Grain Market Insider: July 3, 2023

The CME and Total Farm Marketing offices will be closed

Tuesday, July 4, in observance of Independence Day

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 488 | -0.5 |

| DEC ’23 | 493.5 | -1.25 |

| DEC ’24 | 498 | 1.25 |

| Soybeans | ||

| AUG ’23 | 1467.75 | 25.75 |

| NOV ’23 | 1353.75 | 10.5 |

| NOV ’24 | 1238 | 31.25 |

| Chicago Wheat | ||

| SEP ’23 | 641.75 | -9.25 |

| DEC ’23 | 660.75 | -8.5 |

| JUL ’24 | 691 | -6.75 |

| K.C. Wheat | ||

| SEP ’23 | 796.5 | -3.5 |

| DEC ’23 | 798.75 | -1.5 |

| JUL ’24 | 761.75 | -6.5 |

| Mpls Wheat | ||

| SEP ’23 | 812.5 | -4.5 |

| DEC ’23 | 822 | -4.5 |

| SEP ’24 | 778 | -16 |

| S&P 500 | ||

| SEP ’23 | 4492 | 3.75 |

| Crude Oil | ||

| SEP ’23 | 70.01 | -0.77 |

| Gold | ||

| OCT ’23 | 1948.4 | -0.1 |

Grain Market Highlights

- Marked by low volume as many traders stayed away for an extended July 4th holiday, the corn market failed to hold onto support from the neighboring soybean market as carryover weakness from Friday’s report and weekend rains weighed on prices.

- Following Friday’s surprise USDA 4 million acre drop in soybeans planted acres, follow through buying in soybeans added to last week’s gains, though the November contract settled in the bottom end of its range.

- Continued buying from Friday’s limit up close in soybean oil helped to give an additional support to soybeans and Board Crush margins as December bean oil closed 2.1% higher. Soybean meal traded higher in the overnight but sold off throughout the day to close lower, ending in a bearish reversal.

- News that the EU is considering letting Russia back into the global banking system, along with weak demand and low Russian prices, pressured all three wheat classes to close lower on the day following two-sided trade.

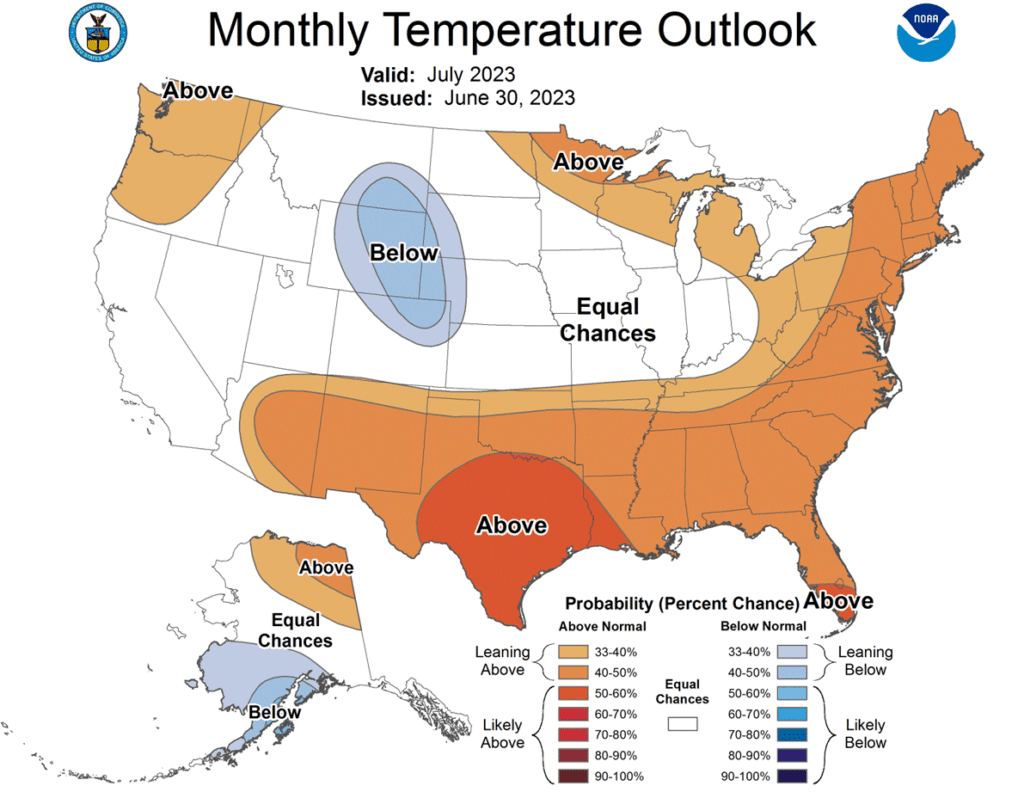

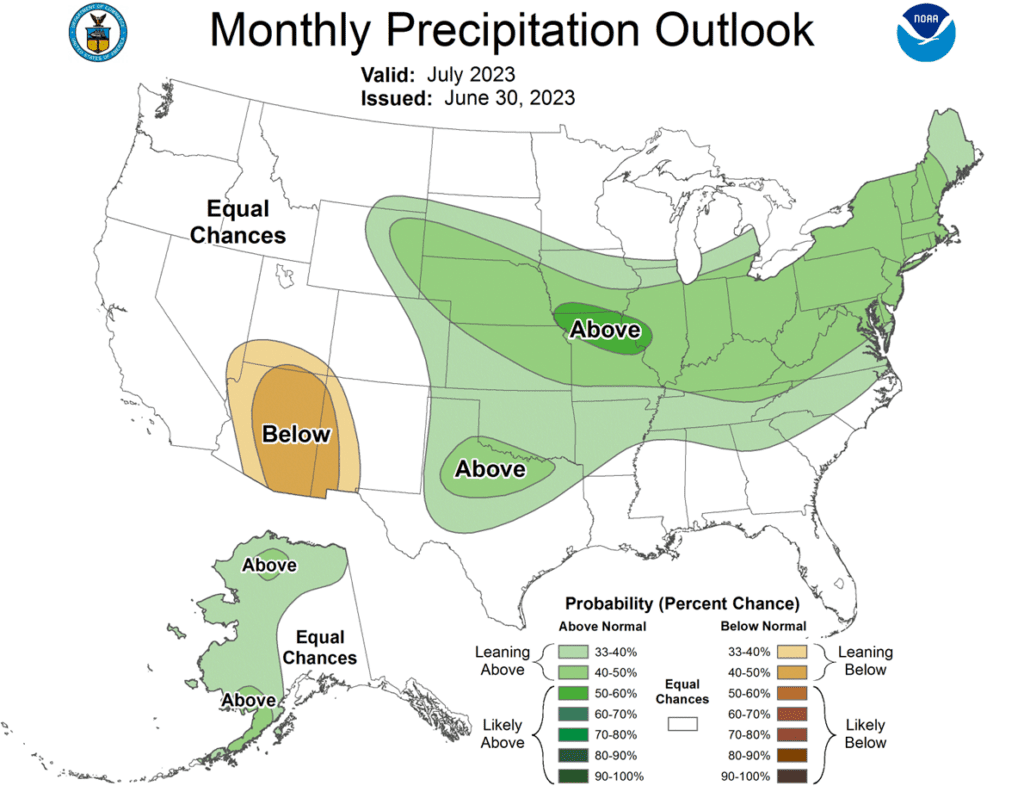

- To see the current US NOAA July Temperature and Precipitation Outlooks, scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is recommended for New Crop 2023 corn. December corn rallied 139 cents from its May 18 low to its high on June 21 on weather and production concerns. The market is currently off that high on poor export sales figures and a forecast that shows increased chances of rain in the next couple of weeks. When Dec corn was trading over 620, Grain Market Insider recommended making a cash sale and buying Dec 580 puts to cover more downside. The Dec 580 puts, paired with the previously recommended Dec 610 calls, yields a combination of options commonly known as a Strangle, which benefits from dramatic market moves either up or down. Considering it is still early in the season, with drought and crop production uncertainty it is too soon to know if the market high is in or not. Either way, the Strangle position is prepared. If conditions improve from here and prices make new lows, unsold bushels will be protected with the 580 puts. If it doesn’t rain again and prices skyrocket to new highs, already sold bushels will be protected by the 610 calls.

- Continue to hold current sales levels for the 2024 crop year. The Dec 24 contract is trading weather much like the rest of the market and posted nearly an eighty-cent range between 5/18 and 6/21 as dry conditions affect the ’23 crop and the potential carryout for the 2024 crop year. For now, continue to be patient as Grain Market Insider would like to see prices in the 570 – 600 level before considering making additional sales recommendations for the 2024 crop.

Market Notes: Corn

- The corn market was digesting Friday’s bearish USDA corn acre numbers, weather forecast, and technical weakness as prices drifted lower into the close of the session. Price action remains weak as Dec corn failed to push back through the key $5.00 price level on the day.

- December corn futures posted a new low for the move, pushing past the low established on 5/18. Finishing with a lower range close, the weak price action will likely keep sellers active on Wednesday as long as support price news is lacking in the market.

- Large areas of the corn belt saw greater than one inch of rainfall over the past few days, which will likely help some areas in need. Many areas of the corn belt are still overall deficient on rainfall totals, and timely rains will be necessary. Forecasts going into next week are still showing a cooler and wetter overall bias.

- The USDA will release weekly crop progress report late on Monday afternoon, and analysts are expecting corn conditions to improve slightly to 51% good/excellent, up 1% from last week. Illinois will still be a watched state as decent rainfall coverage occurred over the weekend, and ratings should stabilize.

- The USDA released weekly export inspections on Monday morning and U.S. exporters shipped 643,000 MT of corn last week. This total was higher than last week’s totals, but year-over-year exports are still lagging by 31%.

Above: The USDA’s Stocks and Acreage report added bearish news to the market with its higher acres estimate. Since the last week of June, prices have been racing towards the 490 – 505 support level which has been in place since January 2021. If the market breaks through the 490 area, there may not be much support until 390 – 415. Overhead lies strong resistance between 595 and 625.

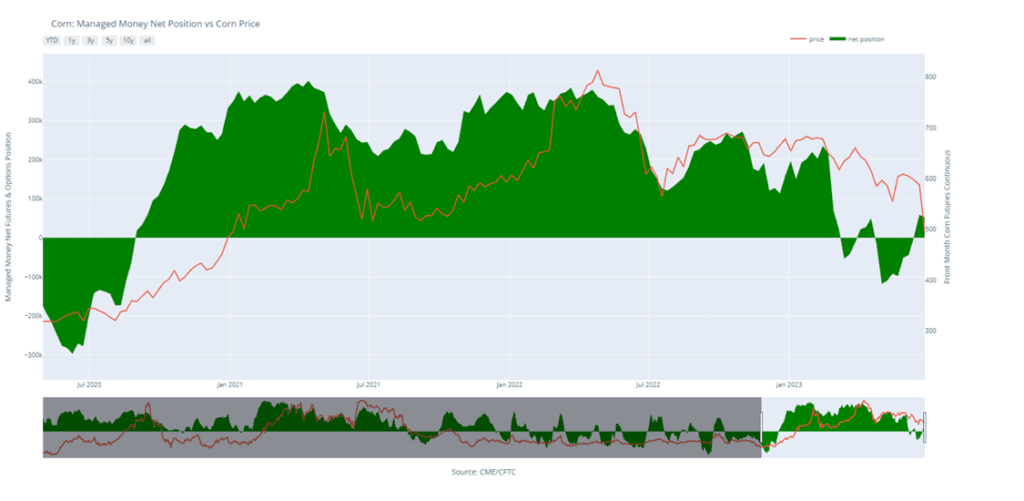

Corn Managed Money Funds net position as of Tuesday, June 27. Net position in Green versus price in Red. Money Managers net sold 5,454 contracts between June 20 – June 27, bringing their total position to a net long 52,845 contracts.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is being recommended for New Crop 2023 soybeans. Changes in weather forecasts and crop conditions will continue to dominate the market. With having just recommended making a cash sale, and with one of the most volatile USDA report days of the year coming this Friday, we would need to see the market rally to 1400 – 1450 area before we would consider recommending any additional sales for the 2023 crop. Otherwise, in light of current crop conditions, we will suggest holding tight on further cash sales for now.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans ended the day higher after Friday’s huge rally, but November beans backed significantly off their highs overnight where they reached the highest levels since late February. Soybean meal closed lower while soybean oil closed higher.

- On Friday, the USDA estimated soybeans at 83.5 million acres, far below the average trade guess of 87.7 million acres and the previous USDA estimate of 87.5 ma. US quarterly soy stocks came in at 796 million bushels, below the trade guess of 812 mb but overshadowed by the huge drop in acres.

- Crop progress will be released later today, and it is expected that good to excellent ratings will increase after the recent rains in some of the driest areas of the Corn Belt. Soybeans are expected to improve by 1% to 52% good to excellent, but that number may come in higher.

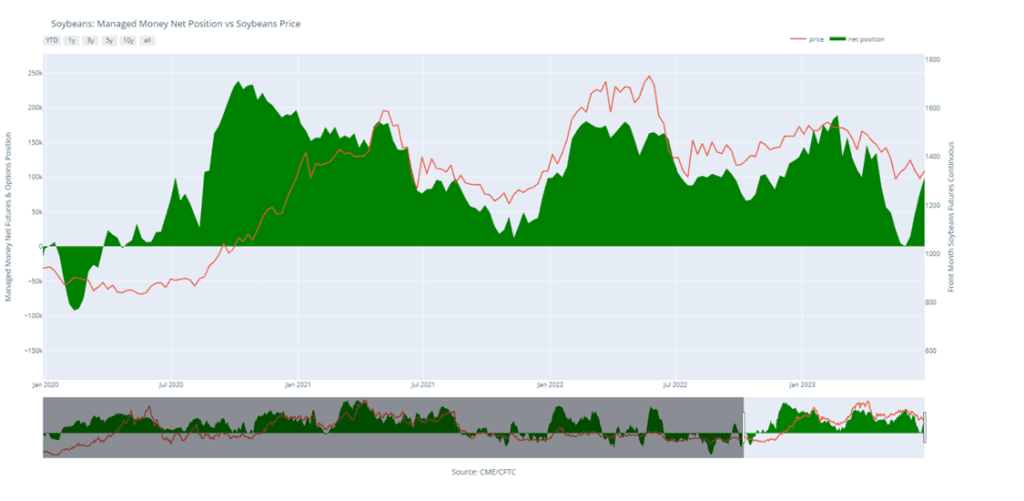

- Friday’s CFTC report showed funds as buyers of soybeans by 22,530 contracts, increasing their net long position to 99,480 contracts.

Above: The USDA’s Stocks and Acreage report gave the market a bullish shot in the arm with a much-reduced acreage estimate. If the market can continue to rally beyond the 1450 area, 1500 – 1550 could be its next target. If not, support could be found between 1340 and 1300 with further support near 1270.

Soybeans Managed Money Funds net position as of Tuesday, June 27. Net position in Green versus price in Red. Money Managers net bought 22,530 contracts between June 20 – June 27, bringing their total position to a net long 99,480 contracts.

Wheat

Market Notes: Wheat

- The European Union is considering letting the Russian Agricultural Bank back into the global SWIFT program. This reduction of sanctions is an effort to get Russia to extend the Black Sea corridor once again – last week Russia said they do not have reason to extend it beyond expiration on July 17. Meanwhile, Russia continues to lead the world for cheap wheat exports, which remains an anchor for US export demand.

- News outlets are reporting that Ukraine is conducting drills for a radiation exposure emergency. According to Ukraine officials, Russia has planted explosives at the Zaporizhzhia nuclear plant. This is the same plant that has had several other scares over the past months after being disconnected from the power grid.

- Weekly wheat export inspections of 12.4 mb for the week ending 6/29 were 64% higher than the week prior 23% higher last year and bring total 23/24 inspections to 40.2 mb.

- As of June 27, funds reduced their net short position in Chicago wheat from about 90,000 contracts to about 55,000 contracts.

- Weather over the next seven days is expected to bring more rain to the western corn belt, which may continue to slow harvest in Kansas and Nebraska.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. In the month of June, the September Chicago wheat contract posted a 163-cent range and has largely been a follower of the corn market which has been mostly driven by weather. While demand remains weak, production concerns in parts of the country remain, as does uncertainty surrounding the Black Sea region and the potential for major exporting countries’ inventory to hit 16-year lows. While Grain Market Insider will continue to monitor the downside for any violation of major support, following the recent sales recommendation it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Price volatility has risen in the last couple of weeks due to the changing weather forecasts and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market next year’s crop. War continues in the Black Sea region, major exporting countries’ stocks expected to fall to 16-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recently recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

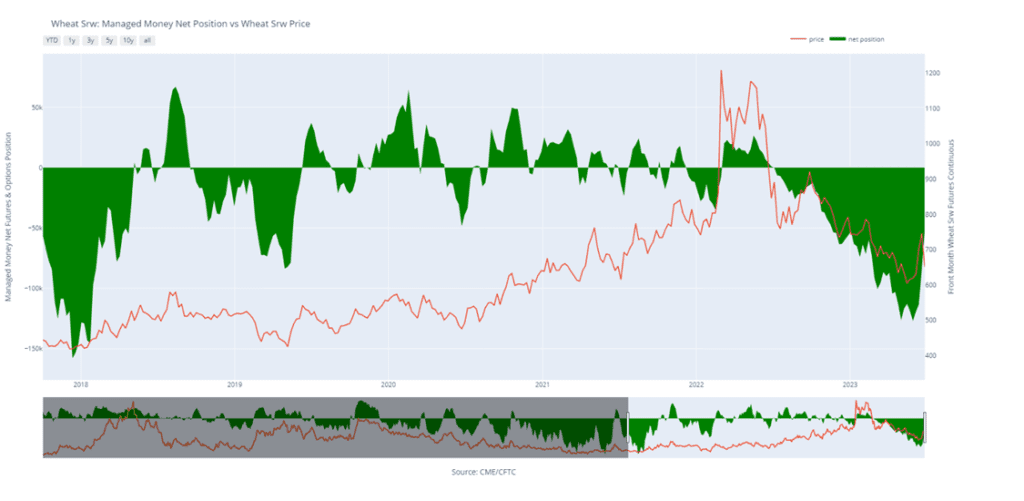

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. This technical formation on the price chart is considered bearish and momentum may be adding to the bearish tone. Support below the market may be found between 650 – 610, while resistance above the market rests between 770 – 810.

Chicago Wheat Managed Money Funds net position as of Tuesday, June 27. Net position in Green versus price in Red. Money Managers net bought 31,966 contracts between June 20 – June 27, bringing their total position to a net short 52,168 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

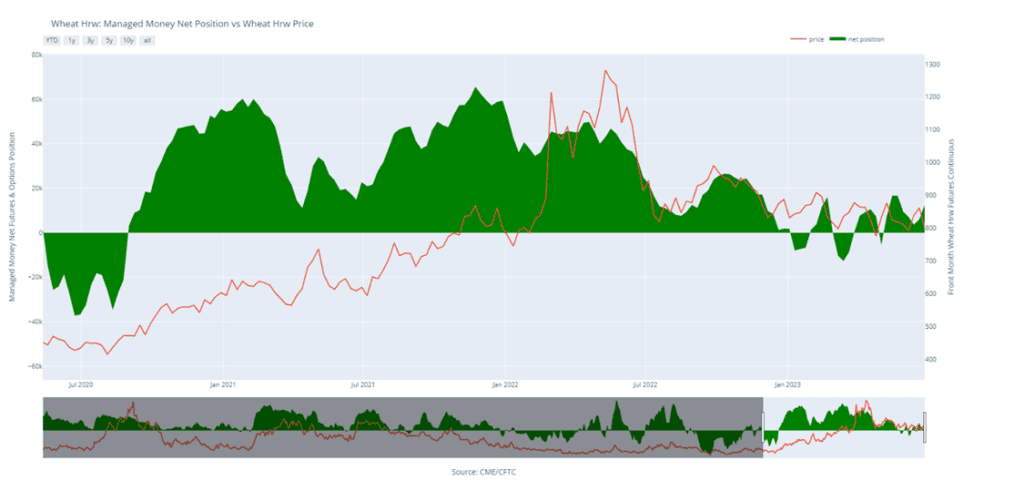

Above: Balancing both production and demand concerns, the September contract continues to trade within the 736 – 919 range established in May. The recent downturn in the market has established heavy resistance above the market between 890 – 920, with initial support coming in between 778 – 763 and key support near the May low of 736.

K.C. Wheat Managed Money Funds net position as of Tuesday, June 27. Net position in Green versus price in Red. Money Managers net bought 6,475 contracts between June 20 – 27, bringing their total position to a net long 12,419 contracts.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell SEP ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

- There continues to be an opportunity to sell 2023 New Crop MINNEAPOLIS Wheat. Weather dominates the market right now, and friendlier forecasts have pushed prices below the 822 support level. Closing below that 822 support signals that the recent uptrend off the May lows may have ended, which poses the risk that the change in trend could erode the price further in the weeks ahead. The first risk being, price drops to the May low of 771, which is where first support comes in. If that level doesn’t hold, then the next risk could be in the 680-710 window. Although making a sale in a down market may be uncomfortable, it’s important at times to have a Plan B with the objective of trying to avoid having to sell bushels at even lower prices in the future if a downtrend takes hold.

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

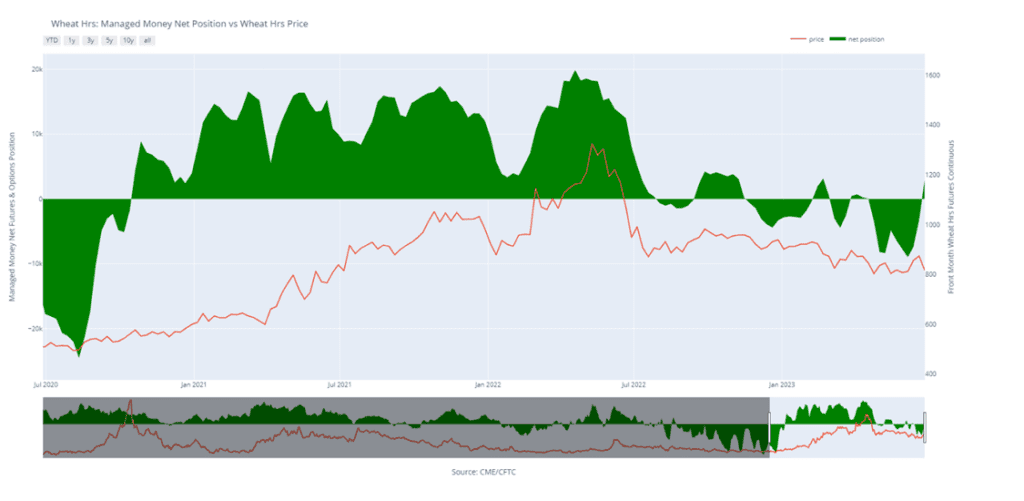

Above: The September contract rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. With the market trading lower, it will need additional bullish news to turn it back around. Should the market continue to fall, support may be found between 770 and 730.

Minneapolis Wheat Managed Money Funds net position as of Tuesday, June 27. Net position in Green versus price in Red. Money Managers net bought 6,263 contracts between June 20 – June 27, bringing their total position to a net long 3,001 contracts.

Other Charts / Weather