5-5 End of Day: Grains Slide as Weather and Macro Pressures Weigh on Markets

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- Corn: Corn futures finished lower as warm, dry forecasts across the Corn Belt supported planting progress and kept selling pressure on the market.

- Soybeans: Soybean futures weakened in bear spreading action, with the front months leading the decline and giving back Friday’s gains. Weak energy prices and ample planting conditions added to the pressure.

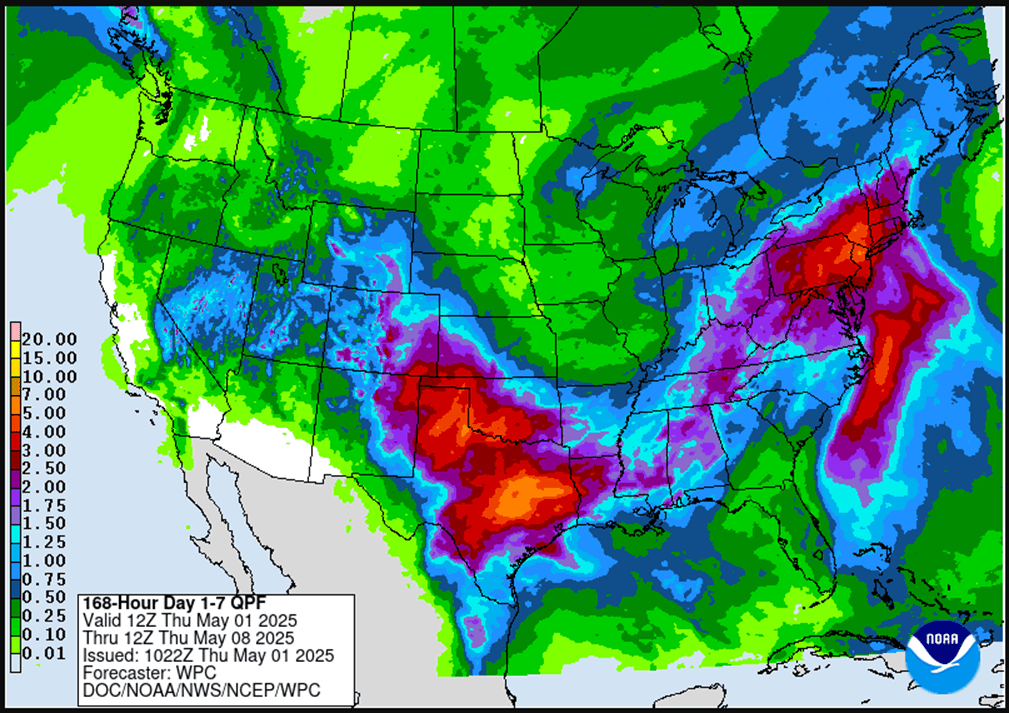

- Wheat: Wheat futures fell sharply, led by winter wheat, as broad commodity weakness and a risk-off tone weighed. Spring wheat losses were modest, supported by dryness in the Northern Plains.

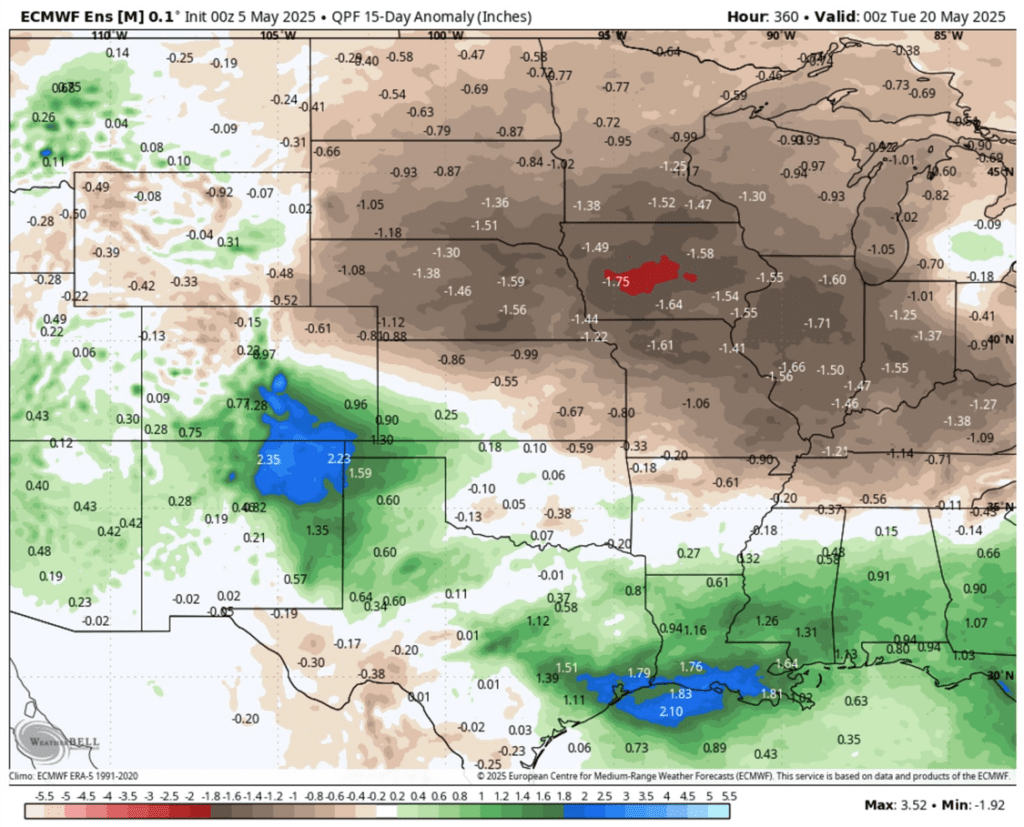

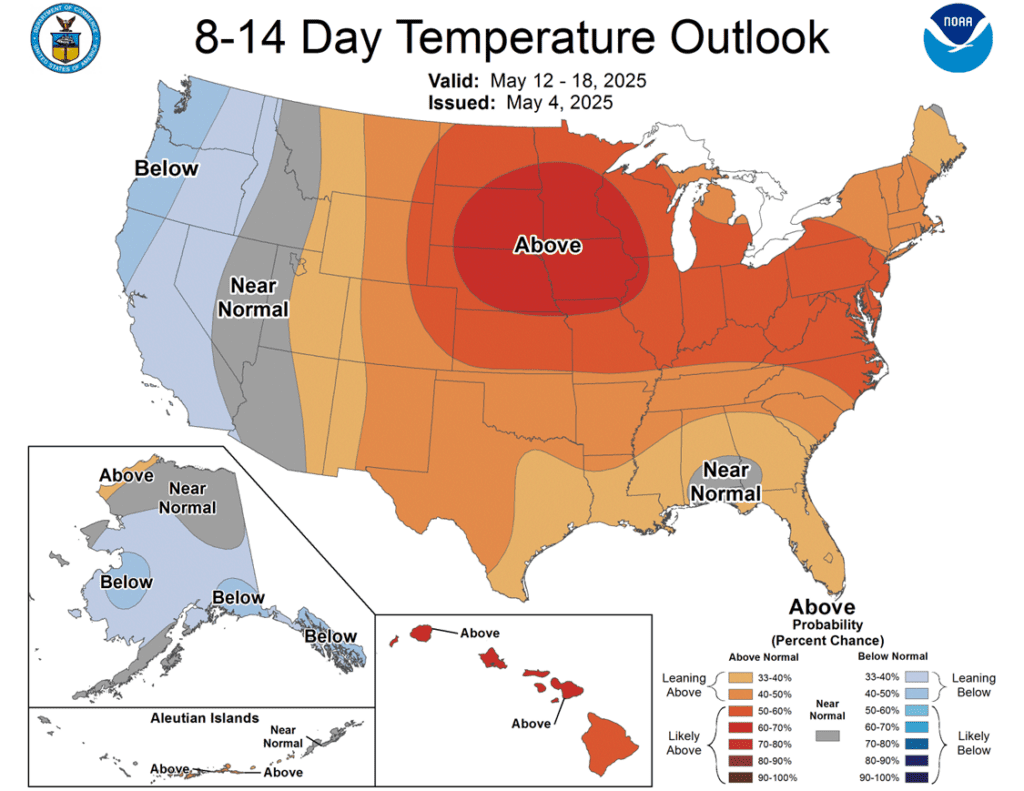

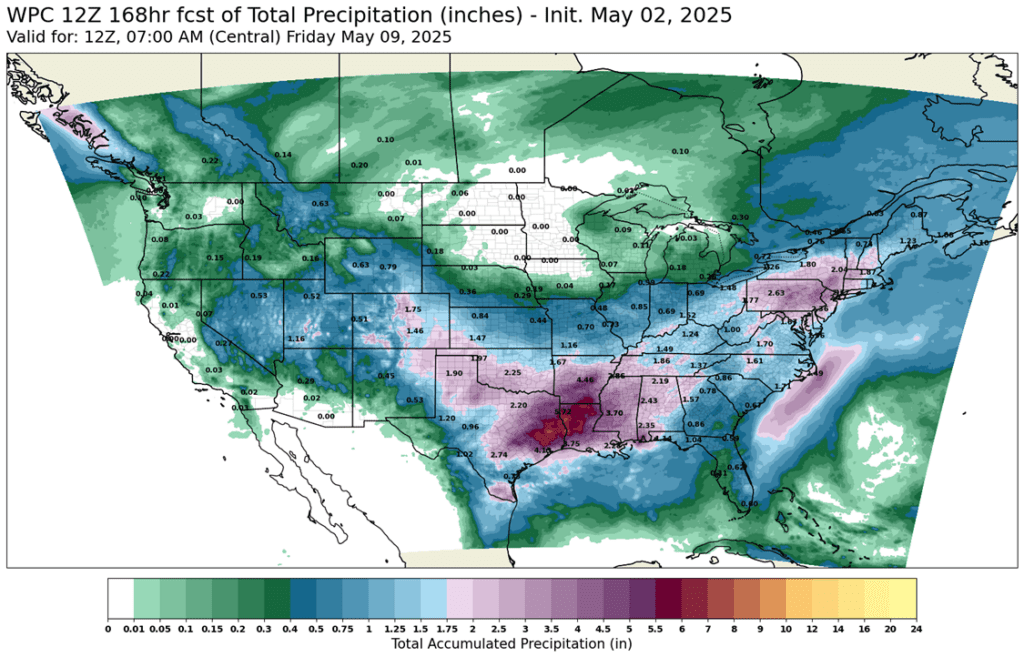

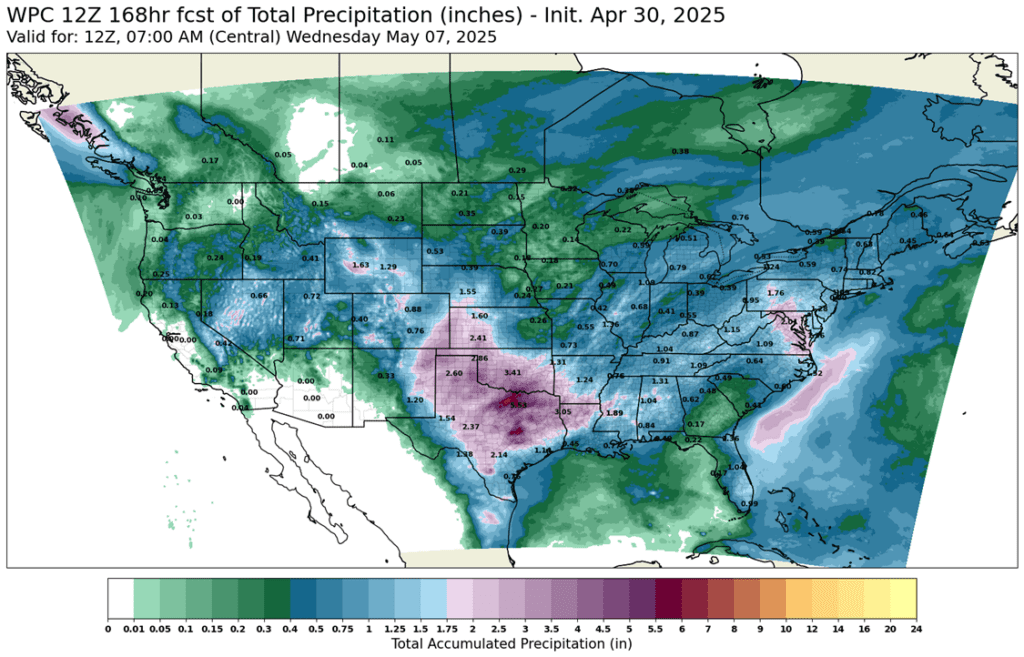

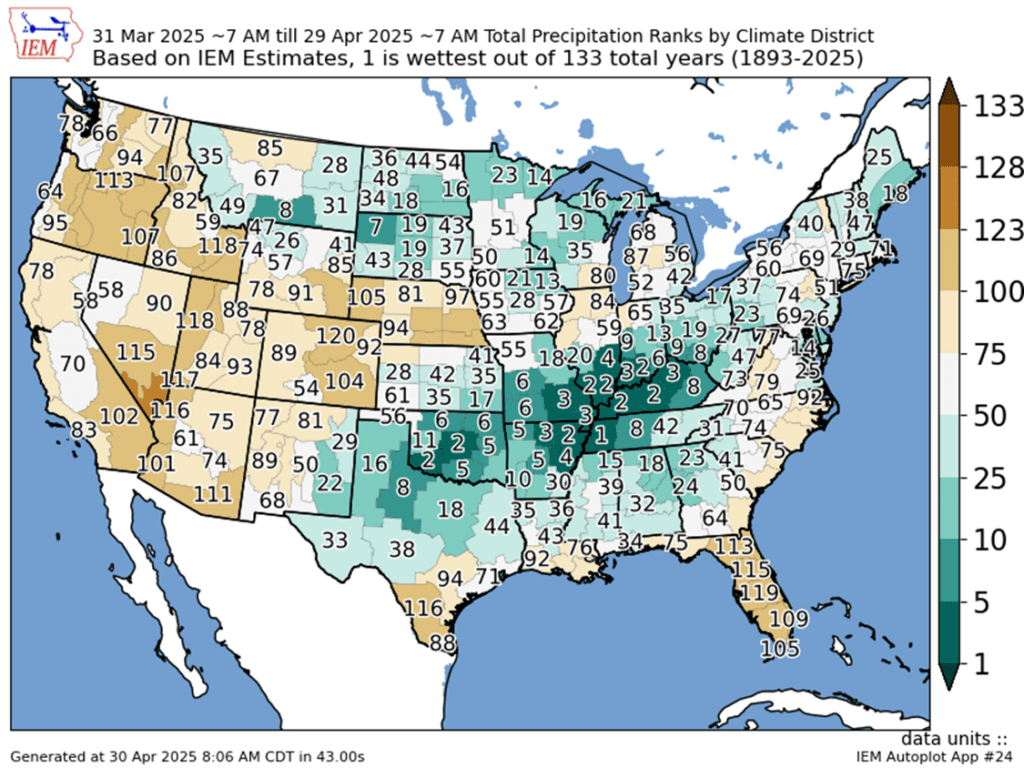

- To see the updated 15-day Quantitative Precipitation Forecast for the U.S. and the 8-14 day temperature outlook U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

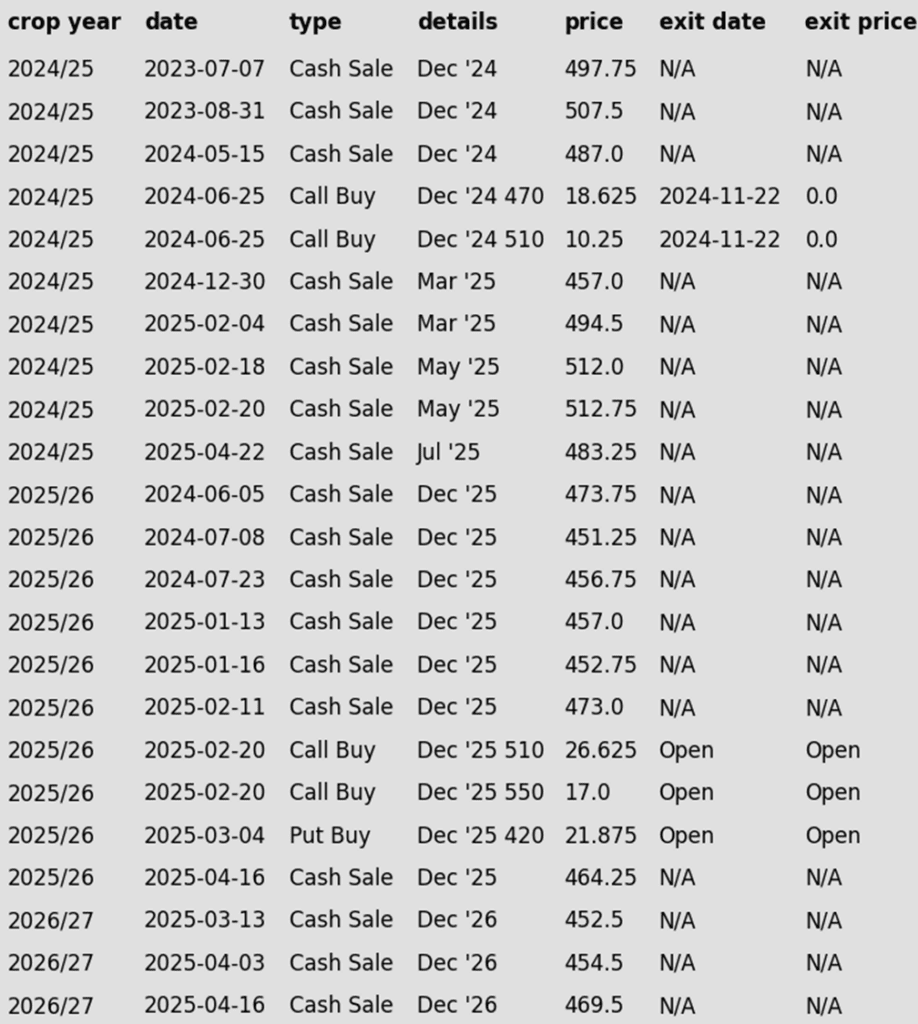

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes: None.

- No upside targets at this time.

- If July regains upward momentum, a Plan B downside sales stop could be added.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- NEW: Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- NEW: Roll-down 510 & 550 December calls if December touches 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- An additional downside target has been added to liquidate another quarter of the 420 December put options. This target may be reached before the 43 ¾ cents target.

- A downside target was also set to roll down the current 510 & 550 call options, which would enhance upside protection on prior cash sales recommendations through the summer.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes: None.

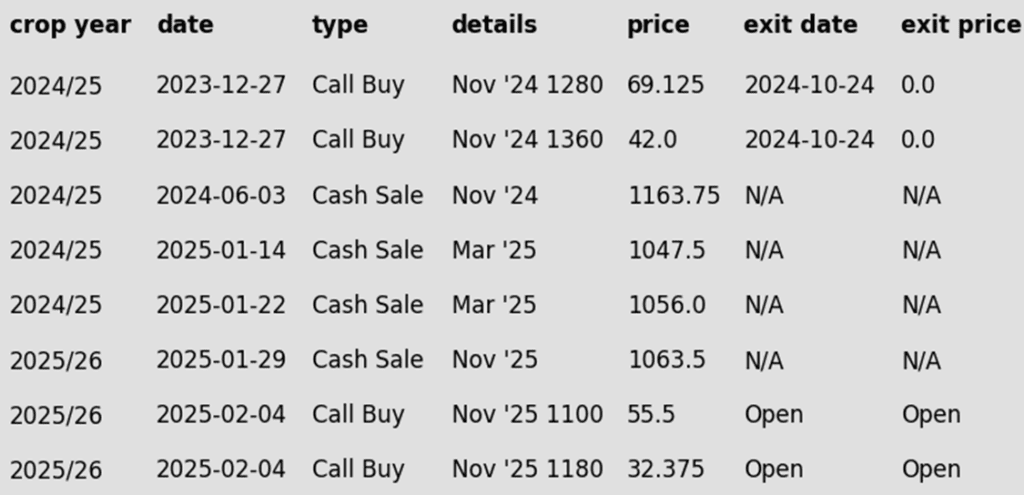

To date, Grain Market Insider has issued the following corn recommendations:

- Technical selling and long liquidation weighed on corn, with prices ending moderately to sharply lower. Favorable weather and solid planting progress kept pressure on the market as supply concerns eased.

- Corn planting is expected to reach around 40% in Monday’s Crop Progress report. Forecasts remain warm and dry across most of the Corn Belt, supporting rapid planting for the 2025/26 crop.

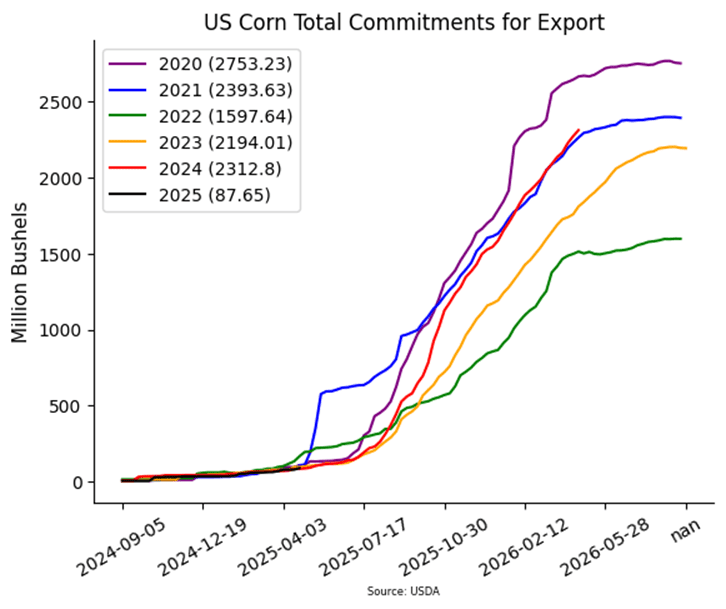

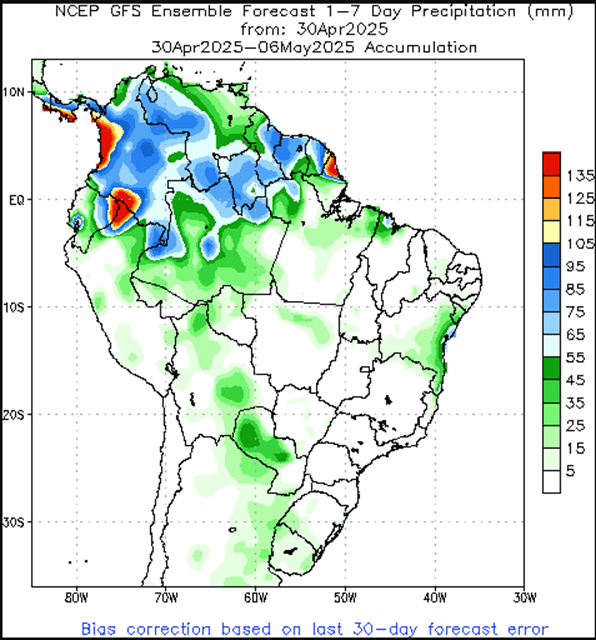

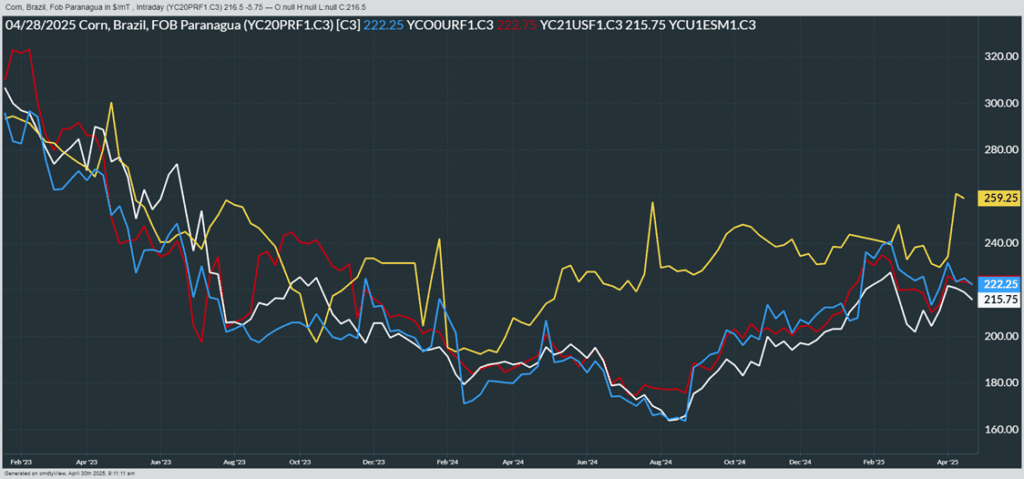

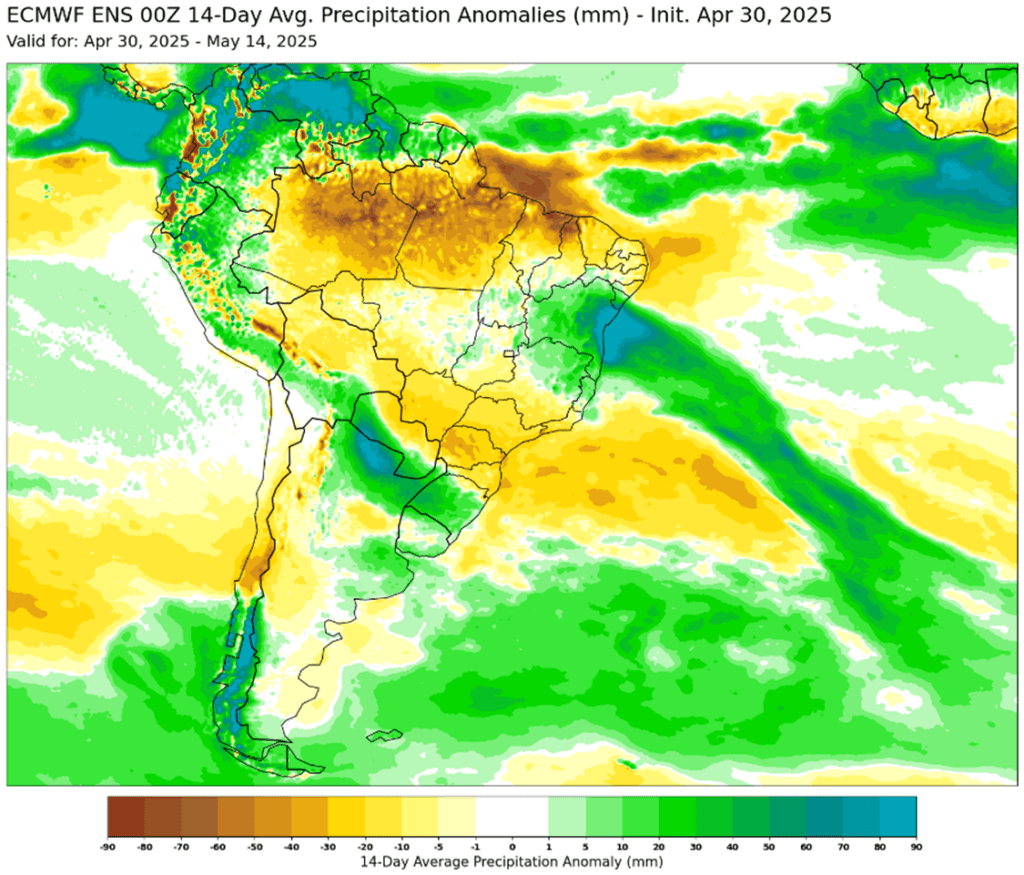

- Weather conditions for the Brazil corn crop have been overall very friendly, and some analyst groups have raised their production forecasts for the key second crop corn. With harvest a few weeks away, the fresh supplies will be in competition with U.S. corn bushels on the export market.

- Weekly U.S. corn export inspections remain strong. For the week ending May 1, inspections totaled 1.608 MMT (63.3 mb), near the top of expectations. Inspections are likely to stay firm until Brazil and Argentina enter the market more aggressively.

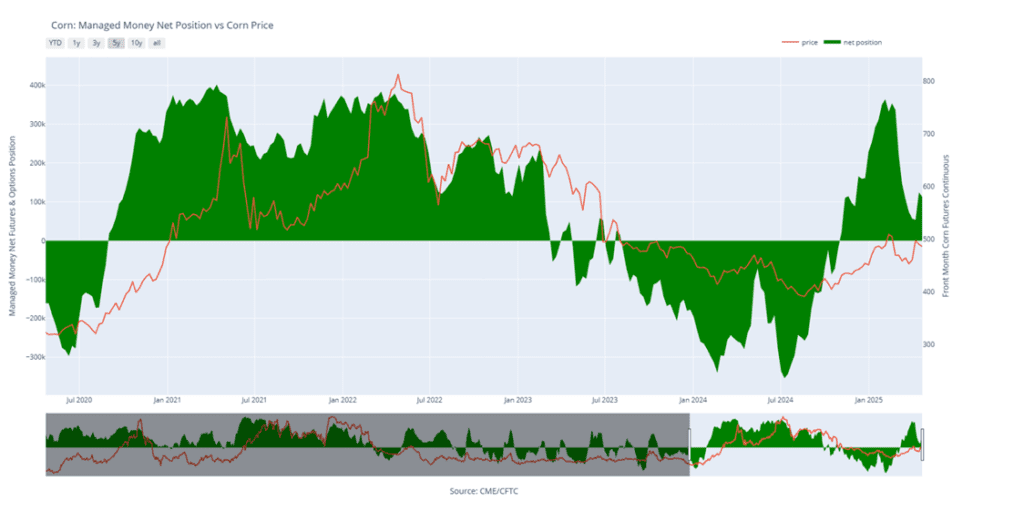

- Managed speculative funds have been pressuring the corn market as traders have cut their current net long positions. On Friday’s Commitment of Traders Report, managed funds reduced their net long position to 71,329 contracts, this was down 41,479 contracts from the previous week’s report as good planting forecasts and Brazil crop expectations have triggered the selling pressure.

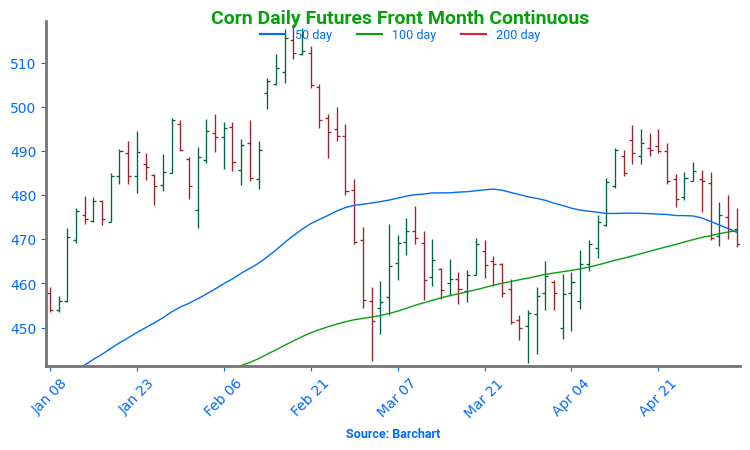

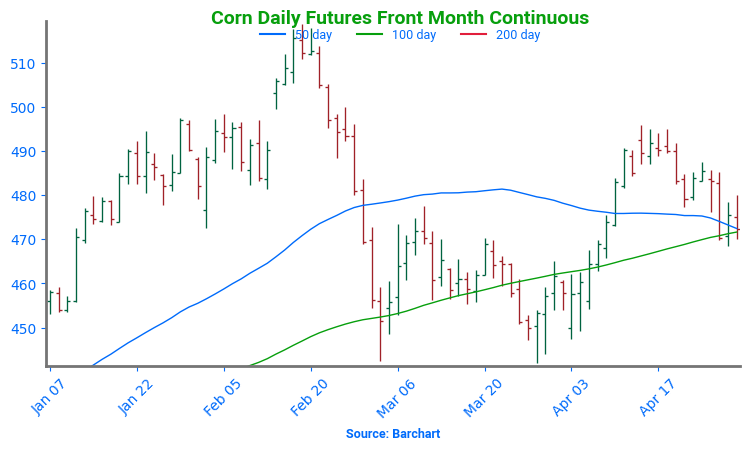

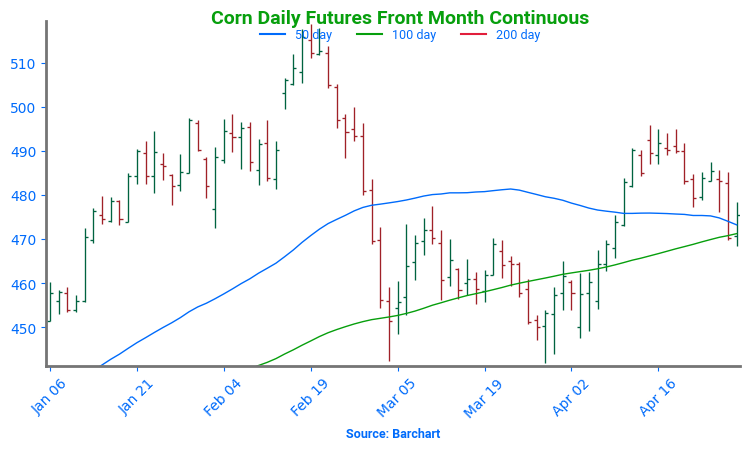

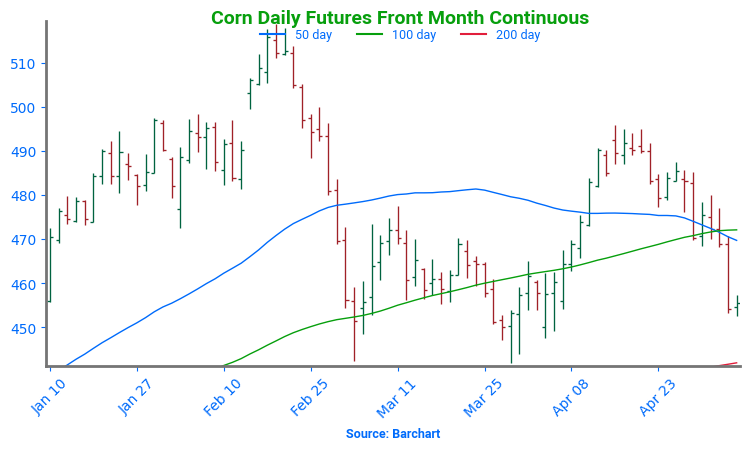

Corn Sandwiched Between Support and Resistance

Corn futures staged a breakout in April after repeatedly defending key support near 450 throughout March. A bullish April WASDE report — driven by stronger-than-expected demand — lit the spark, propelling prices through the 50-day moving average and igniting renewed bullish momentum. As the market enters May, traders are focused on two key drivers: weather outlooks across the Corn Belt and ongoing demand signals. The February highs just above 510 now stand as the next upside target. However, early May weakness has cracked support near 470, leaving the door open for a retest of the familiar 450 level — the early 2025 low — as the next key floor.

Corn Managed Money Funds net position as of Tuesday, April 29. Net position in Green versus price in Red. Money Managers net sold 41,476 contracts between April 22 – April 29, bringing their total position to a net long 71,329 contracts.

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes: None.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- NEW: Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B: Make a cash sale if November closes below 1016.75 support.

- NEW: Tomorrow, Grain Market Insider will recommend adding additional downside coverage via 1040 January put options. Be on the lookout for recommendation alerts tomorrow.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes: None.

- The 1093 cash sales target has been cancelled, leaving only the 1114 target active.

- A target to exit a portion of the 1100 calls if November trades to 1085 has been added. This target would hit before the 88 cents exit target, making the latter target to exit all remaining 1100 calls.

- If you’re behind on sales, target 1063 vs November for a catch-up opportunity. If you’re in line with current recommendations, Plan A remains to make the next cash sale at 1114, while keeping an eye on 1016.75 support as part of Plan B.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes: None.

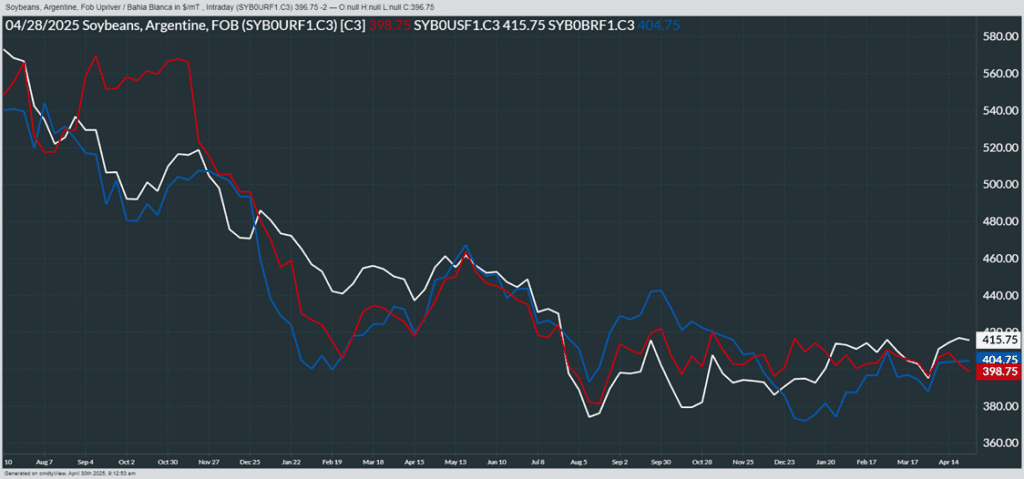

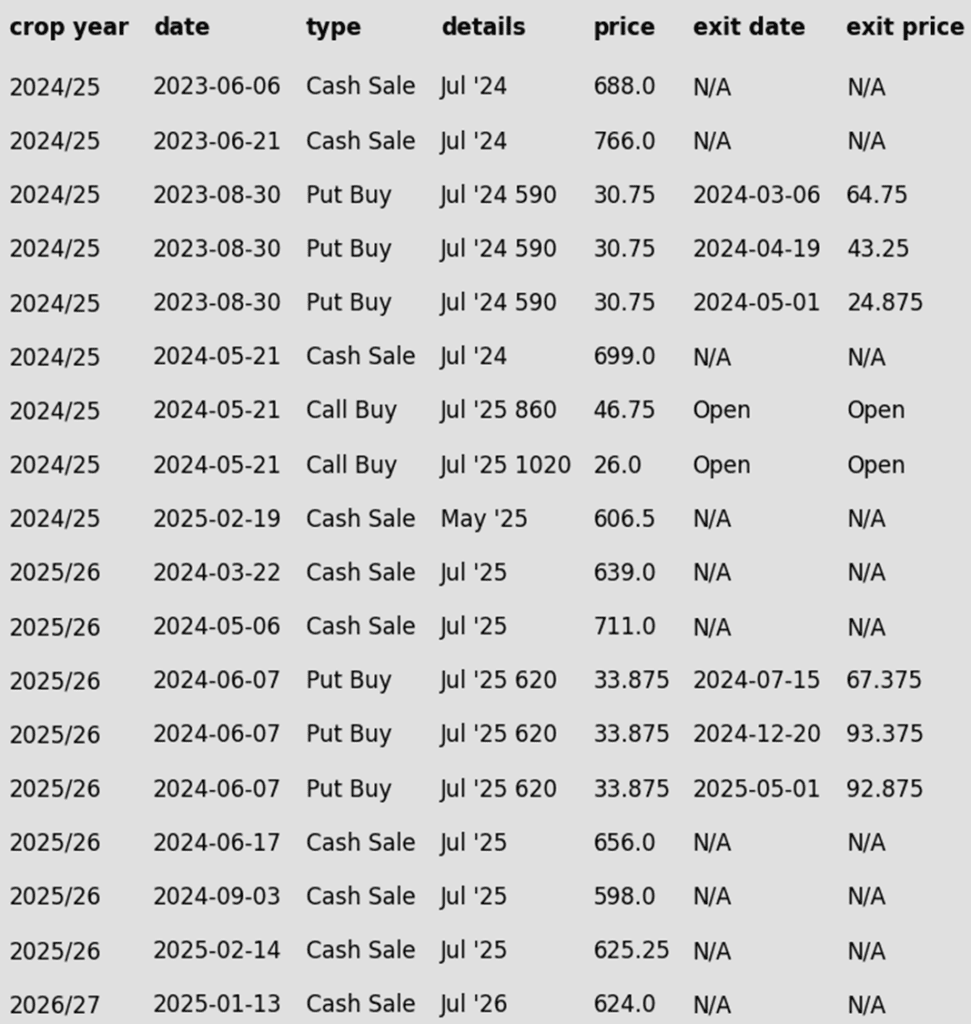

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybean futures closed lower in bear spreading action, with front-month contracts leading the decline and erasing Friday’s gains. Expectations remain for another strong planting pace in Monday’s Crop Progress report. Soybean meal and oil also fell, with oil under heavier pressure following declines in crude and palm oil.

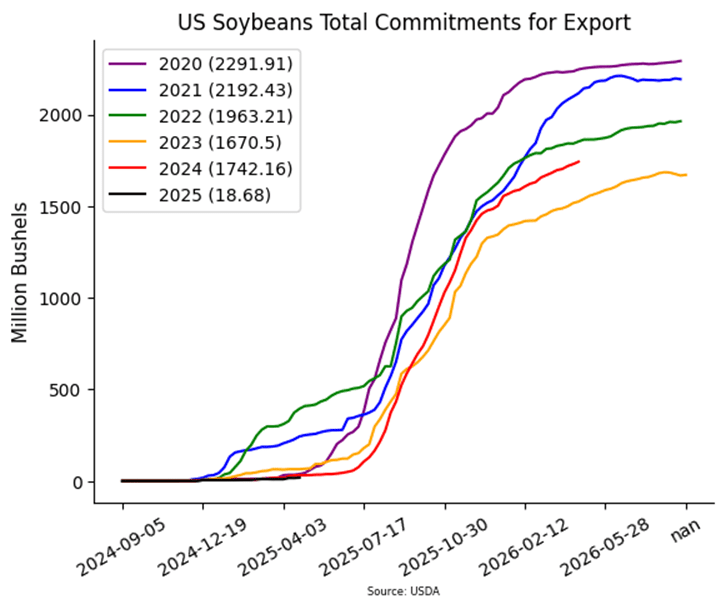

- Weekly export inspections were soft but within trade estimates. For the week ending May 1, inspections totaled 11.9 million bushels, bringing 2024/25 cumulative inspections to 1.597 billion bushels — up 11% from last year. Mexico and China were the top destinations.

- Malaysian palm oil stocks likely posted their biggest monthly increase since August 2023, as production recovered from recent weather disruptions. Rising inventories have added pressure to soybean oil.

- Friday’s CFTC report saw funds as buyers of soybeans by 7,135 contracts which increased their net long position to 38,202 contracts. They bought 12,488 contracts of bean oil and sold 24,716 contracts of bean meal.s.

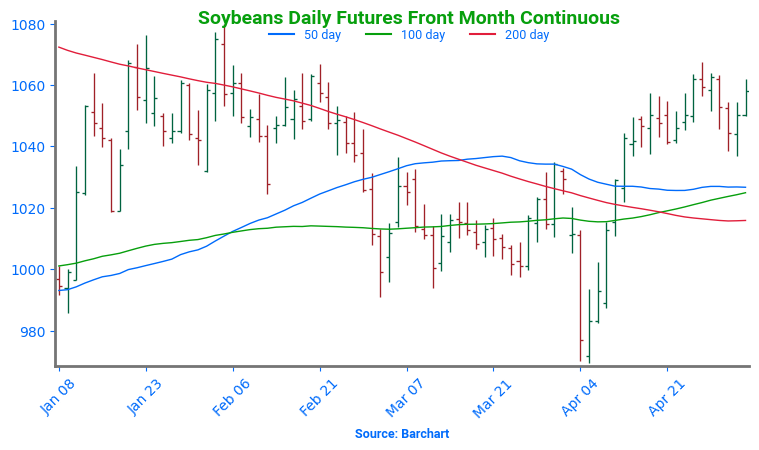

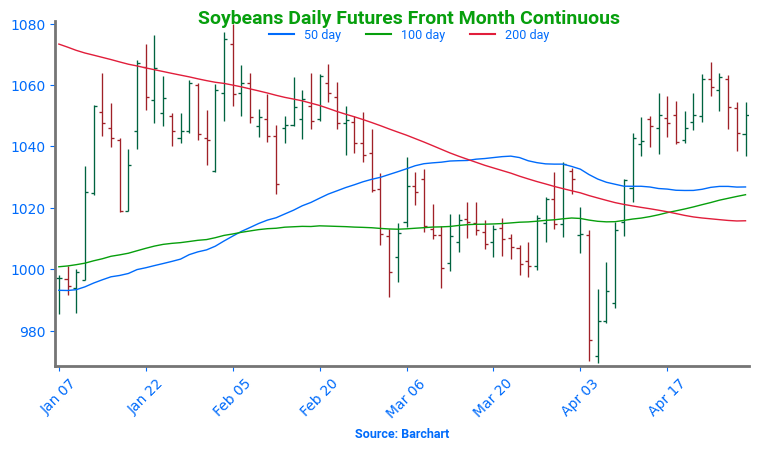

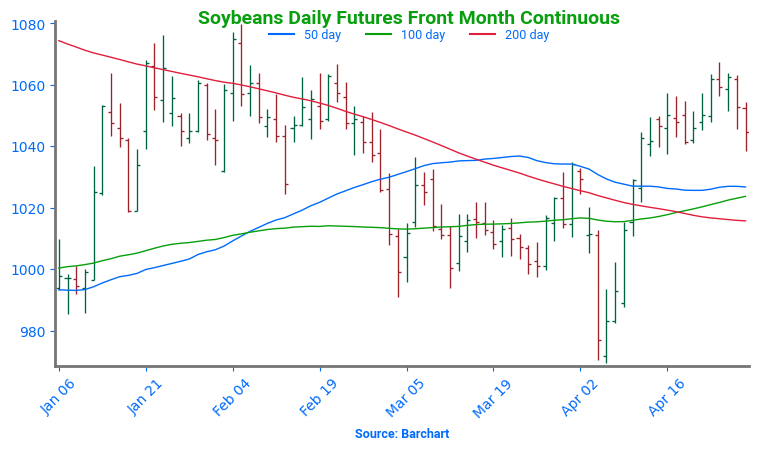

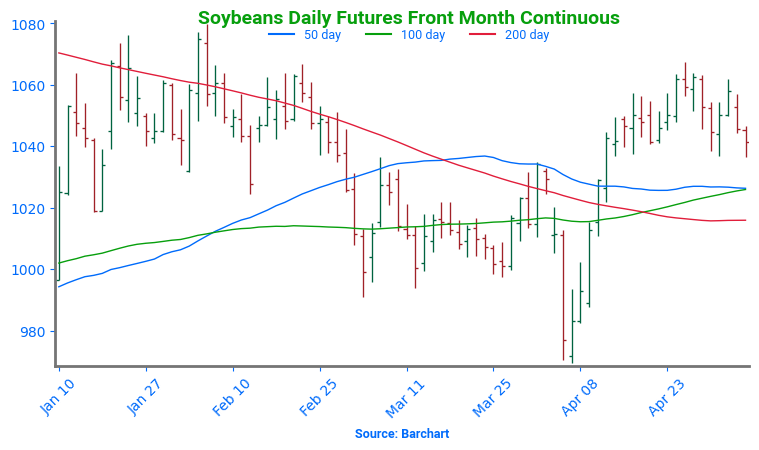

Soybean Futures Hold Above Key Support

Soybean futures plunged in early April as news of fresh tariffs sent prices tumbling below the psychologically important 1000 level — a floor that had held firm throughout March. The break triggered a wave of technical selling, but the dip was short-lived. Aggressive buying interest quickly emerged, sparking a sharp rebound that not only reclaimed the 1000 level but also vaulted futures back above key moving averages. Notably, the 200-day moving average — a persistent ceiling for nearly two years — was decisively overtaken. With momentum building, the market is now setting its sights on a potential retest of the February highs near 1080, while the reclaimed 200-day average is poised to serve as a strong layer of support during any spring setbacks.

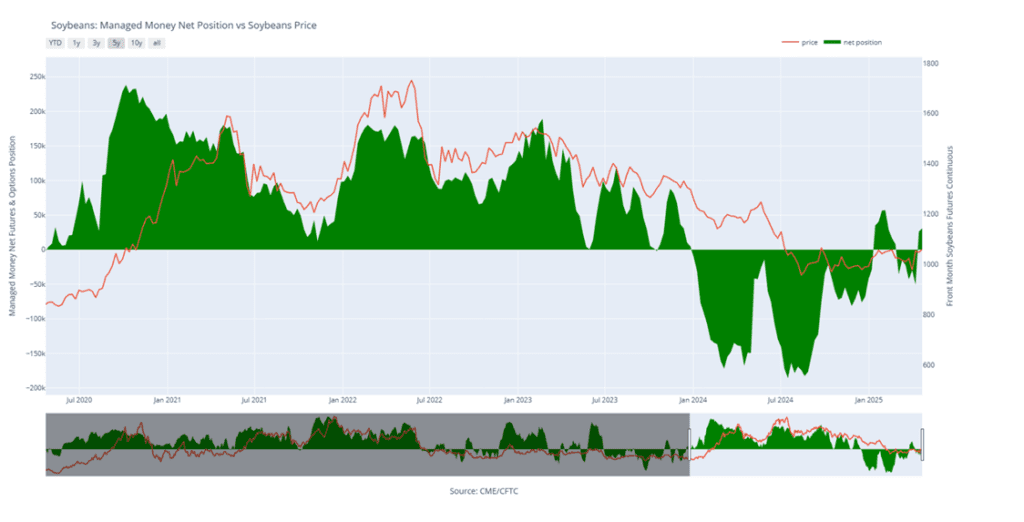

Soybean Managed Money Funds net position as of Tuesday, April 29. Net position in Green versus price in Red. Money Managers net bought 7,135 contracts between April 22 – April 29, bringing their total position to a net long 38,202 contracts.

Wheat

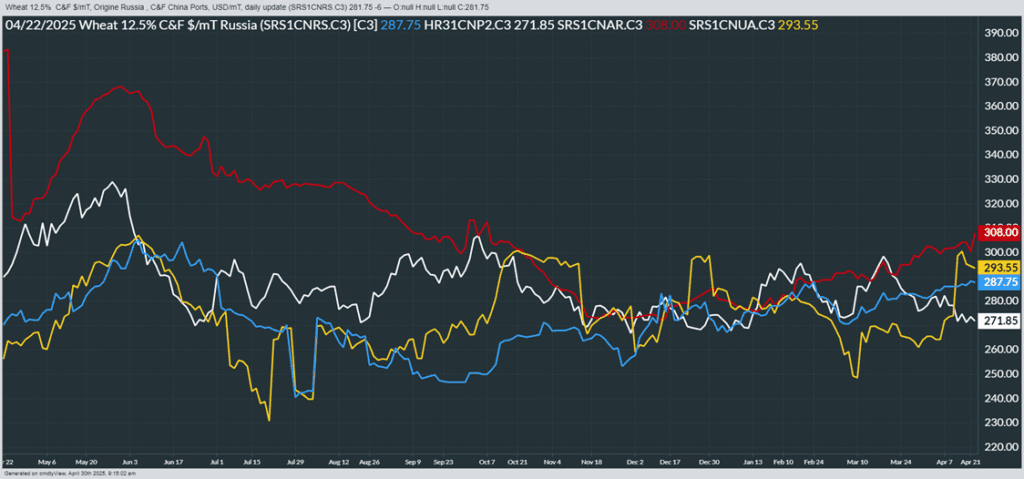

Market Notes: Wheat

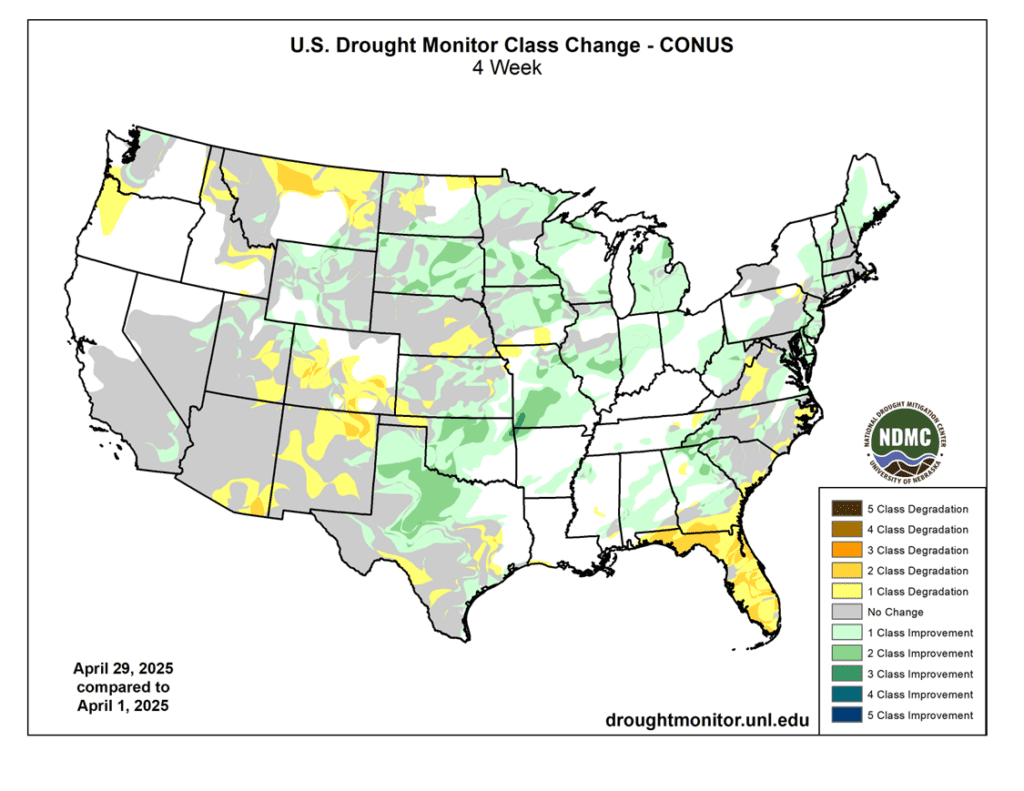

- Wheat futures closed lower across the board, with winter wheat hit hardest. Spring wheat losses were limited as dry conditions in the Northern Plains offered support. It was a broad risk-off day for commodities, with Paris milling wheat and crude oil also sharply lower, adding pressure to U.S. wheat markets.

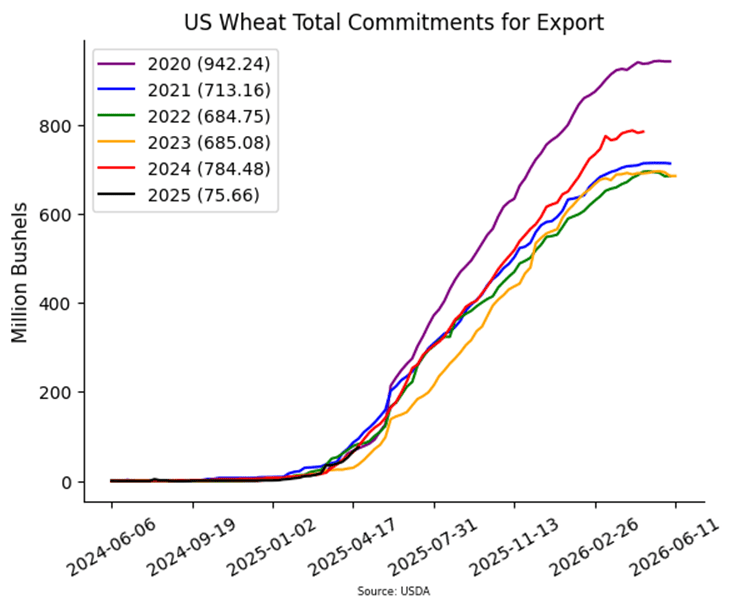

- Weekly wheat inspections of 11.4 mb bring the total 24/25 inspections to 727 mb, which is up 14% from last year and slightly behind the forecasted pace. Total 24/25 exports are estimated by the USDA at 820 mb, up 16% from the year prior.

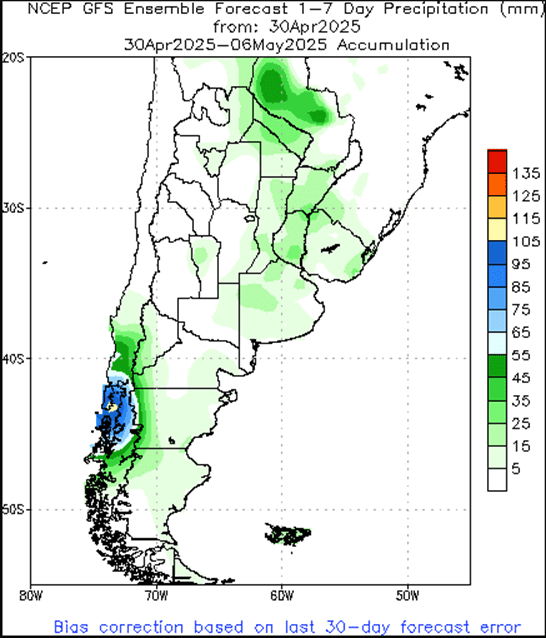

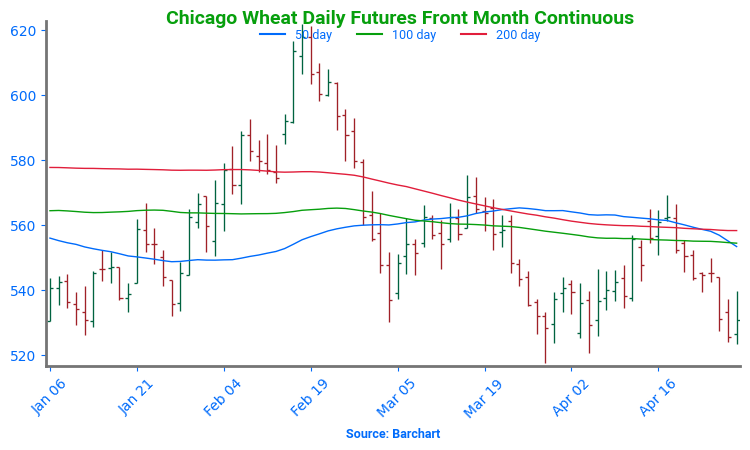

- Forecasted rains in Argentina could delay corn and soybean harvests and winter wheat planting, though the moisture will aid early crop establishment during the May–July planting window.

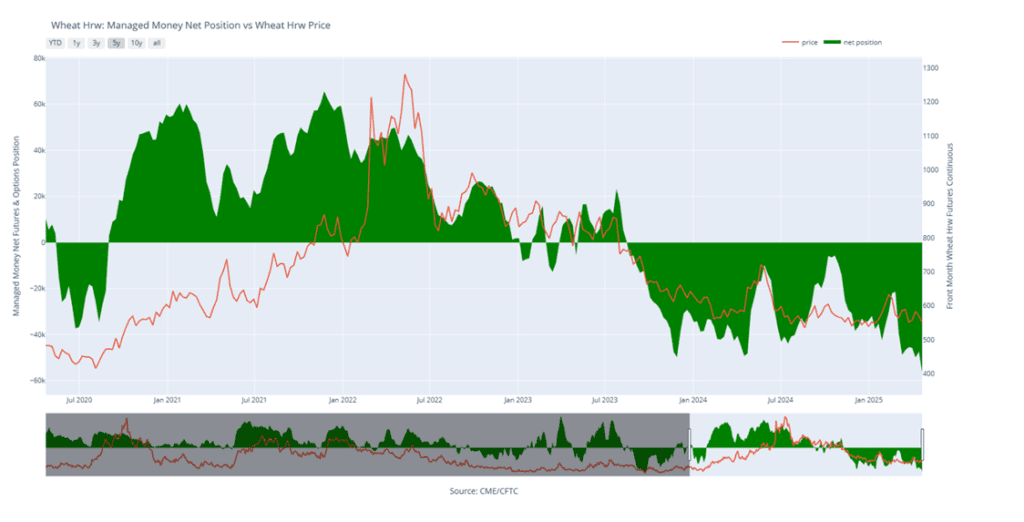

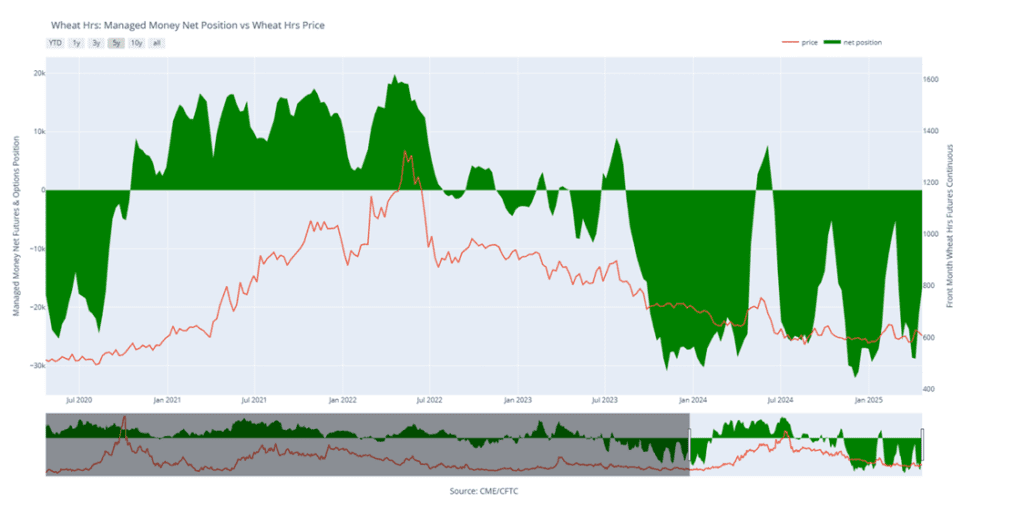

- Friday’s CFTC report showed funds selling a record 31,486 contracts of Chicago wheat, pushing their net short to 121,415 — the largest since June 2023. Across all three U.S. wheat classes, managed money is now net short a record 207,798 contracts.

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 Chicago wheat puts at approximately 92 cents in premium minus fees and commission.

- Plan A:

- NEW: Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- Sales target has been lowered.

- With just 48 days remaining until expiration and following gains from the recent decline in July futures off its April 11 high, it’s time to close out the final portion of the July 620 put options.

2026 Crop:

- Plan A:

- NEW: Target 696 against July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- Sales target has been lowered.

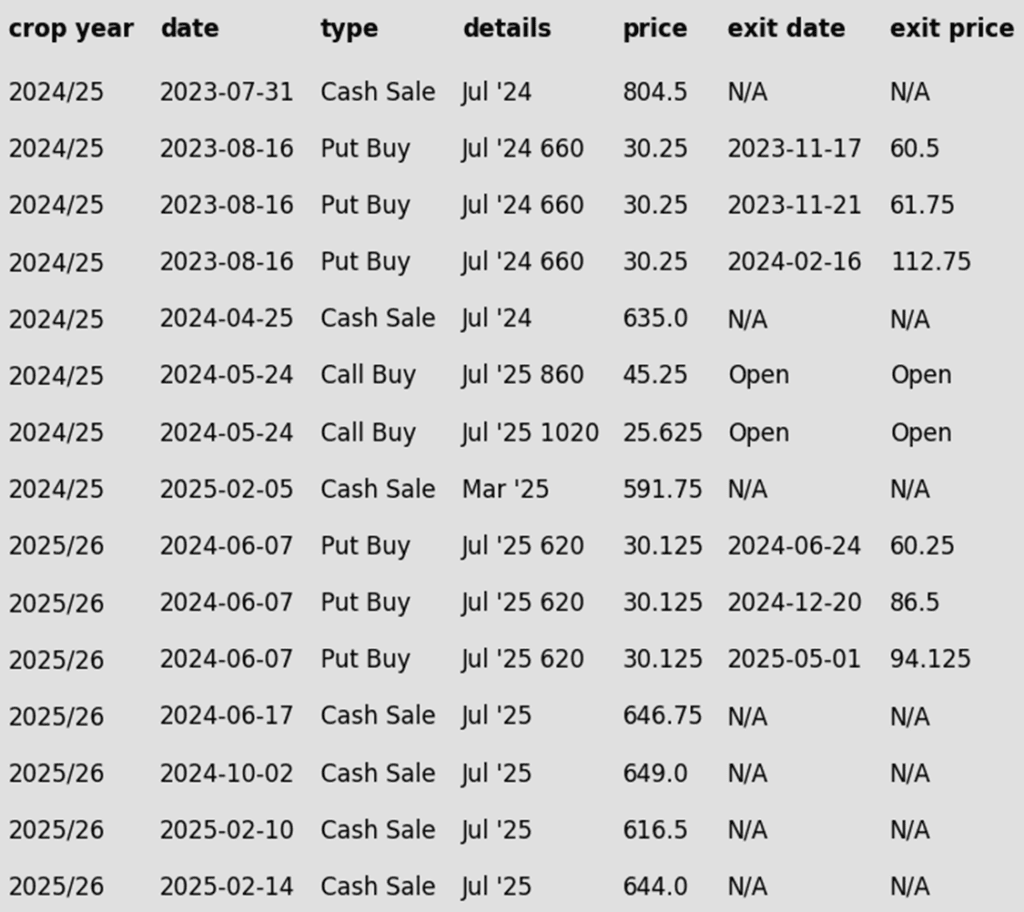

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

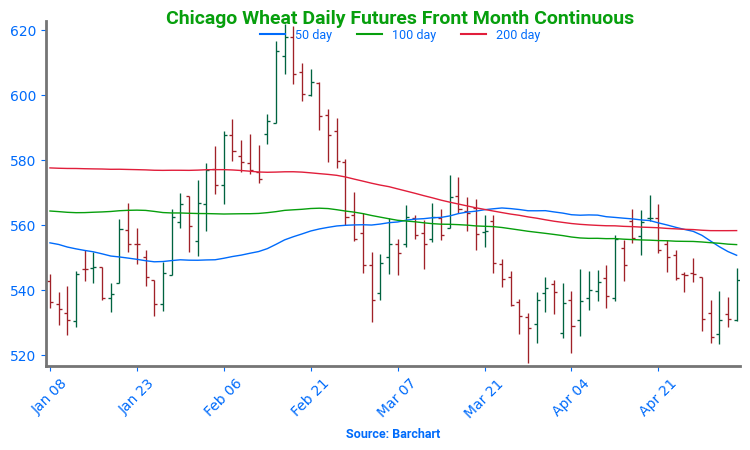

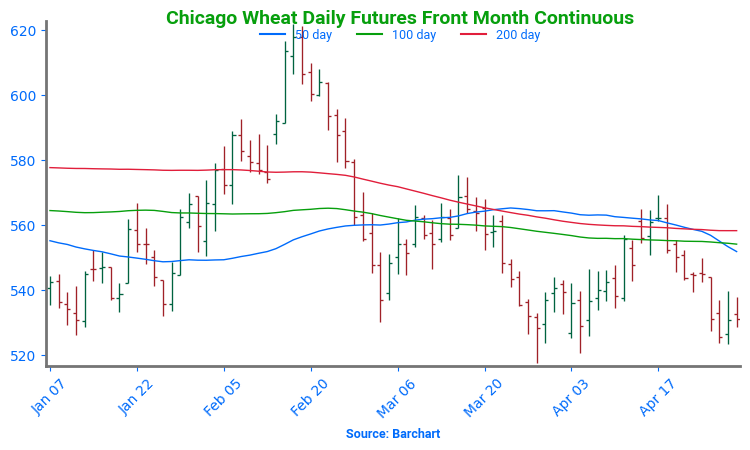

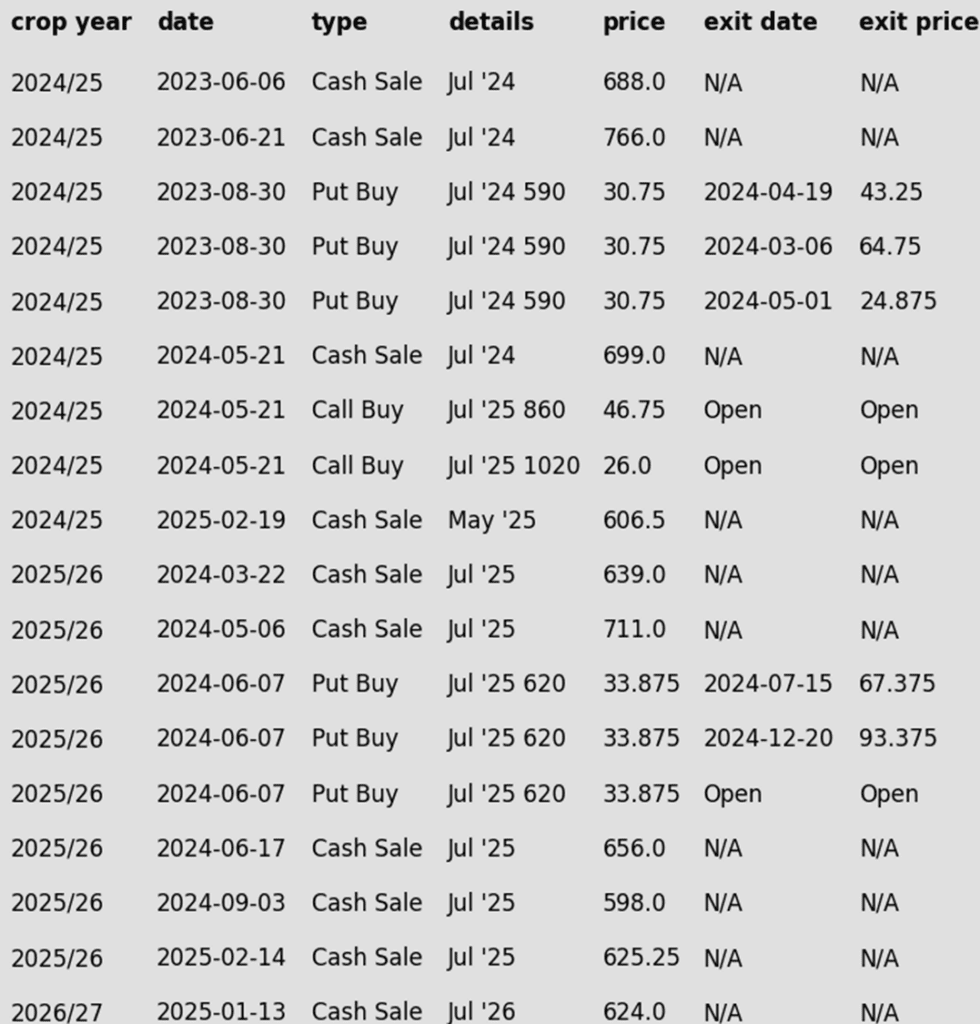

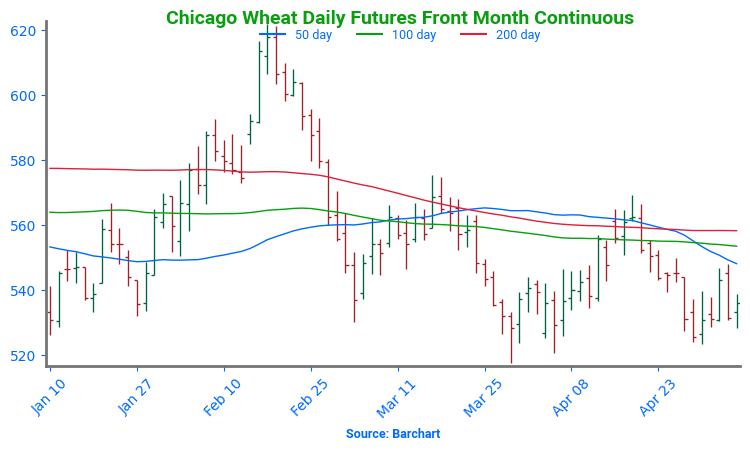

Chicago Wheat Futures Back Near Support

After months of sideways action, Chicago wheat futures broke higher in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, sending futures back into the late 2024 trading range. Support near 530 held firm through March, and should continue to act as support in the near-term. The next key test is the 200-day moving average — a decisive weekly close above it could signal a shift in momentum and potentially kickstart a broader upside trend.

Chicago Wheat Managed Money Funds’ net position as of Tuesday, April 29. Net position in Green versus price in Red. Money Managers net sold 31,486 contracts between April 22 – April 29, bringing their total position to a net short 121,415 contracts.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A:

- NEW: Target 645 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- New:

- Sales target has been lowered.

- With just 48 days remaining until expiration and following gains from the recent decline in July futures off its April 10 high, it’s time to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes: None.

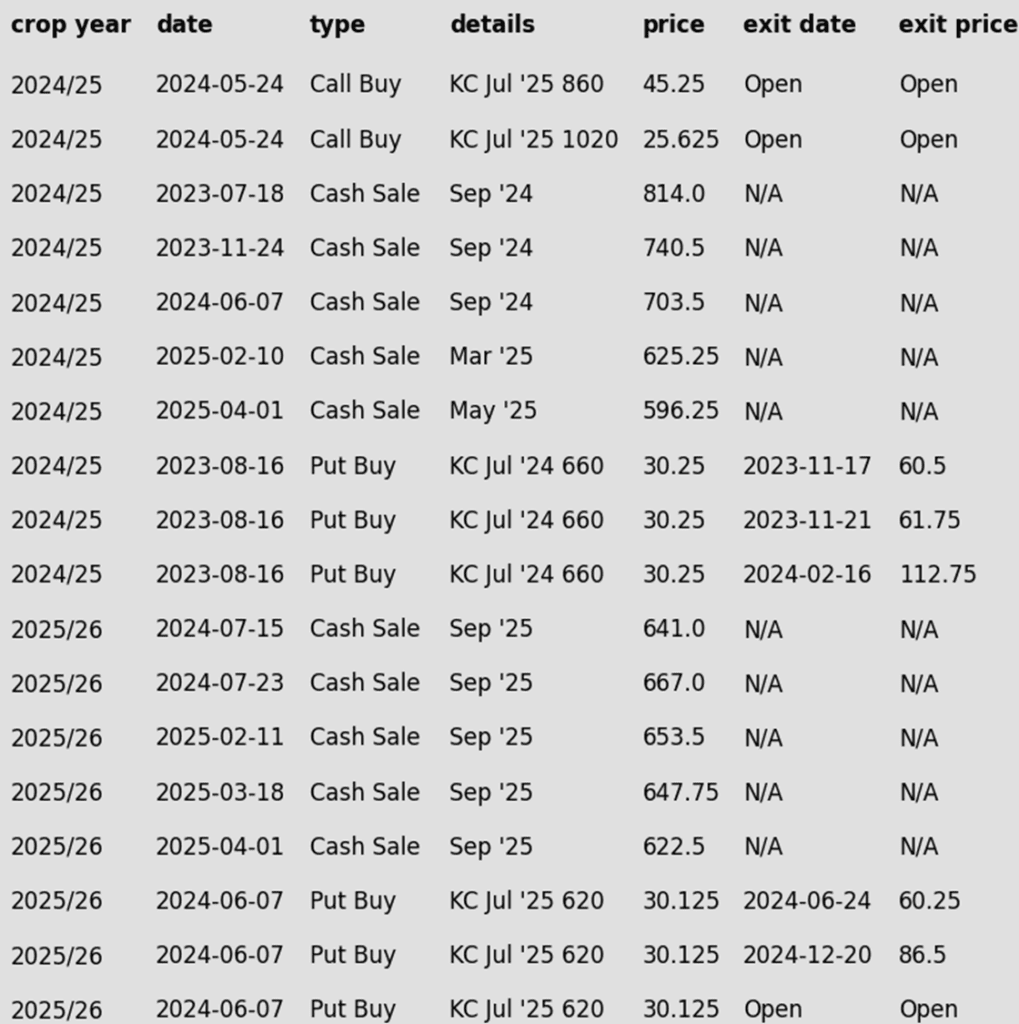

To date, Grain Market Insider has issued the following KC recommendations:

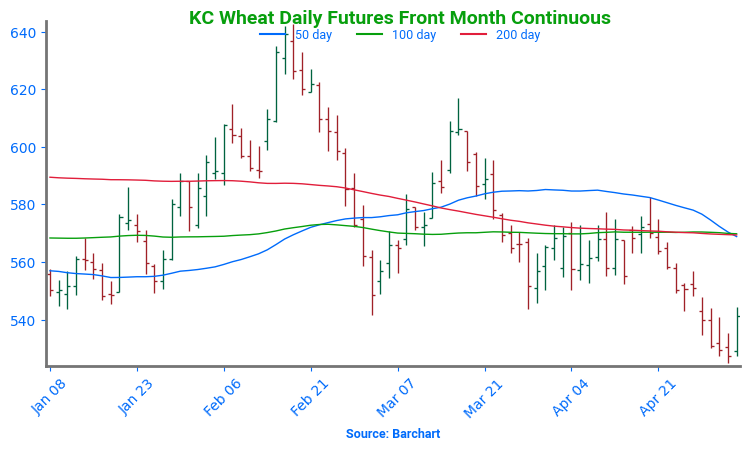

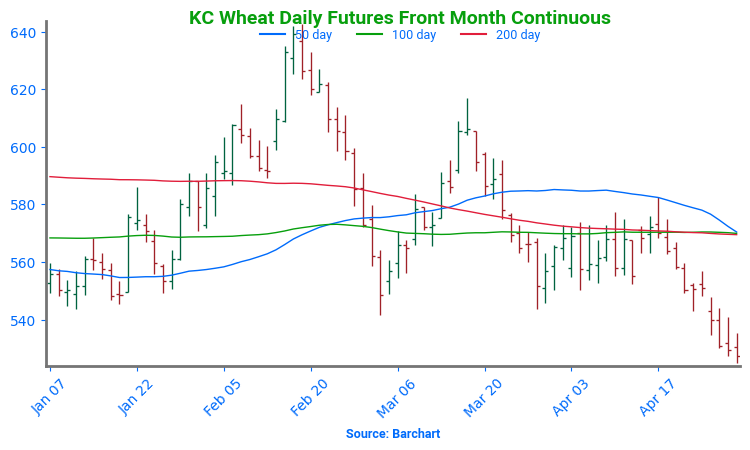

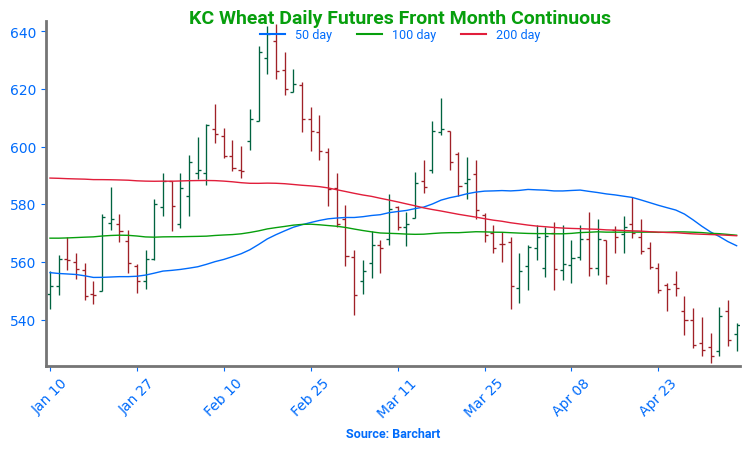

Kansas City Wheat Holding Support, Watching 200-Day Resistance

February was a volatile month for Kansas City wheat, with prices surging higher before tumbling back and ending the month little changed. March and April brought additional weakness, dragging prices near recent lows, but the ability to hold these lows is encouraging. On a rebound, the 200-day moving average will be the first resistance level to watch, with February highs near 640 serving as a more significant upside barrier. On the downside, support near the December lows around 540 should provide a strong floor if selling pressure continues.

KC Wheat Managed Money Funds’ net position as of Tuesday, April 29. Net position in Green versus price in Red. Money Managers net sold 10,645 contracts between April 22 – April 29, bringing their total position to a net short 67,269 contracts.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 48 days remaining until expiration and following gains from the recent decline in July KC futures off its April 10 high, it’s time to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes: None.

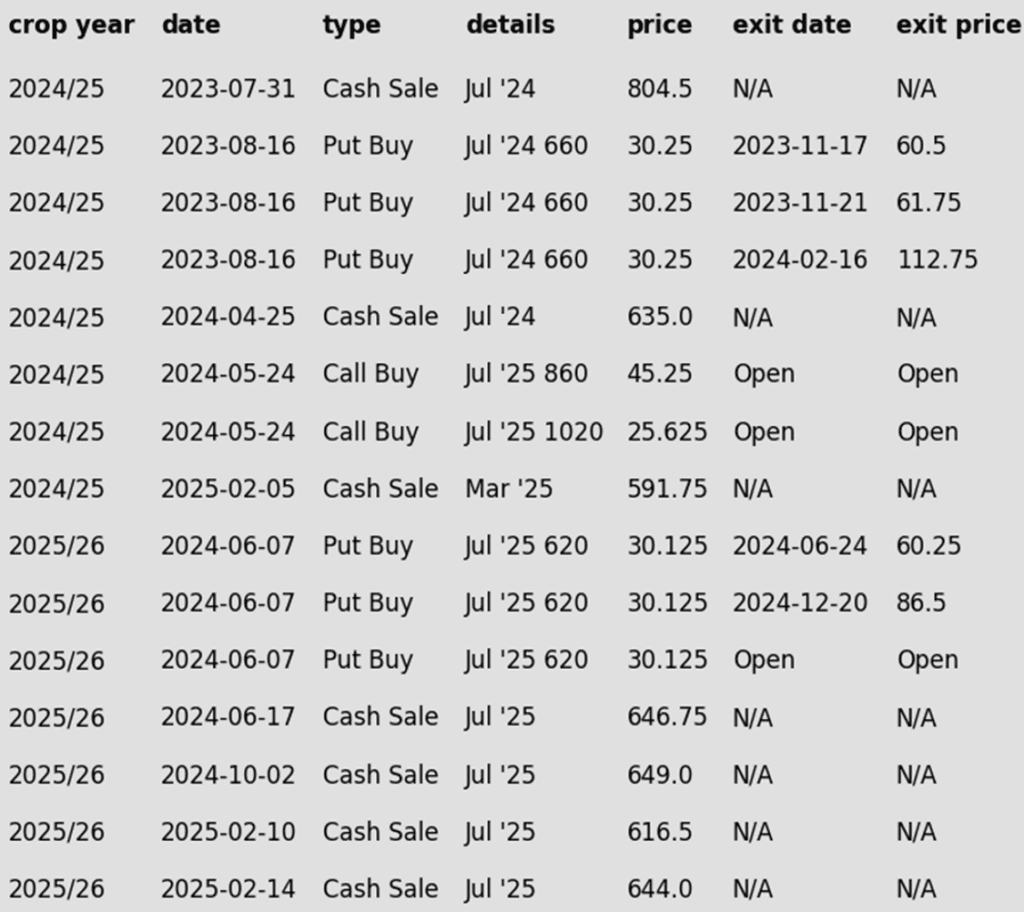

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

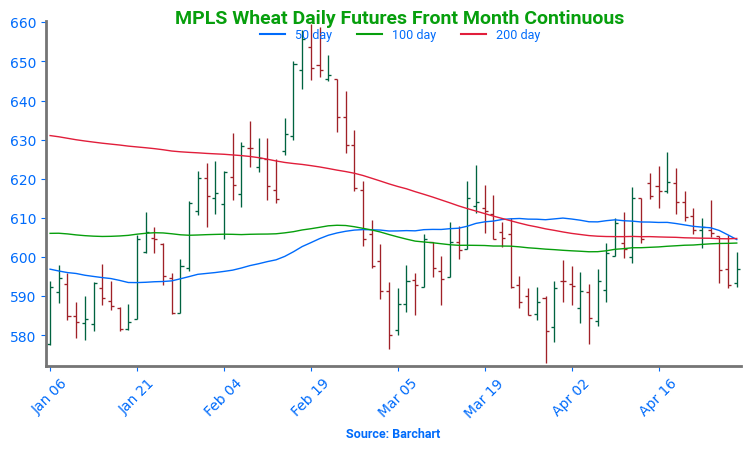

Spring Wheat at a Crossroads

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, though late-month weakness briefly pushed futures back below key technical levels. Unlike the winter wheats, spring wheat has been able to hover near a confluence of moving averages which are acting as support as of now. The next upside target is the February highs near 660. With spring wheat acreage projected to be the lowest in 55 years, weather volatility is likely to play a major role in driving price action this season.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, April 29. Net position in Green versus price in Red. Money Managers net sold 2,532 contracts between April 22 – April 29, bringing their total position to a net short 19,114 contracts.

Other Charts / Weather