 with the 100-day moving average resting near 684. Initial support below the market (should prices turn lower) may be found between 625 and 610 and again near 573.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The bullish reversal from May 31 indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

Continued Opportunity

Sell JUL ’23 Cash

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- Grain Market Insider sees a continued opportunity to sell 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract and there is currently no carry offered.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting has largely been completed, dryness in some areas is increasing. With the market still largely oversold on the weekly charts and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract continues to be weak and consolidate. With winter wheat harvest on the horizon, spillover selling pressure could plague the spring wheat market in the weeks to come. Resistance currently sits between 820 and 855 and then the recent high of 888-1/2. Support below the market may be found between 770 and 760.

Other Charts / Weather