10-16 End of Day: Corn, Soybeans Advance; Wheat Closes Mixed

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Thursday’s corn session ended higher for the third consecutive day, supported by news regarding China.

- 🌱 Soybeans: Soybeans closed higher across the entire soy complex, supported by bullish NOPA crush data released yesterday.

- 🌾 Wheat: Wheat finished mixed, with some downward pressure stemming from a weaker MATIF wheat close.

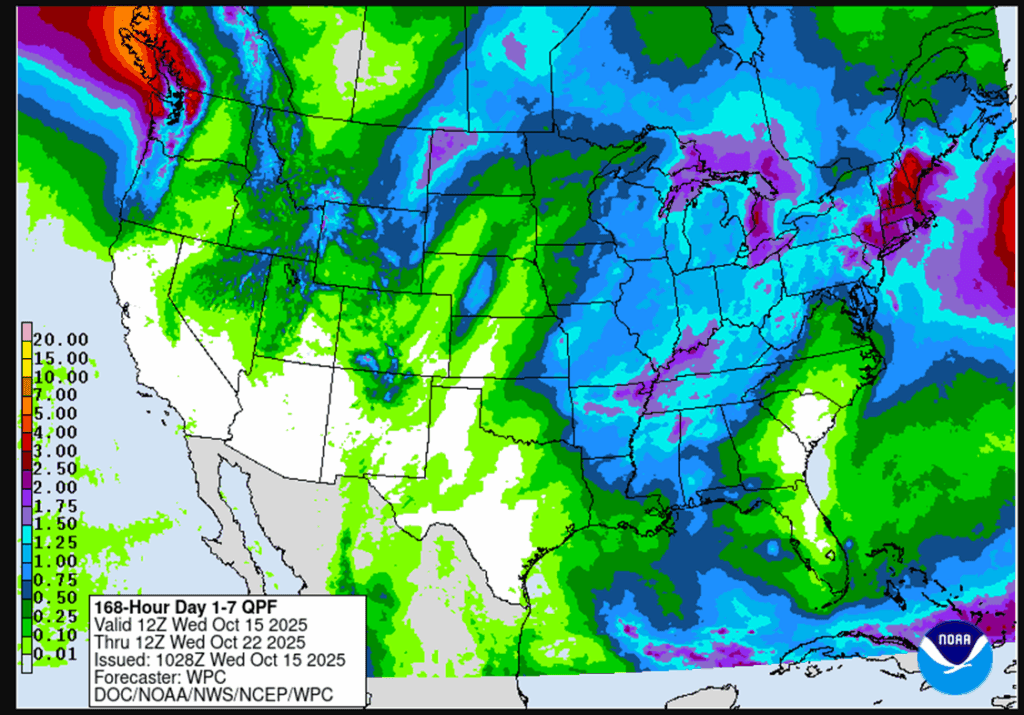

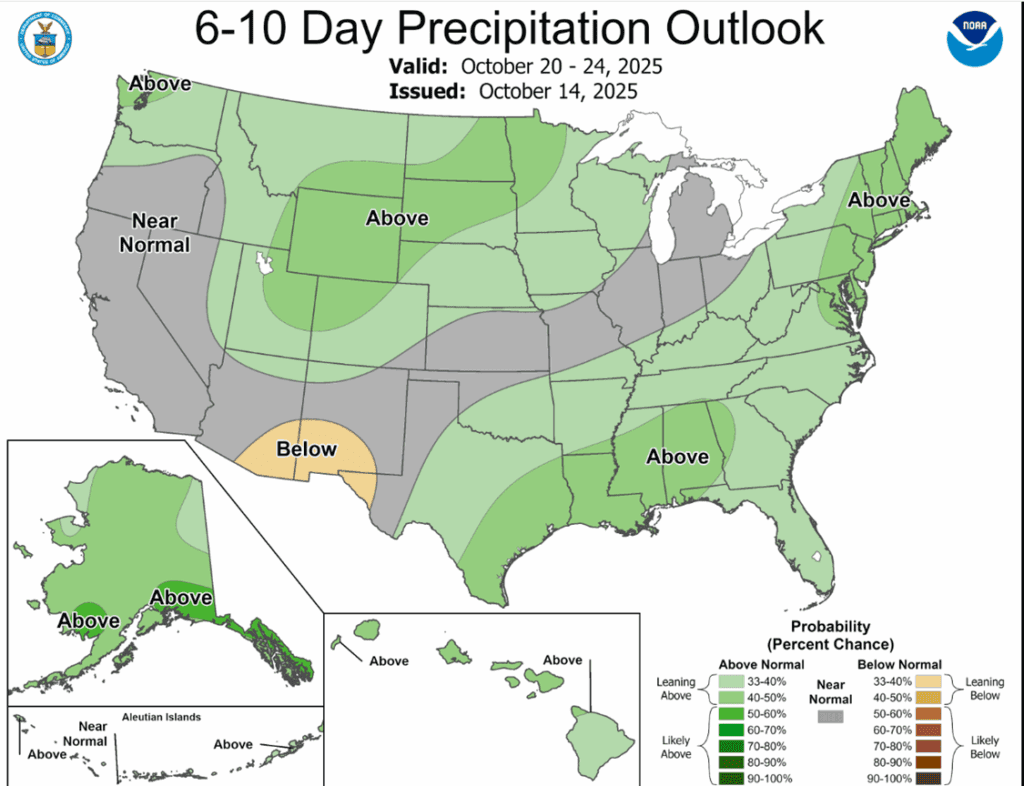

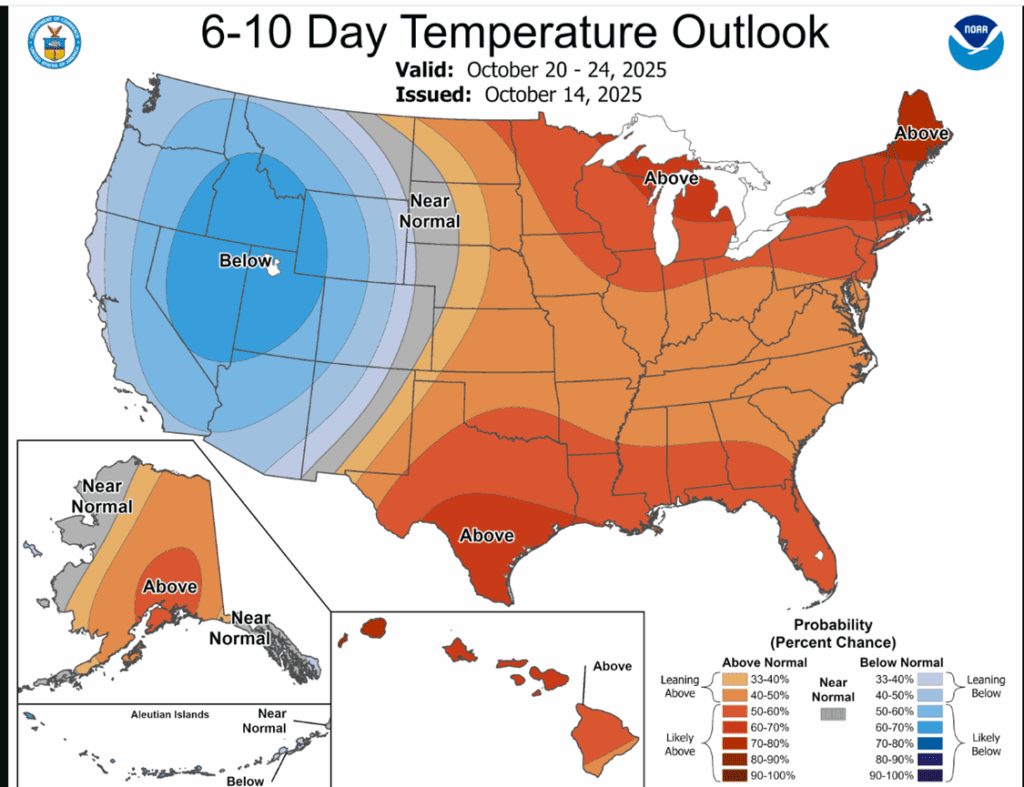

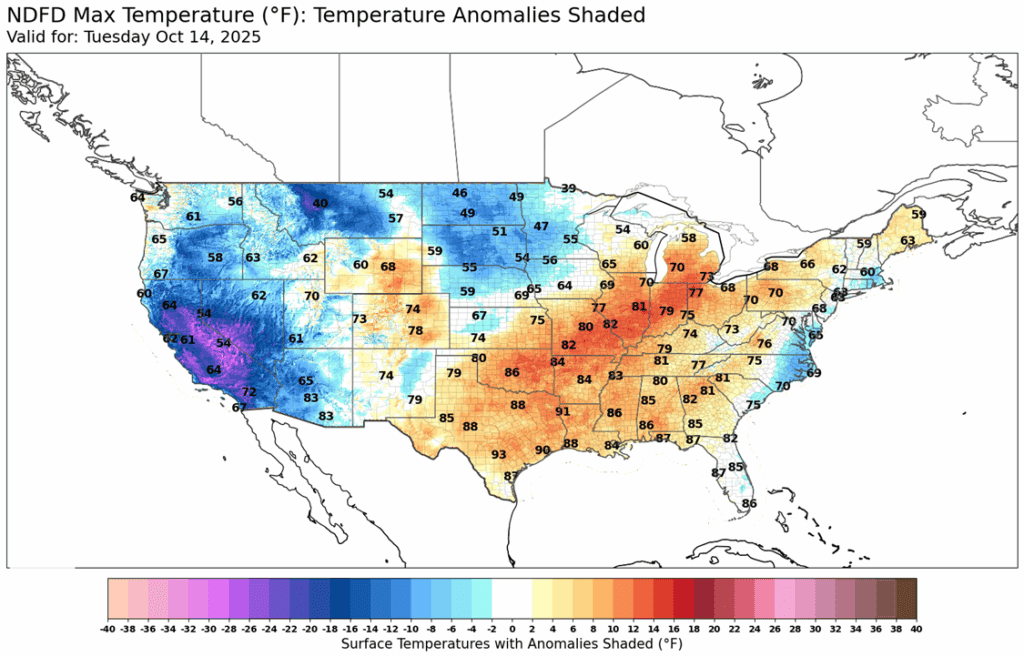

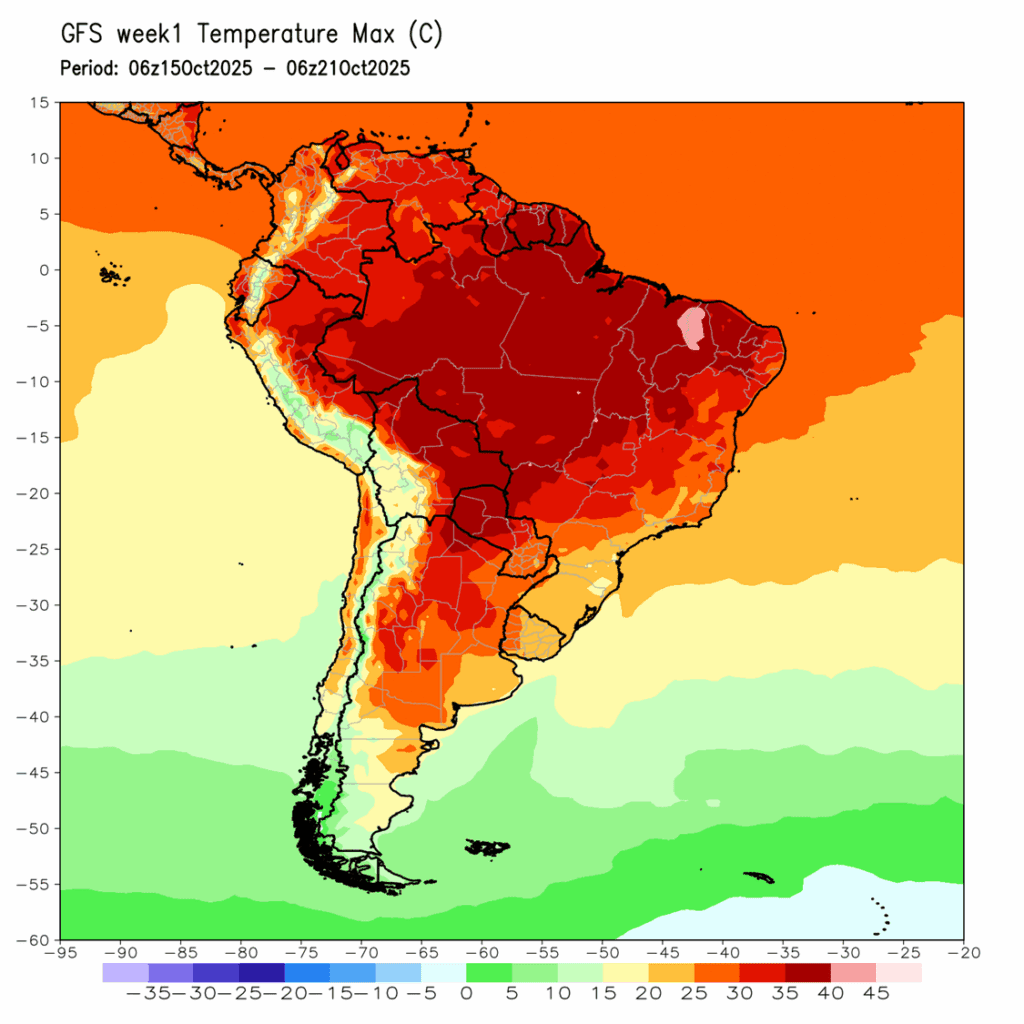

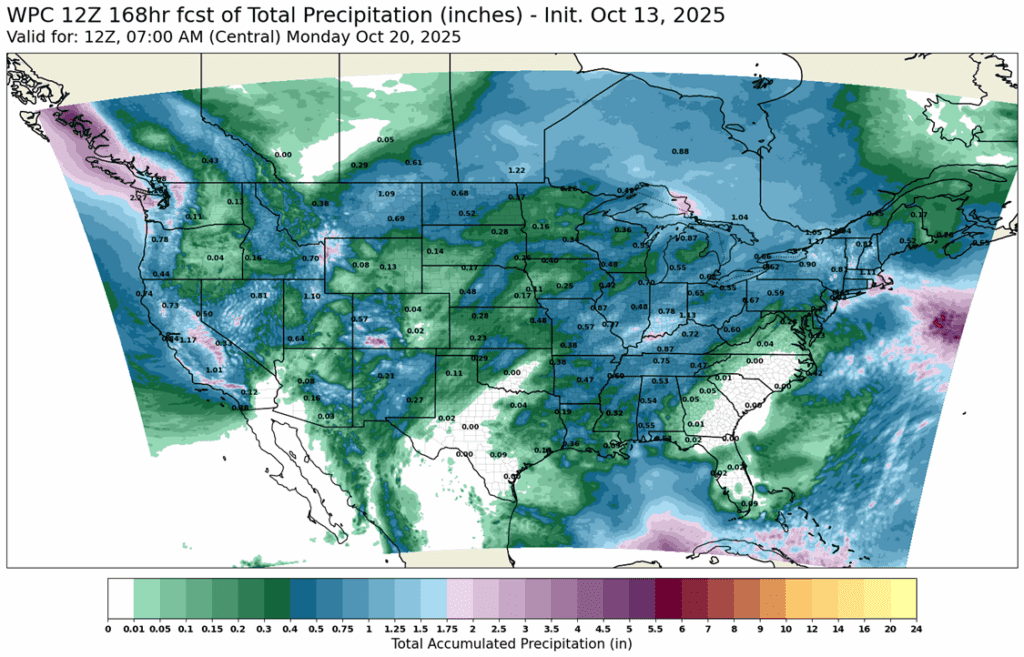

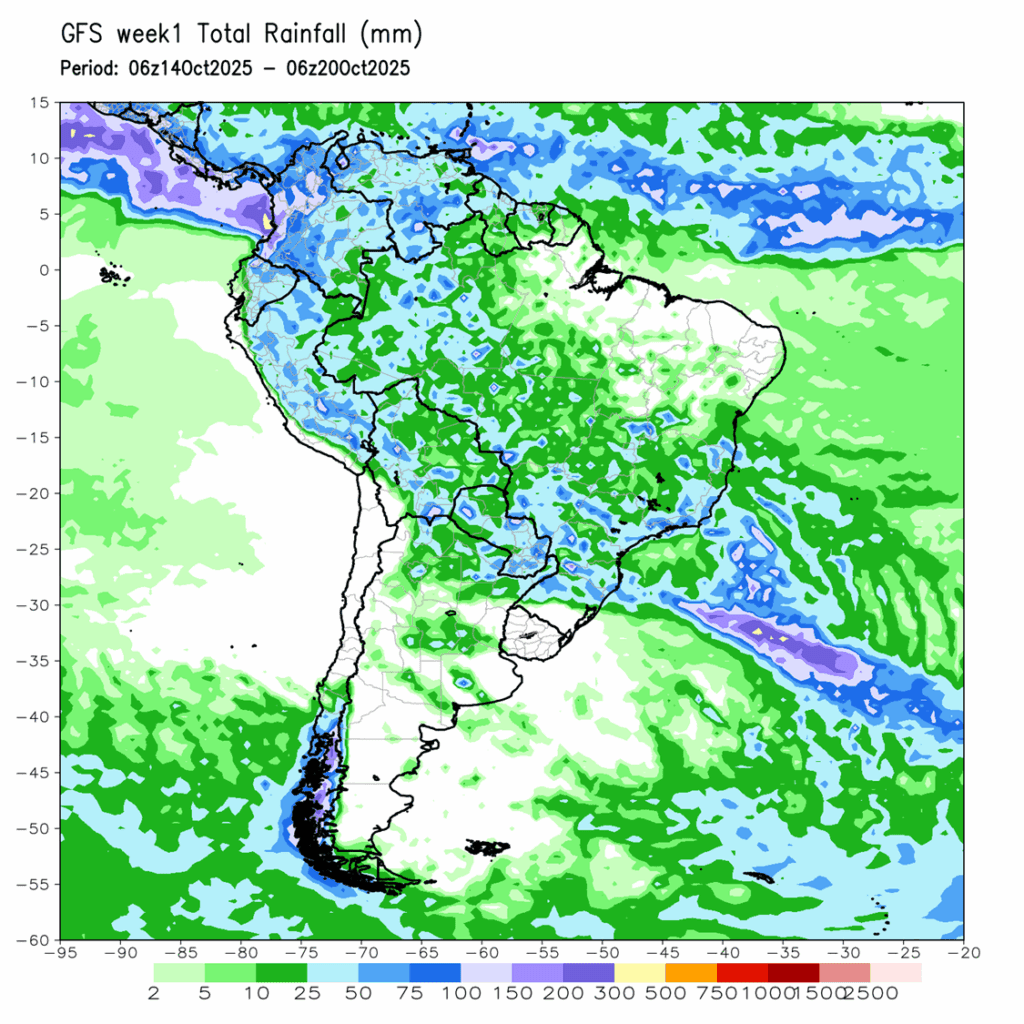

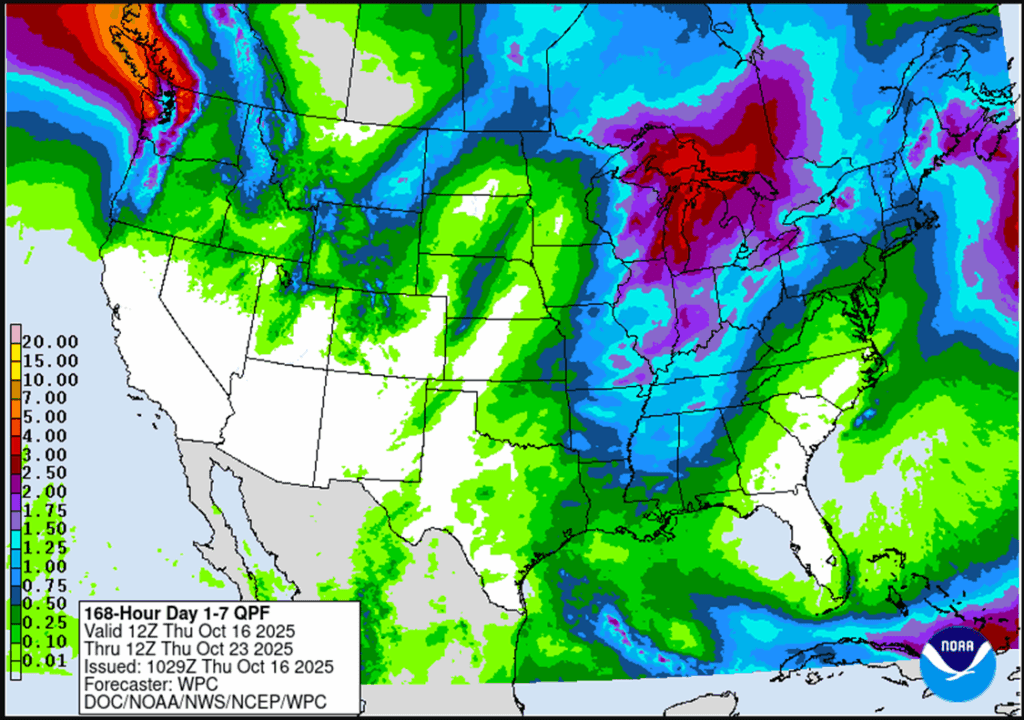

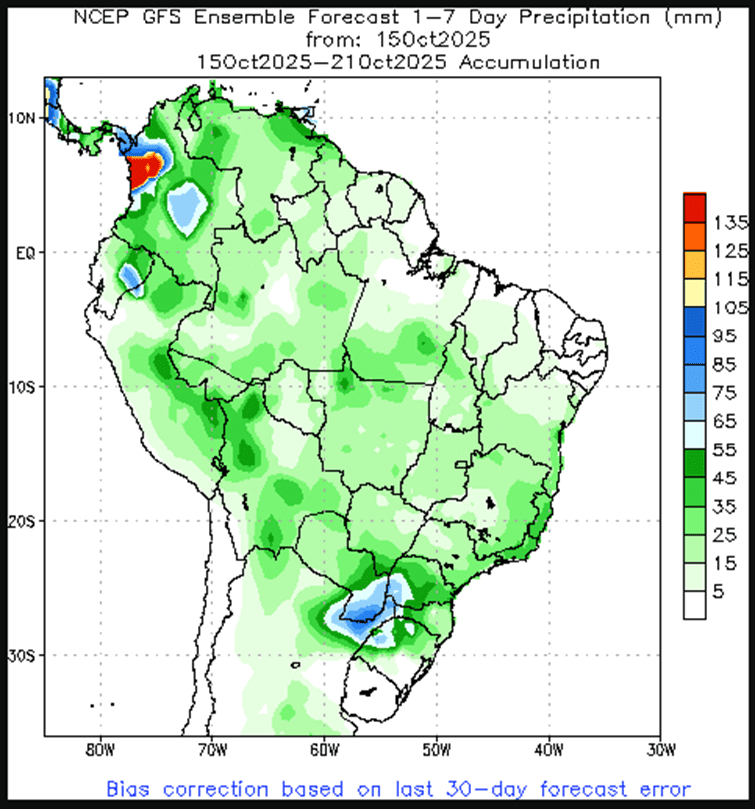

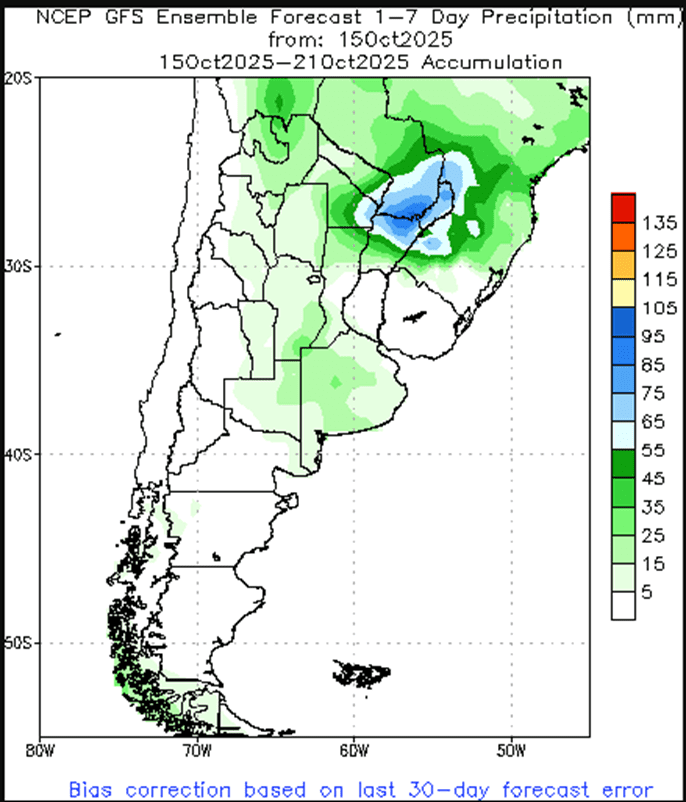

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA, scroll down to the other Charts/Weather section.

- The release of new export data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

- Corn futures finished higher for the third consecutive session on Thursday. Technical buying, along with talk of an extension to China’s tariff exemption deadline, helped push prices to test resistance levels above the market. December futures gained 5 cents to 421 ¾ and March added 3 ¼ to 435 ½.

- Corn futures rallied to resistance just over the 420 level, which held upward momentum for the session. Friday and Monday trade may be key to price action if the market sees additional technical buying strength.

- Grain markets found buying support on talk of an extension to China’s tariff relief deadline. Rhetoric has intensified this week, with a mix of both optimistic and cautious commentary as the meeting between President Trump and President Xi approaches at the end of the month.

- Daily ethanol production for the week ending October 10 averaged 1.074 million barrels. This was a new high daily production for that week of the year. A total of 107 MB of corn was used in the production process, which is just below the total needed to reach the USDA market year target

- Corn harvest pressure may continue to act as a limiting factor for the market. Producers are moving into the final two-thirds of harvest, and a steady flow of fresh bushels is making its way into the pipeline.

Soybeans

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

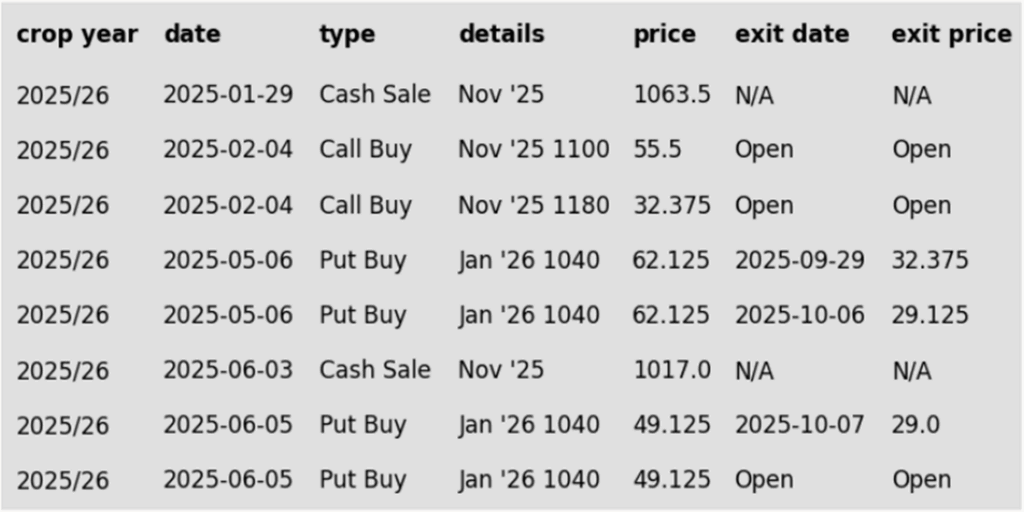

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans ended the day higher thanks to bullish NOPA crush data yesterday but backed off from highs earlier in the day. November soybeans gained 4-1/4 cents to $10.10-3/4 while March gained 4 cents to $10.43-3/4. December soybean meal was up $1.00 to $276.90 and December soybean oil was up 0.07 cents to 50.87 cents.

- The NOPA crush report for September showed U.S. soybean crush topping estimates at 197.86 million bushels, which was up 4.2% from August and up 11.6% from September last year. Domestic demand is encouraging, given Chinese absence.

- Today, Secretary Rollins made multiple announcements regarding the ag sector and soybeans. She said that the U.S. was in talks with some South American nations over the possibility of crushing U.S. and other soybeans in South America. She also said that the U.S. was not waiting to reach a trade deal with China and would open up markets to other countries.

- China has held off on large purchases of Brazilian soybeans for December and January delivery as a result of high Brazilian premiums. China still needs roughly 9 mmt of soybeans and could tap into state reserves to meet short-term needs.

Wheat

Market Notes: Wheat

- Wheat had a mixed close today; while Chicago finished higher, Kansas City settled on both sides of neutral, and Minneapolis MIAX futures posted small losses. December Chi gained 3-3/4 cents to 502-1/2, KC was up 1/2 cent at 488-3/4, and MIAX lost 1-1/2 cents to close at 549-1/2. Some pressure may have stemmed from a lower close for MATIF wheat futures; some contracts of which made new lows this session

- Globally, Algeria is reported to have purchased about 400,000 mt of durum wheat, paying between $324-$334/mt on a CNF basis. Egypt has also reportedly bought two cargoes of wheat from France, paying $240/mt on a FOB basis. Additionally, there is talk that Egypt may be seeking Black Sea wheat too.

- According to their Agriculture minister, Russia has harvested about 132 mmt of grain so far during the 25/26 season. Russia has kept their total grain harvest estimate steady at 135 mmt, of which wheat would account for 90 mmt. Additionally, grain exports this season are projected at 50 mmt.

- Australia is set to see an increase in rainfall for the second half of this month. This should be beneficial for development of their wheat crop. Western Australia could remain drier than normal, but this is not currently a major concern for the crop.

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 565 to 563.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 617.

To date, Grain Market Insider has issued the following KC recommendations:

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center