8-06 Opening Update: Muted Overnight Session as Soybeans Slightly Higher, Corn Lower, Wheat Flat

All prices as of 6:30 am Central Time

|

Corn |

||

| SEP ’25 | 380.5 | -1 |

| DEC ’25 | 401.5 | -0.5 |

| DEC ’26 | 443.5 | -1.5 |

|

Soybeans |

||

| NOV ’25 | 994.25 | 3.5 |

| JAN ’26 | 1013 | 3.75 |

| NOV ’26 | 1050.25 | 3 |

|

Chicago Wheat |

||

| SEP ’25 | 508 | -0.25 |

| DEC ’25 | 528.75 | 0.25 |

| JUL ’26 | 569.25 | 0.5 |

|

K.C. Wheat |

||

| SEP ’25 | 504.75 | 0.25 |

| DEC ’25 | 525.5 | 0.25 |

| JUL ’26 | 568.25 | 1 |

|

Mpls Wheat |

||

| SEP ’25 | 5.7125 | 0.01 |

| DEC ’25 | 5.9375 | 0.0125 |

| SEP ’26 | 6.46 | 0 |

|

S&P 500 |

||

| SEP ’25 | 6341.5 | 16.25 |

|

Crude Oil |

||

| OCT ’25 | 65.23 | 1.03 |

|

Gold |

||

| OCT ’25 | 3389.5 | -18 |

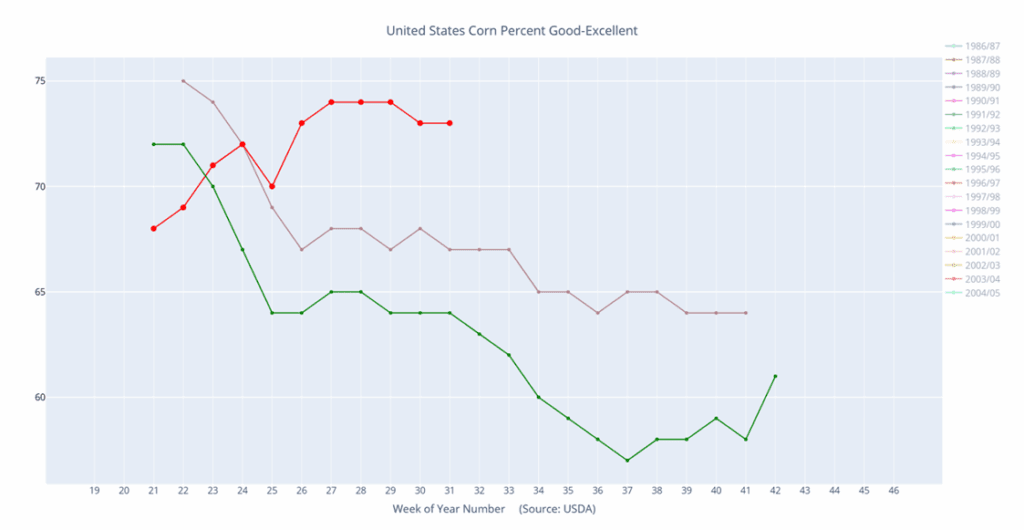

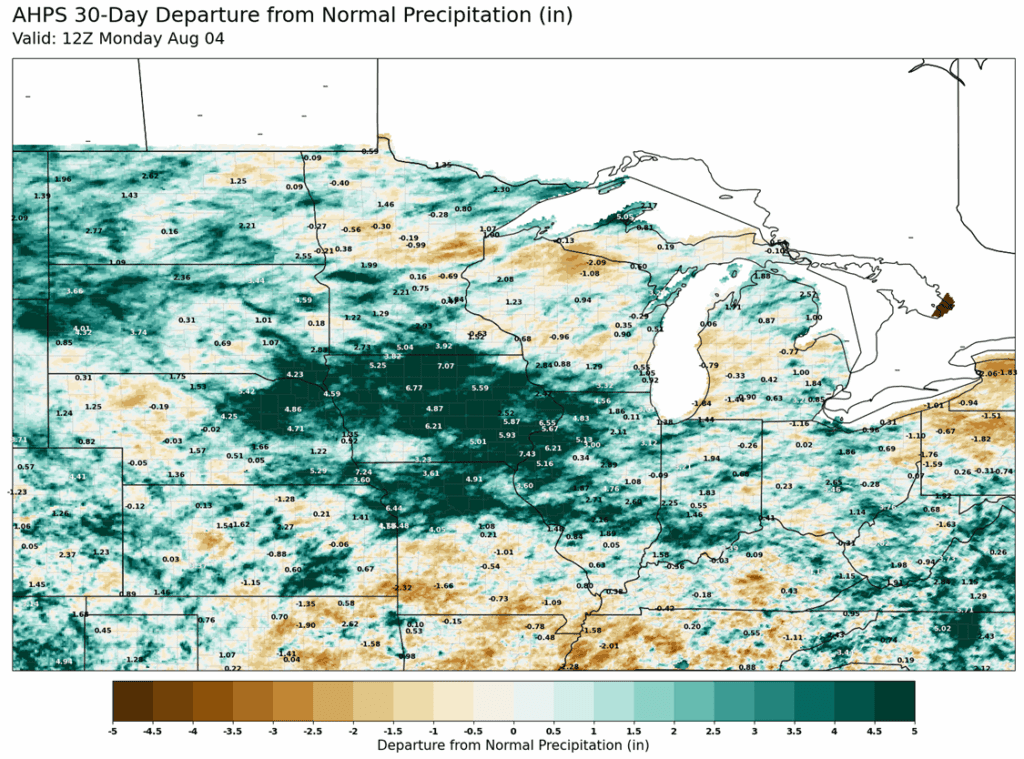

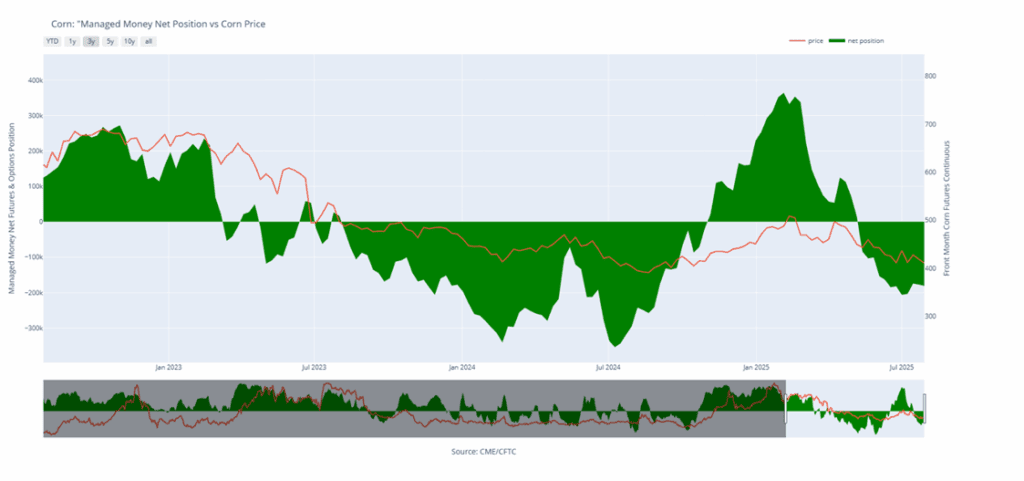

- Dalian, Brazil, and Matif corn futures all lower on expectations of higher supply.

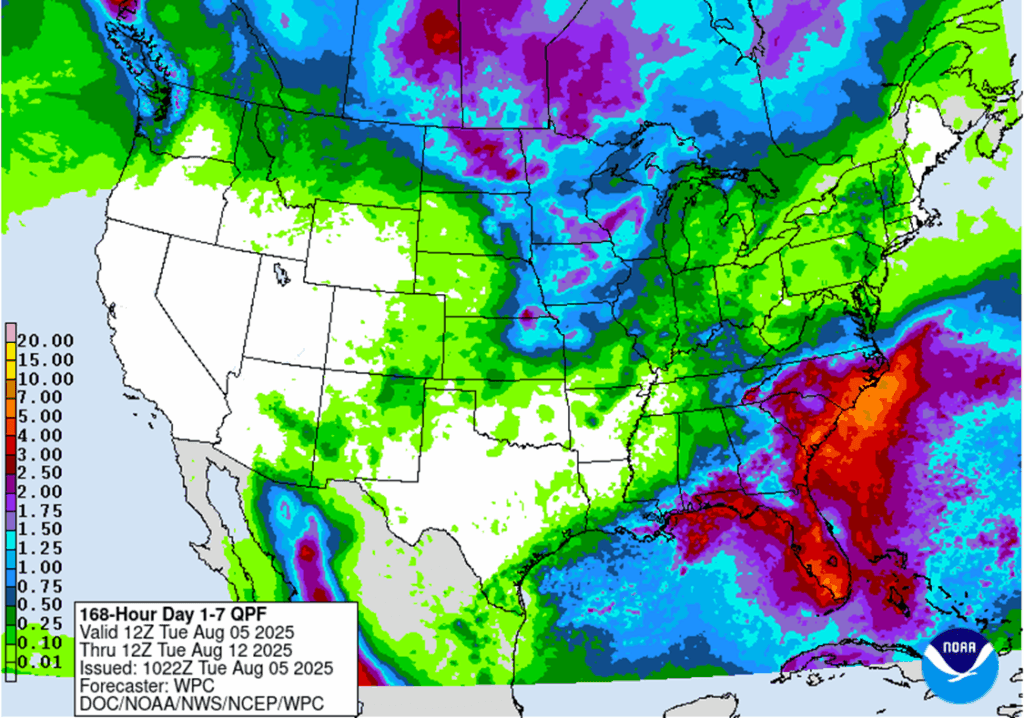

- US domestic basis softens amid potential farmer selling; the Sep-Dec spread at -21 points to ample domestic supply.

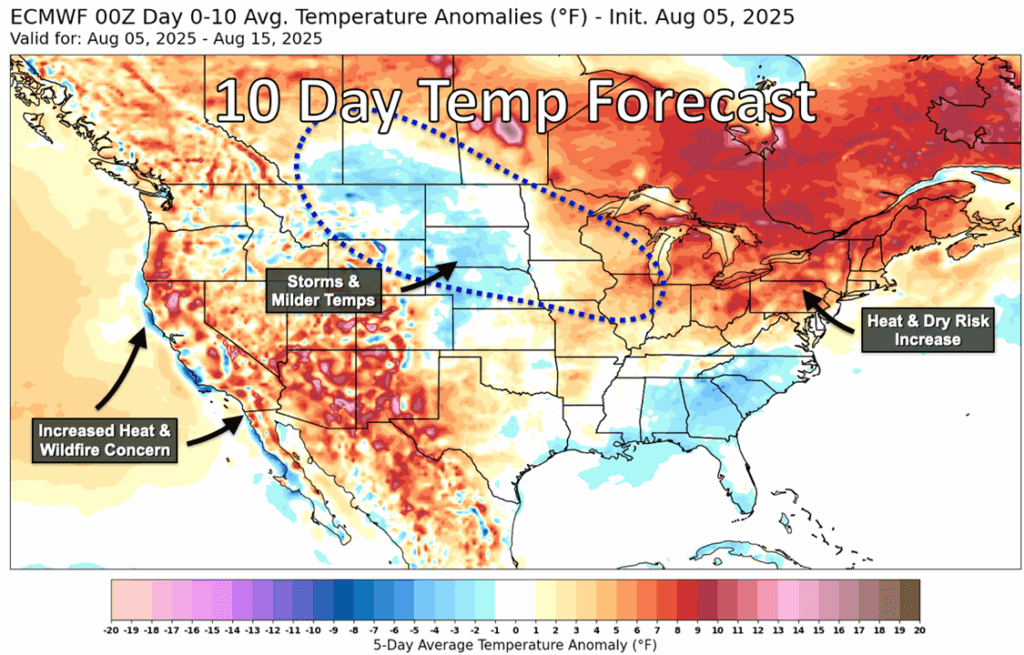

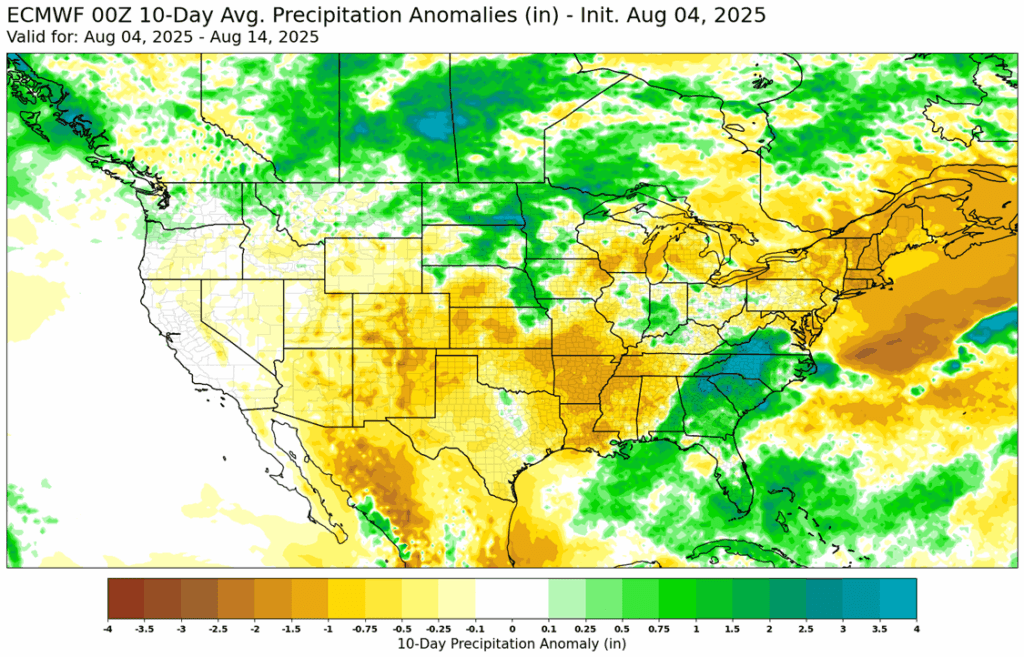

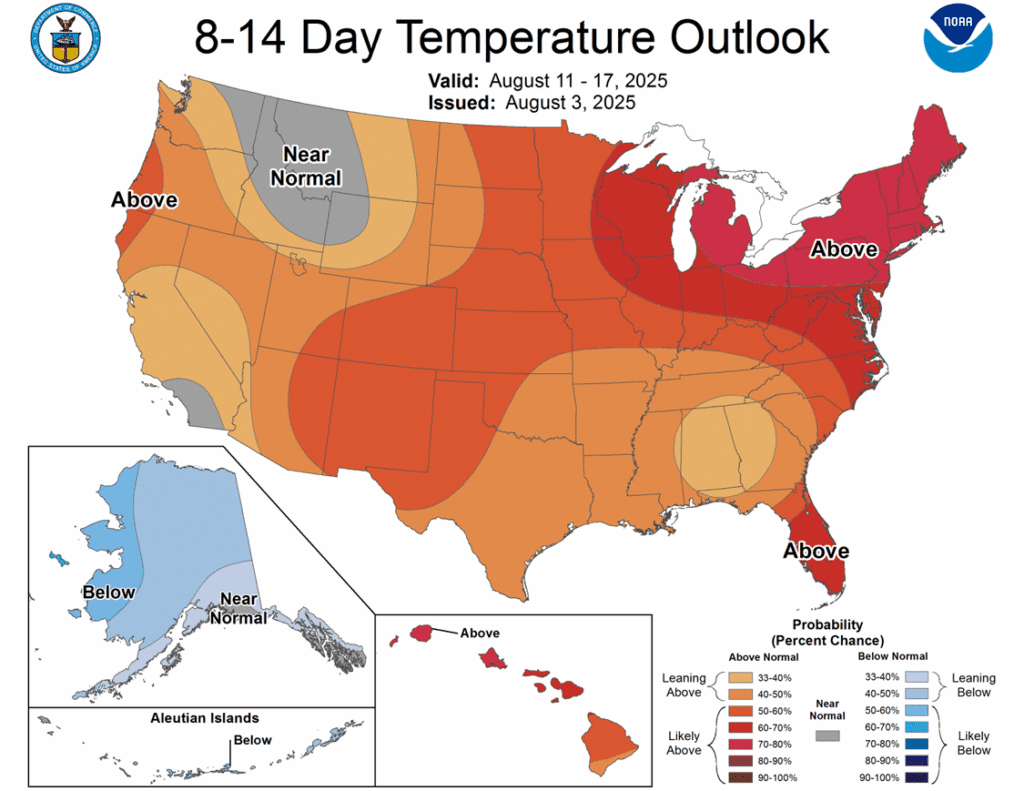

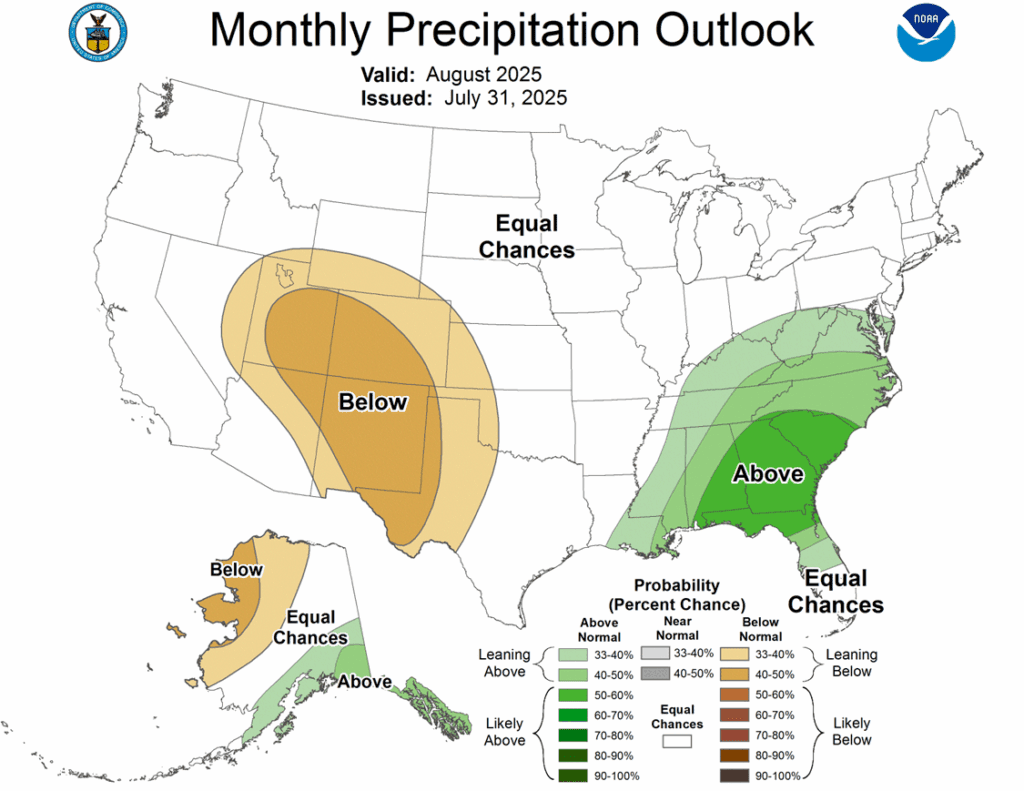

- Warmer, drier Black Sea weather, lower wheat prices boosting feed use, and higher US yield estimates all pressure corn prices ahead of the Aug. 12 USDA report.

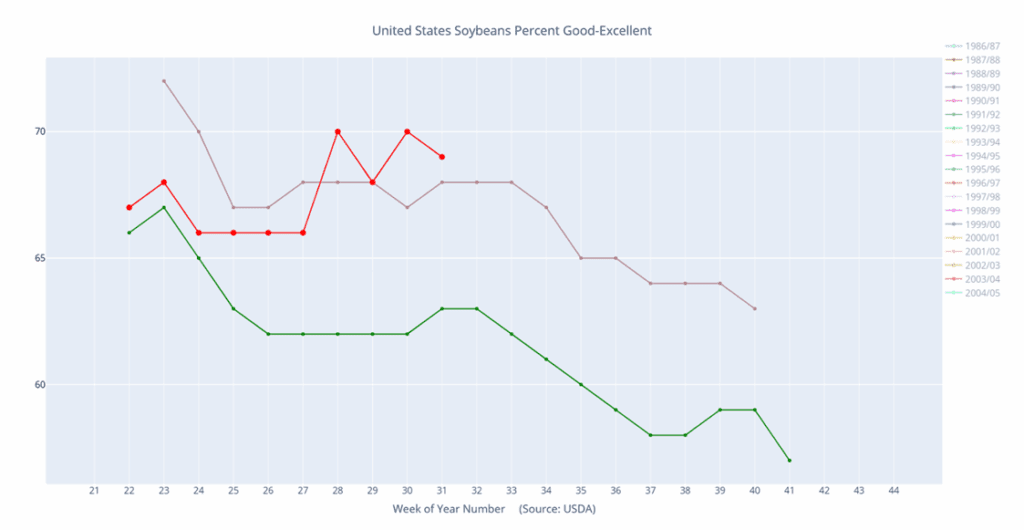

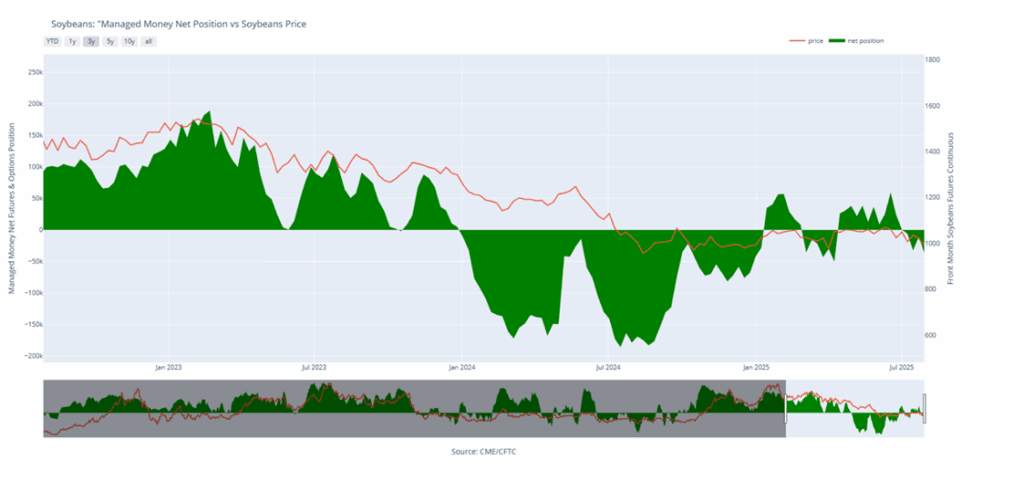

- Soybeans and soymeal fell on negative US/China politics and higher US supply talk, while soyoil and palm oil rose.

- There were 518 soymeal deliveries (442 commercial), Brazil crushers consider slowing/shutdown amid poor margins; soyoil drops on profit-taking.

- Origination challenges keep Brazil basis firm; record exports of 31 mmt for Feb-July. Buyers extend soymeal coverage at near-decade-low prices.

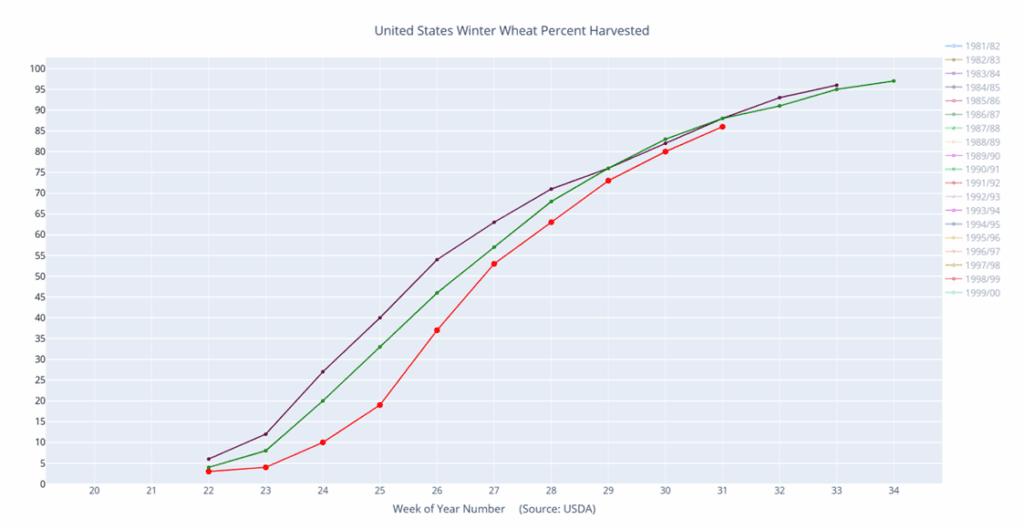

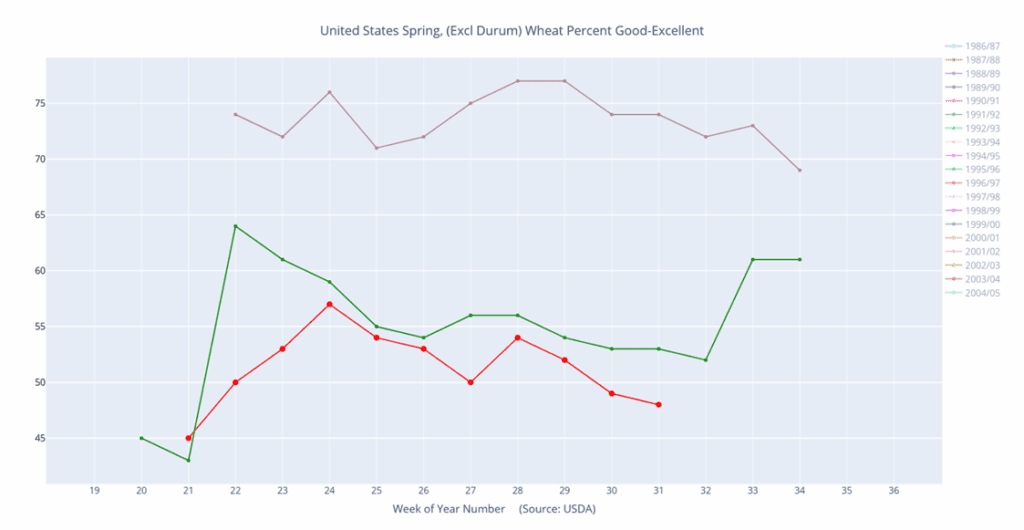

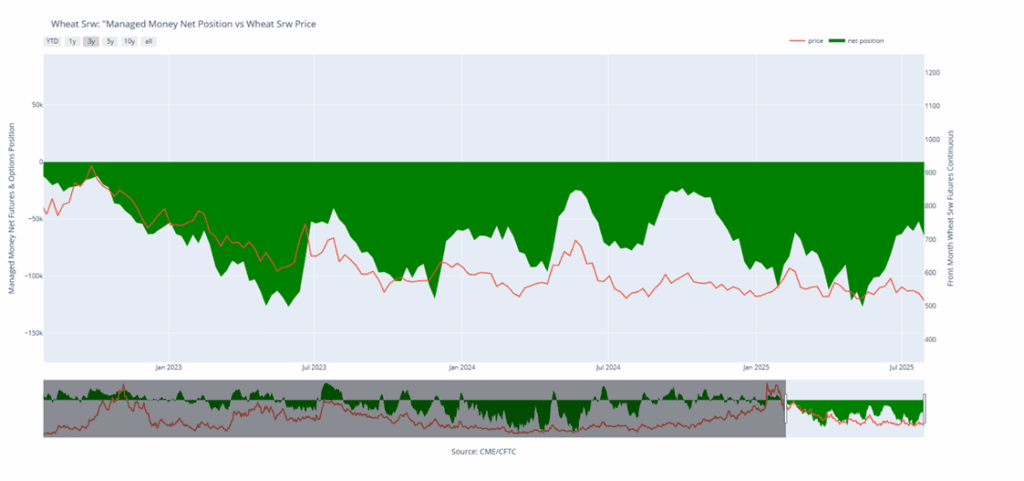

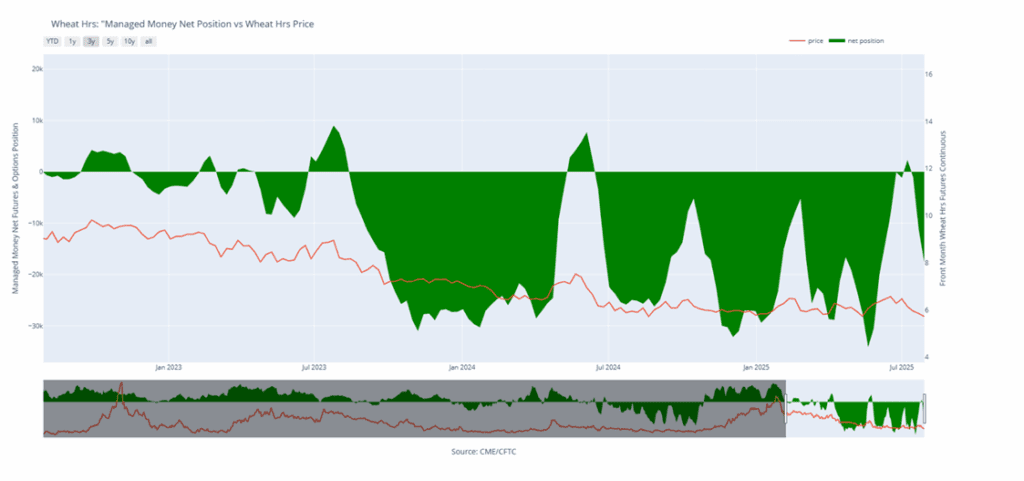

- Funds expected to roll wheat shorts to Dec as technical and fundamental signals worsen.

- Improving Australian crop and ample exporter supplies heighten Oct-Mar export competition.

- US export pace points to approximately 23.1 mmt, just below the strongest level (24 mmt) since 2020.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.