2-24 Opening Update: Grains in the Red to Start the Week

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’25 | 486 | -5.25 |

| JUL ’25 | 504.75 | -4.75 |

| DEC ’25 | 471.5 | -3.5 |

|

Soybeans |

||

| MAR ’25 | 1035 | -4.5 |

| JUL ’25 | 1068 | -5 |

| NOV ’25 | 1054.75 | -5 |

|

Chicago Wheat |

||

| MAR ’25 | 579.5 | -10.5 |

| JUL ’25 | 607.25 | -10 |

| JUL ’26 | 659.25 | 0 |

|

K.C. Wheat |

||

| MAR ’25 | 598.5 | -10.75 |

| JUL ’25 | 623.5 | -10.25 |

| JUL ’26 | 669.25 | 0 |

|

Mpls Wheat |

||

| MAR ’25 | 621.25 | -10.5 |

| JUL ’25 | 649.5 | -10.5 |

| SEP ’25 | 662 | -8 |

|

S&P 500 |

||

| MAR ’25 | 6057.5 | 28.5 |

|

Crude Oil |

||

| APR ’25 | 70.36 | -0.04 |

|

Gold |

||

| APR ’25 | 2961.6 | 8.4 |

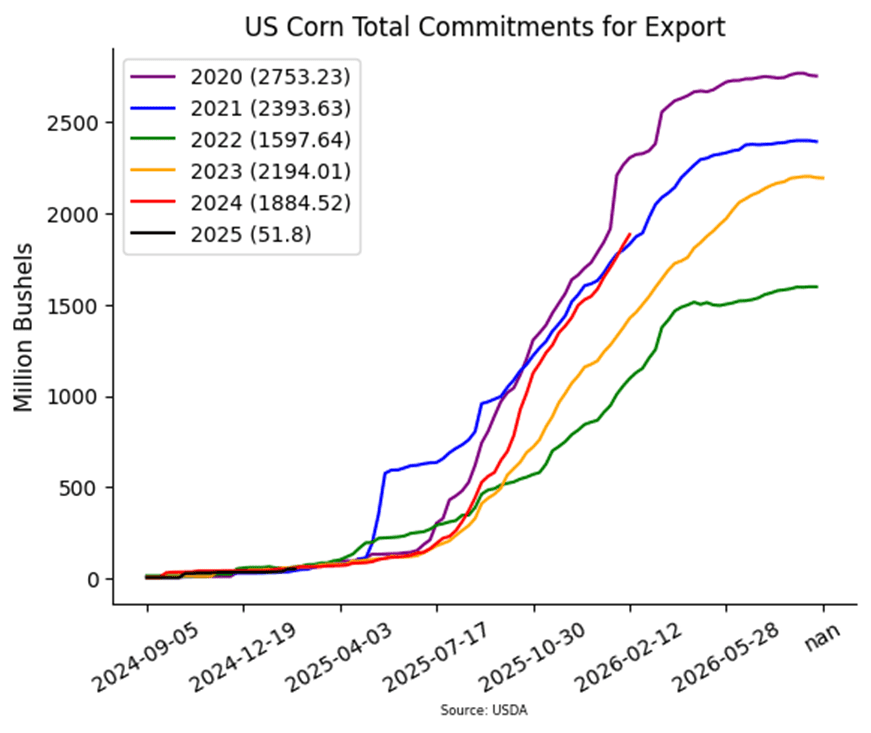

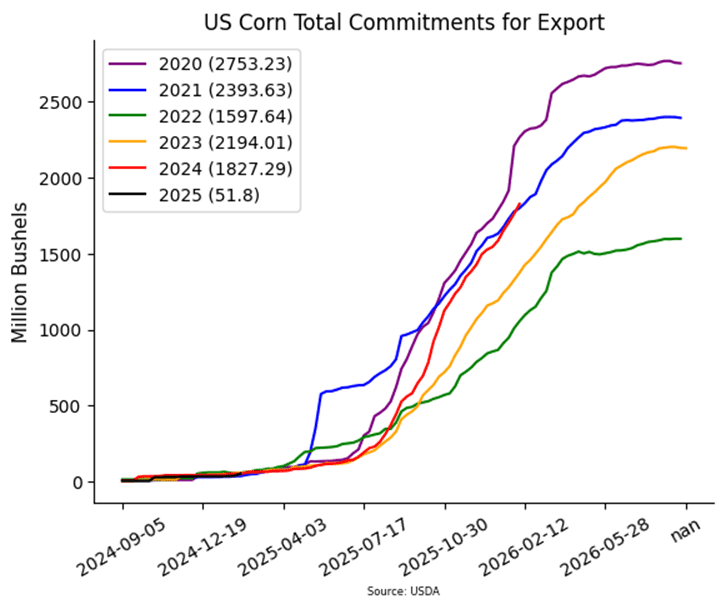

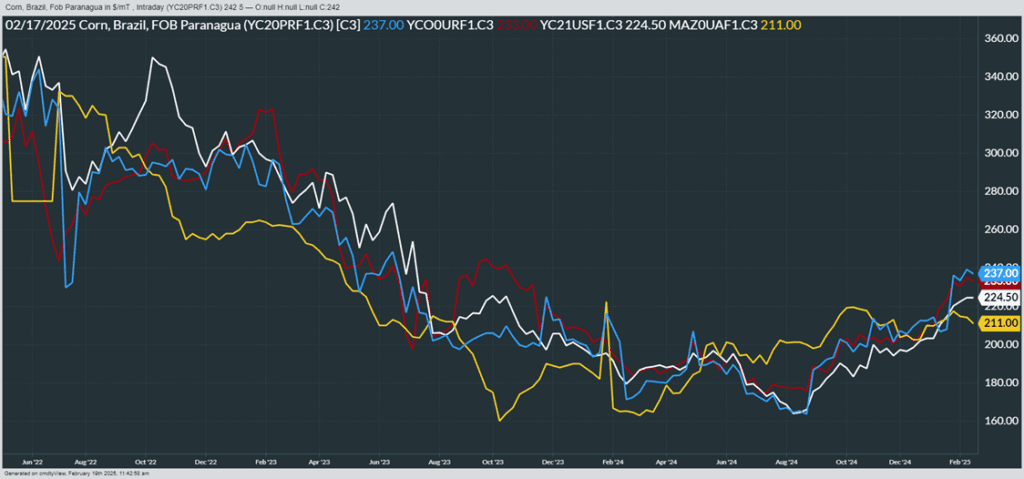

- Corn is trading lower to start the day following losses on Friday that have seen March futures rolling over after briefly exceeding the 5-dollar mark. Pressure is coming from the decision on 25% tariffs for Canada and Mexico that had been pushed off for 30 days.

- US ethanol stocks rose by 2% according to last week’s report to 26.218m bbl, ands analysts were expecting 25.731m. Plant production came in at 1.084m b/d compared to the survey average of 1.078m.

- Friday’s CFTC report showed funds as buyers of corn by 21,144 contracts which increased their net long position to 353,533 contracts bringing them closer to their record net long position.

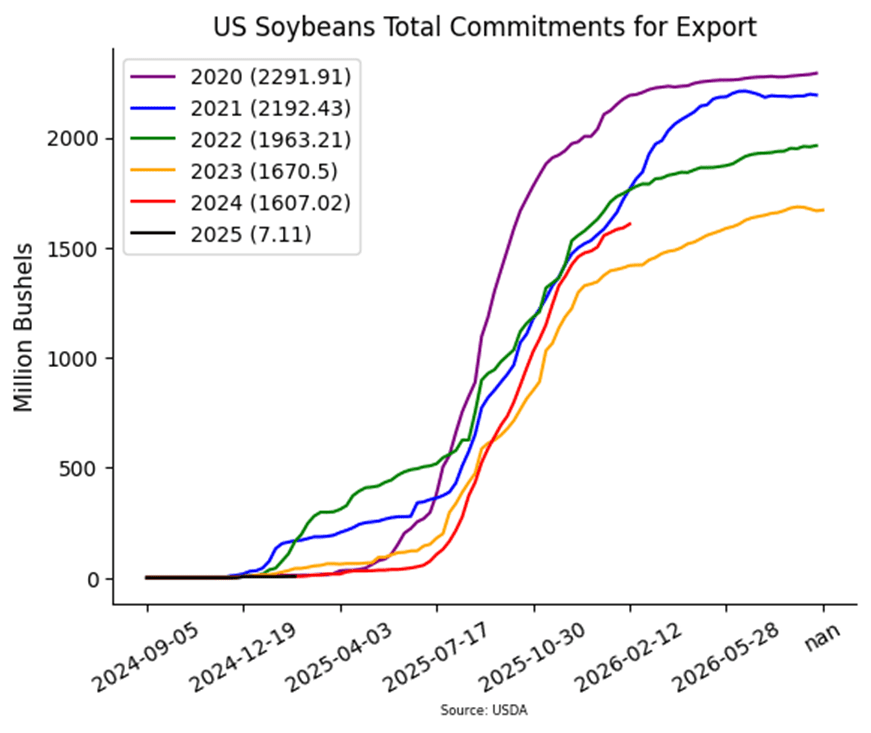

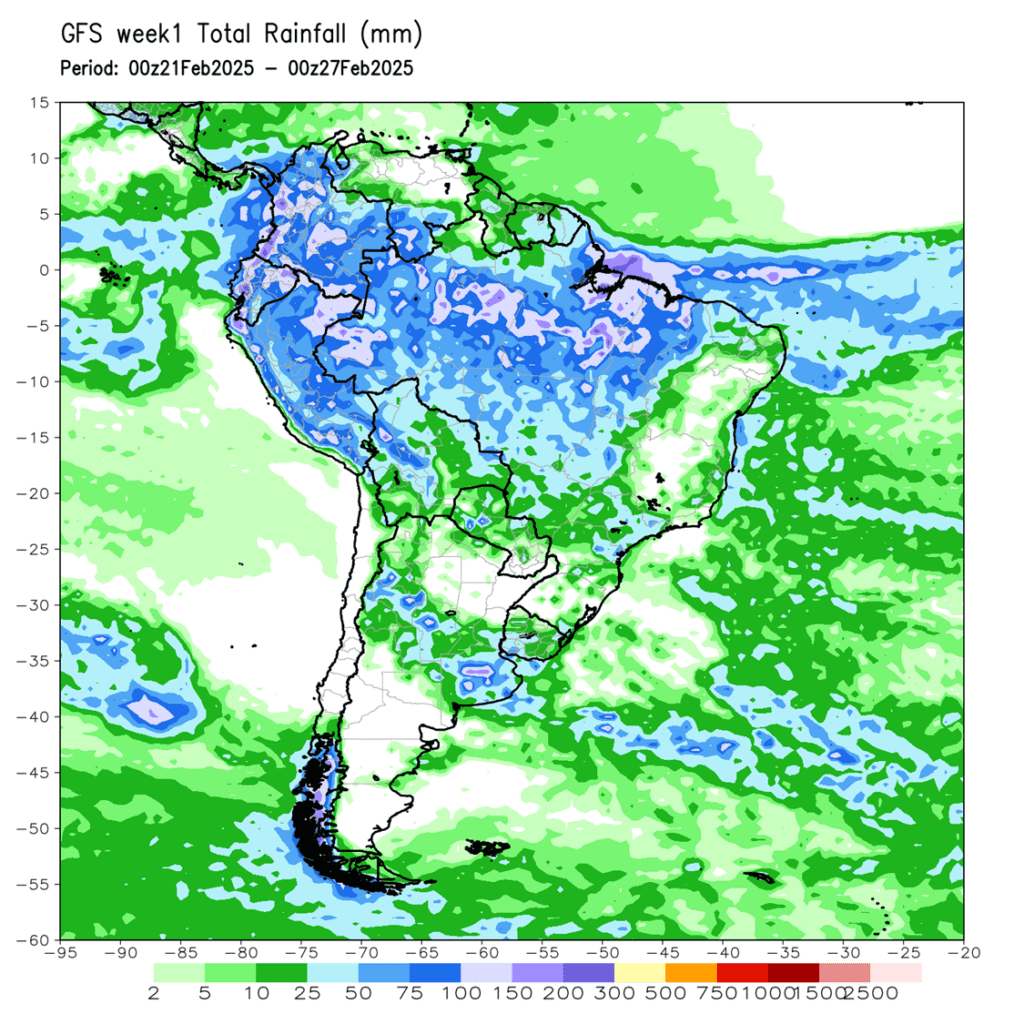

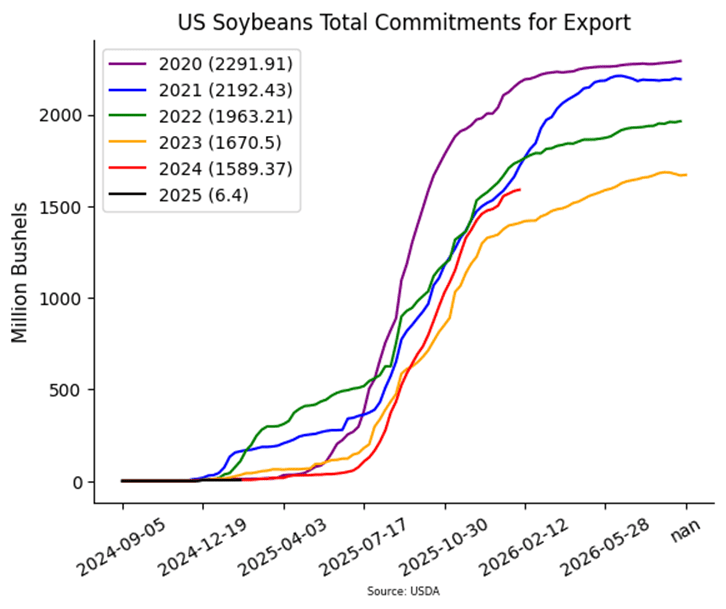

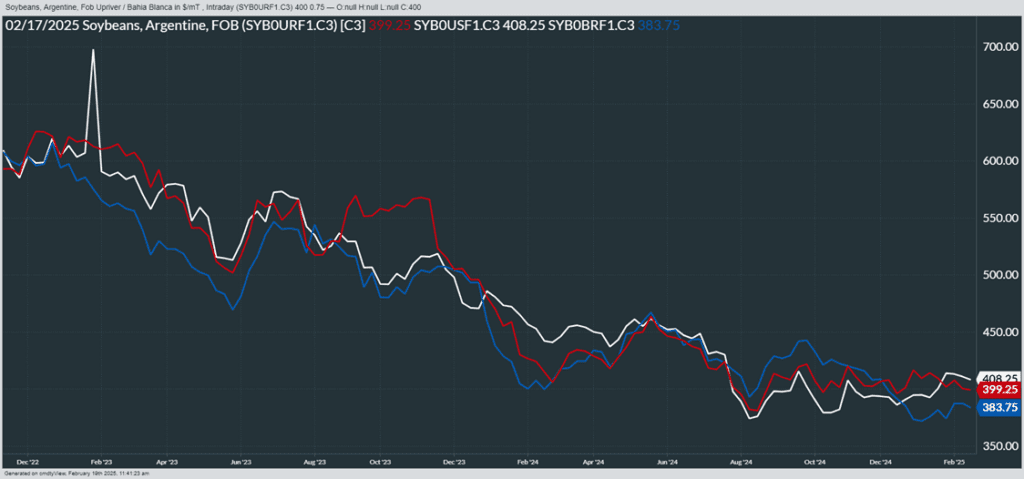

- Soybeans are trading lower this morning but remain in a tight range that began on February 12. Both soybean meal and oil are lower as well as lower wheat drags down both corn and soybeans.

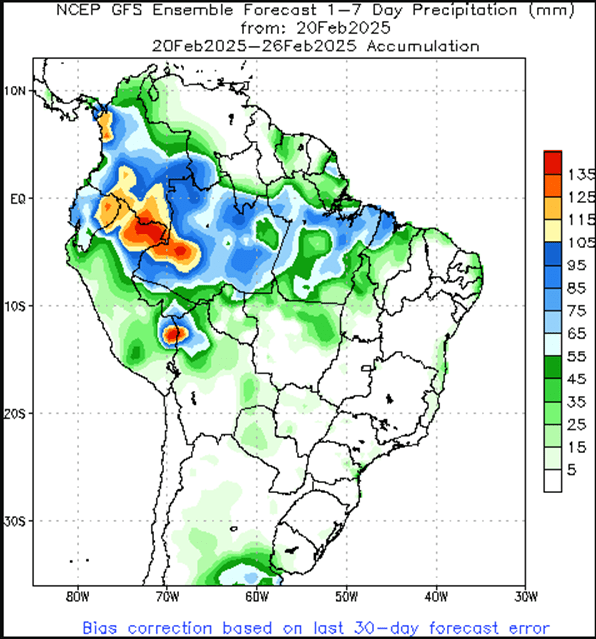

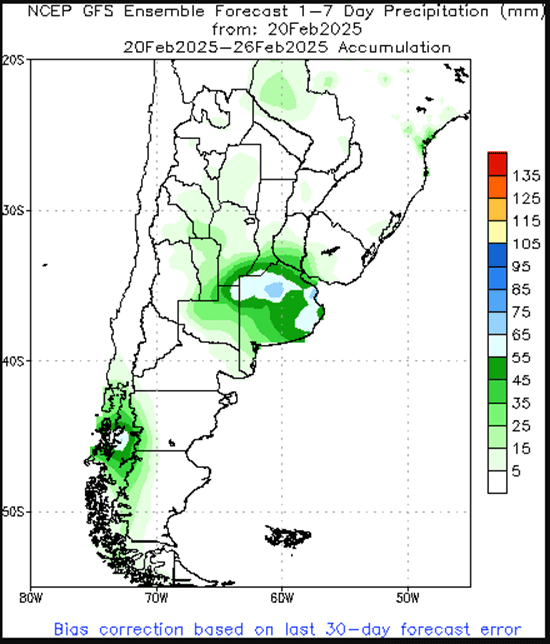

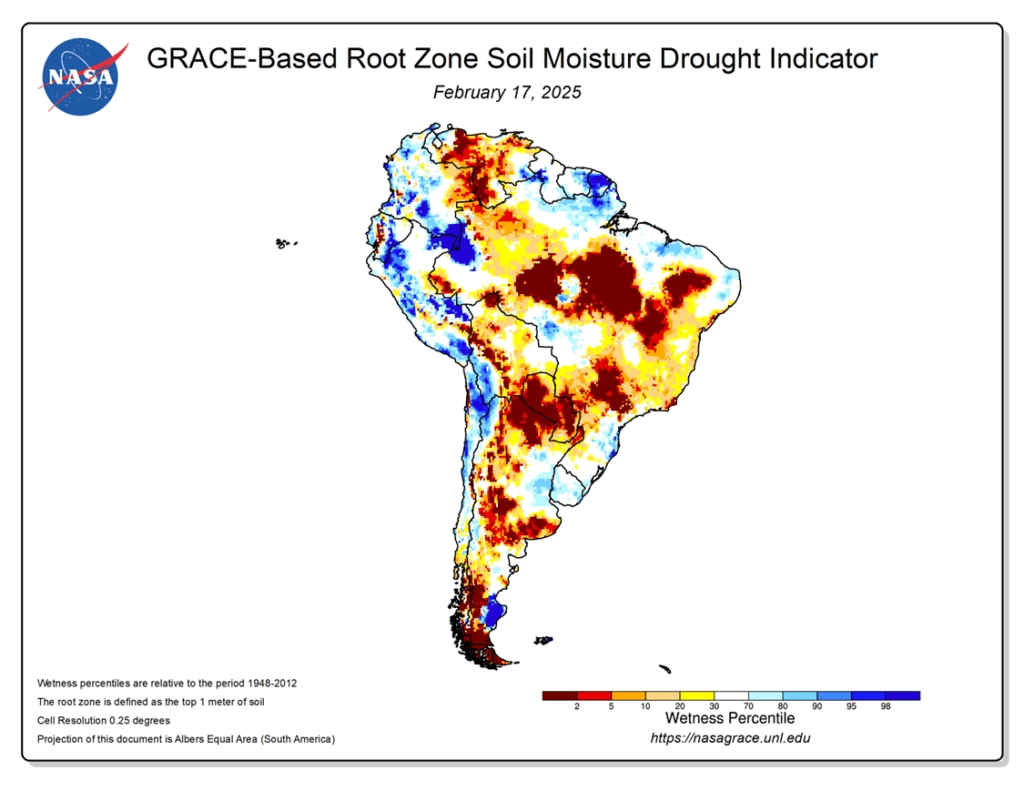

- Agroconsult has cut their estimate for the Brazilian soybean crop by 1.1 mmt but the new estimate is still a record at 171.3 mmt. This would be 15.8 mmt higher than last year’s crop with the center North region making up most of the gains.

- Friday’s CFTC report saw funds as sellers of soybeans by 11,949 contracts leaving them net long 16,526 contracts. They were buyers of soybean oil but sellers of soybean meal.

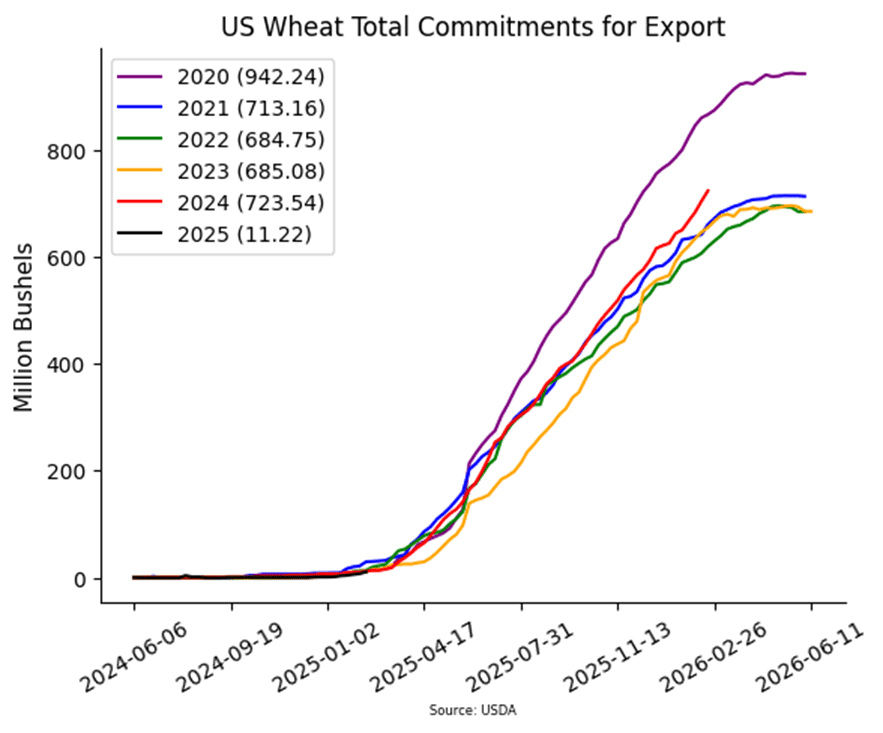

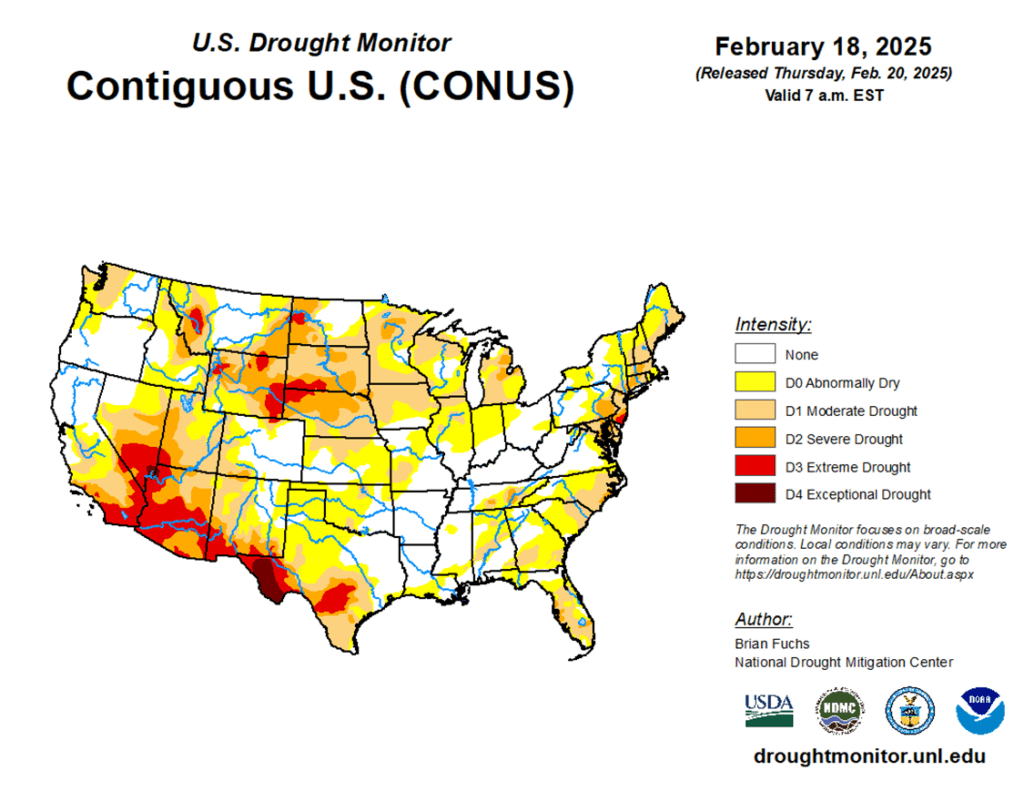

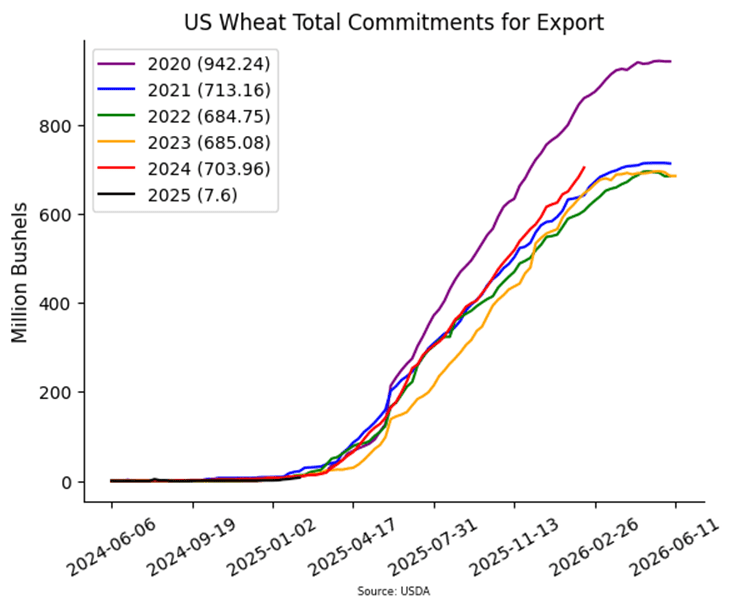

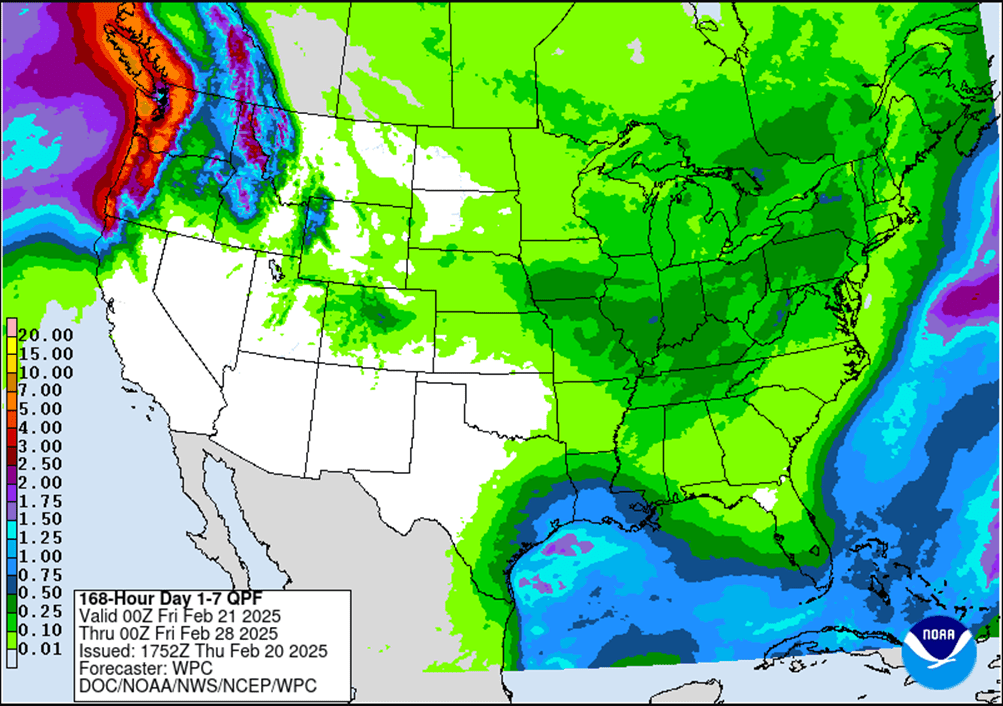

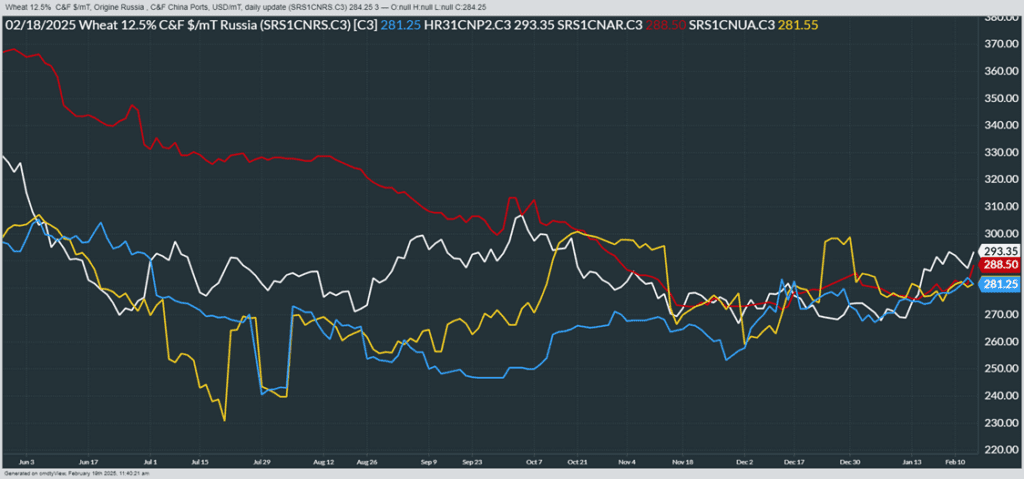

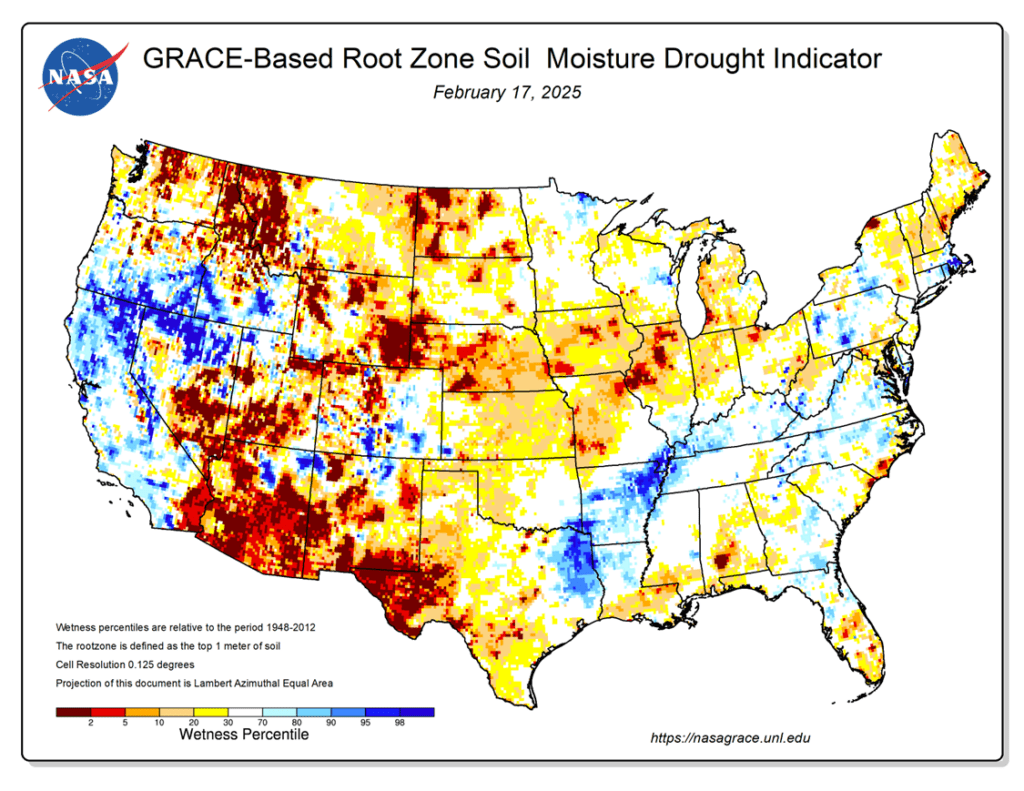

- All three wheat classes are trading lower this morning and are on track for a third lower close out of the past 4 trading sessions. Temperatures across the Midwest are expected to rise which trade views as bearish.

- In France, 2025 wheat plantings are up 10% on improved weather with 6.35 million hectares of winter grains planted for the 2025 harvest. This is up 7.2% from last year’s plantings.

- Friday’s CFTC report saw funds as buyers of Chicago wheat by 21,232 contracts leaving them net short 61,577 contracts. They were buyers of KC wheat by 8,158 contracts leaving them net short 22,090 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.