Grain Market Insider: July 18, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 528.75 | 29.5 |

| DEC ’23 | 534.5 | 28.5 |

| DEC ’24 | 530 | 19.25 |

| Soybeans | ||

| AUG ’23 | 1492 | 8 |

| NOV ’23 | 1395.25 | 17.25 |

| NOV ’24 | 1281.25 | 10 |

| Chicago Wheat | ||

| SEP ’23 | 670.75 | 17 |

| DEC ’23 | 690.5 | 16.75 |

| JUL ’24 | 717.25 | 17.5 |

| K.C. Wheat | ||

| SEP ’23 | 827.25 | 12 |

| DEC ’23 | 832.25 | 12.25 |

| JUL ’24 | 799.75 | 15 |

| Mpls Wheat | ||

| SEP ’23 | 877.5 | -0.75 |

| DEC ’23 | 886.5 | 0.75 |

| SEP ’24 | 815 | 9.5 |

| S&P 500 | ||

| SEP ’23 | 4585.25 | 31.5 |

| Crude Oil | ||

| SEP ’23 | 75.63 | 1.55 |

| Gold | ||

| OCT ’23 | 2000.2 | 24.7 |

Grain Market Highlights

- Short covering, triggered by a warmer and drier forecast and the escalation of tensions in the Black Sea region drove December prices to close above yesterday’s highs.

- Like corn, the soybean market surged higher, aided by soybean meal and a much warmer and drier forecast. Soybean oil on the other hand closed with a 56-point loss and weighed on crush margins, which lost 8 -1/2 cents in the December contracts.

- The addition of war premium and the closure of the Black Sea export corridor likely sparked some short covering and led the wheat complex mostly higher with the exception of September Minneapolis, which closed lower.

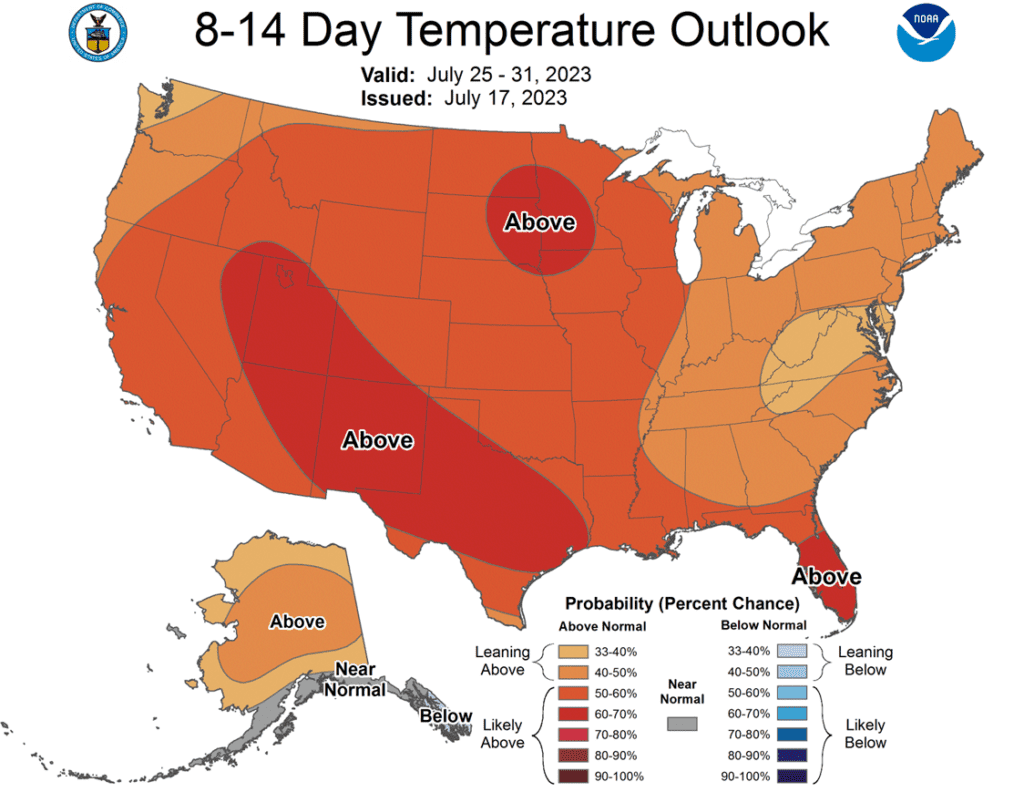

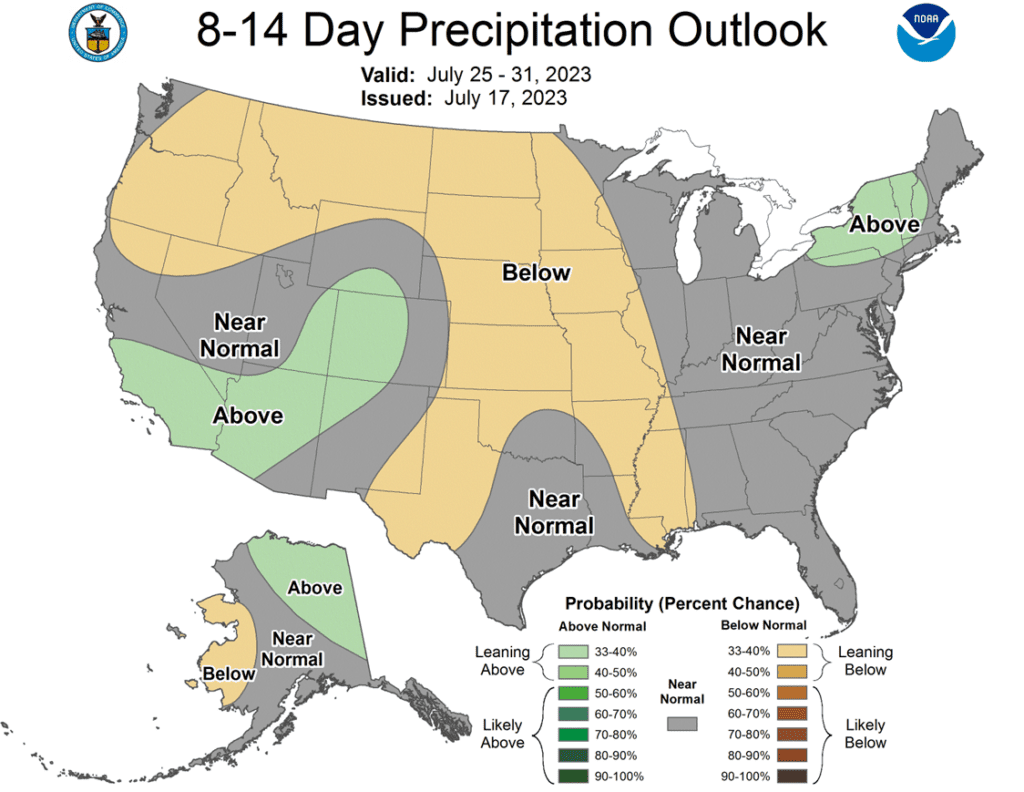

- To see the current US Drought Monitor and maps showing the current US 8 – 14 day Temperature and Precipitation outlook courtesy of NOAA, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

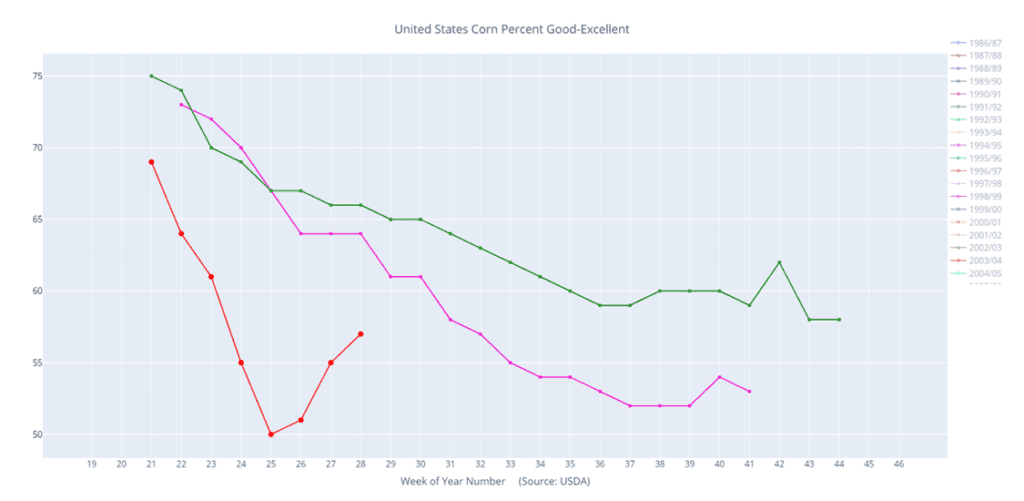

- No action is recommended for New Crop 2023 corn. In the month of June, December corn experienced a 137-cent high to low, swing primarily on weather and production concerns. Since then, planted acreage figures have increased by about 2 mil. acres and pushed the current 2023 carryout estimate north of 2.2 billion bushels, which hasn’t been seen since the 2018/19 crop year. When Dec corn was trading over 620, Grain Market Insider recommended making a cash sale and buying Dec 580 puts to cover more downside. The Dec 580 puts, paired with the previously recommended Dec 610 calls, yielded a combination of options commonly known as a Strangle, which benefits from dramatic market moves either up or down. Considering crop conditions continue to be low with over 60% of the crop experiencing drought, changing weather can still affect final production and rally prices, at which point the 610 calls should gain in value and protect any already sold bushels if the market makes new highs.

- No action is currently recommended for 2024 corn. So far this year the market has seen an extreme amount of volatility with drought, less than stellar crop conditions, and supply and demand estimates that currently put 2023 ending stocks north of 2.2 billion bushels, which would carry over into the 2024 crop year. While growing conditions can still change in the weeks ahead, we are at the time of year when there are more headwinds to rising prices than tailwinds. Grain Market Insider recently recommended making a sale on your 2024 crop, and we currently see no present opportunity to recommend any additional sales at this time. We’ll be watching for another opportunity to suggest adding to early sales levels between now and the beginning of September.

Market Notes: Corn

- The corn market added weather and war premium to its value on Tuesday as prices pushed through resistance, triggering strong money flow into the corn market.

- Technically, the corn market traded through Monday’s reversal high, which likely triggered additional buying and short covering in the market. The strong close has the corn market looking at the 100-day moving average as the next level of resistance.

- The USDA released its weekly crop ratings, and the US corn crop was rated 55% good/excellent, up 2% from last week and above market expectations. The corn crop improved, supported by recent rainfall in areas of the Corn Belt.

- Weather forecasts have turned significantly drier over the next couple weeks, and temperatures are moving to a warmer trend. Despite recent rainfall, 64% of the corn crop is in drought, and needs timely rainfall, and the warmer, drier conditions are timed with the pollination timetable, which could limit potential yield.

- Russia officially leaving the Ukrainian Grain Export deal and the attack on the Odessa port in the Ukraine added additional buying strength to the corn and wheat markets on the session.

Above: Favorable weather and an estimated 2023 carryout north of 2 bil bushels pushed the market through support that was in place since January 2021 and posted a double bottom at 474. This, and the fact that the market is oversold, is supportive if reversal action occurs. In that event, initial resistance could be found between 502 – 538, with heavy resistance up towards 595 – 625. Below the market there may not be much support above 390 – 415, the November ’20 lows, if the corn market falls below the recent low of 474.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell NOV ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

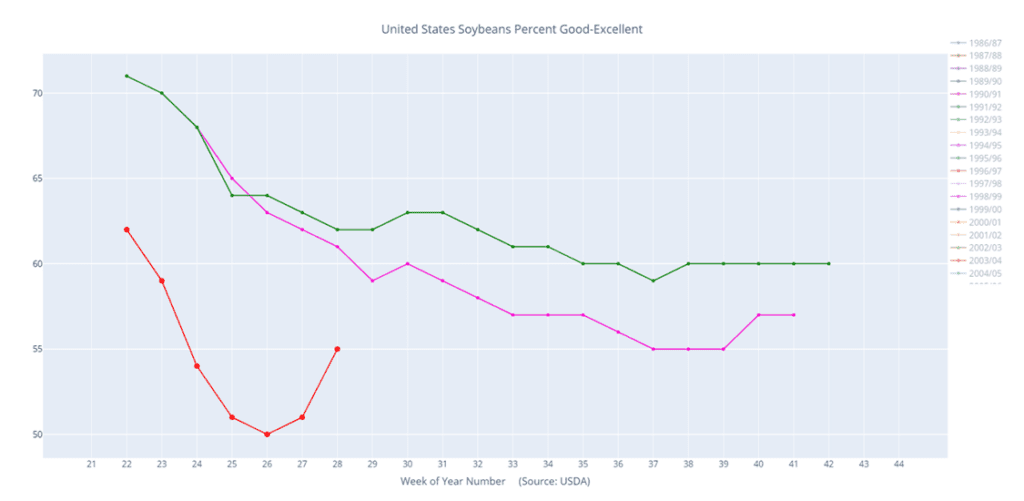

- Grain Market Insider sees an active opportunity to sell a portion of your 2023 soybeans. The USDA shocked the market with bearish expectations for the 2023 soybean crop’s supply and demand. Demand was lowered for both 2022 and 2023 crop years, with an added 25 mbu of 2022 inventory carried over to 2023. The net result being a current ending stocks estimate of 300 mbu for the 2023 crop, a full 50% higher than trade expectations. While the key part of the growing season is still ahead, and production concerns remain, that could turn the market higher again, continued favorable forecasts and improving crop conditions may lead the market to further price erosion. With the very dry conditions that many of you continue to experience, and the tremendous uncertainty that brings to what you’ll have for bushels this fall, we understand if there’s hesitancy to sell anything here. If you are worried about committing physical bushels with a cash sale, consider selling futures or buying put options.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

Market Notes: Soybeans

- Soybeans ended the day higher but slipped from their early highs which exceeded the 14-dollar mark and reached the highest levels since January of this year. The rally in soybean meal has been a major catalyst for moving soybeans higher, but soybean oil ended lower.

- Yesterday’s crop progress showed the soy crop improving more than the average trade guess with an increase of 4 points for a good to excellent rating of 55%. While an improvement, it is the second lowest rating since 2012, and only 20% of the crop is setting pods.

- Soybean meal has been rallying due to Argentina’s shrinking soy crop which is estimated at 21 mmt (4 mmt below the last USDA estimate), and Argentina is the largest exporter of soybean meal.

- With forecasts looking very dry and warm over the next two weeks, weather premium has been added to the market. Crop conditions improved over the past three weeks, but a two-week period of dry weather could easily send ratings back lower.

Above: The soybean charts rolled from the August to the September contract on 7/17 with the 75-cent discount to the September represented by the 52-cent gap on the chart between 7/14 and 7/17. To fill the gap, the market will need additional bullish news to continue higher and trade through the heavy resistance area of 1490 – 1505. If not, and prices retreat, initial support below the market is near 1400 with further support being in the 1350 – 1390 area.

Wheat

Market Notes: Wheat

- Wheat posted sharp gains, perhaps on a delayed reaction to the news of the cancellation of the Black Sea grain corridor. Additionally, some more war premium could be factored in after it was reported that Russia launched a new round of attacks on the port city of Odessa in Ukraine.

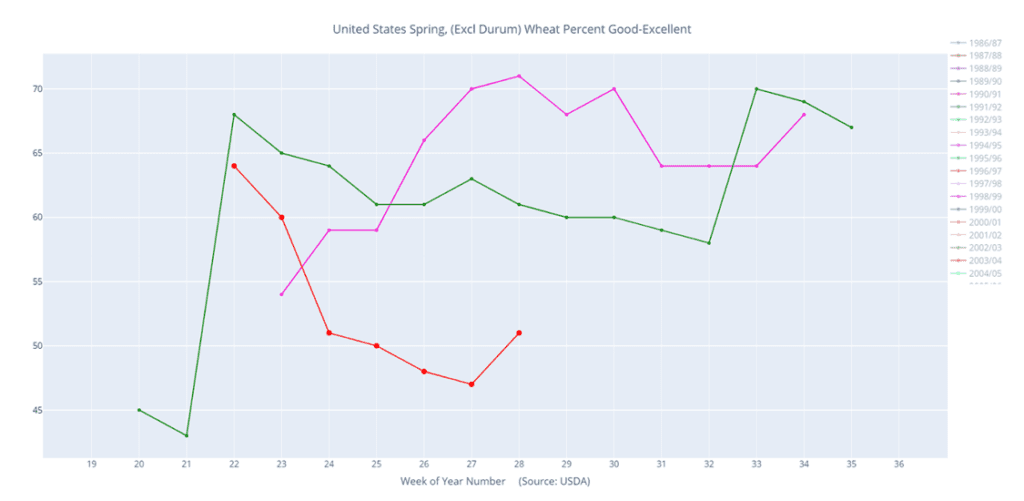

- Yesterday’s Crop Progress report showed that spring wheat condition improved 4% to 51% good to excellent. This may have limited the upside today for MPLS futures, relative to the gains in Chicago and KC.

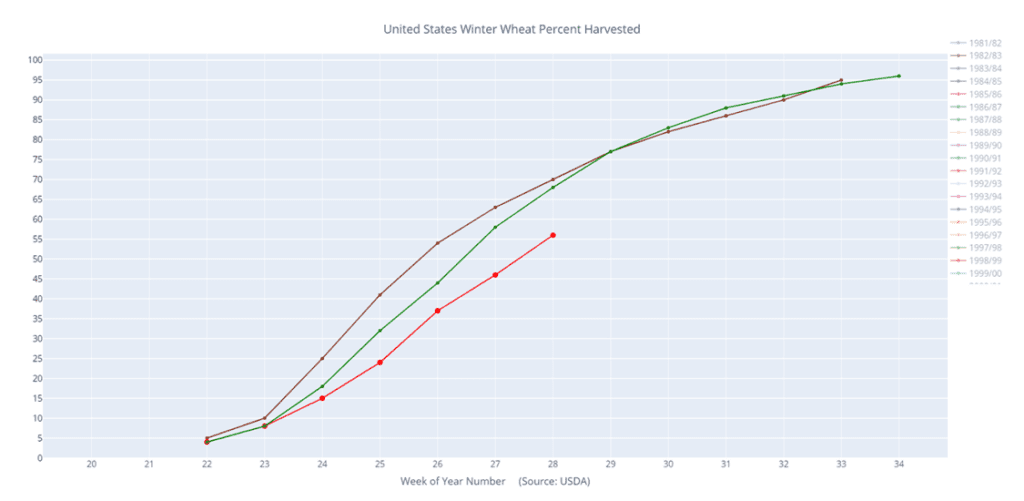

- US winter wheat harvest at 56% complete, continues to lag behind the average pace of 69% complete for this time of year.

- UkrAgroConsult increased their estimate of Russian 23/24 wheat exports to 47 mmt (up 2 mmt). The weaker Russian Ruble may be a contributing factor. Additionally, their estimate of the 2023 Russian wheat harvest was increased by 0.4 mmt to 85.2 mmt.

- Argentina’s wheat planting area estimate has been reduced by Bolsa de Rosario to 5.4 million hectares due to dry conditions. Production was also revised down to 15.6 mmt.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. The wheat market has seen a great amount of volatility in recent weeks and has primarily been a follower of corn which has been driven by weather. Although demand remains weak, the recent closure of the Black Sea corridor, and continued weather concerns in the northern Plains, Canada, Europe, and Russia, still leave many supply questions unanswered. While Grain Market Insider will continue to monitor the downside for any violation of major support following the recent sales recommendation, it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June, price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. While prices have been relatively range bound recently, heavy resistance remains near 730 – 770, the June high, with nearby resistance around 690 – 700. If prices fall back, support below the market may be found between 650 – 610, and again near 570, the May low.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While crop conditions have improved and there are reports of better-than-expected US yields, questions remain about the world wheat supply with the closure of the Black Sea corridor, dryness in Russia, the Canadian Prairies/Northern US Plains, and Europe. With world supplies currently seen at 11-year lows, we continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Balancing both production and demand concerns, the September contract continues to trade within the 736 – 919 range established in May. The recent downturn in the market has established heavy resistance above the market between 890 – 920, with initial support coming in between 778 – 763 and key support near the May low of 736.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

New Alert

Sell SEP ’24 Cash

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

- No action is currently recommended for the 2023 New Crop. Weather dominates the market right now, and though much of the growing season remains, Grain Market Insider suggested making a sale as prices closed below 822 to protect from further downside erosion due to a potential trend change. Seasonally, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to shock the market higher. Insider will consider making sales suggestions if prices improve through this growing season, while also continuing to watch the downside for any further violations of support.

- Grain Market Insider recommends selling a portion of your 2024 spring wheat crop. So far this year we have seen some of the volatility from the 2023 crop, with its challenges from late planting and now dryness, be carried over to the 2024 crop. We are now at that time of year where there are typically more headwinds to prices than tailwinds, and to begin getting some early sales on the books. Now that the market has rallied to within 15 cents of the June high where there is significant overhead resistance, Insider recommends making a sale on a portion of your 2024 spring wheat production by using either SEPT ’24 Minneapolis Wheat futures contracts or a SEPT ’24 HTA contract, so basis can be set at a later, more advantageous time. While $8 prices are not the $9 or $10+ that we have seen in recent years, and weather and geopolitical disruptions can still shock the market higher, they still represent historically good prices to begin making sales.

Above: In the month of June, the September contract rallied towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. The market has since retreated and slowly climbed back, and it will need additional bullish news to be able to trade through the recent highs. Should the market fall back, initial support may be found between 805 – 845 with further downside support between 770 and 730.

Other Charts / Weather