4-10 Opening Update: Grains Trading Higher After EU and other Countries Pause Their Tariffs

All prices as of 6:30 am Central Time

|

Corn |

||

| MAY ’25 | 477 | 3 |

| JUL ’25 | 483.25 | 2.75 |

| DEC ’25 | 452.75 | 2 |

|

Soybeans |

||

| MAY ’25 | 1018.75 | 6 |

| JUL ’25 | 1029.25 | 5.75 |

| NOV ’25 | 1002.5 | 5.5 |

|

Chicago Wheat |

||

| MAY ’25 | 544 | 1.75 |

| JUL ’25 | 558 | 2.25 |

| JUL ’26 | 622.25 | 0 |

|

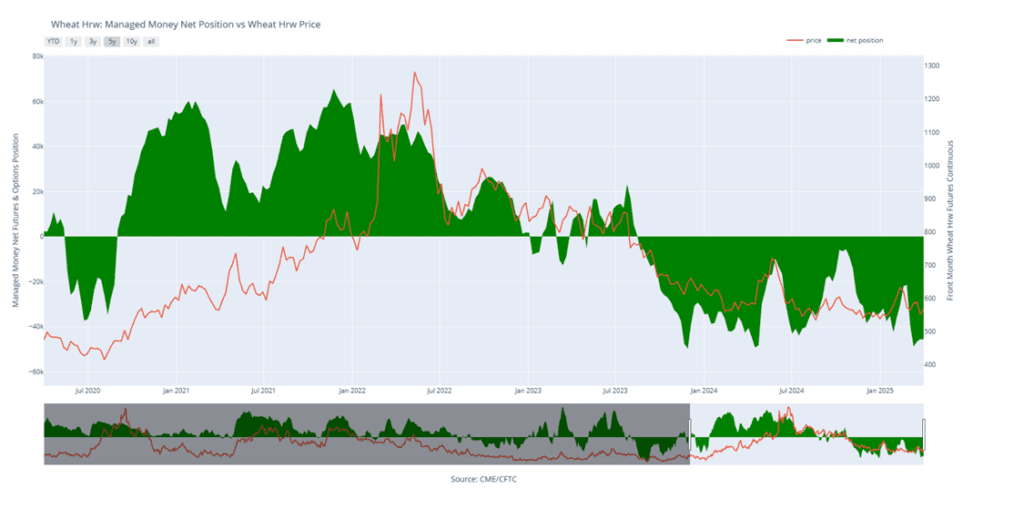

K.C. Wheat |

||

| MAY ’25 | 573 | 5 |

| JUL ’25 | 585.25 | 5 |

| JUL ’26 | 641.25 | 0 |

|

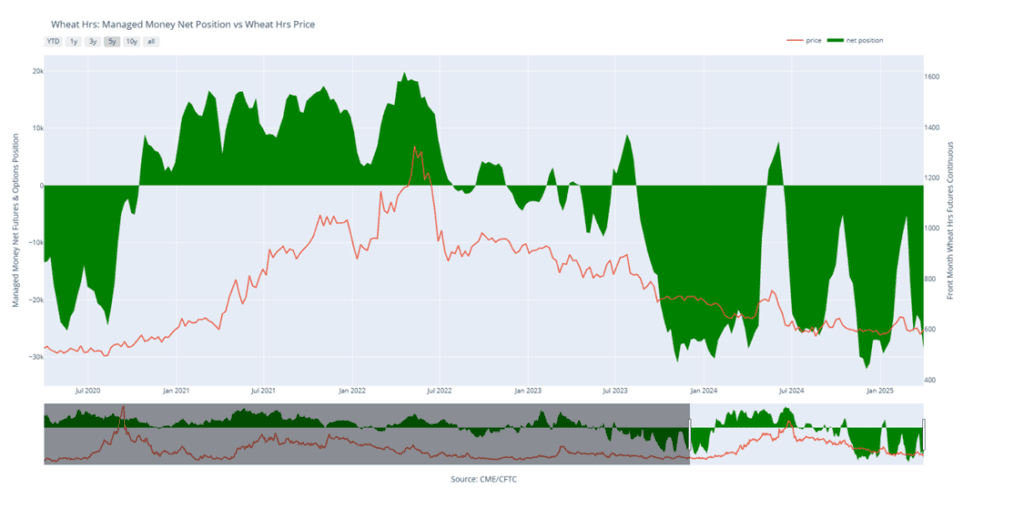

Mpls Wheat |

||

| MAY ’25 | 610.5 | 1.75 |

| JUL ’25 | 624.25 | 2.75 |

| SEP ’25 | 635.75 | 3.25 |

|

S&P 500 |

||

| JUN ’25 | 5395.75 | -95.25 |

|

Crude Oil |

||

| JUN ’25 | 60.33 | -1.49 |

|

Gold |

||

| JUN ’25 | 3134.6 | 55.2 |

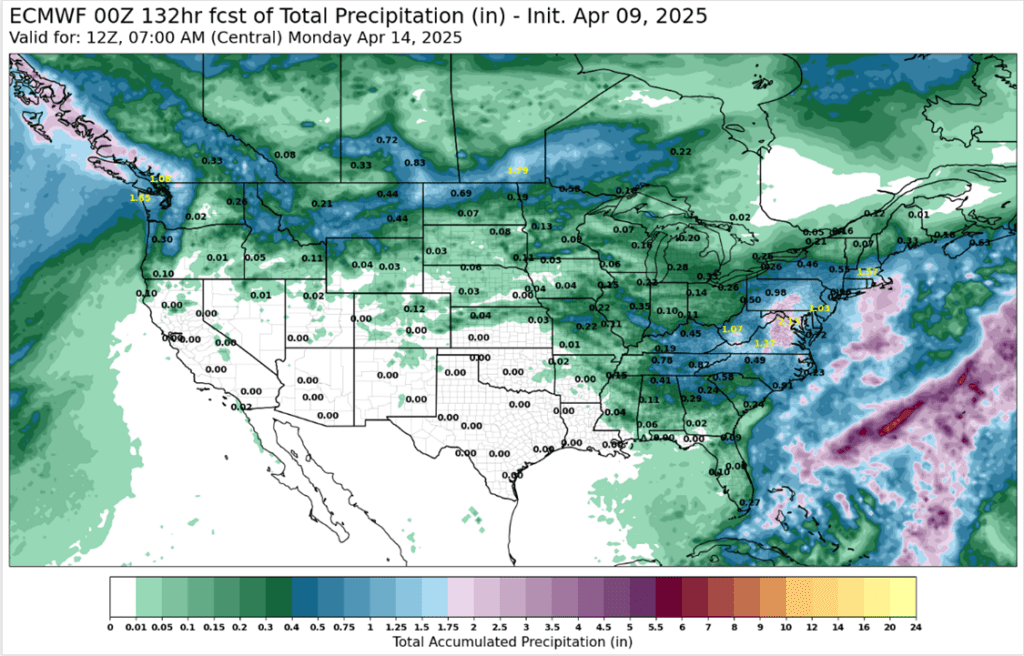

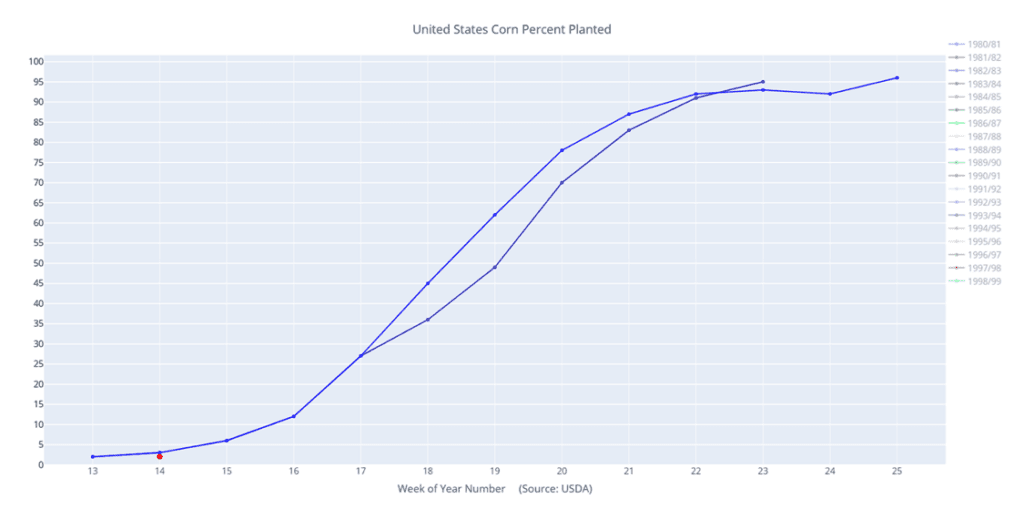

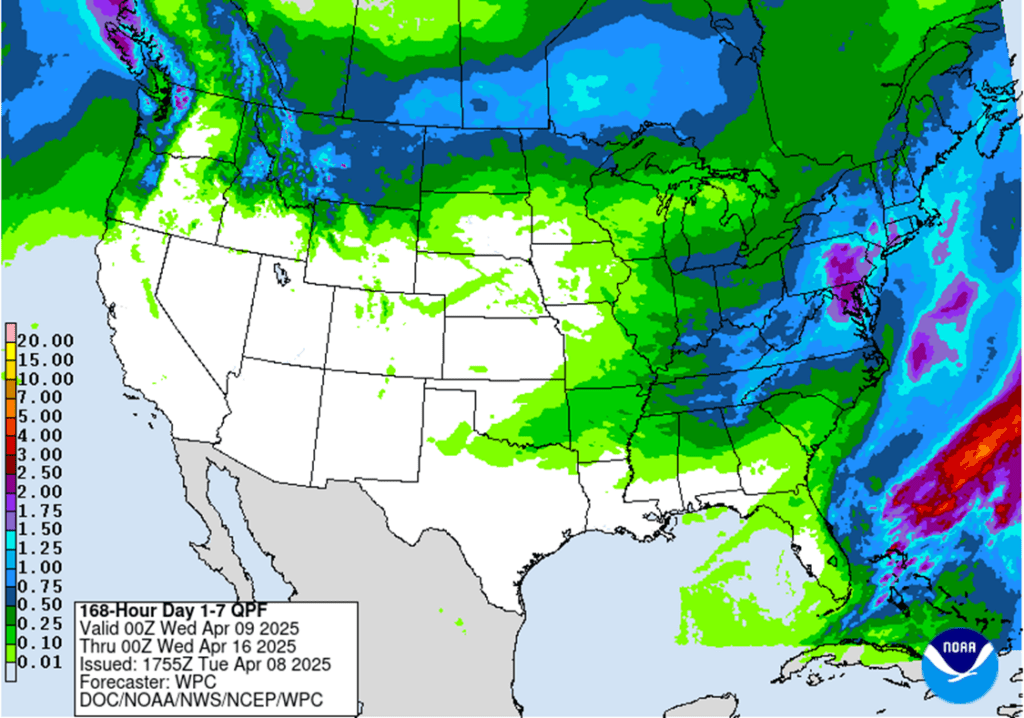

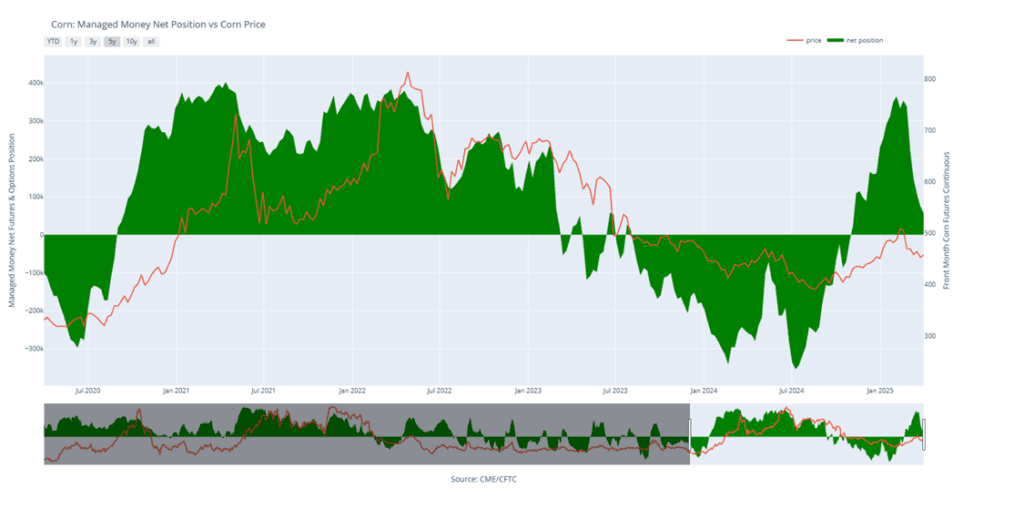

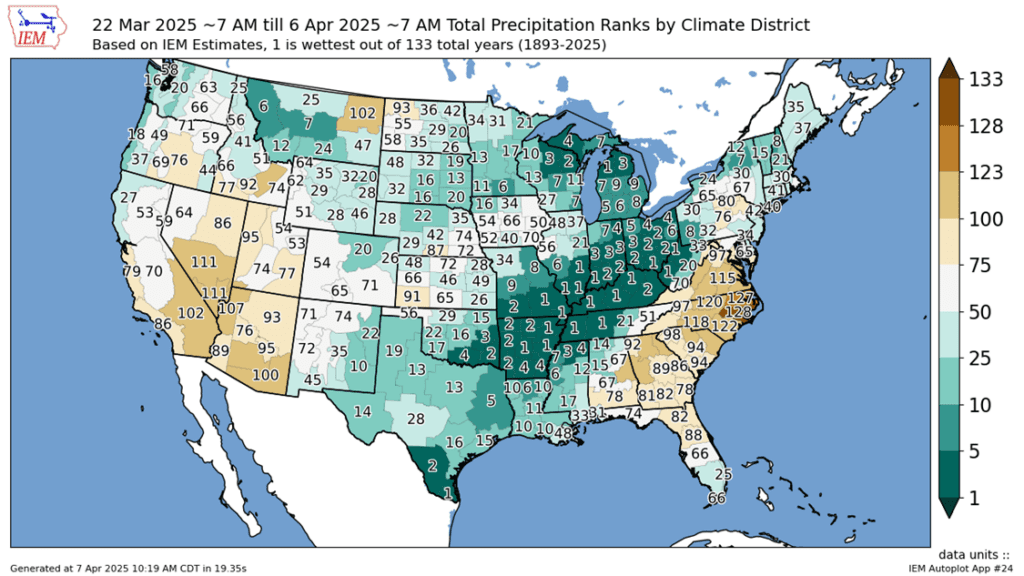

- Corn is trading higher this morning after The EU among other countries decided to pause their tariffs on the US following President Trump’s move to pause tariffs on most countries apart from China for whom he raised tariffs to 125%.

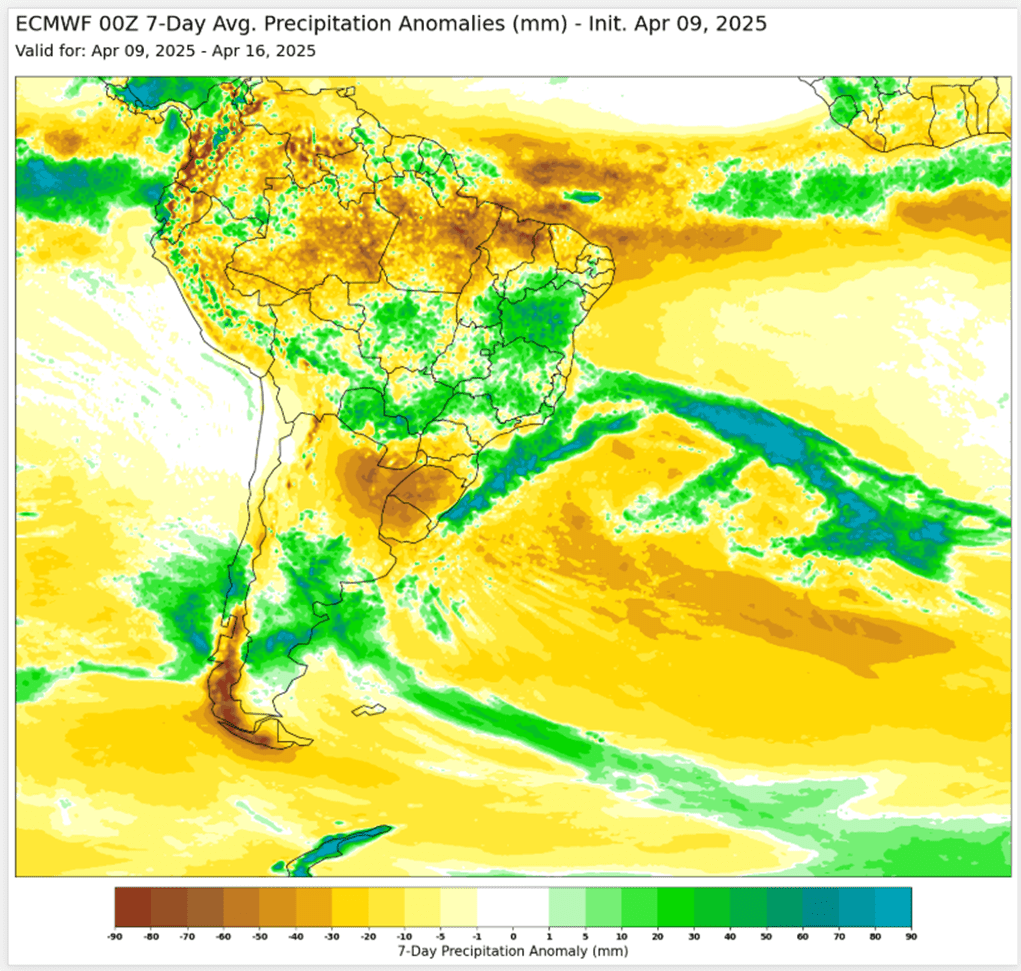

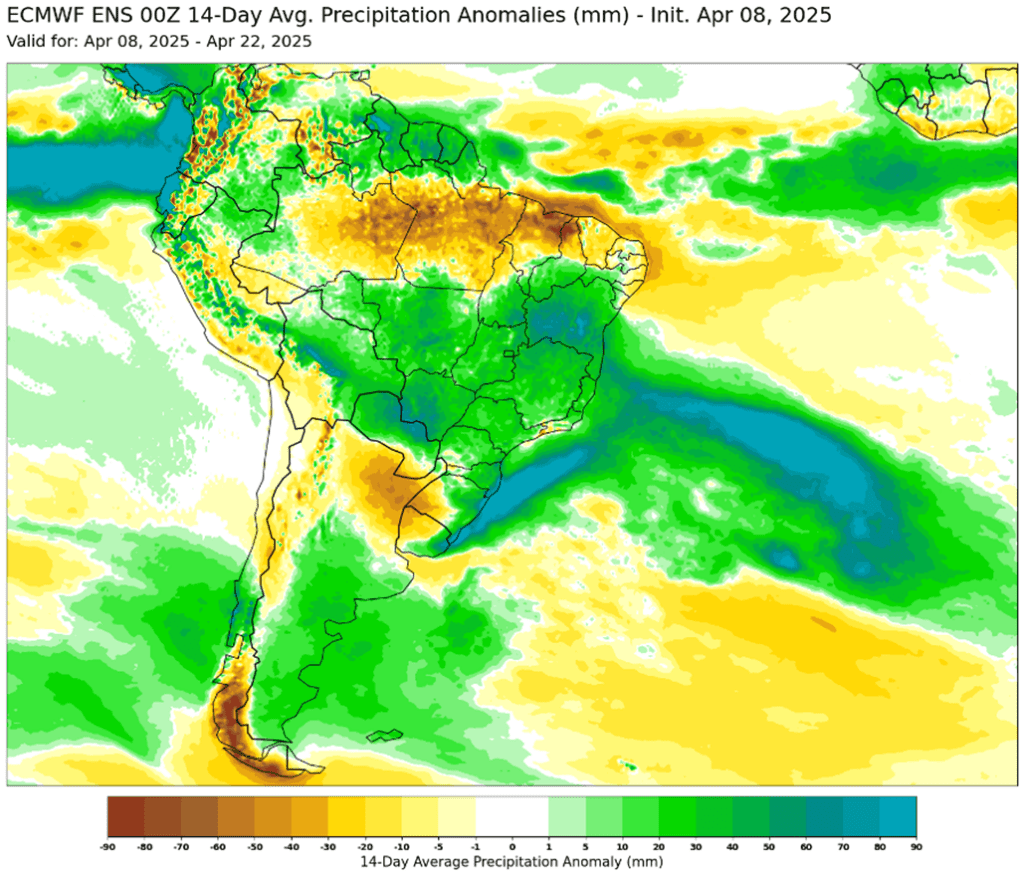

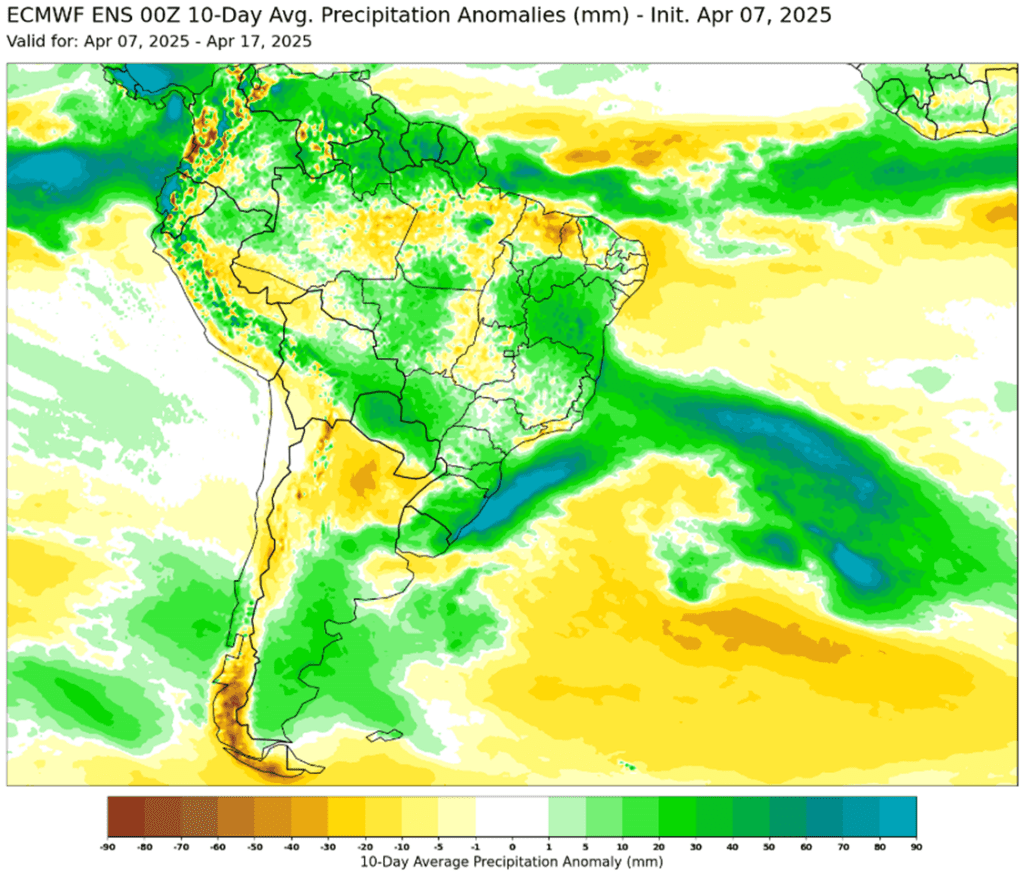

- Yesterday, the Rosario Grain Exchange in Argentina significantly raised its corn output number to 48.5 mmt from 44.5 mmt previously. Brazil’s corn number has fallen slightly.

- Estimates for today’s export sales report see corn sales in a range between 700k and 1,500k tons with an average guess of 1,000k tons. This would compare to 1,338k last week and 335k tons a year ago.

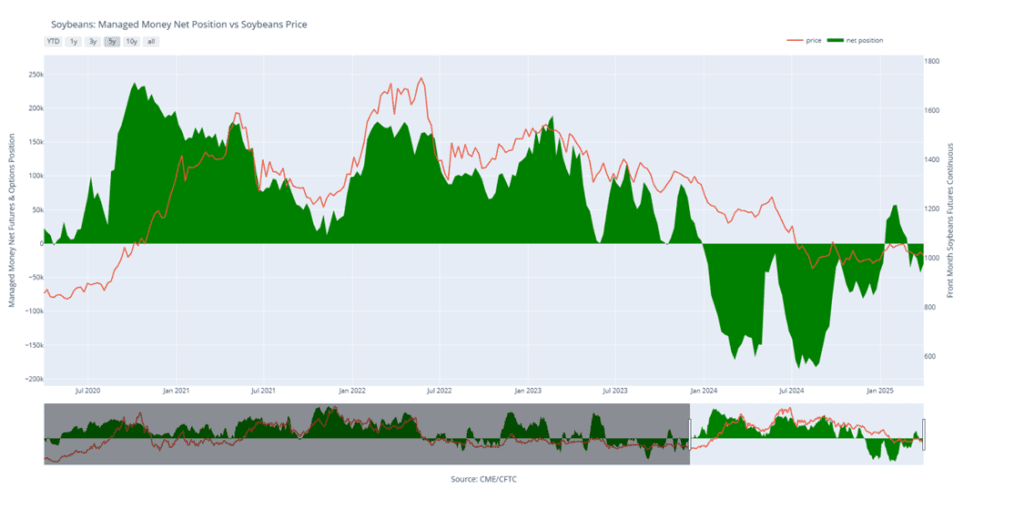

- Soybeans are trading higher on the heels of the news that Trump would pause most tariffs other than China, and this morning the EU’s pause on tariffs for the US. China has not been a large buyer of US beans, so the tariff increase on China has not seemed to dull the bean market.

- Later today, the USDA will release its WASDE report, and estimates show US ending stocks increasing slightly, exports being reduced, but world ending stocks increasing.

- Estimates for today’s export sales report see soybean sales in a range between 200k and 700k tons with an average guess of 400k tons. This would compare to 413k last week and 305k last year.

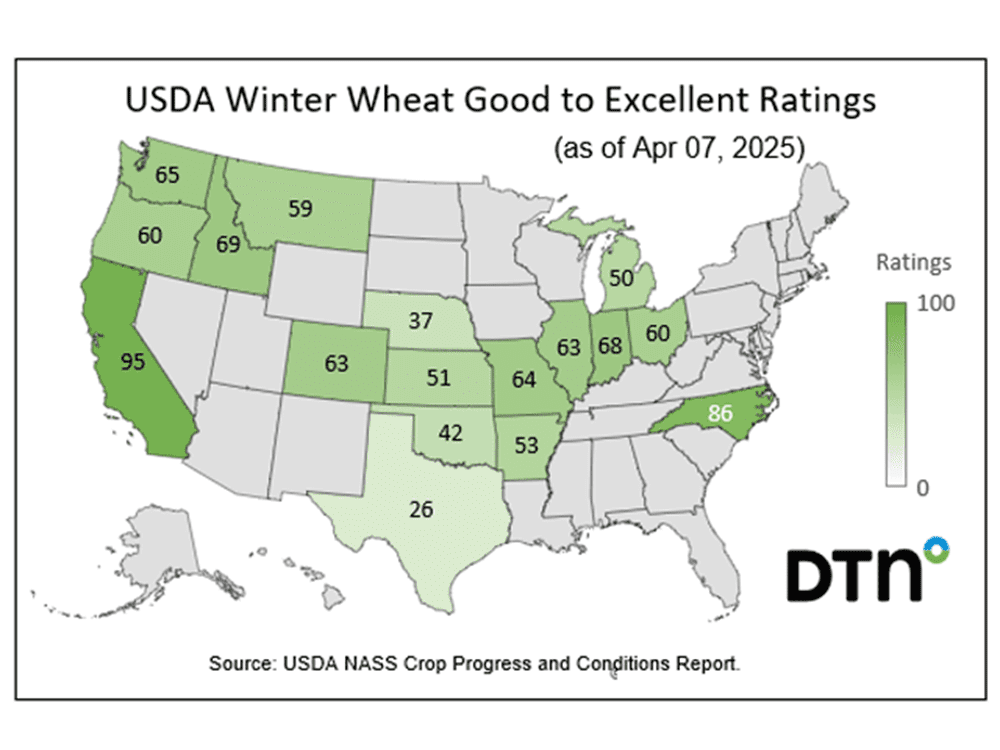

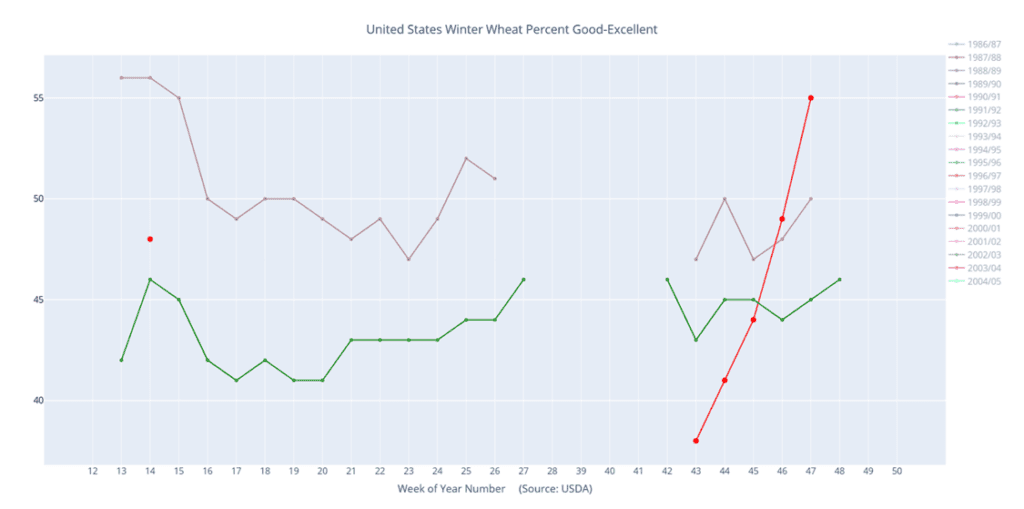

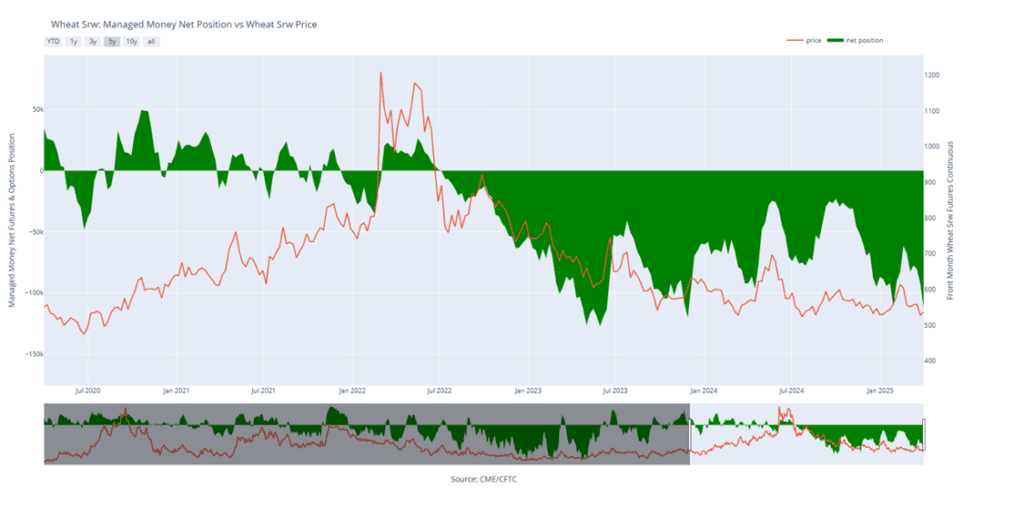

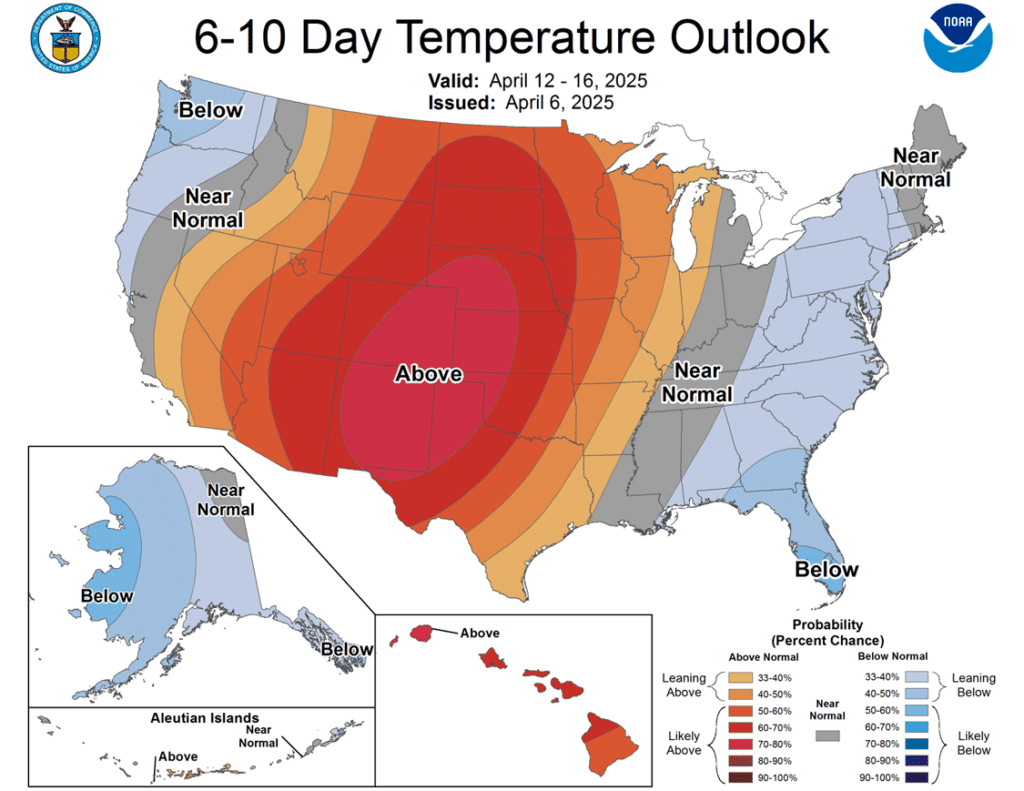

- Wheat is trading higher this morning along with the rest of the grain complex. While the grains have rebounded well over the past two days, equity markets have slipped this morning despite the tariff news on continued recession fears.

- Estimates for today’s export sales report see wheat sales in a range from sales reductions of 100k tons to sales of 550k tons. This would compare to 435k last week and 355k last year.

- For today’s WASDE report, US ending stocks for wheat are expected to increase slightly despite an expected decline in exports. World wheat stocks are expected to increase.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.