01-24 Opening Update: Grains Trading Lower Following Yesterday’s Rally

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’25 | 484.25 | -5.5 |

| JUL ’25 | 496.25 | -4.5 |

| DEC ’25 | 461.75 | -2.5 |

|

Soybeans |

||

| MAR ’25 | 1051.5 | -14 |

| JUL ’25 | 1075.5 | -13 |

| NOV ’25 | 1043.5 | -9.75 |

|

Chicago Wheat |

||

| MAR ’25 | 547.5 | -6.5 |

| JUL ’25 | 571.75 | -6.5 |

| JUL ’26 | 632.25 | 0 |

|

K.C. Wheat |

||

| MAR ’25 | 563.5 | -7.25 |

| JUL ’25 | 582 | -7.75 |

| JUL ’26 | 630 | 0 |

|

Mpls Wheat |

||

| MAR ’25 | 598 | -6.5 |

| JUL ’25 | 618.75 | -6 |

| SEP ’25 | 629.75 | -5 |

|

S&P 500 |

||

| MAR ’25 | 6146.75 | -5.25 |

|

Crude Oil |

||

| MAR ’25 | 75.05 | 0.43 |

|

Gold |

||

| APR ’25 | 2812.5 | 20.6 |

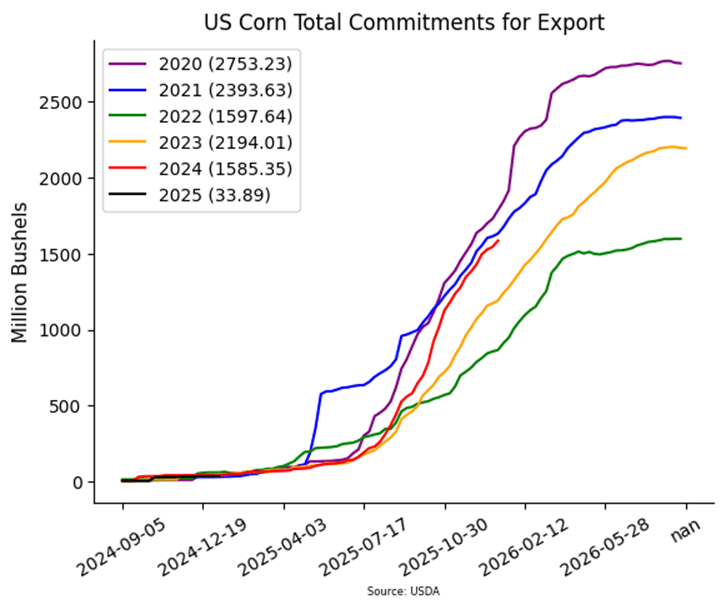

- Corn futures are trading lower this morning with the March contract giving back all of yesterday’s gains so far. Yesterday afternoon, Argentina reported it would lower its export duties on all grains to relieve the agricultural sector which is pressuring all grains.

- JFK Jr. has proposed a ban on high fructose corn syrup (HFCS) for human consumption—a move that could impact the U.S. corn market, which uses approximately 1.3–1.4 billion bushels of corn annually for HFCS production.

- Estimates for today’s export sales report see corn sales in a range between 700k and 1,700k tons with an average guess of 1,067k tons. This would compare to 1,025k a week ago and 992k a year ago.

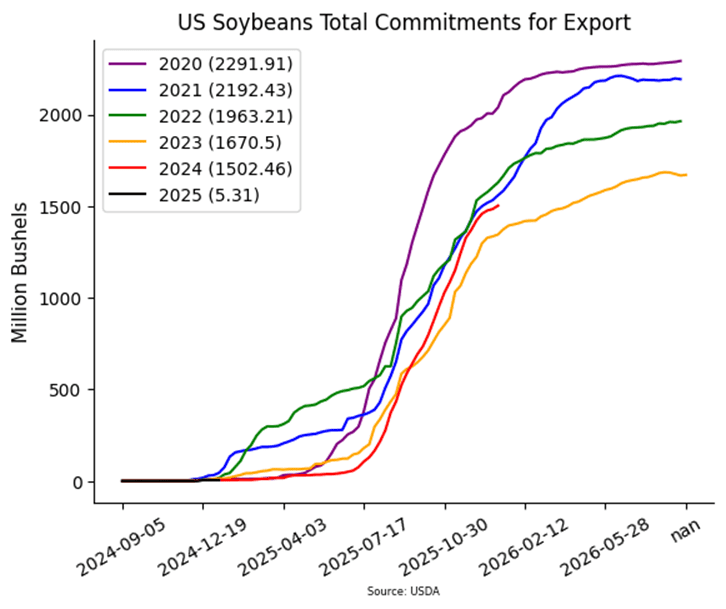

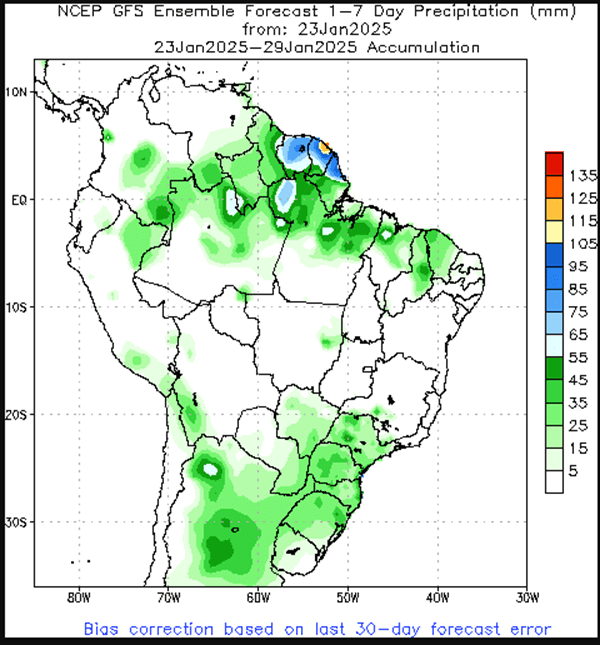

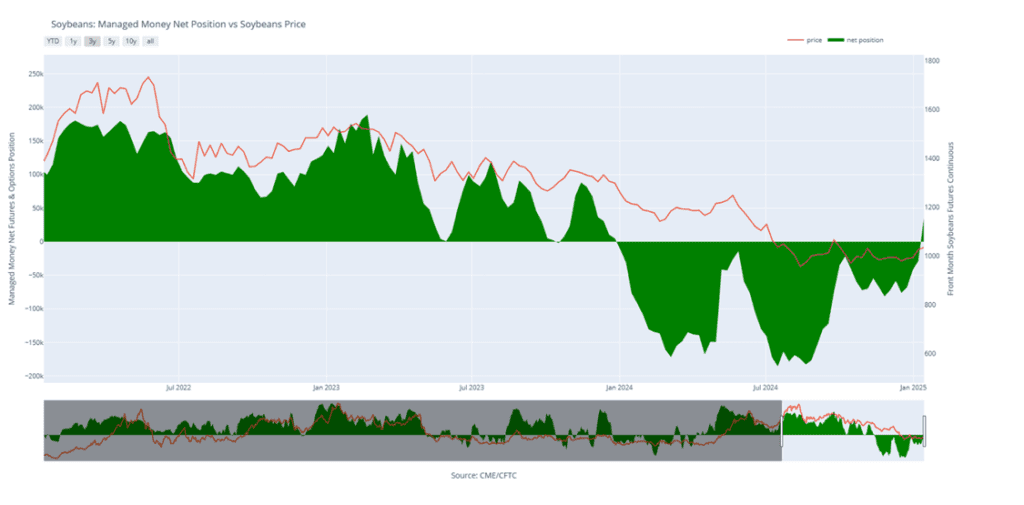

- Soybean futures are trading lower this morning giving back all of yesterday’s gains and then some following Argentina’s announcement that they would lower export duties on grains. Both soybean meal and oil are trading lower.

- President Trump is eyeing February 1 to impose a 10% tariff on Chinese imports. The commodities market is bracing for a rollercoaster ride as headlines flip between optimism and tension on the tariff front.

- Estimates for today’s export sales report see soybean sales in a range between 600k and 1,800k tons with an average guess of 1,067k tons. This would compare to last week’s 569k and 561k a year ago.

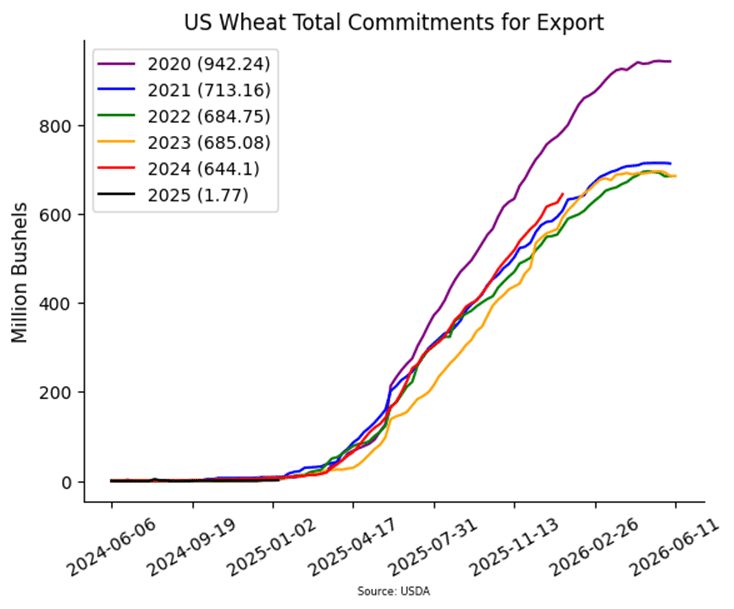

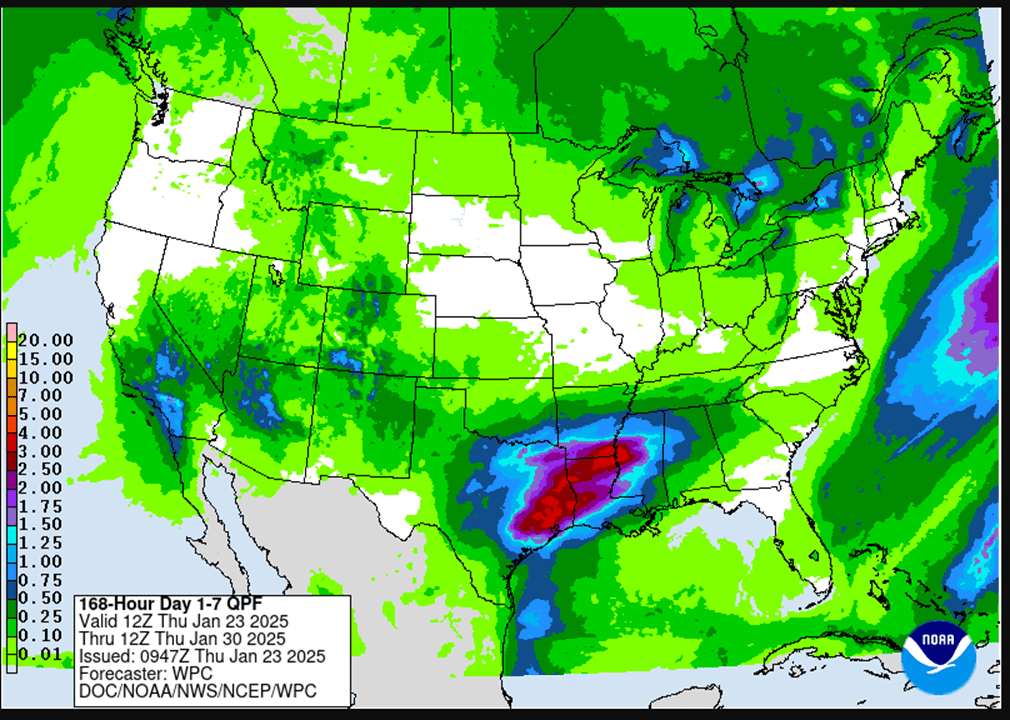

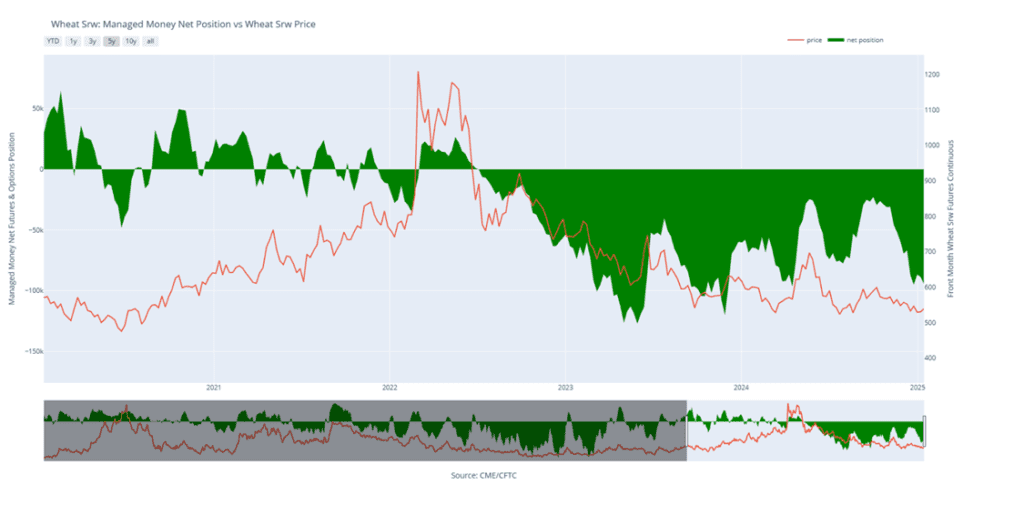

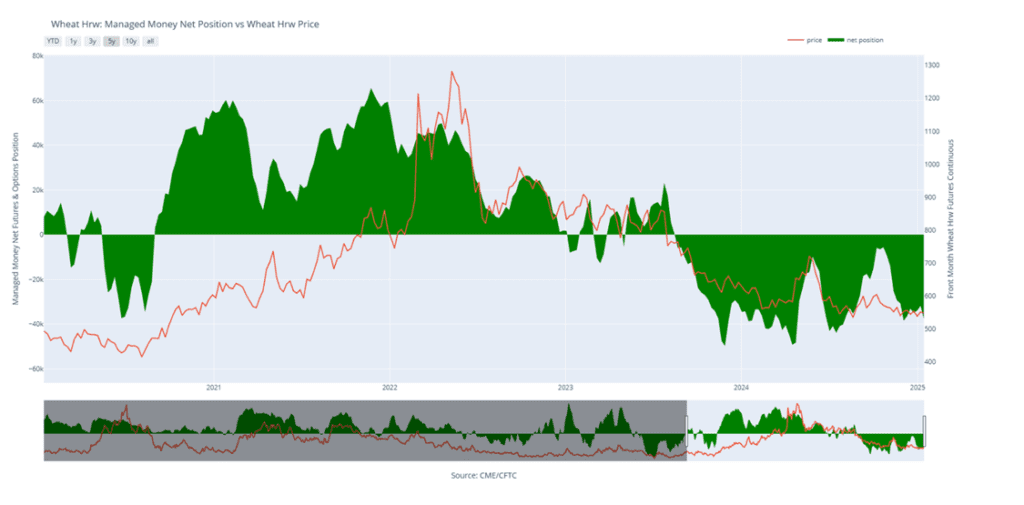

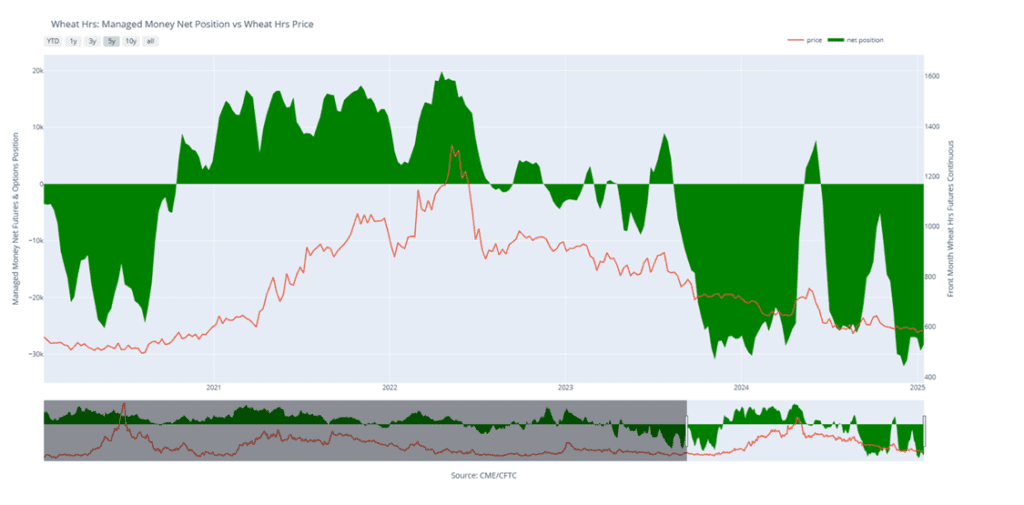

- All three wheat classes are trading lower this morning along with the rest of the grain complex. The move lower in grains comes despite a move lower in the dollar which tends to have an inverse relationship.

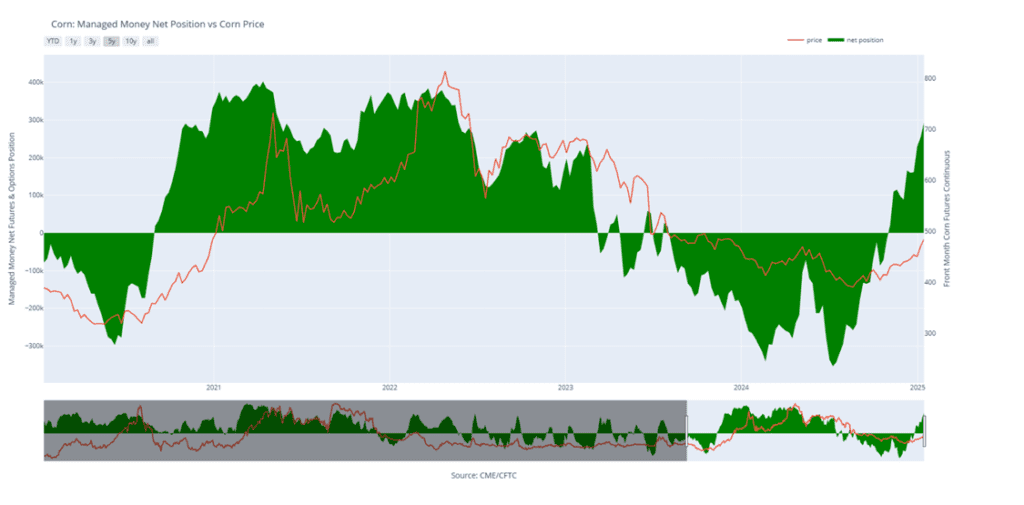

- While wheat continues to lag behind corn and soybeans, bulls point to the near-record gap between managed money’s net short position in wheat and its net long position in corn.

- Estimates for today’s export sales report see wheat sales in a range between 200k and 600k tons with an average guess of 425k tons. This would compare to 522k a week ago and 510k a year ago.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.