6-9 Opening Update: Grains Trading Lower to Start the Week

All prices as of 6:30 am Central Time

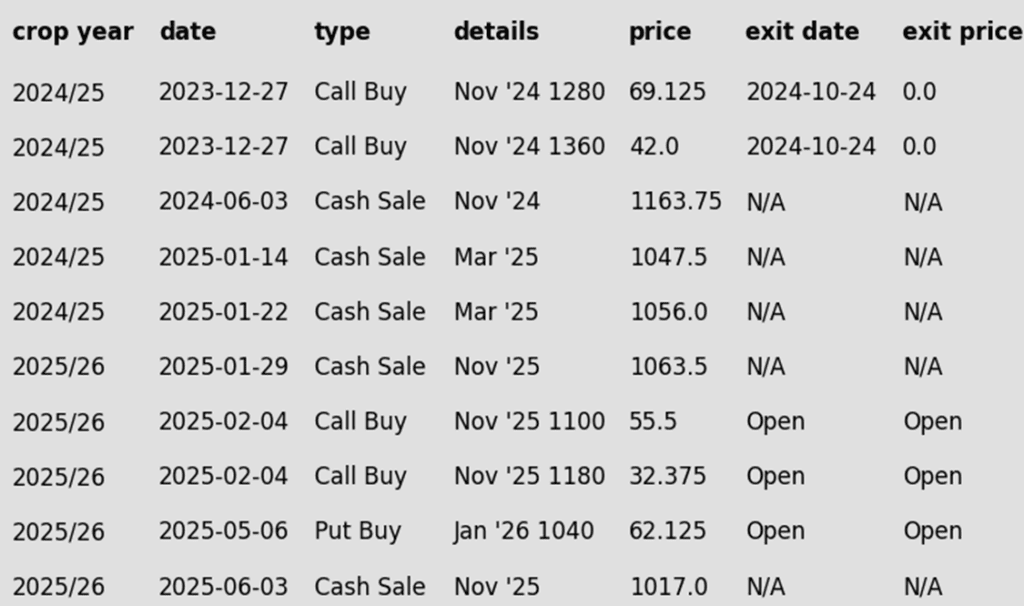

|

Corn |

||

| JUL ’25 | 441.5 | -1 |

| DEC ’25 | 445.75 | -3.5 |

| DEC ’26 | 474 | -2.25 |

|

Soybeans |

||

| JUL ’25 | 1058.5 | 1.25 |

| NOV ’25 | 1037 | 0 |

| NOV ’26 | 1059.5 | -0.25 |

|

Chicago Wheat |

||

| JUL ’25 | 551 | -3.75 |

| SEP ’25 | 565.75 | -3 |

| JUL ’26 | 629 | 4 |

|

K.C. Wheat |

||

| JUL ’25 | 544.25 | -5 |

| SEP ’25 | 558.5 | -4 |

| JUL ’26 | 620 | -0.75 |

|

Mpls Wheat |

||

| JUL ’25 | 632 | -3.25 |

| SEP ’25 | 642 | -2 |

| SEP ’26 | 681.75 | 0 |

|

S&P 500 |

||

| SEP ’25 | 6066.75 | 6.25 |

|

Crude Oil |

||

| AUG ’25 | 63.81 | 0.18 |

|

Gold |

||

| AUG ’25 | 3338.4 | -8.2 |

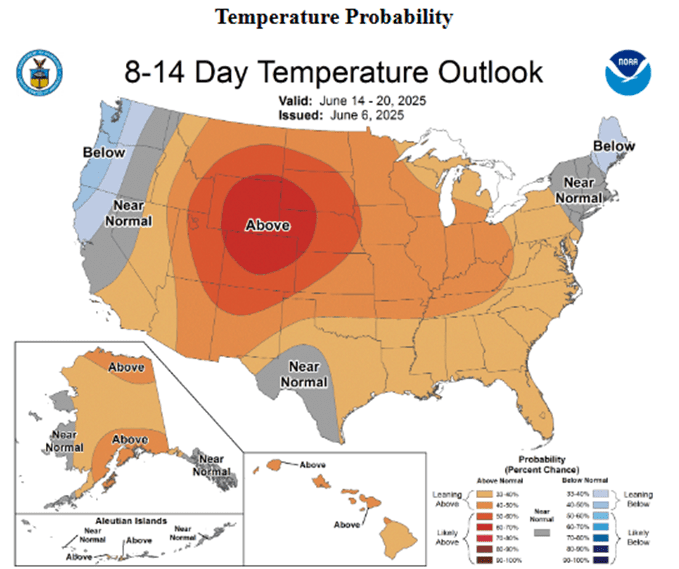

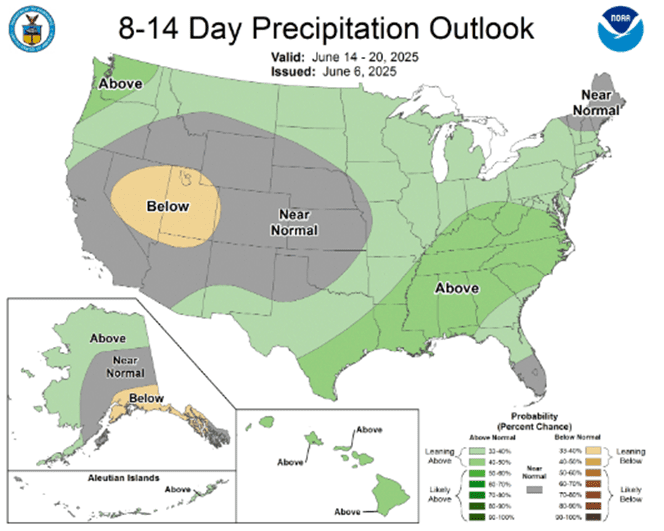

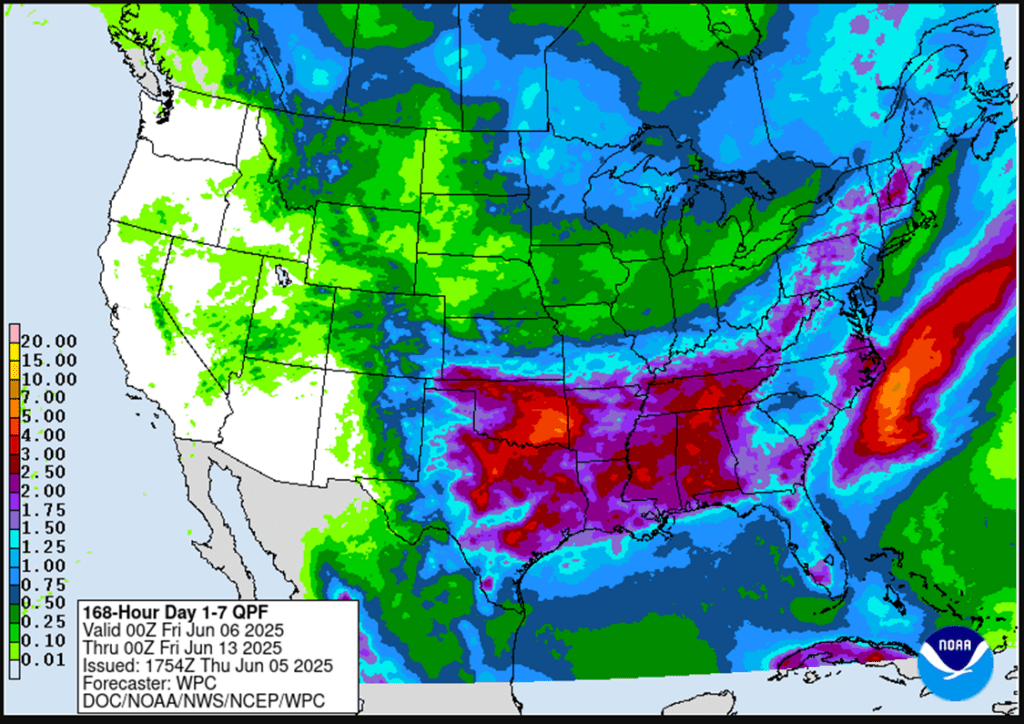

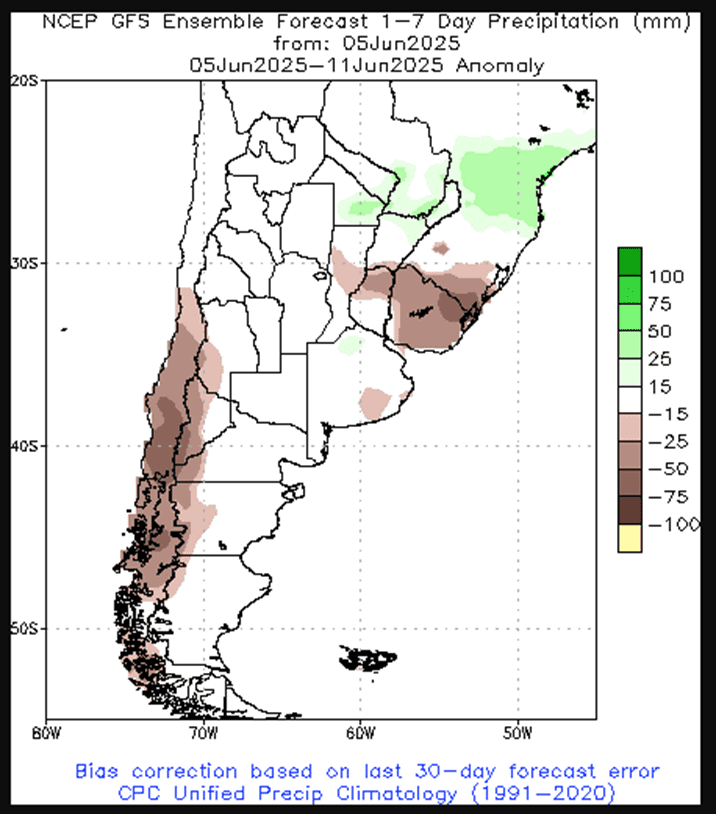

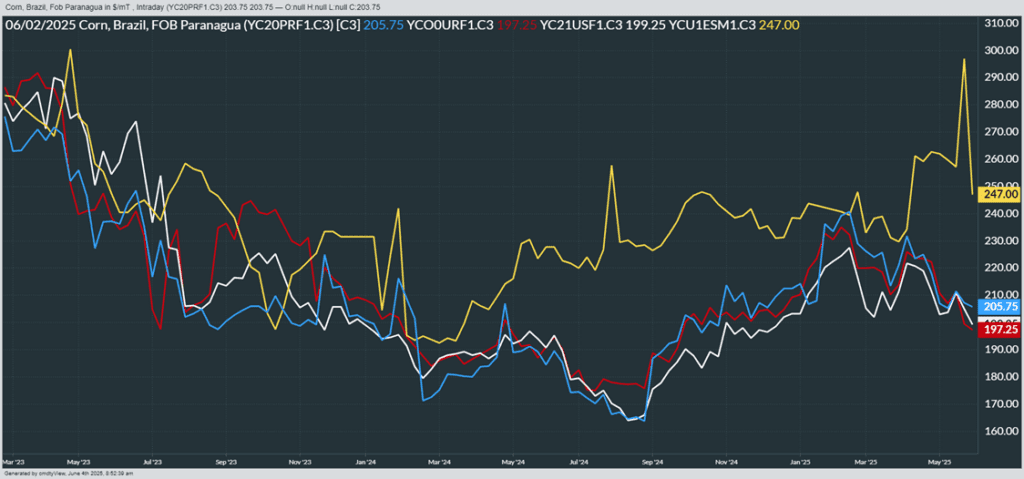

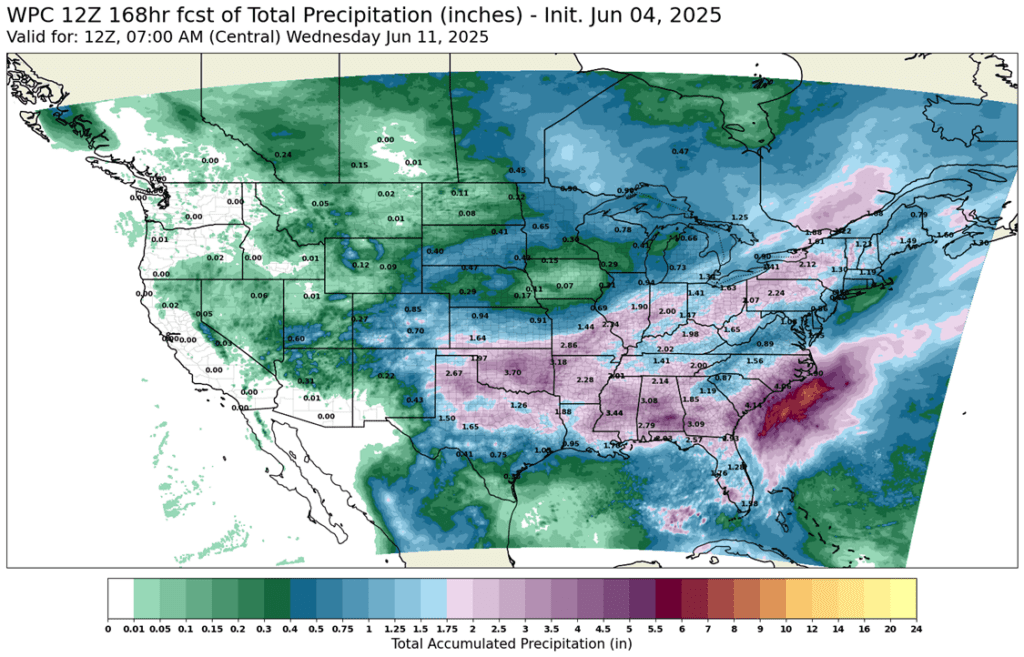

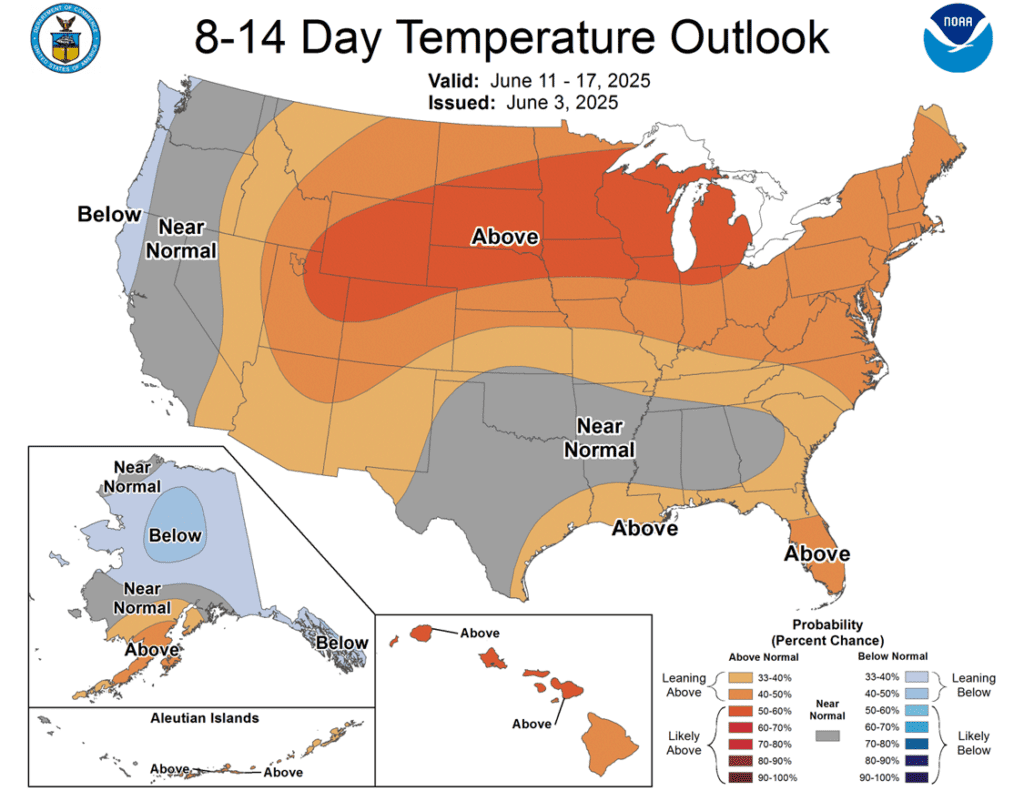

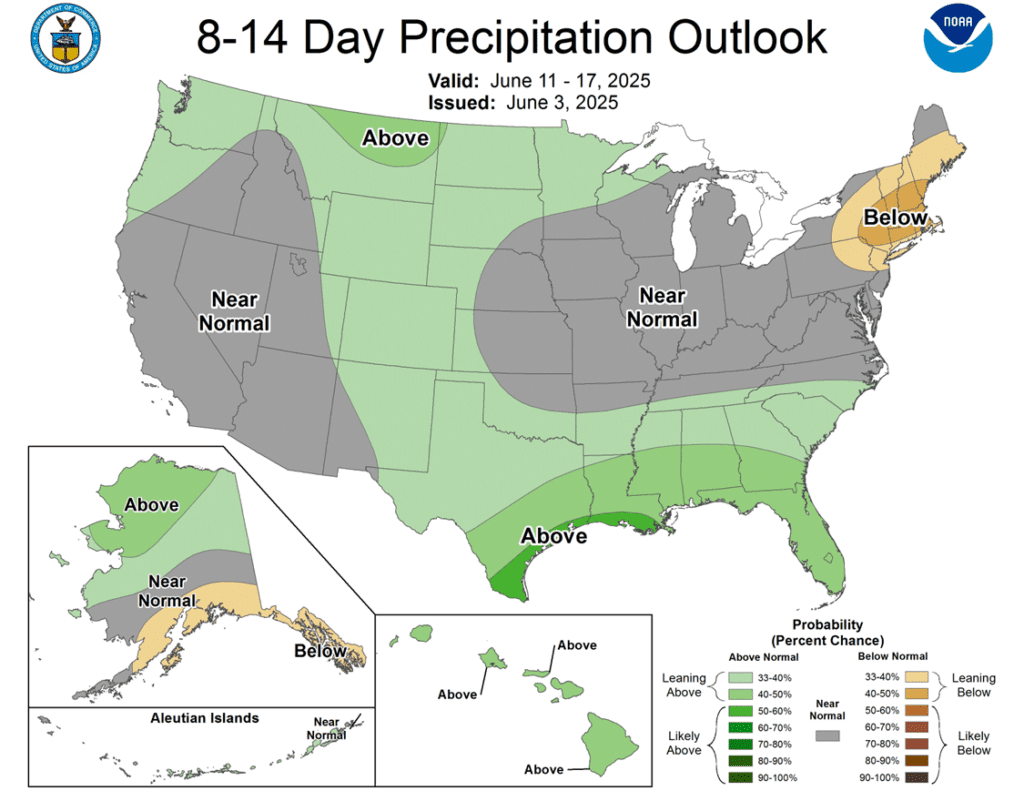

- Corn is trading slightly lower this morning in relatively quiet trade following four consecutively higher closes. Weather forecasts are wet over the next week before they are expected to turn drier this summer.

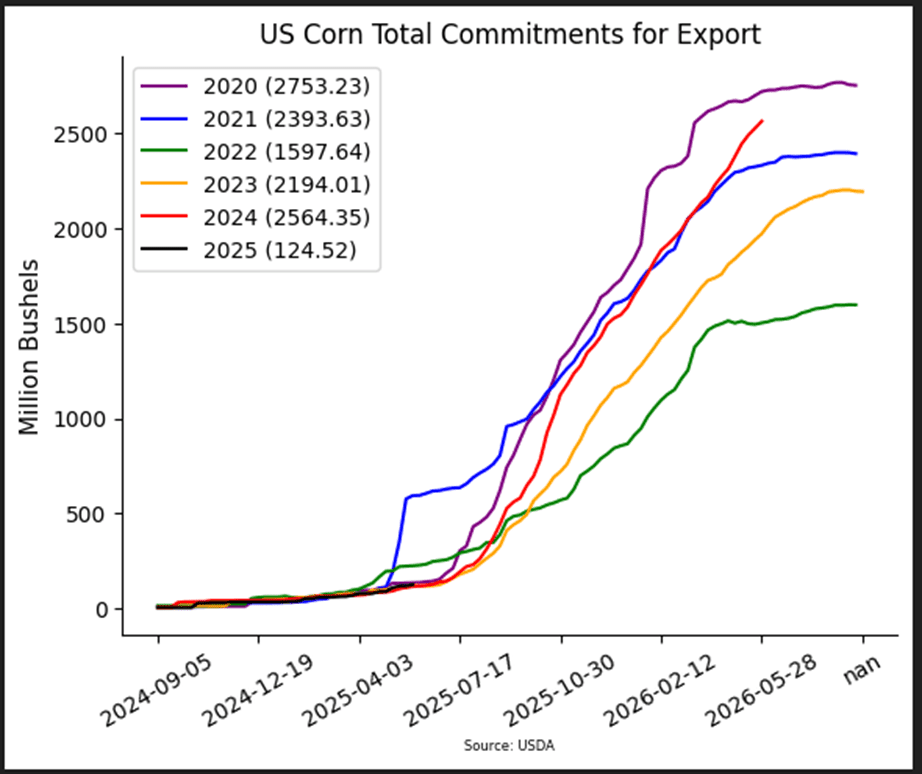

- This Thursday, the USDA will release its WASDE report, and early estimates see corn production slightly lower from last month but relatively unchanged. Ending stocks are expected to fall slightly to 1.789 bb.

- Friday’s CFTC report saw funds sell a whopping 53,283 contracts of corn which left them with a net short position of 154,043 contracts.

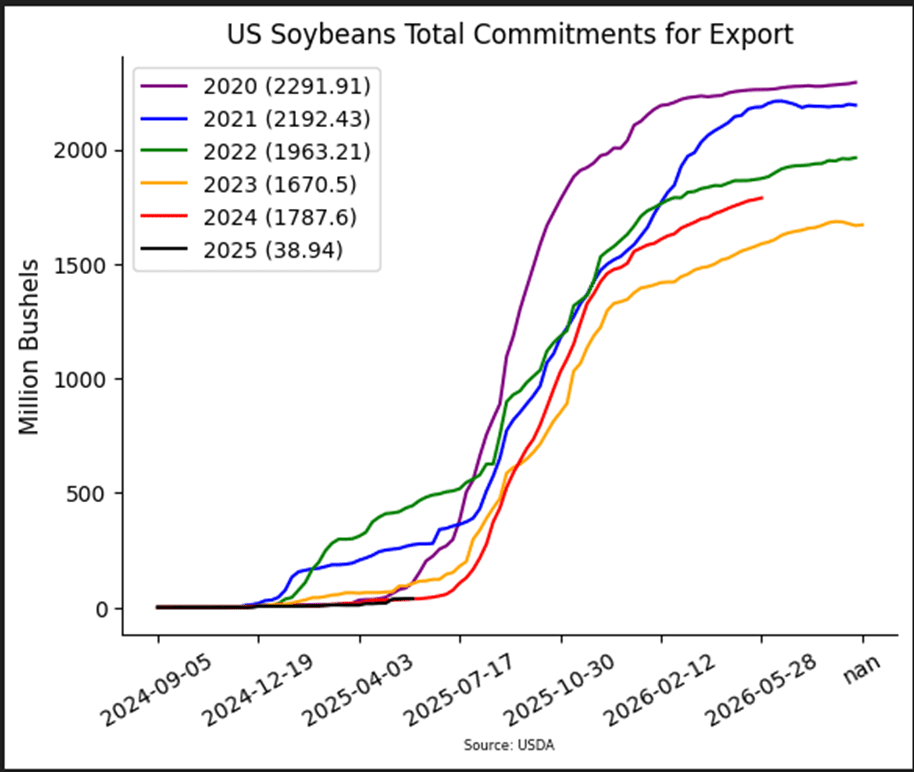

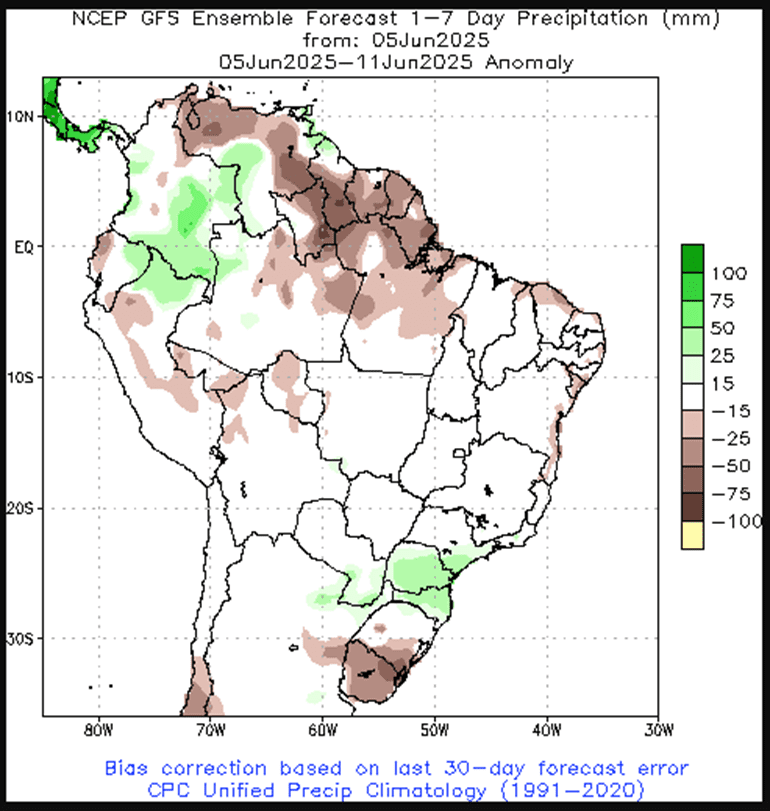

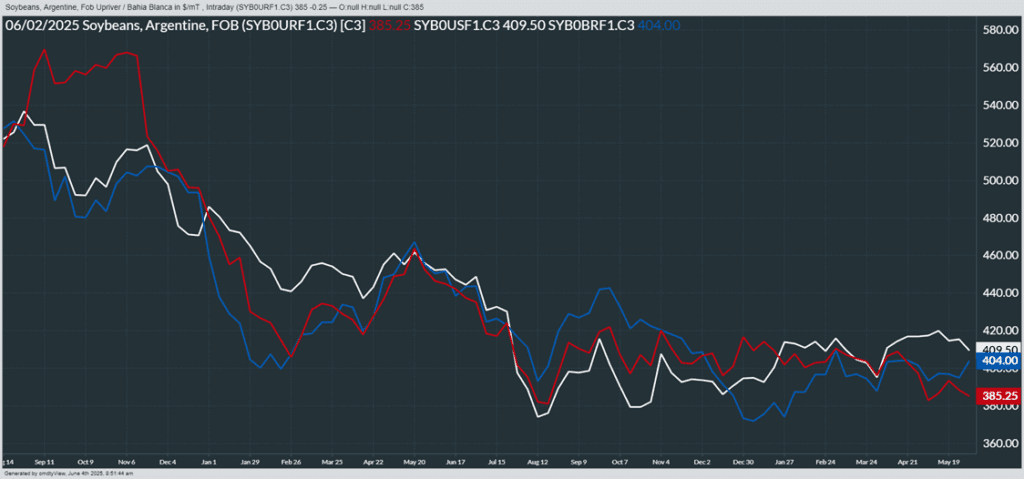

- Soybeans are mixed this morning with the July contract trading higher while deferred contracts are lower. Today would be a fifth consecutive higher close if momentum improves. Soybean meal is trading lower while soybean oil is higher.

- Today, trade officials from the US and China are meeting in London to discuss the trade dispute. After last week’s call between Trump and Xi that was described as productive, things seem to be moving in a positive direction.

- Friday’s CFTC report saw funds as sellers of soybeans by 28,096 contracts which left them with a long position of 8,601 contracts. They sold 21,998 contracts of oil and 2,932 contracts of meal.

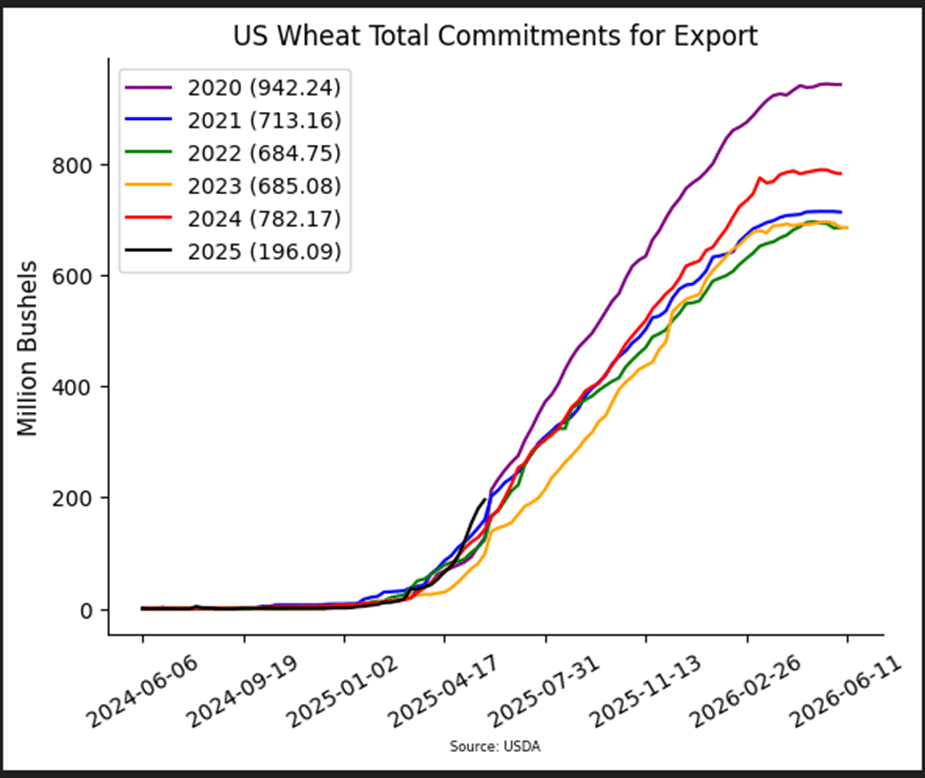

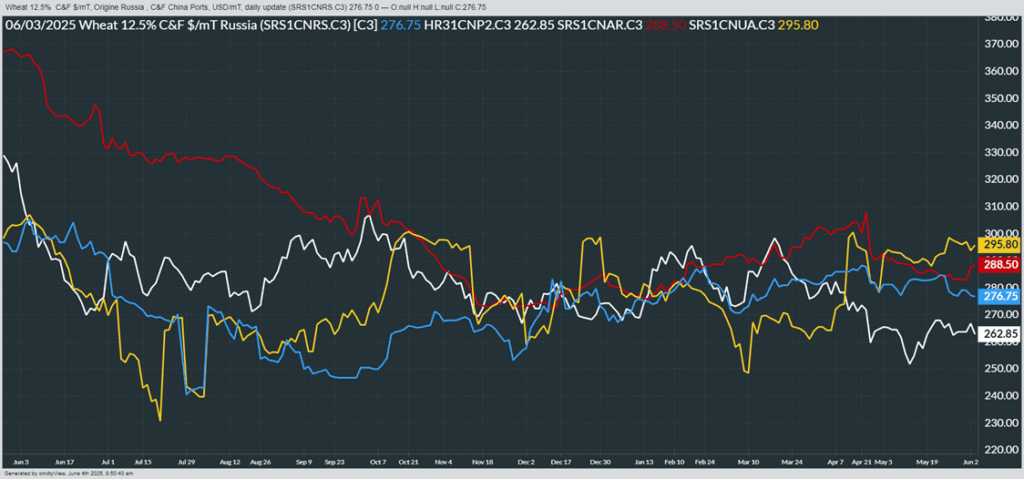

- All three wheat classes are trading lower this morning as funds continue to pile into their massive short position. Global weather and escalations between Ukraine and Russia remain bullish fundamentally.

- Last week, Russia retaliated on Ukraine for the attack that wiped out a large portion of Russia’s air force. This retaliation is causing fears that crucial Black Sea grain exporting infrastructure will be damaged which would be friendly for prices.

- Friday’s CFTC report saw funds as buyers of Chicago wheat by 654 contracts leaving them short 100,572 contracts. They bought back 1,333 contracts of KC wheat which left them short 78,028 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.