Grain Market Insider: August 9, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 481 | -4.75 |

| DEC ’23 | 494.25 | -4.5 |

| DEC ’24 | 514 | -1.5 |

| Soybeans | ||

| NOV ’23 | 1308.5 | 2.5 |

| JAN ’24 | 1318.5 | 2.75 |

| NOV ’24 | 1258.25 | 0.75 |

| Chicago Wheat | ||

| SEP ’23 | 635 | -21.25 |

| DEC ’23 | 661.75 | -19.75 |

| JUL ’24 | 709.5 | -14.25 |

| K.C. Wheat | ||

| SEP ’23 | 761.5 | -9 |

| DEC ’23 | 776 | -5.5 |

| JUL ’24 | 767.5 | -8.25 |

| Mpls Wheat | ||

| SEP ’23 | 819.75 | -11 |

| DEC ’23 | 835.5 | -10 |

| SEP ’24 | 827 | -3 |

| S&P 500 | ||

| SEP ’23 | 4515.5 | -3 |

| Crude Oil | ||

| OCT ’23 | 83.63 | 1.27 |

| Gold | ||

| OCT ’23 | 1930.5 | -10 |

Grain Market Highlights

- Spillover weakness from wheat, favorable weather forecasts, and consolidation ahead of Friday’s USDA report pressed the corn market lower.

- Choppy trade dominated the soybean market today as traders sought to cover open positions and take profits as prices begin to consolidate ahead of Friday’s August update from the USDA.

- Soybean meal and oil closed in opposite directions with meal retreating on long liquidation, while oil rallied on stronger palm and crude oil prices.

- Reports of Putin signing an order requiring payment for Russian ag products in rubles likely pressured the wheat markets to close in negative territory today, giving up much of this week’s gains.

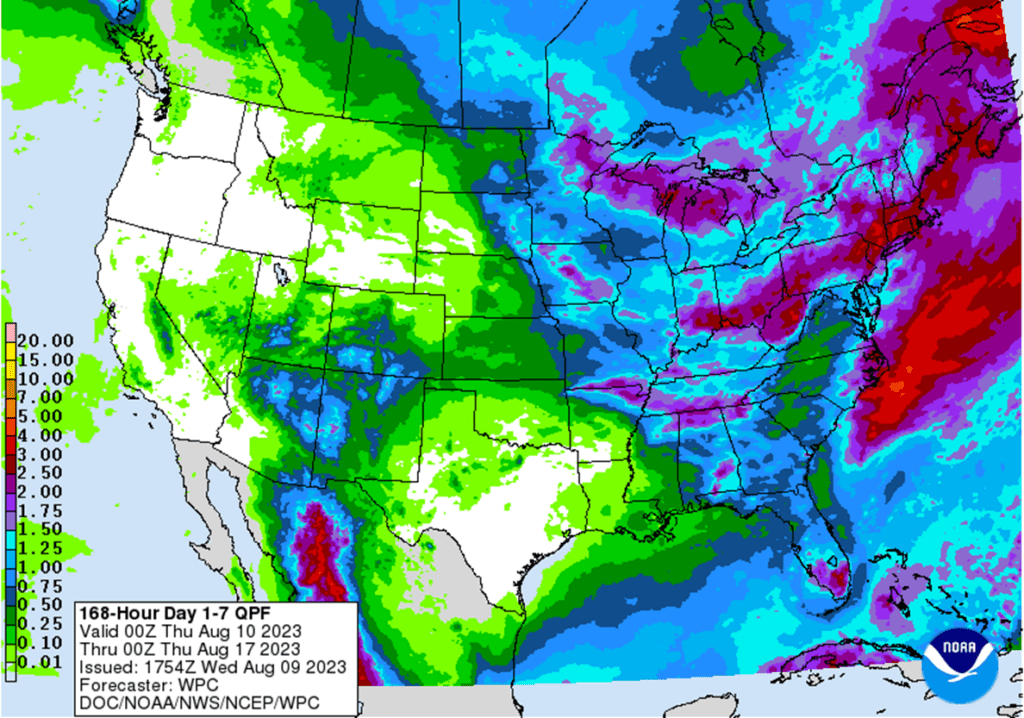

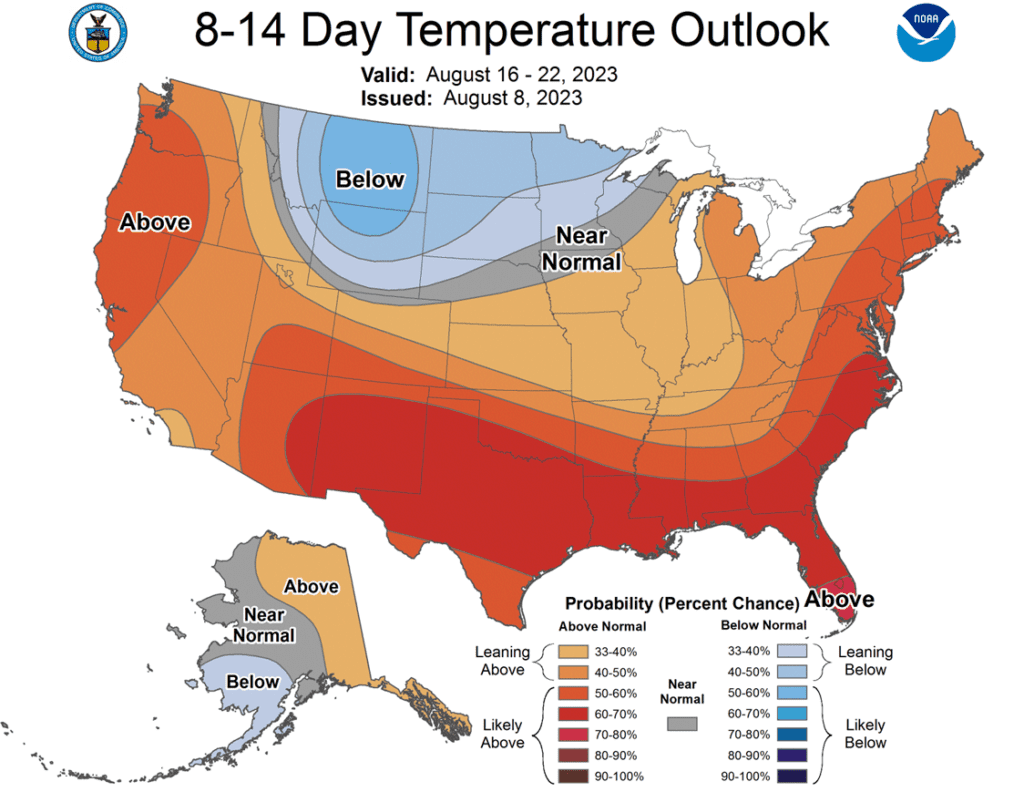

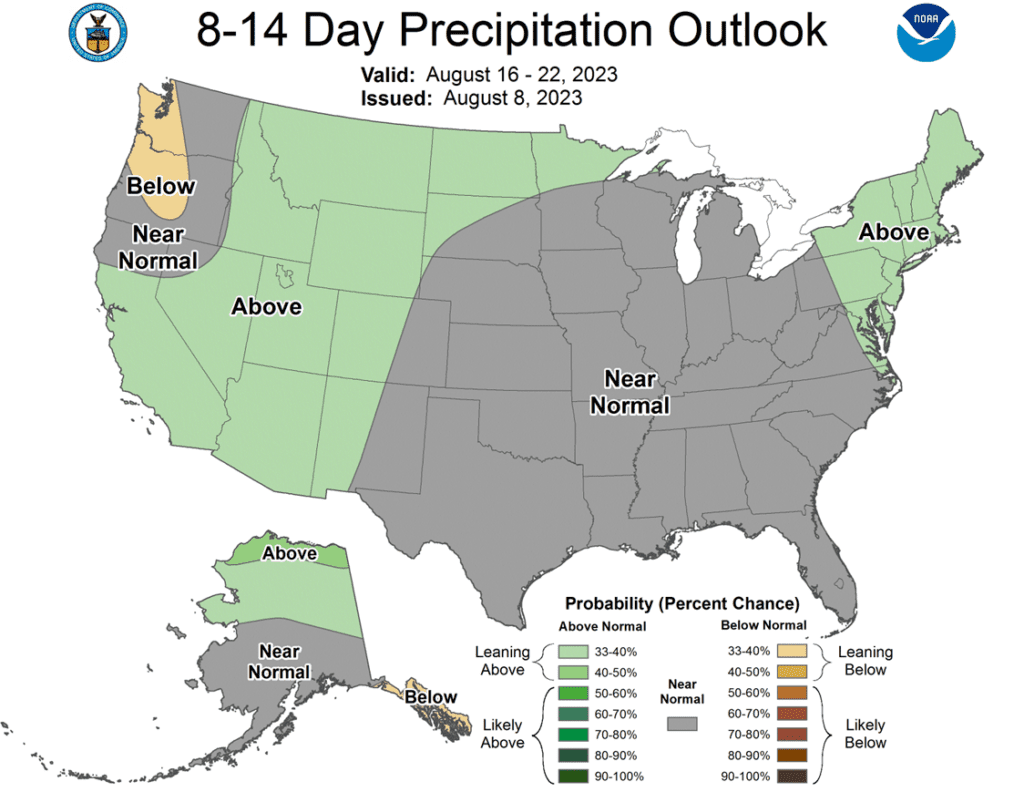

- To see the current US 7-day precipitation forecast and 8 – 14-day Temperature and Precipitation Outlooks courtesy of the Climate Prediction Center, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

Active

Exit Half DEC ’23 580 Puts ~ 87c

2024

No Action

2025

No Action

Corn Action Plan Summary

- For the 2023 corn crop, Grain Market Insider sees an active opportunity to sell half of the previously recommended DEC ‘23 580 puts. At the end of June, Insider recommended buying DEC ’23 580 puts for approximately 30 cents in premium, plus fees and commission. At the time, the US Drought Monitor was showing dryness across the Midwest and weather forecasts were calling for hot and dry conditions. Since then, forecasts have turned more favorable and DEC ’23 corn has dropped over 100 cents, with the recommended 580 puts gaining nearly 200% in value. The growing season isn’t over yet, and the Drought Monitor still shows dry conditions. Following the recent market drop and pick up in export sales, any further yield loss could rally prices. Insider recommends selling half of the previously recommended DEC ’23 580 puts to lock in gains in case prices rally back and holding the remainder, which will continue to protect any unsold bushels if prices erode further going into harvest.

- No action is currently recommended for 2024 corn. In 2012, the best pricing opportunities for Dec 2013 corn were during the 2012 summer runup. Despite the significant yield losses to the 2012 crop, and the fear of running out of corn, the Dec 2013 contract peaked in the summer of 2012, and by Jan 2 of 2013, the price was already down about 12% from the high. We continue to watch the calendar for 2024 corn as this 2023 summer volatility could provide some additional opportunities to get some good early sales on the books in the event of a 2013 type repeat. Insider recently recommended making a sale on your 2024 crop, and we’ll be watching for another opportunity to suggest adding to prior early sales levels between now and the beginning of September.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- Corn futures saw choppy trade before fading during the session as selling in the wheat market, non-threatening weather forecasts, and positioning before Friday’s USDA Crop Production report limited the market.

- Forecasts are staying cooler with a wetter bias for the majority of the Corn Belt into next week, which should help ear fill of the developing crop.

- The USDA will release weekly export sales totals for last week on Thursday morning. Demand is still a concern as expectations for new sales of old crop corn in the report range from 75,000-600,000 mt, and 200,000-600,000 mt for new crop. Last week’s corn export sales were within expectations, but overall, still disappointing.

- The corn market will likely stay choppy as the market prepares for the USDA Crop Production report on Friday. Analysts expect corn yield to drop to 175.6 bushel/acre, limiting some production. Overall carryout should remain heavy around 2.15-2.2 billion bushels.

- Weekly ethanol production was down 4.1% week-over-week. Total production was 1.021 million barrels/day. The amount of corn used for the week is estimated at 102.82 million bushels, staying on pace to reach the USDA target for the marketing year.

Above: Since mid-July, the market retraced about 62% of the prior down move, hit resistance around the 50-day moving average, and turned lower. The market is approaching oversold status on the stochastic indicator with key support near the September contract’s 474 low. If the market receives more bullish input and turns back higher, heavy resistance lies near 555 – 565.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No action is recommended for 2023 soybeans. The USDA injected a lot of volatility into this market beginning with a much lower-than-expected planted acreage estimate, followed by a much larger-than-expected 300mb carryout estimate in its July WASDE. While demand has been weak, we have a bona fide weather market during a crucial period for soybeans and there is little wiggle room for lost yield in this year’s crop. While a drier forecast can still maintain upside potential, plenty of time remains for rain to come and push prices lower, much like in 2012 when July was dry. Then the pattern changed in August, and decent rain fell in parts of the western Corn Belt and IL, sending Nov ’12 soybeans down 20%. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Soybeans ended the day slightly higher but slowly declined from the early morning highs. Soybean meal also began the day higher but ended lower, while soybean oil traded higher along with higher crude oil and palm oil.

- Day two of the DTN Yield Tour showed estimates of 60.2 bpa for Illinois, 58.8 for Indiana, and 58.7 for Ohio. If the yield estimate for Illinois holds, it would be a new record high. On Friday, the USDA will give their estimates for national yields.

- The export group, ANEC, has pegged Brazil’s August soybean exports at 8.8 mmt versus 5 mmt in August the previous year, proving that Brazil continues to dominate the export market. Despite that, China has made a solid number of purchases from the US over the past two weeks in an attempt to shore up their supplies.

- There is some concern about Chinese economic data after producer price data fell by 4.4%, a sign of deflation, but they have remained active buyers of agricultural products.

Above: The market posted a bullish reversal on 8/08 after trending lower since 7/27 and trading through 1350 support. Additionally, the fact that the market is showing signs of being oversold is supportive to prices. If prices continue to the upside, resistance can be found near 1400 and again around 1450. If not, initial support below the market may be found near 1328 with further support between 1318 – 1300.

Wheat

Market Notes: Wheat

- Reports that Putin signed a decree requiring payment for Russian ag exports to be made in rubles pressured the wheat complex lower today, along with consolidation ahead of Friday’s USDA report where the trade is anticipating a 23/24 carryout near 598 mb.

- Ukraine has said that if Russia continues to target Ukrainian ports and export routes, they would begin picking targets that would “prevent their waters from being blocked”. Although, it wasn’t specified when they might begin engaging with Russian targets.

- Ukraine’s 23/24 grain exports have totaled 2.76 mmt so far in the June/July season, of which 1.08 mmt has been wheat. Exports have been affected since Russia stepped up their attacks on export routes, with some reports indicating they are down 40%.

- According to the European Commission, EU SRW exports for the season starting July 1 have reached 2.92 mmt through August 6, which is down 16% from year ago levels that were 3.48 mmt.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. The wheat market has seen a great amount of volatility in recent weeks and has primarily been a follower of corn, which has been driven by weather. Although demand remains weak, the closure of the Black Sea corridor, and the continued supply uncertainty, which that brings to the market, still leaves many supply questions unanswered. While Grain Market Insider will continue to monitor the downside for any violation of major support following the recent sales recommendation, it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June, price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices continue to be volatile, plenty of time remains to market the 2024 crop. The war continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Since testing the June high on 7/25, the market has retreated and support near 620 has held. September wheat is oversold and appears to be consolidating at the lower end of the 622 – 777 range. If the market breaks out to the downside, psychological support could be found near 600 with key support near 573, while heavy resistance remains above the market around 777 – 808.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. As harvest winds down and more becomes known about this year’s crop with some reports of better-than-expected yields, questions remain about the world wheat supply. The war continues in the Black Sea region, Ukraine’s export capabilities remain uncertain, and dryness continues in key production areas of the world. With world supplies currently seen at 11-year lows, we continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- No action is currently recommended for the 2024 crop. Demand and supply concerns out of the Black Sea continue to dominate the market right now, and Insider suggested making a sale as prices closed below 817 to protect from further downside erosion due to a potential change in trend with cheap supplies continuing to flow from Russia and Ukraine hampering US export demand. While prices continue to be volatile, plenty of time remains to market the 2024 crop. The war continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, Grain Market Insider would need to see prices north of 850 before considering recommending any additional sales, while also keeping an eye on the market to see if any major support is broken.

- No Action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: September KC wheat has retreated following the key reversal on 7/25 and is poised to test the 735 – 745 support area, which coincides with this year’s lows. Additionally, the market is showing signs of being oversold, and is considered supportive if prices reverse higher. If prices do reverse to the upside, overhead resistance lies near 830.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature to price volatility this growing season with continued dryness concerns in not only the US, but also Canada and Australia. As we enter harvest season, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to move prices higher. Insider will consider making sales suggestions if prices improve, while also continuing to watch the downside for any further violations of support.

- No action is recommended for the 2024 crop. This year has been marked with volatility from adverse weather to geopolitical disruptions and has given us historically good prices to begin making early sales. While prices continue to be volatile, plenty of time remains to market the 2024 crop. The war continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, Grain Market Insider will continue to consider making sales recommendations if prices improve, while also keeping an eye on the downside should prices break support.

- No Action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the bearish reversal on 7/25, the market has retreated and is oversold, which could be supportive if prices reverse higher. For now, support below the market may be found near the psychological support level of 800, while resistance remains above the market near 950.

Other Charts / Weather