Grain Market Insider: July 5, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 485.25 | -2.75 |

| DEC ’23 | 493.5 | 0 |

| DEC ’24 | 499 | 1 |

| Soybeans | ||

| AUG ’23 | 1468.75 | 1 |

| NOV ’23 | 1355 | 1.25 |

| NOV ’24 | 1251.75 | 13.75 |

| Chicago Wheat | ||

| SEP ’23 | 674.25 | 32.5 |

| DEC ’23 | 690.25 | 29.5 |

| JUL ’24 | 715 | 24 |

| K.C. Wheat | ||

| SEP ’23 | 846.25 | 49.75 |

| DEC ’23 | 844.5 | 45.75 |

| JUL ’24 | 792 | 30.25 |

| Mpls Wheat | ||

| SEP ’23 | 857.5 | 48.25 |

| DEC ’23 | 863.5 | 45.25 |

| SEP ’24 | 800 | 24 |

| S&P 500 | ||

| SEP ’23 | 4485.5 | -6.75 |

| Crude Oil | ||

| SEP ’23 | 72 | 2.09 |

| Gold | ||

| OCT ’23 | 1943 | -5.6 |

Grain Market Highlights

- Driven by updated crop conditions and weather conditions, the corn market traded both sides of unchanged before settling on the positive side in sympathy with soybeans and wheat.

- After trading on both sides of unchanged like corn, November soybeans settled just 1 ¼ cents higher with strength being drawn from a higher soybean oil market, while lower soybean meal added resistance to prices.

- Soybean oil likely found support from much higher crude and heating oil prices that were 3.2% and 5.1% higher respectively, implying higher demand for bean oil may be ahead.

- Continued concerns regarding explosives being placed at the Zaporizhzhia nuclear power plant in Ukraine likely supported all three wheat classes to close sharply higher on the day.

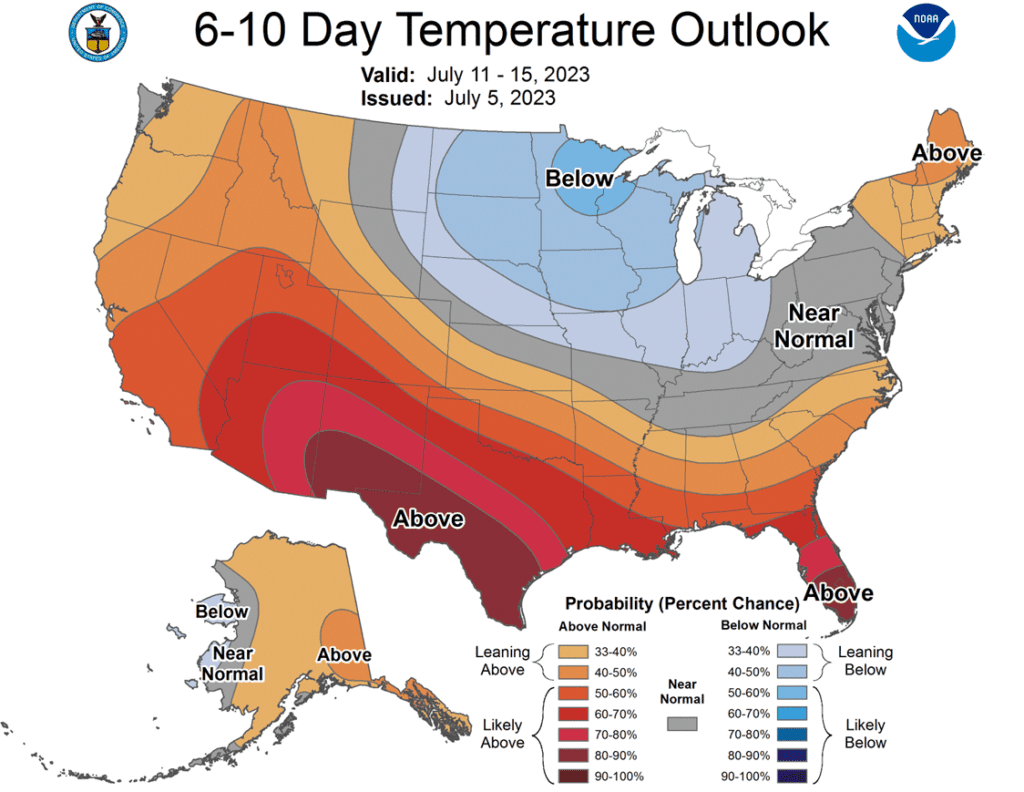

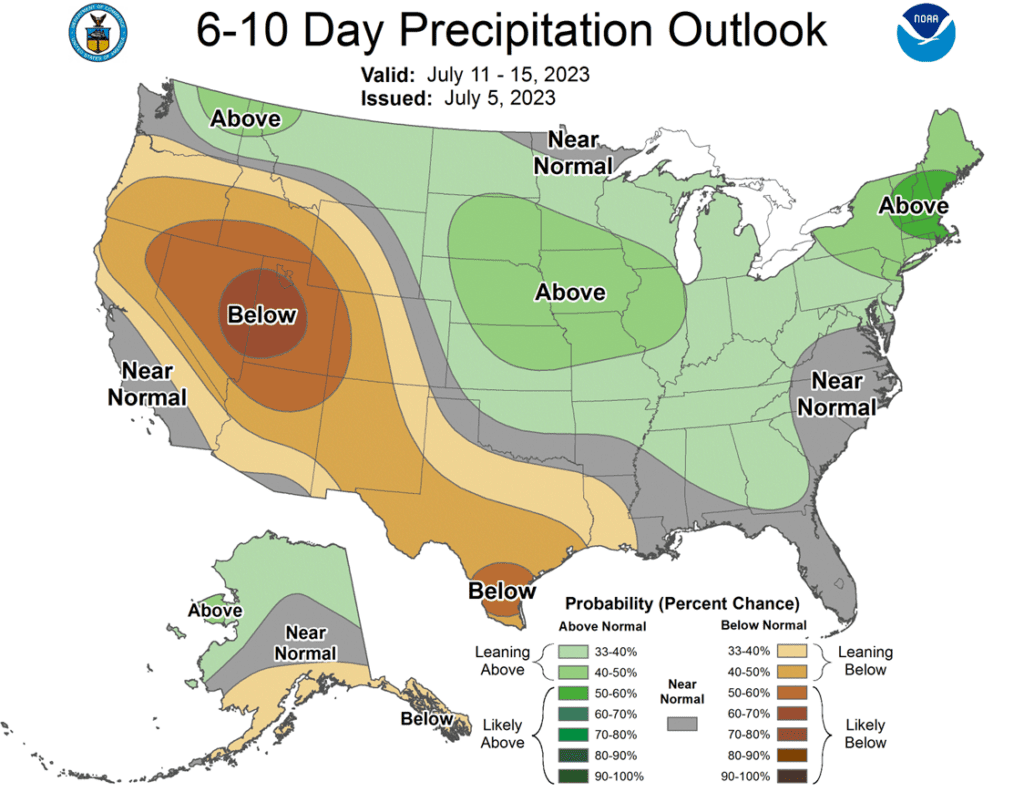

- To see the current US NOAA 6 – 10 day Temperature and Precipitation Outlooks, scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

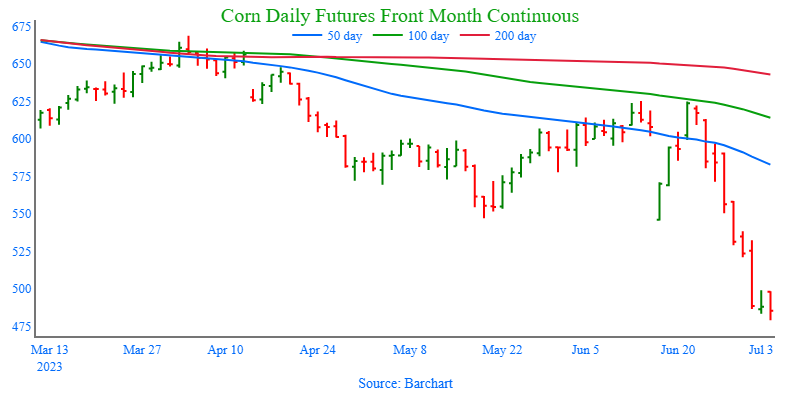

- No action is recommended for New Crop 2023 corn. December corn rallied 139 cents from its May 18 low to its high on June 21 on weather and production concerns. The market is currently off that high on poor export sales figures and a forecast that shows increased chances of rain in the next couple of weeks. When Dec corn was trading over 620, Grain Market Insider recommended making a cash sale and buying Dec 580 puts to cover more downside. The Dec 580 puts, paired with the previously recommended Dec 610 calls, yields a combination of options commonly known as a Strangle, which benefits from dramatic market moves either up or down. Considering it is still early in the season, with drought and crop production uncertainty it is too soon to know if the market high is in or not. Either way, the Strangle position is prepared. If conditions improve from here and prices make new lows, unsold bushels will be protected with the 580 puts. If it doesn’t rain again and prices skyrocket to new highs, already sold bushels will be protected by the 610 calls.

- Continue to hold current sales levels for the 2024 crop year. The Dec 24 contract is trading weather much like the rest of the market and posted nearly an eighty-cent range between 5/18 and 6/21 as dry conditions affect the ’23 crop and the potential carryout for the 2024 crop year. For now, continue to be patient as Grain Market Insider would like to see prices in the 570 – 600 level before considering making additional sales recommendations for the 2024 crop.

Market Notes: Corn

- After trading both sides of unchanged and making a new low for the move. December corn found support below the market on very oversold conditions and a sharply higher wheat market to close unchanged.

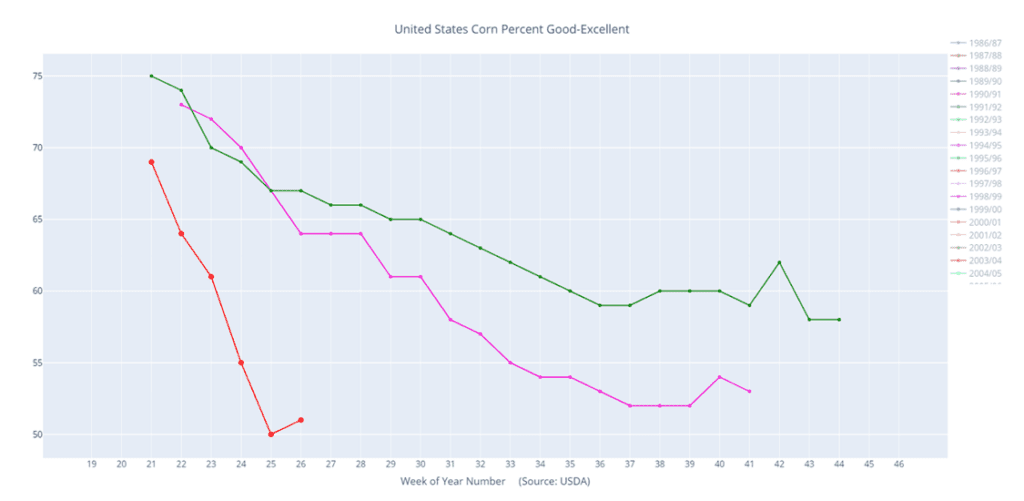

- The USDA released their updated crop ratings for corn Monday afternoon, raising the Good/Excellent rating 1%, to 51%. While the overall rating came in as expected, Illinois’ G/E rating improved 10% to 36%.

- Although the current crop conditions have improved, they continue to be the lowest since 2012, with some feeling that current conditions imply a yield closer to 171.5 bpa. This would suggest a crop size of 14.75 billion bushels based on the updated USDA acreage numbers and imply a 300 mil. bu increase to carryout based on current USDA usage.

- Corn used in ethanol production for the month of May was weak and only came in at 437.5 mil. bu, bringing this year’s total used to 3.835 bil bu, which is down 4% from the USDA’s current estimate of down 4%. At this point in the marketing year, it seems unlikely that usage will reach USDA estimates without any adjustments lower.

- Cooler temperatures are expected to move through the Midwest in the next 24 – 36 hours. While normal to slightly below normal temperatures are expected this weekend, with above average rain in the southwest Corn Belt and 1 – 1.5 inches of rain expected in IL and IN.

Above: The USDA added a bearish 4 million acres to its planted acreage estimate on June 30. The September contract is now extremely oversold and has broken through the 490 – 505 support level that has been in place since January 2021. The oversold condition of the market would be considered supportive to higher prices if reversal action occurs; if not, there may not be much support until 390 – 415. Overhead lies strong resistance between 595 and 625.

2023/24 Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is being recommended for New Crop 2023 soybeans. No action is being recommended for New Crop 2023 soybeans. While changing weather forecasts will continue to dominate price action, a potentially much lower than anticipated 2023 carryout looms over the market due to low crop condition ratings and a reduced planted acreage estimate. Grain Market Insider is still eyeing a rally to the 1400 – 1450 area before considering any additional 2023 cash sales. Yet given the time of year and how fast prices can change direction, we’re willing to change that plan at a moment’s notice. In view of the current crop conditions and carryout situation and that we recently recommended making a cash sale, we suggest holding tight on further cash sales for now.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

Market Notes: Soybeans

- Soybeans ended mixed today with the July contract fading lower as its in the delivery process. While November closed slightly higher as trade seems to be focusing less on the recent acreage report and more on upcoming weather which should be wet over the next 7 days.

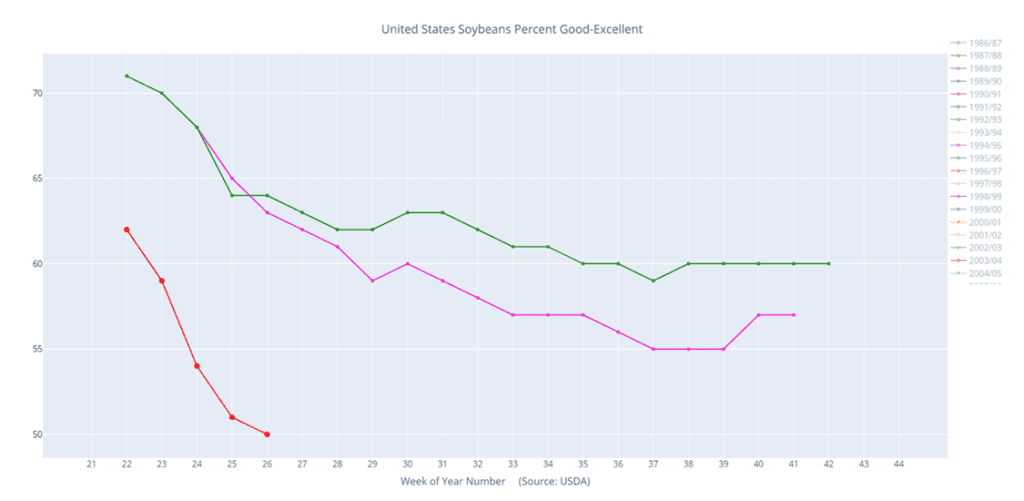

- Crop progress was released late on Monday and showed soybean conditions declining surprisingly, despite the very beneficial rains that fell over the Corn Belt last week. Soybeans are now at 50% good to excellent and 29% poor to very poor. 24% of the crop is blooming and 4% is setting pods, both below average.

- News today was relatively quiet, and the market is trying to find direction. After Friday’s Stocks and Acreage reports and Monday’s Crop Progress report, there is a lot of data for traders to digest. The next USDA supply and demand report on July 12 may help the market to find direction.

- Palm oil reserves in Malaysia may rise to a four-month high. June inventory grew 11% from the previous month to 1.86 million tons. Down the road, El Nino could have an impact on palm oil production, however.

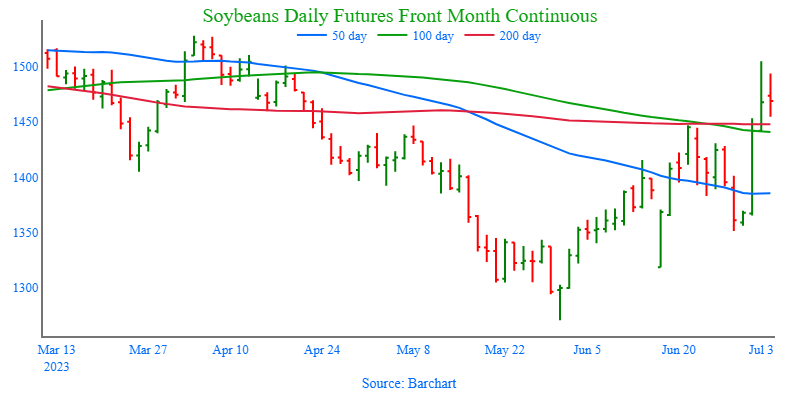

Above: The USDA’s Stocks and Acreage report gave the market a bullish shot in the arm with a much-reduced acreage estimate. If the market can continue to rally beyond the 1450 area, 1500 – 1550 could be its next target. If not, support could be found between 1340 and 1300 with further support near 1270.

2023/24 Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- Wheat posted strong gains today, seemingly on concern about the situation in the Black Sea. Explosives have reportedly been planted at the Zaporizhzhia nuclear power plant in Ukraine. Both Russia and Ukraine are blaming each other, and naturally this is causing an increase in tensions and concern for the welfare of the region.

- Aside from the nuclear plant, there is also question as to whether the Black Sea export corridor will be renewed on July 18th. There continues to be talk out of Russia that they will not renew the agreement, but traders have heard that story before.

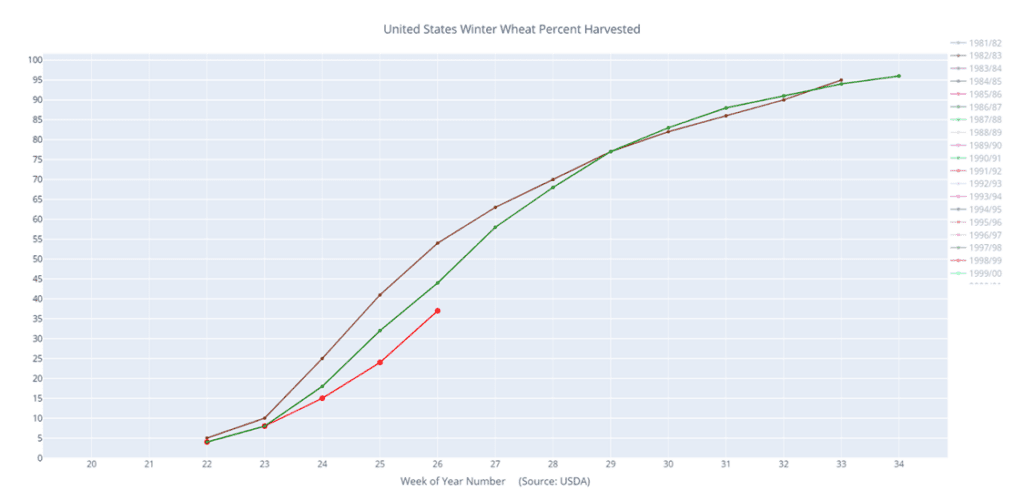

- Monday’s crop progress report showed spring wheat condition down 2% from last week, now at 48% good to excellent. This also was supportive to the wheat market today. As for winter wheat, condition was left unchanged at 40% G/E, but harvest pace is still well behind at only 37% complete versus 46% on average.

- Argentina is planting wheat, with the Argentina Secretariat of Agriculture saying that 23/24 will have 6.1 million hectares planted. For the 23/24 marketing year, Argentina wheat production may increase to 18 – 19 mmt versus 12.6 mmt in 22/23.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. In the month of June, the September Chicago wheat contract posted a 163-cent range and has largely been a follower of the corn market which has been mostly driven by weather. While demand remains weak, production concerns in parts of the country remain, as does uncertainty surrounding the Black Sea region and the potential for major exporting countries’ inventory to hit 16-year lows. While Grain Market Insider will continue to monitor the downside for any violation of major support, following the recent sales recommendation it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Price volatility has risen in the last couple of weeks due to the changing weather forecasts and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market next year’s crop. War continues in the Black Sea region, major exporting countries’ stocks expected to fall to 16-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recently recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. This technical formation on the price chart is considered bearish and momentum may be adding to the bearish tone. Support below the market may be found between 650 – 610, while resistance above the market rests between 770 – 810.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

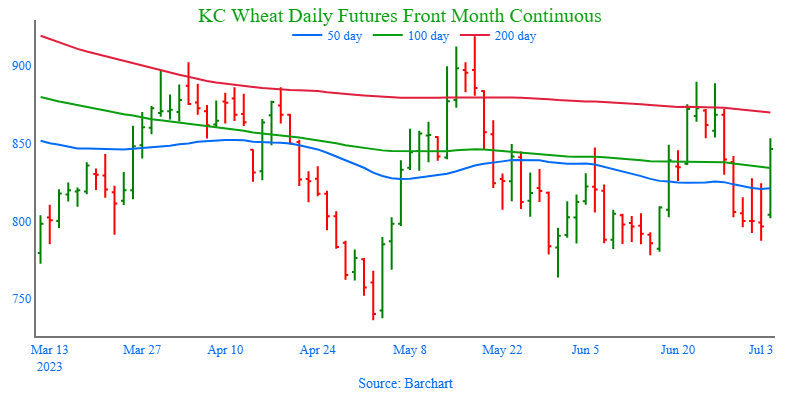

Above: Balancing both production and demand concerns, the September contract continues to trade within the 736 – 919 range established in May. The recent downturn in the market has established heavy resistance above the market between 890 – 920, with initial support coming in between 778 – 763 and key support near the May low of 736.

2023/24 Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell SEP ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

- There continues to be an opportunity to sell 2023 New Crop MINNEAPOLIS Wheat. Weather dominates the market right now, and friendlier forecasts have pushed prices below the 822 support level. Closing below that 822 support signals that the recent uptrend off the May lows may have ended, which poses the risk that the change in trend could erode the price further in the weeks ahead. The first risk being, price drops to the May low of 771, which is where first support comes in. If that level doesn’t hold, then the next risk could be in the 680-710 window. Although making a sale in a down market may be uncomfortable, it’s important at times to have a Plan B with the objective of trying to avoid having to sell bushels at even lower prices in the future if a downtrend takes hold.

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

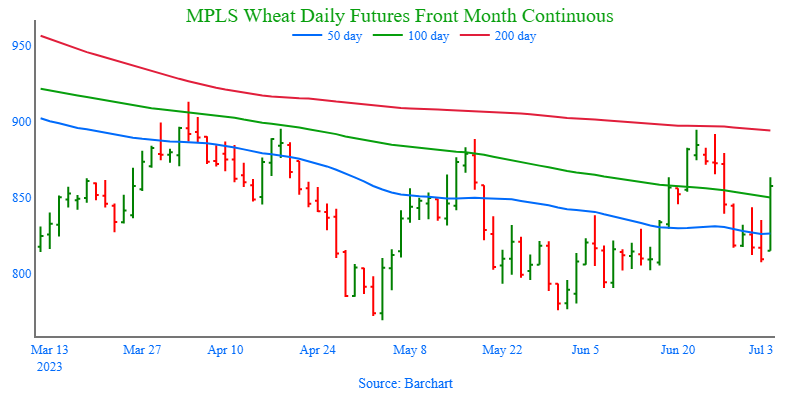

Above: The September contract rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. With the market trading lower, it will need additional bullish news to turn it back around. Should the market continue to fall, support may be found between 770 and 730.

Other Charts / Weather