Grain Market Insider: June 14, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| JUL ’23 | 607.75 | -4.75 |

| DEC ’23 | 549.25 | -2 |

| DEC ’24 | 517.25 | 1.25 |

| Soybeans | ||

| JUL ’23 | 1388.25 | -11 |

| NOV ’23 | 1240 | 0.5 |

| NOV ’24 | 1191.5 | 0.75 |

| Chicago Wheat | ||

| JUL ’23 | 630.25 | -6 |

| SEP ’23 | 641.25 | -6.75 |

| JUL ’24 | 684.25 | -7.75 |

| K.C. Wheat | ||

| JUL ’23 | 785.75 | -6 |

| SEP ’23 | 782.25 | -8 |

| JUL ’24 | 756 | -11 |

| Mpls Wheat | ||

| JUL ’23 | 809.25 | -0.5 |

| SEP ’23 | 807.75 | -1.75 |

| SEP ’24 | 781.75 | -3.5 |

| S&P 500 | ||

| SEP ’23 | 4392.75 | -24 |

| Crude Oil | ||

| AUG ’23 | 68.33 | -1.25 |

| Gold | ||

| AUG ’23 | 1958.5 | -0.1 |

Grain Market Highlights

- Corn prices recovered somewhat from their overnight lows that were weighed down due in part to the rain that fell in parts of the northeastern and eastern Corn Belt yesterday.

- An increase in Brazil’s crop production estimate and weakness in their export basis weighed on July soybeans as they may hinder further US sales, while New Crop contracts held small gains in carryover support from yesterday’s rally.

- Falling Russian prices and the continuing harvest in Texas added pressure to all three wheat classes and pushed them to close lower.

- The two day Federal Reserve meeting to determine whether to increase interest rates concluded this afternoon, leaving the current rates unchanged, which was largely anticipated by the market and may have added pressure to the US dollar and its move lower.

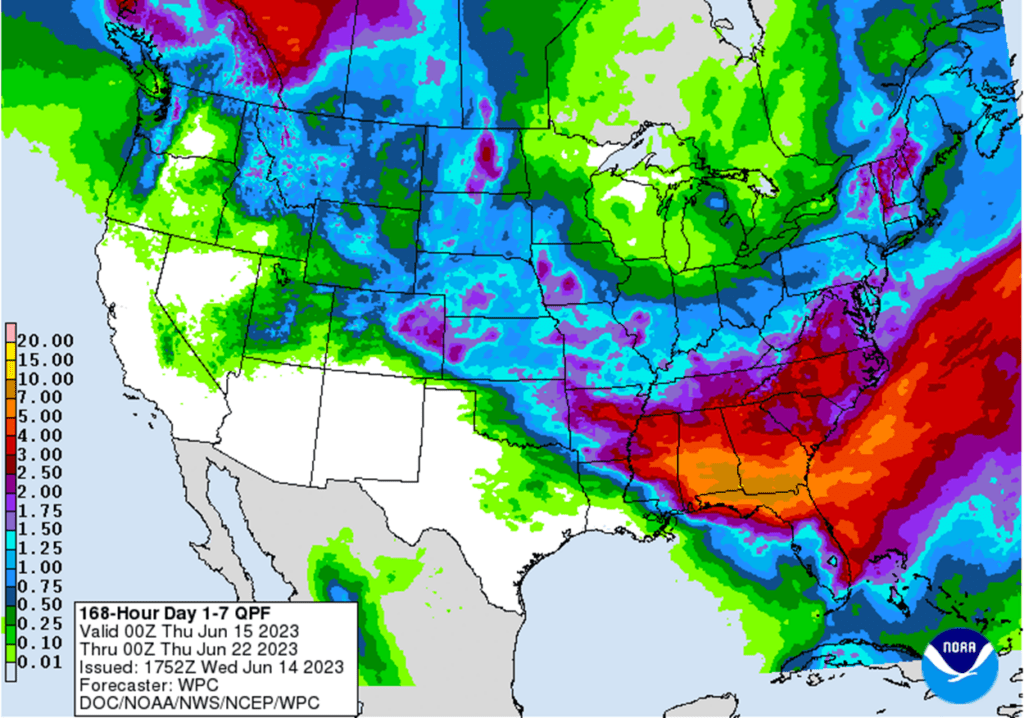

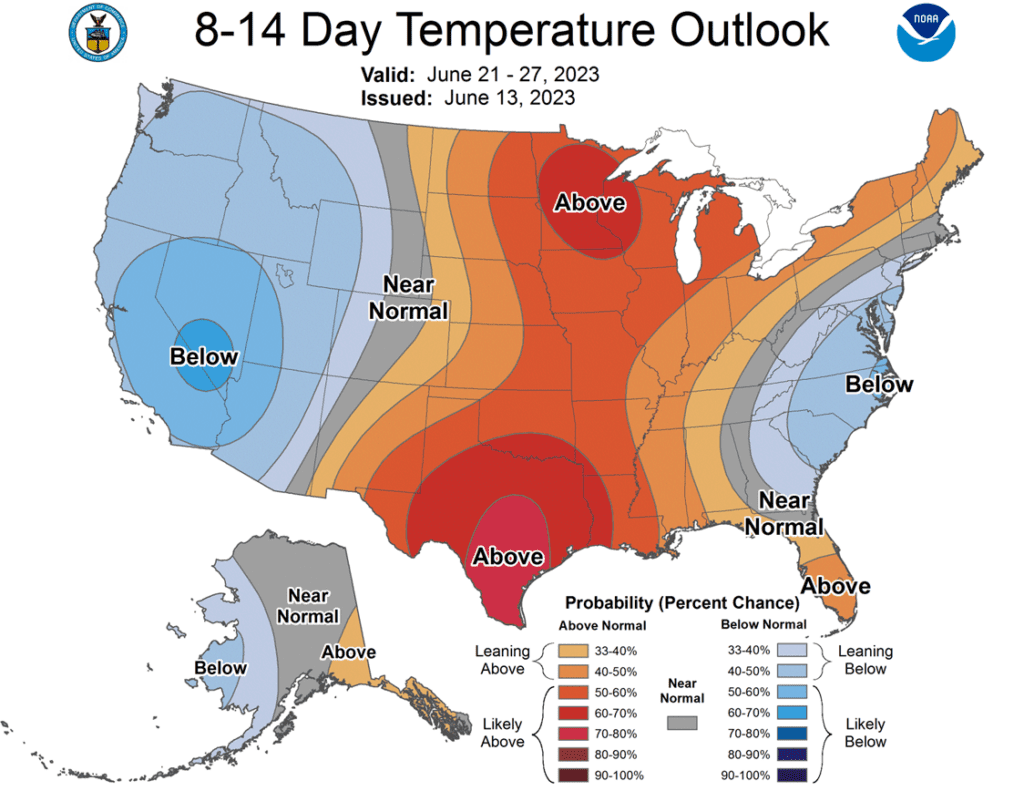

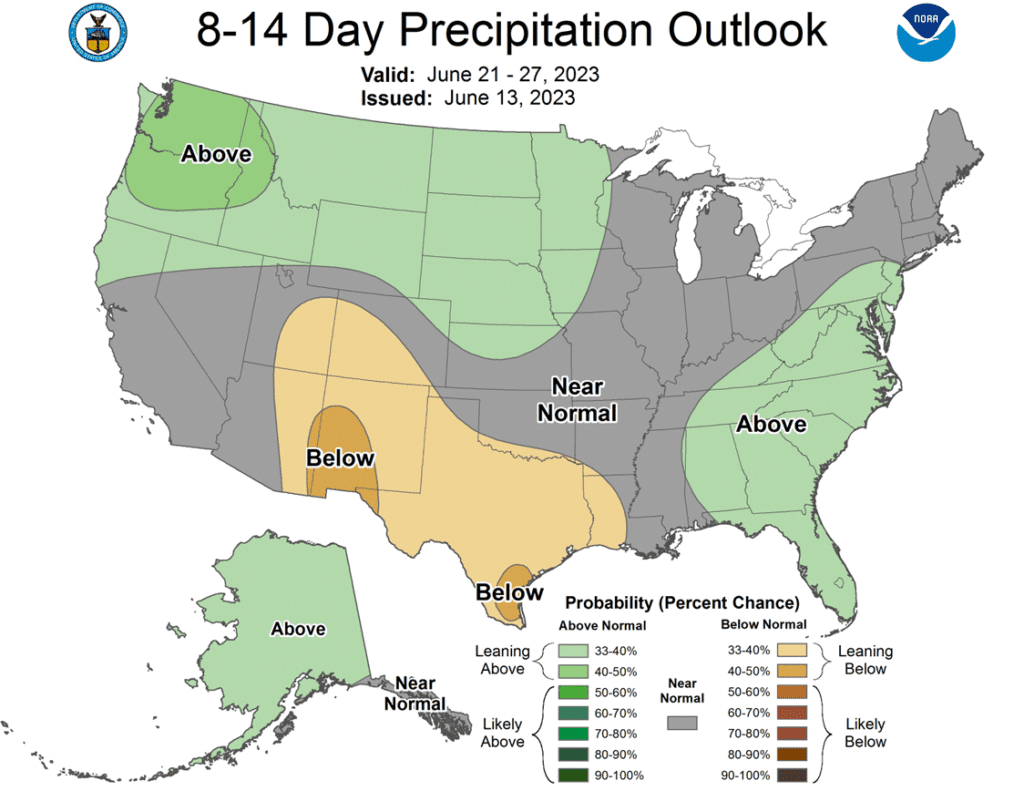

- To see the updated 7-day NOAA Precipitation Outlook and, NOAA 8-14 Day Temperature and Precipitation Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn has had nearly a 60-cent rally in the last couple of weeks. Expect volatility to remain in the market; a changing weather forecast can push the market significantly in either direction. If you still have Old Crop to sell, consider using this rally to begin pricing some of those bushels. Don’t forget, there is a significant inverse between the July and September futures contracts, which could be lost when bids get rolled from one contract to the next.

- No action is recommended at this time for New Crop. With dryness building in the Midwest and an estimated fund short position near 40k contracts, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you don’t happen to have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- Corn futures finished mixed on the session, pressured on the overnight session by rainfall in the northeastern and eastern Corn Belt. Concerns regarding the direction of the Fed regarding interest rates limited both commodity and equity markets overall on the day.

- The weather forecast overall remains spotty as rainfall coverage is expected to be hit-or-miss for the next seven days. Despite some recent, but limited, rainfall in many areas of the Corn Belt are still in need of additional and timely rainfall.

- Demand will stay a focus on Thursday with the USDA releasing weekly export sales. Expectations are for old crop sales to range from –110,000 MT – 550,000 MT and New crop from 0 – 350,000 MT, as U.S. corn export prices struggle against cheaper global competition.

- Weekly ethanol margins remain rangebound with the weekly Ethanol Production report showing production of 18,000 barrels/day and stocks down 722,000 barrels. Overall corn usage for ethanol is still behind the USDA pace needed to reach targets for the marketing year.

Above: The breakout above the recent congestion area has the market knocking on the door of the next resistance area between the 100-day moving average near 630 and the April high of 647-1/2, and while a test of the April high is within reach, the market is showing some signs of being overbought. Initial support below the market rests between 595 and 575, with additional support near 550.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

Continued Opportunity

Sell JUL ’23 Cash

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- Grain Market Insider sees a continuing opportunity to sell 2022 Old Crop soybeans and take advantage of the recent rally. July soybeans have rallied nearly 130 cents from the May low and are approaching the psychological resistance level of 1400. Additionally, with a 70+ cent inverse to the August contract, much of that value may be lost as end users roll bids from the July contract.

- We recommend not adding to current sales levels for the new 2023 crop at this time. A quick planting pace with favorable conditions and South American competition greatly pressured soybeans in April and May. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1300 to 1350 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans ended the day mixed with July lower, but November slightly higher. As for the products, soybean meal closed lower, while soybean oil ended higher despite a decline in crude oil.

- Prospects for rain are improving in the forecast with good, widespread rains expected across the Midwest that should begin to fall Thursday and into the weekend. If significant rains fall over the upcoming three-day weekend, prices might face some selling pressure.

- Today, the Federal Reserve announced that they would not be raising interest rates this month, but that they would likely implement two more “small hikes” before the year is over. This noticeably weighed on the stock market as the trade was expecting either no more hikes this year or one more, and the comment likely weighed on commodities as well.

- The EPA was supposed to make their decision about biofuel mandates today, which had given the soy complex support yesterday, but the decision was delayed until June 21. The decision could provide support for soybeans and the expansion of biodiesel.

Above: After a strong close last week, July soybeans will look for follow-through momentum to turn around a down-trend that has been in place since April. The strong close above the 20-day moving average is a great sign of a short-term trend change higher. If prices were to set back, support should be found near 1340 with nearby resistance near the 1420 area.

Wheat

Market Notes: Wheat

- Rain in the Plains states may slow harvest short term. In any case, this year’s winter wheat harvest could be close to the smallest in 50 years because of the drought experienced in the southwestern Plains this growing season.

- Western Canada has been too dry in spring wheat areas, but there are chances for rain over the coming week in Alberta and Saskatchewan, and the front could potentially make it into Manitoba as well. This moisture would be welcomed for the spring wheat crop.

- Both Brazil and Argentina are experiencing potential frost and freezing conditions. While there is not much concern about Brazil’s safrinha corn at this time, the low temperatures over the next few days could slow germination and growth of Argentina’s winter wheat crop.

- This afternoon, the Fed announced a pause in interest rate increases. However, they said there might be a couple more hikes later this year. Financial markets did not like this result, and some of that negativity may have spilled over into the commodity complex.

- In general, the grain trade is in a weather market, and the European weather model shows a bit more moisture than it did previously. This offered some weakness to corn and soybeans, which likely weighed on wheat as well.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. With good price action to start June, the market may be positioned for a short covering rally as new crop harvest quickly approaches. We continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No new action is recommended for the 2024 crop at this time. Prices have rallied nicely off of lows to start the month of June. With continued Black Sea tensions July of 2024 futures prices should be able to build off of the recent lows. We are currently targeting the 750-775 area to advance further on sales.

Above: The bullish reversal from May 31 indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The bullish reversal from May 31 indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

New Alert

Sell JUL ’23 Cash

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- Grain Market Insider recommends selling 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract and there is currently no carry offered.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting has largely been completed, dryness in some areas is increasing. With the market still largely oversold on the weekly charts and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract continues to be weak and consolidate. With winter wheat harvest on the horizon, spillover selling pressure could plague the spring wheat market in the weeks to come. Resistance currently sits between 820 and 855 and then the recent high of 888-1/2. Support below the market may be found between 770 and 760.

Other Charts / Weather