10-27 Opening Update: Grains Sharply Higher on Positive China Trade Talks

- Corn futures are trading sharply higher with prices a penny off their highs from September. December is up 7 cents to $4.30-1/4 and March is up 7-1/2 cents to $4.44-1/2. The next target would be the 200-day moving average at 4.37 for December.

- While traders still anticipate a very large crop to be harvested this season, export demand has been very strong, and there is a possibility that the USDA could increase demand on the balance sheet. Harvest is now past the halfway point.

- With the continued government shutdown, we can only estimate fund activity. Over the past 5 days, funds are estimated to have bought back 6,000 contracts of corn and are likely buying back a significant amount today. Funds still hold a net short position.

Corn Futures Find Support: Corn futures rebounded from the 410 level, a key area of structural support. Prices have since broken through resistance at the upper end of their short-term trading range near 424. However, prices were unable to break structural resistance near 430. The 430 level continues to serve as an area of strong technical resistance.

- Soybean futures are sharply higher this morning thanks to news that a Chinese trade deal is likely. November soybeans are up 23-1/2 cents to $10.65-1/4 while March is up 19-1/2 cents to $10.93-1/4. December soybean meal is up $3.70 to $297.80 and December soybean oil is up 0.50 cents to 50.77 cents.

- Overnight, US Treasury Secretary Bessent told the US Sunday new programs that when China’s Xi and President Trump announced a trade deal on Thursday, US farmers would feel very good about this season and the next few years. This immediately brought prices higher.

- Over the past 5 trading days, funds are estimated to have bought 11,000 contracts of soybeans which would add to their already net long position. They were net buyers of both meal and bean oil.

Soybeans Retest Overhead Resistance: Soybean futures have continued to move higher as the market takes an optimistic stance regarding trade tensions with China. Prices are retesting overhead resistance near 1062. A second point of resistance can be found near 1080, a level that has not been traded above for over a year. Support can be found in a band of moving averages near 1026.

- Wheat is significantly higher to start the day with December Chicago wheat up 13-1/2 cents to $5.26, KC wheat up 12-3/4 to $5.14-1/4, and Minn wheat up 9 cents to $5.66. Chicago wheat is nearly 35 cents off its recent low.

- The IGC raised its estimate for global grain stockpiles on wheat and corn for the 25/26 season. Wheat stockpiles have been increased to 275 mmt from 270 mmt in a previous estimate.

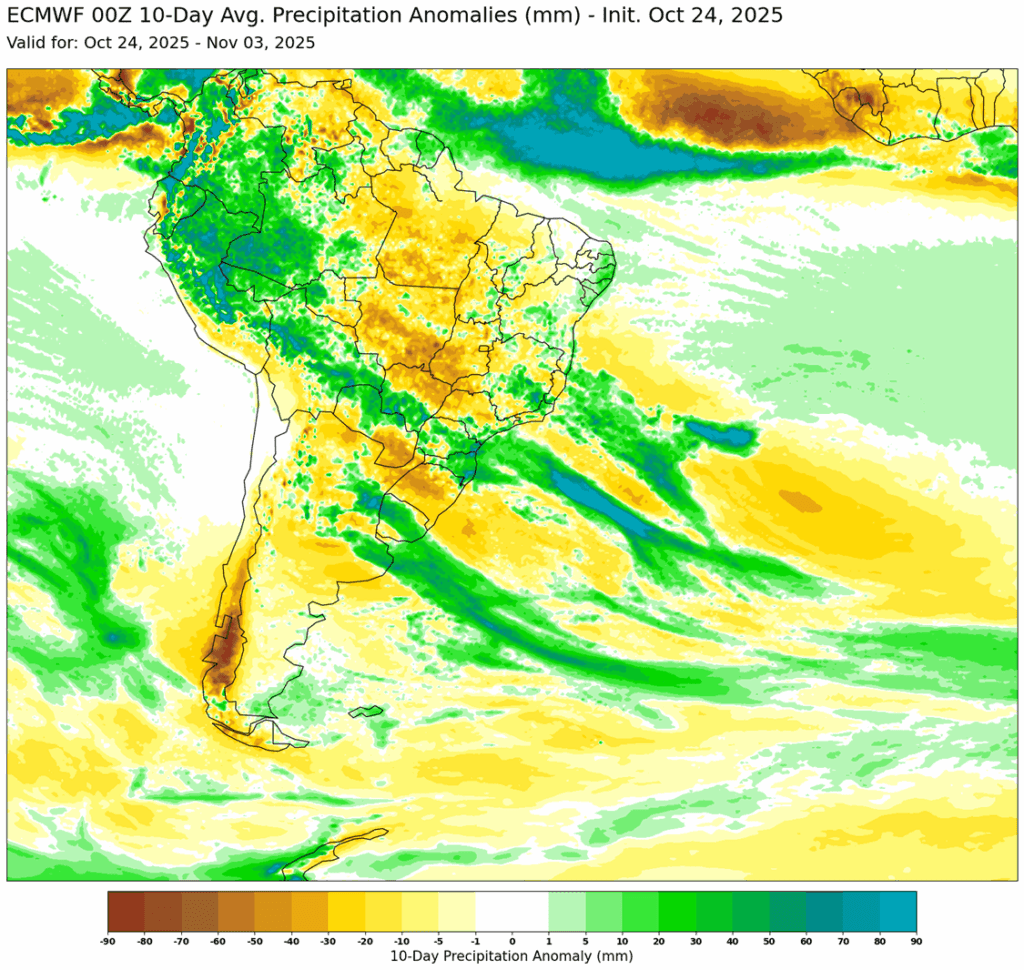

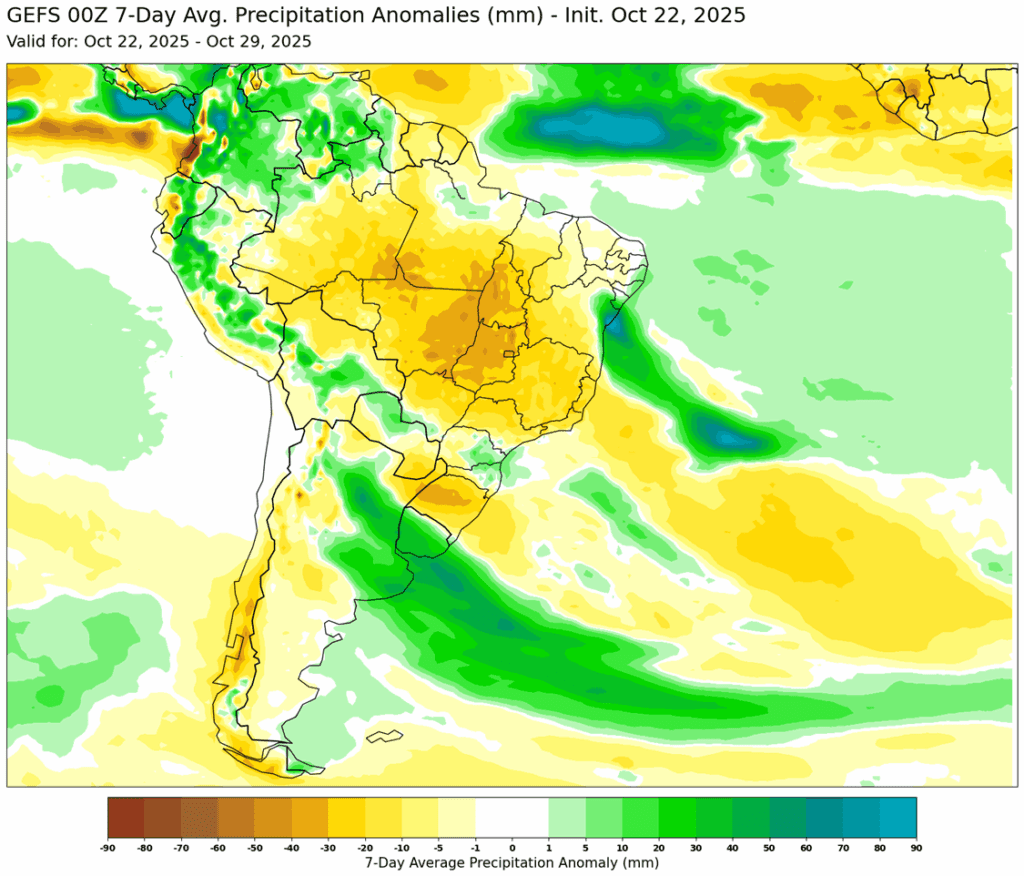

- The Buenos Aires Grain Exchange updated their estimates for wheat planting progress in Argentina. Production is estimated at 22.0 mmt which would compare to 18.6 mmt last year. 5.3% of the crop has been harvested at this point.

Chicago Wheat Approaches Resistance: Wheat futures found support soon after breaking below the 502 level and have since continued to trend slightly higher. Prices are approaching key technical resistance near 517 at the 50-day moving average. Support can be found near 491, the near-term low.

KC Wheat Continues Higher, Approaches Resistance: KC wheat has trended higher following a strong daily reversal on October 14. Prices have risen to approach technical resistance at the 50-day moving average, near 505. Should prices break above, a second point of technical resistance can be found near 518 in the 100-day moving average. Support has been established near 477.

Spring Wheat Finds Support, Reverses Higher: Spring wheat futures found support near 545 and reversed higher in a strong fashion. The first point of technical resistance can be found at the 50-day moving average, near 567.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.