10-13 Midday: Grain Markets Mixed: Soybeans and Wheat Up, Corn Under Pressure

Grain Market Insider Interactive Quote Board

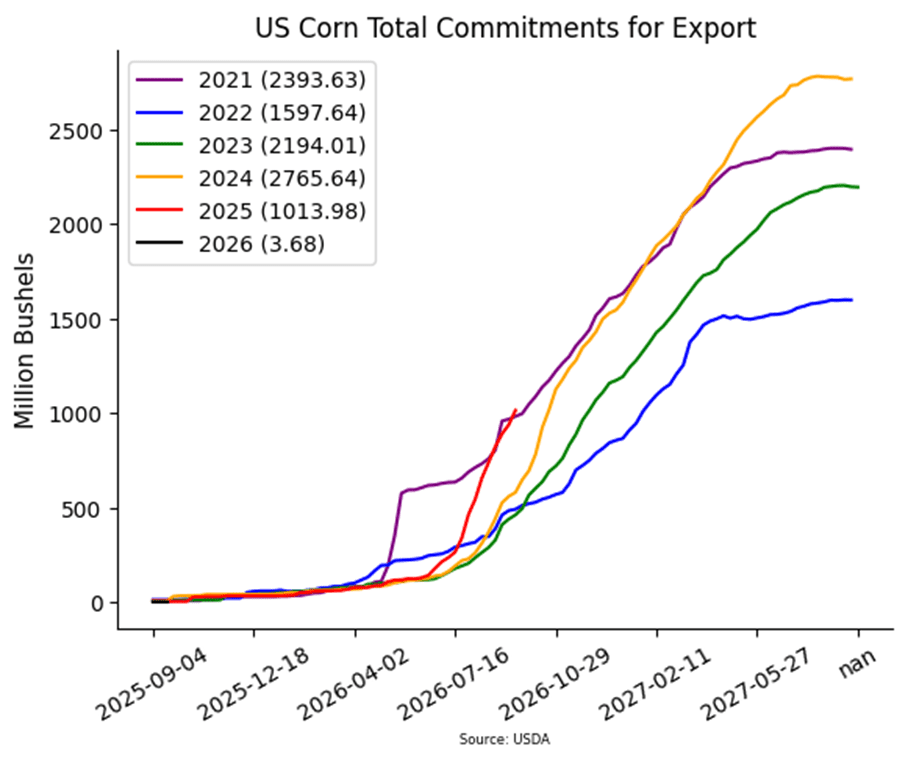

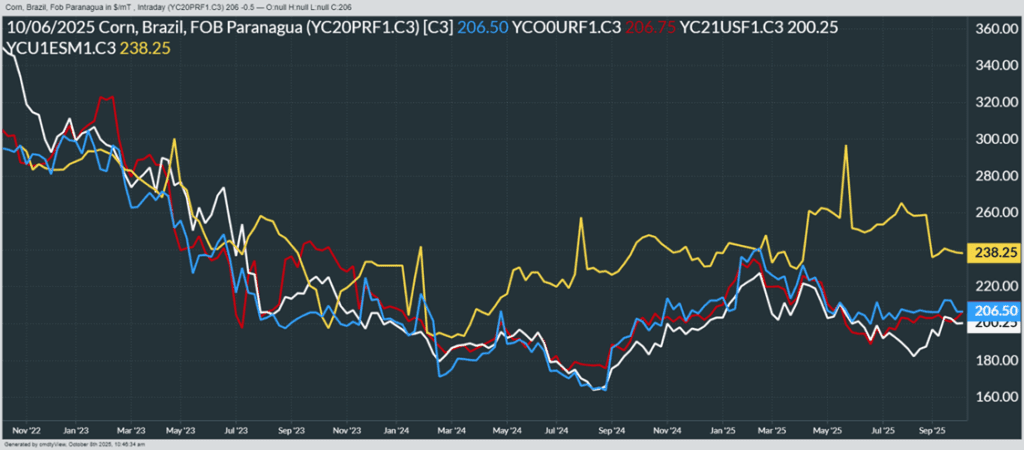

- Corn futures are trading lower to start the week, following Friday’s market reaction to President Trump’s announcement that he saw no reason to meet with China. While the news had a larger impact on soybeans, it also pressured corn, triggering heavy fund selling of approximately 19,500 contracts. Corn open interest rose by more than 22,000 contracts, indicating that new shorts were active in pushing prices lower.

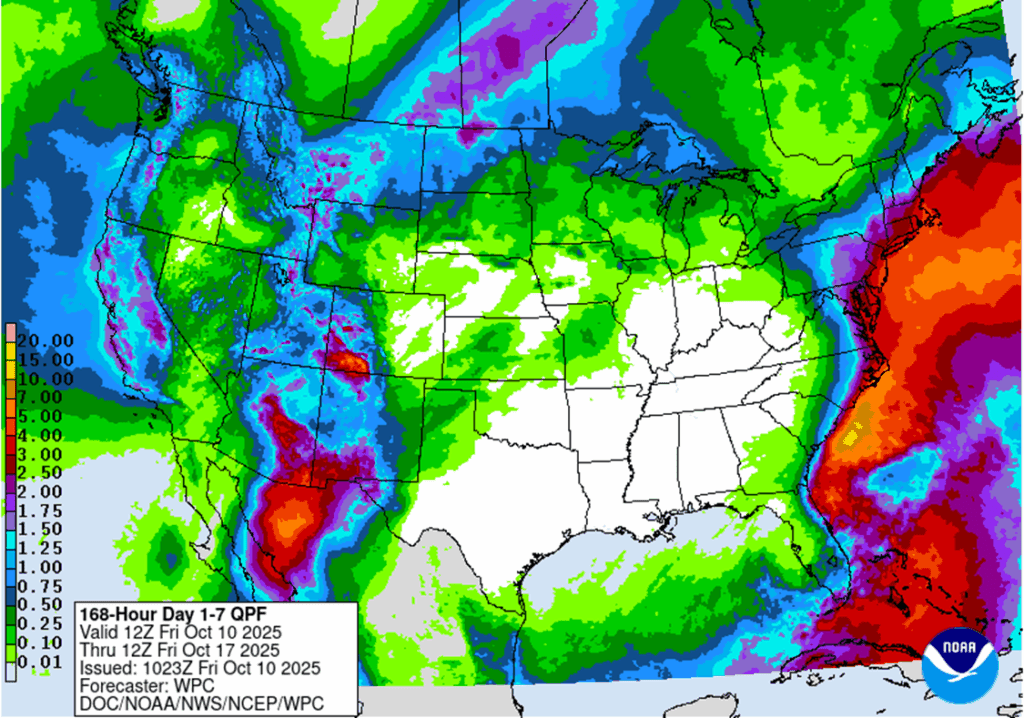

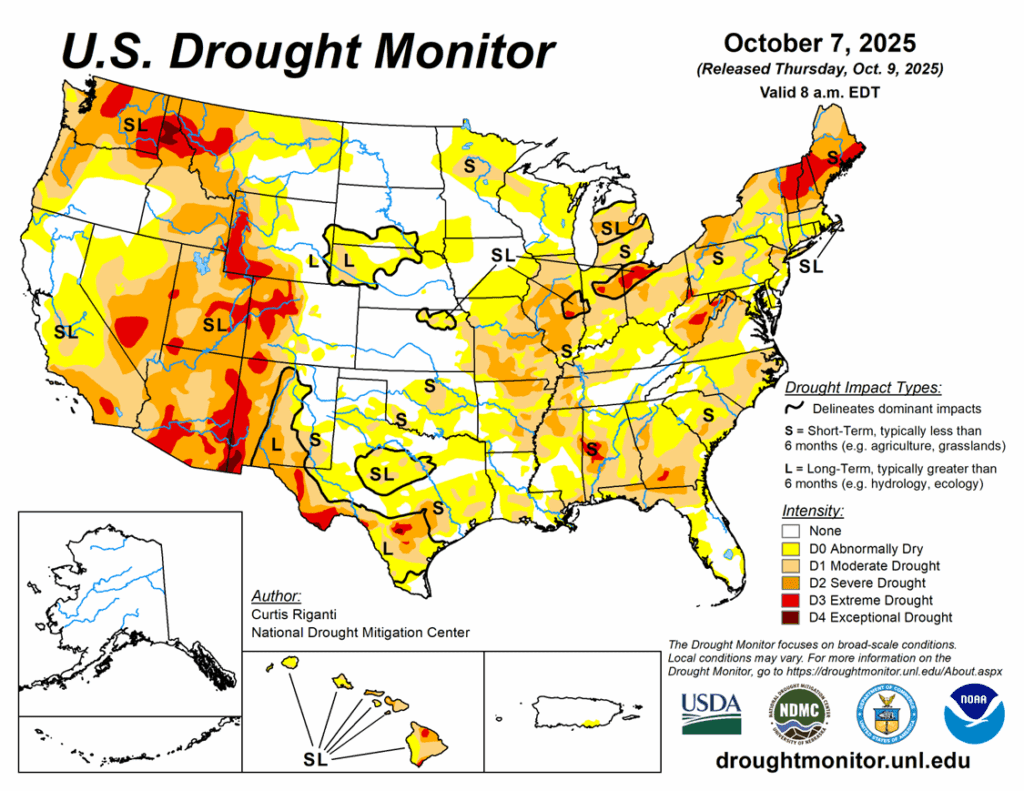

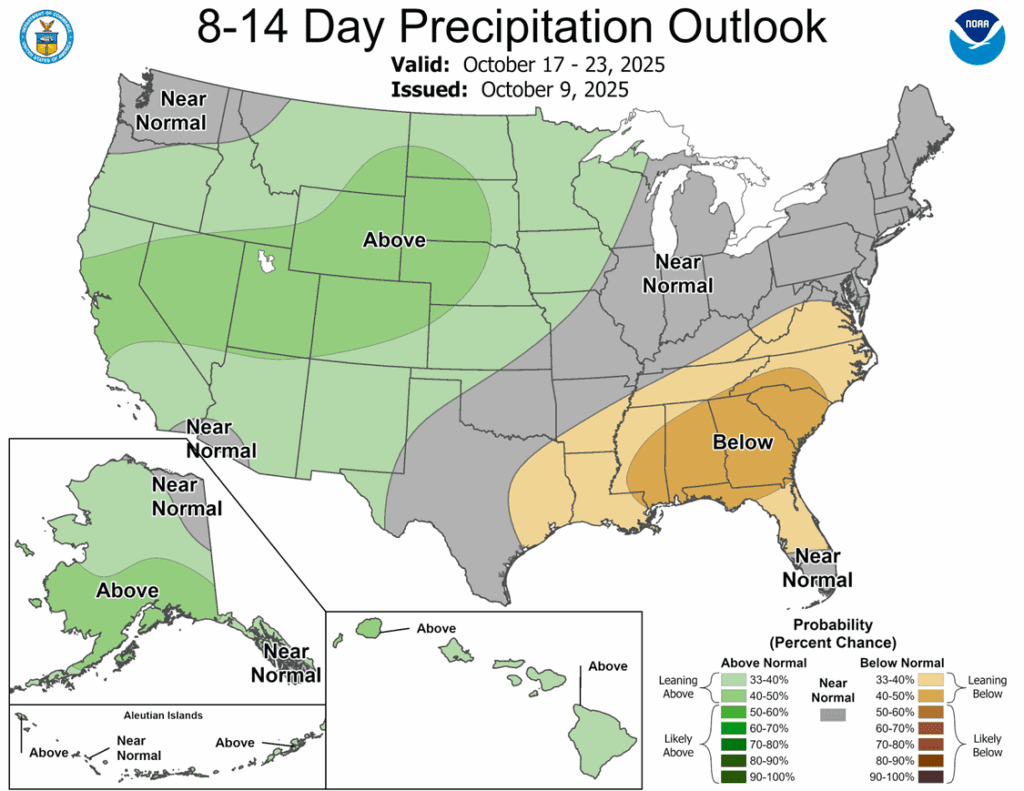

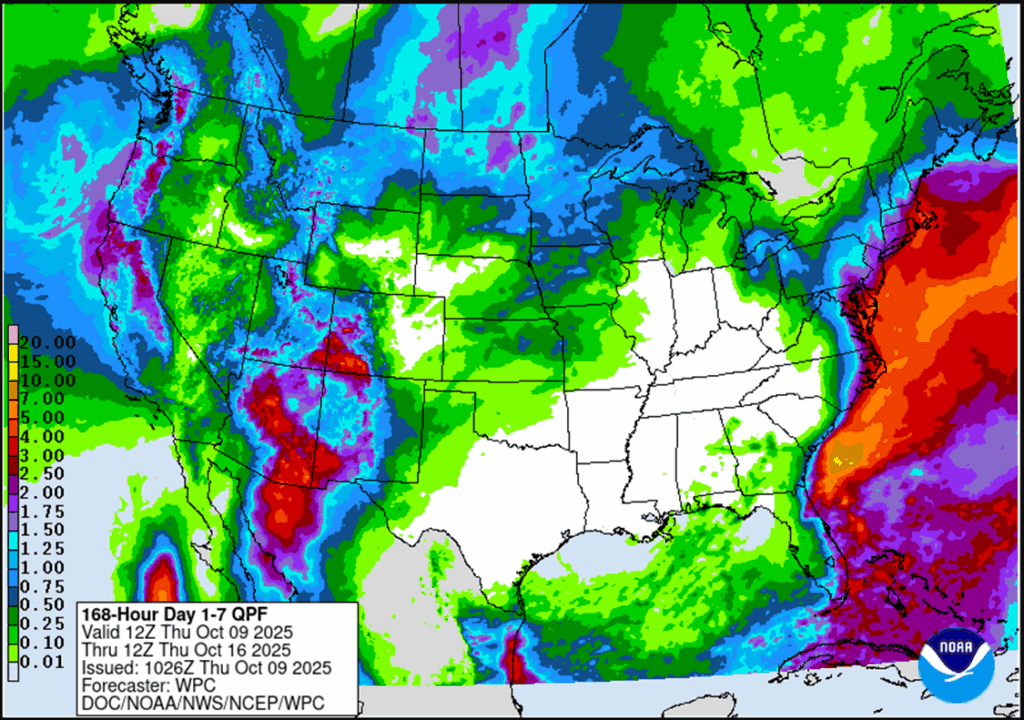

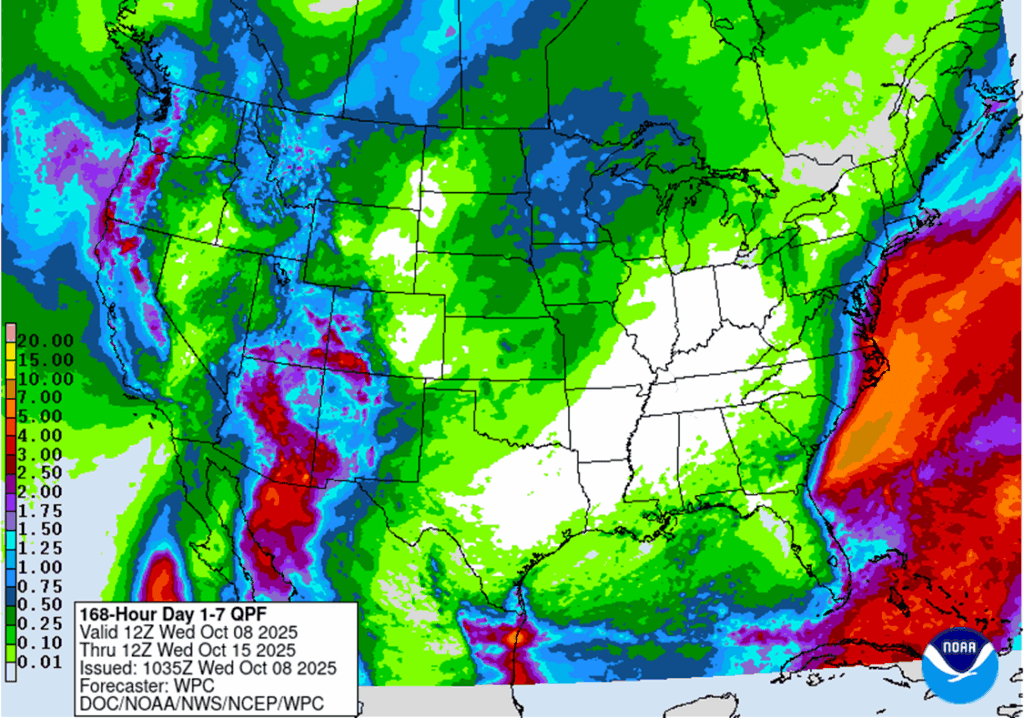

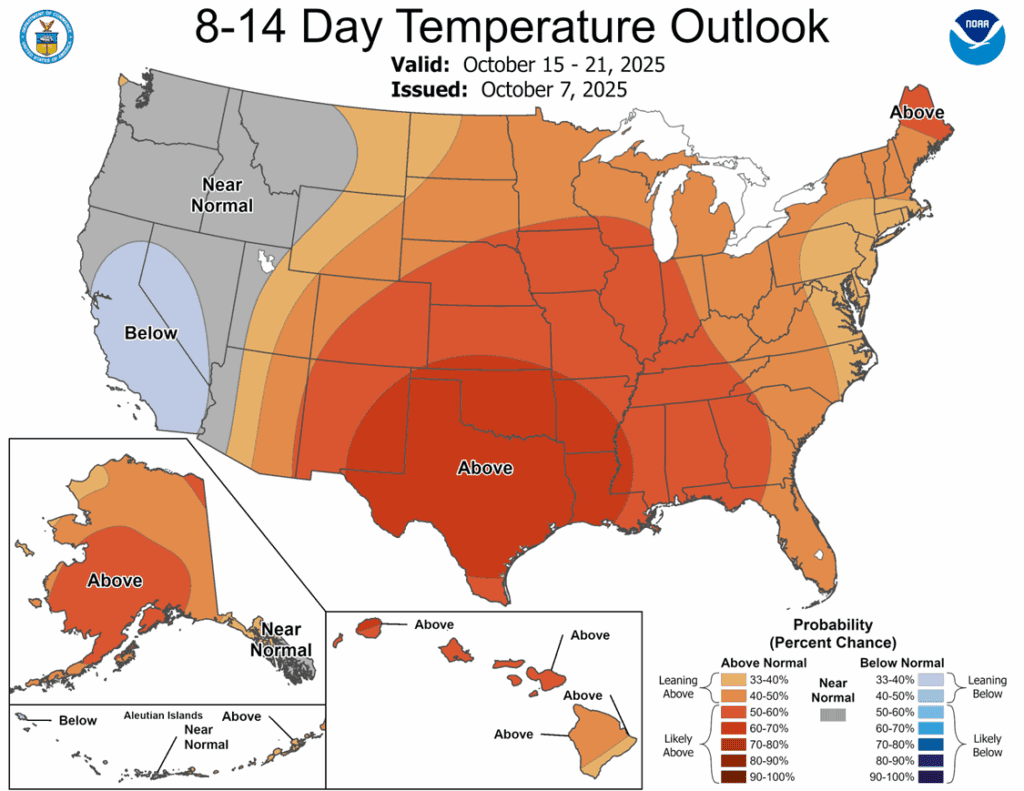

- The U.S. corn harvest is estimated at 45–50% complete. The pace is expected to slow later this week as scattered showers move into the western Corn Belt and spread eastward, with the 6–10 day forecast showing above-normal precipitation for the eastern Belt.

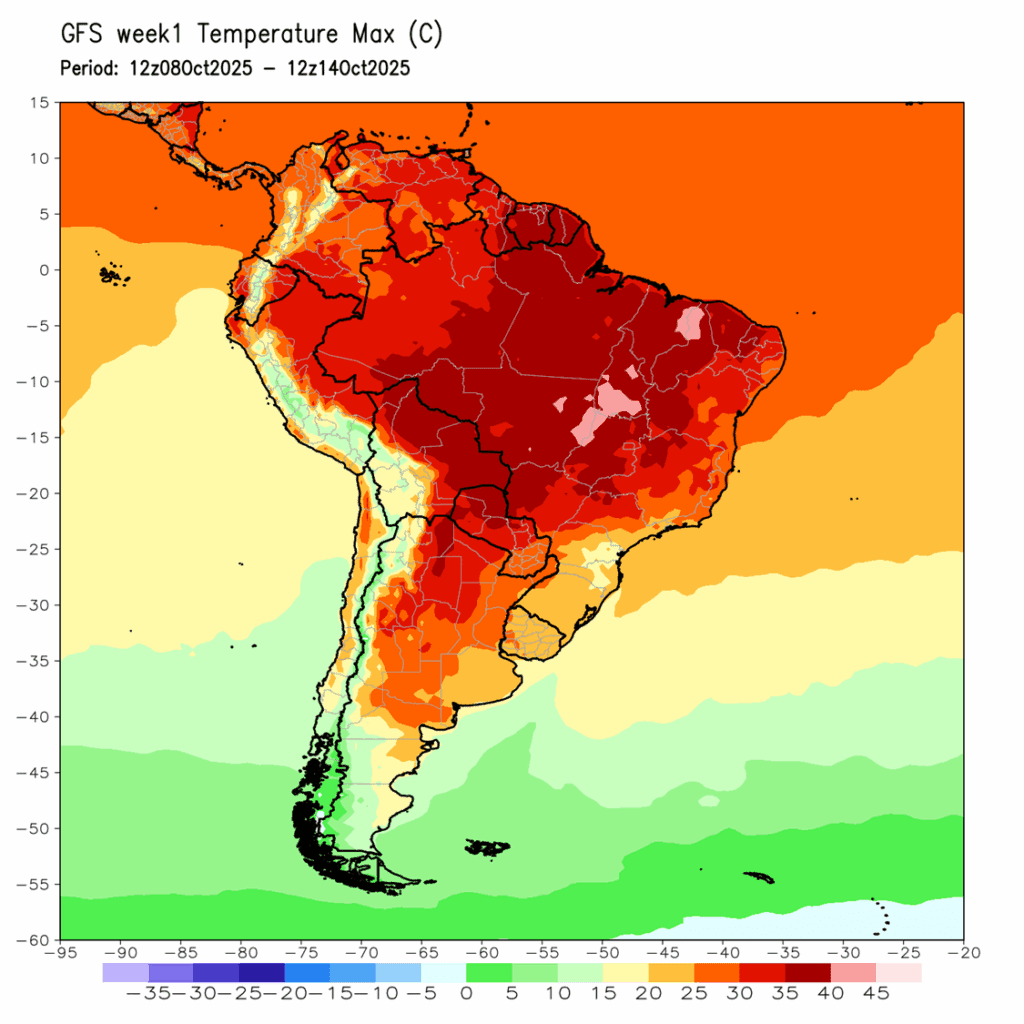

- Brazil’s CONAB will release its 2025/26 estimates tomorrow. Planted area is expected to rise to 22.8 million hectares, up from 21.9 million last season, while production is anticipated at 141.3 million metric tons, compared with 139.7 million last year.

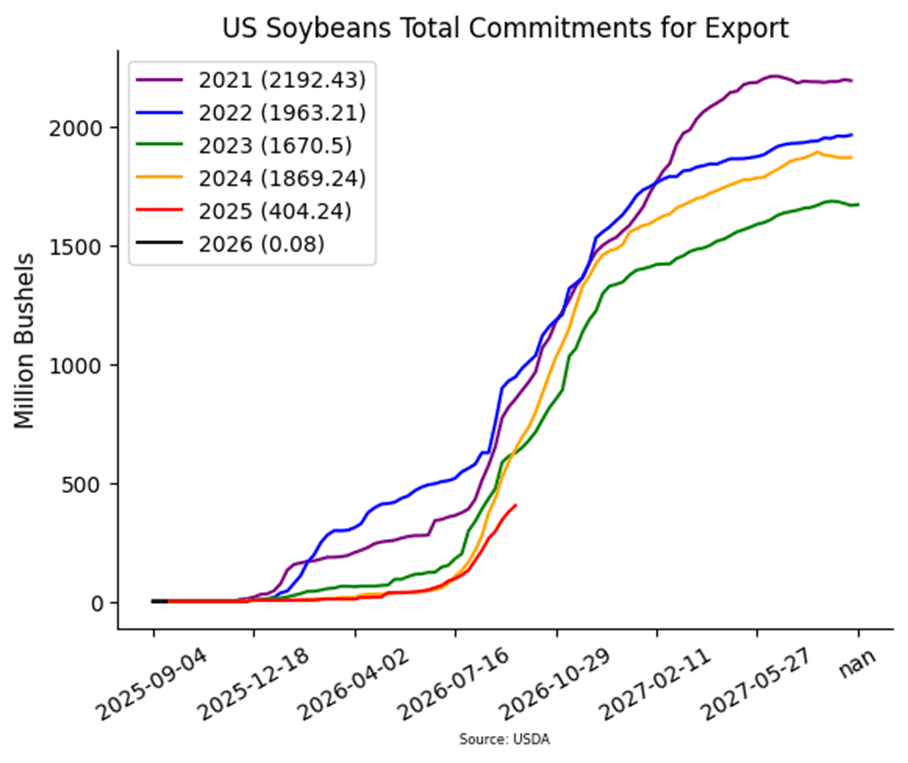

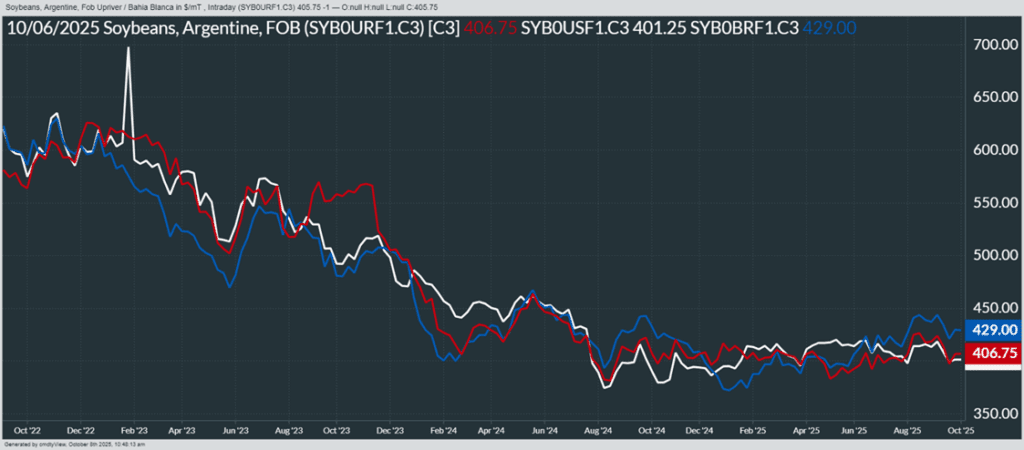

- Soybean futures are trading higher at midday, posting modest gains as the market rebounds from Friday’s decline. Prices are recovering after President Trump’s announcement this morning that trade talks with China remain on track for early November. This follows his earlier statement on Friday, suggesting there was no reason to meet with China at that time. Meanwhile, soybean meal is posting slight losses, while soybeans and soybean oil are both seeing modest gains.

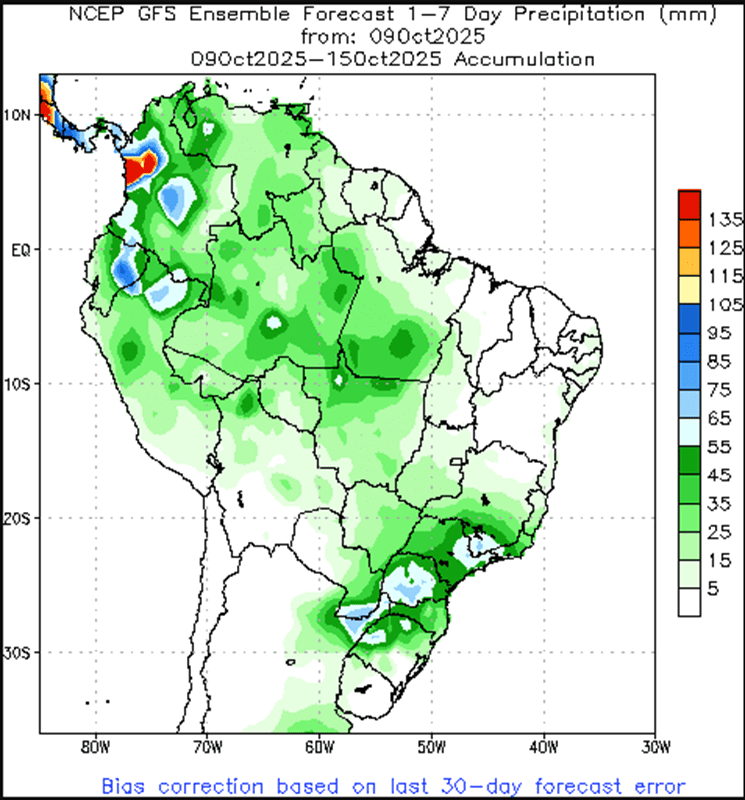

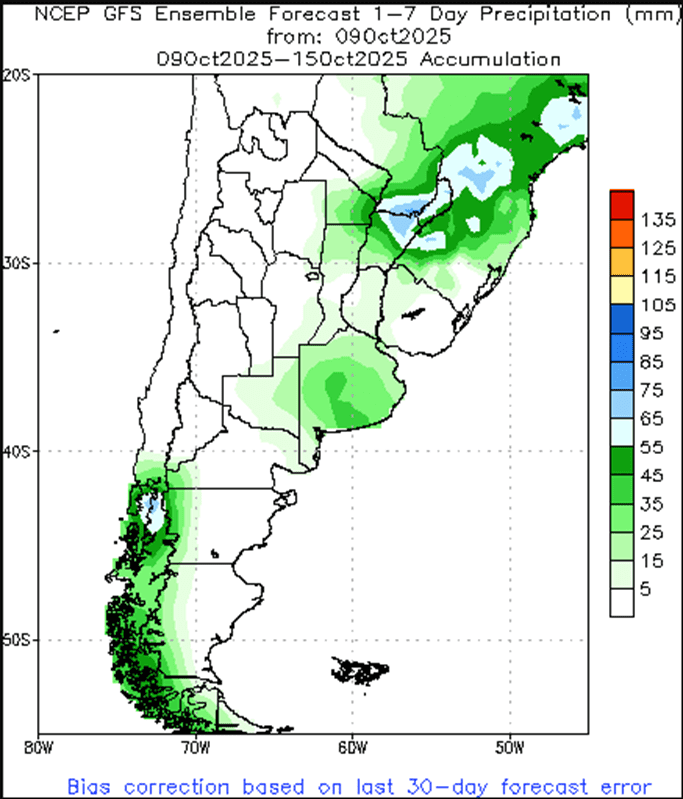

- Patria reports that Brazil’s soybean planting is 12.48% complete, well ahead of 5.28% at the same time last year. Scattered rains are expected across parts of Brazil this week, which should improve soil moisture conditions and support further planting progress.

- There will be no U.S. government data released today, but Brazil’s CONAB is set to publish its first outlook for the 2025/26 crop tomorrow morning. The agency is expected to project planted area at 49.1 million hectares, up from 47.4 million last season, with production forecast at 179 million metric tons compared to 171.5 million last year.

- The U.S. soybean harvest is estimated to be around 65–70% complete. However, scattered rains across the western Corn Belt this week may slow harvest activity, with additional rainfall expected to move into the eastern Belt heading into the weekend.

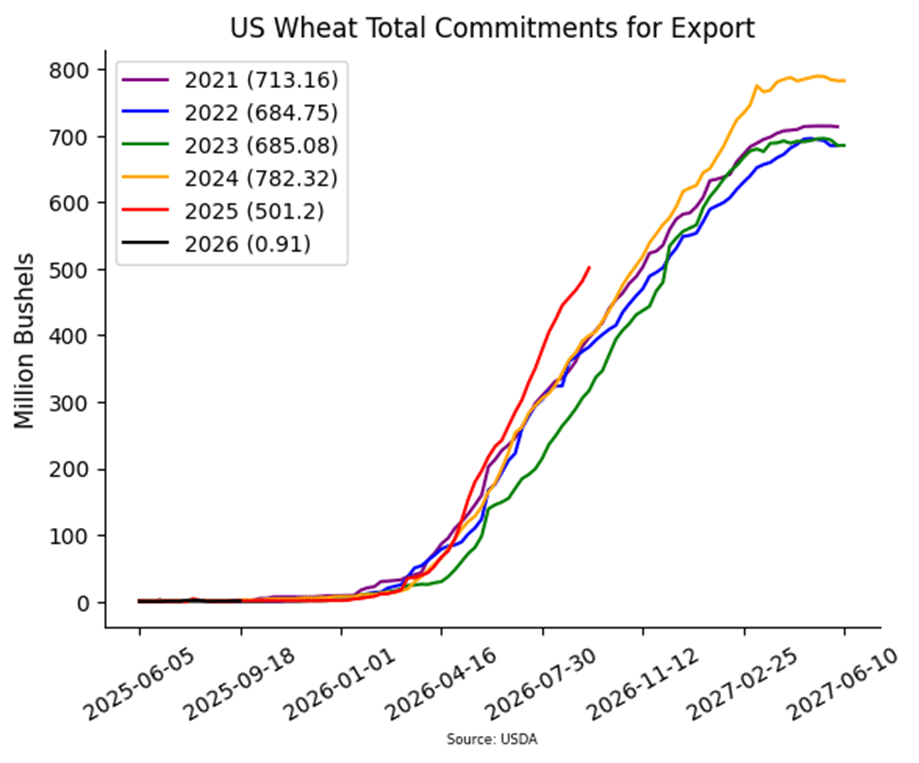

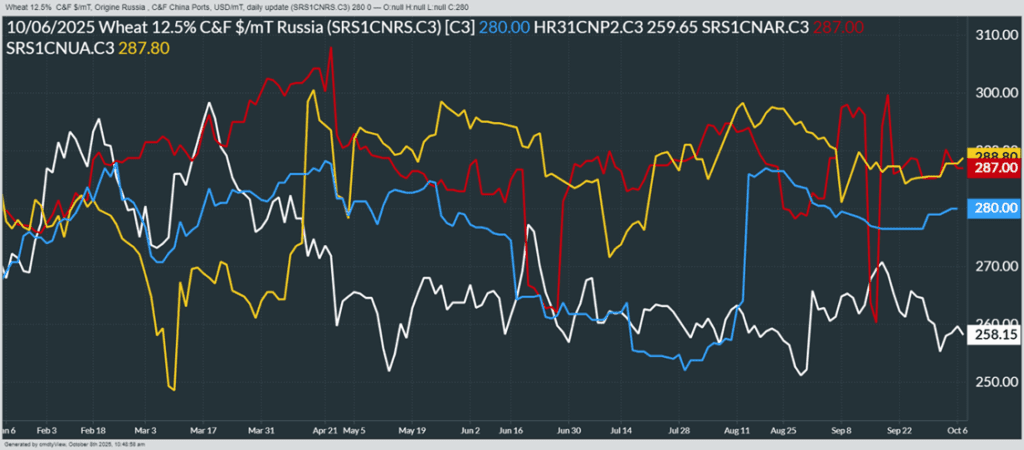

- Wheat futures are trading higher at midday despite reports of increased Russian production. Traders remain optimistic following President Trump’s statement that U.S.–China trade talks are on track for early November.

- Open interest in wheat rose by nearly 15,000 contracts on the decline, suggesting that new sellers were confident in driving the market to fresh lows.

- Wheat continues to struggle, with global supplies remaining ample and U.S. ending stocks weighing heavily on the market.

- The Russian wheat export pace is accelerating this month, with estimates of 5.0 million tons shipped, up from 4.6 million in September. However, exports for the July–September period are down 30% compared to the same period last year.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.