01-15 Opening Update: Grains Mixed in Overnight Trade

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’25 | 476.25 | 1.75 |

| JUL ’25 | 489.75 | 0.75 |

| DEC ’25 | 457 | 0.25 |

|

Soybeans |

||

| MAR ’25 | 1048.5 | 1 |

| JUL ’25 | 1073 | 0.5 |

| NOV ’25 | 1048.75 | -0.75 |

|

Chicago Wheat |

||

| MAR ’25 | 544.5 | -1.75 |

| JUL ’25 | 567 | -1.5 |

| JUL ’26 | 623.75 | -3.5 |

|

K.C. Wheat |

||

| MAR ’25 | 556 | -4.75 |

| JUL ’25 | 575.25 | -4.25 |

| JUL ’26 | 623 | 0 |

|

Mpls Wheat |

||

| MAR ’25 | 588 | -1.5 |

| JUL ’25 | 606 | -1.75 |

| SEP ’25 | 617.75 | -1.25 |

|

S&P 500 |

||

| MAR ’25 | 5904.25 | 22 |

|

Crude Oil |

||

| MAR ’25 | 76.78 | 0.41 |

|

Gold |

||

| APR ’25 | 2733.5 | 23.4 |

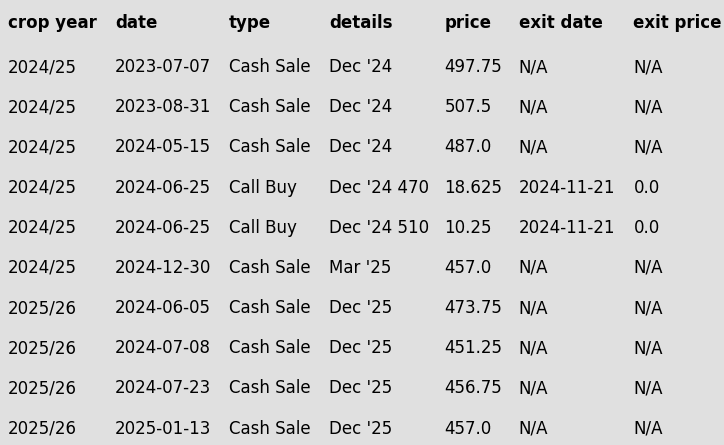

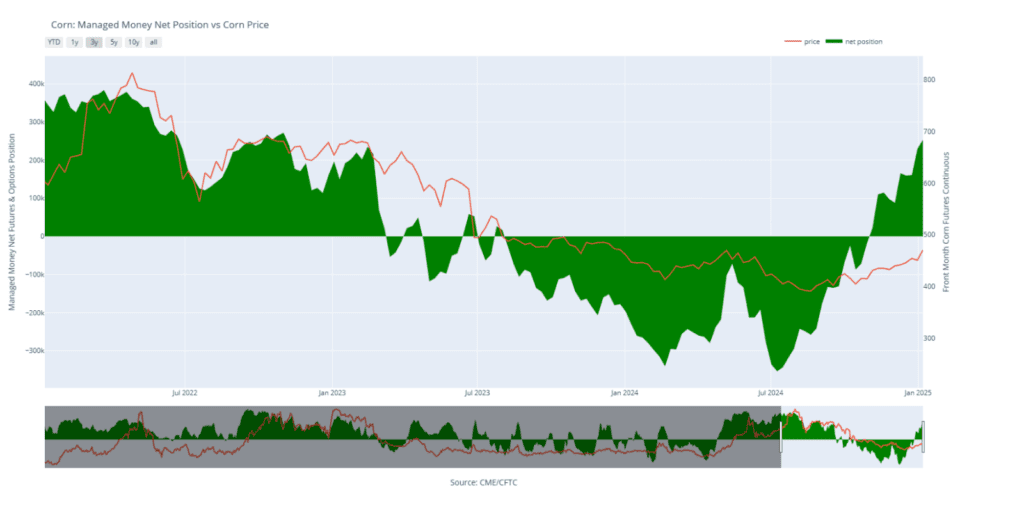

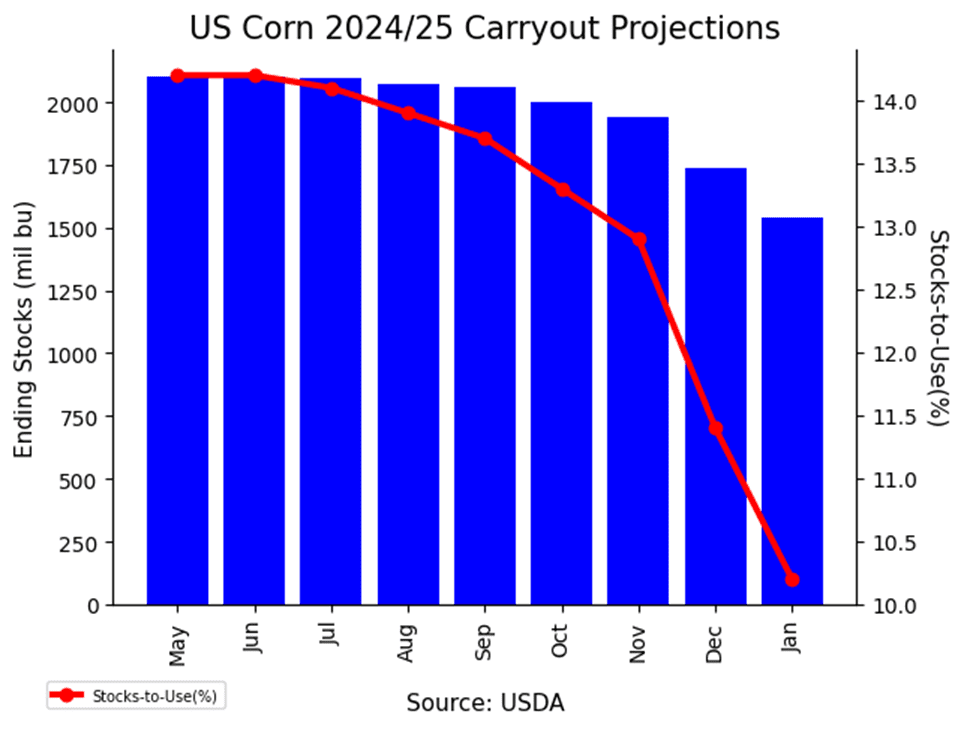

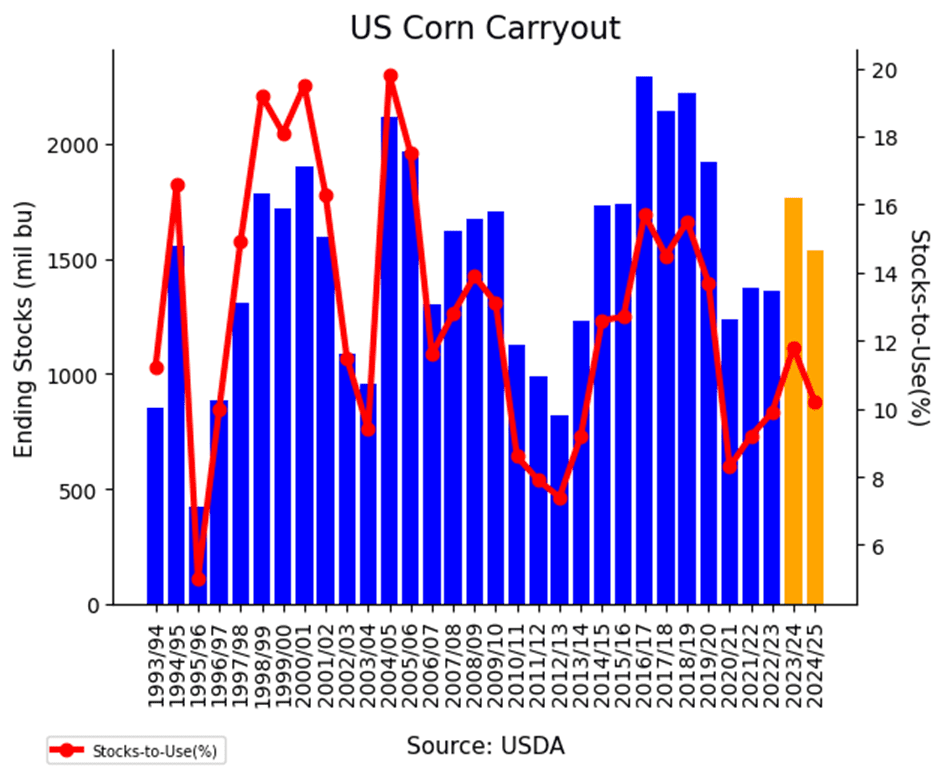

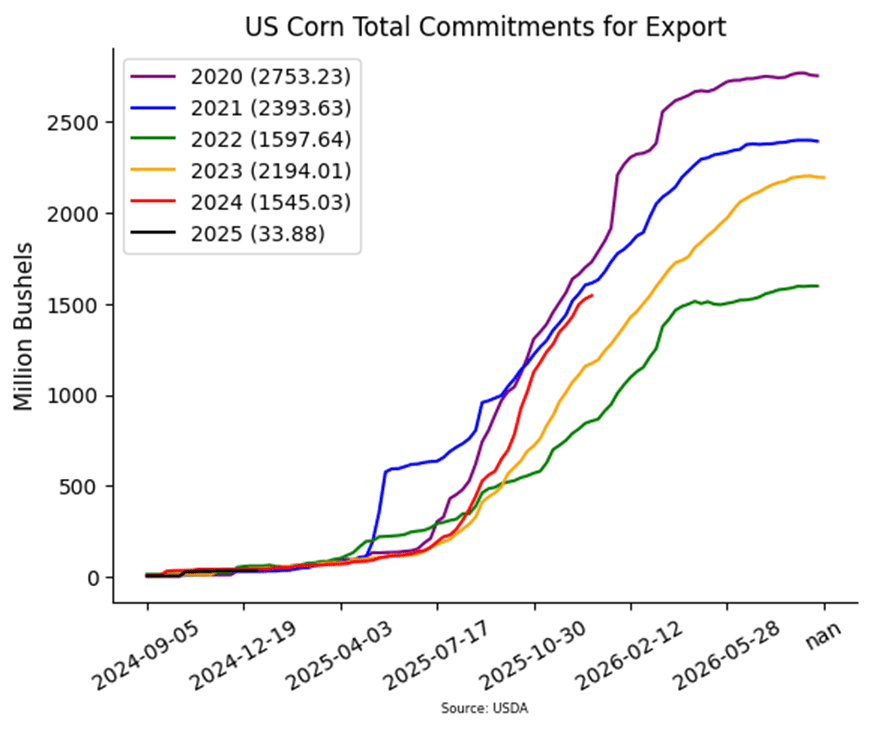

- Corn is trading steady to two cents higher this morning in a quiet overnight session. March corn ranged from 474 to 477 overnight, while December corn traded between 455 and 457.50.

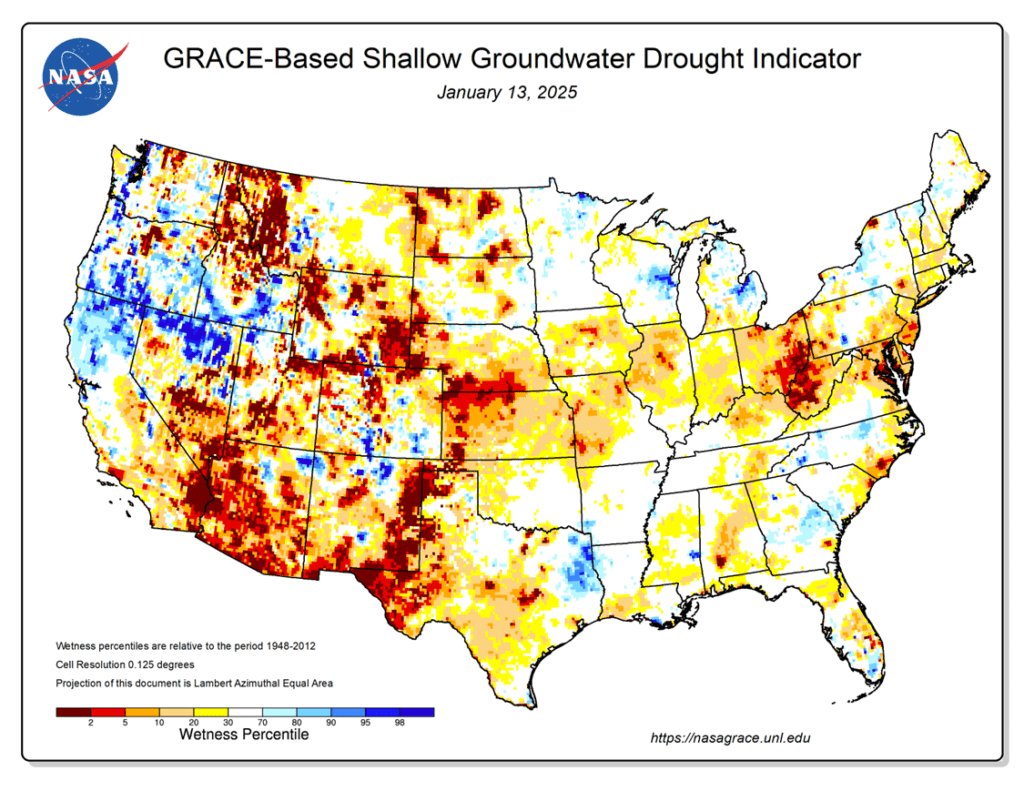

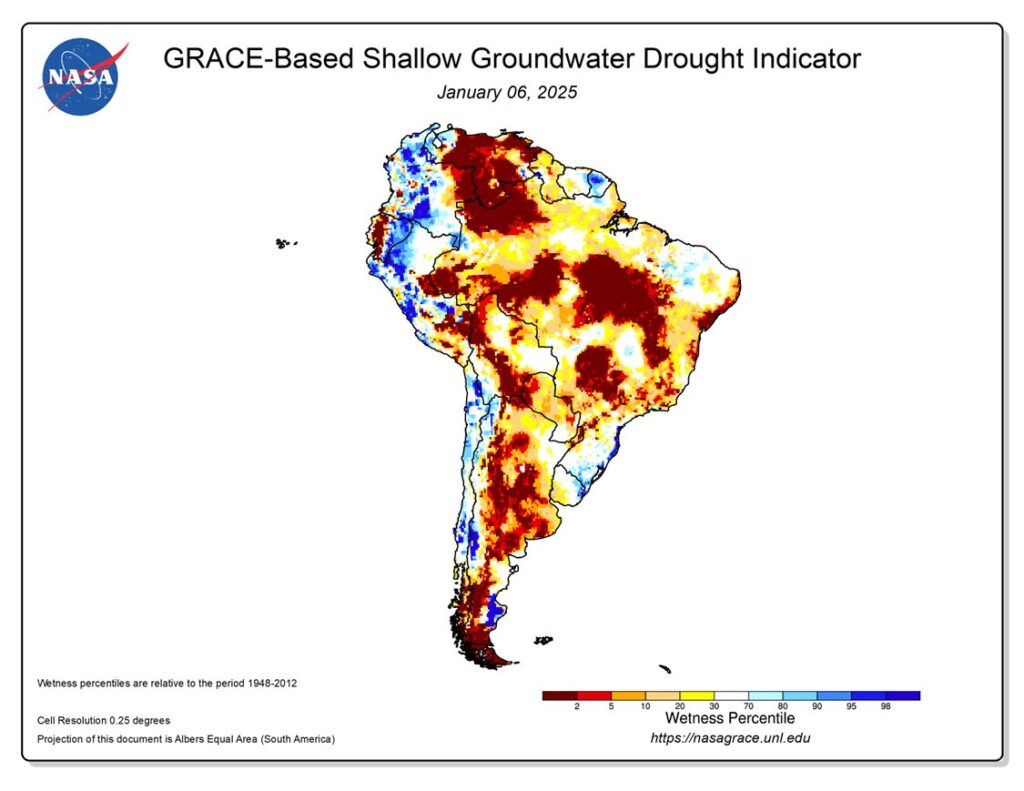

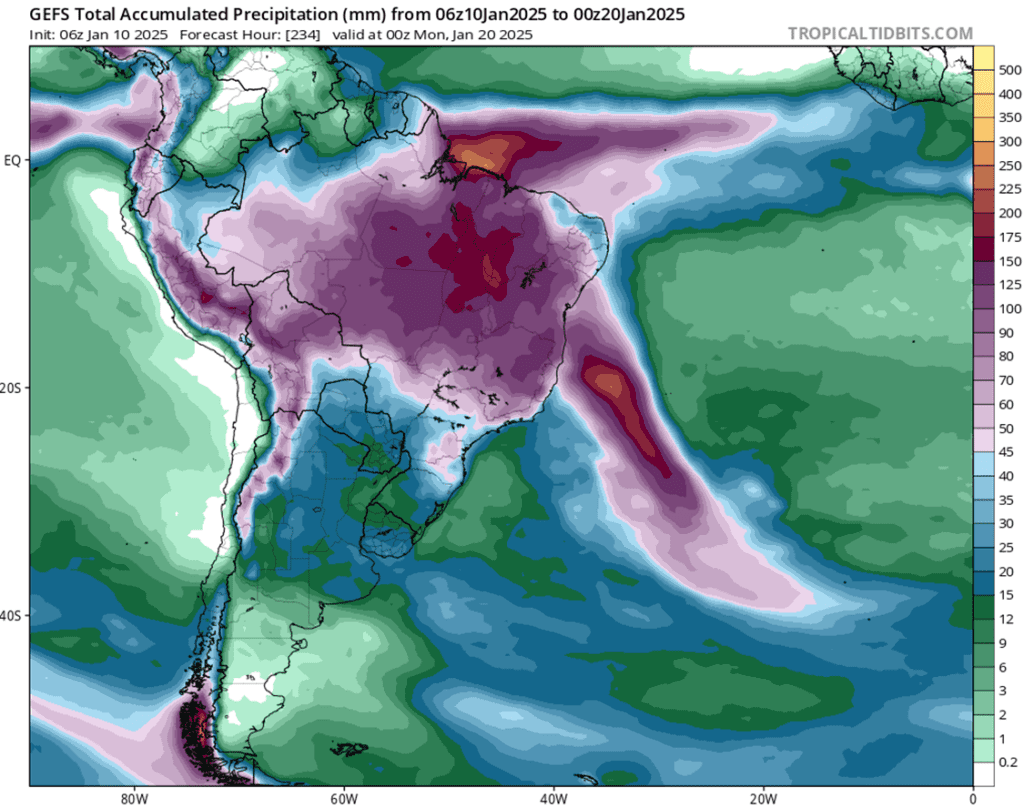

- In southern Brazil, the harvest of the first-crop corn and the planting of the second-crop safrinha corn have begun. The state of Paraná reported that 1% of the first-crop corn has been harvested, and 2% of the safrinha corn has been planted. Despite some drier areas, first-crop yields are generally expected to be good.

- In Argentina, corn planting is approximately 92% complete. Early crop ratings are mixed, with 58% of the crop rated as fair to very poor, while 42% is rated good to excellent.

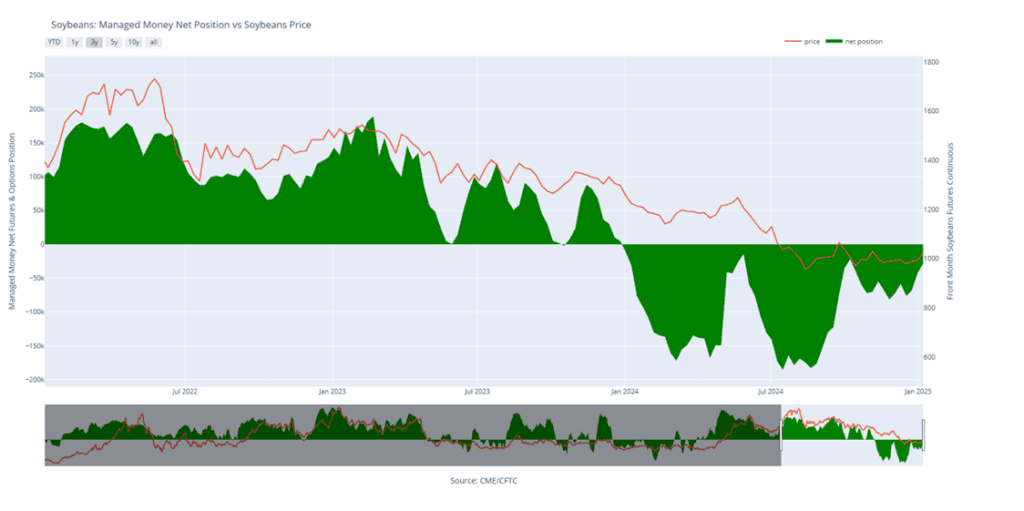

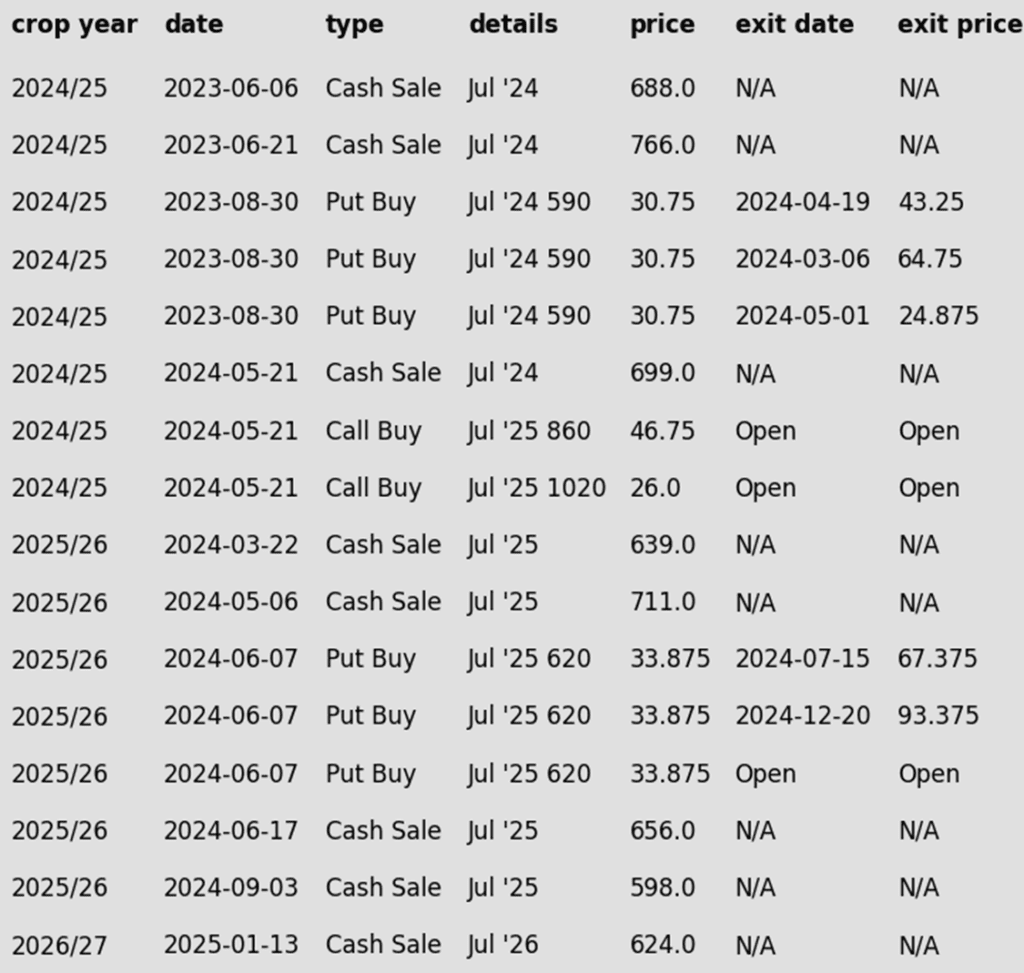

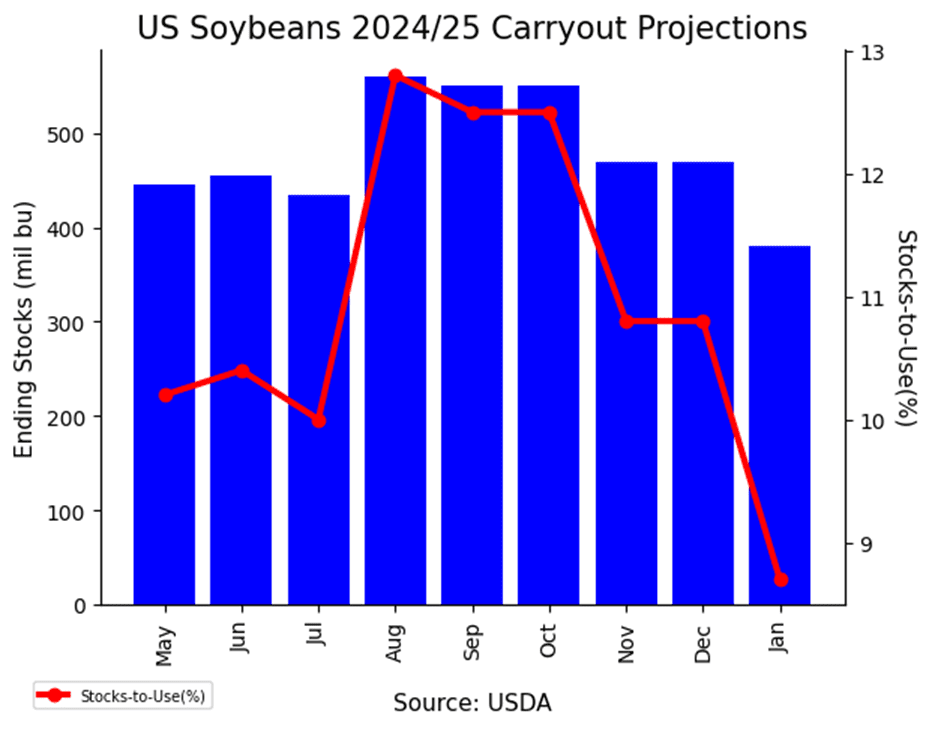

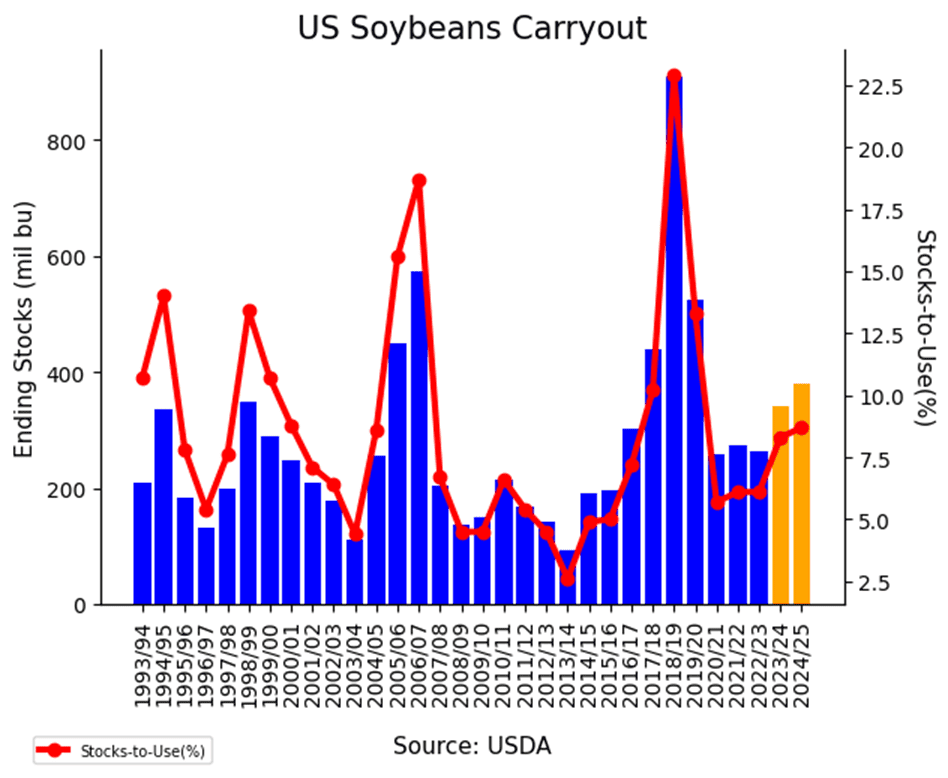

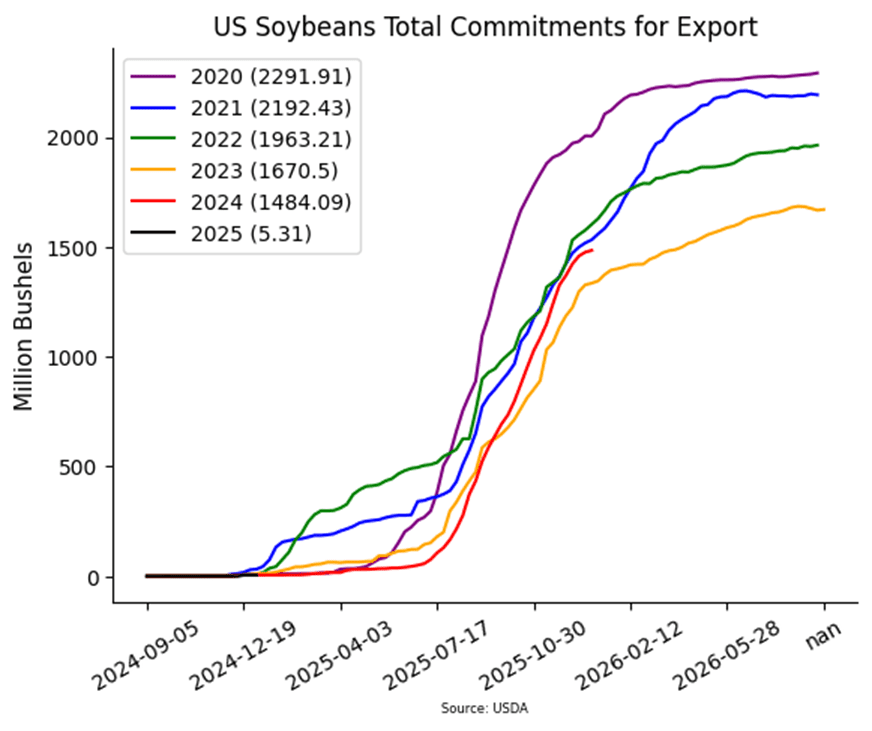

- Soybeans are mixed, trading between a penny higher to a penny lower. The March contract traded overnight between 1044 and 1051.25, while the November contract ranged from 1045.25 to 1052.50. Soybean meal and oil are mixed: meal is up by one to two dollars, while soybean oil is down about half a percent.

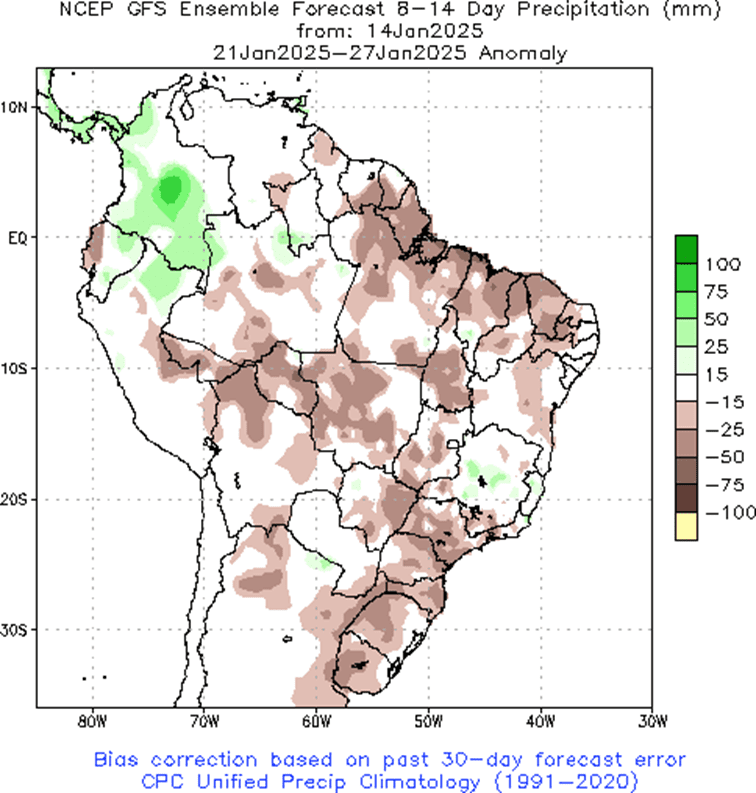

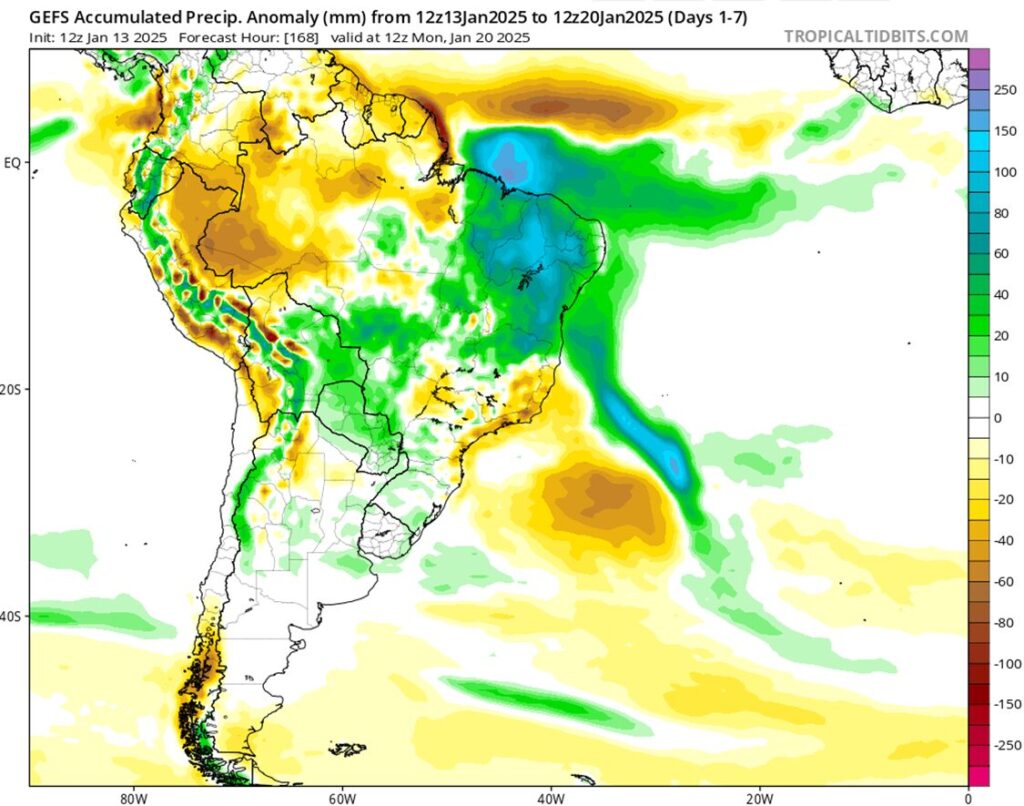

- Expectations for Brazil’s soybean crop have been lowered slightly, with one analyst reducing their estimate by 1 million tons to 170 million. Rainfall over the past week favored northern and eastern Brazil, while southern Brazil experienced mostly dry conditions. The forecast shows favorable rain prospects for northern Brazil, with increased chances of rainfall in southern Brazil later this week and into next week.

- In Argentina, soybean planting is approximately 97% complete. Early crop ratings are mixed, with 51% rated as fair to very poor, while 49% are rated good to excellent.

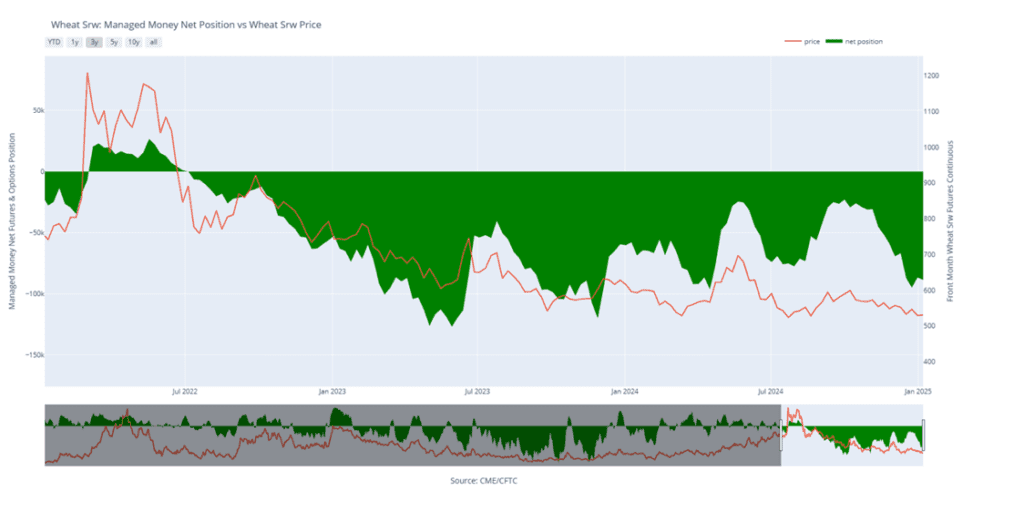

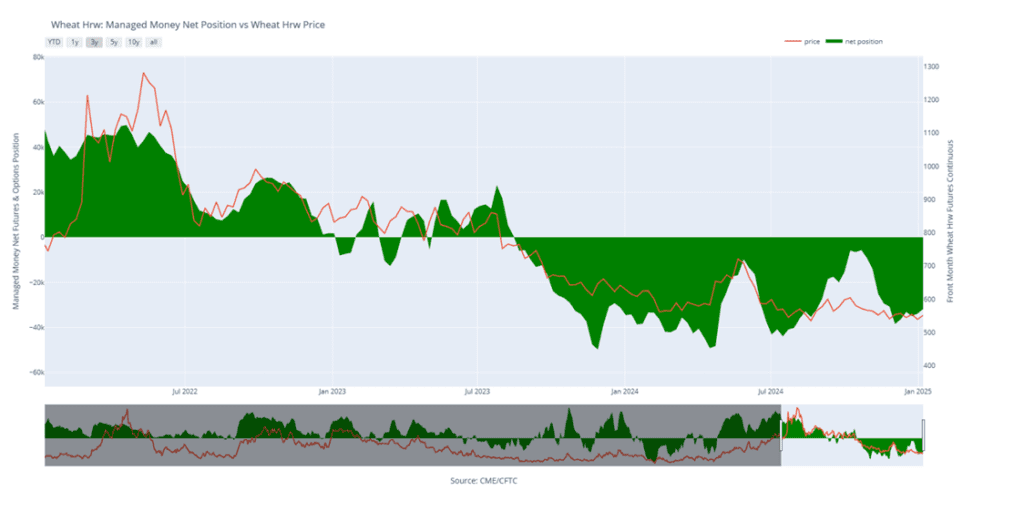

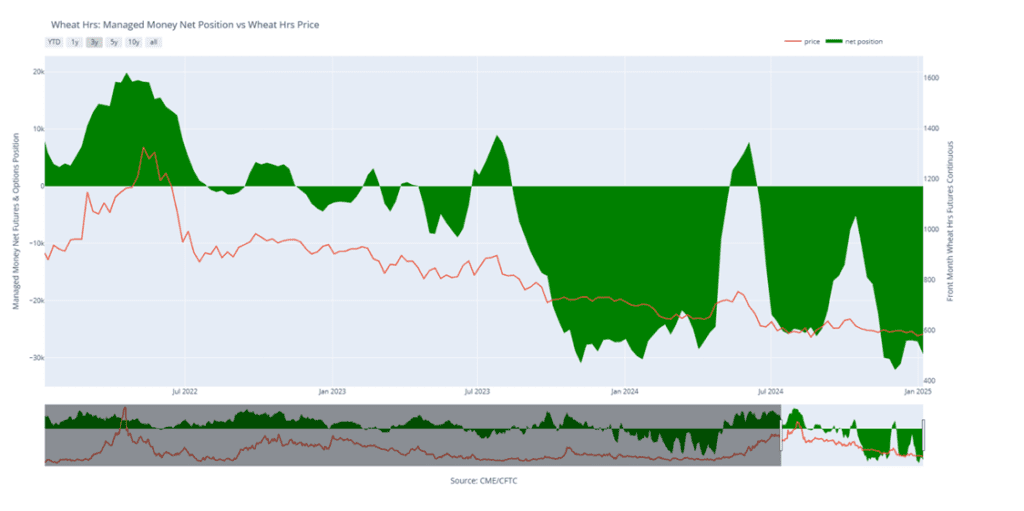

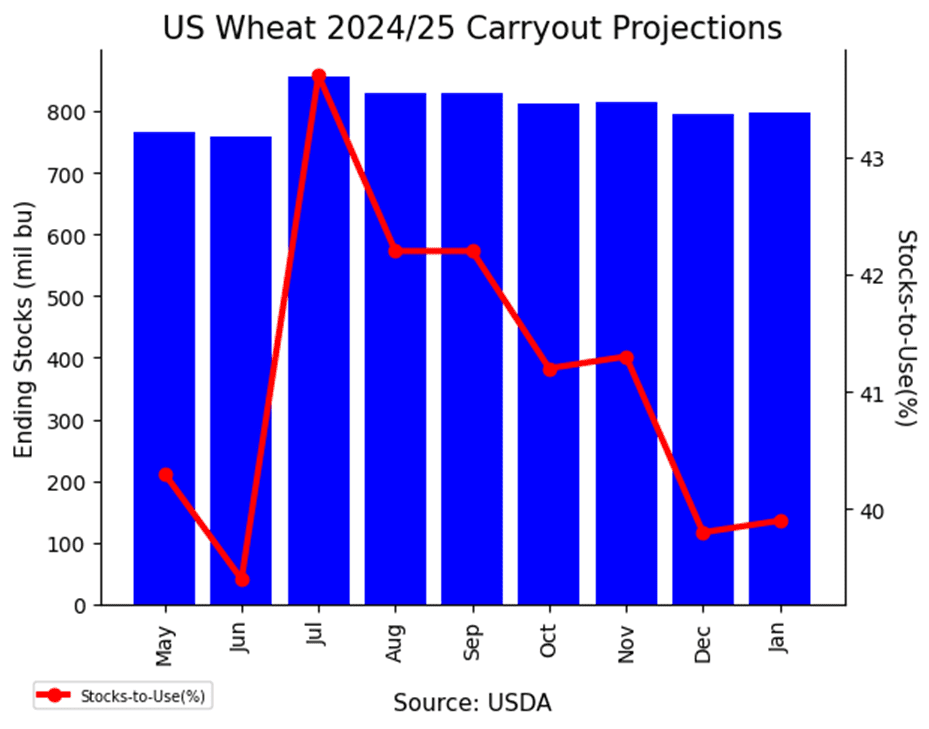

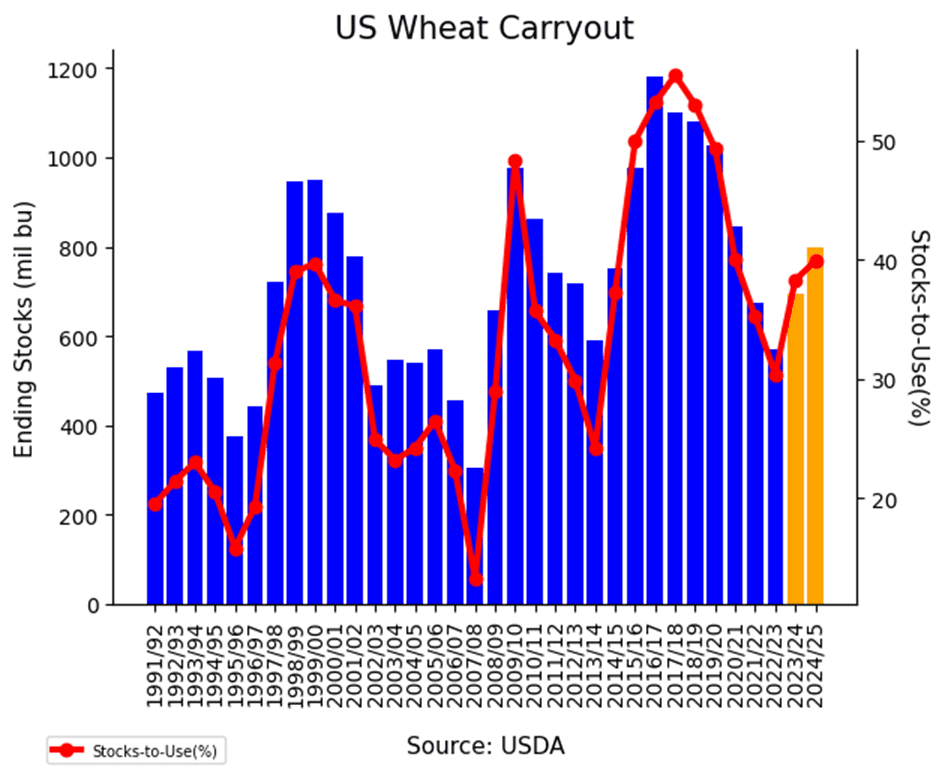

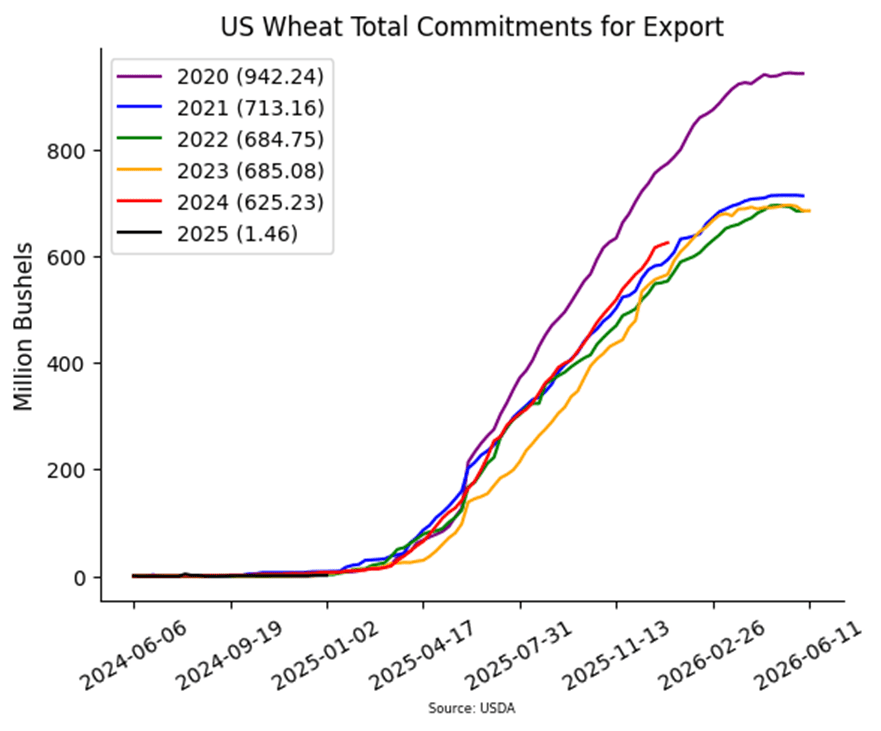

- Wheat is trading lower this morning, with overnight trading ranges of four to eight cents.

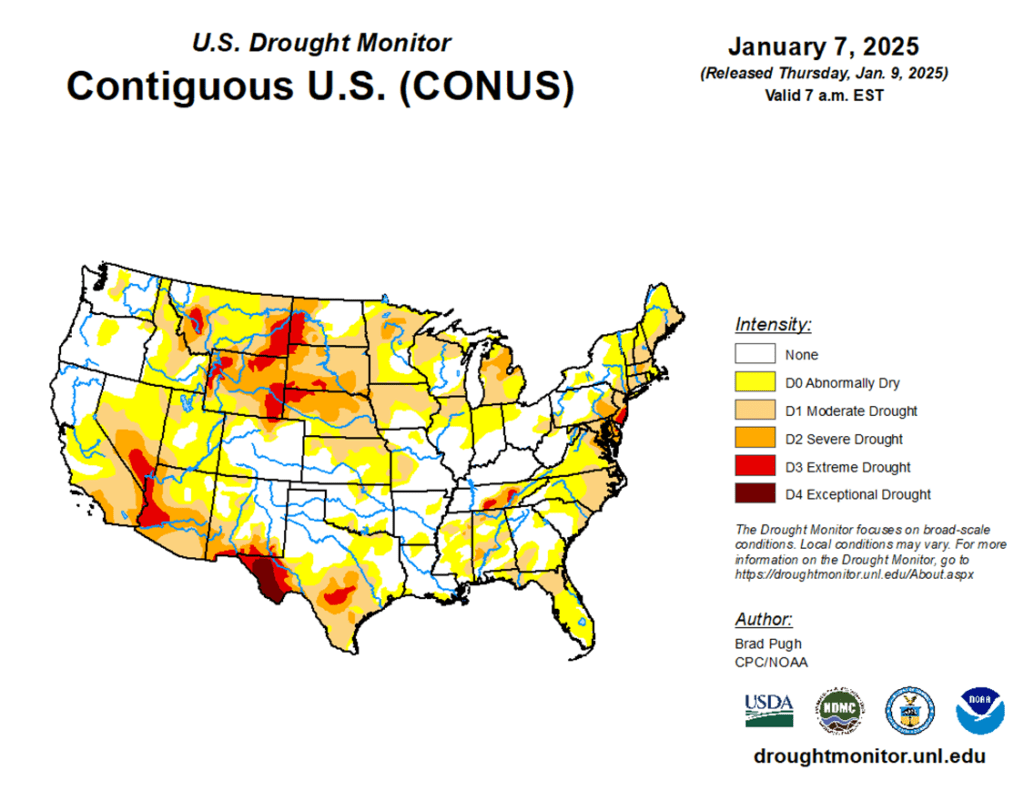

- The wheat market continues to underperform compared to corn and soybeans, with the U.S. dollar remaining a significant headwind for wheat prices. Despite a 70-basis-point decline yesterday, the dollar index is still up 9% from its September low of 99.86.

- Japan has issued a tender for 132,888 metric tons of wheat, with 48,308 metric tons allocated to the U.S.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.