02-04 Opening Update: Corn Mixed, Soybeans and Wheat Lower to Start the Day

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’25 | 489.25 | 0.5 |

| JUL ’25 | 502 | -1.5 |

| DEC ’25 | 463.75 | -1.5 |

|

Soybeans |

||

| MAR ’25 | 1057.25 | -1 |

| JUL ’25 | 1084.5 | -2.5 |

| NOV ’25 | 1059.75 | -3.5 |

|

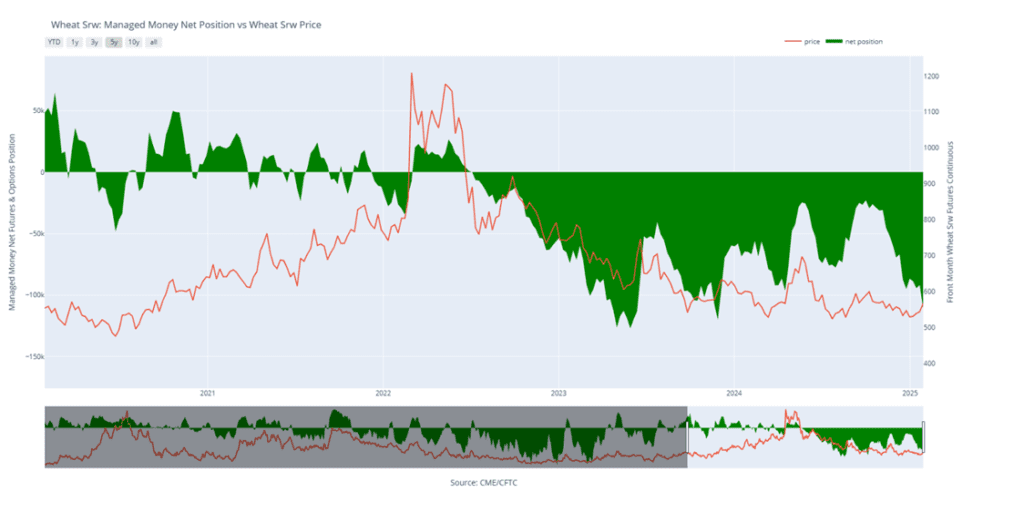

Chicago Wheat |

||

| MAR ’25 | 562.5 | -4.25 |

| JUL ’25 | 585.75 | -4.5 |

| JUL ’26 | 640.75 | 0 |

|

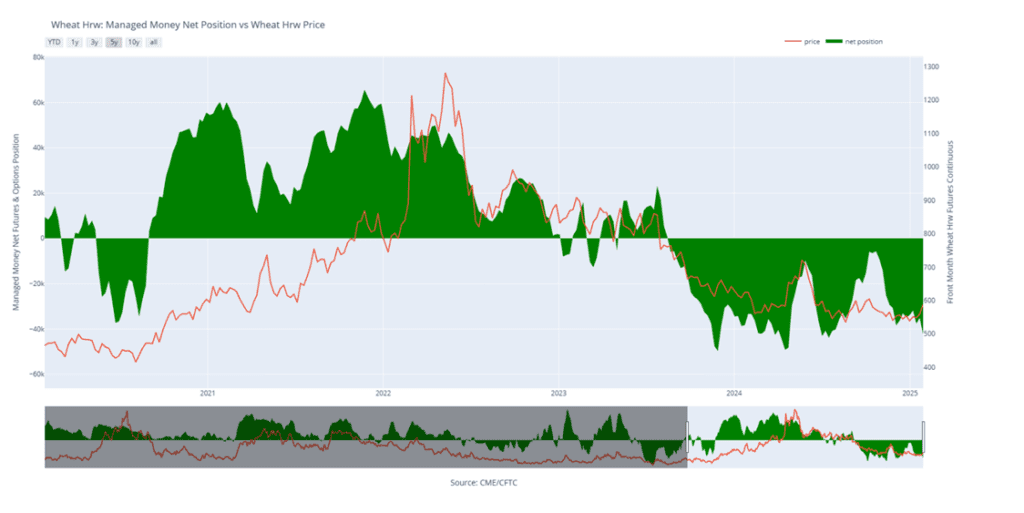

K.C. Wheat |

||

| MAR ’25 | 579 | -6.75 |

| JUL ’25 | 597.75 | -6.75 |

| JUL ’26 | 645.75 | 0 |

|

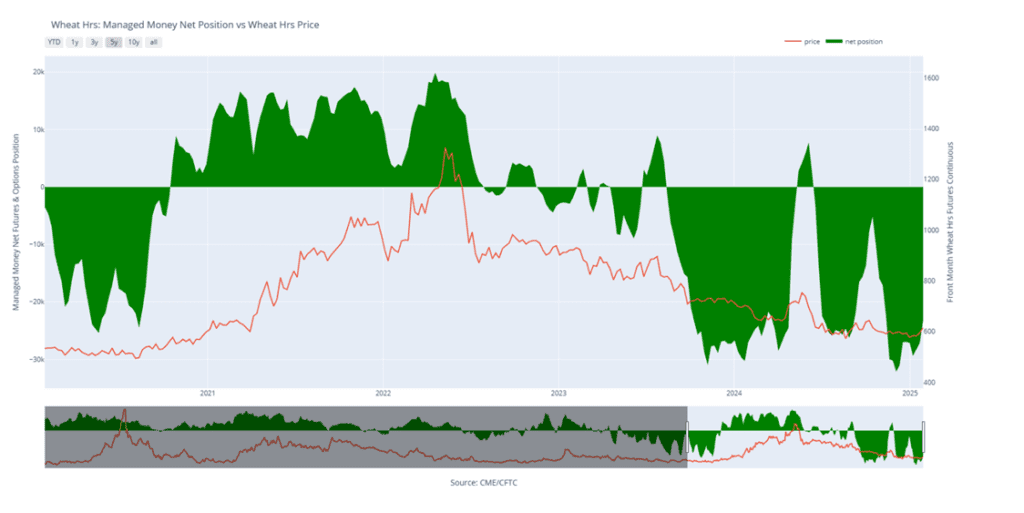

Mpls Wheat |

||

| MAR ’25 | 608 | -8.5 |

| JUL ’25 | 626.5 | -7.5 |

| SEP ’25 | 637 | -6.5 |

|

S&P 500 |

||

| MAR ’25 | 6020.5 | -1.75 |

|

Crude Oil |

||

| APR ’25 | 71.14 | -1.25 |

|

Gold |

||

| APR ’25 | 2845.8 | -11.3 |

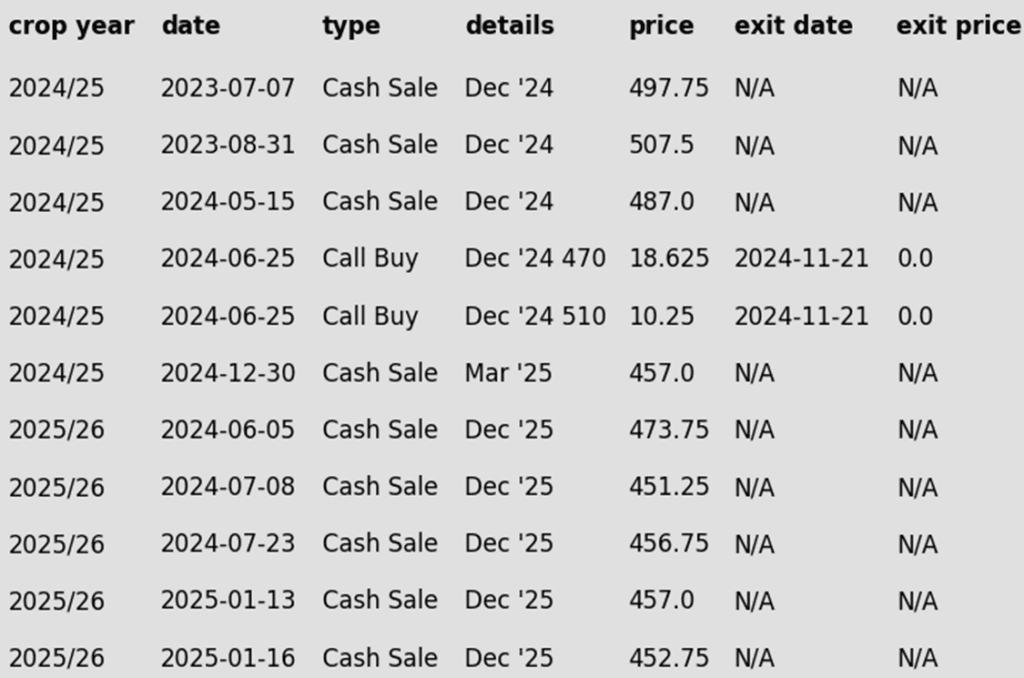

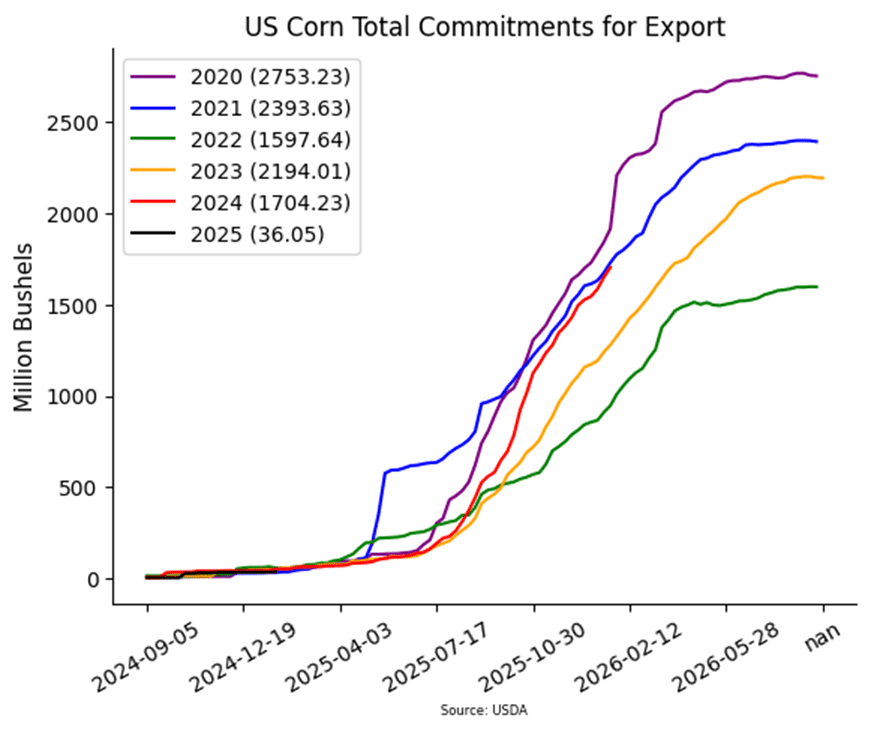

- Corn is mixed this morning with the March contract slightly higher while the deferred months are lower. Yesterday’s trad was very volatile with an initial gap lower which was followed by a rally that filled all gaps on the chart after tariffs were pushed off for 30 days with Mexico.

- Yesterday, after Mexico made concessions which resulted in the tariff implementation date being pushed back, the same thing happened with Canada in a phone call at 2pm. Canada agreed to heighten border security, and the tariffs on Canadian goods was pushed back for another 30 days.

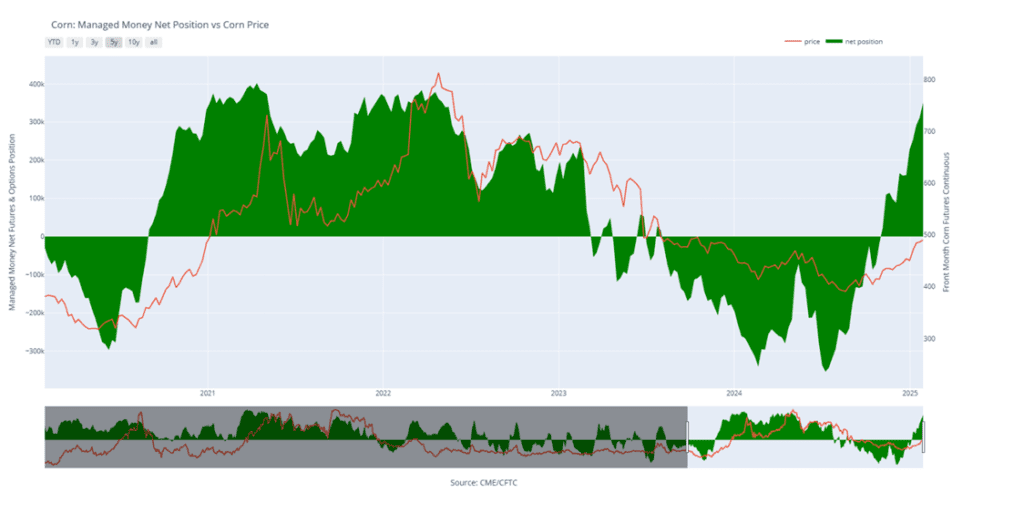

- Friday’s CFTC report saw funds as buyers which brought them to a net long position of 350,721 contracts, but since then, they are estimated to be long closer to 374,270 contracts which is nearing record long territory.

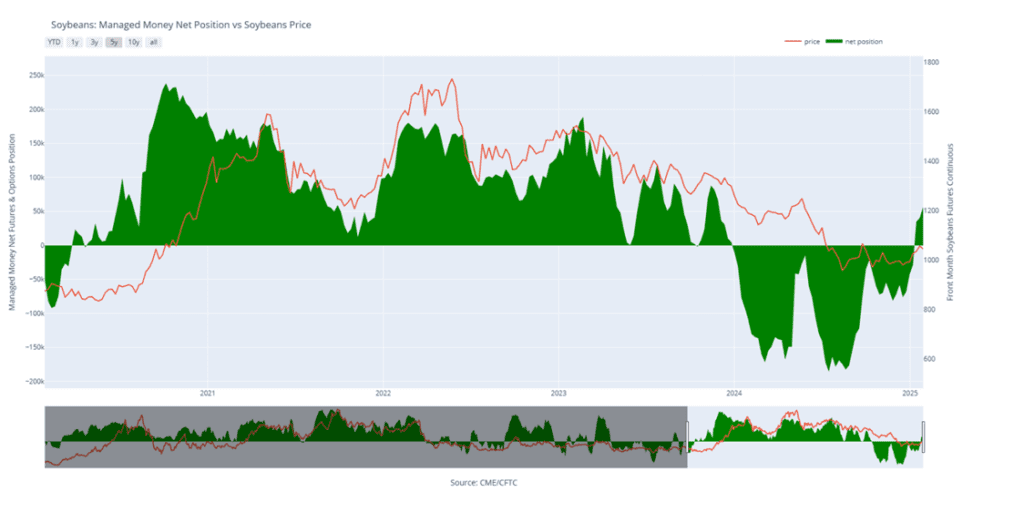

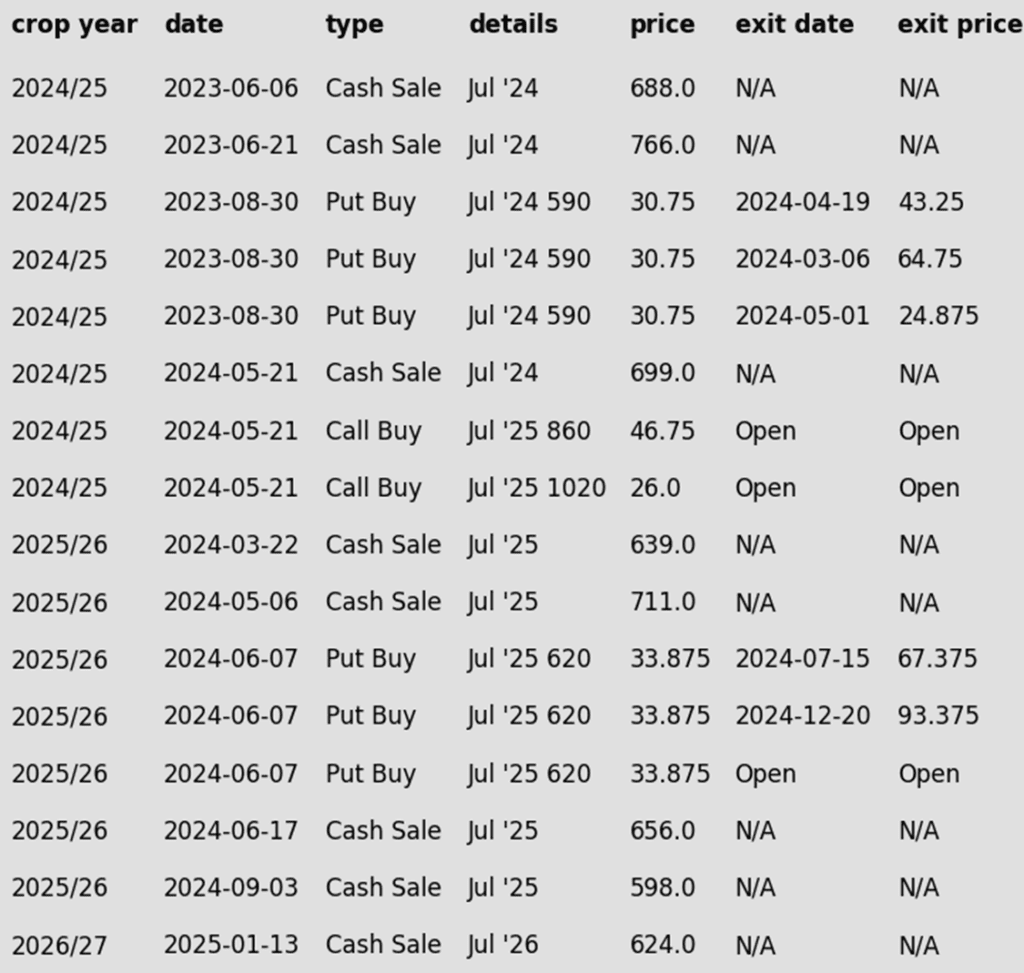

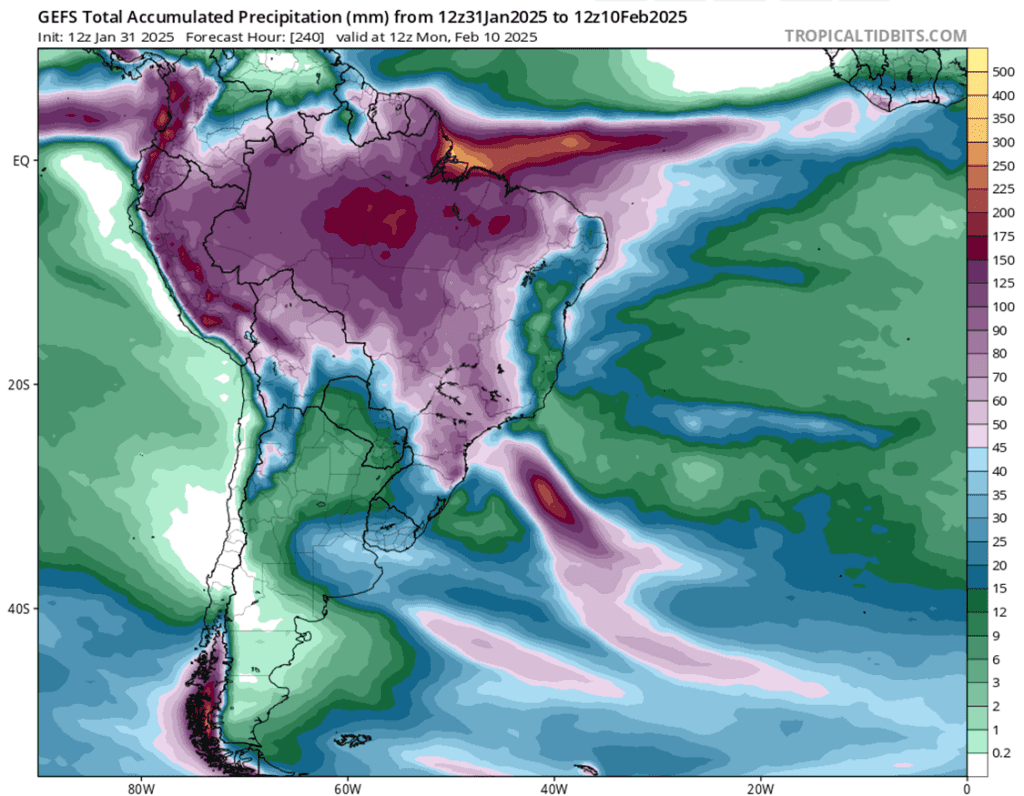

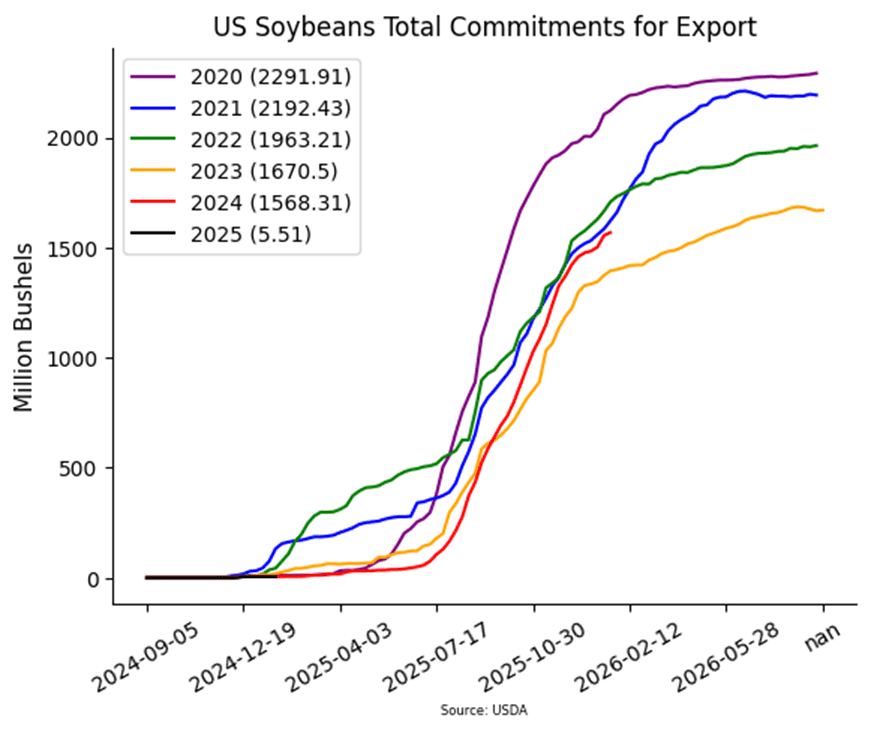

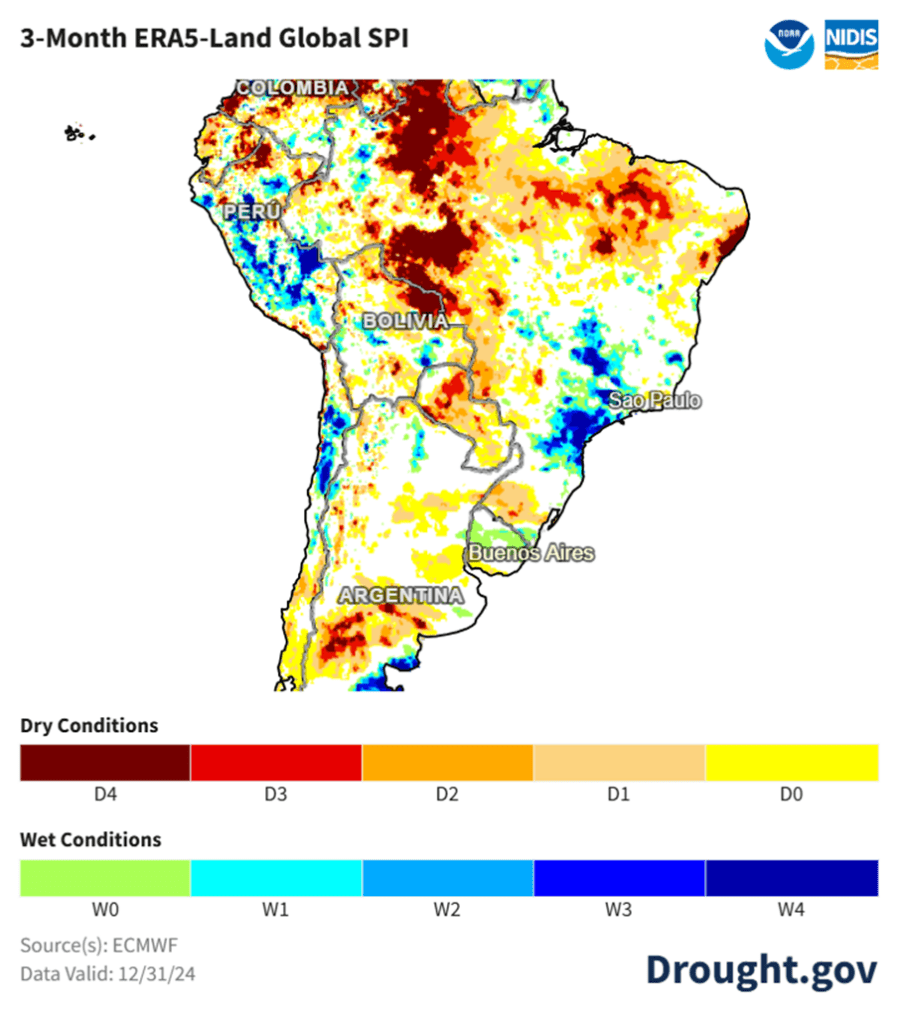

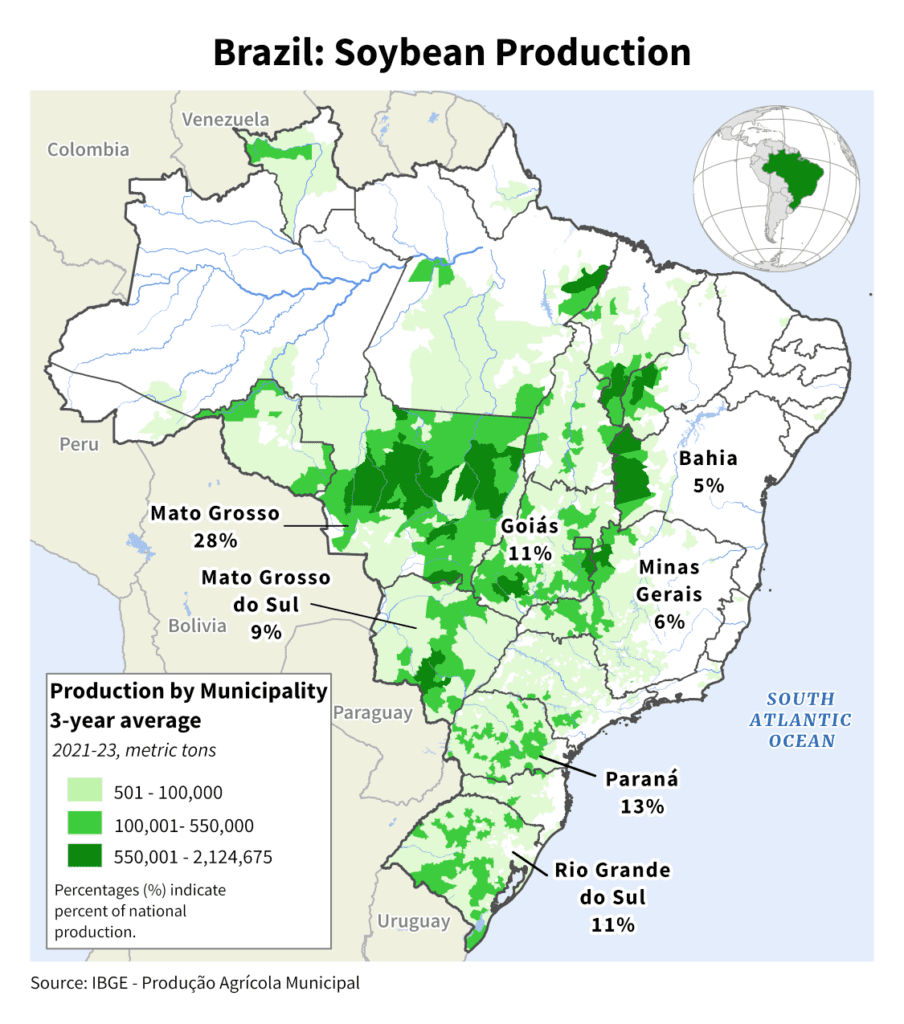

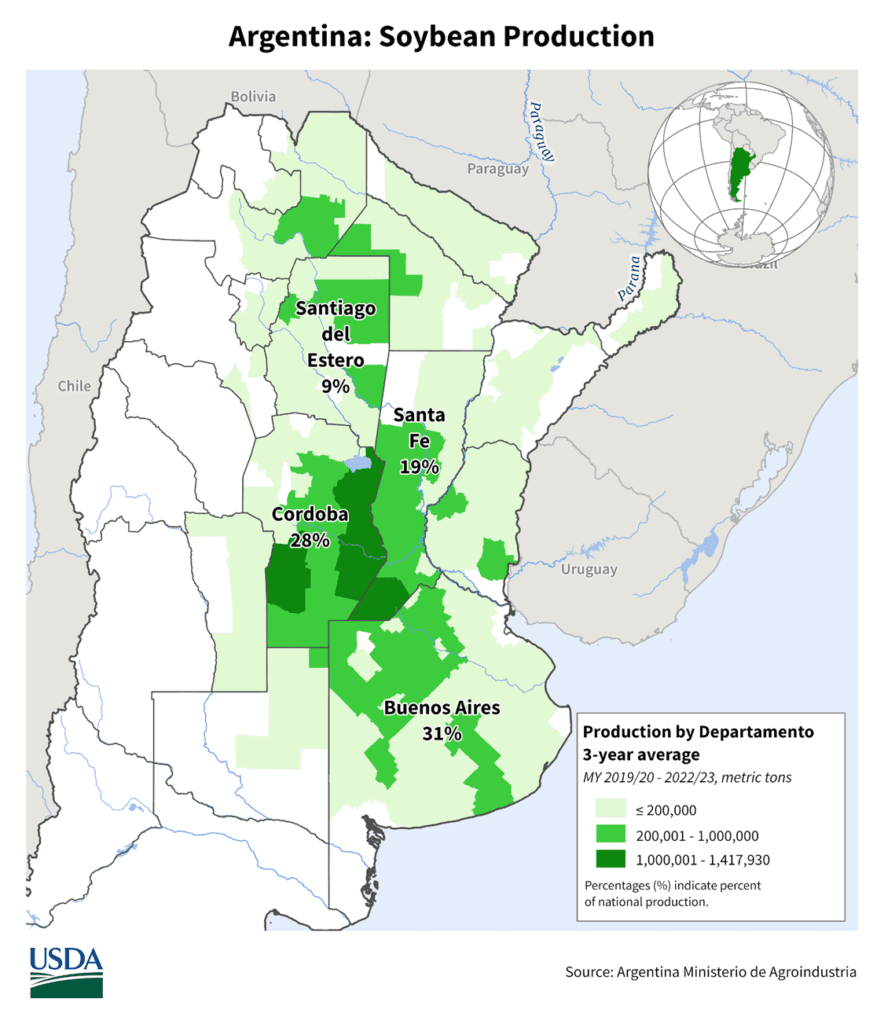

- Soybeans are trading lower this morning as yesterday, tariffs for Canada and Mexico were held off, but China retaliated by placing tariffs on some US goods. This leads to concerns over export demand for soybeans. Soybean meal is trading higher while soybean oil is lower.

- Yesterday, the US inspected 1,013k tons of soybeans for export. This compared to 738k tons the previous week and 1,751k tons a year ago at this time.

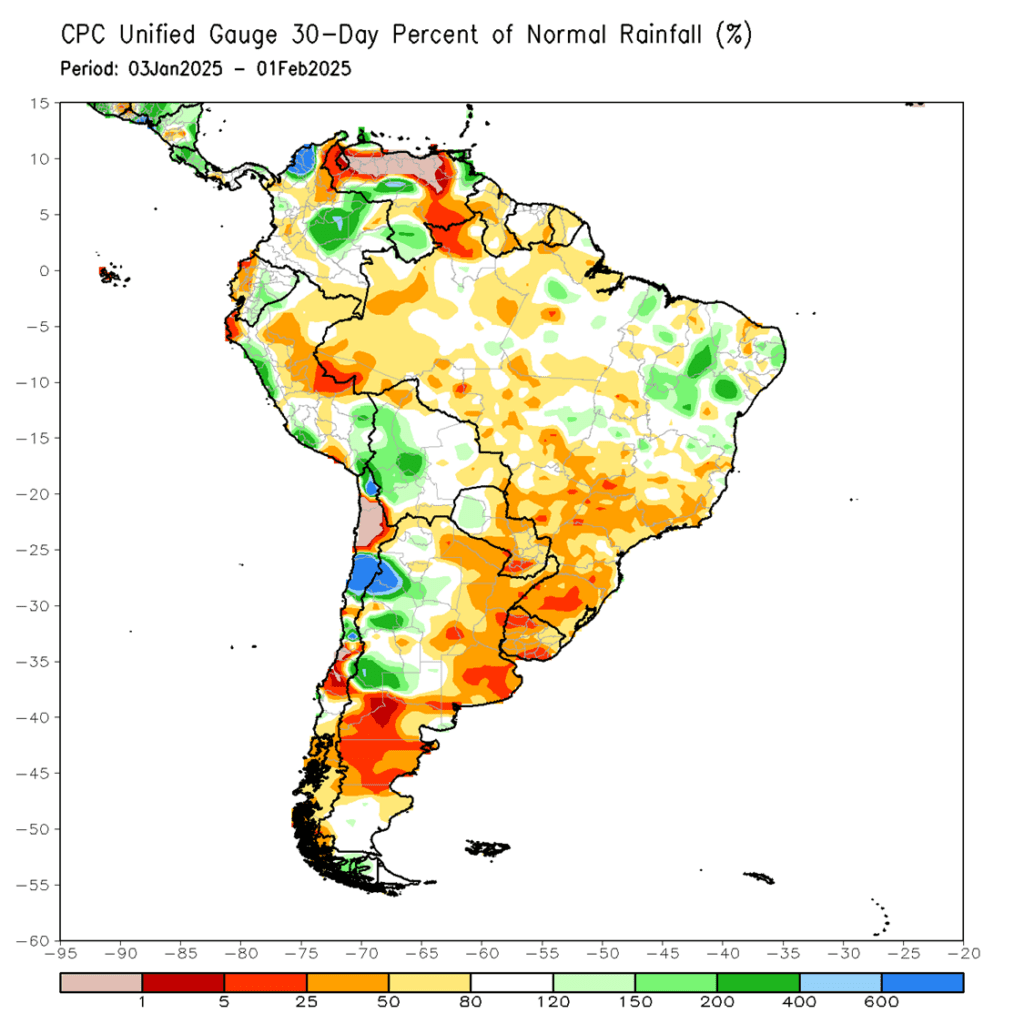

- Brazil’s 24/25 soybean harvest is reportedly 7.6% complete as of January 31 which compares to a pace of 15.7% the previous year and the 5-year average of 11.8% at this time.

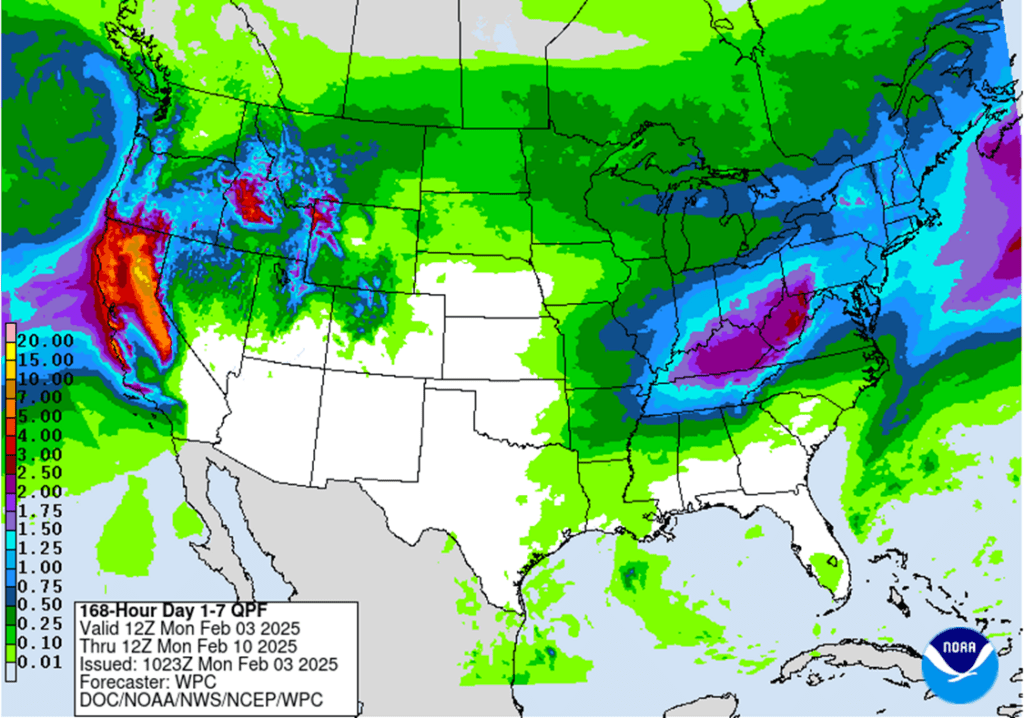

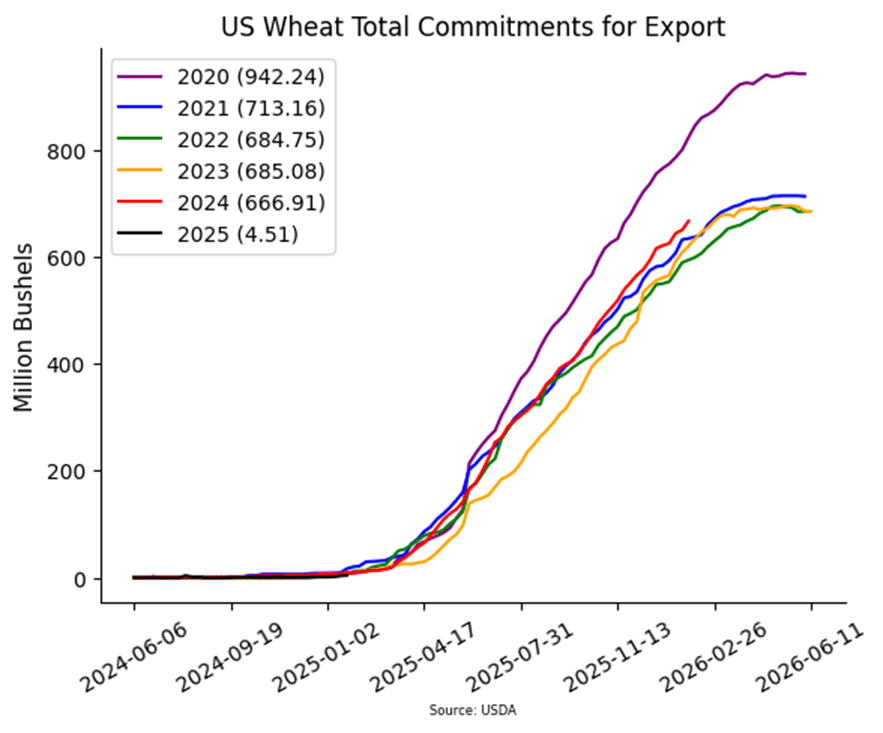

- All three wheat classes are trading lower this morning after stronger but volatile trade yesterday. Tariffs against Canada would have been supportive to wheat due to the quantity of wheat imports from the country, but now those tariffs are postponed.

- SovEcon has cut its estimate of Russian wheat export outlook as a result of limited supplies and low profitability for shipments abroad. Their export outlook is now at 42.8 mmt which is 2% lower than the previous estimate.

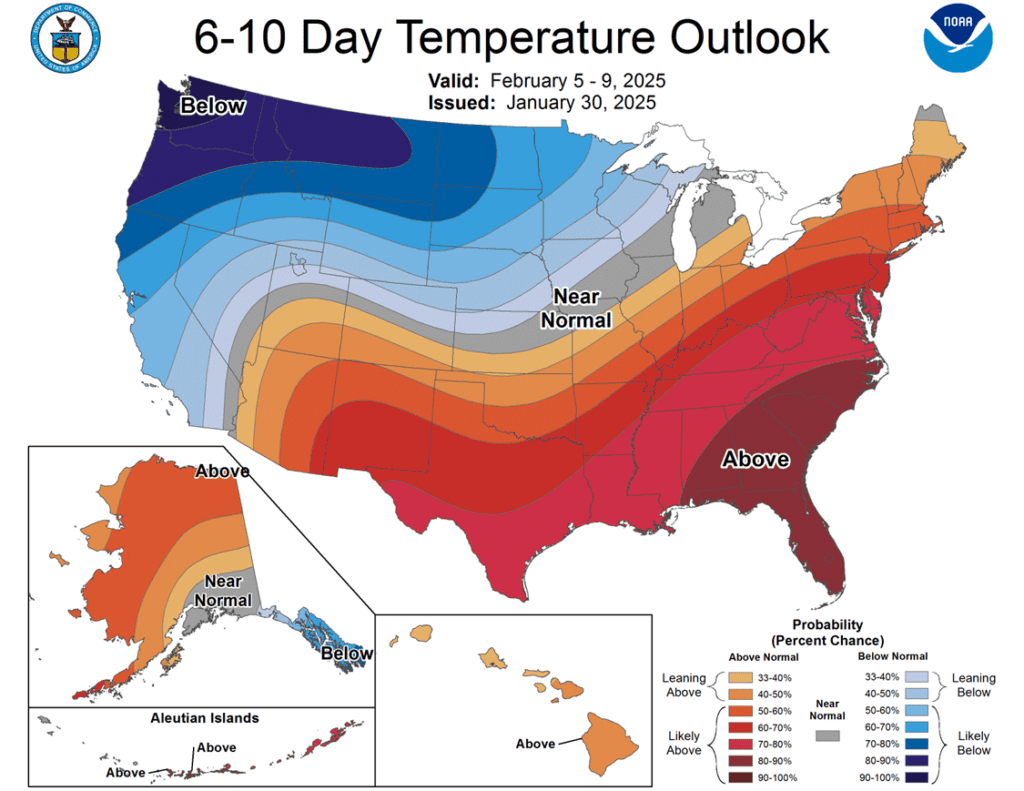

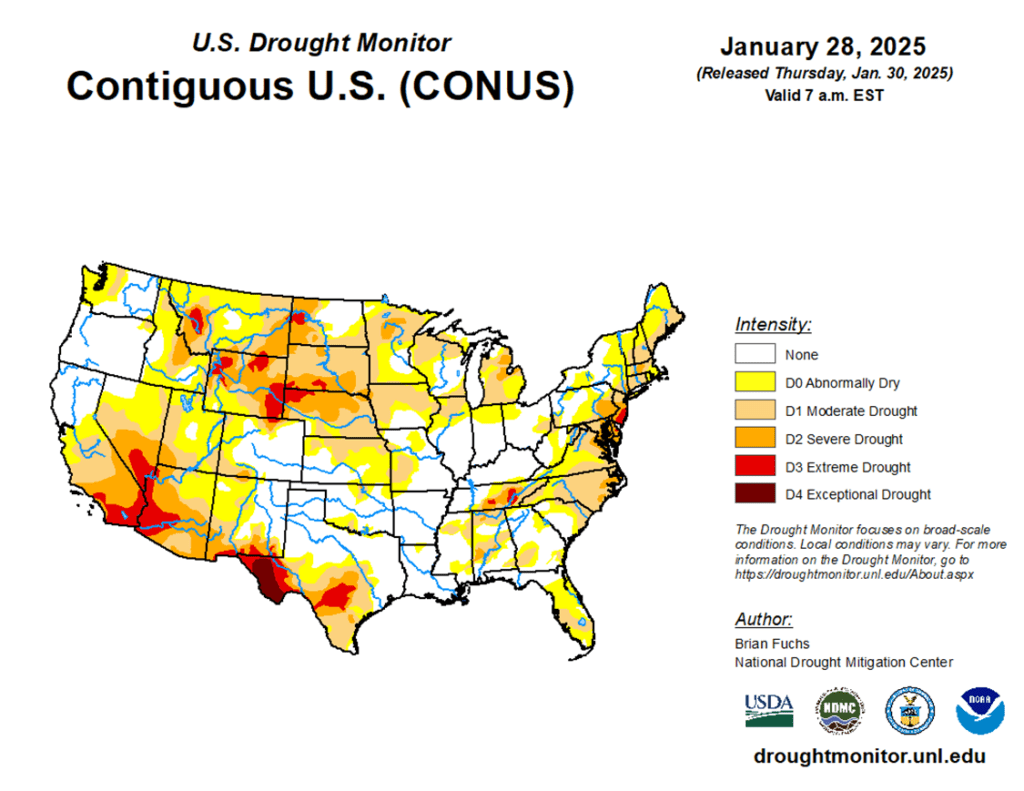

- US winter wheat crop conditions were updated yesterday and saw the good to excellent rating in Kansas increasing to 50% from 47% the previous week. Oklahoma on the other hand fell by 5% to 40%, and conditions in Texas fell by 5% to 37%.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.