Grain Market Insider: July 13, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 493.5 | 17.25 |

| DEC ’23 | 500.5 | 16.75 |

| DEC ’24 | 508.75 | 12.75 |

| Soybeans | ||

| AUG ’23 | 1484.75 | 40.5 |

| NOV ’23 | 1369.75 | 42 |

| NOV ’24 | 1260.25 | 33.25 |

| Chicago Wheat | ||

| SEP ’23 | 639.75 | 7 |

| DEC ’23 | 659.5 | 7.25 |

| JUL ’24 | 690 | 8.25 |

| K.C. Wheat | ||

| SEP ’23 | 806 | 3 |

| DEC ’23 | 810.75 | 3.75 |

| JUL ’24 | 770.5 | 2.75 |

| Mpls Wheat | ||

| SEP ’23 | 861.75 | 8.25 |

| DEC ’23 | 867.25 | 7.75 |

| SEP ’24 | 786.5 | -6.5 |

| S&P 500 | ||

| SEP ’23 | 4537.25 | 29.75 |

| Crude Oil | ||

| SEP ’23 | 76.74 | 1.2 |

| Gold | ||

| OCT ’23 | 1983 | 2.2 |

Grain Market Highlights

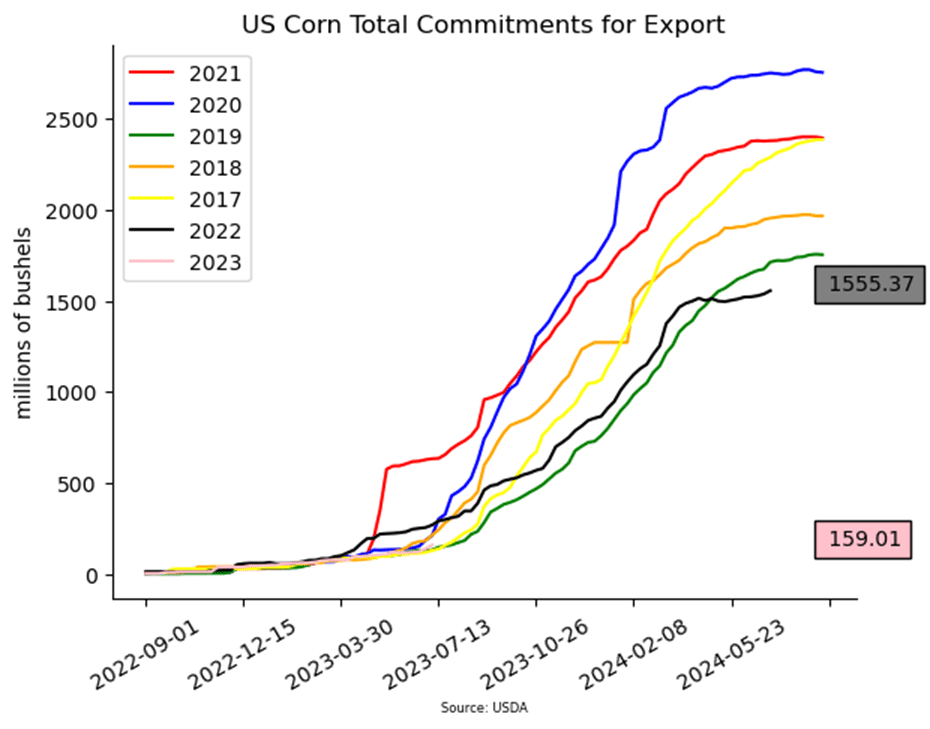

- US corn export sales last week for both Old and New Crop were above trade expectations and the largest since March. This friendly news helped corn erase nearly all of yesterday’s losses.

- A drier long-range forecast and the fact that 57% of the crop remains in drought conditions helped to rally the soybean complex higher today, surpassing yesterday’s losses.

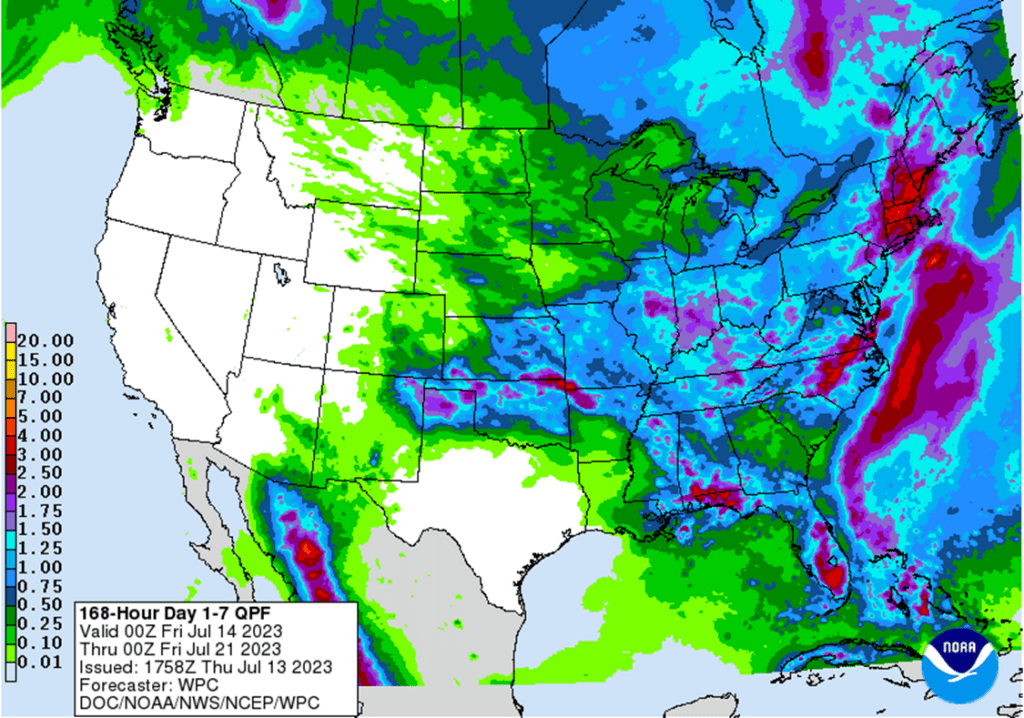

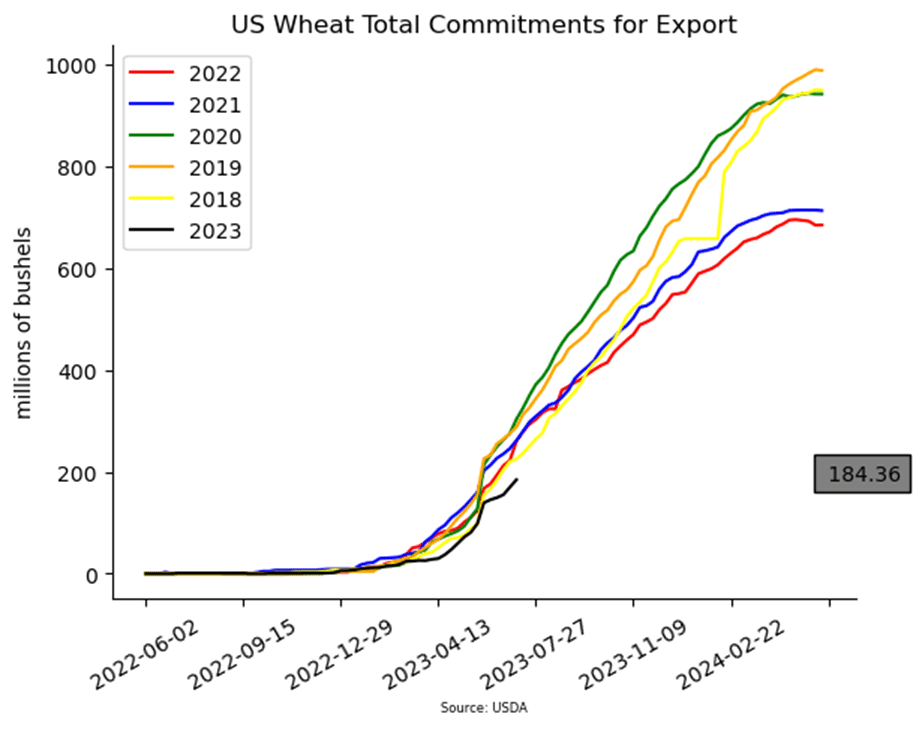

- Wheat markets followed corn and soybean prices higher. Spring wheat producing areas experiencing drought now total 25%, rainfall looks limited for these areas over the next week.

- The US Dollar Index continued its move lower, falling to its lowest level since April 2022. A weaker US dollar is supportive to commodities.

- To see the US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

Active

Sell DEC ’24 Cash

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is recommended for New Crop 2023 corn. In the month of June, December corn experienced a 137-cent high to low, swing primarily on weather and production concerns. Since then, planted acreage figures have increased by about 2 mil. acres and pushed the current 2023 carryout estimate north of 2.2 billion bushels, which hasn’t been seen since the 2018/19 crop year. When Dec corn was trading over 620, Grain Market Insider recommended making a cash sale and buying Dec 580 puts to cover more downside. The Dec 580 puts, paired with the previously recommended Dec 610 calls, yielded a combination of options commonly known as a Strangle, which benefits from dramatic market moves either up or down. Considering crop conditions continue to be low with over 60% of the crop experiencing drought, changing weather can still affect final production and rally prices, at which point the 610 calls should gain in value and protect any already sold bushels if the market makes new highs.

- Grain Market Inside sees continued opportunity to sell a portion of your 2024 Corn. While the market has seen some extreme volatility in recent weeks, we are entering a time of year when prices tend to have more headwinds than tailwinds to the upside. Also, with the USDA’s surprise acreage jump, continued rain in the forecast and slow demand, the size of the 2023 crop still has the potential to yield a carryout north of 2 billion bushels. A large 2023 carryout in the US, combined with the large corn crop in Brazil, could pose greater headwinds for 2024 prices. With it being the time of year to start getting early sales for next year on the books, and no recent bullish catalyst from the Stocks or Acreage reports, we are suggesting making a sale for the 2024 corn crop using either a DEC ’24 HTA contract or DEC ’24 futures, so the basis can be set at a later more advantageous date. While $5.00 futures is not the $6.00 or $7.00, we’ve become accustomed to the last few years, it’s still historically a good price to be getting some early sales on the books at.

Market Notes: Corn

- Buyers returned to the corn market on Thursday, as prices finished with strong double-digit gains. Spillover support from the soybean market, and a short squeeze in the July futures, with expiration on Friday, helped triggered the buying support.

- Weekly exports sales reported this morning for corn were slightly above market expectations. The USDA reported Old Crop sales of 18.4 mb and New Crop sales of 19.4 mb. Numbers are still overall disappointing as Old Crop sales need to average 26.5 mb weekly to hit the USDA export sales target of 1.650 billion bushels for the 2022-23 marketing year.

- The strong price action with December corn pushing back over the $5.00 price level and closing above the 10-day moving average could likely set up additional buying strength on Fridays open. The key to today’s price movement will be follow-through to end the week.

- Traders are questioning final yield projections, as 64% of the corn crop is still experiencing some form of drought, down 3% from last week. In addition, the fungal disease, Tar Spot, is now being found in six states. The spread of this disease will be watched by the market.

- The U.S. Dollar Index has broken through the 100-basis point level and traded to its lowest level since April 2022 on the prospects that Fed interest rate hikes may be coming to an end. The weaker dollar has helped trigger some money flow into the commodity and equity markets.

Above: The USDA added a bearish 4 million acres to its planted acreage estimate on June 30. The September contract is now extremely oversold and consolidating in the 480 – 505 support level that has been in place since January 2021. The oversold condition of the market would be considered supportive to higher prices if reversal action occurs; if not, there may not be much support until 390 – 415. Overhead lies strong resistance between 595 and 625.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

Active

Sell NOV ’23 Cash

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- Grain Market Insider sees an active opportunity to sell a portion of your 2023 soybeans. The USDA shocked the market with bearish expectations for the 2023 soybean crop’s supply and demand. Demand was lowered for both 2022 and 2023 crop years, with an added 25 mbu of 2022 inventory carried over to 2023. The net result being a current ending stocks estimate of 300 mbu for the 2023 crop, a full 50% higher than trade expectations. While the key part of the growing season is still ahead, and production concerns remain, that could turn the market higher again, continued favorable forecasts and improving crop conditions may lead the market to further price erosion. With the very dry conditions that many of you continue to experience, and the tremendous uncertainty that brings to what you’ll have for bushels this fall, we understand if there’s hesitancy to sell anything here. If you are worried about committing physical bushels with a cash sale, consider selling futures or buying put options.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

Market Notes: Soybeans

- Soybeans, along with soybean meal and oil, saw big gains today that surpassed yesterday’s losses after the USDA increased the 22/23 carryout to 255 mb and announced a 23/24 carryout of 300 mb, 50% larger than the 200 mb figure that was expected.

- Today’s gains were largely fueled by the fact that 57% of the US soybean crop is experiencing drought conditions with a drier long range forecast for the north central Midwest, and a sharply lower US dollar.

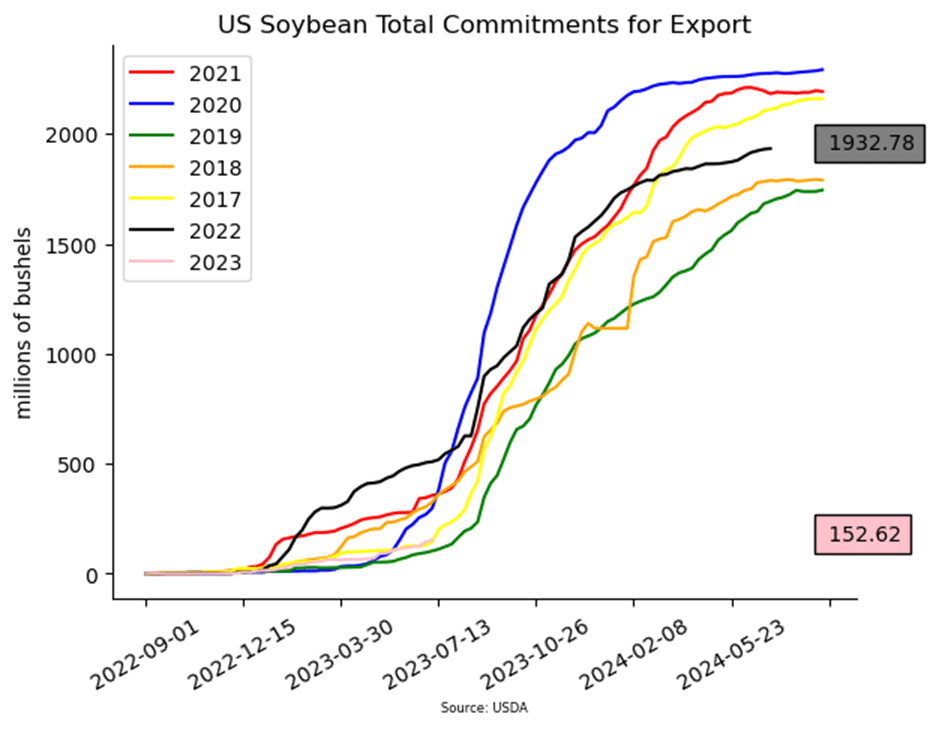

- This morning, the USDA announced that private exporters reported a sale of 315,704 metric tons of soybeans for delivery to Mexico during the 2023/2024 marketing year.

- Chinese customs data shows that soybean imports in June totaled 10.27 mmt, representing a 24.5% increase versus last June, and year over year imports have risen 13.6% to 52.575 mmt, mostly on large purchases of cheap Brazilian soybeans. Chinese demand may be slowing in the second half of the year though, as hog herds begin to shrink due to the lack of profitability and less feed is needed, according to a Chinese consultant, Sitonia Consulting.

- Anec reports that Brazil’s soybean exports are seen reaching 10.45 mmt in July, with soybean meal exports reaching 2.5 mmt for the same period. This compares to just 7 mmt of soybeans and 2.07 mmt of meal exported for the same time last year.

Above: The soybean market is struggling with heavy resistance in the 1490-1505 area and posted a bearish reversal following the July 12 USDA report. The market reversed sharply higher on July 13, but prices need to show continued strength to negate the bearish action from report day. Initial support below the market is near 1425 with further support being in the 1350 – 1390 area.

Wheat

Market Notes: Wheat

- The USDA reported an increase of 14.5 mb of wheat export sales for 23/24. The USDA is projecting 725 mb of exports in 23/24, and commitments now total 184 mb (down 29% from last year).

- Despite a negative report yesterday, all three US wheat futures classes rebounded today and closed in positive territory. It may have been a case of “follow the leader” though, as corn and soybean futures led the charge higher.

- The US Dollar Index continues to decline, breaking below the 100 level today. This is most likely tied to yesterday’s CPI and today’s PPI data, which showed easing inflation. There is thought that the Fed may be close to the end of raising interest rates, and this might be putting some risk premium back into financial and commodity markets.

- In the face of a negative report yesterday, global wheat ending stocks (minus China) are still at an 11-year low.

- Matif wheat closed a little higher, gaining about 1.50 – 2.00 euros. Support may be building for wheat (both US and abroad) at these lower levels. Additionally, there is still uncertainty surrounding the impending expiration of the Black Sea Grain Initiative. Putin reportedly asked for an extension if Russia is let back into the SWIFT banking program.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. In the month of June, the September Chicago wheat contract posted a 163-cent range and has largely been a follower of the corn market which has been mostly driven by weather. While demand remains weak, production concerns in parts of the country remain, as does uncertainty surrounding the Black Sea region and the potential for major exporting countries’ inventory to hit 16-year lows. While Grain Market Insider will continue to monitor the downside for any violation of major support, following the recent sales recommendation it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Price volatility has risen in the last couple of weeks due to the changing weather forecasts and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market next year’s crop. War continues in the Black Sea region, major exporting countries’ stocks expected to fall to 16-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recently recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. This technical formation on the price chart is considered bearish and momentum may be adding to the bearish tone. Support below the market may be found between 650 – 610, while resistance above the market rests between 770 – 810.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Balancing both production and demand concerns, the September contract continues to trade within the 736 – 919 range established in May. The recent downturn in the market has established heavy resistance above the market between 890 – 920, with initial support coming in between 778 – 763 and key support near the May low of 736.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

- No action is currently recommended for the 2023 New Crop. Weather dominates the market right now, and though much of the growing season remains, Grain Market Insider suggested making a sale as prices closed below 822 to protect from further downside erosion due to a potential trend change. Seasonally, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to shock the market higher. Insider will consider making sales suggestions if prices improve through this growing season, while also continuing to watch the downside for any further violations of support.

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

Above: The September contract rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. With the market off those highs, it will need additional bullish news to be able to trade through them. Should the market continue to fall, support may be found between 770 and 730.

Other Charts / Weather