11-15 Opening Update: Grains Trading Higher Following Yesterday’s Sell-Off

All prices as of 6:30 am Central Time

|

Corn |

||

| DEC ’24 | 419.75 | 0.75 |

| MAR ’25 | 432 | 1.25 |

| DEC ’25 | 437 | -0.25 |

|

Soybeans |

||

| JAN ’25 | 996.75 | 9.25 |

| MAR ’25 | 1007.5 | 8.25 |

| NOV ’25 | 1020.5 | 7 |

|

Chicago Wheat |

||

| DEC ’24 | 533.5 | 3.25 |

| MAR ’25 | 551.5 | 3.25 |

| JUL ’25 | 568 | 3 |

|

K.C. Wheat |

||

| DEC ’24 | 535.75 | 2.75 |

| MAR ’25 | 549.25 | 2.5 |

| JUL ’25 | 566.75 | 2.5 |

|

Mpls Wheat |

||

| DEC ’24 | 571.5 | 5 |

| MAR ’25 | 589.75 | 4 |

| SEP ’25 | 622 | 4.25 |

|

S&P 500 |

||

| DEC ’24 | 5946.75 | -31.5 |

|

Crude Oil |

||

| JAN ’25 | 68.32 | -0.21 |

|

Gold |

||

| JAN ’25 | 2584.3 | -0.6 |

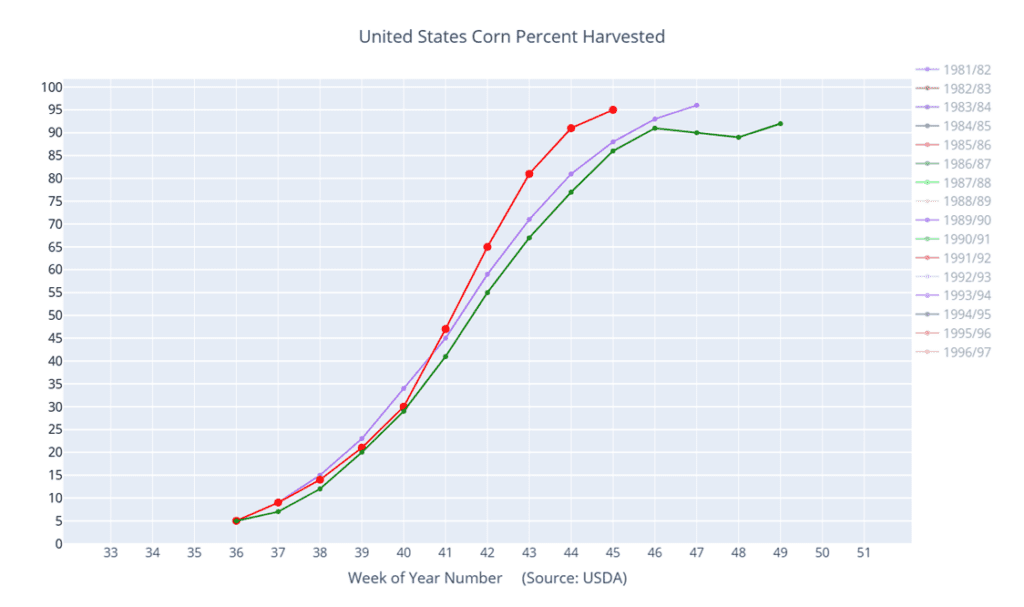

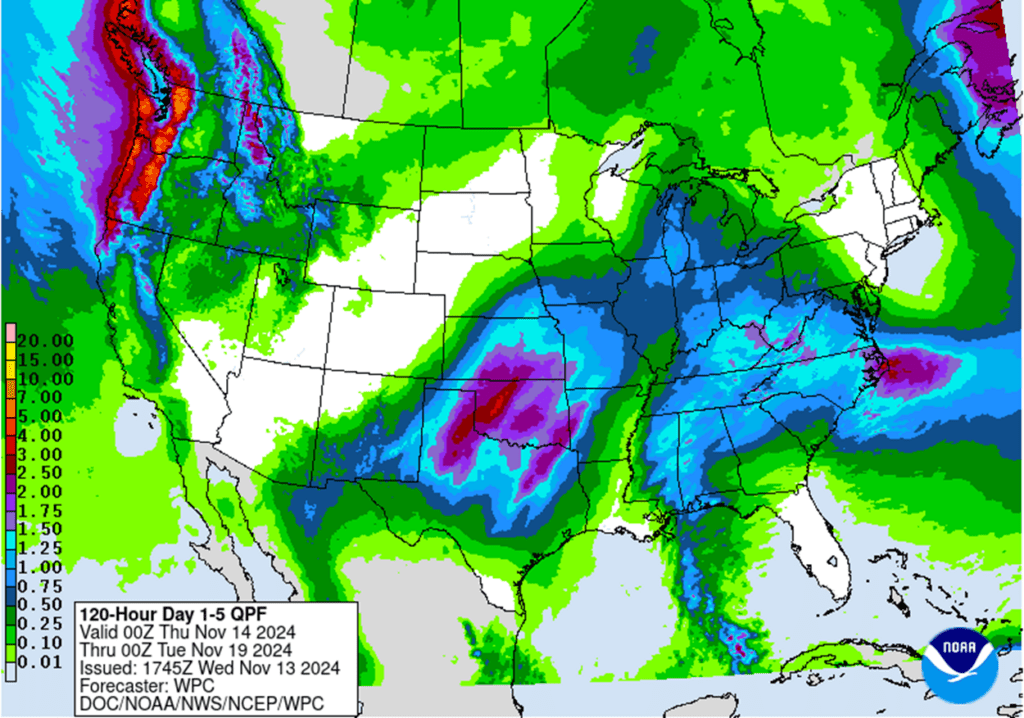

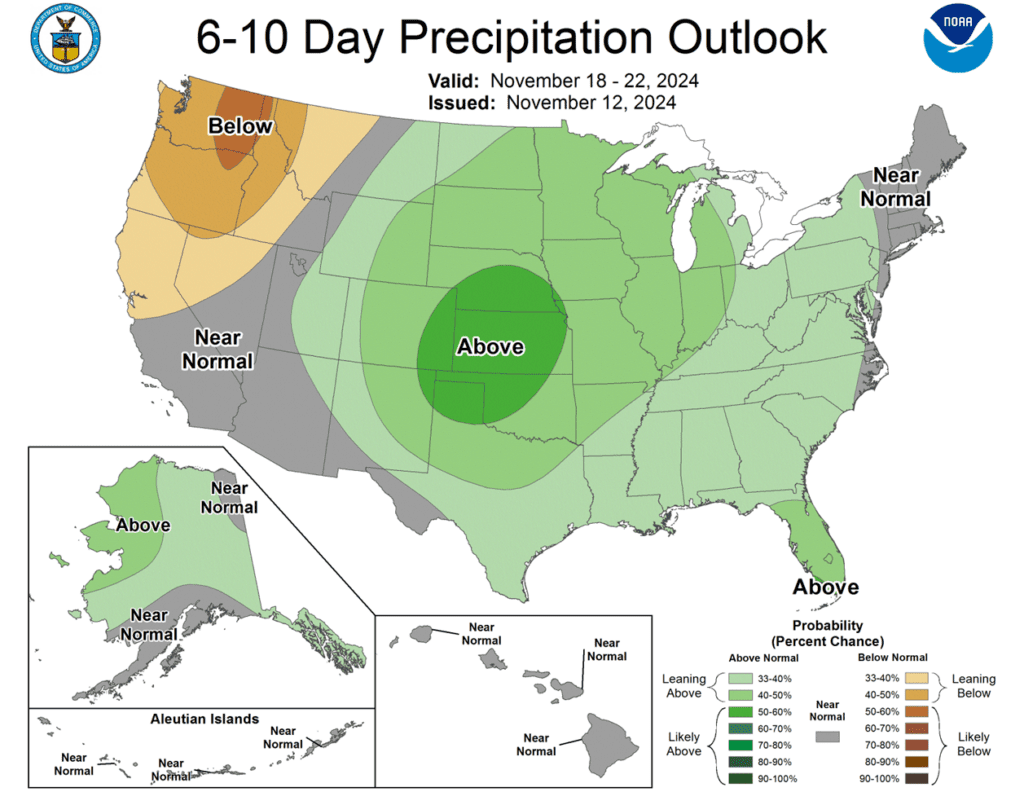

- Corn futures are trading slightly higher this morning taking back some of yesterday’s losses. The weak price action yesterday seemed to stem more from lower soybeans and wheat as fundamentals have been good with strong export demand.

- The range of trade estimates for today’s export sales report are relatively wide and are between 600k and 2,600k tons with an average guess of 1,635k tons. A number on the higher end of this range would not be surprising given the recent flash sales. This would compare to last year’s sales of 1,808k tons.

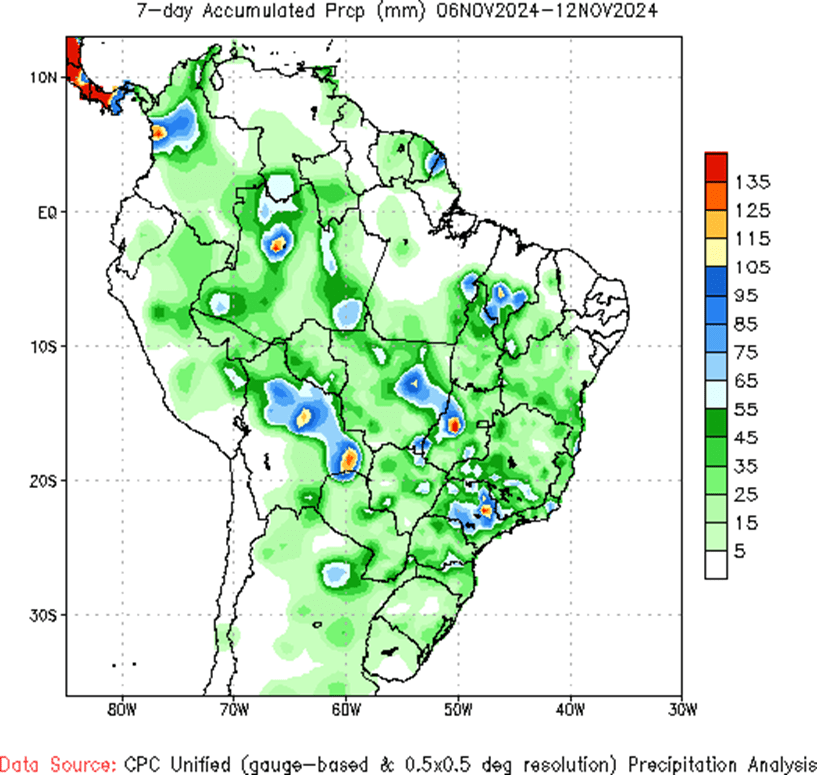

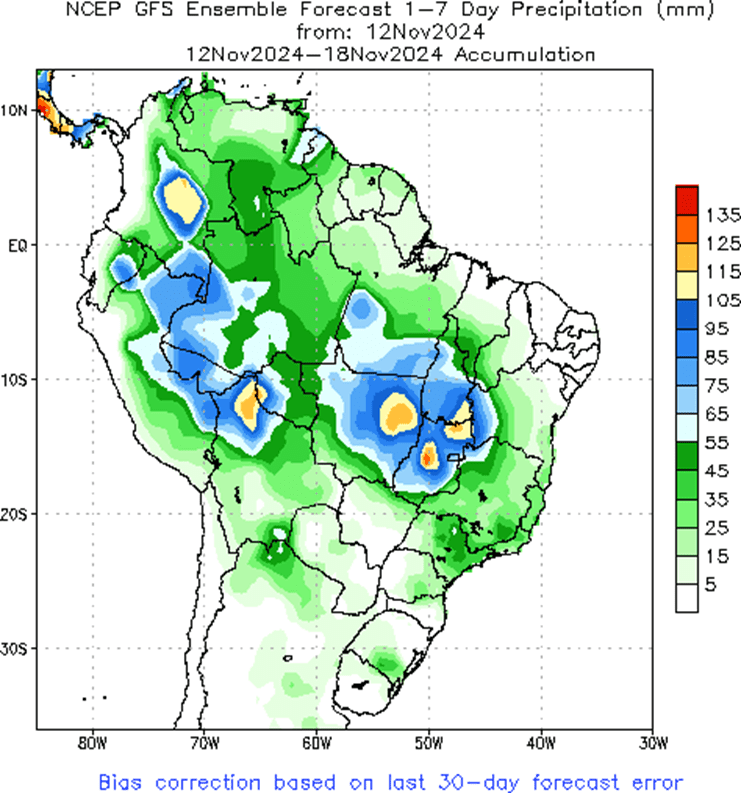

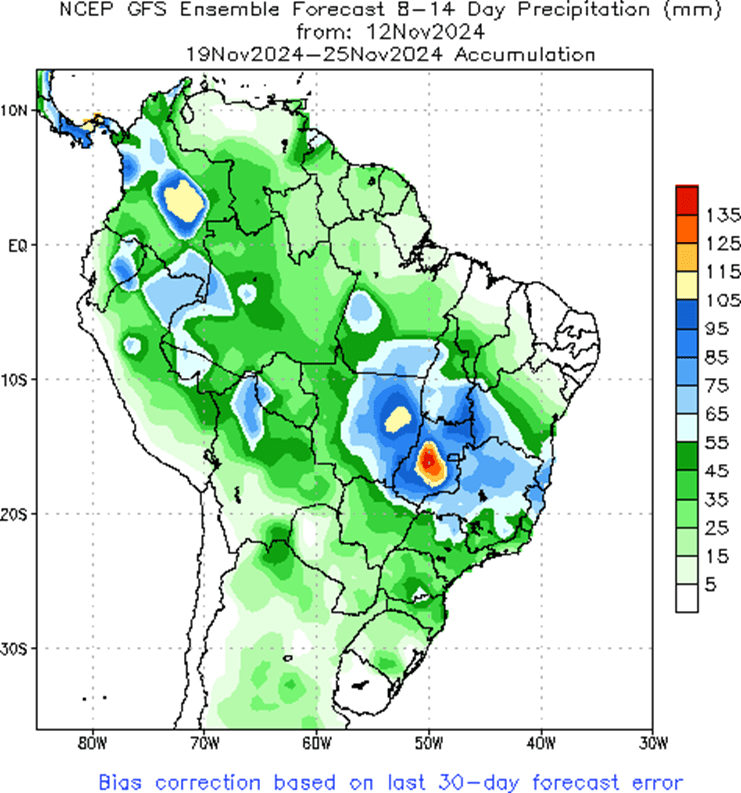

- In Brazil, CONAB released its new estimates for grain production yesterday and it sees planted acreage falling very slightly by 9k hectares, but production increasing to 119.81 mmt thanks to an increase in yield expectations.

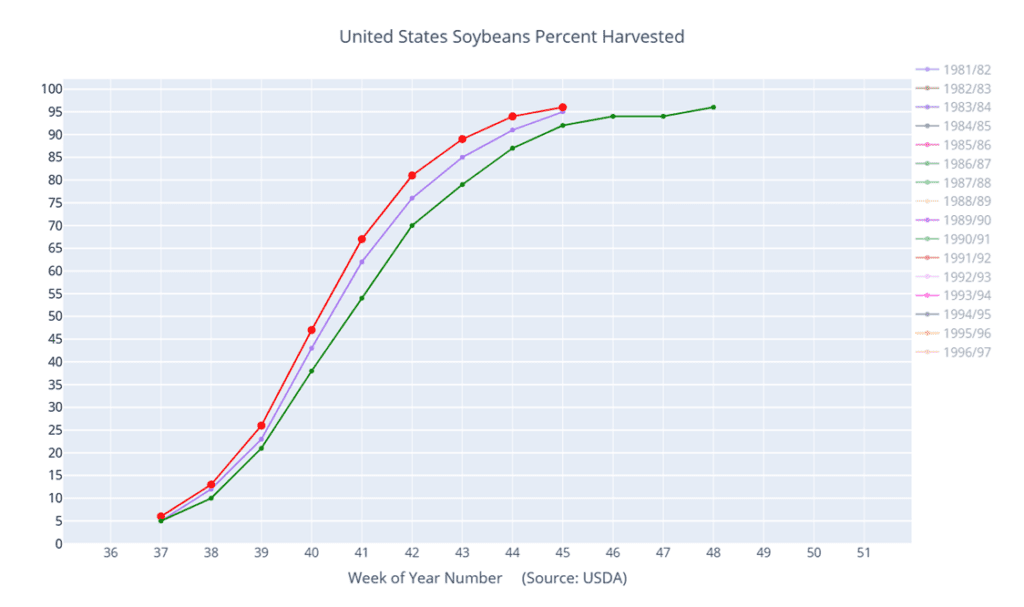

- Soybeans are trading higher this morning as well following yesterday’s sharp sell-off that was likely a result of technical selling along with higher Brazilian production estimates. Soybean meal is slightly lower while soybean oil is trading higher. Today’s soybean crush report is expected to be strong at 193 mb.

- Estimates for today’s export sales report see soybean sales in a range between 1,000k and 2,400k tons with an average guess of 1,773k tons. This would compare to 2.037k tons last week and 3,853k last year.

- CONAB has revised its estimate for Brazilian soybean production higher at 166.14 mmt from 166.05 mmt last month. Planted area is expected to increase while yield estimates are unchanged.

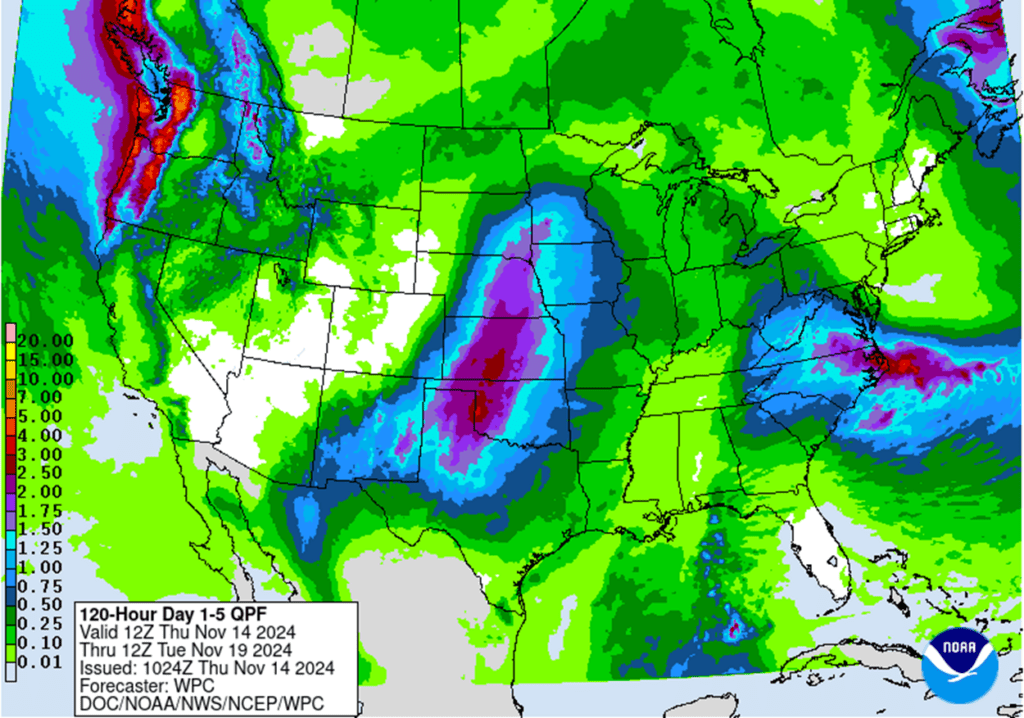

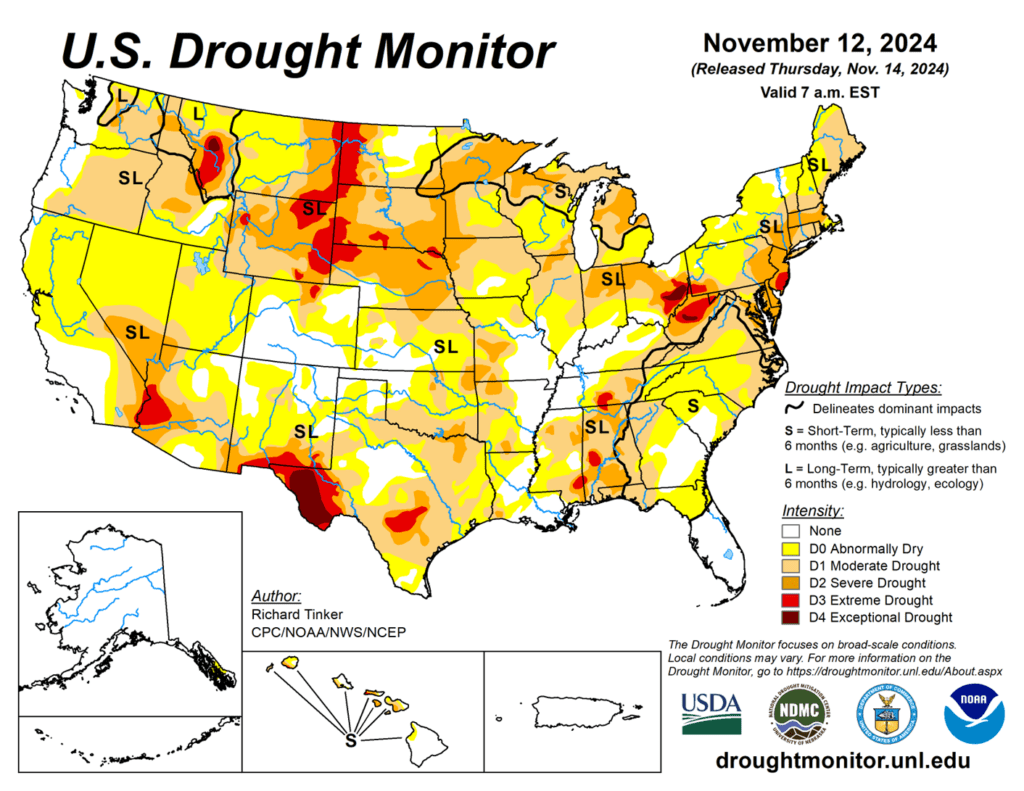

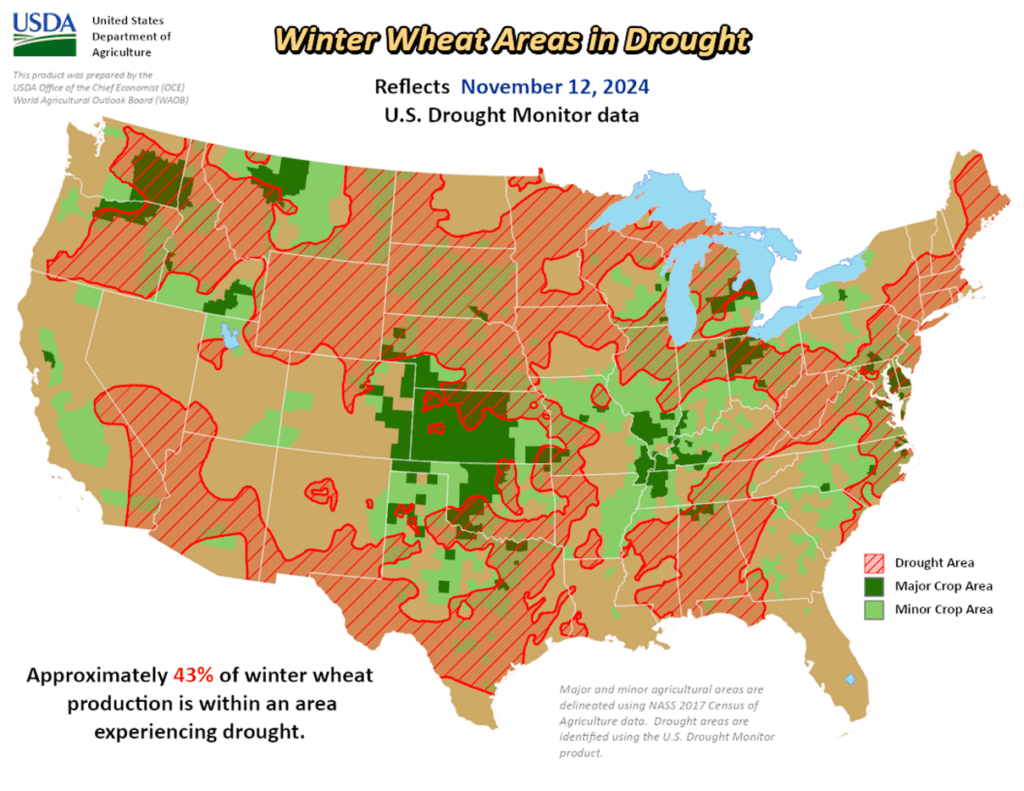

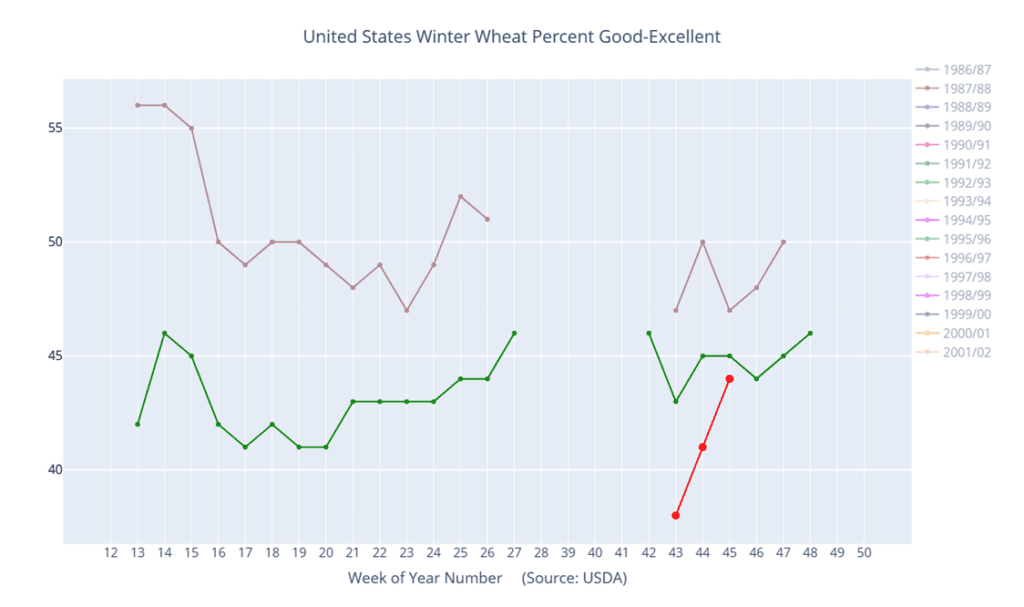

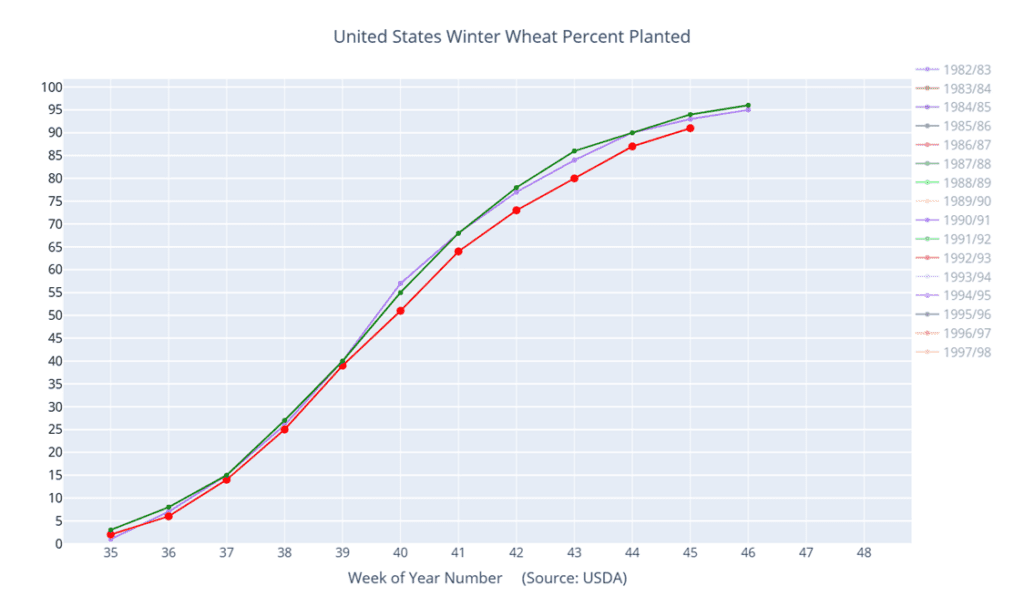

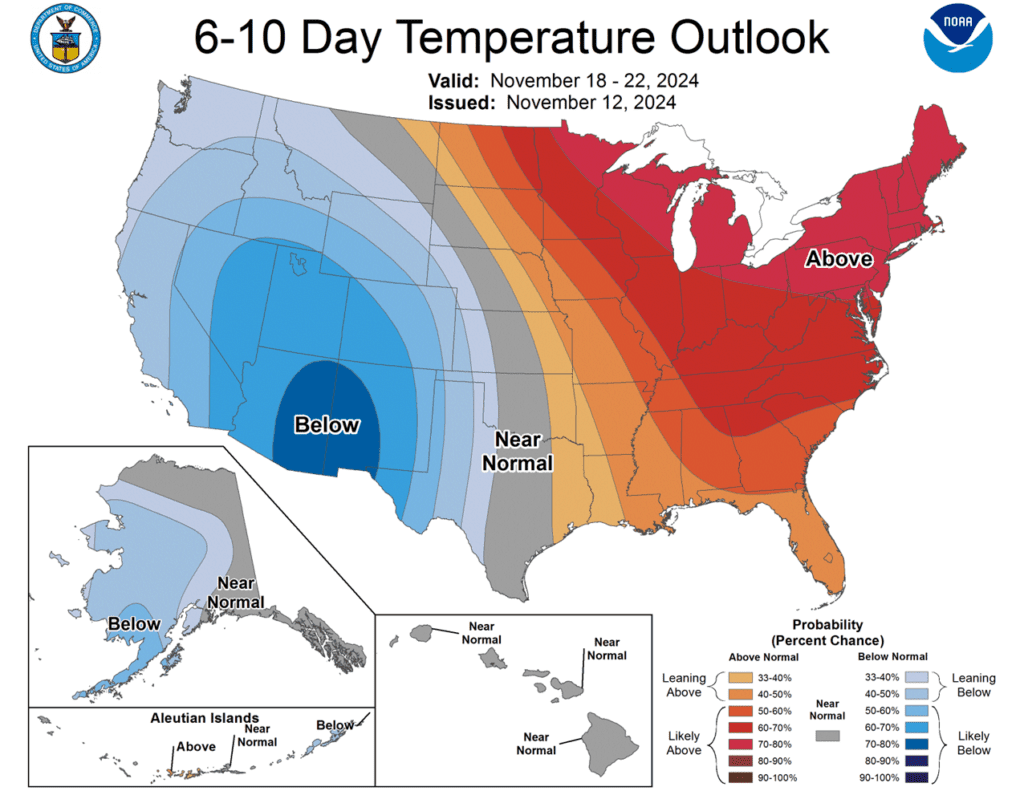

- All three wheat classes are trading higher this morning with Minneapolis leading the way up. Wheat futures have fallen every day since the election as the dollar has rallied making wheat more expensive to purchase from the US.

- Estimates for today’s export sales report see wheat sales in a range between 250k and 650k tons with an average guess of 403k tons. This would compare to 375k tons last week and 176k the previous year.

- In India, wheat production for 25/26 has been revised slightly lower to 112.4 mmt due to a decline in yield estimates in key northern producing states with warmer weather.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.