3-24 Opening Update: Grains Trading Lower to Start the Week

All prices as of 6:30 am Central Time

|

Corn |

||

| MAY ’25 | 460.75 | -3.5 |

| JUL ’25 | 468.25 | -3.25 |

| DEC ’25 | 449 | -2 |

|

Soybeans |

||

| MAY ’25 | 1007 | -2.75 |

| JUL ’25 | 1018.75 | -2.75 |

| NOV ’25 | 1005.75 | -2 |

|

Chicago Wheat |

||

| MAY ’25 | 551.25 | -7 |

| JUL ’25 | 567.5 | -7 |

| JUL ’26 | 637.5 | -0.75 |

|

K.C. Wheat |

||

| MAY ’25 | 580.75 | -8 |

| JUL ’25 | 595.75 | -7.75 |

| JUL ’26 | 657.5 | 0 |

|

Mpls Wheat |

||

| MAY ’25 | 601 | -4 |

| JUL ’25 | 617 | -3.75 |

| SEP ’25 | 631.75 | -3.5 |

|

S&P 500 |

||

| JUN ’25 | 5785.5 | 67.25 |

|

Crude Oil |

||

| MAY ’25 | 68.77 | 0.49 |

|

Gold |

||

| JUN ’25 | 3060.2 | 11.8 |

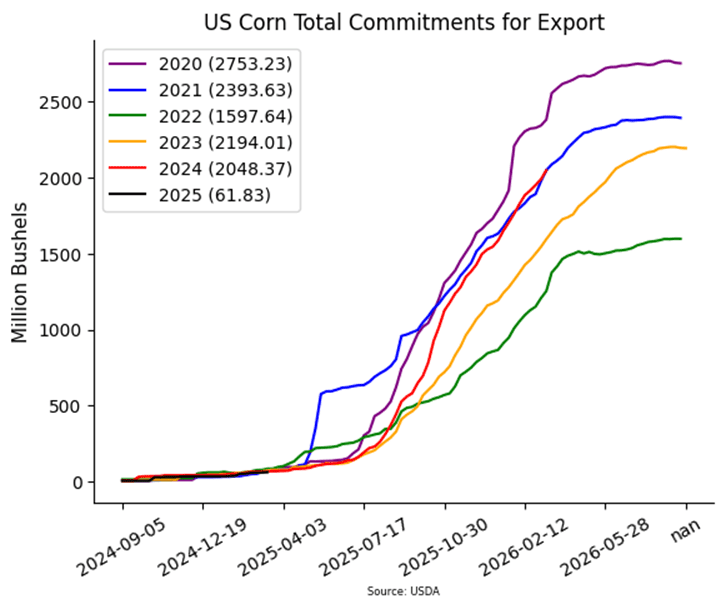

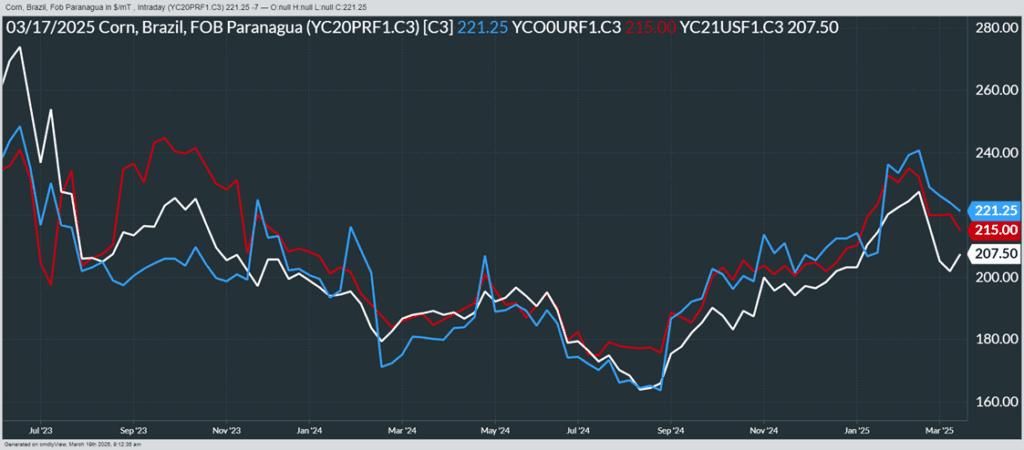

- Corn are trading lower to start the day after gaining 5-3/4 cents last week. Pressure may be coming from the uncertainty of tariffs which are coming again next week along with the upcoming planting intentions report which may show a large number for corn.

- The USDA ag attaché sees Mexican corn imports down in 25/26 as a result of higher domestic production. They see local prices driving a larger planting area.

- Friday’s CFTC report saw funds as sellers of corn by 39,271 contracts as of March 18. This reduced their net long position to 107,270 contracts.

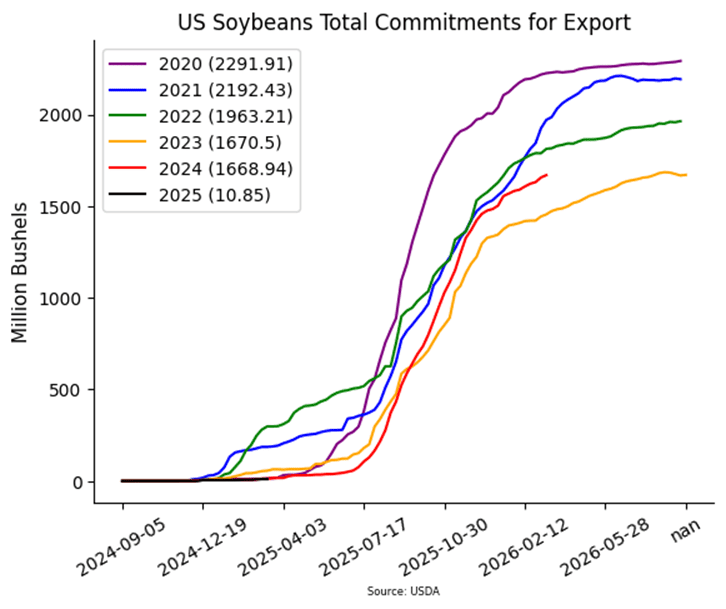

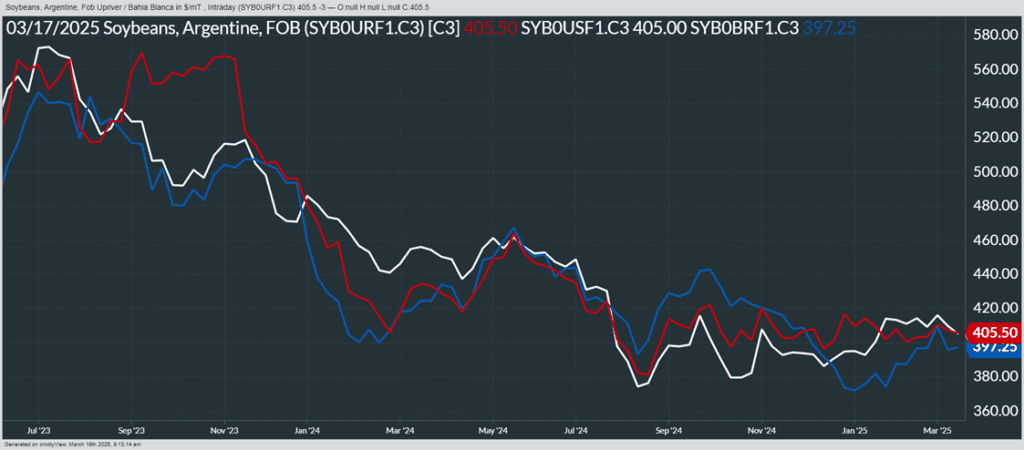

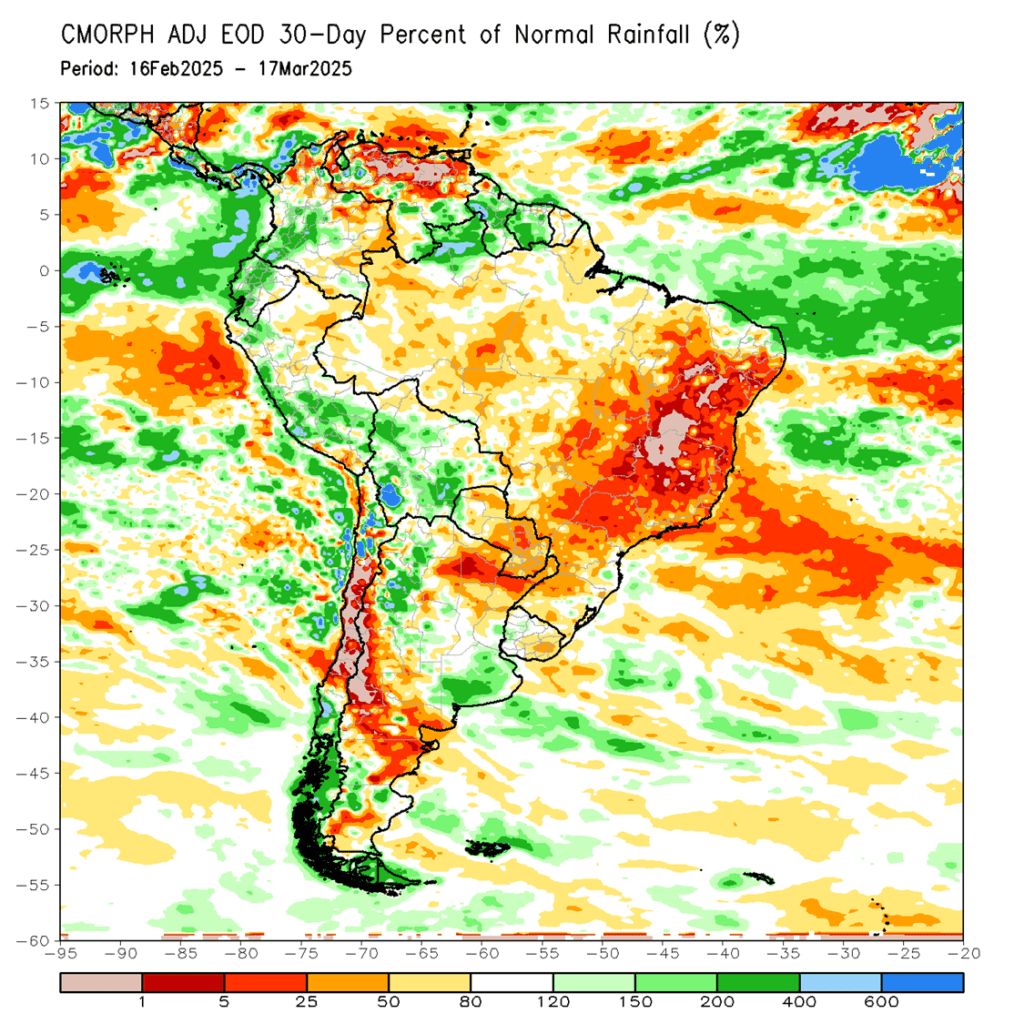

- Soybeans are trading lower this morning and although they have trended lower since the beginning of February, they have been rangebound over the past two weeks. If planting intentions are lowered in the upcoming report, soybeans could see a boost. Both soybean meal and oil are lower as well.

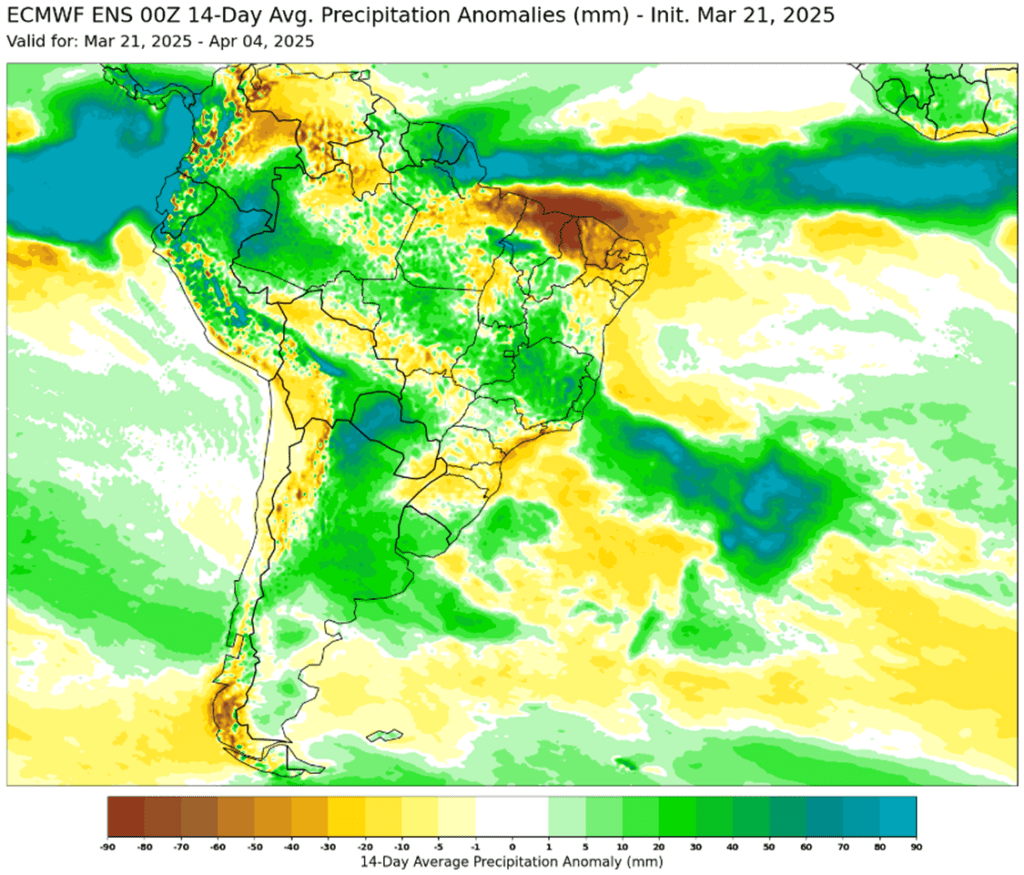

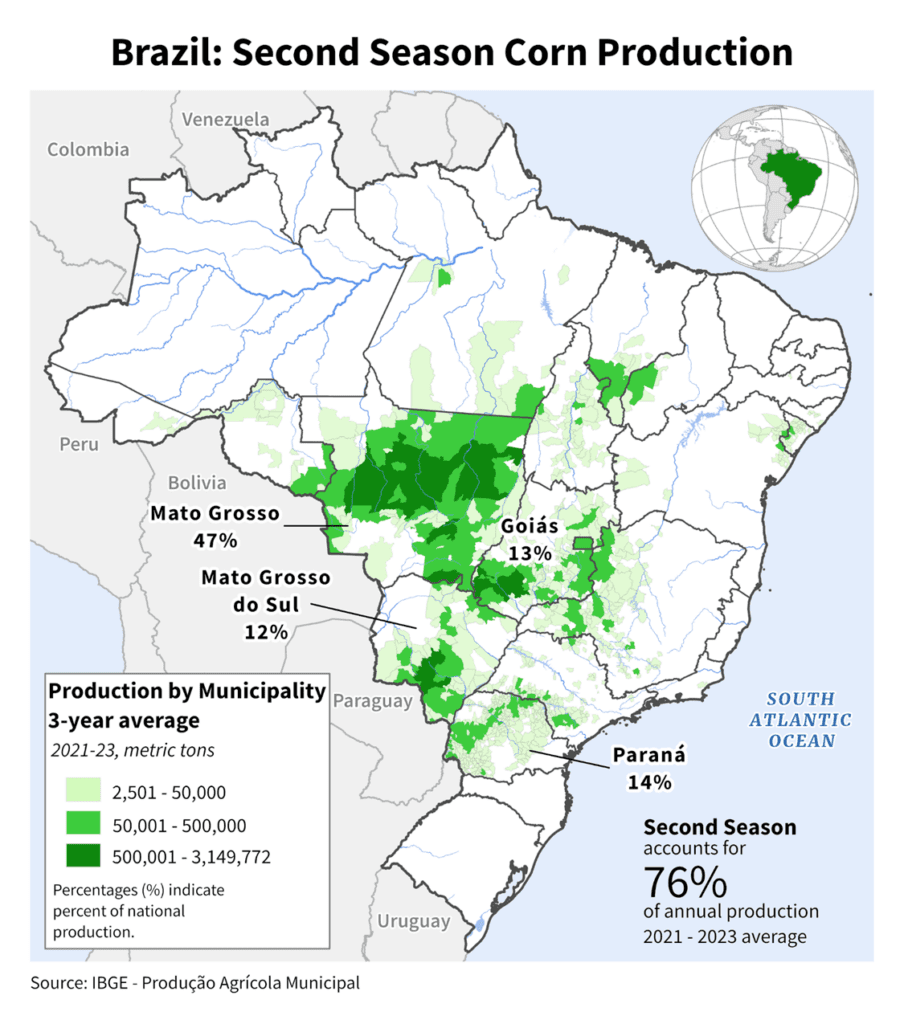

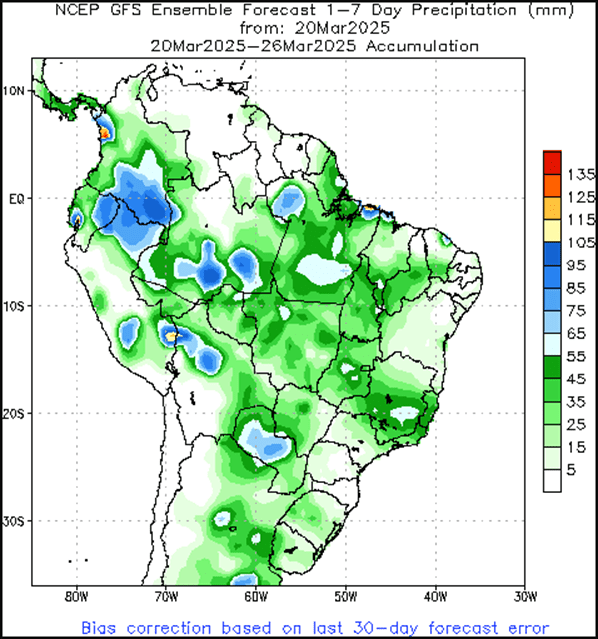

- The Brazilian soybean harvest is reportedly 73.84% complete which compares to 69.33% at this time last year. The US ag attaché to Brazil sees production at 173 mmt for the 25/26 crop.

- Friday’s CFTC report saw funds as sellers of soybeans by 6,461 contracts increasing their net short position to 22,005 contracts. They sold 13,757 contracts of bean oil and bought 11,014 contracts of meal.

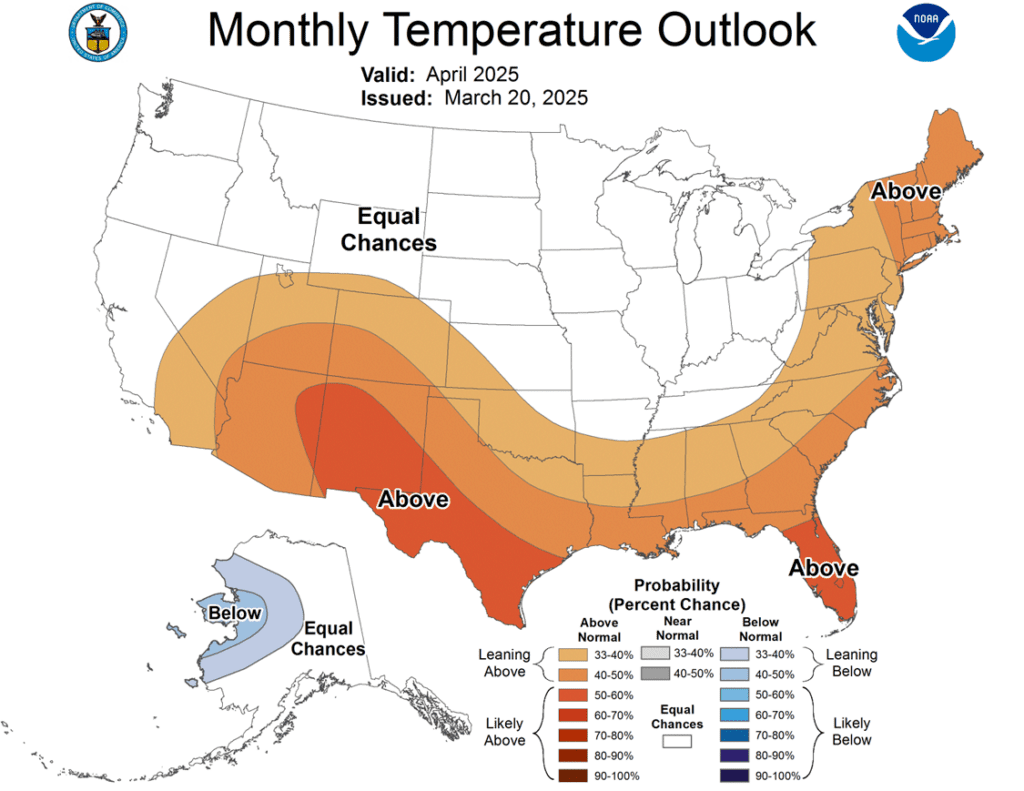

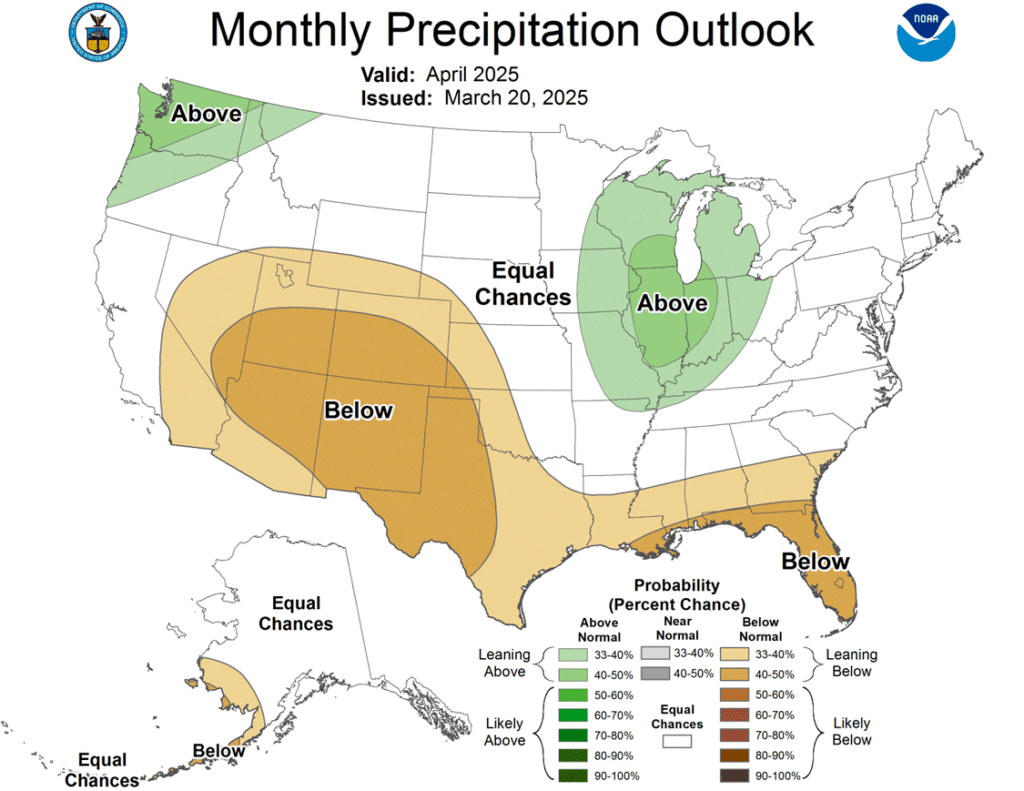

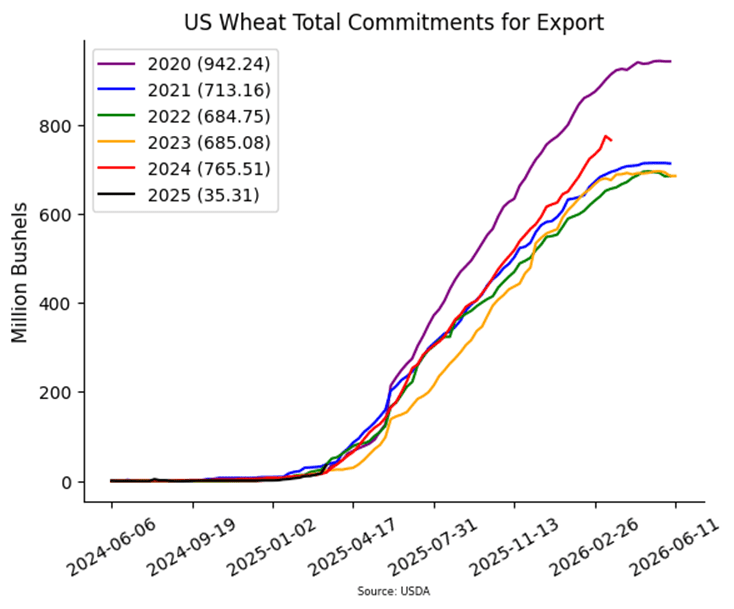

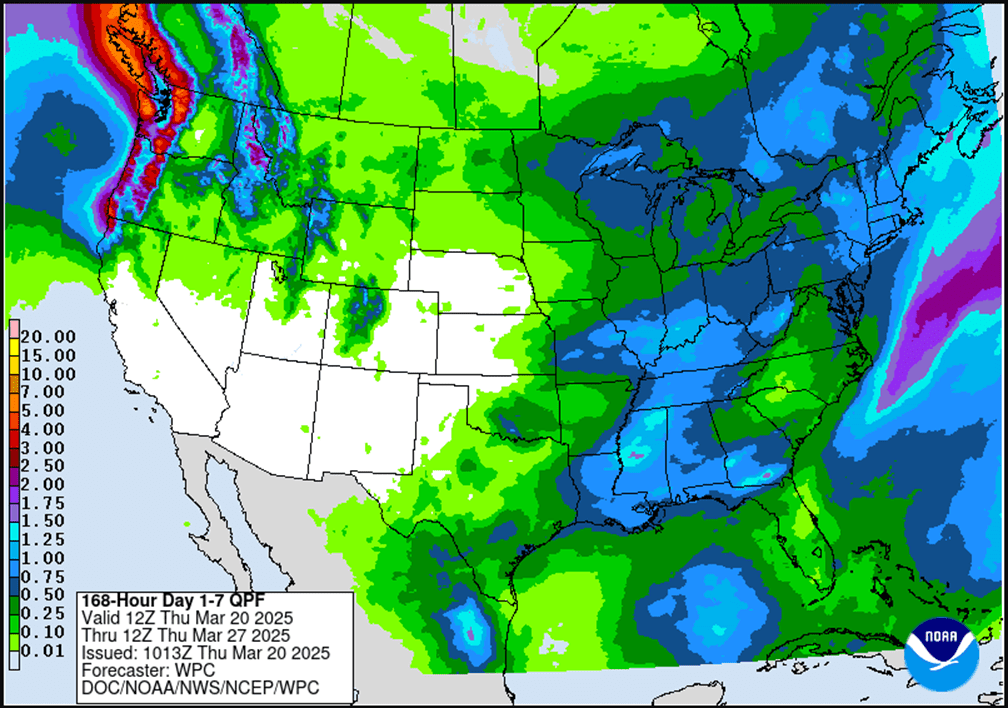

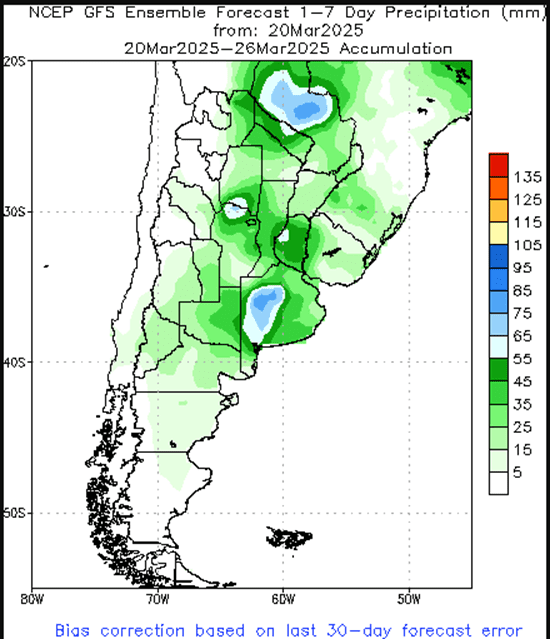

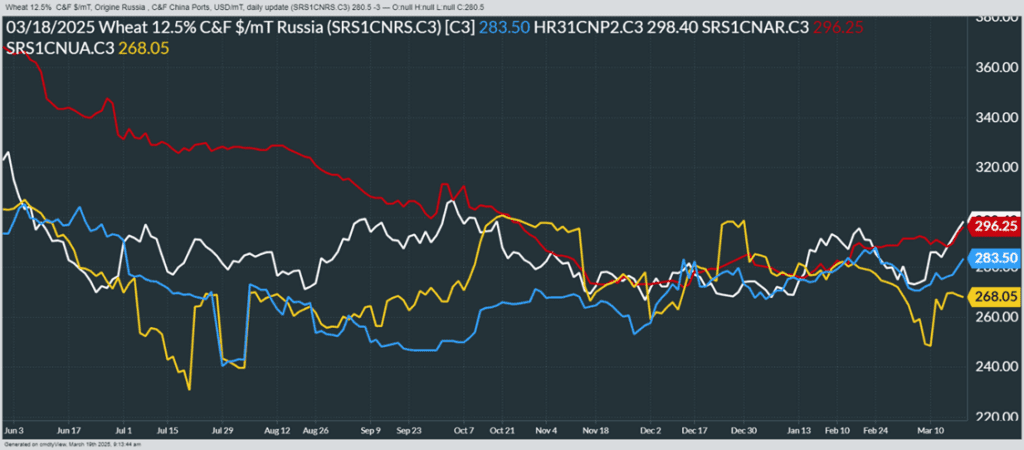

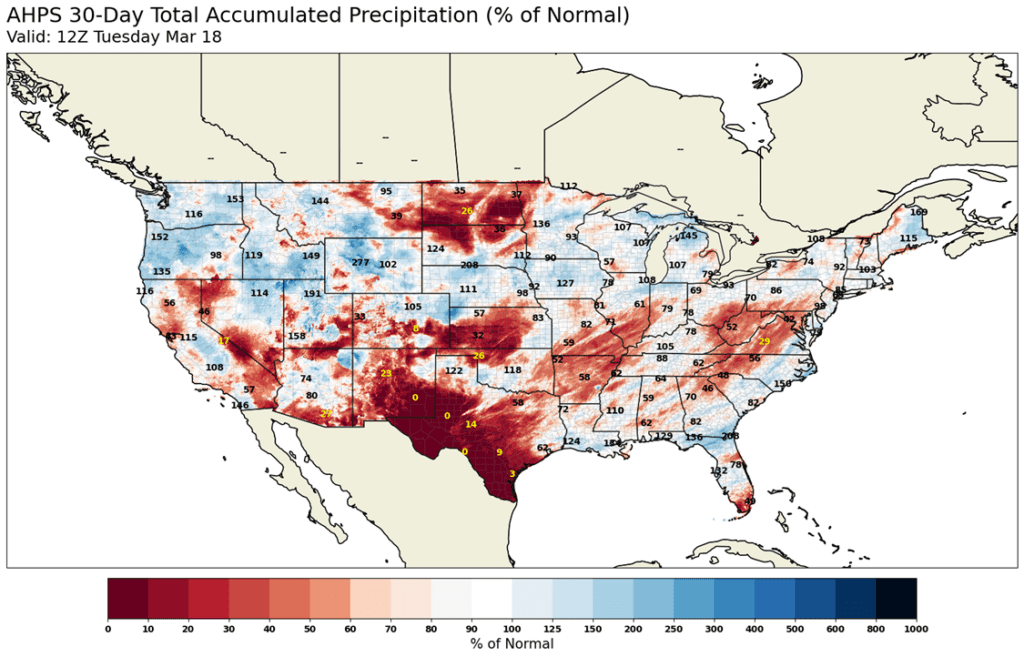

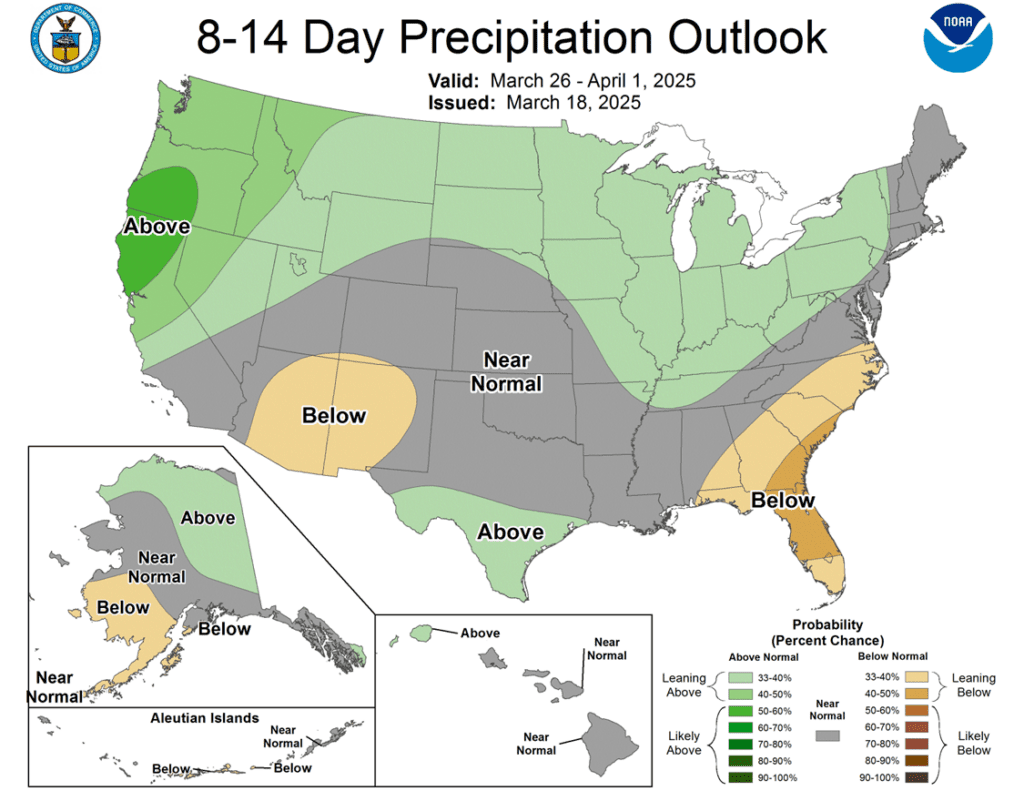

- All three wheat classes are trading lower this morning along with the rest of the grain complex as tariff fears and uncertainty pressure markets. Needed rains for HRW wheat areas mostly missed over the weekend which could lower crop conditions.

- The US has begun ceasefire talks with Russia in the Black Sea region to secure a maritime peace before coming to a wider agreement with the war. Putin’s primary demand is how much Ukrainian territory Russia will get to keep.

- Friday’s CFTC report saw funds as sellers of Chicago wheat by 3,256 contracts leaving them net short 80,668 contracts. They bought back 2,059 contracts of KC wheat which left them short 46,663 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.