Grain Market Insider: July 31, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 504 | -17 |

| DEC ’23 | 513 | -17.25 |

| DEC ’24 | 517.25 | -9.75 |

| Soybeans | ||

| AUG ’23 | 1445.75 | -41 |

| NOV ’23 | 1331.75 | -50.75 |

| NOV ’24 | 1251.75 | -34.25 |

| Chicago Wheat | ||

| SEP ’23 | 665.75 | -38.5 |

| DEC ’23 | 691.75 | -36.25 |

| JUL ’24 | 727.25 | -27.25 |

| K.C. Wheat | ||

| SEP ’23 | 812.75 | -43.5 |

| DEC ’23 | 829.5 | -39.75 |

| JUL ’24 | 804.5 | -28 |

| Mpls Wheat | ||

| SEP ’23 | 855.75 | -40.25 |

| DEC ’23 | 869.5 | -37.5 |

| SEP ’24 | 824 | -24.5 |

| S&P 500 | ||

| SEP ’23 | 4605 | -1.5 |

| Crude Oil | ||

| SEP ’23 | 81.77 | 1.19 |

| Gold | ||

| OCT ’23 | 1986.7 | 6.7 |

Grain Market Highlights

- Good weekend rains, an improving weather forecast and a Brazilian safrinha harvest that is moving along, all weighed heavily on the corn market.

- Despite strong export inspections, soybeans closed sharply lower as traders moved to extract weather premium following better than expected weekend rains and a more favorable forecast ahead.

- Soybean meal and oil also closed sharply lower on the day, with December meal down 2.4%, while soybean oil was down 3.9%, pressured from weaker palm oil.

- Spillover weakness from the corn market and an agreement to use Croatia’s ports to export Ukrainian grain, far outweighed the positive influence of export inspections that were above the 14 mb/week needed to reach the USDA’s forecast.

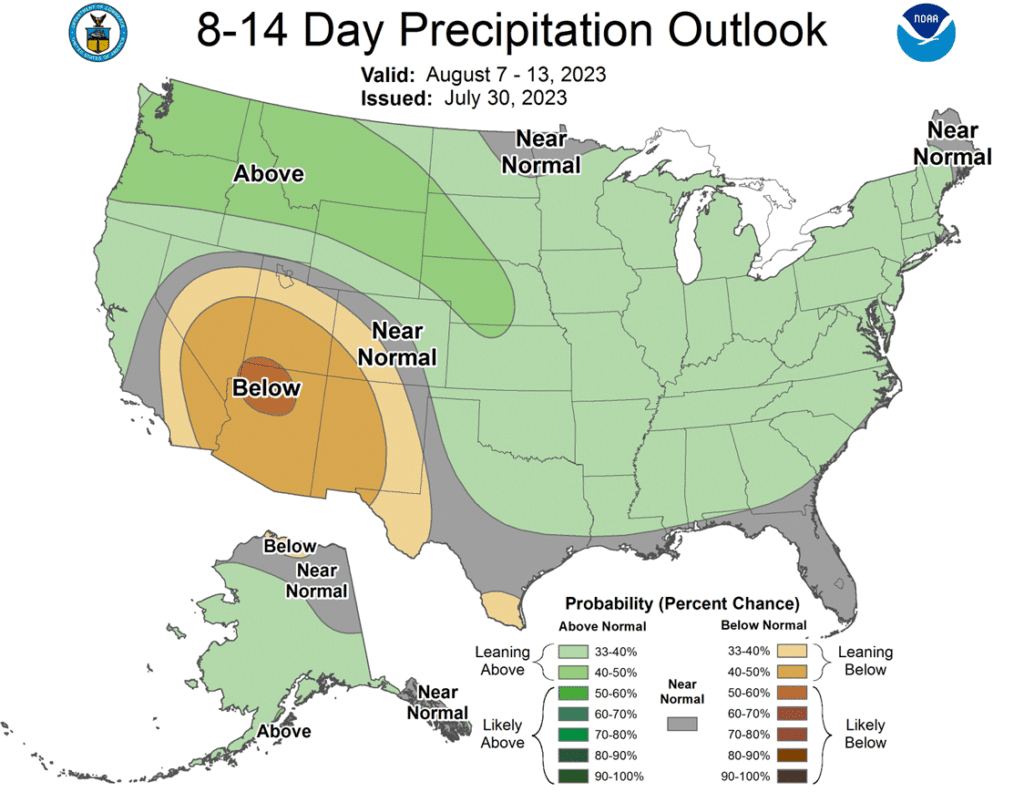

- To see the current 8–14-day temperature and precipitation outlooks courtesy of the Climate Prediction Center, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is recommended for New Crop 2023 corn. The future price potential for Dec 23 corn continues to be at the mercy of each new weather forecast. Dryness and dry weather forecasts pushed Dec corn from the May low to the June high with a gain of 137 cents, which was promptly erased and then some by mid-July, leaving the market 149 cents off that June high, with a surprise jump in acres and more favorable forecasts. During the runup in early June, we warned that any change in the forecast to wetter weather could erase all the gains as corn didn’t have much of a bullish fundamental story without a supply side shock fueled by lower yields. Overall, our thought process has not changed from a month ago and with the tremendous uncertainty, and subsequent volatility still in front of us, we continue to recommend holding the Strangle options position, comprised of the previously bought Dec 610 calls and Dec 580 puts. A turn back to wetter weather and we wouldn’t be surprised to see sub-500 corn again, and if dry weather persists, we wouldn’t be surprised to see corn prices north of 700. Under either of these scenarios the Strangle will benefit and doesn’t require trying to outguess the weather.

- No action is currently recommended for 2024 corn. In 2012, the best pricing opportunities for Dec 2013 corn were during the 2012 summer runup. Despite the significant yield losses to the 2012 crop, and the fear of running out of corn, the Dec 2013 contract peaked in the summer of 2012, and by January 2, 2013, the price was already down about 12% from the high. We continue to watch the calendar for 2024 corn as this 2023 summer volatility could provide some additional opportunities to get some good early sales on the books in the event of a 2013-type repeat. Insider recently recommended making a sale on your 2024 crop, and we’ll be watching for another opportunity to suggest adding to prior early sales levels between now and the beginning of September.

Market Notes: Corn

- The corn market broke apart technically and saw strong selling pressure triggered by weekend rains and August forecast that should allow for good overall development of the corn crop.

- The entire grain complex was under pressure on the day, corn futures opened with a price gap lower on the overnight session and the selling pressure was maintained as market prices dropped through key moving averages. Dec corn posted its lowest close since July 18. The weak technical picture and lack of bullish news may have Dec corn poised to retest the July lows near $4.80.

- Weekly export inspections were within trade expectations at 20.6 mb. Total inspection for old crop exports is still running 33% behind last year, but equal to the pace to reach the USDA target with one month left in the marketing year.

- Brazilian corn harvest continues to progress, analyst estimate that this year’s Brazil corn harvest is near 50% complete, which is running nearly 20% behind last yeas pace. The influence of the fresh Brazil supplies pressures global corn prices.

Above: Since mid-July, the market retraced about 62% of the prior down move, hit resistance around the 50-day moving average and turned lower. The market appears to be correcting from being overbought and broke through the 520 support level. Key support lies near the 474 low, and should the market turn back higher, heavy resistance lies near 555 – 565.

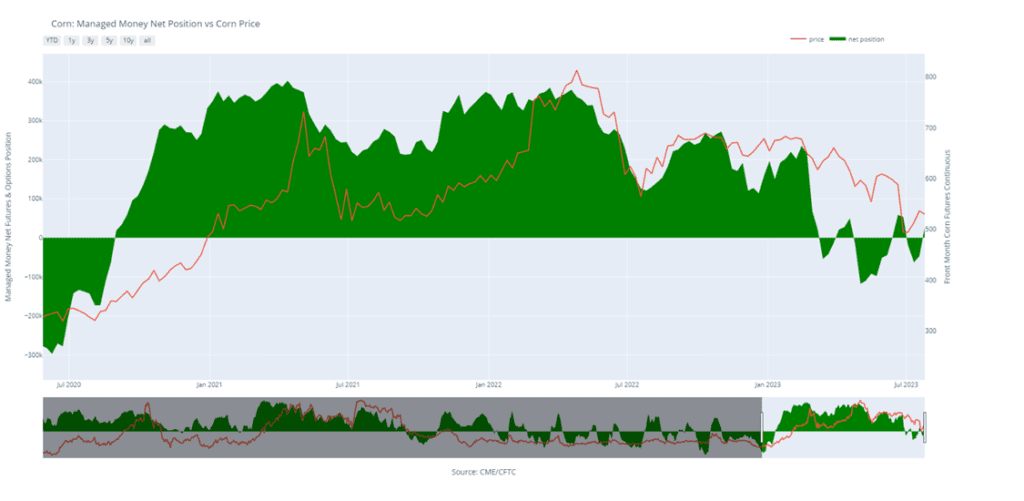

Corn Managed Money Funds net position as of Tuesday, July 25. Net position in Green versus price in Red. Managers net bought 73,529 contracts between July 18 – 25, bringing their total position to a net long 26,603 contracts.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is recommended for 2023 soybeans. The USDA injected a lot of volatility into this market beginning with a much lower-than-expected planted acreage estimate, followed by a much larger-than-expected 300mb carryout estimate in its July WASDE. While demand has been weak, we have a bona fide weather market during a crucial period for soybeans and there is little wiggle room for lost yield in this year’s crop. While a drier forecast can still maintain upside potential, plenty of time remains for rain to come and push prices lower, much like in 2012, when July was dry. Then the pattern changed in August, and decent rain fell in parts of the western Corn Belt and IL, sending Nov ’12 soybeans down 20%. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

Market Notes: Soybeans

- Soybeans ended the day sharply lower with large losses in soybean meal and oil. Weather forecasts over the weekend turned cooler and wetter for the next 7 days and potentially longer, which was likely the main pressuring factor.

- Exports were surprisingly active today considering the price action with 132,000 mt sold to China and 183,300 mt of soy cake and meal sold to the Philippines. There have been friendly underlying fundamentals that are being overshadowed by the current forecasts.

- Soybean inspections totaled 12.1 mb for the week ending Thursday, July 27 which puts total inspections for 22/23 at 1.856 bb, which is down 6% from the previous year. Brazil is maintaining their lead in soy exports, but the US should become more competitive later this year.

- Apart from updated weather forecasts adding pressure to prices, November soybeans are in a bearish ascending wedge pattern which would put the next downside target area near 12.55, but the overnight trade also left a gap on the chart above the market at 13.79 which the market may look to fill.

Above: On 7/27 the market posted a bearish reversal, turning the market lower. Initial support below the market may come in around the 1350 – 1318 level and again near the May low of 1270-3/4. Above the market heavy resistance remains around 1490 – 1505.

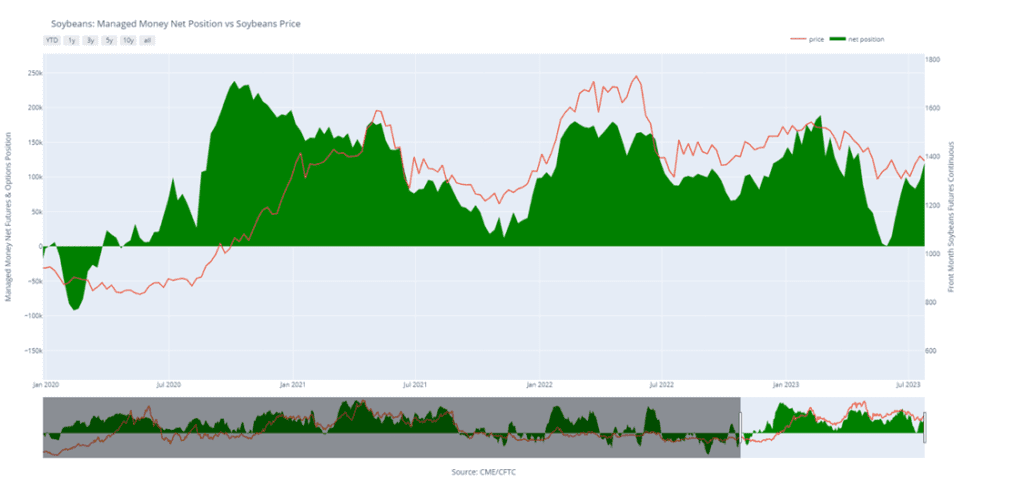

Soybean Managed Money Funds net position as of Tuesday, July 25. Net position in Green versus price in Red. Money Managers net bought 24,925 contracts between July 18 – 25, bringing their total position to a net long 120,739 contracts.

Wheat

Market Notes: Wheat

- All three US wheat markets closed sharply lower alongside Paris milling wheat futures. This is the fourth consecutive lower close for Chicago wheat. A lack of follow through attacks in Ukraine put the market on the defensive. News that Ukraine launched a drone strike on Moscow was not enough to trigger a rally either.

- Weekly wheat inspections of 21.4 mb bring the 23/24 total inspections to 101 mb, which is down 5% from last year. Currently, the USDA is estimating wheat exports at 725 mb.

- According to SovEcon, Russia’s wheat harvest is now projected to be 87.1 mmt. Previously, the estimate was 86.8 mmt, and this revision higher may have also offered weakness to wheat today.

- Possibly adding more pressure to the market was the spring wheat tour last week that found yields higher than expected.

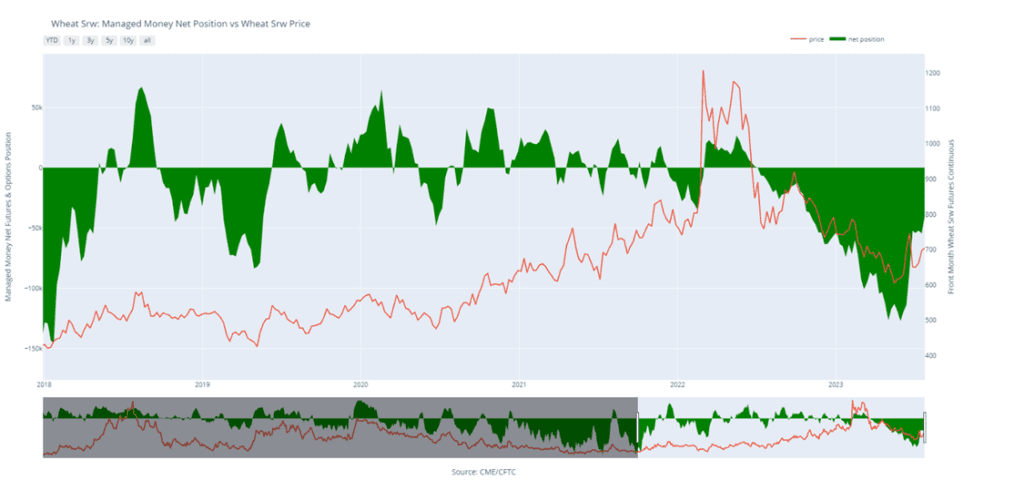

- As of last Tuesday, the CFTC said the funds were still short 40,000 contracts of Chicago wheat. Given market action at the end of last week and to begin this week, it is likely they are adding to short positions.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. The wheat market has seen a great amount of volatility in recent weeks and has primarily been a follower of corn which has been driven by weather. Although demand remains weak, the recent closure of the Black Sea corridor, and continued weather concerns in the northern Plains, Canada, Europe, and Russia, still leave many supply questions unanswered. While Grain Market Insider will continue to monitor the downside for any violation of major support following the recent sales recommendation, it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June, price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices continue to be volatile, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Since testing the June high on 7/25, the market has retreated and is poised to test support near the 620 – 610 area between the July and June lows respectively. Key support may be found below the 600 psychological support level near 573. Heavy resistance remains above the market around 777 – 808.

Chicago Wheat Managed Money Funds net position as of Tuesday, July 25. Net position in Green versus price in Red. Money Managers net bought 14,086 contracts between July 18 – 25, bringing their total position to a net short 40,332 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

New Alert

Sell JUL ’24 Cash

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While crop conditions have improved and there are reports of better-than-expected US yields, questions remain about the world wheat supply with the closure of the Black Sea corridor, dryness in Russia, the Canadian Prairies/Northern US Plains, and Europe. With world supplies currently seen at 11-year lows, we continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Grain Market Insider recommends selling a portion of your 2024 K.C. Wheat crop today. Weather and supply concerns from the Black Sea have dominated the market and recent news of rising tensions in the Black Sea region pushed the market higher. With little follow-through to the upside on talk that Ukrainian supplies should still be able to enter the world market, prices have retreated below the 817 support level. Closing below that 817 support signals that the uptrend from the recent July low may have ended, which poses the risk that a change in trend could erode prices further. First, prices could drop to the July low of 758-1/2. If support there doesn’t hold, there is a risk that prices could further erode to the 740 – 724 level near the April low. Although making a sale in a down market may be uncomfortable, it’s important at times to have a Plan B with the objective of trying to avoid having to sell bushels at even lower prices in the future if a downtrend takes hold. Insider recommends making a sale on a portion of your 2024 K.C. wheat production by using either JUL ’24 K.C. Wheat futures or a JUL ’24 HTA contract, so basis can be set at a later, more advantageous time.

- No Action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The September K.C. wheat contract posted a bearish reversal on 7/25 after testing heavy resistance near 920. Prices have become over bought and retreated. Support below the market is near 763 – 778. Should prices reverse higher, heavy resistance remains in the 920 – 930 area.

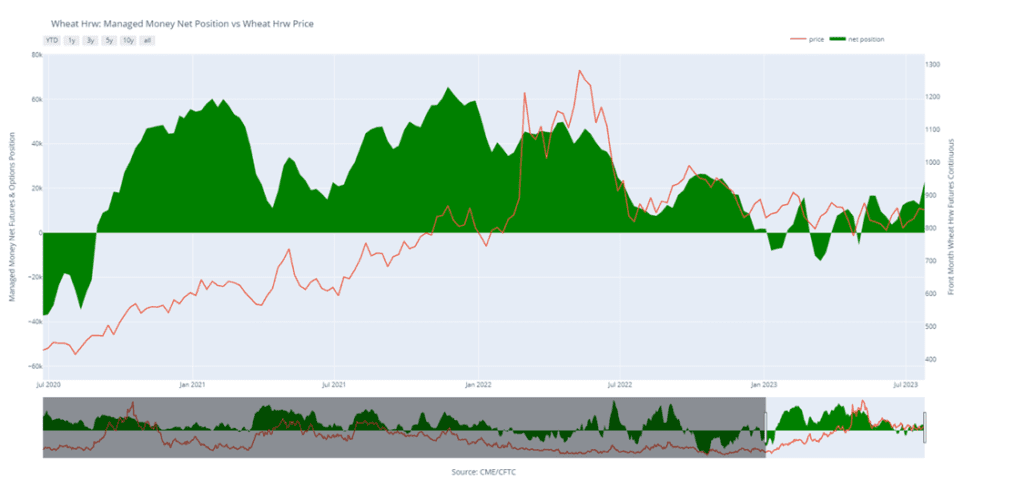

K.C. Wheat Managed Money Funds net position as of Tuesday, July 25. Net position in Green versus price in Red. Money Managers net bought 10,495 contracts between July 18 – 25, bringing their total position to a net long 23,145 contracts.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

- No action is currently recommended for the 2023 New Crop. Weather dominates the market right now, and though much of the growing season remains, Grain Market Insider suggested making a sale as prices closed below 822 to protect from further downside erosion due to a potential trend change. Seasonally, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to shock the market higher. Insider will consider making sales suggestions if prices improve through this growing season, while also continuing to watch the downside for any further violations of support.

- No action is recommended for the 2024 crop. This year has been marked with volatility from adverse weather to geopolitical disruptions and has given us historically good prices to begin making early sales. While prices continue to be volatile, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, Grain Market Insider will continue to consider making sales recommendations if prices improve while also keeping an eye on the downside should prices break support.

Above: September Minn. wheat’s rally of nearly 180 cents to test last winter’s highs culminated in a bearish reversal after the contract became mildly overbought. Prices have since retreated and may test the 865 – 845 initial support area, with further support near 800. If more bullish input is received, the market could turn higher again to retest the heavy resistance area near 950.

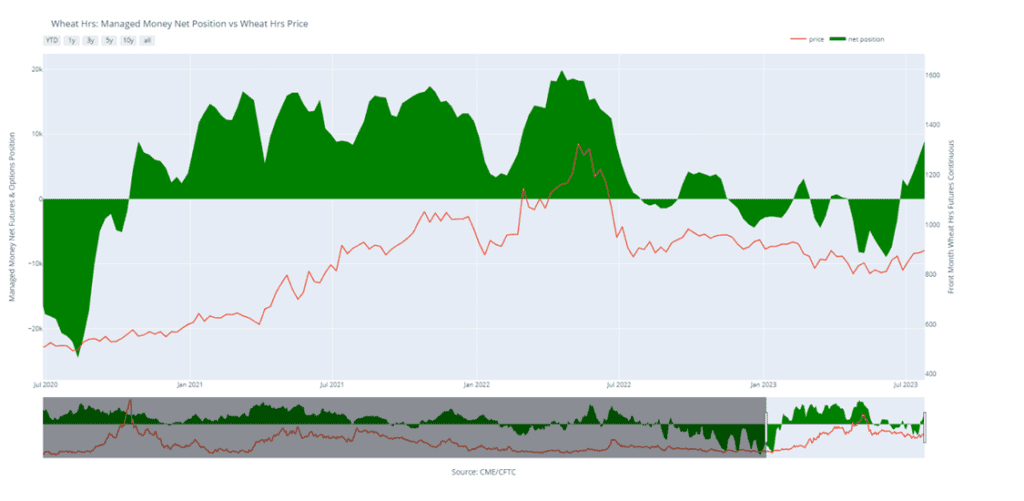

Minneapolis Wheat Managed Money Funds net position as of Tuesday, July 25. Net position in Green versus price in Red. Money Managers net bought 2,379 contracts between July 18 – 25, bringing their total position to a net long 8,966 contracts.

Other Charts / Weather