12-16 Opening Update: Grains Higher to Start the Week, Wheat Leading

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’25 | 443.5 | 1.5 |

| JUL ’25 | 454.25 | 1.25 |

| DEC ’25 | 440.75 | 1.75 |

|

Soybeans |

||

| JAN ’25 | 992 | 3.75 |

| MAR ’25 | 997.5 | 2.5 |

| NOV ’25 | 1006.75 | 0.5 |

|

Chicago Wheat |

||

| MAR ’25 | 556 | 3.75 |

| MAY ’25 | 565.75 | 3.5 |

| JUL ’25 | 572 | 3.25 |

|

K.C. Wheat |

||

| MAR ’25 | 563 | 6 |

| MAY ’25 | 570.75 | 5.5 |

| JUL ’25 | 578 | 4.75 |

|

Mpls Wheat |

||

| MAR ’25 | 603 | 4.5 |

| JUL ’25 | 615 | 1.5 |

| SEP ’25 | 624 | 1.25 |

|

S&P 500 |

||

| MAR ’25 | 6141.5 | 15.75 |

|

Crude Oil |

||

| FEB ’25 | 70.14 | -0.68 |

|

Gold |

||

| FEB ’25 | 2682.1 | 6.3 |

- Corn is trading higher this morning after prices began to slip last Wednesday likely driven by farmer selling. Today’s export sales report is expected to show firm demand today.

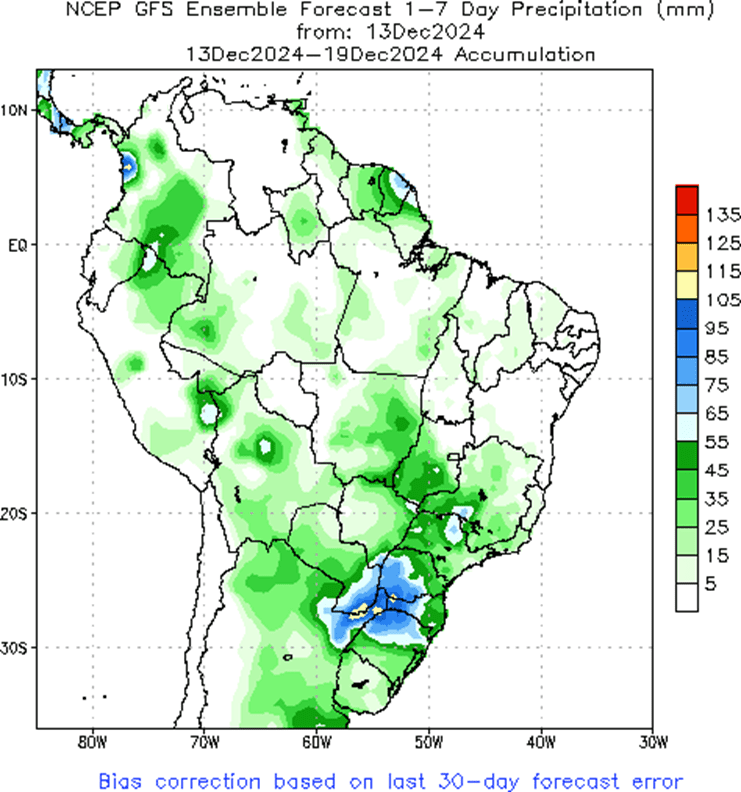

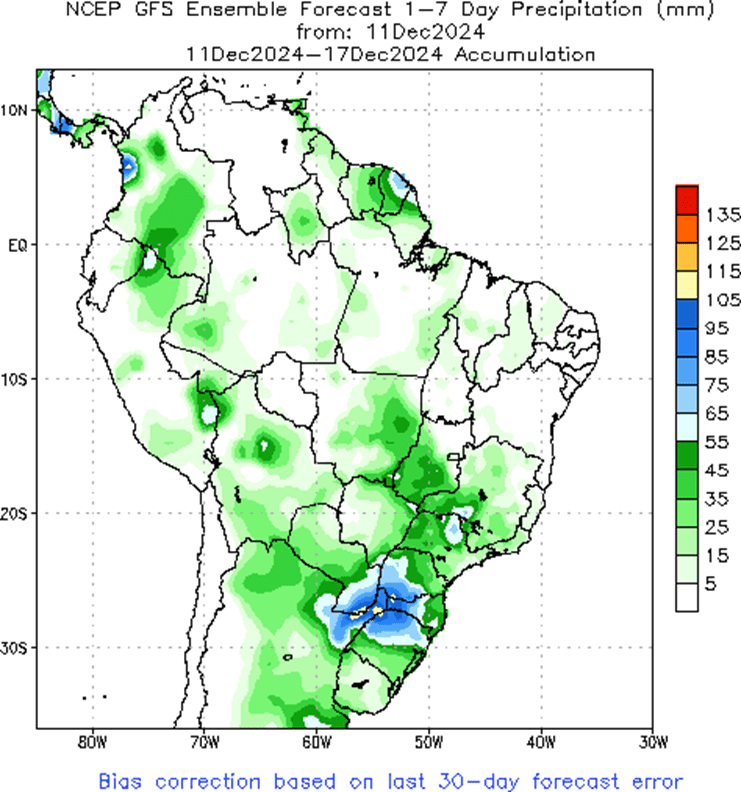

- In Brazil, corn prices are firm, but CONAB and other analysts are expecting that 24/25 corn production will exceed last year’s by 3.4% and reach 119.63 mmt.

- Friday’s CFTC report showed funds as buyers of corn as of December 10 in a big way. They bought 77,670 contracts which increased their net long position to 165,890 contracts. Since the July low at 353,983 shorts, the funds have bought 519,873 net long contracts. This swing in fund money generated a 48 cent rally off the lows.

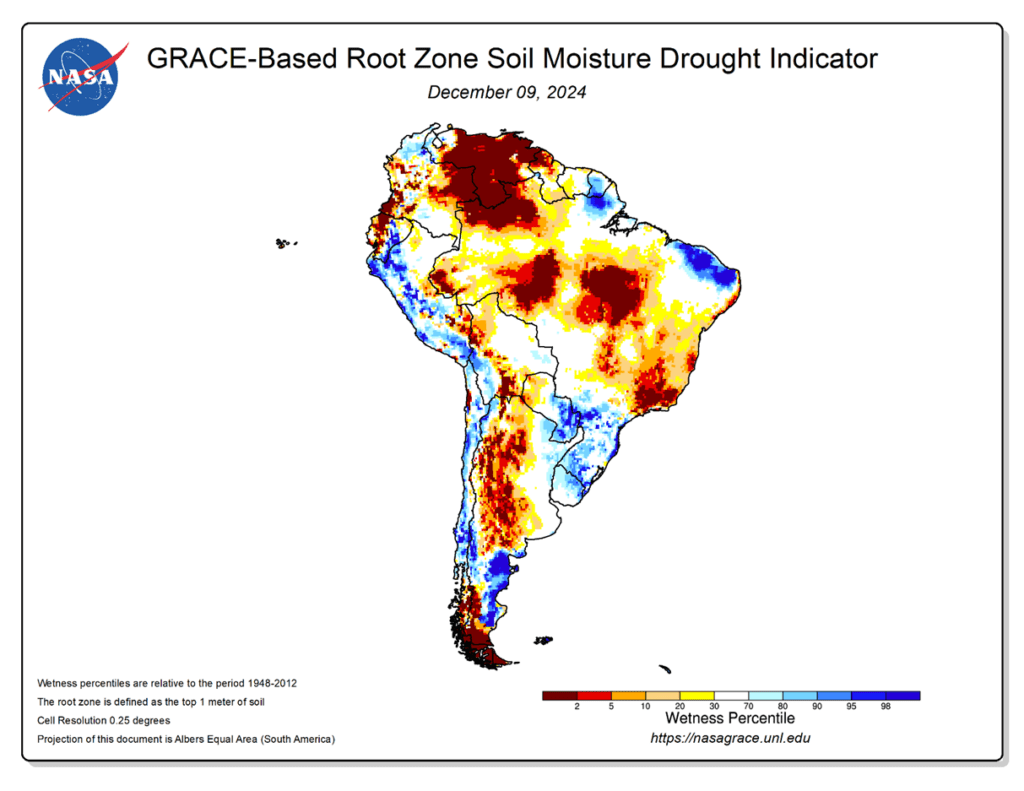

- Soybeans are trading higher this morning as trade anticipates good export inspections numbers as well as strong NOPA crush numbers. Soybean meal is leading the complex higher while soybean oil is lower.

- The NOPA crush report will be released at 11am, and expectations are that it will total 196.7 million bushels which would be 3 mb shy of the October record. Large crush numbers have created excess soybean meal supplies.

- Friday’s CFTC report showed funds as buyers of soybeans by 13,897 contracts which reduced their net short position to 58,320 contracts as of December 10.

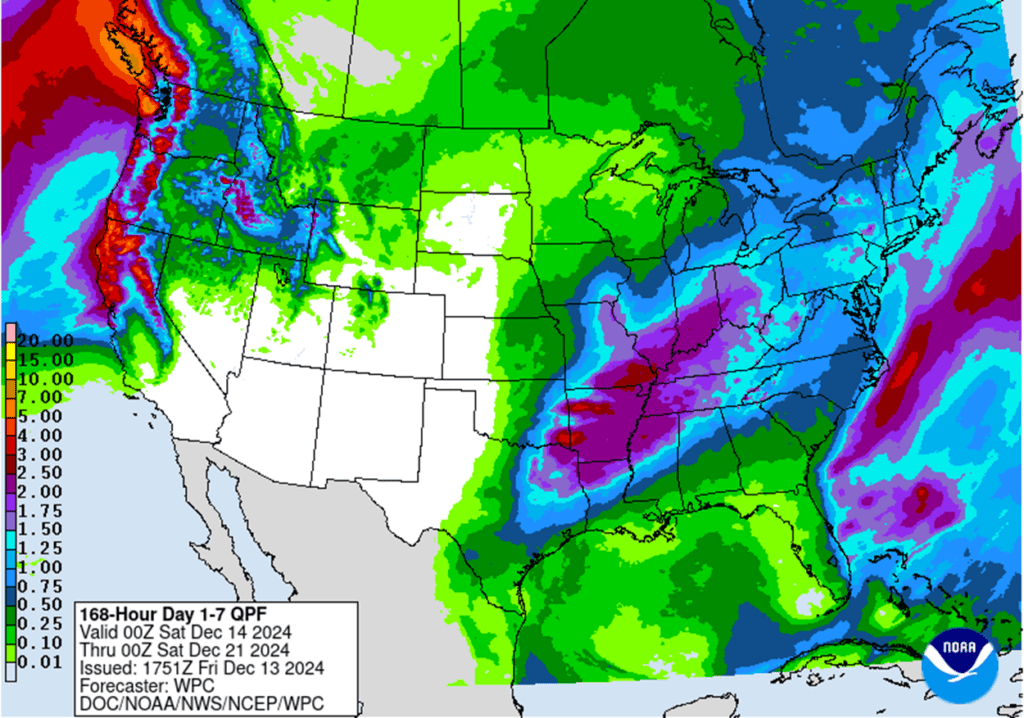

- All three wheat classes are trading higher this morning with KC wheat leading the way. European wheat futures have rallied, and concerns remain about the Russian wheat crop, both situations favorable to US prices.

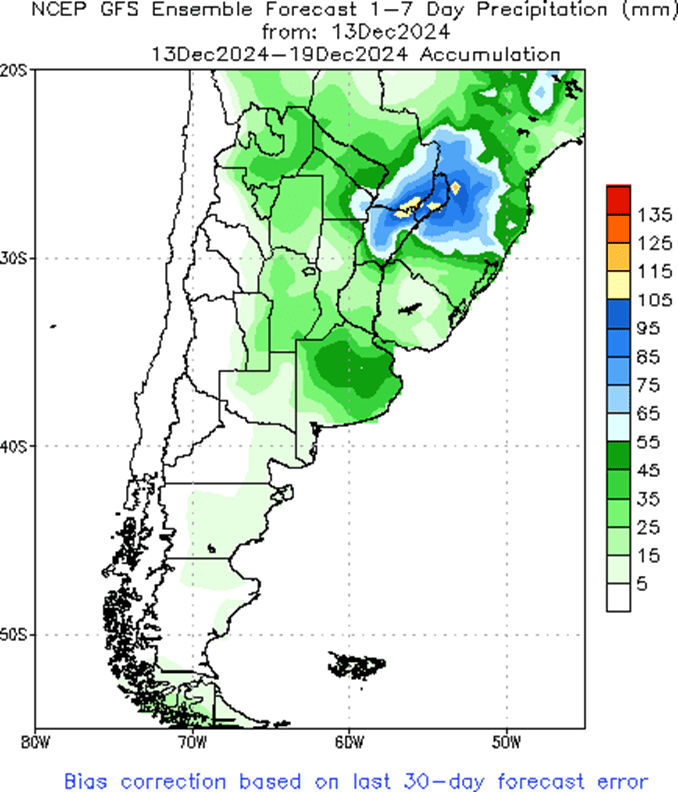

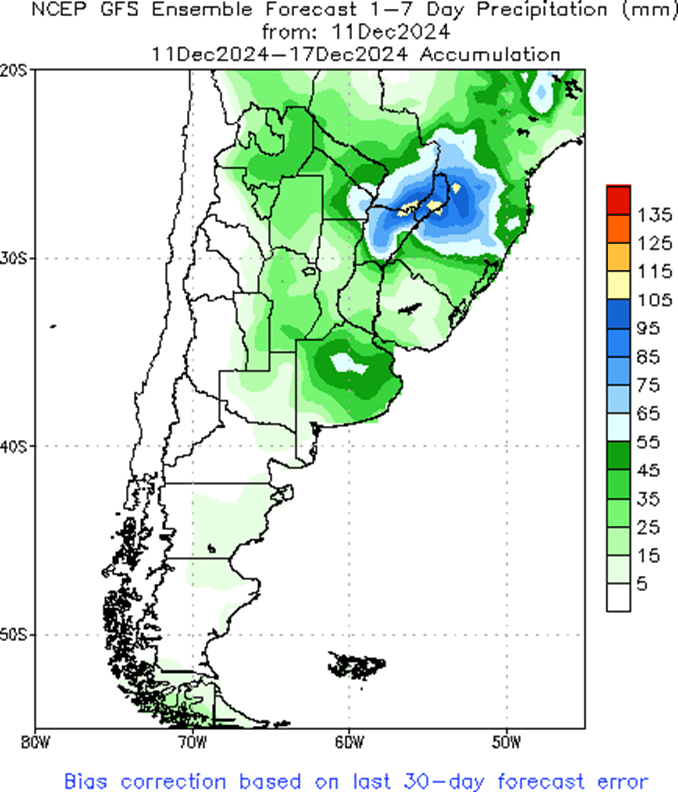

- In Argentina, estimates for the 24/25 wheat crop production have been increased by 0.5 mmt with over half the crop now harvested. Larger producer, Russia, may reportedly see cuts to their production which would be friendly.

- Friday’s CFTC report showed funds as buyers of Chicago wheat by 2,607 contracts reducing their net short position to 66,779 contracts. Funds bought back 1,994 contracts reducing their net short position to 36,436 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.