3-18 End of Day: Corn and Wheat Mixed, Soybeans Lower in Quiet Tuesday Trade

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- Corn: Futures ended mixed Tuesday as selling pressure weighed on front-end contracts, while new crop contracts held onto fractional gains.

- Soybeans: Soybeans closed slightly lower, staying rangebound, with soybean meal leading the decline while soybean oil posted gains.

- Wheat: Wheat closed mixed, fading from early session strength, with Kansas City futures leading gains.

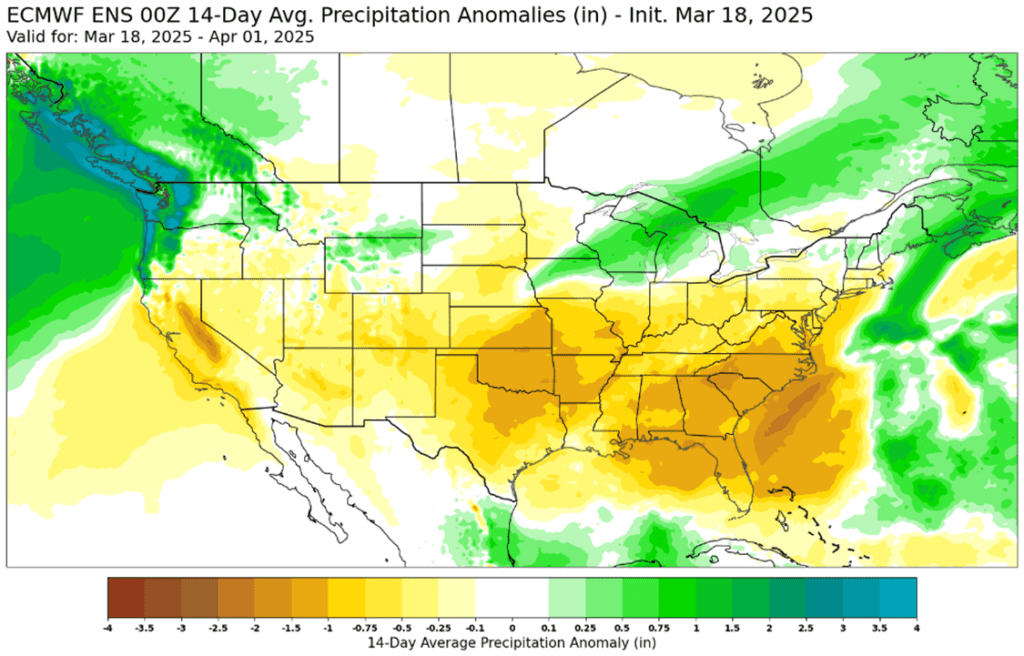

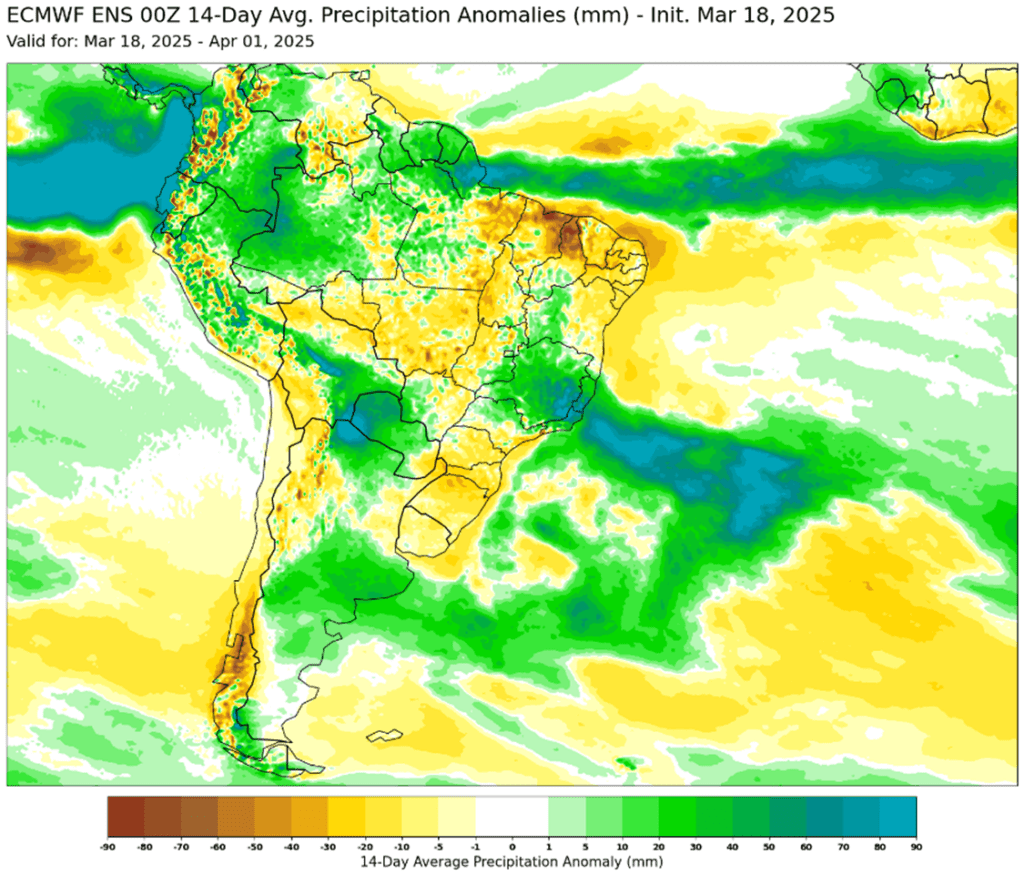

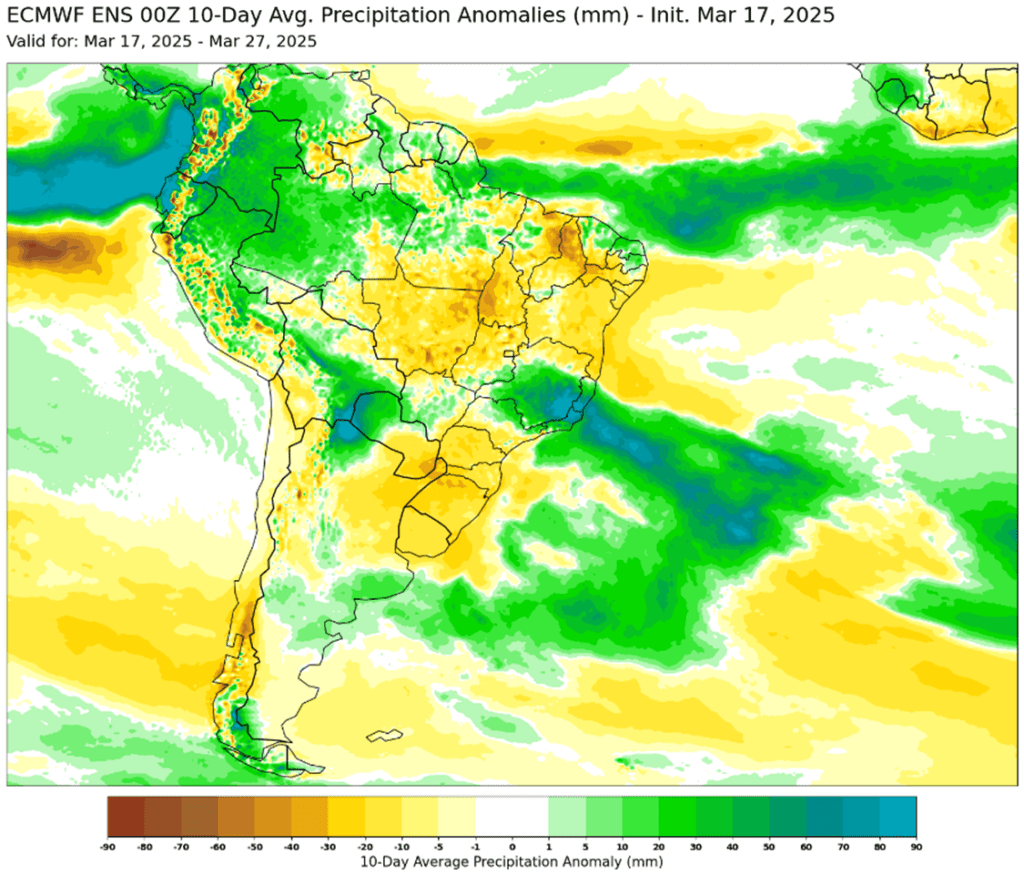

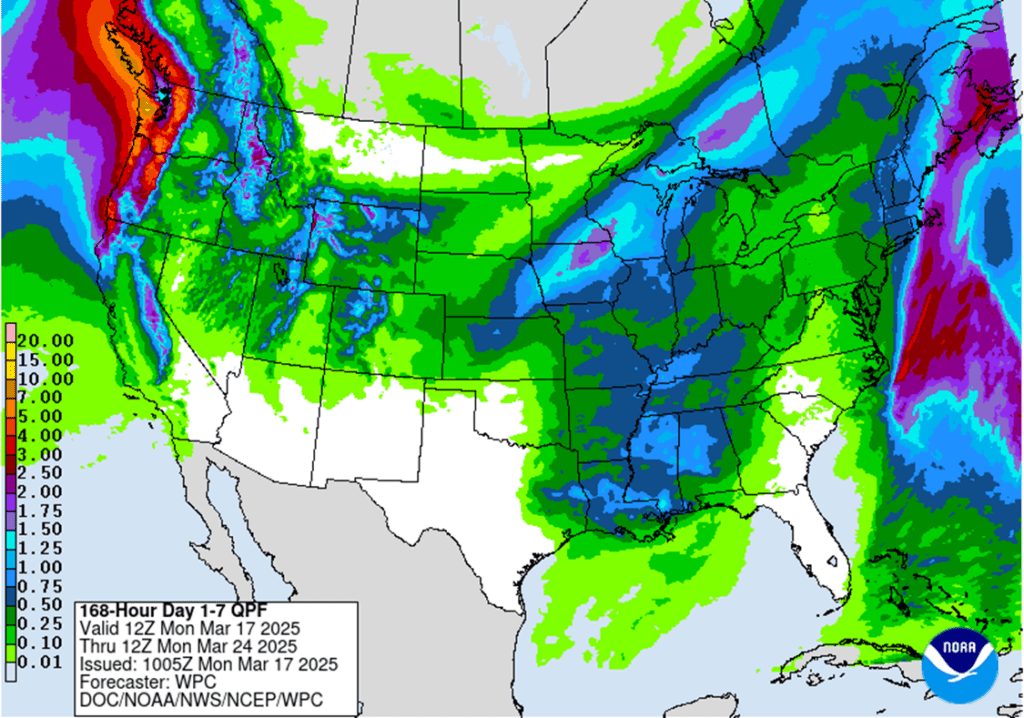

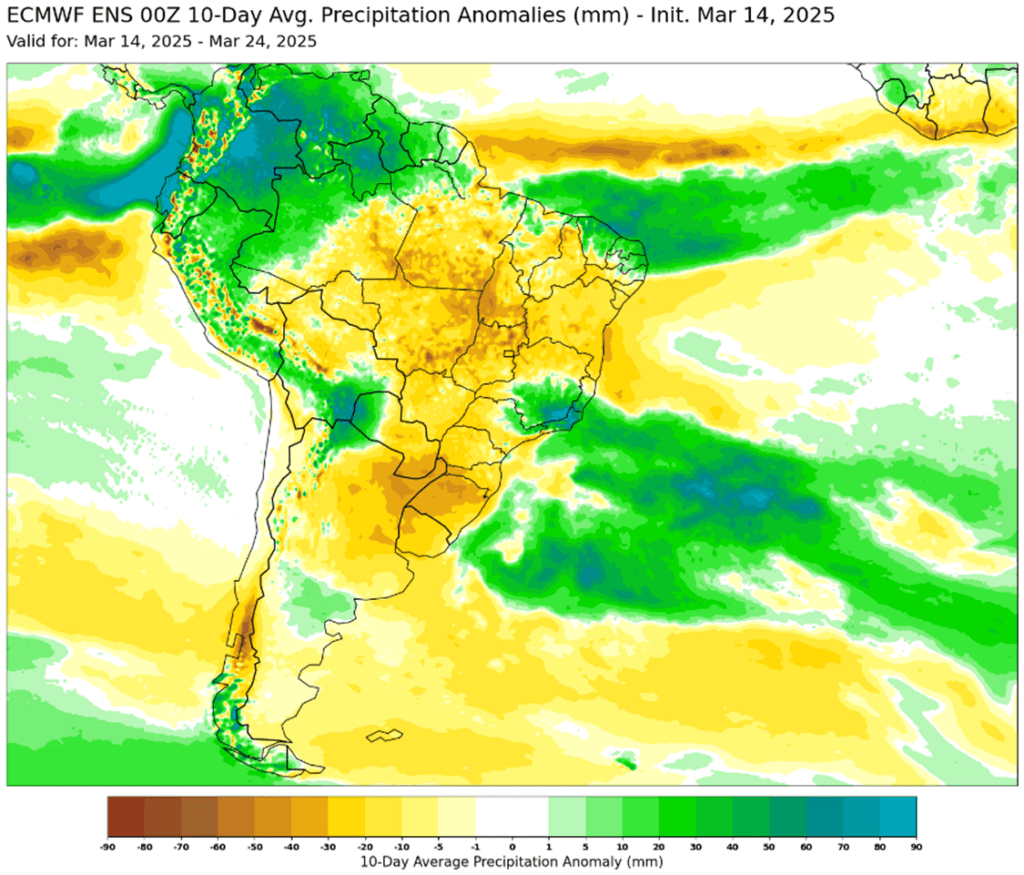

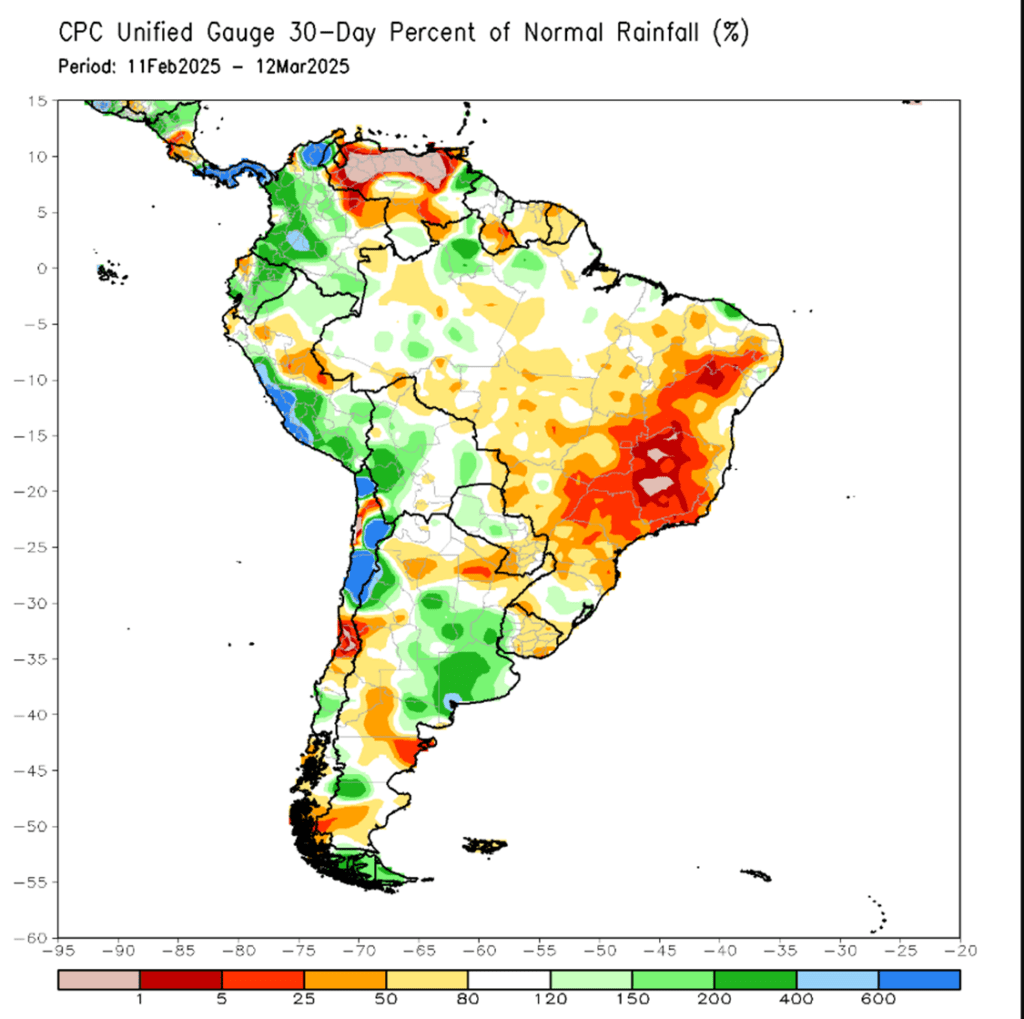

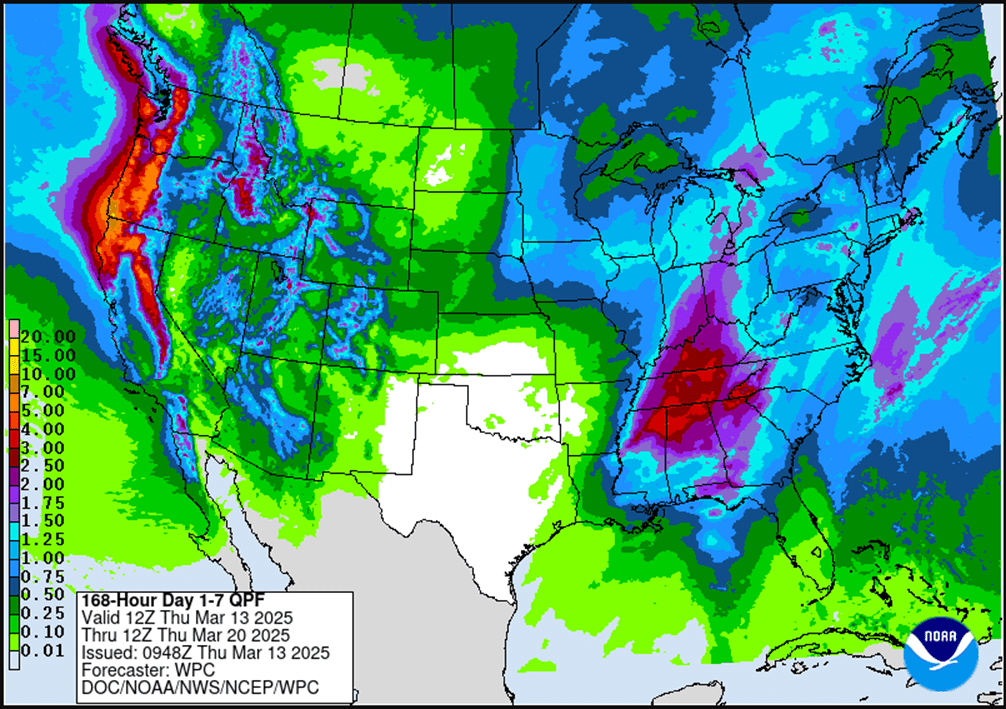

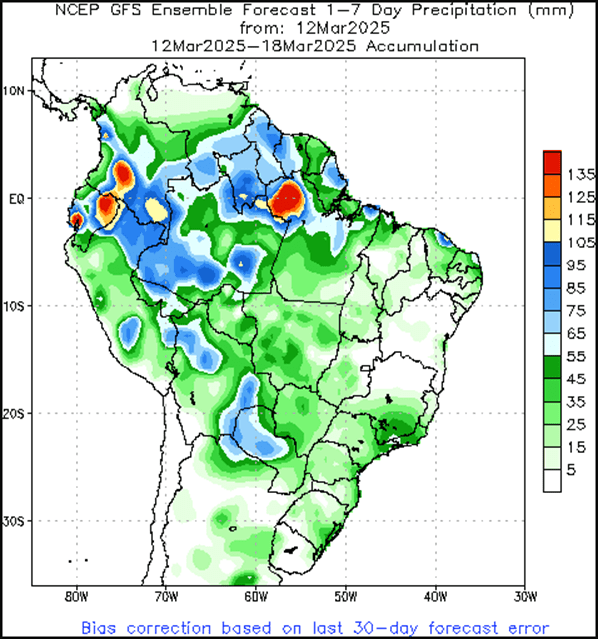

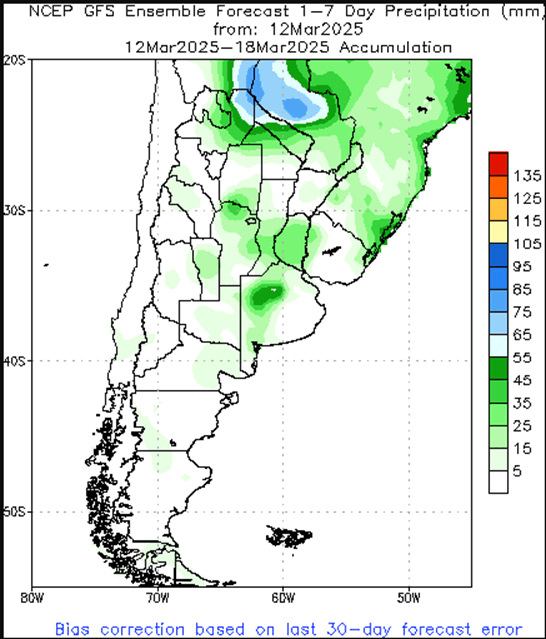

- To see the updated 14-day GEFS precipitation forecast for South America and the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

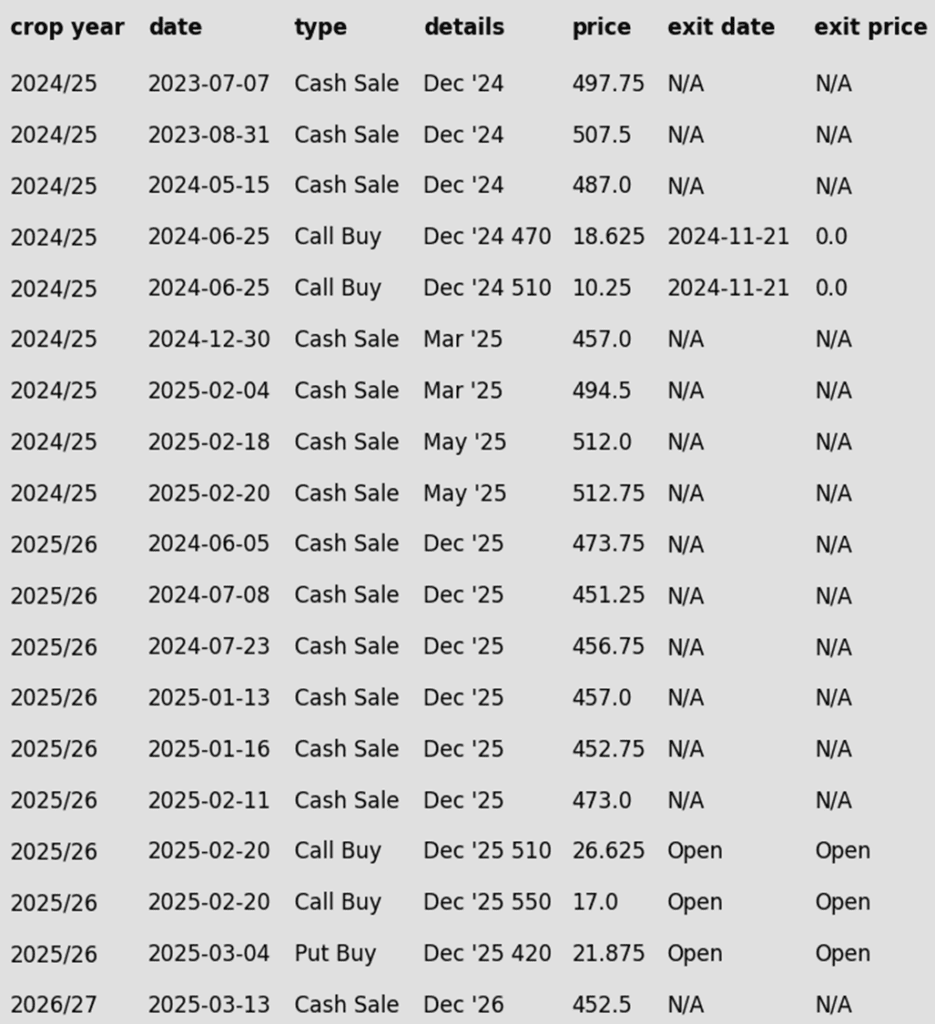

- Since last summer, seven official sales recommendations have been made at an average price of 495.50. If you are behind, target 480 vs May as a first spot to begin catching up.

- Grain Market Insider has not yet set an official price target for an eighth sale but remains satisfied with the sales recommendations made to date. The Prospective Plantings and Grain Stocks reports, scheduled for release on March 31, are approaching quickly. Given the high volatility typically seen on report day, Grain Market Insider is likely to hold off on any new recommendations until after the report — unless market conditions shift significantly.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Since last spring, six sales recommendations have been made for the 2025 crop at an average price of 460.75. If you are behind, target 462 vs December as a first spot to begin catching up.

- Grain Market Insider feels confident about the overall strategy heading into the volatile March 31 reports and into spring/summer. There are the six sales recommendations on the books at an average price of 460.75. Additionally, 510 and 550 call options are in place to capture upside potential if the highs are not in. On the downside, 420 put options cover unsold bushels, providing protection against lower prices. This balanced strategy allows flexibility to adjust as the market moves in either direction.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell the first portion of your 2026 corn crop.

- Details: Early sales can be impactful in years when prices trend sideways or lower. For last year’s 2024 corn crop, the sales recommendations made in 2023 at 497.75 and 507.50 ended up outperforming anything offered after January 1, 2024, for bushels that had to be sold at harvest. While this won’t be the case every year, history shows that sideways or lower years tend to outnumber higher years. Consistently applying early sales strategies year after year can provide long-term benefits.

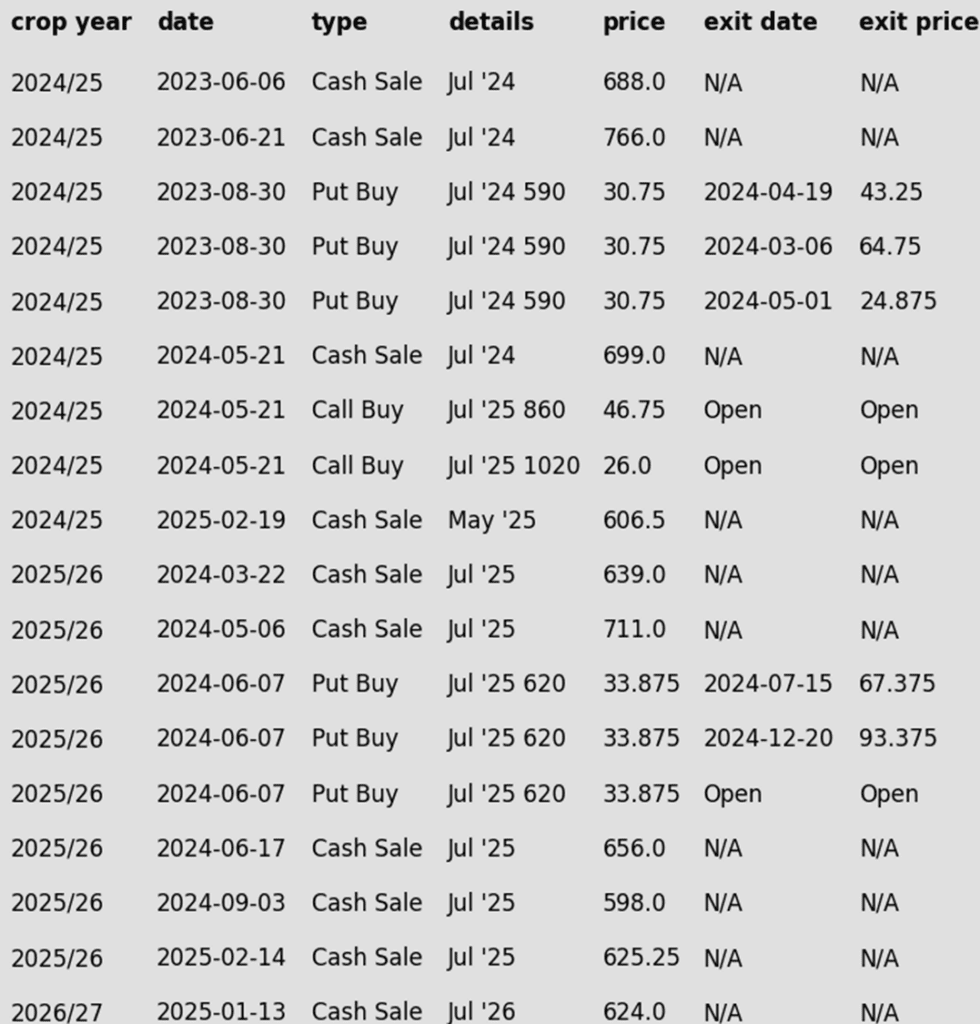

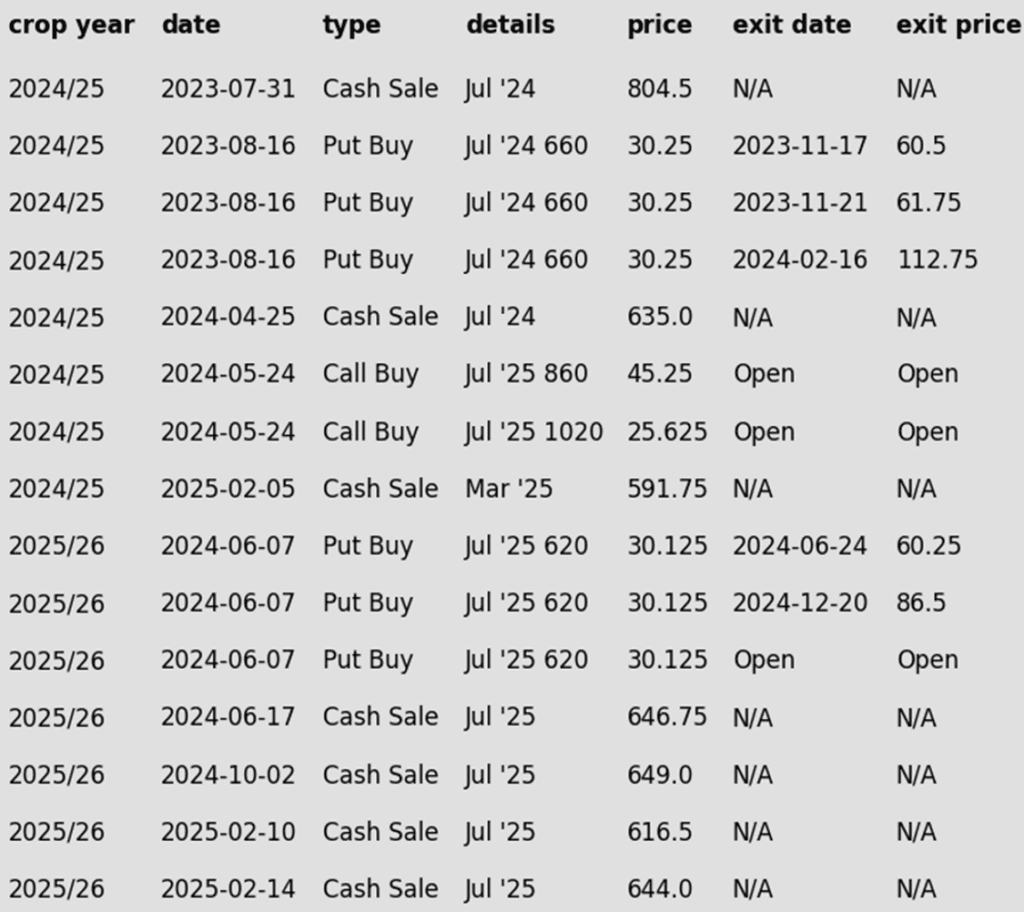

To date, Grain Market Insider has issued the following corn recommendations:

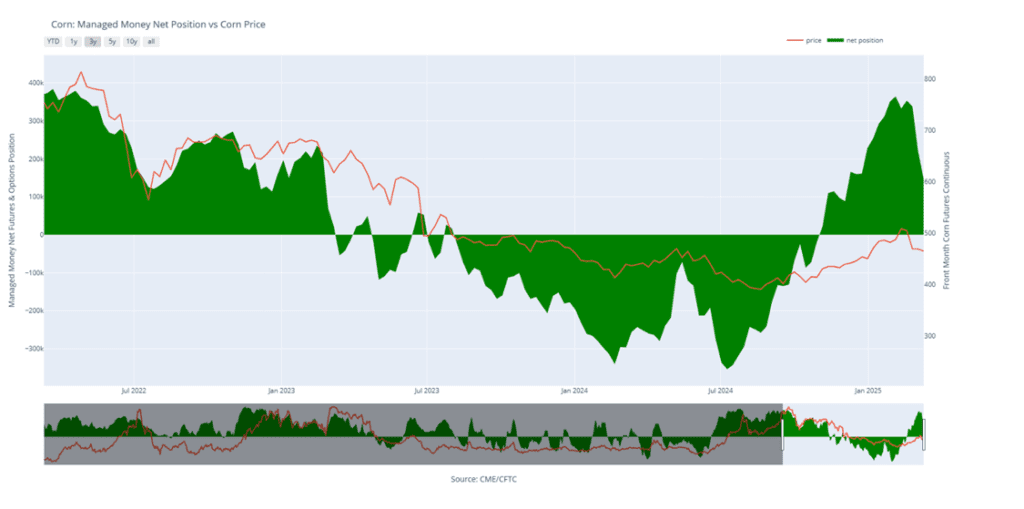

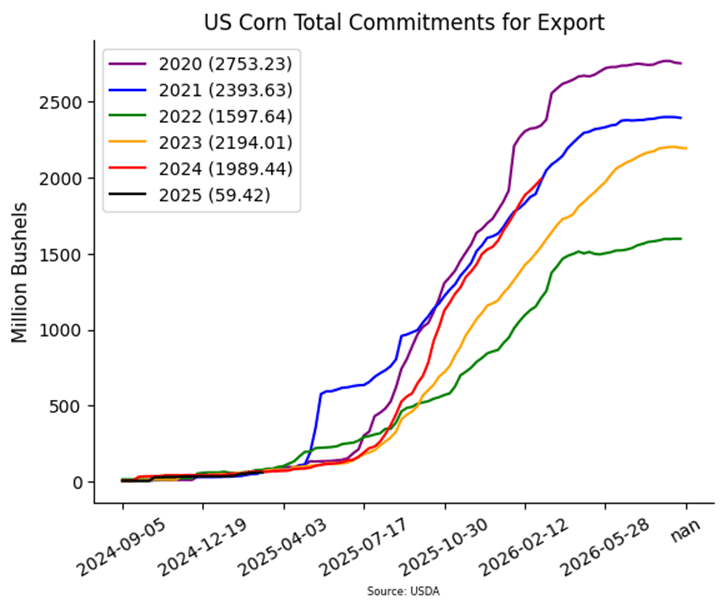

- The corn market saw selling pressure in the front end of the market to finish with mixed trade on the close Tuesday. A calmer wheat market allowed sellers to continue to liquidate long positions at the front end of the market.

- Technically, the May futures contract tested the 200-day moving average support level during the session. Failure of this point to hold would likely trigger additional long liquidation as speculators have been reducing their length in the market given market volatility.

- Traders are positioning ahead of the USDA Prospective Planting and Grain Stocks Report at month-end, which could set the tone for old and new crop markets.

- With the recent drop in crude oil prices, ethanol margins have tightened. Weekly ethanol production reports have remained supportive of the market, but demand could slow if margin remain tight. Current usage of corn for ethanol production is running ahead of the pace to reach USDA market year targets.

Corn Finds Support Near 450

After hitting 16-month highs in late February, corn prices pulled back sharply to test the 100-day moving average and trendline support near 450. This rebound suggests a potential short-term low that can be built off as we head towards spring. Initial resistance is expected near the 50-day moving average, while key support remains at 450, with stronger support at the 200-day moving average.

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs May. Buy calls with a close over 1079.75 vs May.

- Plan B: No active targets.

- Details:

- Since last spring, three official sales recommendations have been made at an average price of 1089. If you’re behind, consider targeting 1056 vs May as a good starting point to begin catching up.

- The official target for a fourth sale is 1107 vs May. Since soybeans tend to have later seasonal pricing opportunities than corn, the plan is to aim for an aggressive target for now.

- A close above the February high resistance of 1079.75 would trigger a recommendation to re-own the three prior sales with August call options.

2025 Crop:

- Plan A: Next cash sale at 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- There has been one official sales rec on 2025 soybeans to date. If you’re behind, consider targeting 1040 vs November to catch up.

- If the 1100 November calls can be exited for 88 cents, that should cover the cost of the 1180 calls, providing a net-neutral cost position that can continue to protect the upside on the previous sales recommendation.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Still not expecting the first targets for at least another couple months.

To date, Grain Market Insider has issued the following soybean recommendations:

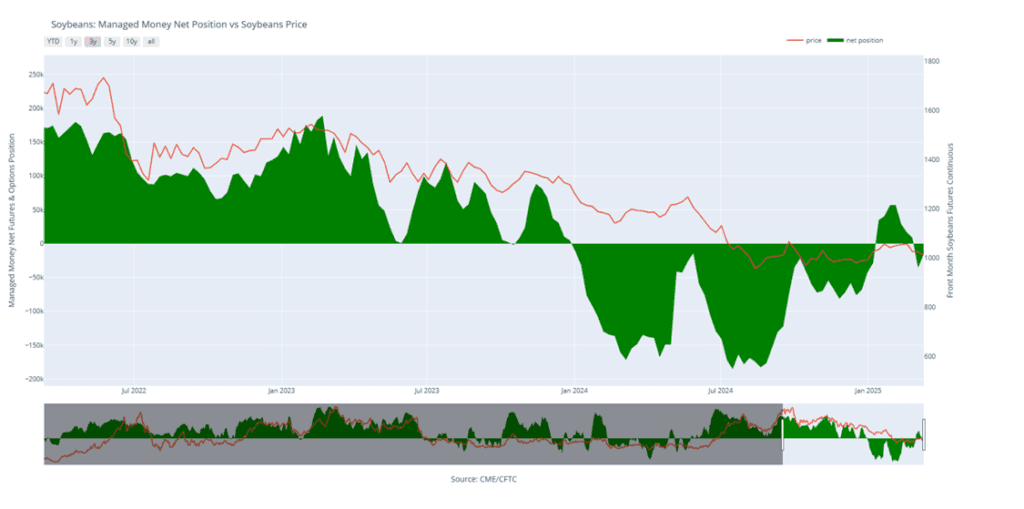

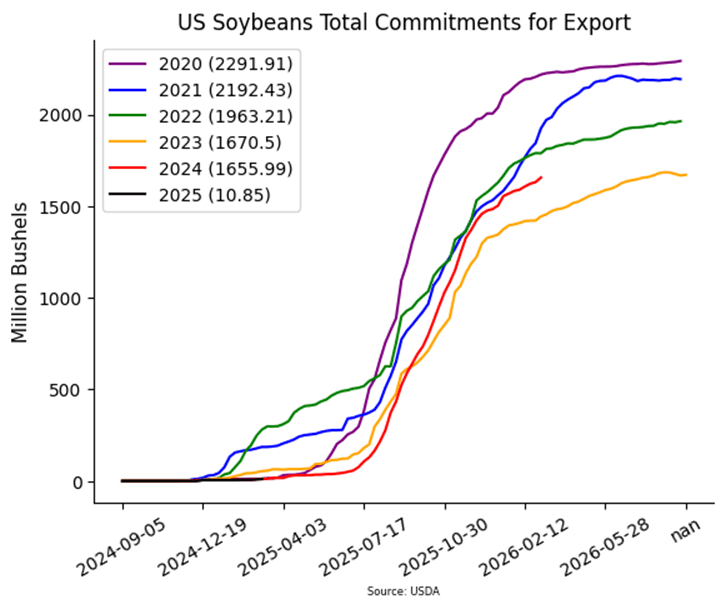

- Soybeans ended the day lower with futures largely rangebound since the beginning of the month. Slow export demand and the Brazilian harvest which is nearly completed have kept soybeans from rallying significantly, but they remain off contract lows. Soybean meal led soybeans lower today while soybean oil was higher.

- Yesterday’s NOPA crush report saw soybean crush for February at 177.87 million bushels which was well below the average trade guess of 188.0 mb. This compares to 200.38 mb in the month of January and was also down from last year at this time. Soybean oil stocks came in at 1.503 billion pounds, which was above trade estimates and the prior month.

- Brazil’s soybean harvest reached 70% as of March 13, the fastest pace on record per AgRural. The southeast and northern regions expect above-average rainfall in the next 6-10 days.

- Yesterday’s export inspections report saw 647k tons of soybeans inspected for export which compared to 854k the previous week and 700k tons a year ago. Soybean export demand in the future may weaken with the continuation of US tariffs on China.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a key resistance level that has capped gains for 18 months. As March began, improved weather and harvest pressure in South America caused a sharp price decline. Support held around the 1000 level, with stronger support near 950. If prices continue to rebound, initial resistance is at 1030, with the 200-day moving average remaining a critical barrier.

Wheat

Market Notes: Wheat

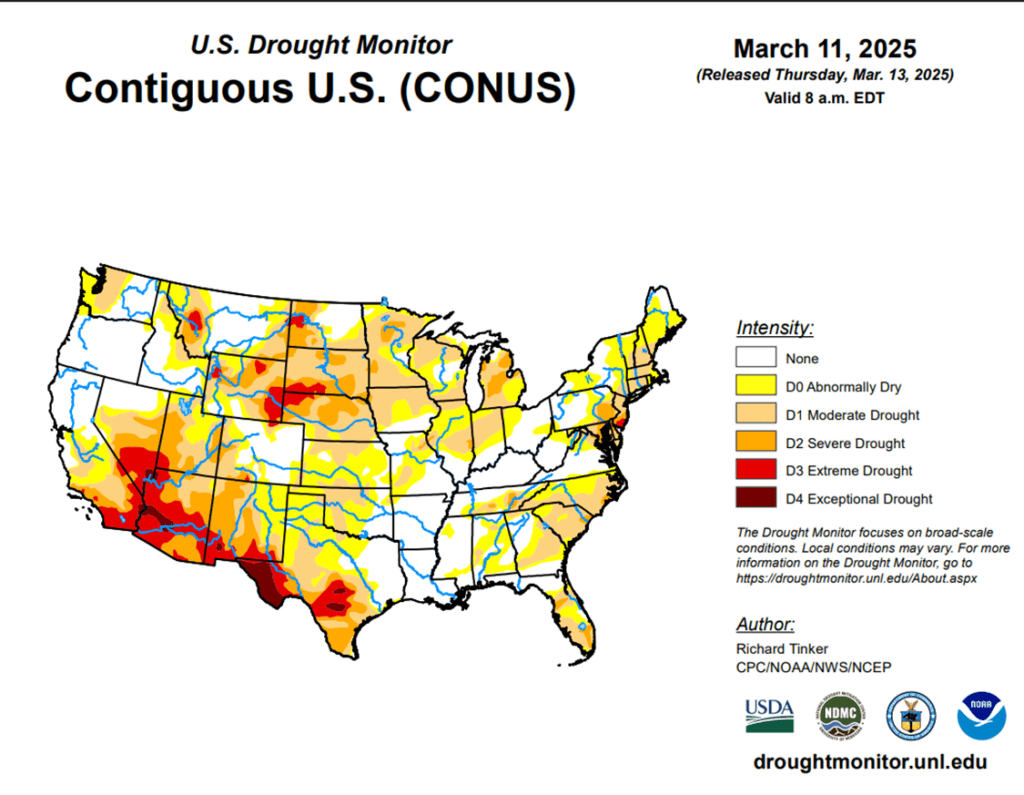

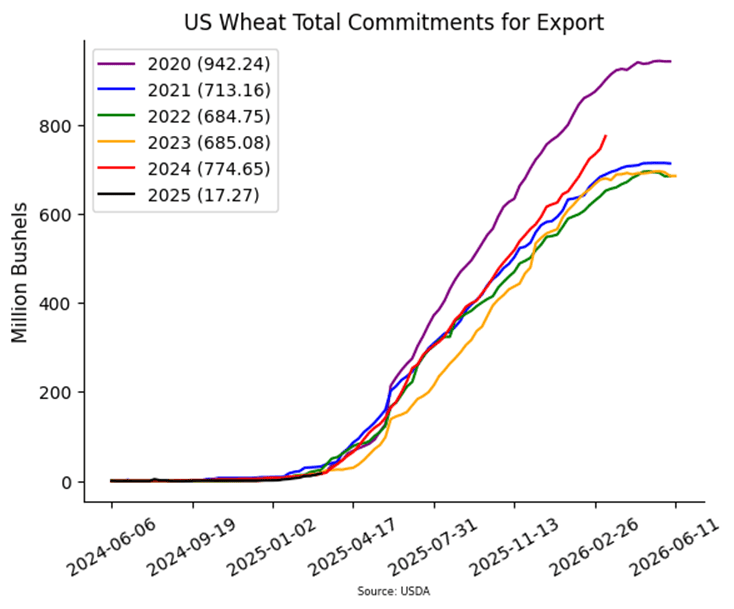

- Wheat closed in mixed fashion today, fading off of earlier strength; Kansas City futures remained the upside leader. Paris milling wheat also had a mixed close, offering no direction for the US market. Relative weakness into the close might be explained by a storm system expected to bring precipitation to much of the central plains and Midwest over the next 48 hours.

- Select states released updated winter wheat crop ratings – Texas and Oklahoma conditions held steady at 28% and 46% good to excellent, respectively. However, ratings in Kansas declined 4% to 48% GTE, while Colorado fell 7% to 60% GTE.

- President Trump spoke with Russian President Putin for over an hour regarding the Ukraine war, with reports indicating a potential 30-day ceasefire focused on energy infrastructure.

- As of March 16, European Union soft wheat exports have reached 14.92 mmt since the export season began in July. This total is down 35% from the same time period last year.

2024 Crop:

- Plan A: Target 701 vs May to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 701 hits.

2025 Crop:

- Plan A: Target 714 vs July ‘25 to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 714 hits.

2026 Crop:

- Plan A: Target 704 vs July ‘26 to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 704 hits.

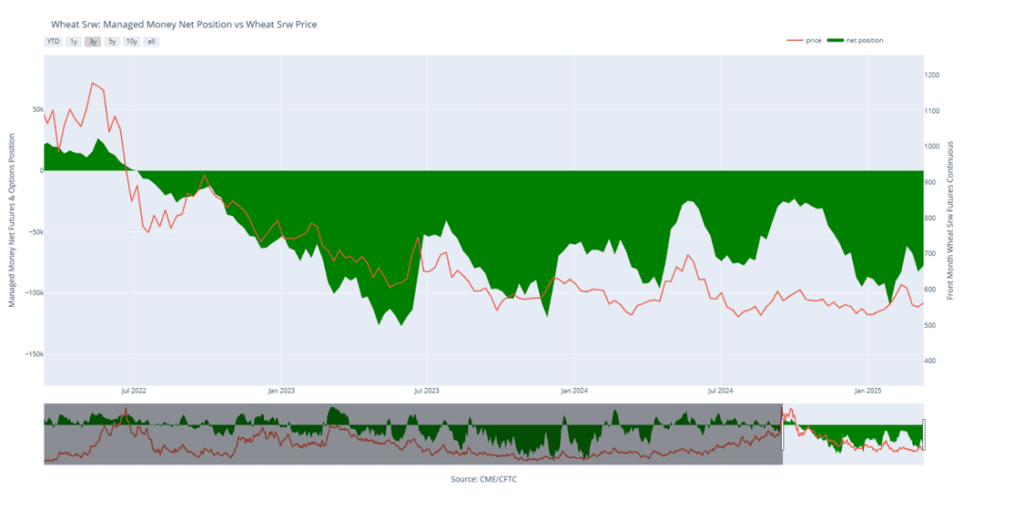

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat’s Volatile Breakout and Retreat

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, surging to key resistance at the early October highs just above 615. However, the late February peak proved to be a turning point, as futures retreated sharply, slipping back into the previous trading range that defined the end of 2024. Support has so far held near 540, the lower boundary of this range, while the 200-day moving average looms as a key resistance level near 570. A decisive weekly close above the 200-day could signal a potential trend reversal and renewed upside momentum.

2024 Crop:

- Plan A: Target 717 vs May to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 717 hits.

2025 Crop:

- Plan A: Target 677 vs July ’25 to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 677 hits.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Still not expecting the first targets for another two to three months — likely around May or June.

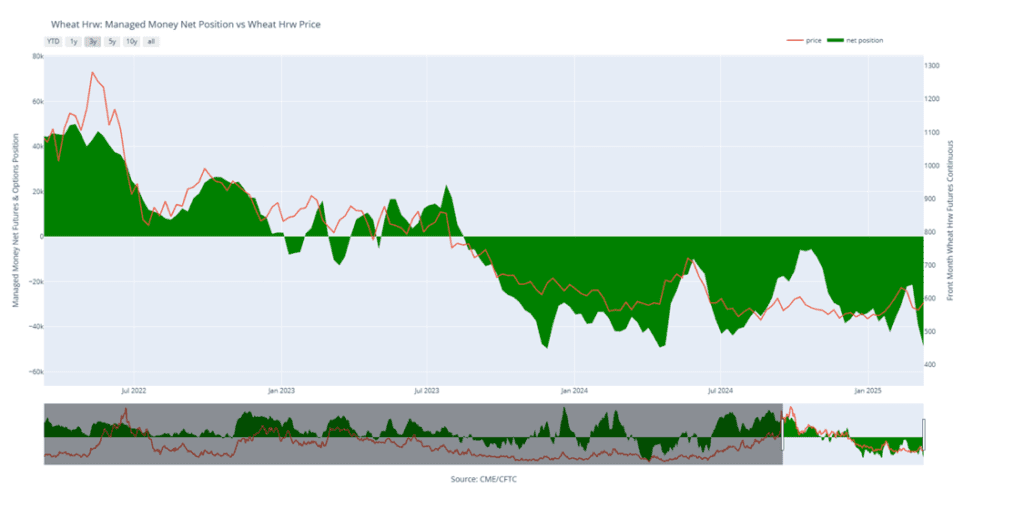

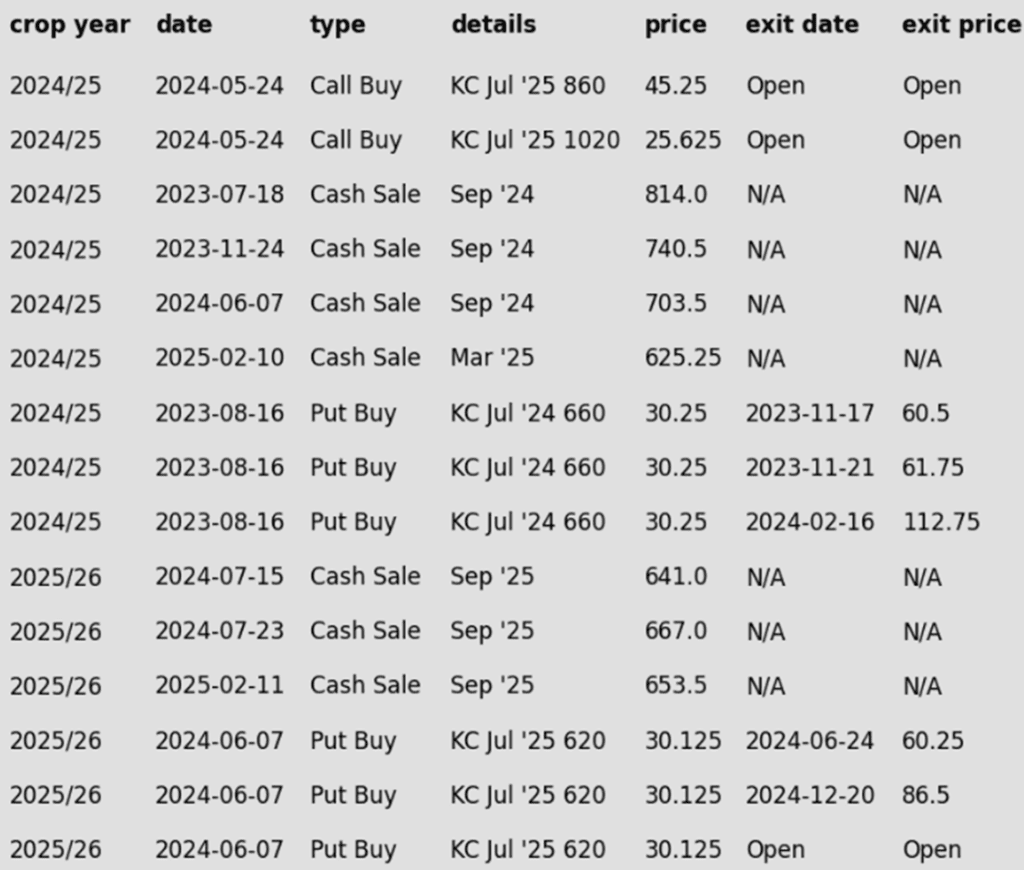

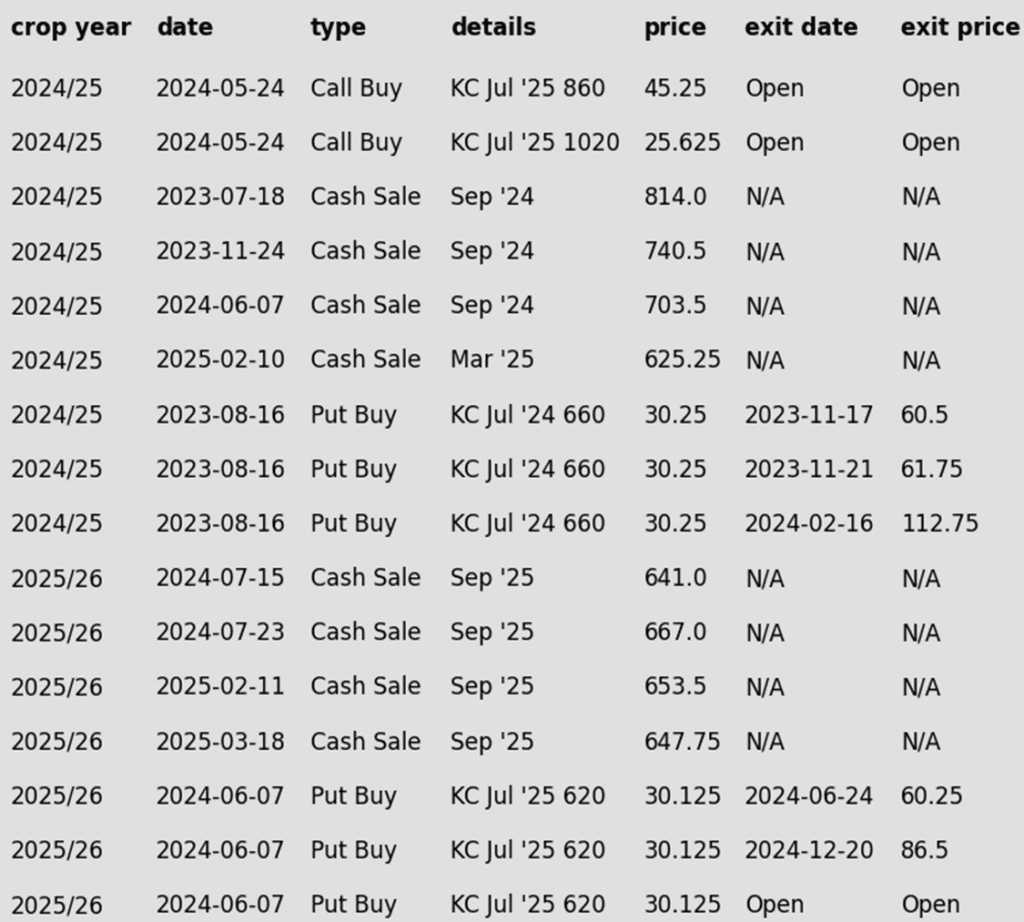

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Faces Key Technical Test

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, the rally lost steam in late February, leading to a sharp retreat back into the previous trading range. Support has held firm near 540, the lower boundary of this range, while the 200-day moving average is expected to serve as resistance on any attempted rebound. A decisive close above key resistance will be crucial for reigniting the uptrend as the market heads into spring.

2024 Crop:

- Plan A: Target 625 vs May to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 625 hits.

2025 Crop:

- NEW ACTION – Sell another portion of your 2025 HRS wheat crop.

- Target Hit: The September contract has rebounded over 40 cents from the current March low, hitting the 647.75 sales target today. This marks the fourth sales recommendation for the 2025 Hard Red Spring wheat crop, with an average price of 652.

- Plan A: No active targets. 647.75 target hit today – 3/18/25.

- Plan B: No active targets.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Still not expecting the first targets for another three to four months — likely around June or July.

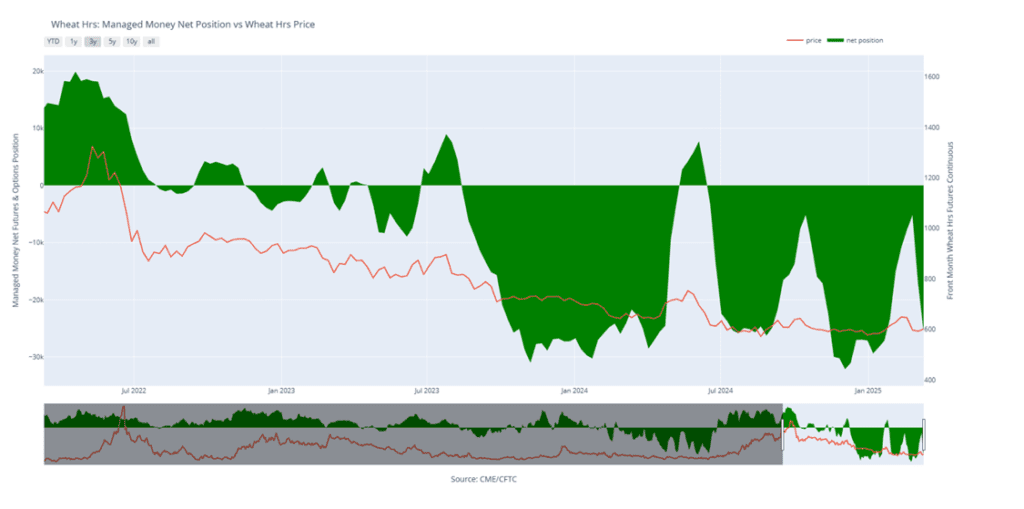

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Struggles to Hold Breakout

Spring wheat broke out of its prolonged sideways range in late January, sparking bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, dragging futures back below key moving averages. Looking ahead, the 200-day moving average is expected to act as resistance on any rebound, while previous lows near 580 should provide a key support level. A sustained move above resistance would be needed to reignite the uptrend.

Other Charts / Weather