Grain Market Insider: April 25, 2023

| Corn | ||

| MAY ’23 | 646.5 | -4.75 |

| JUL ’23 | 607.75 | 0.25 |

| DEC ’23 | 548.25 | 0.75 |

| Soybeans | ||

| MAY ’23 | 1445.25 | -20 |

| JUL ’23 | 1417.5 | -18.5 |

| NOV ’23 | 1266 | -10.75 |

| Chicago Wheat | ||

| MAY ’23 | 638.75 | -4.75 |

| JUL ’23 | 653 | -4 |

| JUL ’24 | 690.75 | -3 |

| K.C. Wheat | ||

| MAY ’23 | 818.25 | -14.75 |

| JUL ’23 | 803 | -14.5 |

| JUL ’24 | 771 | -6.25 |

| Mpls Wheat | ||

| MAY ’23 | 837.75 | -5 |

| JUL ’23 | 836.5 | -4.25 |

| SEP ’24 | 789 | 16.75 |

| S&P 500 | ||

| JUN ’23 | 4101.5 | -58 |

| Crude Oil | ||

| JUN ’23 | 77.27 | -1.49 |

| Gold | ||

| JUN ’23 | 2008.8 | 9 |

Grain Market Highlights

- Corn traded lower into support near 600 for the July contract on slow demand but reversed off the lows to close mixed with only the May contract closing lower on the day.

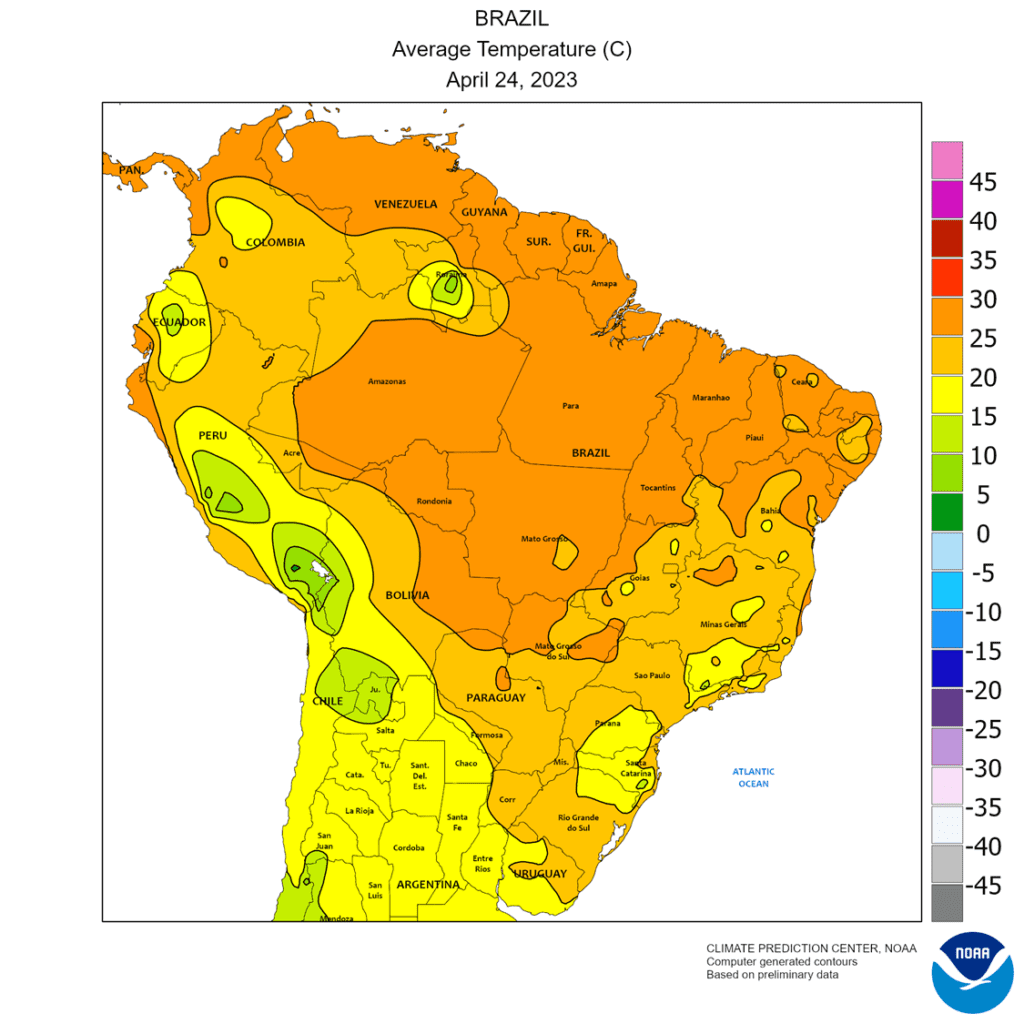

- Soybeans closed in the red as funds liquidate long positions on demand concerns with Brazilian export prices well below US offers.

- Soybean meal and oil also continued to slide lower on slowing meal demand, and weaker crude and Malaysian palm oil.

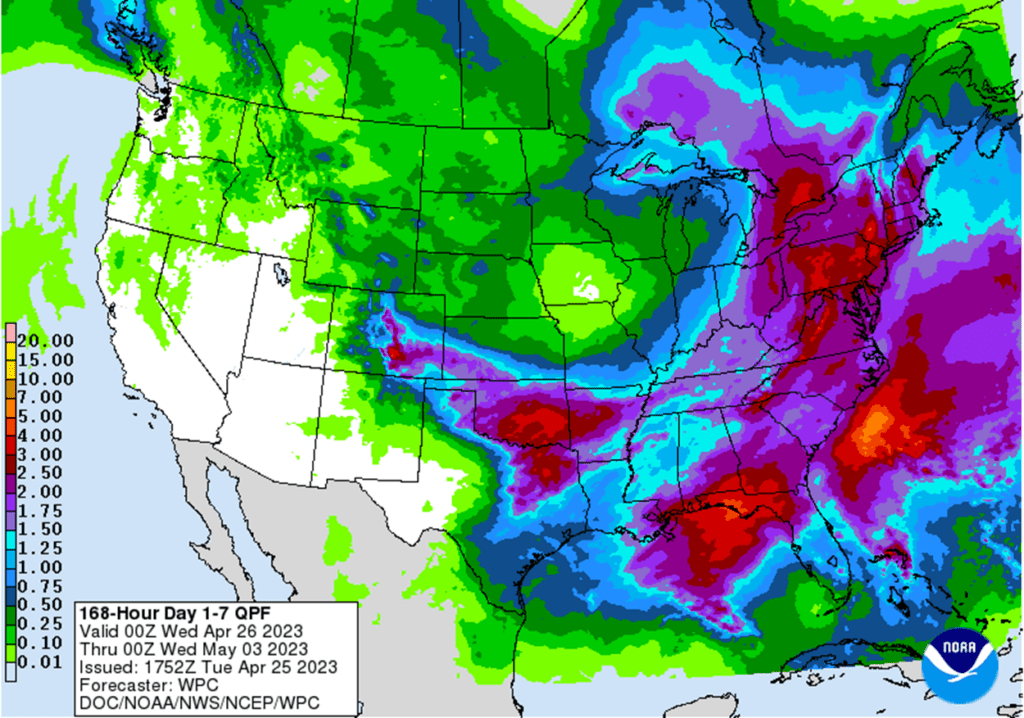

- The forecast for rain in the Southern Plains continued to weigh on the wheat markets today with KC contracts leading the way.

- Adding pressure to the grain markets, the US Dollar traded higher, overtaking yesterday’s losses on renewed concerns in the banking system.

Note – For the best viewing experience, some Grain Market Insider content may be best viewed in horizontal mode.

Corn

Action Plan: Corn

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. China’s recent purchases have slowed, weighing on prices. Our intent is to maximize any remaining opportunities the market may present as we begin to move towards the latter stages of the marketing year when end-users vie for tightly held supplies and weather concerns can build premium.

- Be patient to take further action for New Crop. We are moving into a time of year when we may be looking for option-buying opportunities and given market factors that could move the price of corn above $7 or below $5, owning both calls and puts could be warranted for a period of time.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

Market Notes: Corn

- The May contract was likely pressured due to traders rolling long positions to the July contract to avoid the delivery process which begins with First Notice Day on Friday.

- The lack of export activity reflects good weather for Brazilian corn production and their cheaper export values versus the US.

- Most deferred contracts posted a small hook reversal meaning prices closed higher after trading below yesterday’s low price. This might be a signal that selling interest is beginning to wane.

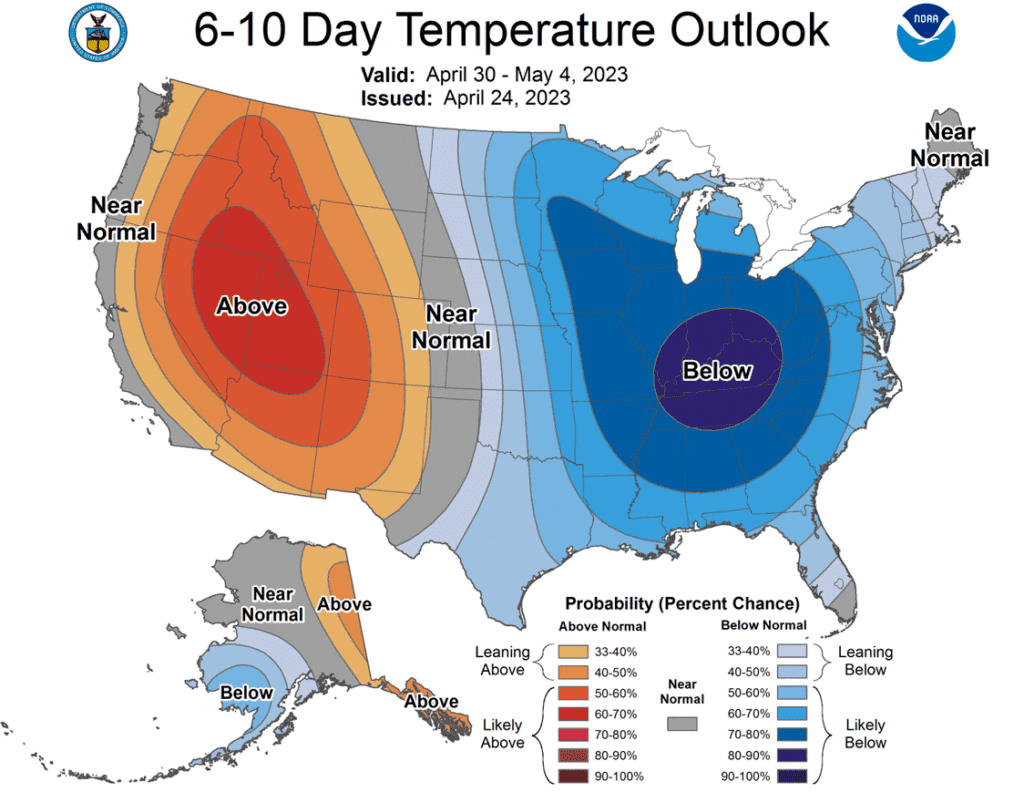

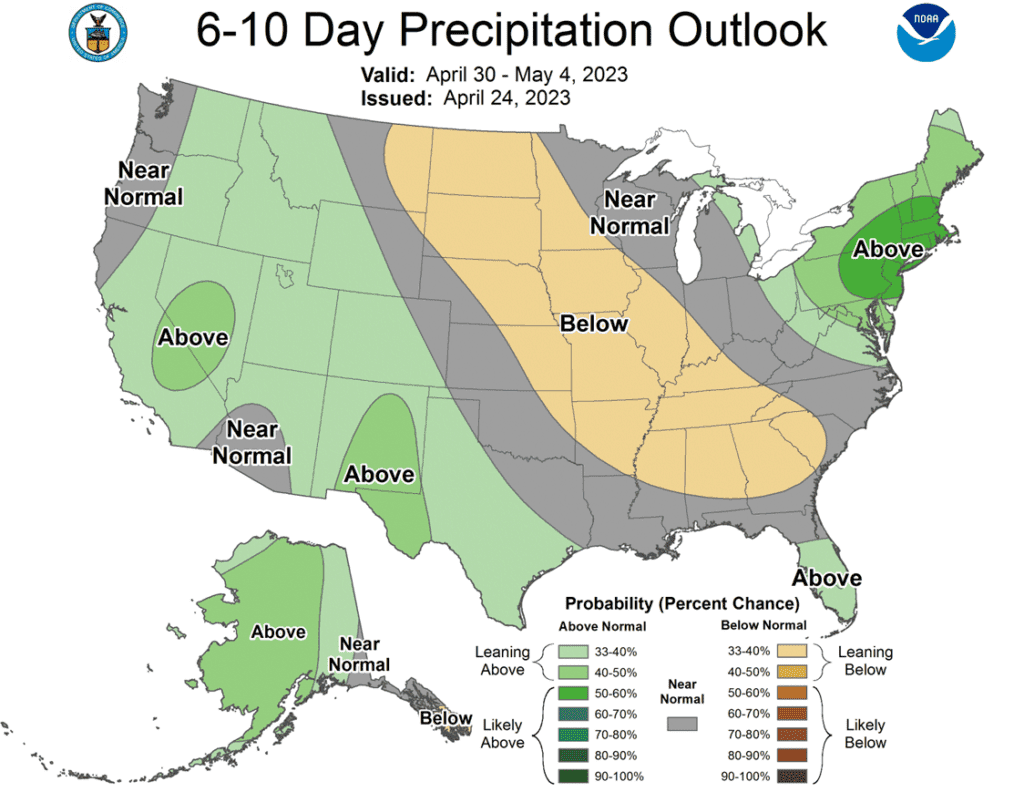

- The forecast looks drier but still below normal temperatures for most of the Midwest implying many will not get started until the first week of May, or later.

- The USDA’s planting progress report from Monday indicated 14% of the crop was planted, ahead of the 5-year average of 11%. Illinois is 18% complete versus the 5-year average of 11%. Despite less-than-ideal weather in the north, planting progress, so far, is slightly ahead of schedule.

While the near-term trend is down, and the market is oversold. The firm close off the 601 low could provide additional support if buyers enter the market and take profits. Resistance now lies near the recent high of 647-1/2, with further resistance between 660 and 670. Support below the market for the July contract rests between 607 and 600, and then again between 568 and 562.

Soybeans

Action Plan: Soybeans

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Soybeans Action Plan Summary

- We recommend holding current sales levels for Old Crop. We are beginning to push into the May-June seasonal window of opportunity, where prices could bounce as processors begin to push to keep supplies flowing.

- We recommend not adding to current sales levels for the new 2023 crop. Our research indicates there is about a 74% likelihood of improved prices moving into the June time frame as weather premium is built into the market.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

Market Notes: Soybeans

- Soybeans closed lower for the fifth consecutive day and were under pressure from both soybean meal and oil, but bean oil posted the biggest losses as crude fell over 1.50 a barrel.

- The US Dollar moved higher today putting pressure on most commodities including the soy complex, but the downward momentum is also coming from major selling of cash beans out of Brazil at relatively much cheaper prices.

- Brazil’s harvest is now over 95% complete with yields exceeding original estimates, and storage is becoming an issue there prompting many producers to unload on cash sales which has weakened prices and basis.

- US soybean planting is 9% complete and ahead of the 5-year average of 4% with Illinois at 15%, Iowa at only 5%, Louisiana at 41%, and Mississippi at 34% complete.

The market has given back most of the gains from the rally off the March lows. The near-term trend is down, and key support lies near 1405 with further support near 1350. Should support hold and buyers enter the market, resistance may be found between 1460 and 1501.

Wheat

Market Notes: Wheat

- Though all three wheat classes posted losses, they all finished roughly 9-10 cents above their daily lows.

- The forecast for rain in Kansas and Oklahoma offered some weakness, with general coverage of up to 1.5 inches of rain expected, while some areas could see as much as 2 inches.

- On the Crop Progress report, the USDA rated winter wheat 26% good to excellent, down 1% from last week. Additionally, they said that only 5% of the spring wheat crop has been planted versus 12% on average.

- The next renewal of the Black Sea grain deal is in a few short weeks, but there is still uncertainty about whether Russia will renew or not.

- According to APK Inform, Ukraine’s grain production could fall to only 45.6 mmt in 23/24, versus 86 mmt prior to the war.

- The higher US Dollar Index today offered no help to the wheat market. As of this writing, it is up about 0.52 at 101.87.

Action Plan: Chicago Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Chicago Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. We continue to look for any remaining opportunities the market may present as the marketing year begins winding down.

- We recommend not taking any action on the 2023 crop at this time. Corn and K.C. wheat are near historic premiums to Chicago wheat, which could lend support to the Chicago contracts if HRW production concerns persist, or any develop for corn. There is also a 53% likelihood of better prices in the next 60 days according to our research.

- No action is recommended at this time for the 2024 crop. We are looking for stronger markets to present themselves as we move further into the marketing year.

The market broke below the March low of 654 and is oversold. The reversal off the 642-1/2 low could add further support if buyers come into the market to cover short positions and take profits, with initial resistance near 668 and again between 718 and 724. While initial support may be found near 642-1/2 and again near 610.

Action Plan: KC Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

KC Wheat Action Plan Summary

- We continue to look for any remaining opportunities the market may present as the marketing year begins winding down for Old Crop. No action is recommended at this time for the 2022 Old Crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and concerns continue with the dry growing conditions. Additionally, our research shows there is a 53% likelihood of better prices in the next 30 days.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

The July contract continues to be under the bearish influence of the key reversal left on 4/03. Support may be found near 791 and again near 772. While initial resistance lies near 835 and then near 886.

Action Plan: Mpls Wheat

Calls

2022

No Action

2023

No Action

2024

No Action

Cash

2022

No Action

2023

No Action

2024

No Action

Puts

2022

No Action

2023

No Action

2024

No Action

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. We look for better pricing opportunities for the 2022 crop with potential planting concerns and a seasonal tendency for better prices as we move through springtime.

- No action is recommended on the 2023 crop at this time. The snowy and cold winter has given rise to wet conditions and planting concerns which may present good selling opportunities in the coming weeks.

- We continue to be patient to market any of the 2024 crop. Due to the lack of liquidity for the 2024 crop, there may not be any recommendations until late spring or early summer. This is the time for patience, not action.

The July contract continues to be under the bearish influence of the reversal left on 4/03. Support may be found between 845 and 825. While resistance could be found between 895 and 913.

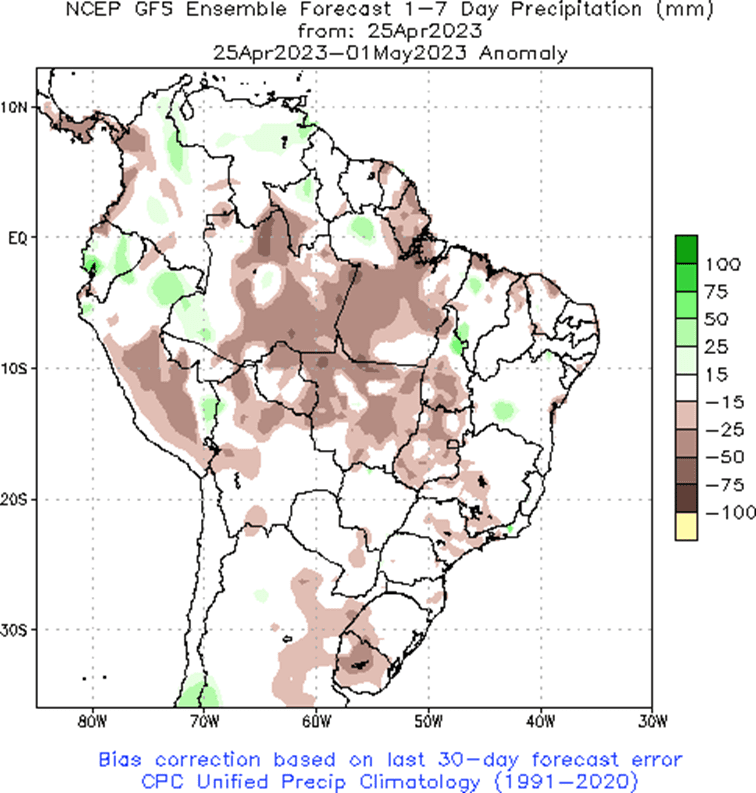

Other Charts / Weather