Grain Market Insider: August 24, 2023

All prices as of 1:45 pm Central Time

| Corn | ||

| SEP ’23 | 472.25 | -4 |

| DEC ’23 | 488.25 | -2.25 |

| DEC ’24 | 508.75 | 1 |

| Soybeans | ||

| NOV ’23 | 1371.75 | 11.25 |

| JAN ’24 | 1383.5 | 12.5 |

| NOV ’24 | 1303 | 8 |

| Chicago Wheat | ||

| SEP ’23 | 604 | -8.5 |

| DEC ’23 | 631.75 | -8 |

| JUL ’24 | 681.25 | -6 |

| K.C. Wheat | ||

| SEP ’23 | 753 | -2 |

| DEC ’23 | 762.5 | -1.25 |

| JUL ’24 | 752 | -0.5 |

| Mpls Wheat | ||

| SEP ’23 | 774.75 | -9.75 |

| DEC ’23 | 799.25 | -4 |

| SEP ’24 | 815.25 | 1.75 |

| Su0026P 500 | ||

| SEP ’23 | 4408.5 | -38.5 |

| Crude Oil | ||

| OCT ’23 | 79.07 | 0.18 |

| Gold | ||

| OCT ’23 | 1926.7 | -3.2 |

Grain Market Highlights

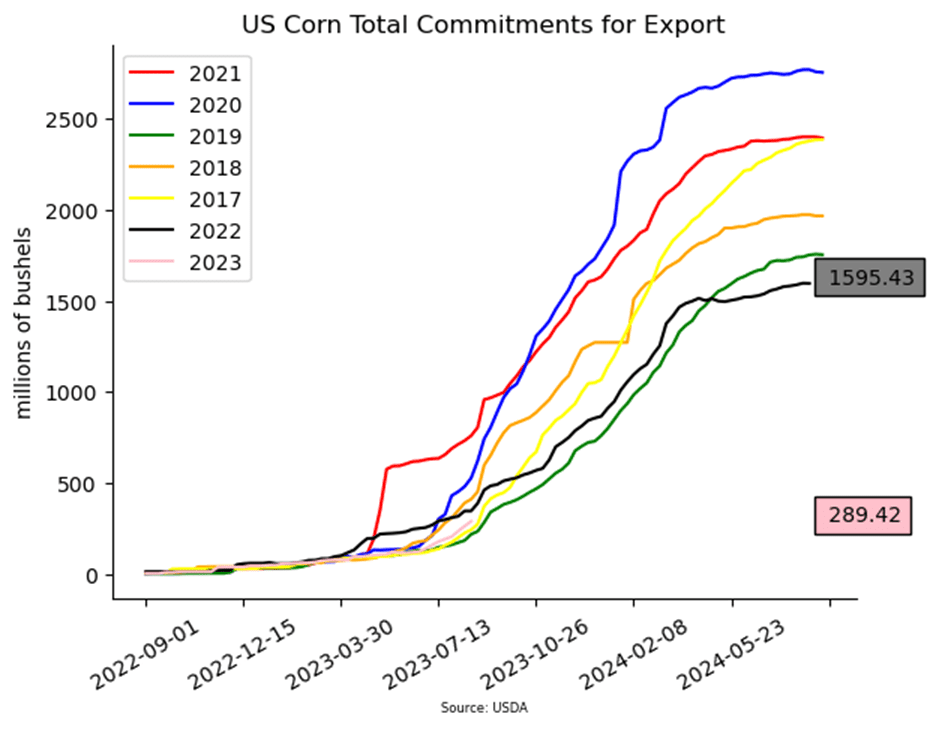

- Weak export sales, in addition to reports of decent yields with plenty of variability from Pro Farmer’s crop tour, had the corn market searching for value as it settled the day mixed after choppy trade, with nearby contracts weaker, while deferred contracts closed higher.

- The need for additional rain and a strong soybean meal market, with $11.30 gains in the December contract, outweighed the negativity from soybean oil and helped rally soybeans back toward this week’s highs.

- The rally in meal may have come from a rising Brazilian export basis and talk that they might slow their crush pace, which could swing demand to the U.S., increasing meal exports.

- Despite decent export sales that came in above expectations and 13% higher from the previous week, the wheat market continued to consolidate as the entire complex closed weaker on the day, with the exception of Sept. ’24 Minneapolis, which closed higher.

- The U.S. dollar rebounded today to challenge yesterday’s highs and the recent strength, while adding resistance to commodity markets could stem from flight to quality buying where, traders view the current U.S. economy more favorably than its EU counterparts.

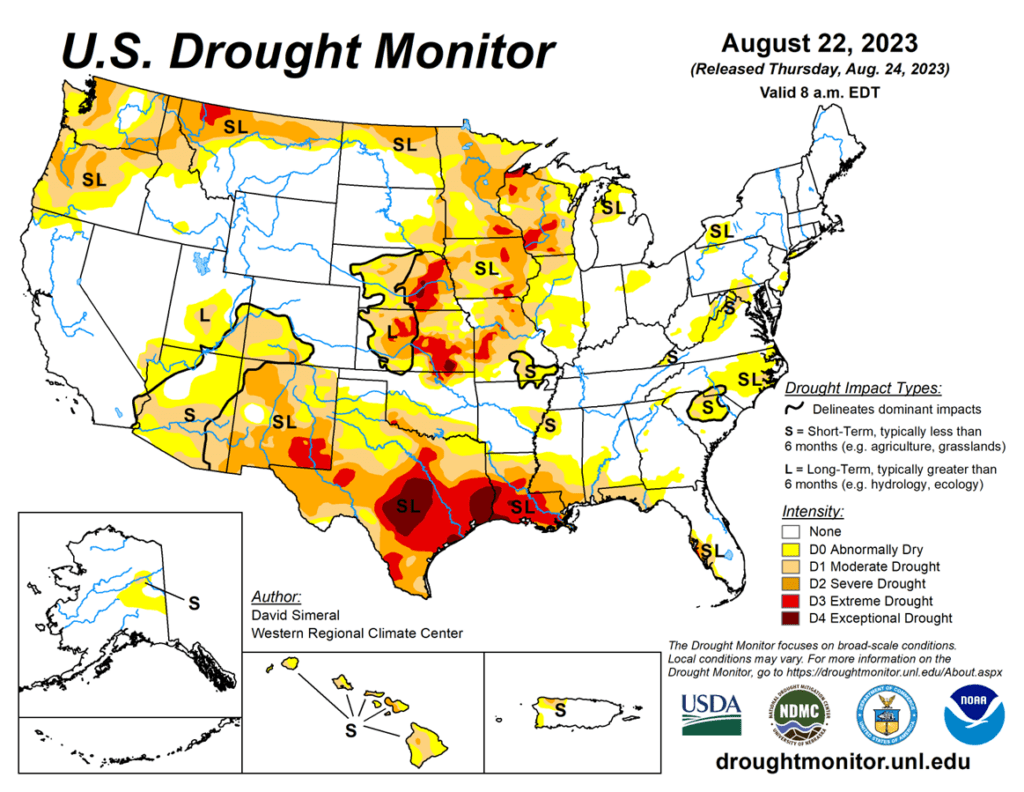

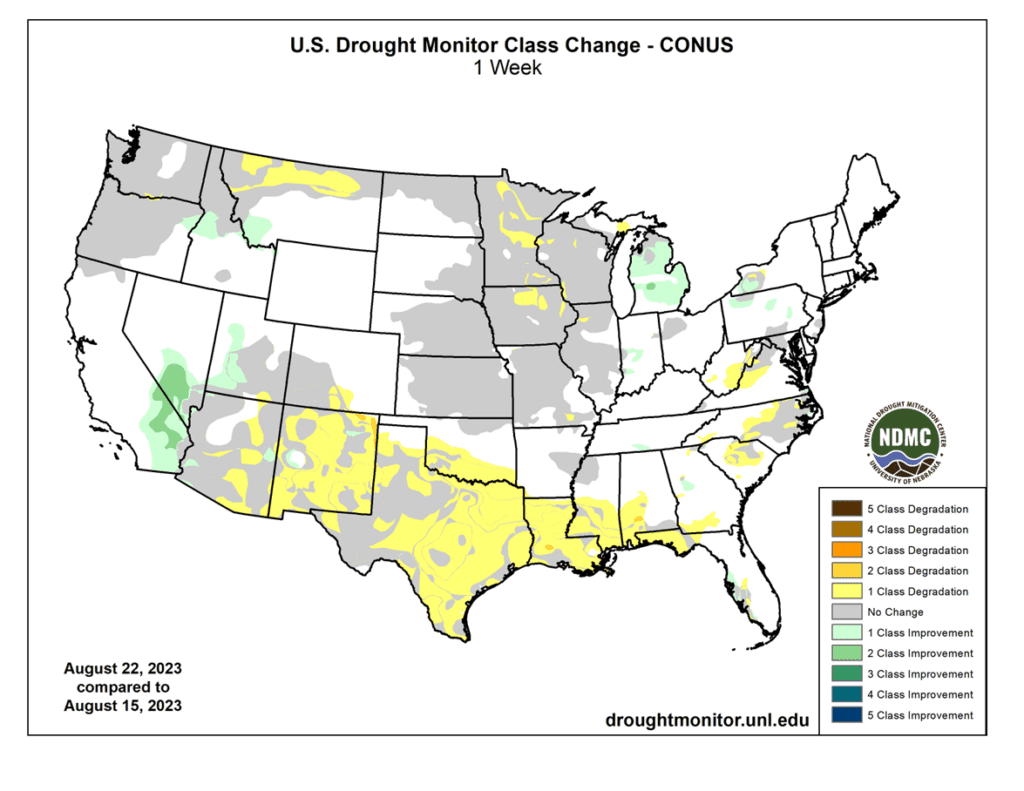

- To see the current U.S. Drought Monitor and a map showing the Drought Monitor class changes, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No action is recommended for the 2023 corn crop. This year’s growing season has been marked by dry conditions and changing weather forecasts, which have swung prices nearly 150 cents from high to low. Though dry conditions remain, with a great amount of variability in crop conditions from region to region, it may not be until after harvest before we know the full effect this growing season had on yields. Just as Insider recently recommended selling half of the previously recommended DEC 580 puts to lock in gains in case the market turns higher, Insider will continue to monitor market conditions and may consider recommending selling the remaining DEC 580 puts if conditions warrant it. While many unknowns could still shock the market higher, seasonality and current trends suggest we may not see a shift to higher prices until after harvest.

- No action is currently recommended for 2024 corn. In 2012, the best pricing opportunities for Dec 2013 corn were during the 2012 summer runup. Despite the significant yield losses to the 2012 crop, and the fear of running out of corn, the Dec 2013 contract peaked in the summer of 2012, and by Jan 2 of 2013, the price was already down about 12% from the high. We continue to watch the calendar for 2024 corn as this 2023 summer volatility could provide some additional opportunities to get some good early sales on the books in the event of a 2013 type repeat. Insider recently recommended making a sale on your 2024 crop, and we’ll be watching for another opportunity to suggest adding to prior early sales levels between now and the beginning of September.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Corn

- Corn futures saw choppy and pressured trade before settling with small losses on the day. Dec corn slipped 2 ¼ cents, as the Pro Farmer tour continues to find solid yields, but a lot of variability. Soft export sales report and expiration of September options on Friday limit the market’s upside.

- Demand will stay the focus of the market. The USDA released weekly export sales numbers for last week on Thursday morning. Old crop sales saw net cancellations of 22,500 MT, but added 673,500 MT to the new crop book. The current marketing year ends on Aug 31.

- September corn options expire on Friday, which could lead to an increase in volatility as prices have a tendency to move to large areas of open interest. As of Thursday morning, there were 17,660 open puts at the Sept. 480 strike price.

- The Pro Farmer crop tour continues to find variable, but moderately good yields, which may confirm the possible corn supply available this harvest. Yesterday, Pro Farmer forecasted corn yield in Illinois of 193.72 bu/acre, above last year’s levels. The tour moved into Iowa and Minnesota for its last day of sampling on Thursday, with a final yield projection to be released on Friday afternoon.

- Longer range weather forecasts are pushing the heat dome back to the South, but the Corn Belt will have limited rainfall until next week. The forecasted conditions may push maturity and limit any chances for the crop to finish out strong.

Above: After trading mostly sideways since the end of July, December corn posted a bearish reversal on 8/21 after testing the 495 – 516 resistance level. The reversal is a bearish development, likely needing bullish input to turn prices back higher. Should that happen, resistance above the market remains between 495 – 516. If not and prices turn lower, support may be found near 460 and again near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

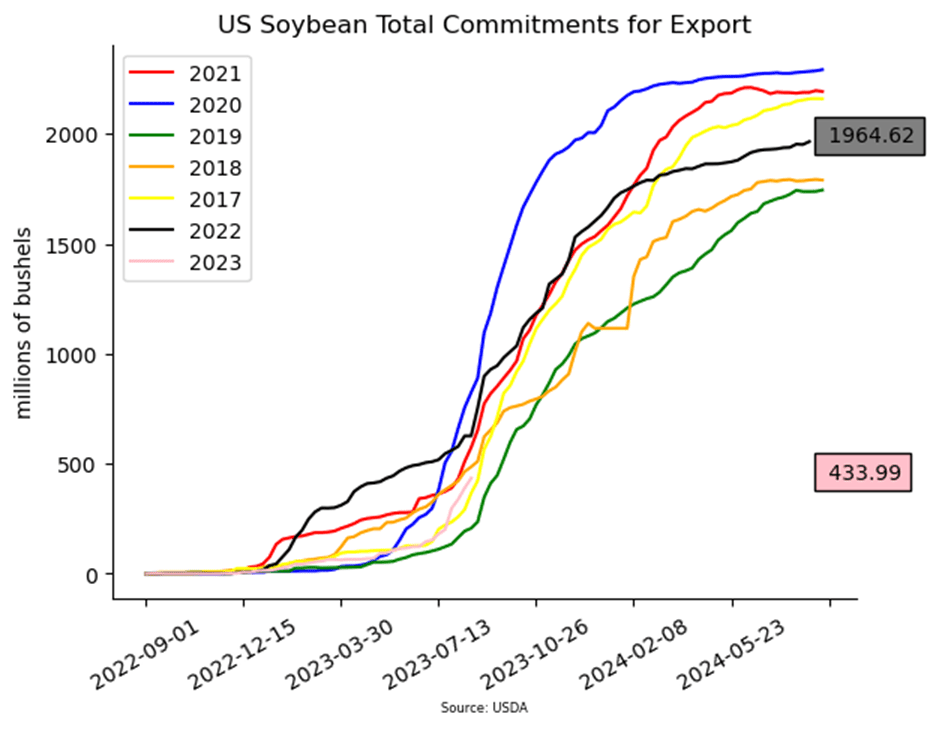

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from the changing weather forecasts, crop conditions, and export sales. We ended the month of July experiencing hot conditions with little rainfall and weak export sales. Since then, conditions have become more favorable, and export sales have picked up. While much of the crop remains in drought conditions, which can maintain upside potential, timely rains may come and push prices lower. Much like in 2012, when July was dry, and the pattern changed in August, when decent rain fell in parts of the western Corn Belt and IL, sending Nov ’12 soybeans down 20%. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Market Notes: Soybeans

- Soybeans ended the day higher for the second day, along with soybean meal, but soybean oil was lower. Demand for soybean meal has been firm with Brazilian soymeal basis up $22 per ton this week, and an export sale of 100,000 mt of soybean cake was reported to unknown destinations.

- Temperatures today hit a range between 98 and 106 degrees in Nebraska, Missouri, Iowa, and Illinois at a critical time for the soy crop, but temperatures are expected to drop after today. Although the heat is expected to subside, another two weeks of dry conditions are also expected.

- The Pro Farmer tour finished its rounds of Illinois yesterday, and found an average of soybean pod counts in a 3×3 area at 1,270.61, which is above a year ago and the 3-year average. The tour is in Iowa today, and results can be expected by tomorrow, but early corn yields were seen struggling today.

- China is conducting trials on GMO soybeans and corn, as well as yields, were up to 11.6% higher in those trials. China has not yet approved commercial planting of GMO grains, but may change that stance as they try to become as independent as possible.

Above: Since the end of July, the soybean market has turned lower, and attempts to rally have been met with resistance between 1381 and 1401. If the market breaks through to the upside, it may find further resistance near the 200-day moving average. If prices break to the downside, support below the market may be found between 1318 – 1300.

Wheat

Market Notes: Wheat

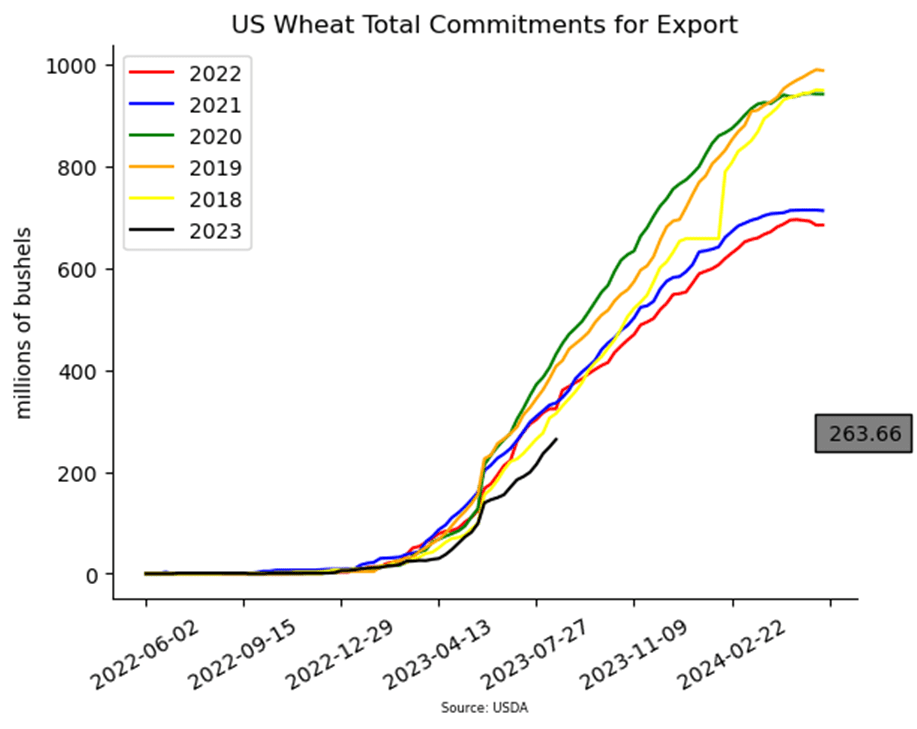

- Today, the USDA released export sales for last week and reported an increase in wheat sales totaling 14.9 mb for 23/24. Shipments last week totaling 12.7 mb were below the 13.9 mb pace needed to reach the 700 mb USDA export goal.

- The US dollar rebounded today, keeping pressure on wheat. Russian exports also added pressure to the market. While they set a $270 per ton floor on wheat exports, it only applies to public tenders, whereas, private tenders are reportedly cheaper and still beating out many world origins.

- While Argentina continues to be too dry, the Rosario Stock Exchange said that rains should pick up in October with a milder El Nino, and should offer some relief as the southern hemisphere heads into summer.

- France is the largest wheat producer and exporter in the EU. According to Agritel, French wheat exports are projected to increase to 17 mmt in 23/24, as compared to 16.4 mmt in the previous season. They did leave the French wheat harvest unchanged at 34.8 mmt.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 crop. Since the end of May, the wheat market has been largely rangebound, influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the rearview mirror, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward the 650 level before considering any additional sales.

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices continue to be volatile, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, the world stock to use ratio is the lowest in 8 years, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The Chicago wheat market appears to be consolidating and is recovering from being oversold. Initial support below the market resides between 596 and 573. Above the market, resistance could be found between 664 and 684.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

Active

Enter(Buy) JUL ’24 KC 660 Puts ~ 30c

2025

No Action

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. As more becomes known about this year’s crop with some reports of better than expected yields, questions remain about the world wheat supply. War continues in the Black Sea region, Ukraine’s export capabilities remain uncertain, and dryness continues in key production areas of the world. With a world stock to use ratio at its lowest level in 8 years, we continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales. At the same time, we continue to watch the bottom end of the range that prices have traded in since late 2022. A close below the bottom end would reduce the probability of getting to 950 – 1000 and would increase the risk of prices falling into the 600 – 650 range.

- Grain Market Insider sees an active opportunity to buy July ’24 660 K.C. wheat puts on a portion of your 2024 HRW wheat crop for approximately 30 cents plus commission and fees. While weather has been a dominant feature of the market this year with dry growing conditions and harvest delays, slow export demand and cheap Russian exports remain major headwinds to prices. The market has turned lower in recent weeks and July K.C. Wheat has traded through a major support area around 738. Trading below 738 support signals that the major trend may be turning down and poses the risk that prices could erode further in the weeks ahead, possibly to the next level of support, the September ’21 low of 678. If the 678 level were to fail, next support could be the 560 – 573 level. Buying July ’24 660 K.C. Wheat puts on a portion of your HRW wheat production should help protect future sales from further downside erosion, while still allowing for upside appreciation should the market turn higher.

- No Action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The K.C. wheat market continues its sideways trend between 733 – 780, with the low end of the range acting as initial support, while the upper end of the range acts as initial resistance. If prices break out to the upside, psychological resistance sits around the 800 area. While below the market, the next area of major support is near the September ’21 low of 670.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

Active

Enter(Buy) JUL ’24 KC 660 Puts ~ 30c

2025

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature to price volatility this growing season, with continued dryness concerns in not only the U.S., but also Canada and Australia. While there typically isn’t a strong likelihood of higher prices until after harvest is complete, both weather and geopolitical events can change suddenly to move prices higher. Insider will consider making sales suggestions if prices improve, while also continuing to watch the downside for any further violations of support.

- Grain Market Insider sees an active opportunity to buy July ‘24 660 K.C. wheat puts on a portion of your 2024 Spring wheat crop for approximately 30 cents plus commission and fees. While weather has been a dominant feature of the market this year with a wet spring, late planting, and growing conditions that have been less than ideal, slow export demand and cheap Russian exports remain major headwinds to prices. The market has turned lower in recent weeks and July K.C. Wheat has traded through a major support area around 738. Trading below 738 support signals that the major trend may be turning down and poses the risk that prices could erode further in the weeks ahead, possibly to the next level of support, the September ’21 low of 678. If the 678 level were to fail, next support could be the 560 – 573 level. The K.C. wheat market is highly correlated to the Minneapolis wheat market and much more liquid, which makes it a better choice when employing options strategies for Spring Wheat. Buying July ’24 660 K.C. Wheat puts on a portion of your spring wheat production should help protect future sales from further downside erosion, while still allowing for upside appreciation should the market turn higher.

- No Action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Since 7/25, the market has been in a down trend and is oversold. Currently, key support below the market lies near the May low of 769, with the next support level near the June ’21 low of 730. Above the market, nearby resistance could be found near 820 – 837.

Other Charts / Weather