12-26 Opening Update: Grains Will Resume Trade at 8:30am Following Christmas Holiday

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’25 | 448.5 | 0 |

| JUL ’25 | 457.25 | 0 |

| DEC ’25 | 437.25 | 0 |

|

Soybeans |

||

| JAN ’25 | 975.25 | 0 |

| MAR ’25 | 981.25 | 0 |

| NOV ’25 | 994 | 0 |

|

Chicago Wheat |

||

| MAR ’25 | 534.75 | 0 |

| MAY ’25 | 545.25 | 0 |

| JUL ’25 | 552.5 | 0 |

|

K.C. Wheat |

||

| MAR ’25 | 543.75 | 0 |

| MAY ’25 | 551.75 | 0 |

| JUL ’25 | 560.25 | 0 |

|

Mpls Wheat |

||

| MAR ’25 | 589.5 | 0 |

| JUL ’25 | 605 | 0 |

| SEP ’25 | 614.25 | 0 |

|

S&P 500 |

||

| MAR ’25 | 6078.75 | -19.25 |

|

Crude Oil |

||

| FEB ’25 | 70.39 | 0.29 |

|

Gold |

||

| FEB ’25 | 2640.7 | 5.2 |

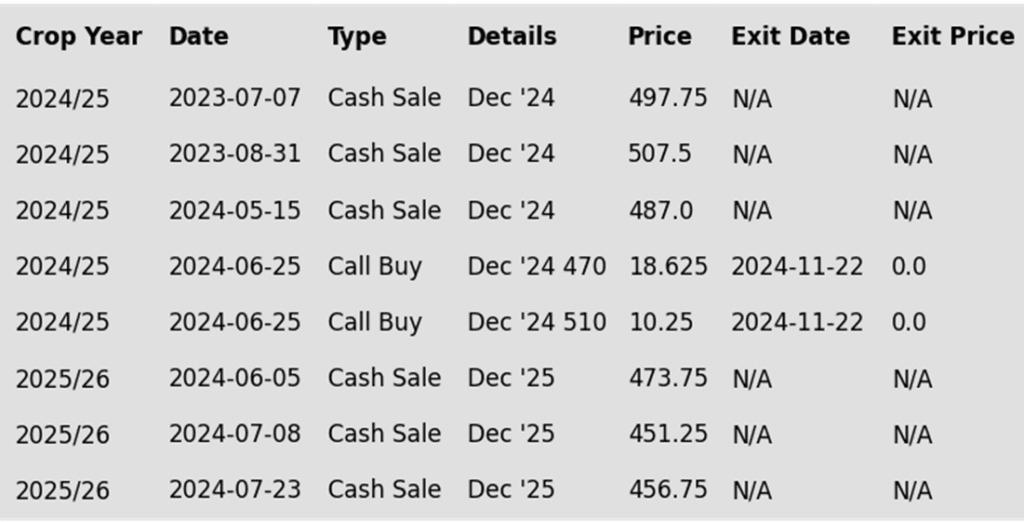

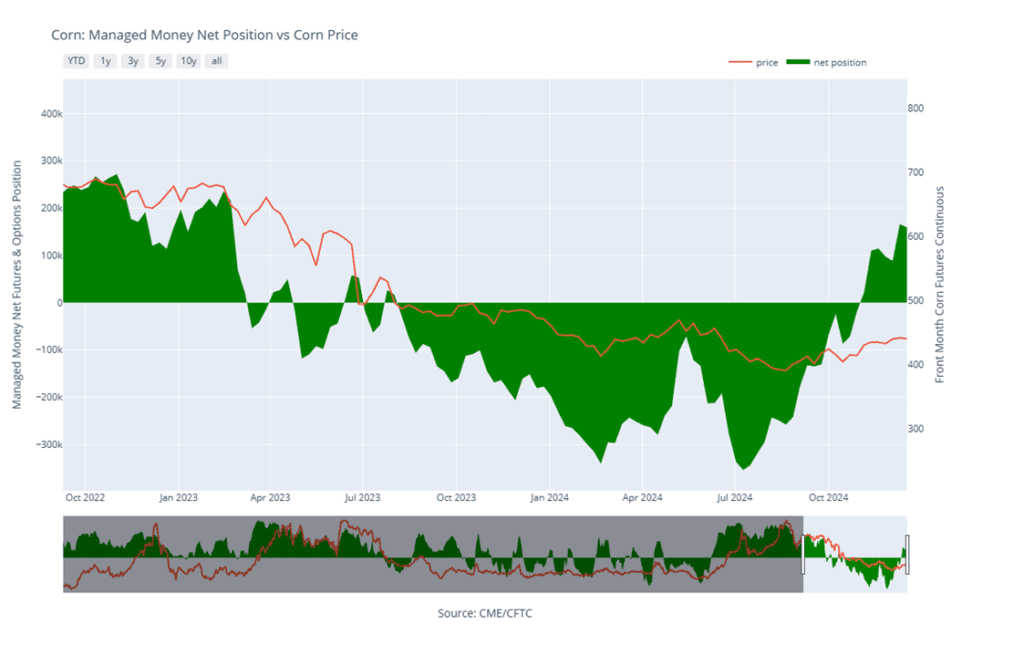

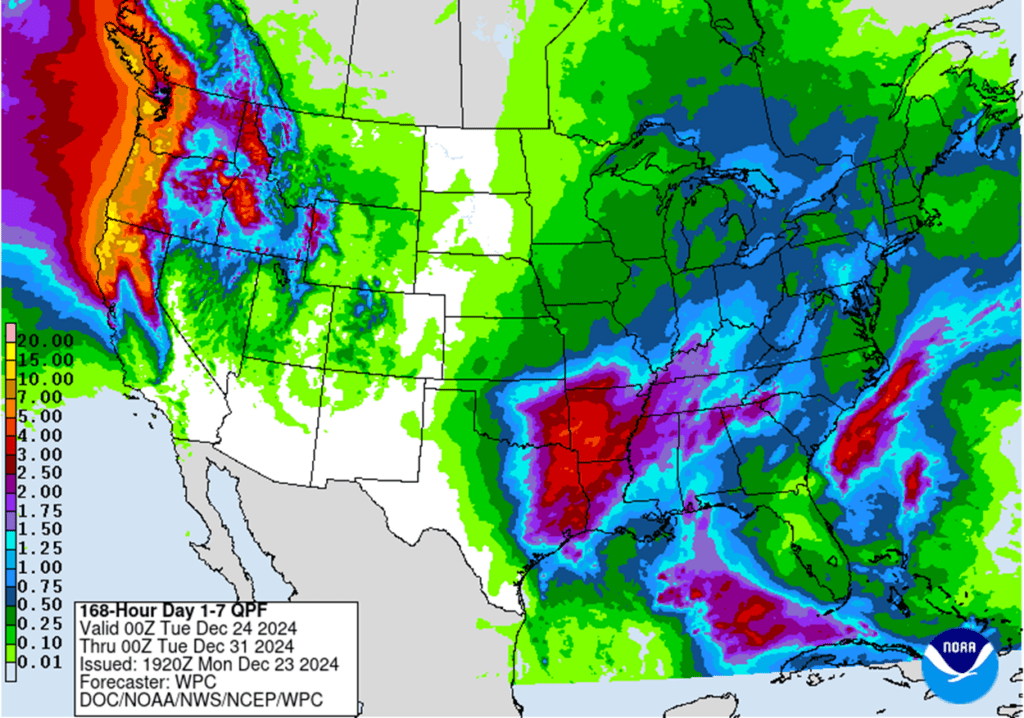

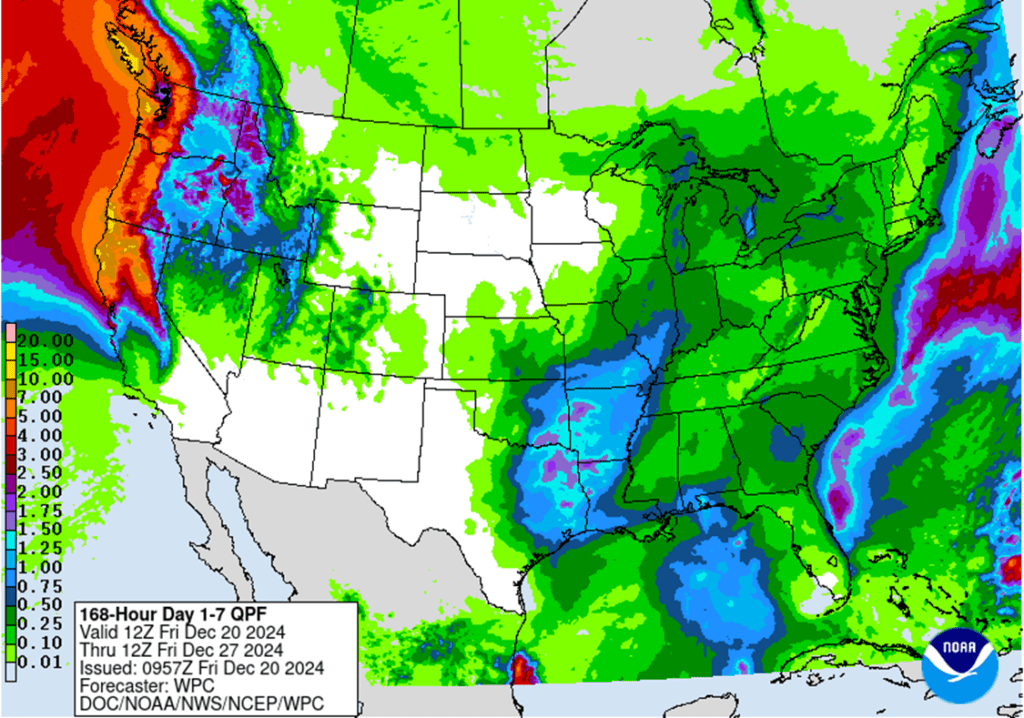

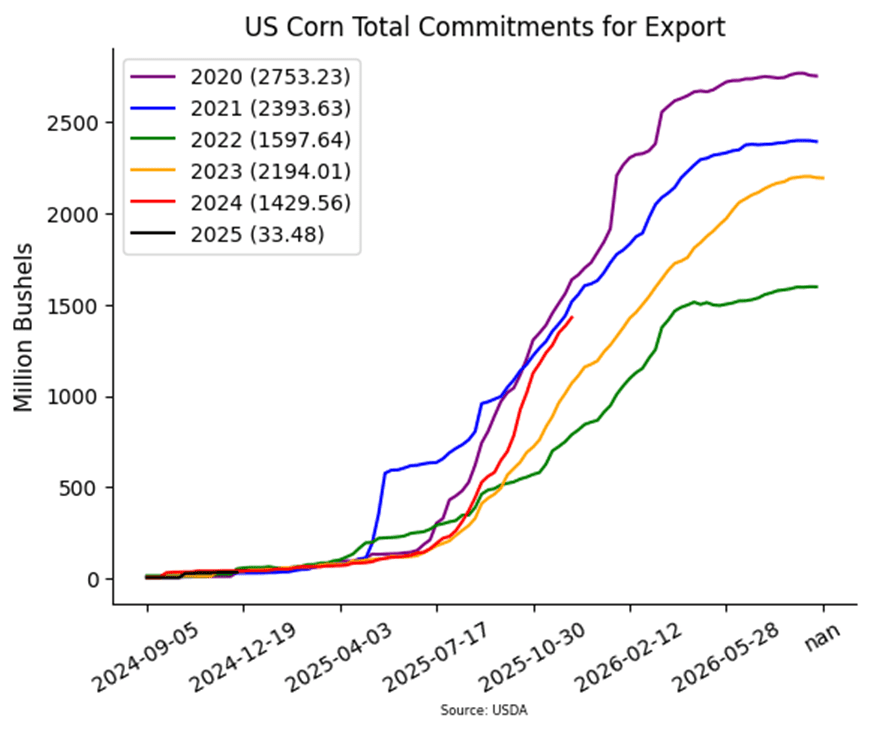

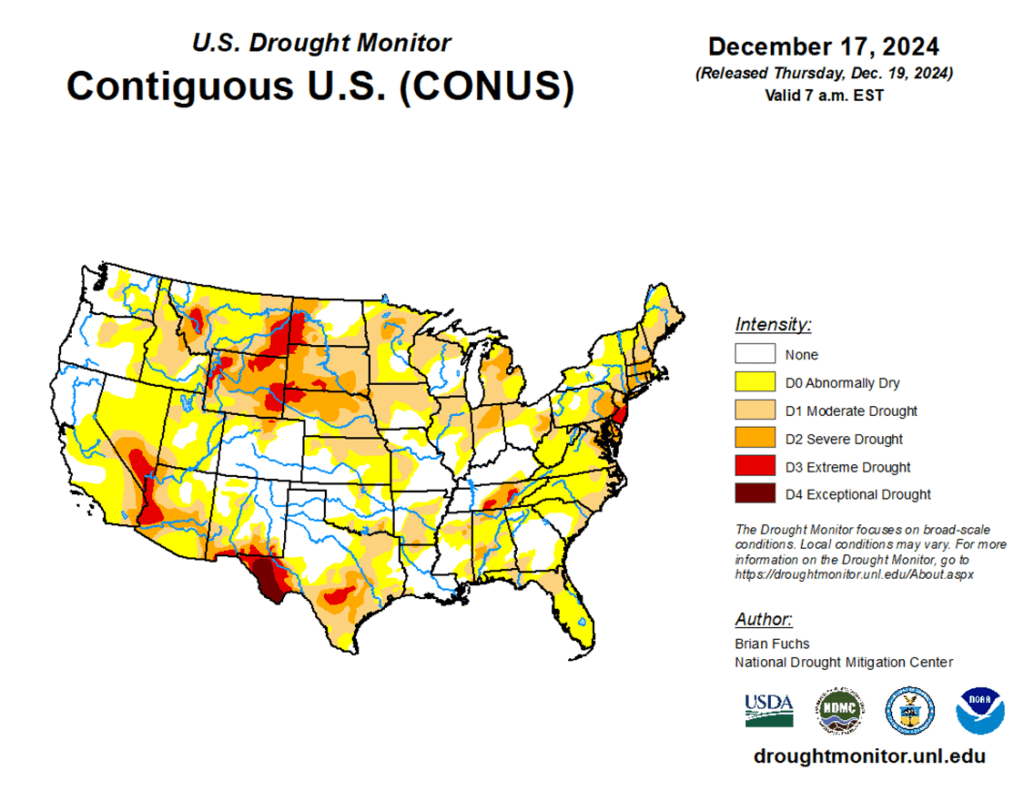

- Corn ended the day on Tuesday near the top of its recent range and near resistance at $4.50 in the March contract. Corn has technically been in an uptrend since August, but has been unable to break $4.50.

- Estimates for 2025 corn planted acreage see numbers higher than last year. This year, 91.8 million acres were planted, and 94.6 million are projected for next year.

- Basis levels in corn have begun to slip as higher futures have encouraged producers to make cash sales.

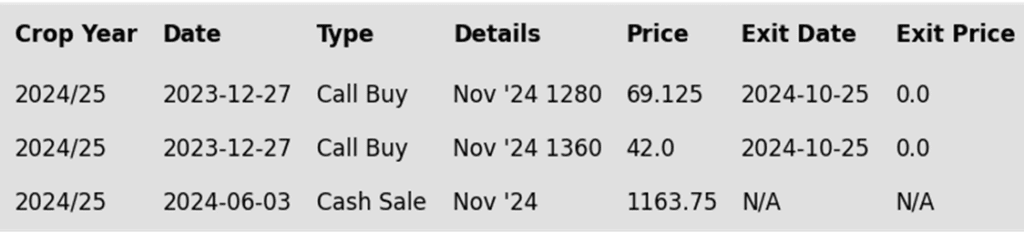

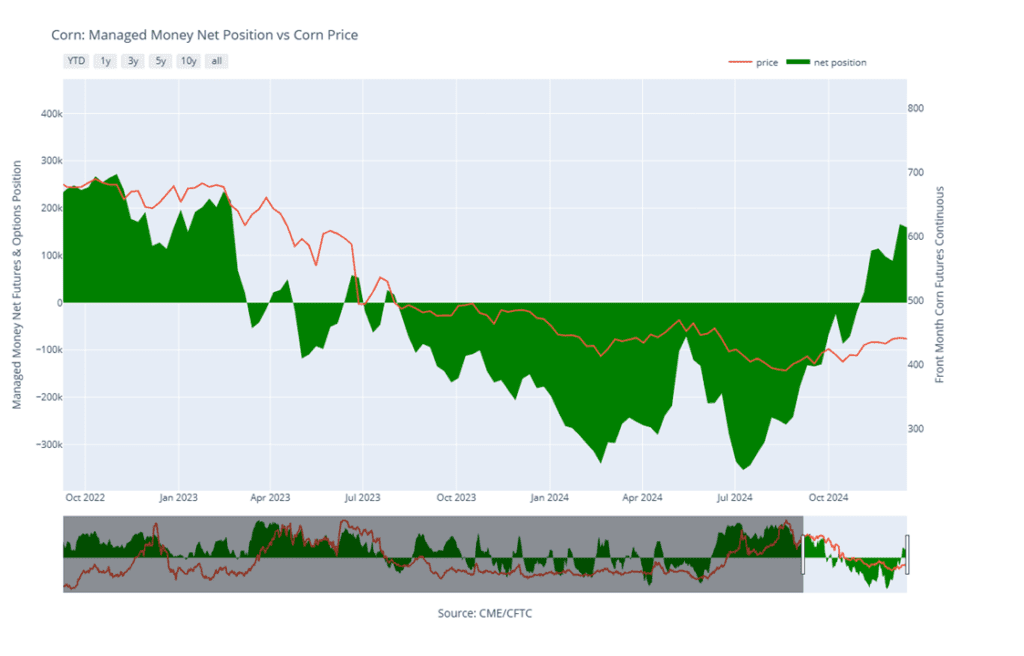

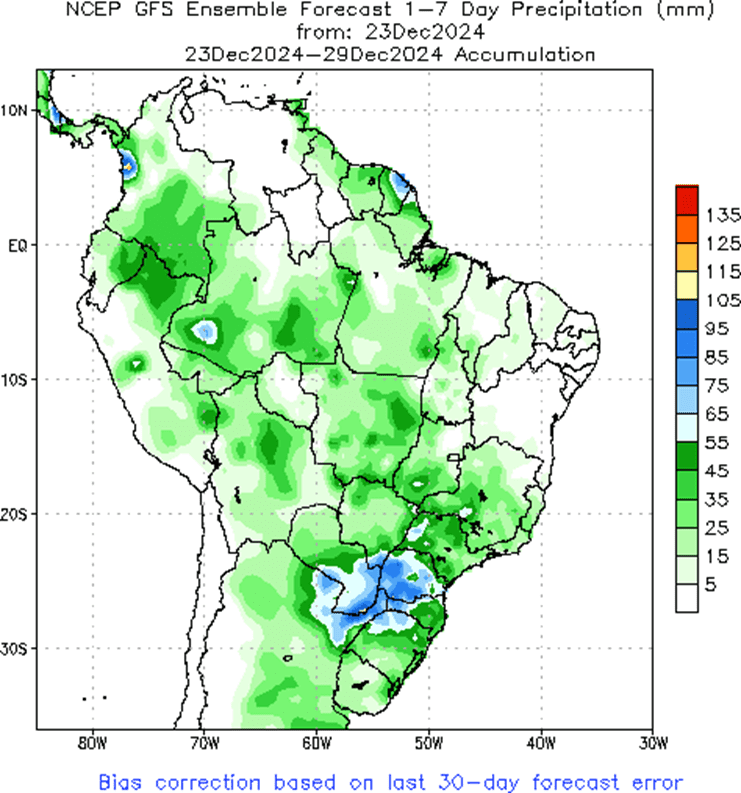

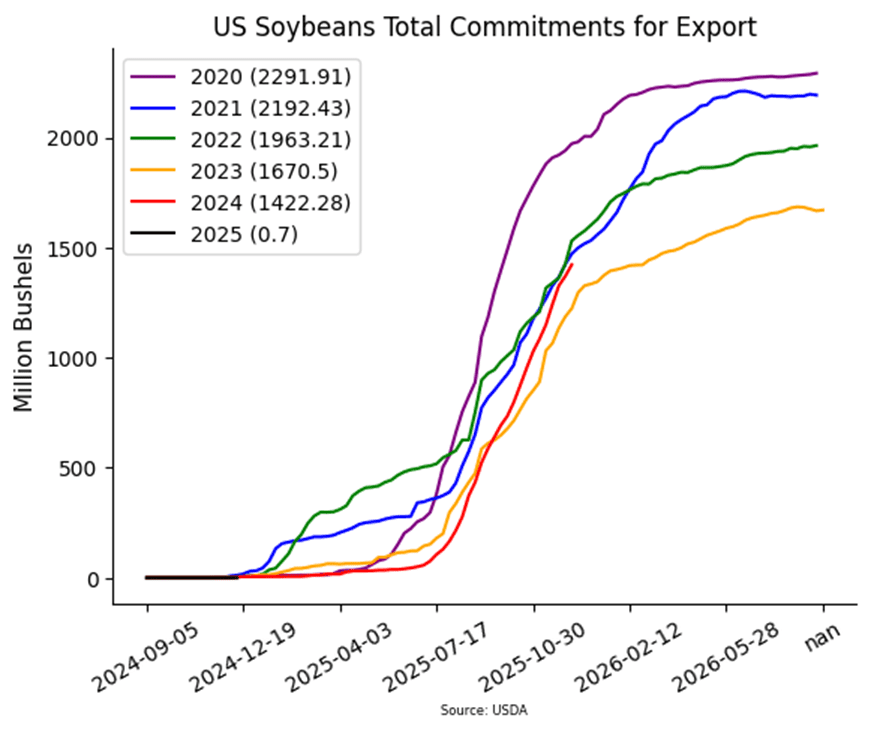

- Soybeans closed 4 cents higher on Tuesday, and while prices have recovered from their recent contract lows at $9.47 in the March contract, are still in an overall down trend.

- The Brazilian real is already trading today and is higher this morning which could give an indication of higher soybean prices as they have been positively correlated recently.

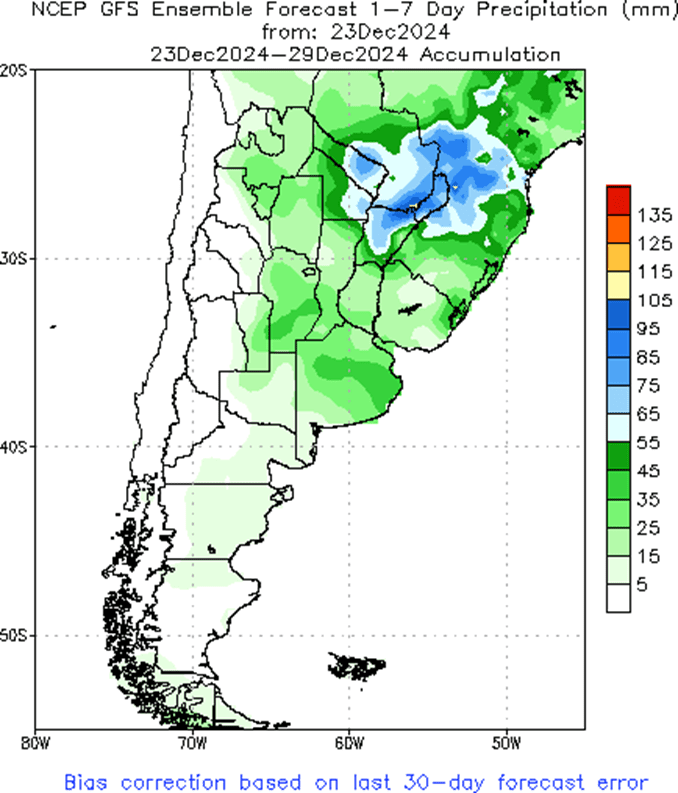

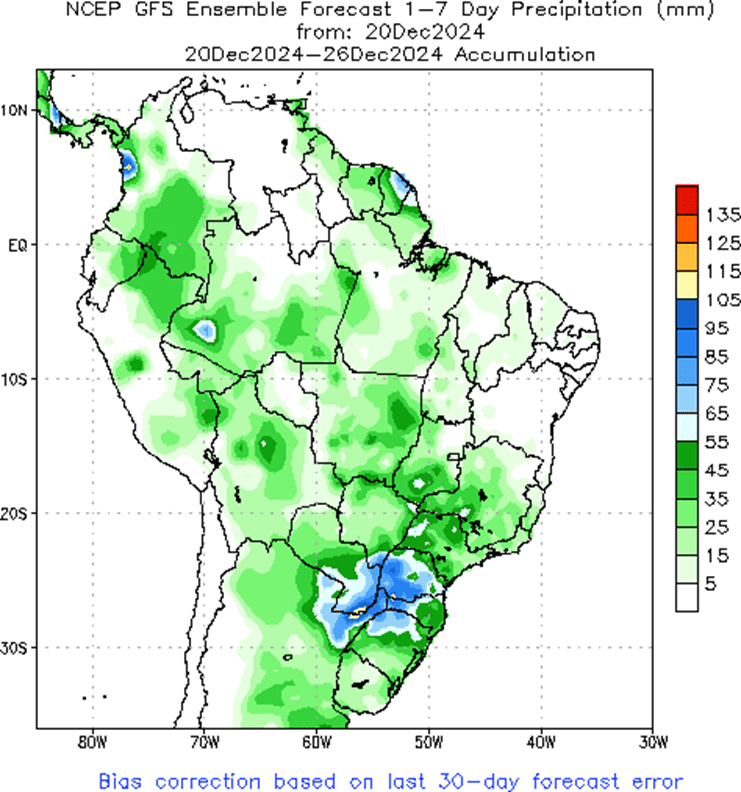

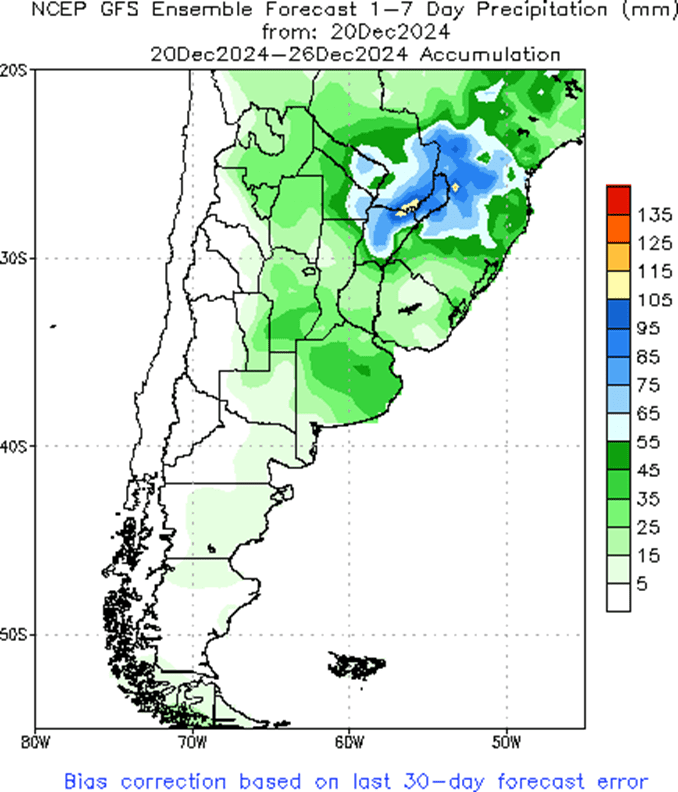

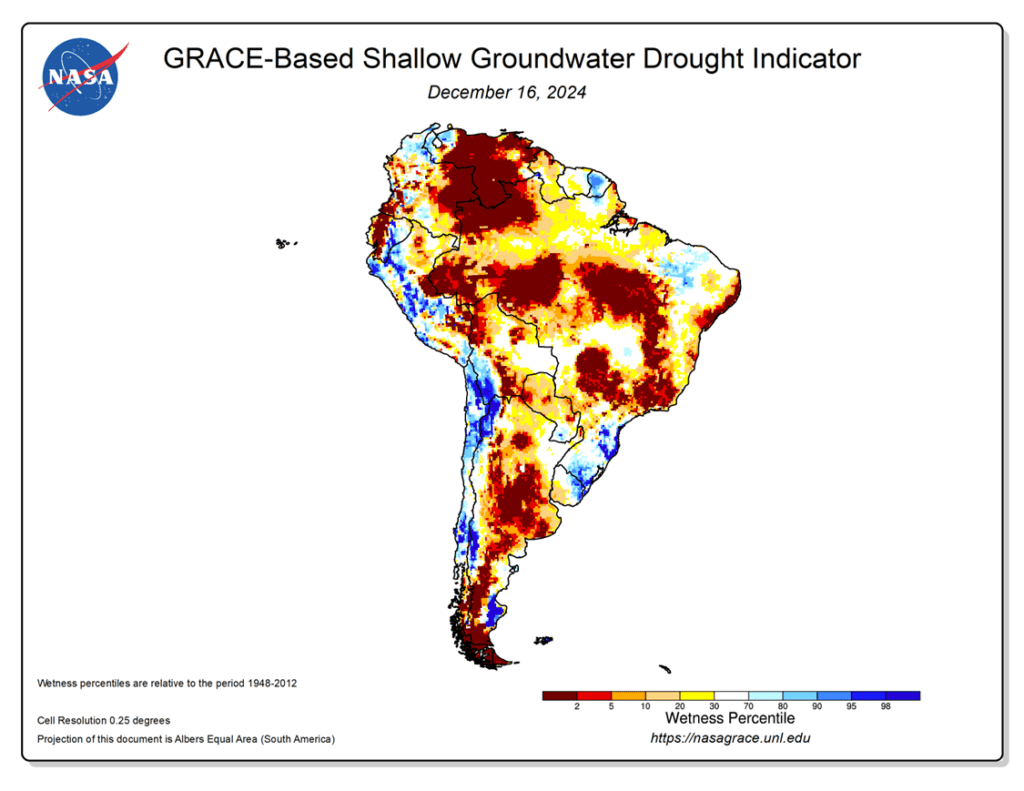

- While the majority of Brazil has seen very good weather, the southern part of the country along with Argentina may now be facing a period of dry weather which could be friendly for soybean meal prices.

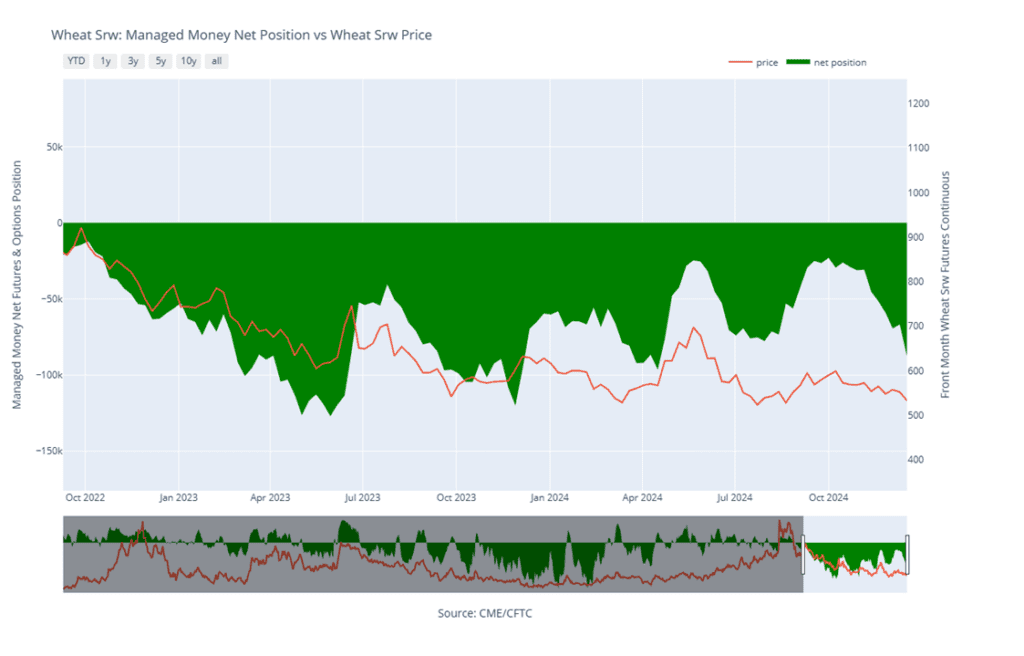

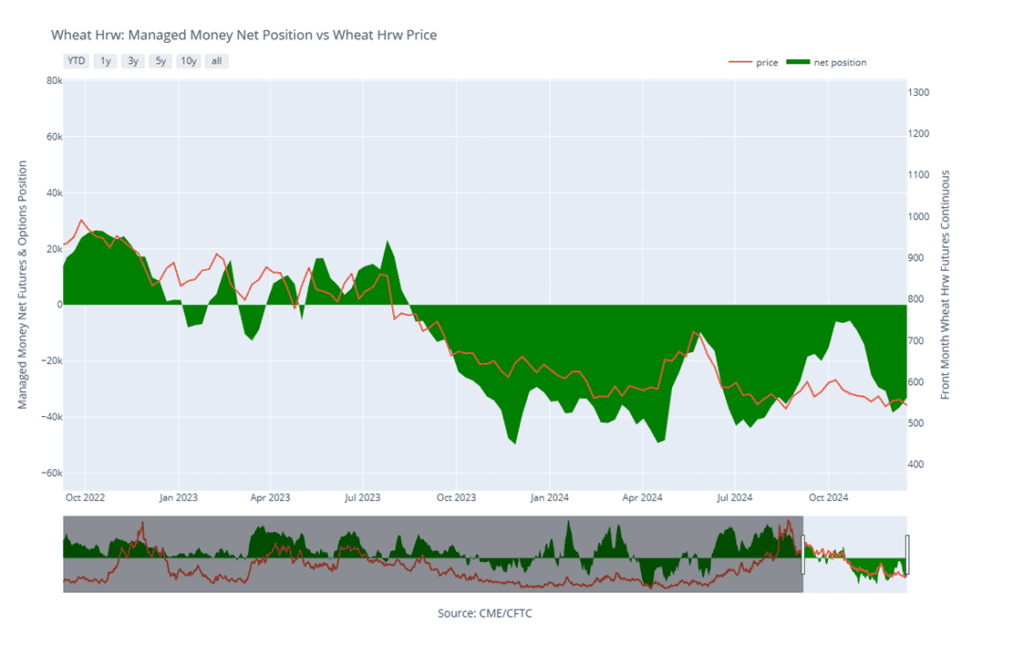

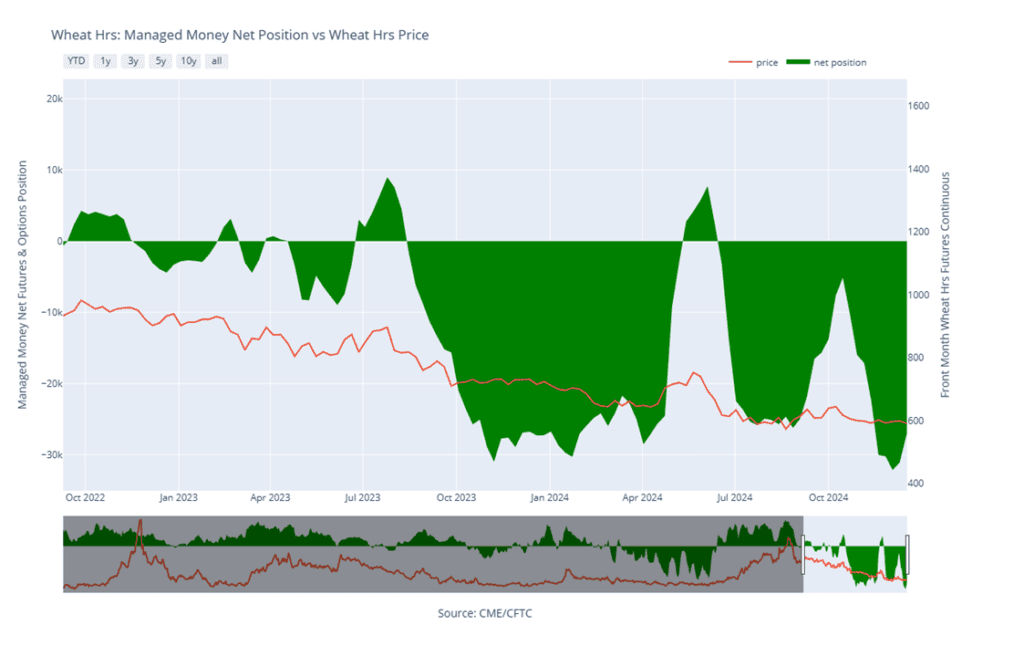

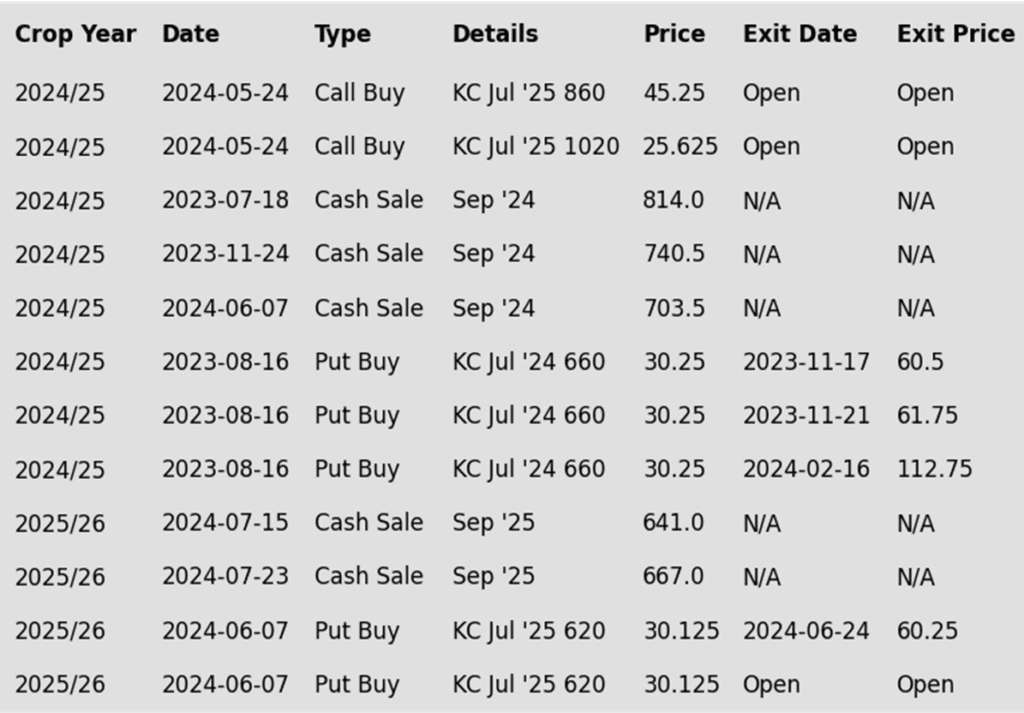

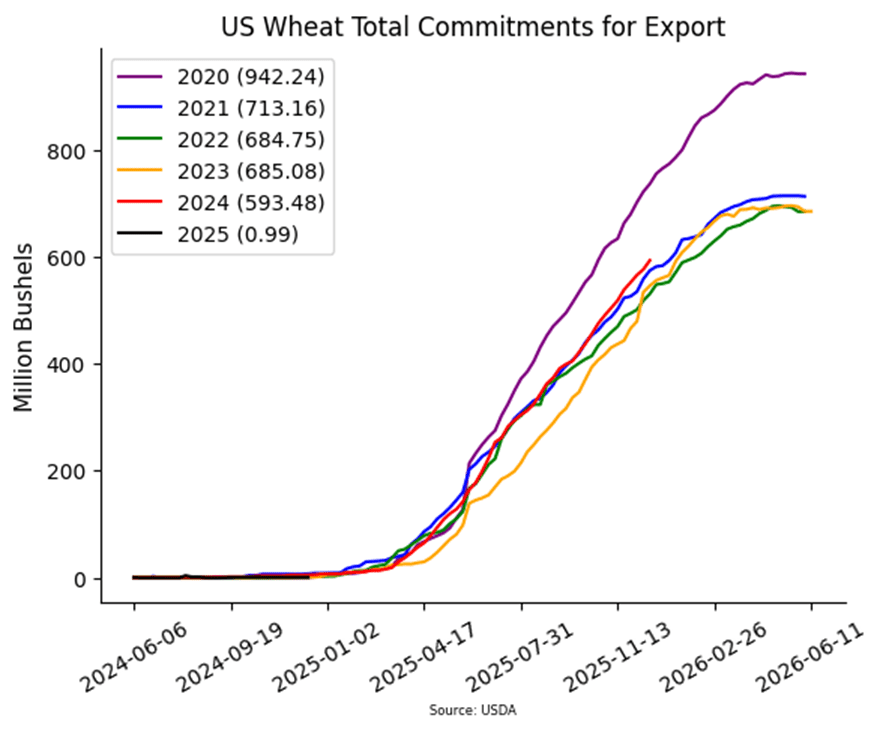

- All three wheat classes ended the day lower on Tuesday and remain in downtrends. The dollar is trading slightly lower which could lend some support to wheat futures.

- Turkey announced that it will ease their strict wheat import policy next year in an effort to increase supplies and lower domestic prices.

- SovEcon has downgraded the 24/25 Russian wheat export forecast to 43.7 mmt from 44.1 mmt previously as a result of lower expected production.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.