Grain Market Insider: July 14, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 506.5 | 13 |

| DEC ’23 | 513.75 | 13.25 |

| DEC ’24 | 517 | 8.25 |

| Soybeans | ||

| AUG ’23 | 1480.25 | -4.5 |

| NOV ’23 | 1370.75 | 1 |

| NOV ’24 | 1270 | 9.75 |

| Chicago Wheat | ||

| SEP ’23 | 661.5 | 21.75 |

| DEC ’23 | 680.75 | 21.25 |

| JUL ’24 | 707.75 | 17.75 |

| K.C. Wheat | ||

| SEP ’23 | 829 | 23 |

| DEC ’23 | 833.5 | 22.75 |

| JUL ’24 | 792.25 | 21.75 |

| Mpls Wheat | ||

| SEP ’23 | 884.25 | 22.5 |

| DEC ’23 | 889.5 | 22.25 |

| SEP ’24 | 800 | 13.5 |

| S&P 500 | ||

| SEP ’23 | 4542.25 | -1.25 |

| Crude Oil | ||

| SEP ’23 | 75.3 | -1.46 |

| Gold | ||

| OCT ’23 | 1983.7 | 0.8 |

Grain Market Highlights

- After posting a double bottom on Thursday, December corn broke out of its recent range and surged higher to close the week with a bullish reversal on the weekly chart.

- The soybean market closed mixed, with Old Crop lower and New Crop higher. Early strength allowed the market to post a new high for the move before giving way to choppy trade ahead of the weekend, as traders book profits.

- Bearish reversals in crude and heating oil likely added to the negativity in soybean oil, which bled over to soybeans and December Board Crush, which suffered a 4-1/4 cent loss, while December meal squeezed out a $1.10 gain.

- Reports of India banning rice exports, continued dryness in the northern Plains, and the possible expiration of the Black Sea grain deal added support to the wheat complex today, with all three classes finishing strong to close out the week.

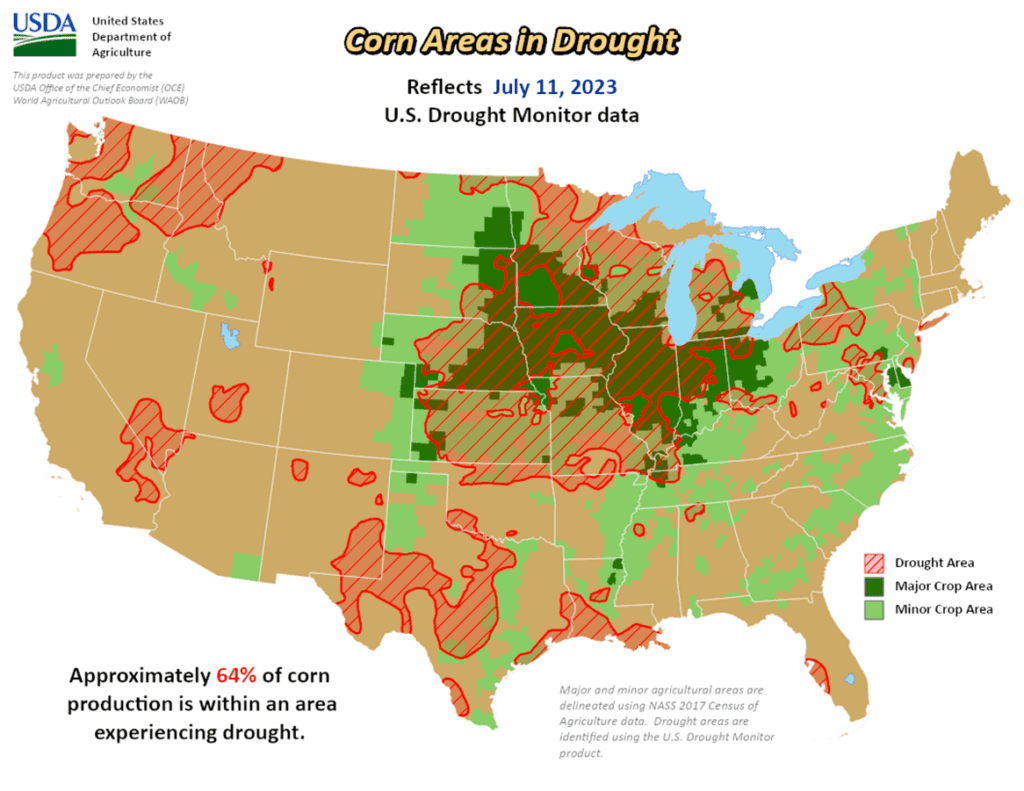

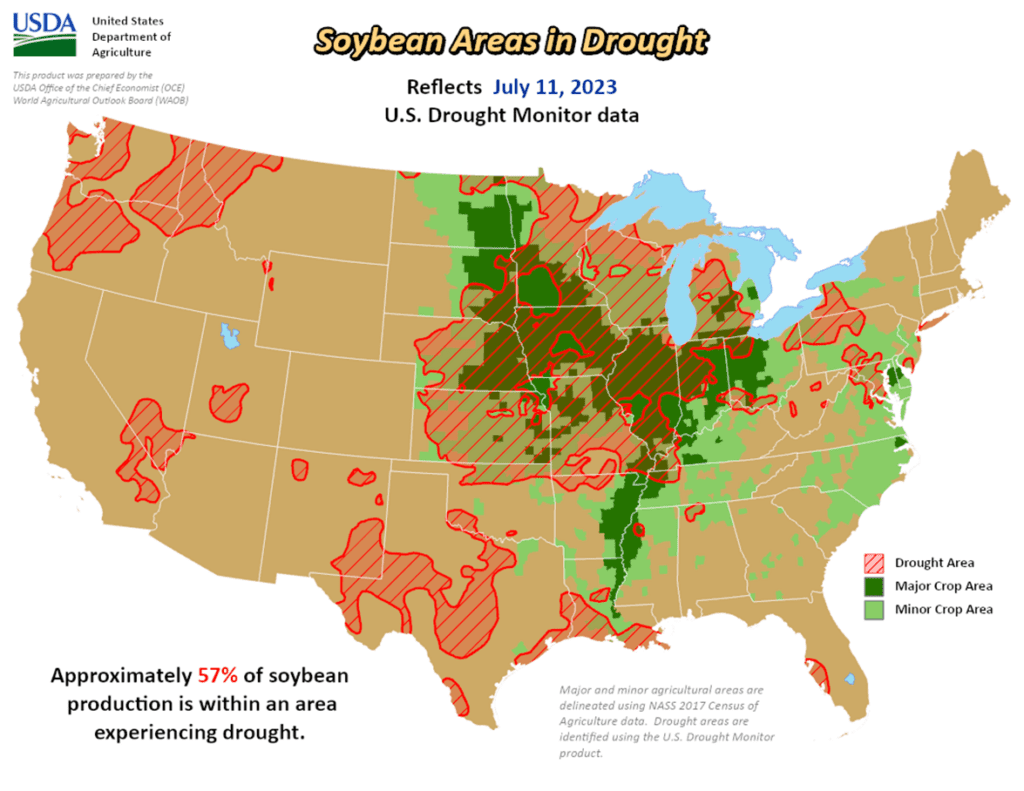

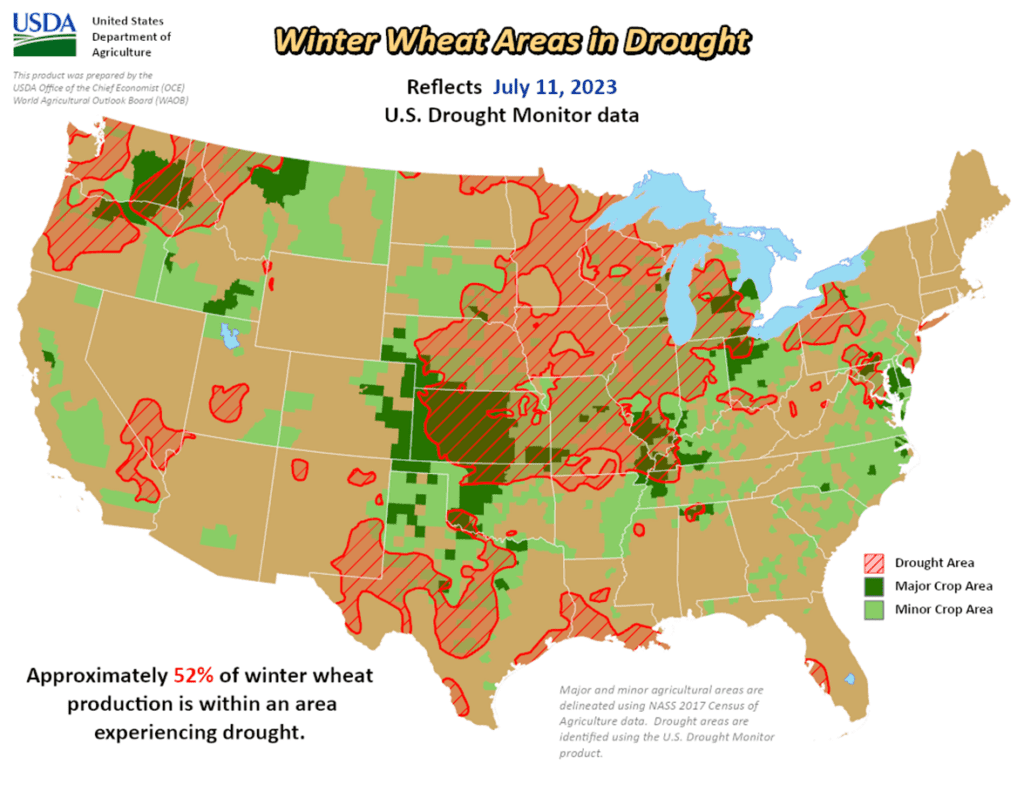

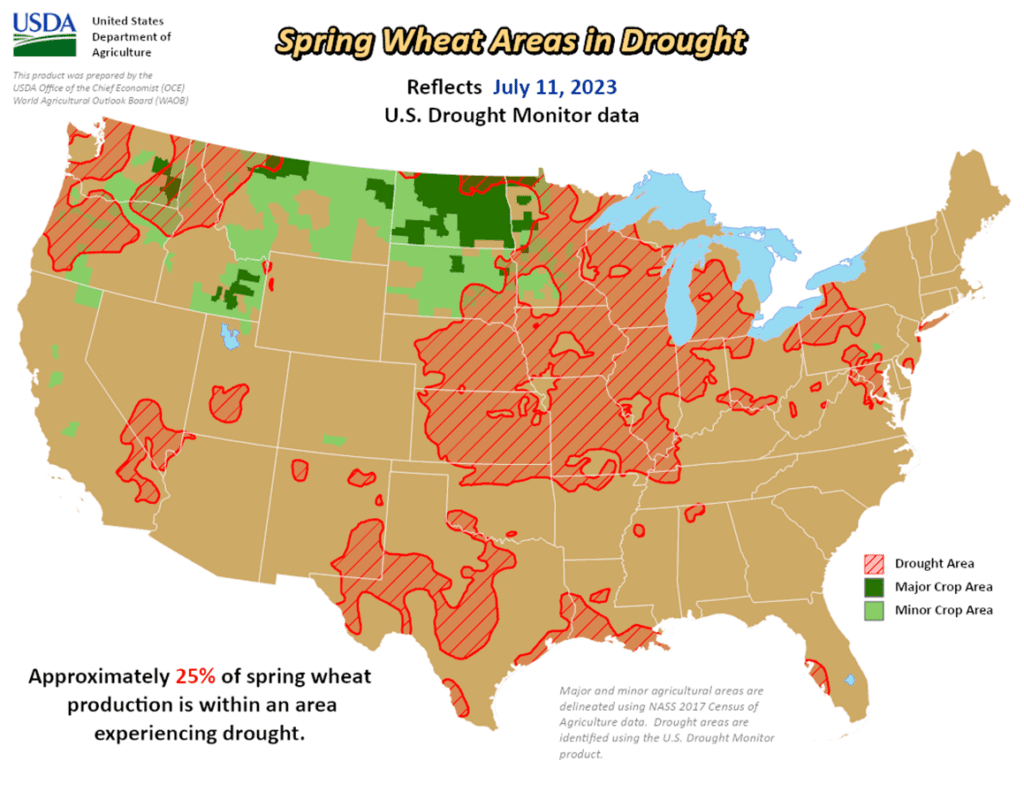

- To see maps showing the percentage of crops in drought, courtesy the USDA and US Drought Monitor, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

Active

Sell DEC ’24 Cash

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

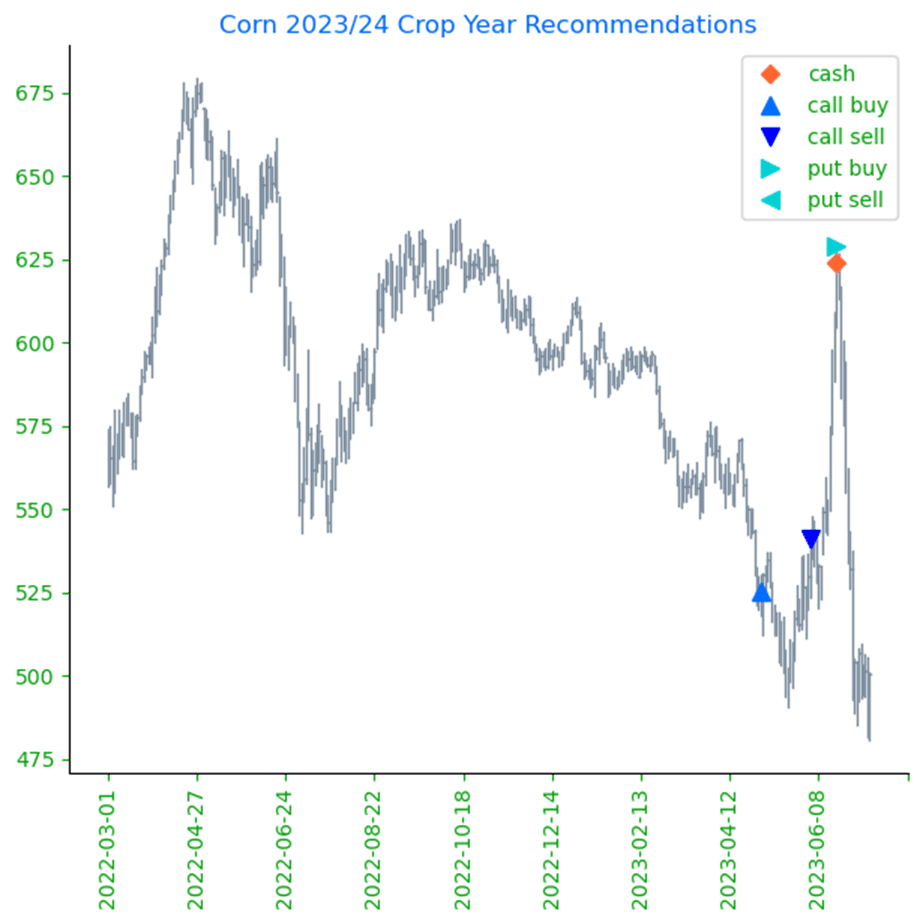

- No action is recommended for New Crop 2023 corn. In the month of June, December corn experienced a 137-cent high to low, swing primarily on weather and production concerns. Since then, planted acreage figures have increased by about 2 mil. acres and pushed the current 2023 carryout estimate north of 2.2 billion bushels, which hasn’t been seen since the 2018/19 crop year. When Dec corn was trading over 620, Grain Market Insider recommended making a cash sale and buying Dec 580 puts to cover more downside. The Dec 580 puts, paired with the previously recommended Dec 610 calls, yielded a combination of options commonly known as a Strangle, which benefits from dramatic market moves either up or down. Considering crop conditions continue to be low with over 60% of the crop experiencing drought, changing weather can still affect final production and rally prices, at which point the 610 calls should gain in value and protect any already sold bushels if the market makes new highs.

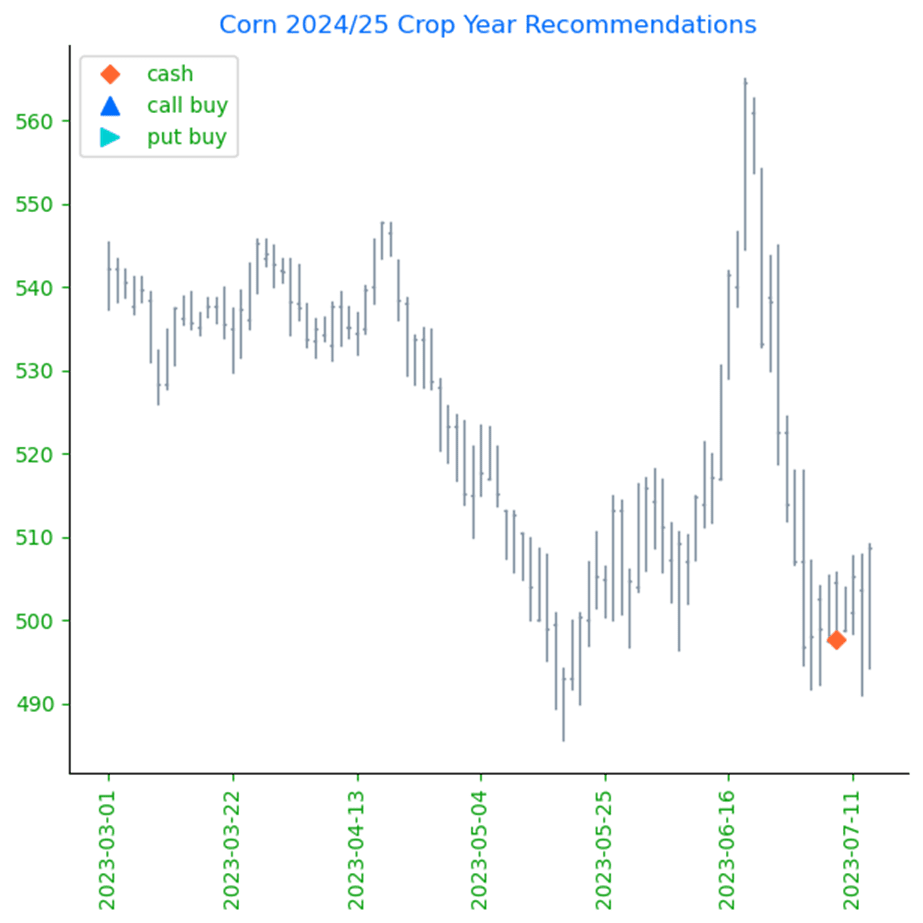

- Grain Market Inside sees continued opportunity to sell a portion of your 2024 Corn. While the market has seen some extreme volatility in recent weeks, we are entering a time of year when prices tend to have more headwinds than tailwinds to the upside. Also, with the USDA’s surprise acreage jump, continued rain in the forecast and slow demand, the size of the 2023 crop still has the potential to yield a carryout north of 2 billion bushels. A large 2023 carryout in the US, combined with the large corn crop in Brazil, could pose greater headwinds for 2024 prices. With it being the time of year to start getting early sales for next year on the books, and no recent bullish catalyst from the Stocks or Acreage reports, we are suggesting making a sale for the 2024 corn crop using either a DEC ’24 HTA contract or DEC ’24 futures, so the basis can be set at a later more advantageous date. While $5.00 futures is not the $6.00 or $7.00, we’ve become accustomed to the last few years, it’s still historically a good price to be getting some early sales on the books at.

Market Notes: Corn

- Corn showed some muscle to finish near session highs, following through from yesterday. This may in part stem from skepticism of the USDA’s latest numbers.

- The 8-14 day weather forecast may also have lent some support to futures today, with an outlook for warmer and drier conditions across much of the Midwest. With 64% of the US corn crop said to still be experiencing drought conditions, fundamental support may be building at these lower price levels.

- On a bearish note, CONAB increased their estimate of Brazilian corn production to 127.8 mmt from 125.7 mmt previously, which for now, is likely to keep pressure on the export front.

- Although the US dollar was slightly higher today, it is still well below where it was a week ago. This decline has likely taken some downward pressure off the grain markets and allowed for some breathing room.

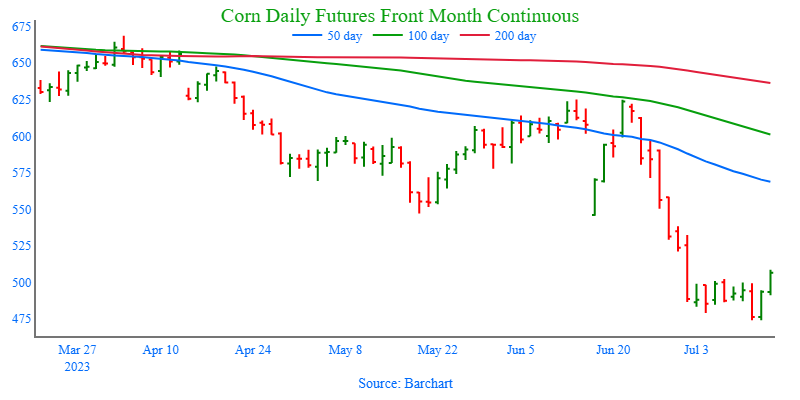

Above: Favorable weather and an estimated 2023 carryout north of 2 bil. bushels pushed the market through support that was in place since January 2021 and posted a double bottom at 474. This, and the fact that the market is oversold, is supportive if reversal action occurs. In that event, initial resistance could be found between 502 – 538, with heavy resistance up towards 595 – 625. Below the market there may not be much support above 390 – 415, the November ’20 lows.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell NOV ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

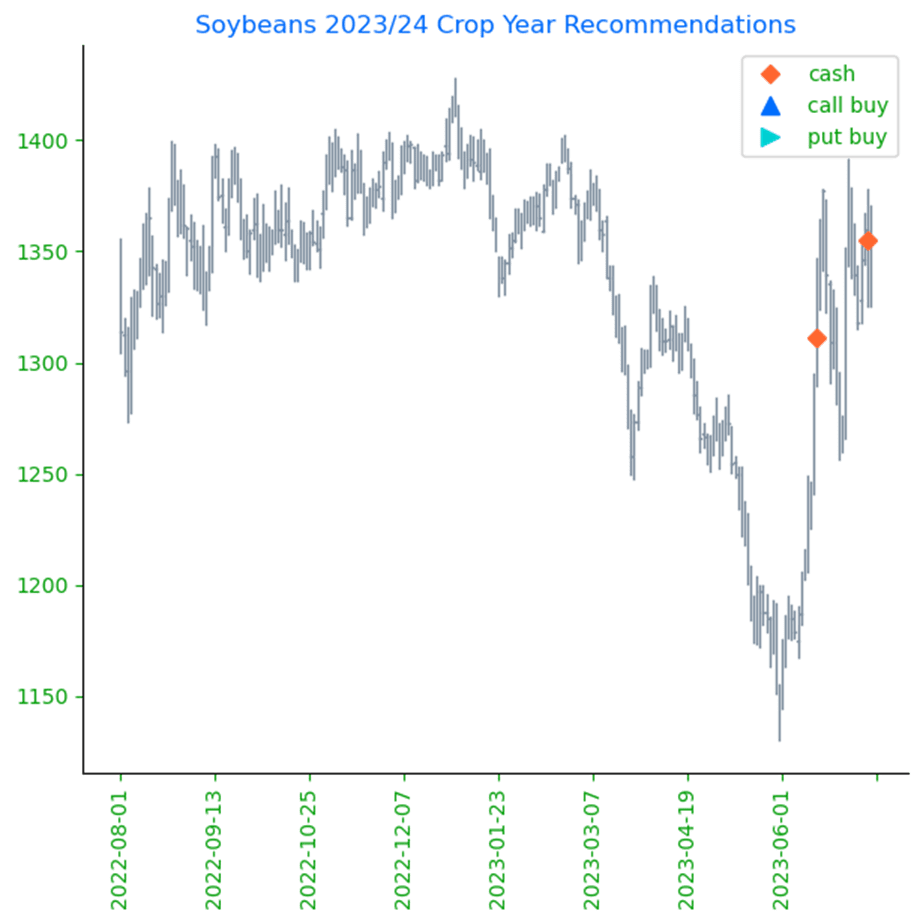

- Grain Market Insider sees an active opportunity to sell a portion of your 2023 soybeans. The USDA shocked the market with bearish expectations for the 2023 soybean crop’s supply and demand. Demand was lowered for both 2022 and 2023 crop years, with an added 25 mbu of 2022 inventory carried over to 2023. The net result being a current ending stocks estimate of 300 mbu for the 2023 crop, a full 50% higher than trade expectations. While the key part of the growing season is still ahead, and production concerns remain, that could turn the market higher again, continued favorable forecasts and improving crop conditions may lead the market to further price erosion. With the very dry conditions that many of you continue to experience, and the tremendous uncertainty that brings to what you’ll have for bushels this fall, we understand if there’s hesitancy to sell anything here. If you are worried about committing physical bushels with a cash sale, consider selling futures or buying put options.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

Market Notes: Soybeans

- Led by negativity in the energy markets, weakness in soybean oil weighed on soybeans and likely led to some profit taking and choppy trade after posting a new high for the move. Both Old and New Crop contracts closed the week in relative unison, with August beans showing a 52-1/2 cent gain, while November posted a 53 cent gain, despite the USDA’s bearish report on Wednesday.

- Following Wednesday’s surprising USDA report, some are questioning the USDA’s 52 bpa yield estimate with 57% of the US soybean crop experiencing some level of drought, though this is down 3% from last week.

- China has reportedly been an active buyer of Brazilian soybeans, purchasing 20 – 25 cargoes for May – July 2024 delivery, in addition to US soybeans purchased off the PNW for October delivery.

- Expectations for Monday’s NOPA soybean crush report are for 170.568 mb of soybeans crushed in June, down 4.1% from May, but expected due to seasonal downtime for maintenance and repairs, and if realized, it would be a record for the month.

- Updated Consumer Price Index (CPI) and Producer Price Index (PPI) information released this week showed inflation levels are slowing, reducing the possibility of further rate hikes by the Fed, and likely adding early support to prices.

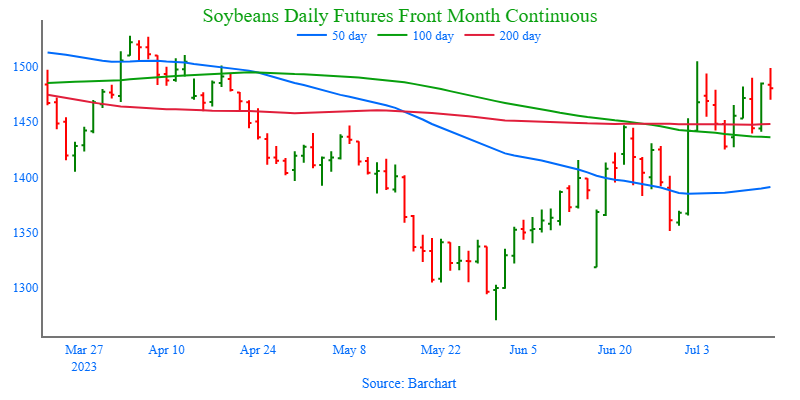

Above: The soybean market is struggling with heavy resistance in the 1490-1505 area and posted a bearish reversal following the July 12 USDA report. The market reversed sharply higher on July 13, but prices need to show continued strength to negate the bearish action from report day. Initial support below the market is near 1425 with further support being in the 1350 – 1390 area.

Wheat

Market Notes: Wheat

- News reports that India will ban rice exports may have contributed to the strong close in the wheat market. India generally exports a large percentage of the world’s rice, so if they are short on supply, they may turn to wheat as another food staple. Some believe this could mean they will need to import wheat down the road, offering support.

- Early next week, the Black Sea export corridor deal will expire. As of writing, no agreement on an extension has been reached. Russia has allegedly stated that they will offer an extension, but only in exchange for reduced sanctions on their banking system (namely, being let back into the SWIFT program). Either way, this could mean more volatility for wheat next week.

- According to the Buenos Aires Grain Exchange, their 23/24 wheat planting estimate for Argentina is unchanged from their last projection at 6.0 mmt.

- Canada is still too dry, and it is impacting their spring wheat crop. Much like areas of the northern US Plains that are experiencing the same problem.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

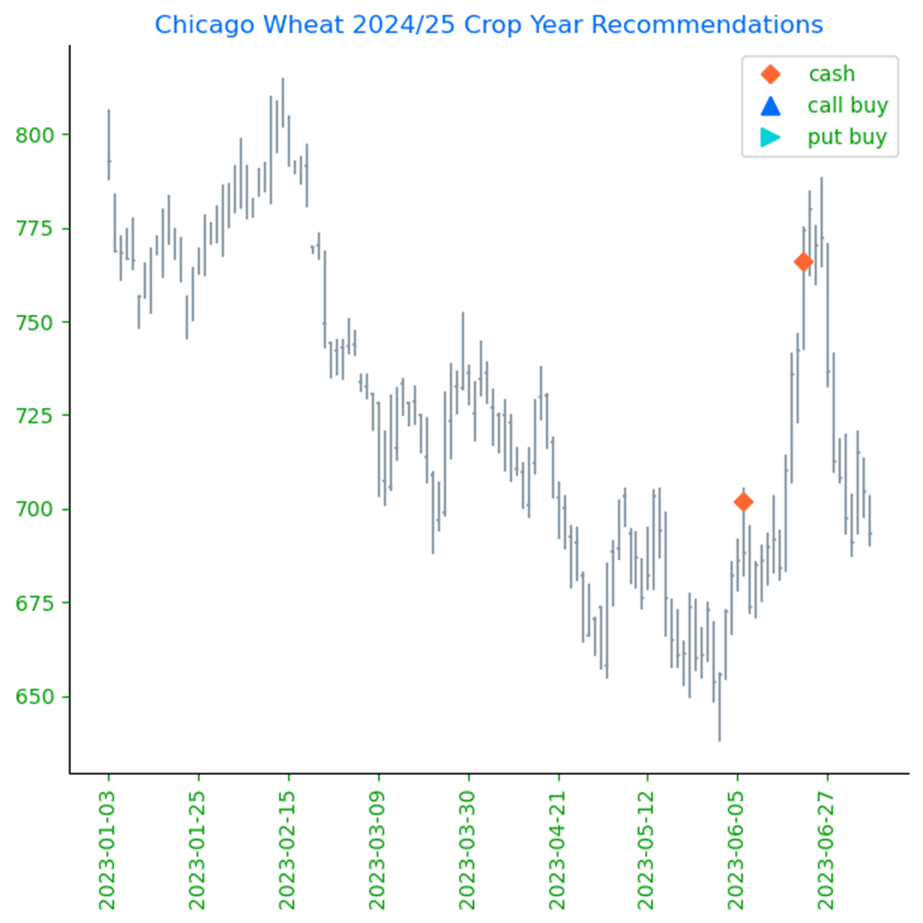

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. In the month of June, the September Chicago wheat contract posted a 163-cent range and has largely been a follower of the corn market which has been mostly driven by weather. While demand remains weak, production concerns in parts of the country remain, as does uncertainty surrounding the Black Sea region and the potential for major exporting countries’ inventory to hit 16-year lows. While Grain Market Insider will continue to monitor the downside for any violation of major support, following the recent sales recommendation it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June, price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. This technical formation on the price chart is considered bearish and momentum may be adding to the bearish tone. Support below the market may be found between 650 – 610, while resistance above the market rests between 770 – 810.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

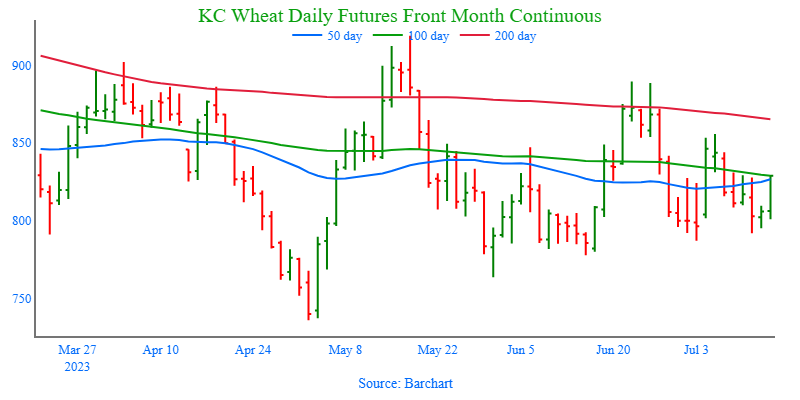

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Balancing both production and demand concerns, the September contract continues to trade within the 736 – 919 range established in May. The recent downturn in the market has established heavy resistance above the market between 890 – 920, with initial support coming in between 778 – 763 and key support near the May low of 736.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

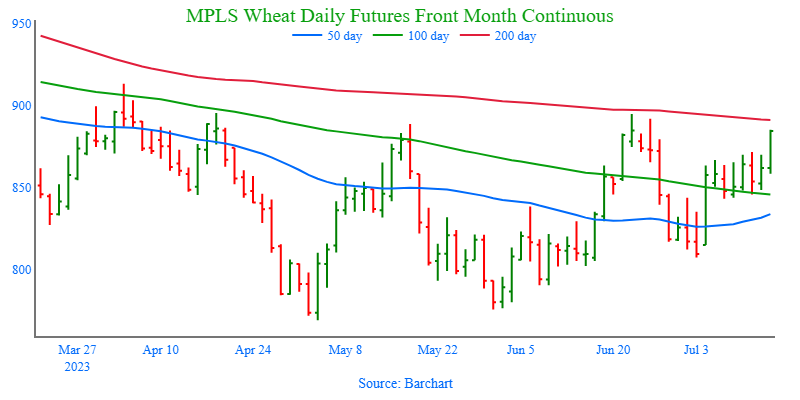

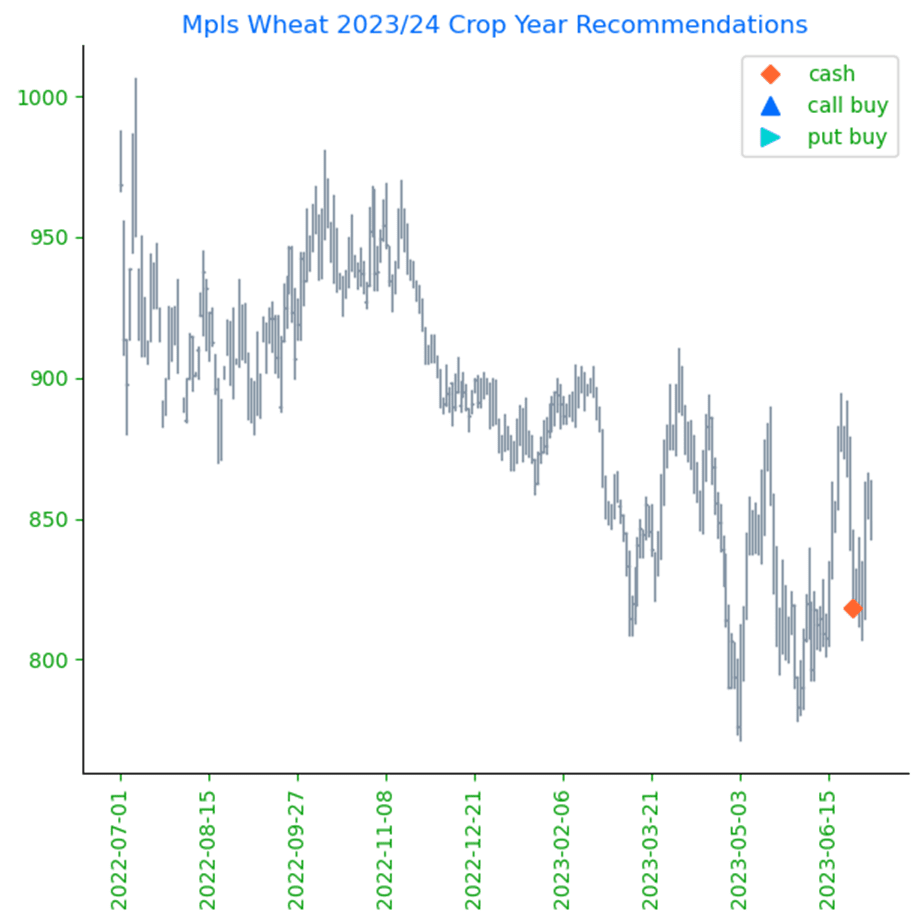

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

- No action is currently recommended for the 2023 New Crop. Weather dominates the market right now, and though much of the growing season remains, Grain Market Insider suggested making a sale as prices closed below 822 to protect from further downside erosion due to a potential trend change. Seasonally, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to shock the market higher. Insider will consider making sales suggestions if prices improve through this growing season, while also continuing to watch the downside for any further violations of support.

- No action is recommended for the 2024 crop. With weather dominating the market right now, 2024 prices can be heavily influenced by 2023 carryover estimates and prices. As dryness increases in the spring wheat areas and with major exporting countries’ stocks at 11-year lows, Grain Market Insider would like to see September futures prices in the 800 – 825 range before we would consider suggesting making any sales recommendations, while keeping an eye on the recent lows for any violation of support.

Above: In the month of June, the September contract rallied towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. The market has since retreated and slowly climbed back, and it will need additional bullish news to be able to trade through the recent highs. Should the market fall back, initial support may be found between 805 – 845 with further downside support between 770 and 730.

Other Charts / Weather