2-18 End of Day: Grains Green to Start the Week

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- Corn: Futures surged to start the week, with March closing above $5 for the first time in 16 months and December hitting its highest level since last June.

- Soybeans: Closed higher supported by soybean oil and stronger corn and wheat futures. Export inspections and NOPA crush for January both came in below expectations.

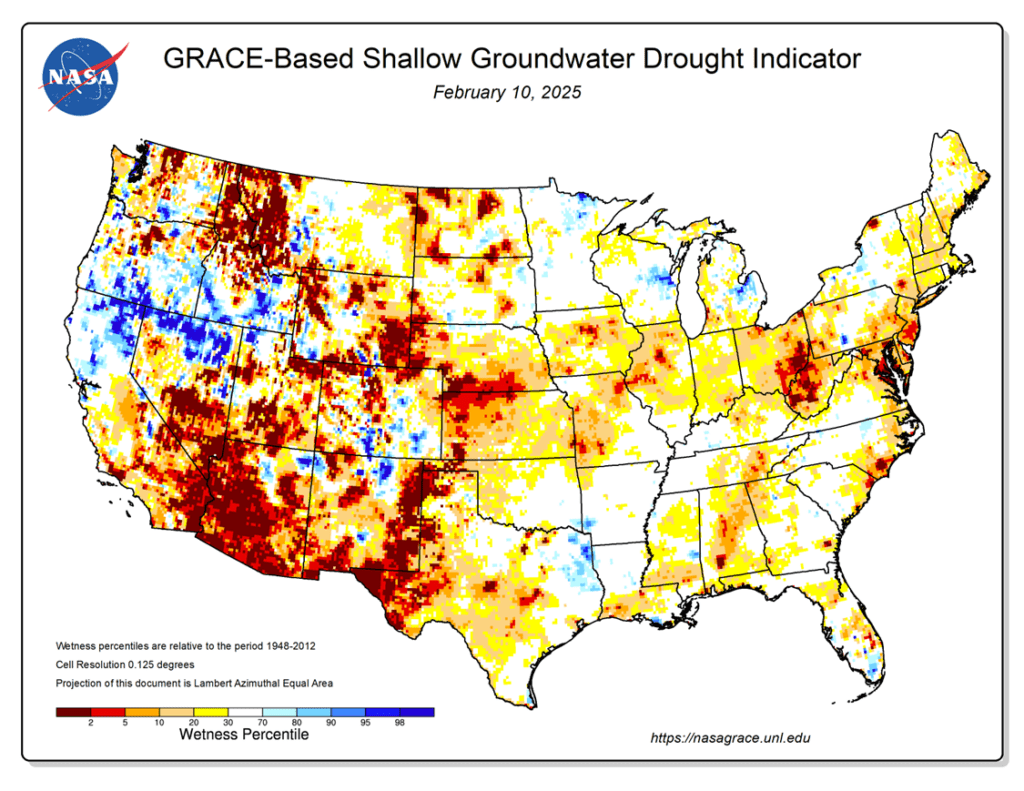

- Wheat: Strength in corn lifted wheat futures Tuesday, with all three classes posting modest gains. Bitter cold temperatures across the Plains fueled winterkill concerns and supported buying.

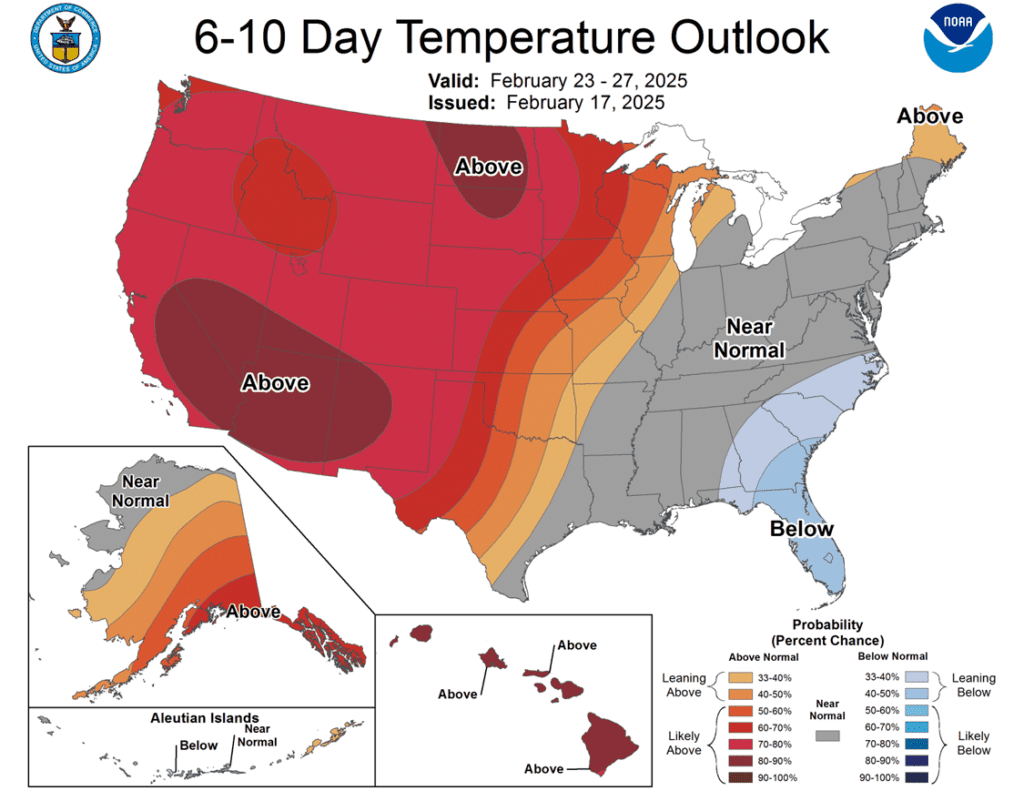

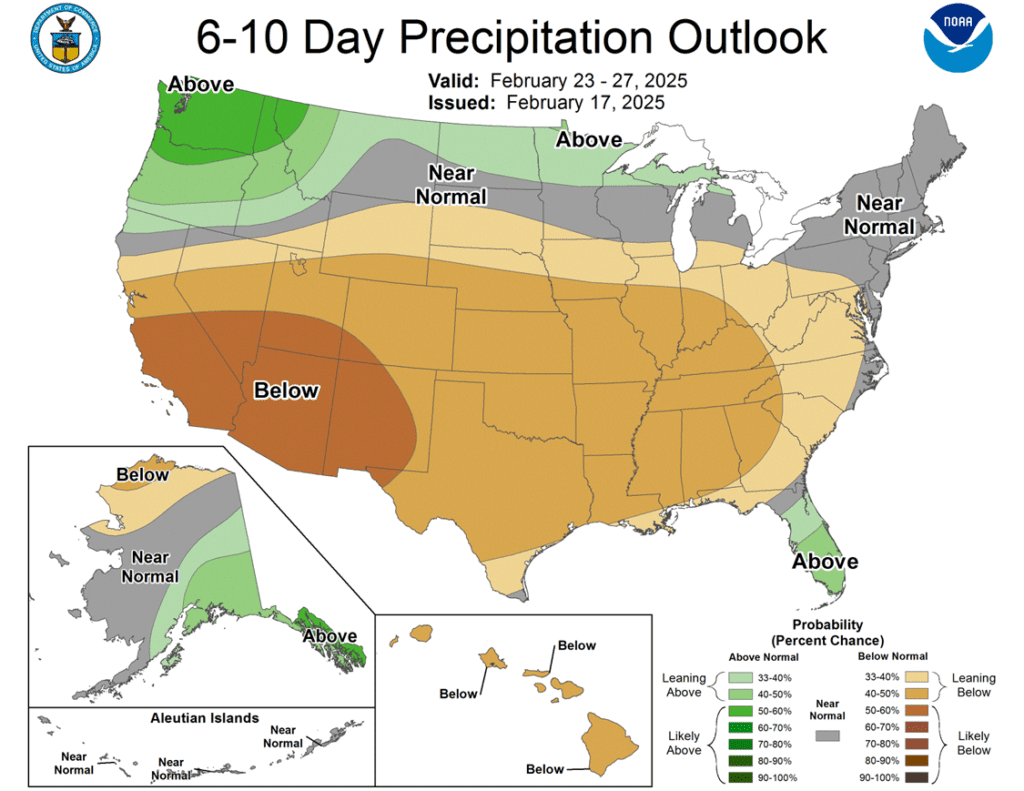

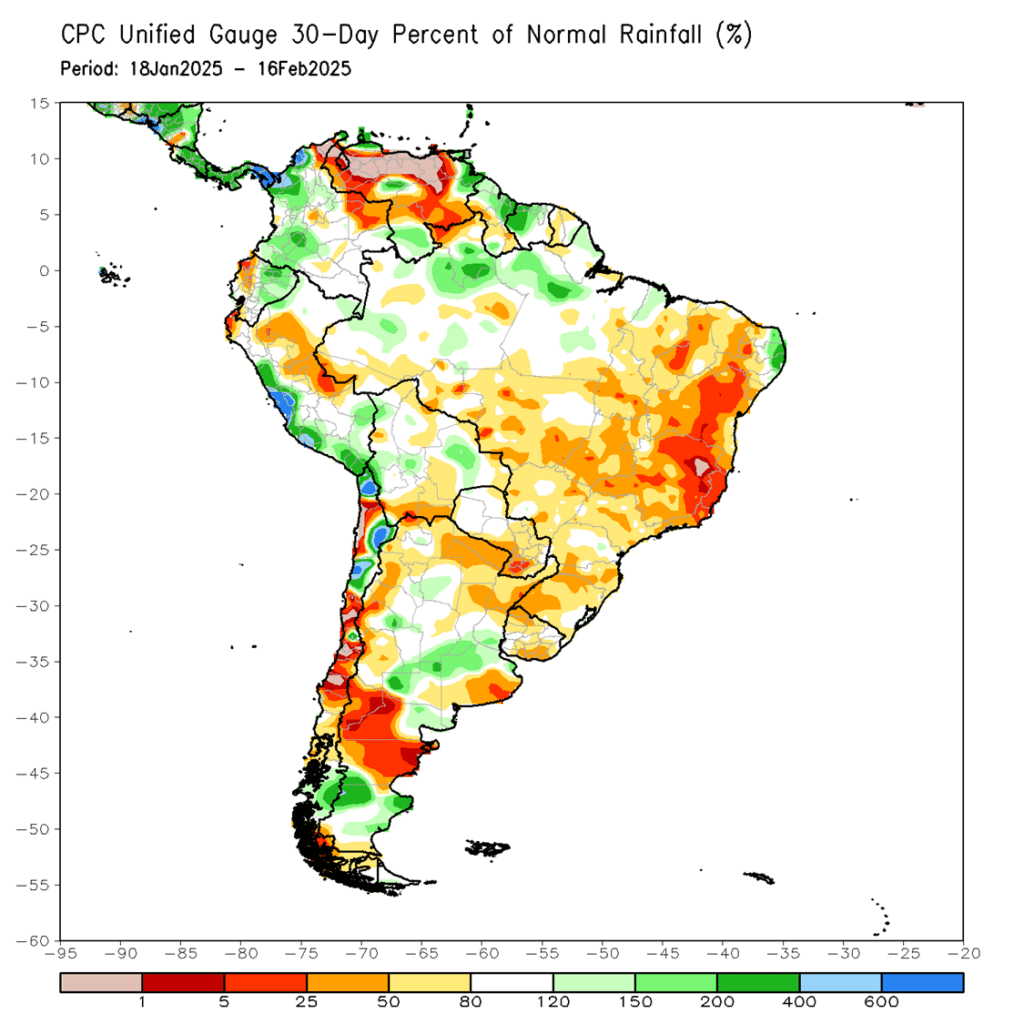

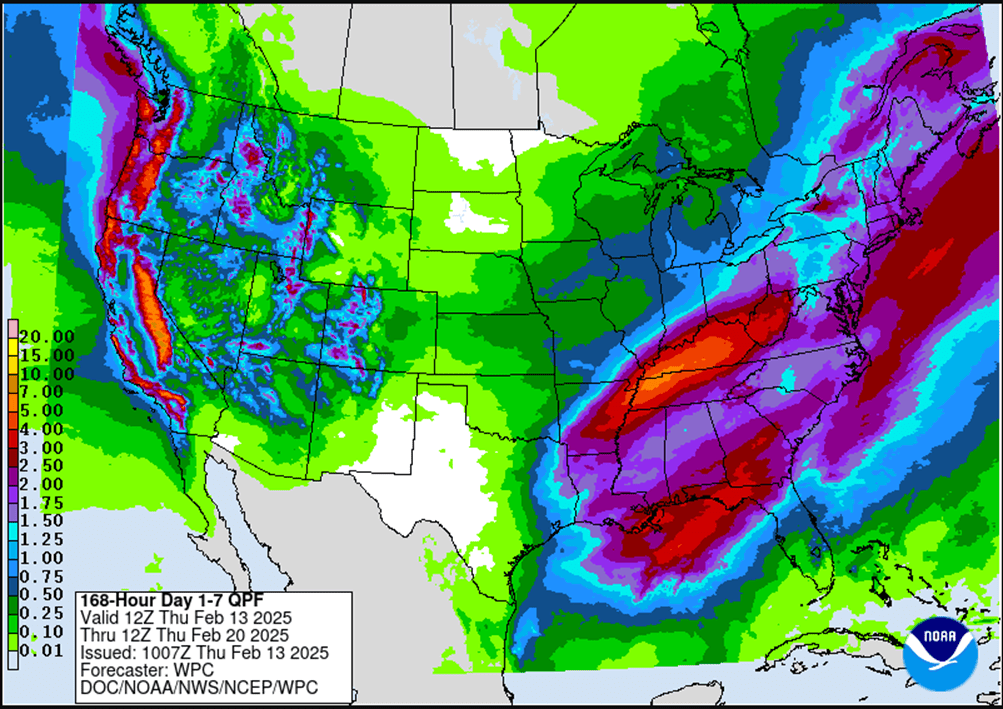

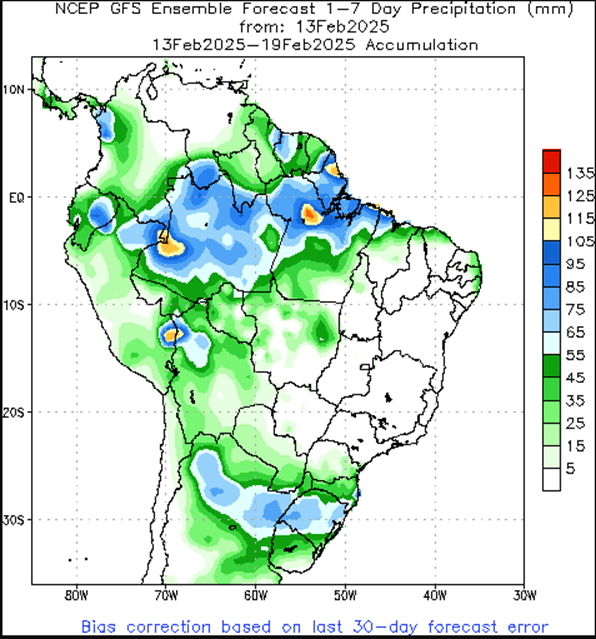

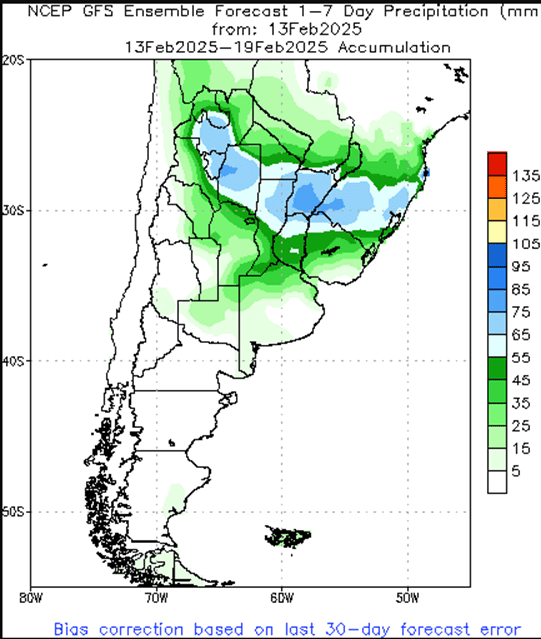

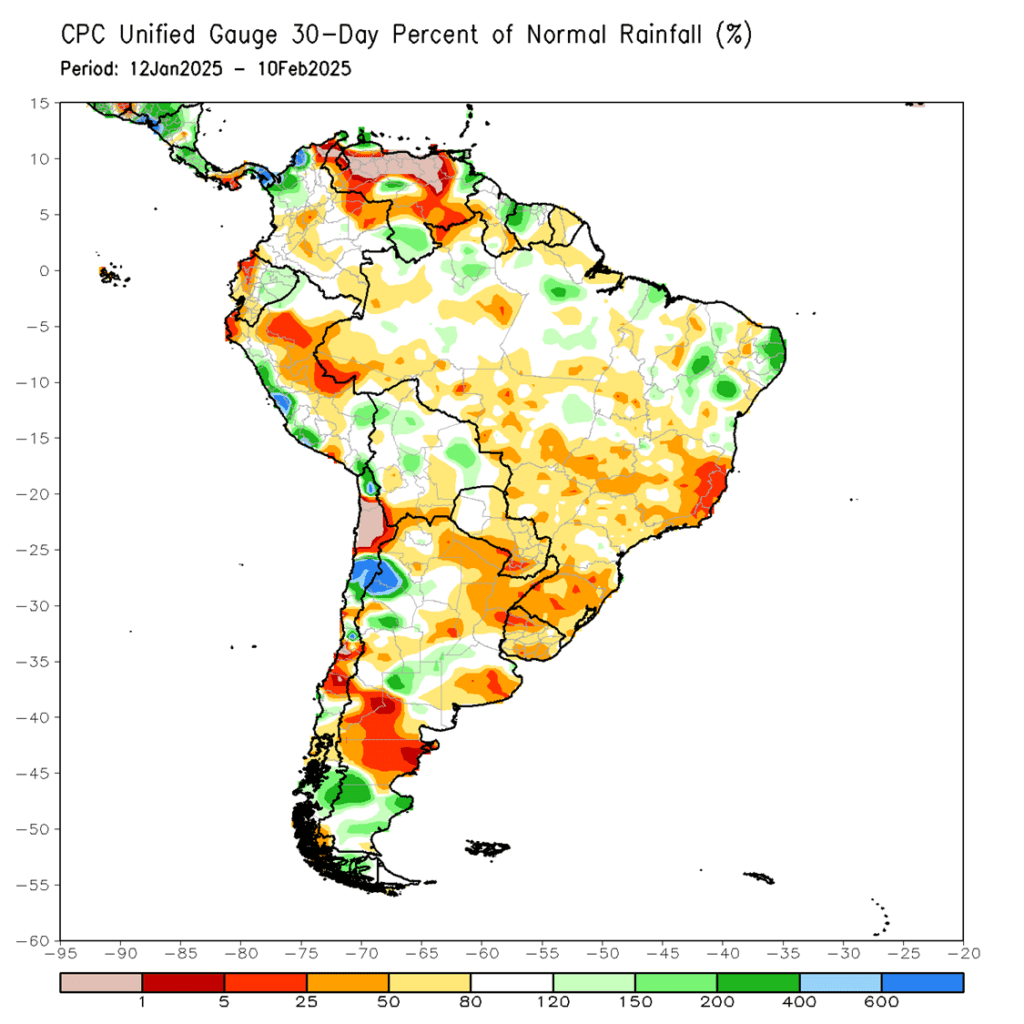

- To see the updated U.S. 6-10 day precipitation and temperature outlooks as well as the 30-day percent of normal rainfall map for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- NEW ACTION – Sell another portion of your 2024 corn crop.

- Targets shifted to May: As volume and open interest shift to the May ’25 contract, Grain Market Insider has adjusted its target range from the March ’25 to the May ’25 contract. Today’s market strength pushed May ’25 to the upper end of the 495–515 target range, triggering a recommendation to sell another portion of your 2024 corn crop today.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2025 new crop corn.

- Major Resistance at 479: December ‘25 faces strong resistance at 479. A decisive close above this level could signal broader upside potential as we move into the spring planting window.

- Potential Call Option Strategy: If prices break through 479, stay tuned for a possible call option recommendation. This strategy would hedge against existing sales while positioning you for upside exposure in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–3 weeks.

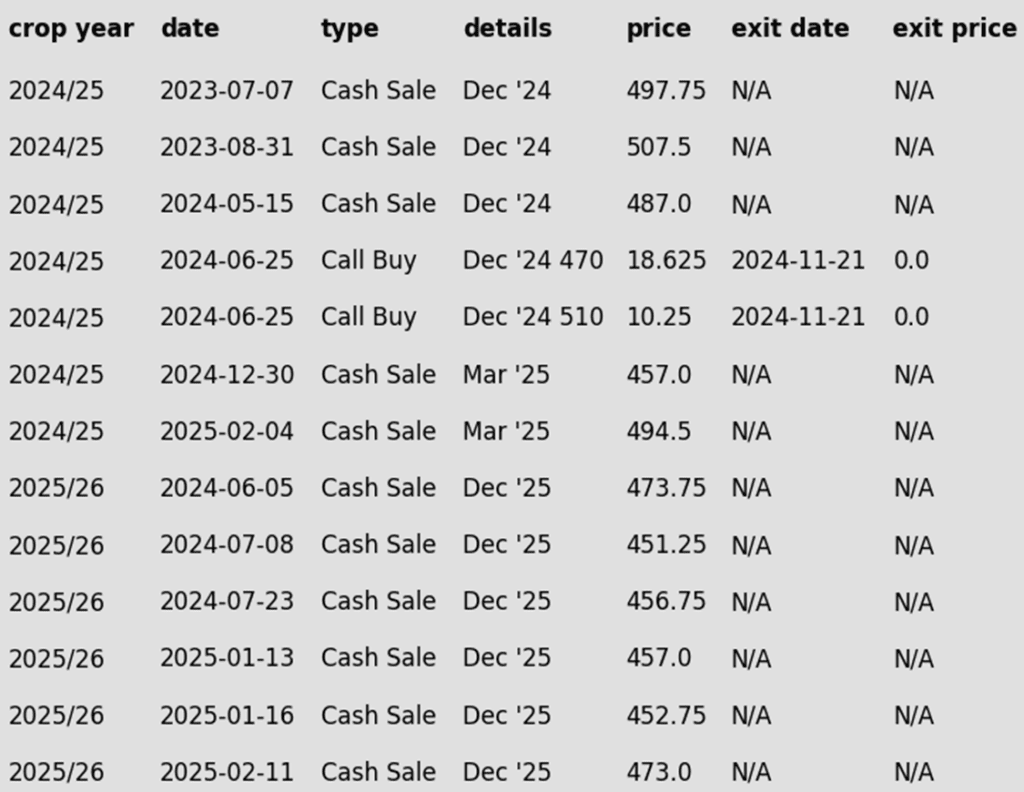

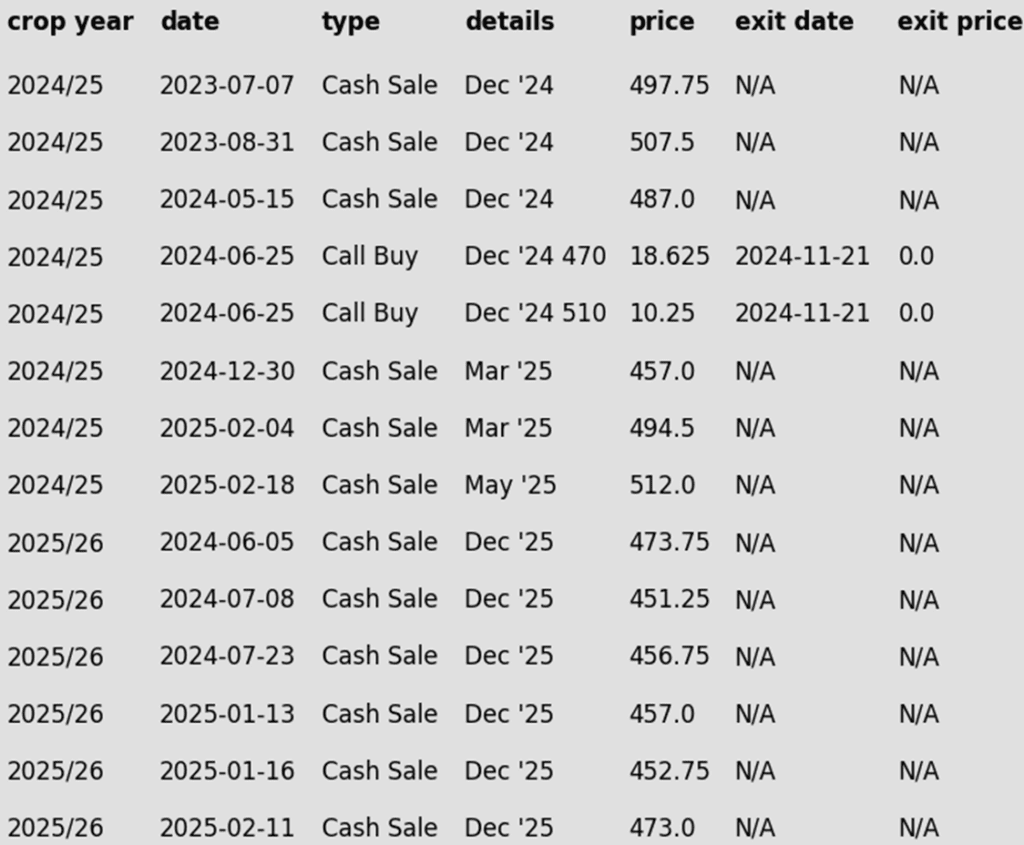

To date, Grain Market Insider has issued the following corn recommendations:

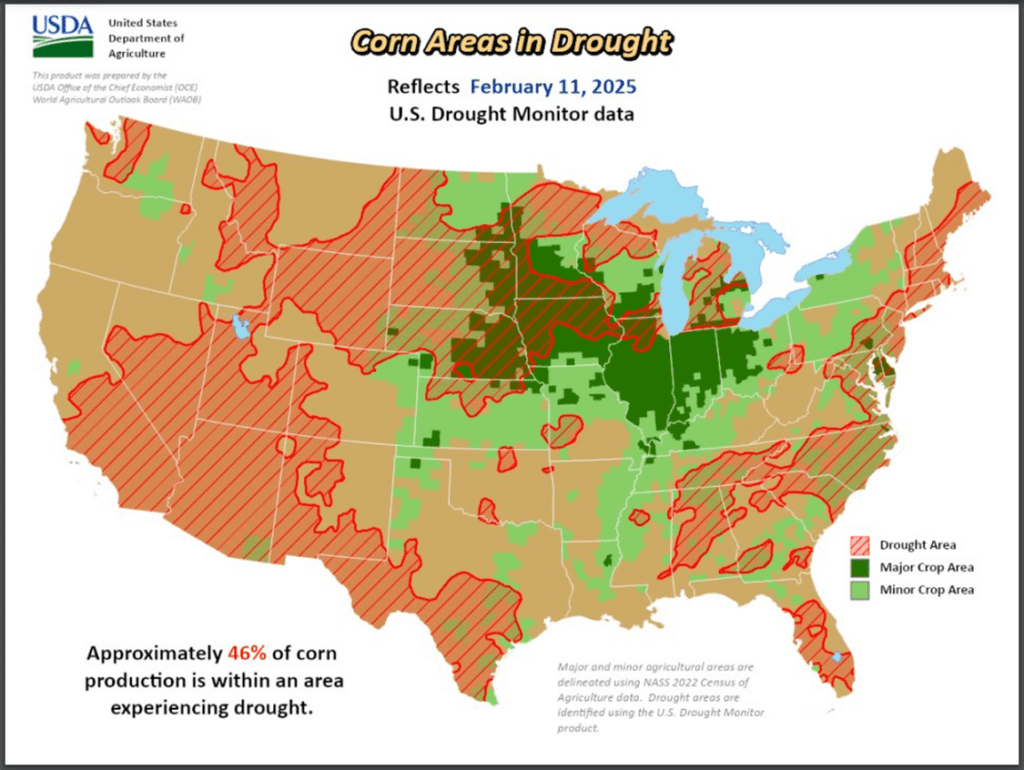

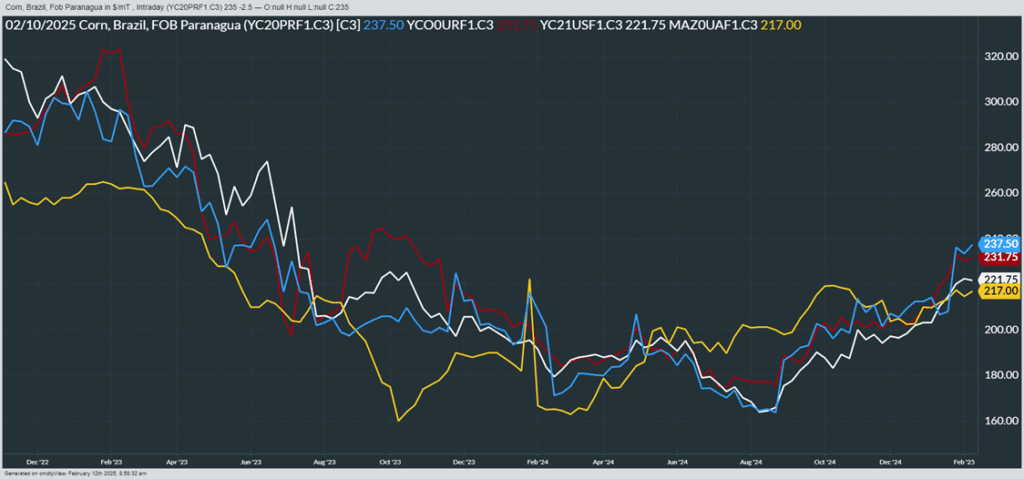

- Money flowed into the corn market for the first trading day of the week as corn futures finished with strong gains. The March contract closed above the $5 level for the first time in 16 months. New crop December corn futures finished at their highest level since last June.

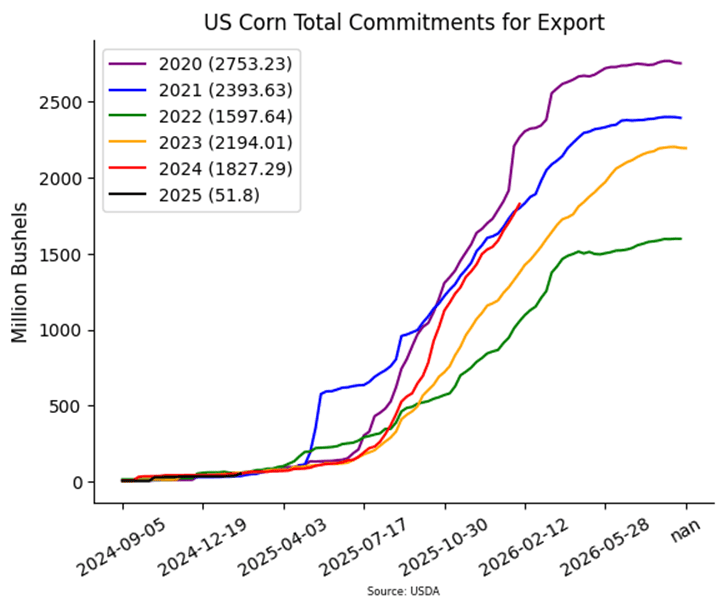

- Strong demand continues to fuel the market. Weekly export inspections for February 13 reached 1.611 MMT (63.4 mb), the highest for that week in 43 years, with exports running 35% ahead of last year and above USDA targets.

- Preliminary data suggests that corn exports from the U.S. may have broken a 35-year-old record for the month of January. It is estimated that the U.S. shipped over 6 MMT (236 mb) in the month of January.

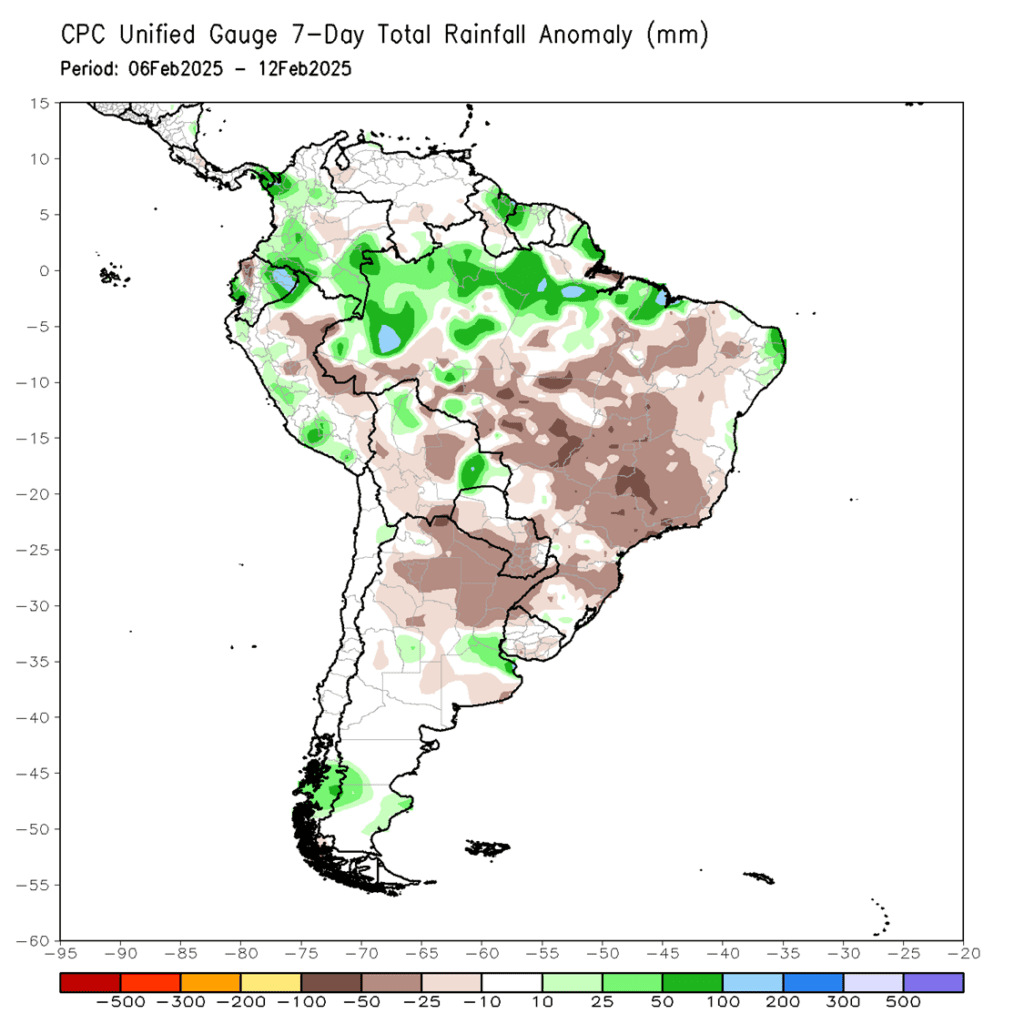

- Brazil’s second-crop corn planting is behind schedule at 36% complete (up from 20% last week but below last year’s 59%), as farmers push to finish planting within the ideal weather window despite recent improvements in weather conditions.

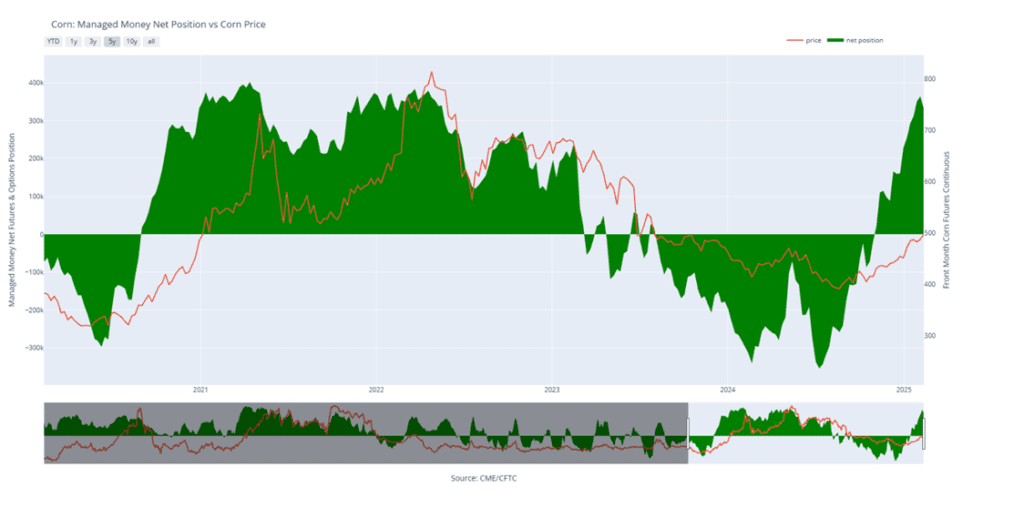

Corn Bulls Charge Ahead, Eyeing $5 Breakout

Corn’s rally since harvest shows no signs of slowing, fueled by aggressive fund buying and steady demand. Strong technical support remains at 475, with an added safety net near the 450-breakout zone. Now, the market is locked in on the $5 mark—a pivotal resistance level that could open the gates for the next leg higher. With bullish momentum firmly in the driver’s seat, the question remains: can the bulls break through, or will the rally hit a wall?

Above: Corn Managed Money Funds net position as of Tuesday, February 11. Net position in Green versus price in Red. Money Managers net sold 31,828 contracts between February 4 – February 11, bringing their total position to a net long 332,389 contracts.

Soybeans

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to sit tight for now on any additional sales.

2025 Crop:

- New Sales Target Range: 1090 – 1125 vs November ‘25.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on the recent sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring.

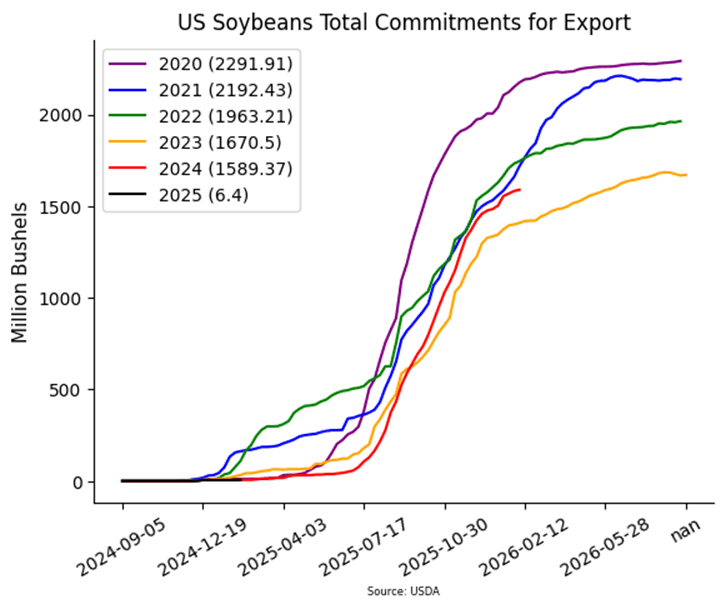

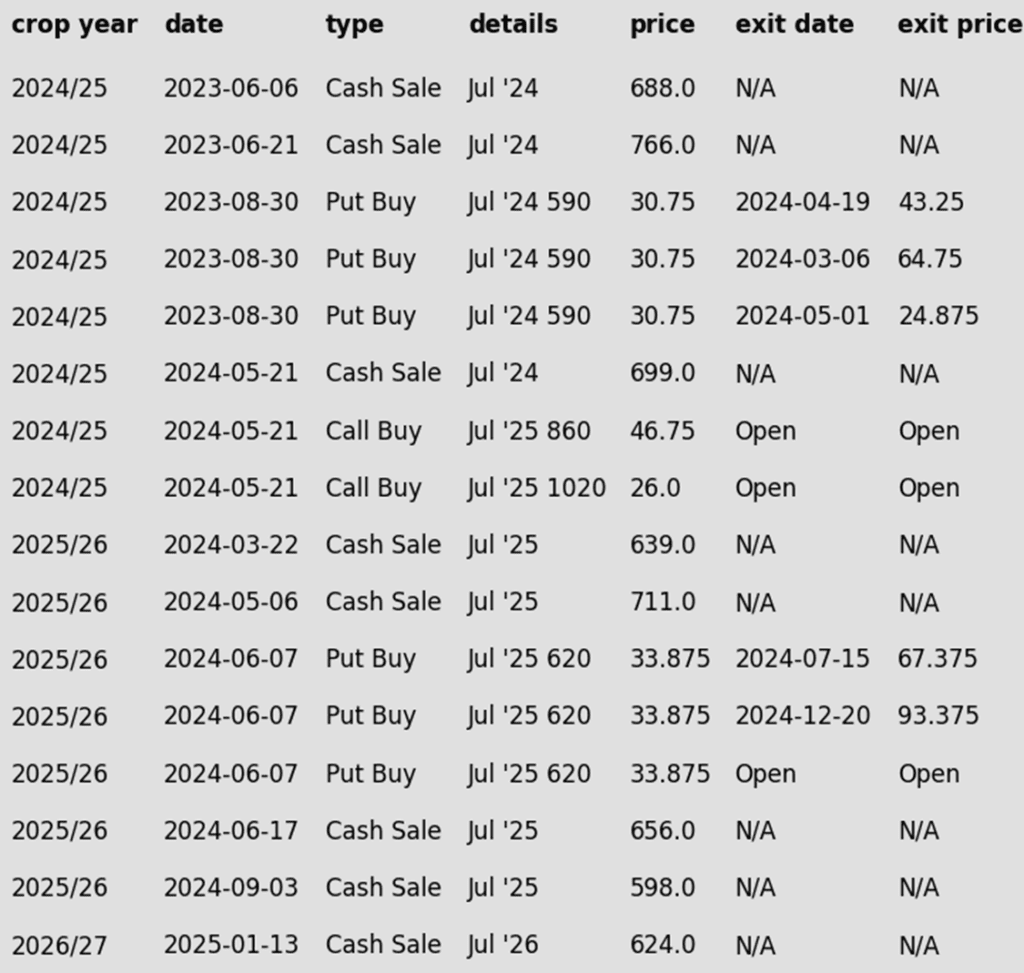

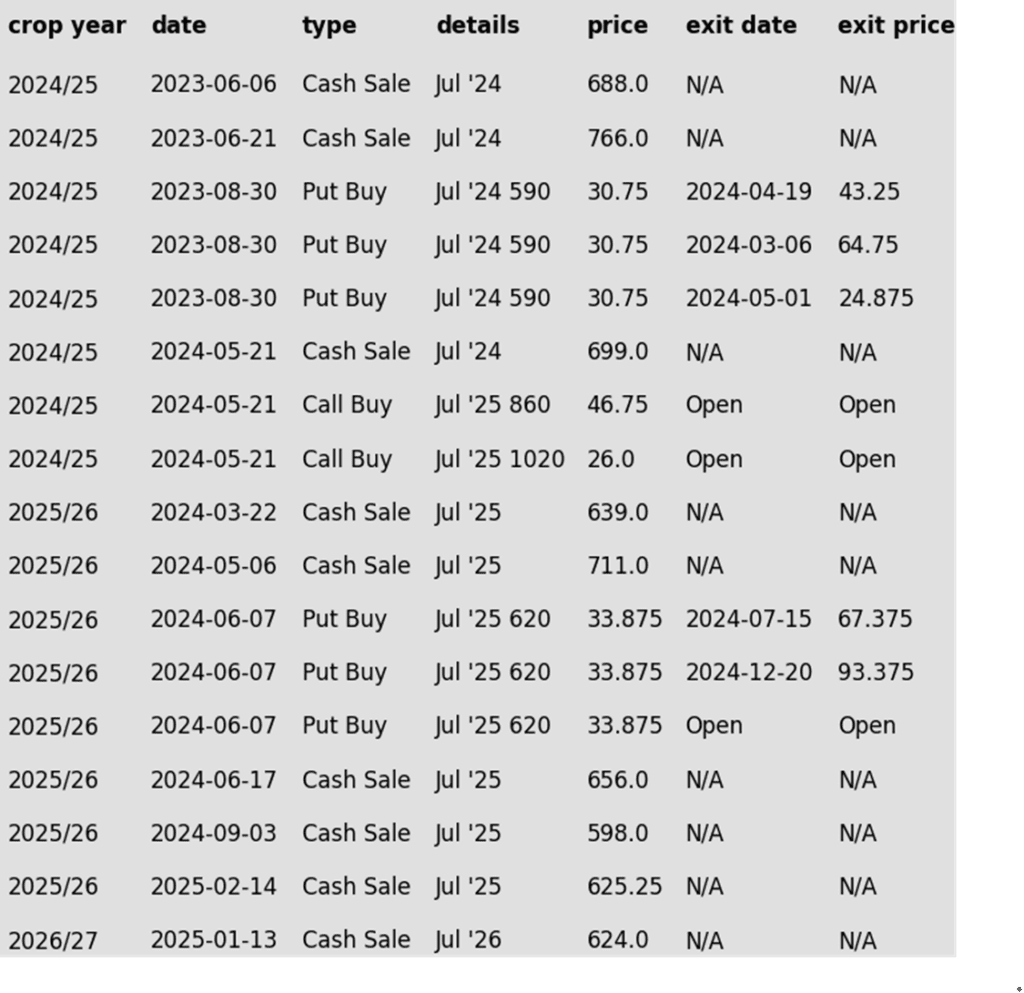

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans ended the day higher led by soybean oil and bullish sentiment in corn and wheat. March futures rebounded from overnight lows that saw prices down as much as 10 cents. Export inspections were disappointing and NOPA crush numbers were below expectations. Soybean meal was lower to end the day while soybean oil followed crude oil higher.

- Today’s export inspections report showed a total of 26.5 million bushels of soybeans inspected for export for the week ending February 13. Total inspections in 24/25 are now at 1.323 mb which is up 12% from the previous year. This was below the lowest range of trade estimates as Brazilian harvest progresses.

- Today’s NOPA Crush report saw January soybean crush coming in at 200.38 million bushels compared to the average trade guess of 204.5 mb. This was also below last month’s 206.6 mb but higher than last year’s crush at this time of 185.8 mb.

- Friday’s CFTC report saw funds as sellers of 28,554 contracts of soybeans which left them with a net long position of 28,475 contracts. They were net buyers of bean oil and sellers of meal.

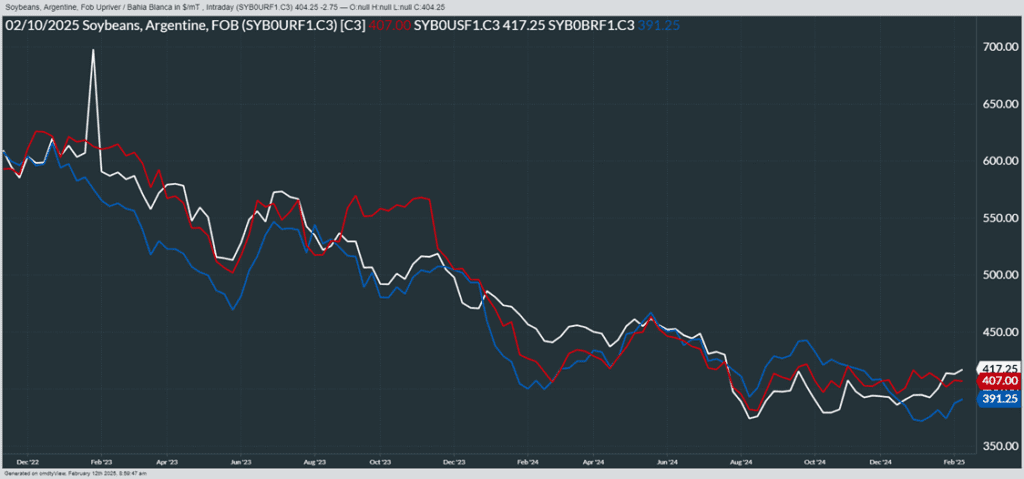

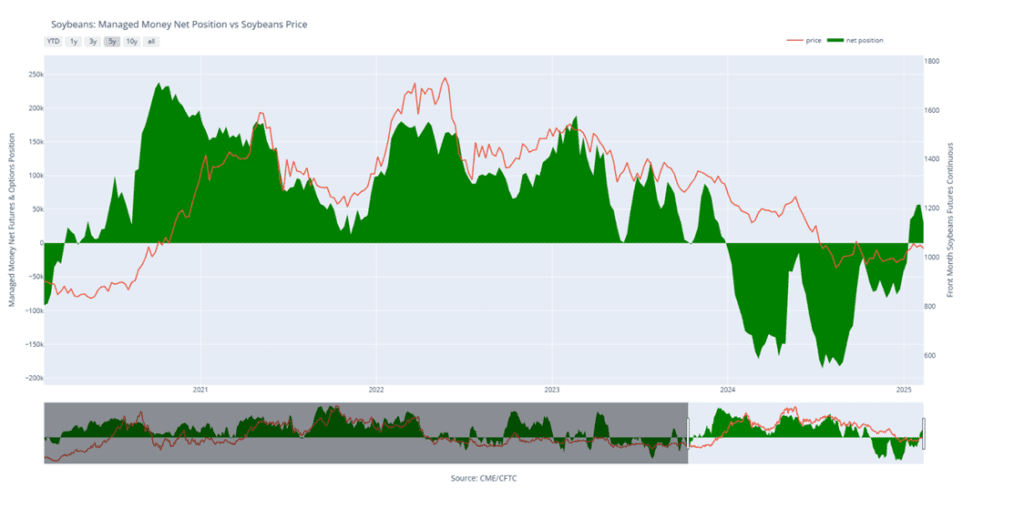

Soybeans Eye Breakout After Repeated Tests

Front-month soybean futures are knocking on the door of the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A clean break above this level could ignite bullish momentum and signal a fresh leg higher. On any retreat, solid support is seen near $10, while initial resistance stands at $11, with a bigger hurdle looming near $11.40. The battle lines are drawn—will soybeans finally break free?

Above: Soybean Managed Money Funds net position as of Tuesday, February 11. Net position in Green versus price in Red. Money Managers net sold 28,554 contracts between February 4 – February 11, bringing their total position to a net long 28,475 contracts.

Wheat

Market Notes: Wheat

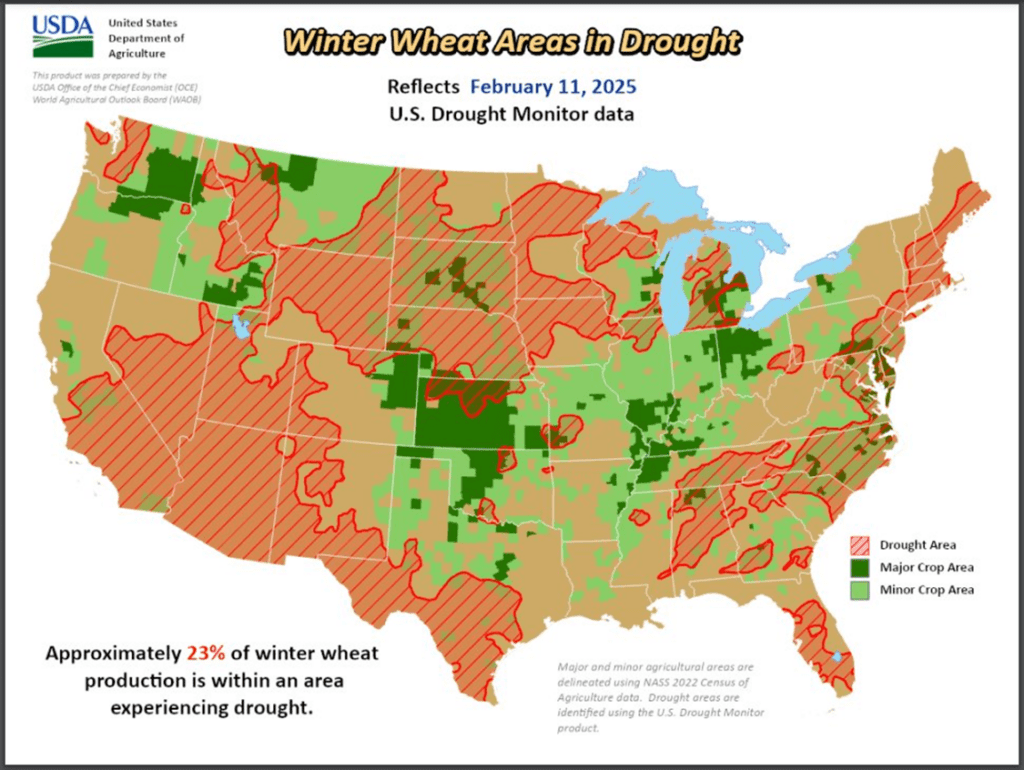

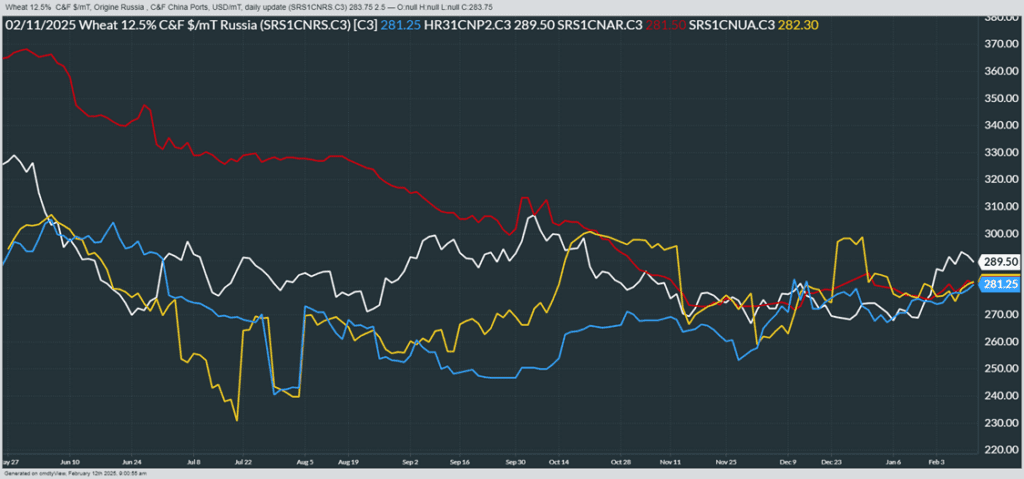

- Wheat futures posted modest gains across all classes, supported by strength in corn, soybeans, and Matif wheat. Bitter cold in the Midwest and Plains continues to raise winterkill concerns in areas with limited snow cover.

- Weekly wheat inspections reached 9.2 mb, bringing the 24/25 total to 546 mb, up 22% from last year and ahead of USDA’s 850 mb export target (up 20% YoY).

- Diplomats from the U.S. and Russia met today in Saudi Arabia to discuss negotiations for ending the war in Ukraine. However, Ukrainian ambassadors were reportedly absent from these discussions, which raises questions as to what type of agreement will be reached, if any. Nevertheless, traders will be keeping an eye on these talks, as it could impact wheat trade in that region of the world.

- IKAR reported Russian wheat export values rose $2/mt to $247/mt FOB last week and lowered February 2025 export estimates to 1.6-1.8 mmt from 2 mmt, well below February 2024’s 4.1 mmt.

- Since their export season began on July 1, Ukraine has shipped 27.5 mmt of grain, according to their ag ministry. This is up about 2% year over year. Wheat exports in specific account for 11.5 mmt of that total, which is up 9% year over year.

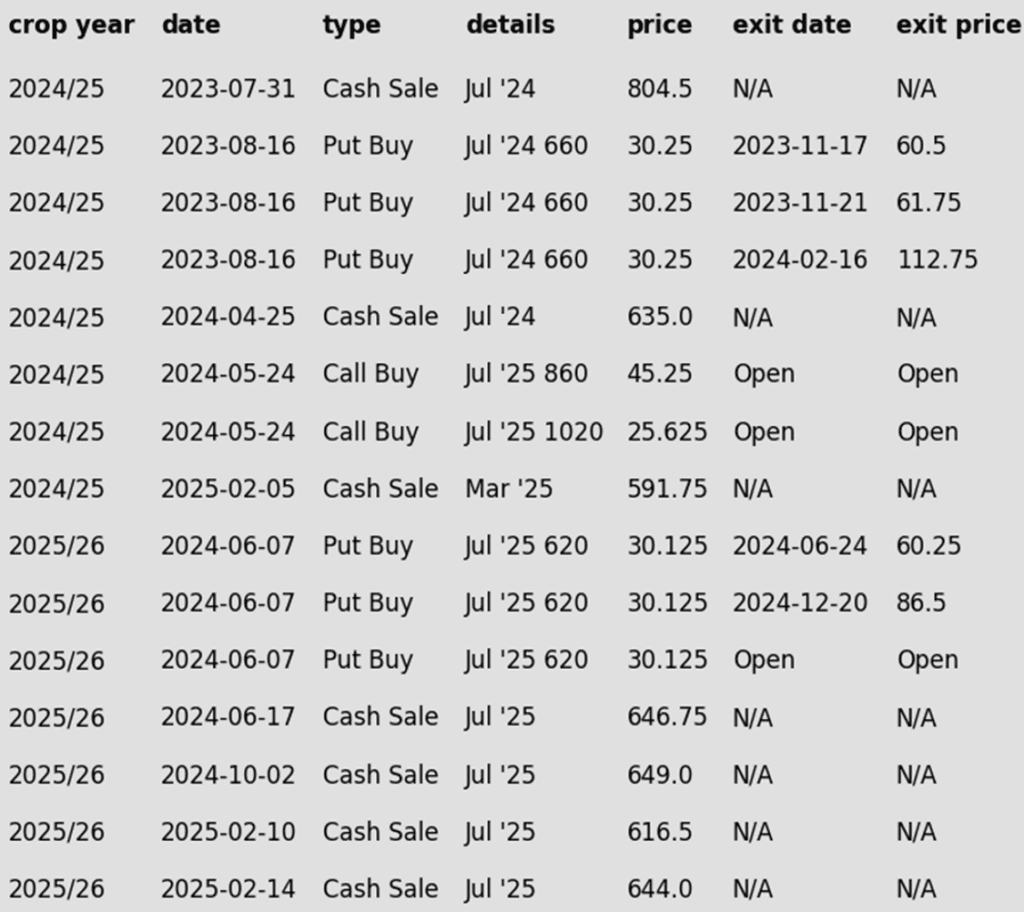

2024 Crop:

- No Change: The 680-705 range for March ‘25 remains the next potential target for a sale.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2025 SRW wheat crop.

- Next Target: If the July contract can maintain its uptrend, the next sales target range would be 690-715 vs. July ‘25.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

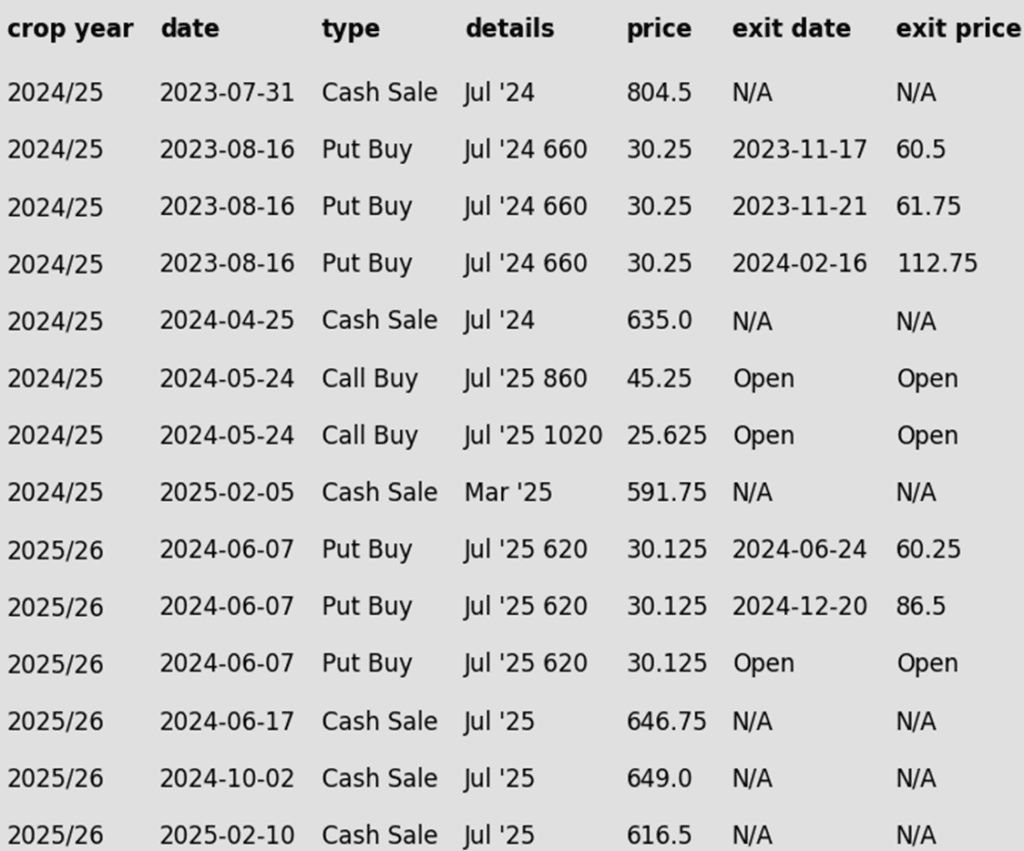

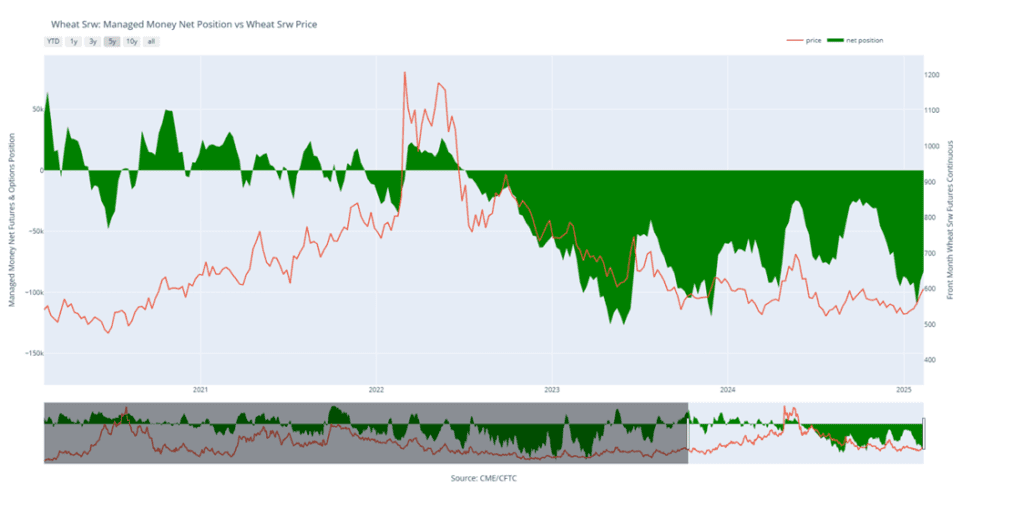

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Out with Force

Chicago wheat shattered its prolonged sideways grind with a powerful February surge, hitting key resistance at the early October highs just above 615. This decisive weekly close above the 200-day moving average sets the stage for the MA to act as firm support on any near-term dips. Next upside targets loom near 650, with stronger resistance waiting in the 680-700 zone.

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, February 11. Net position in Green versus price in Red. Money Managers net bought 7633 contracts between February 4 – February 11, bringing their total position to a net short 82,809 contracts.

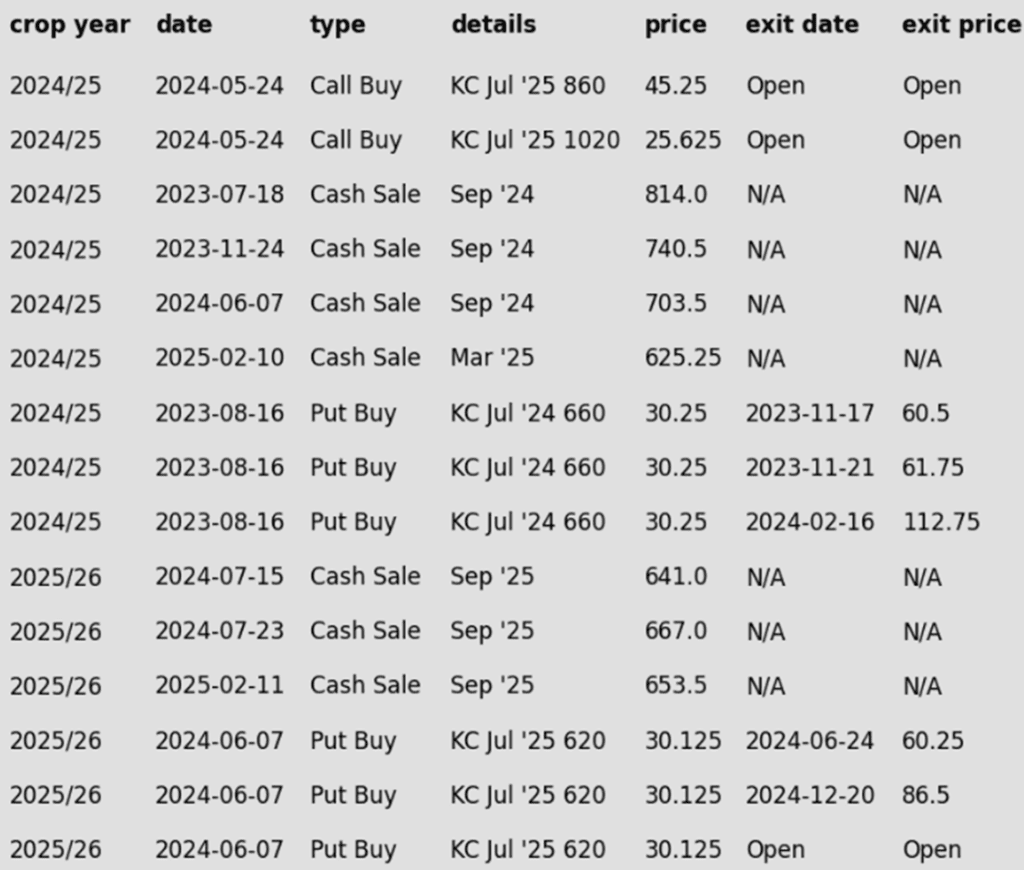

2024 Crop:

- Grain Market Insider recommended selling a portion of your 2024 HRW wheat crop on February 5 at 591.75 vs March ‘25.

- No Official Targets: Following the latest sales recommendation, there are currently no active target ranges to make additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2025 HRW wheat crop.

- Two Sales: Grain Market Insider advised two sales last week—one on Monday and another on Friday—as the July ’25 contract extended its rally for a fourth straight week.

- Key Levels: The July ’25 contract is now just 4 cents below the September high of 653.75, marking a 99-cent rebound from the December low.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

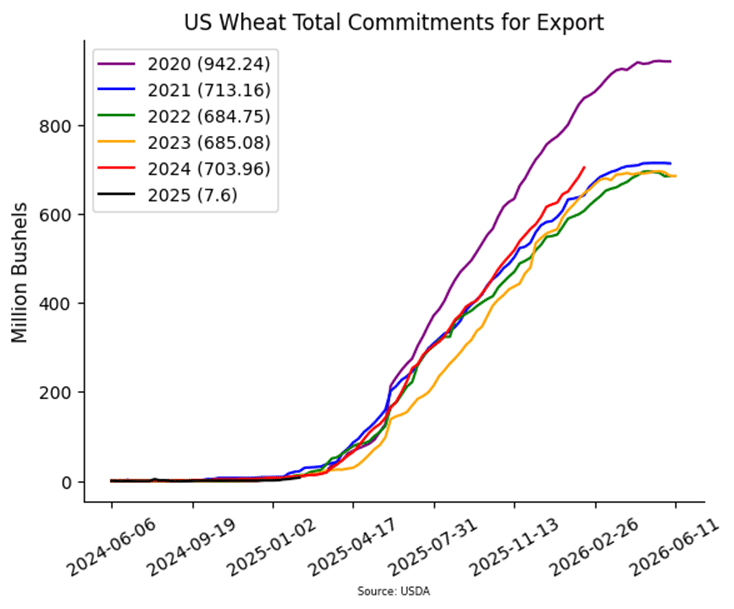

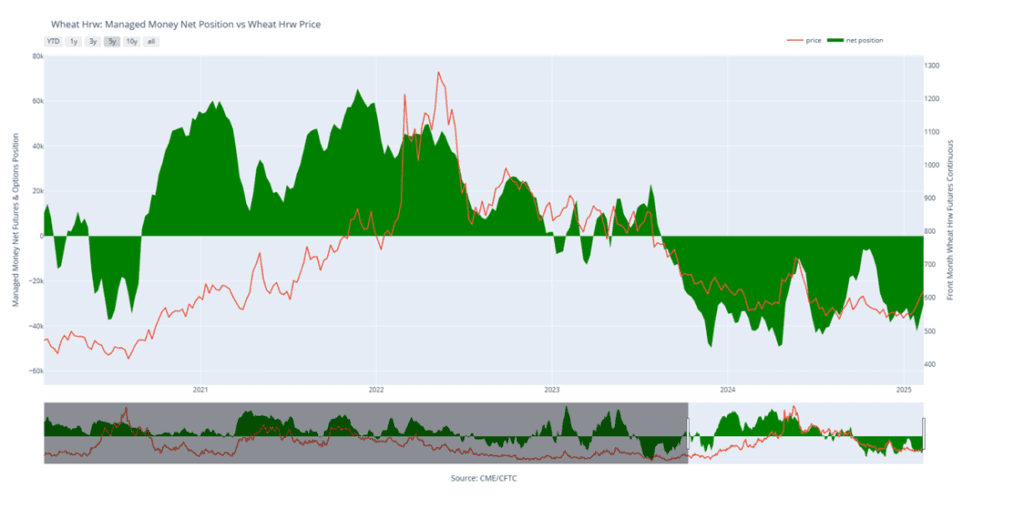

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Ignites Rally Potential

Kansas City wheat futures launched into February with bullish momentum, closing above the 200-day moving average and challenging multi-month highs near 620. A breakout above the October peak of 623 could spark a run toward the coveted 700 mark. On the flip side, the 200-day MA offers initial support, with a sturdier safety net resting near 575.

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, February 11. Net position in Green versus price in Red. Money Managers net bought 5,733 contracts between February 4 – February 11, bringing their total position to a net short 30,248 contracts.

2024 Crop:

- Grain Market Insider recently recommended selling a portion of your 2024 HRS wheat crop on February 10.

- Hold: Sit tight on making any additional sales for now given the recent recommendation.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2025 HRS wheat crop.

- Hold: No additional sales are recommended at this time, given the recent guidance.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout Confirmed

Spring wheat shook off its doldrums in late January, surging past its prolonged sideways range and flashing bullish signals. A mid-February close above the 200-day moving average strengthens the breakout case. Initial support stands at the 200-day MA, with firmer footing near 615 — the top of the old range. On the upside, 650 is the first hurdle to clear before bulls set their sights on the elusive 700 mark.

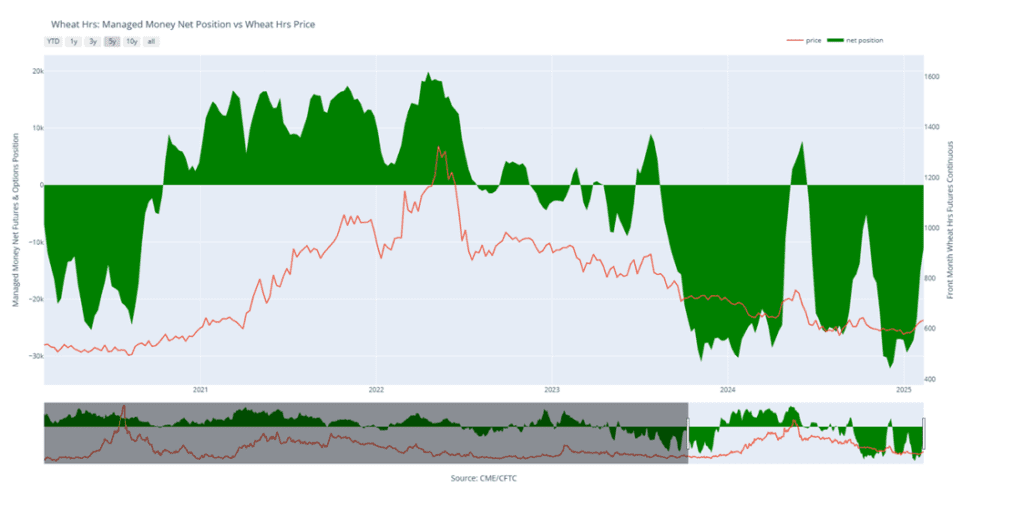

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, February 11. Net position in Green versus price in Red. Money Managers net bought 4,172 contracts between February 4 – February 11, bringing their total position to a net short 10,912 contracts.

Other Charts / Weather