6-17 End of Day: Grains Finish Higher as Wheat Leads on Technical Strength; Soy Extends Rally, Corn Follows

The CME and Total Farm Marketing Offices will be closed Thursday, June 19, in Observance of Juneteenth

All Prices as of 2:00 pm Central Time

Grain Market Highlights

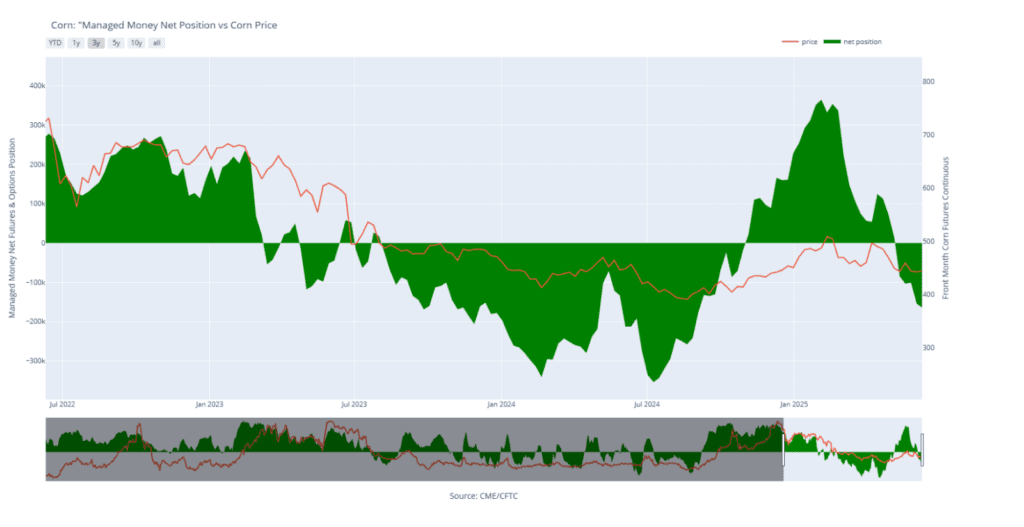

- 🌽 Corn: Corn futures ended higher Tuesday, supported by strength across the grain complex, though July bucked the trend, slipping 4 cents.

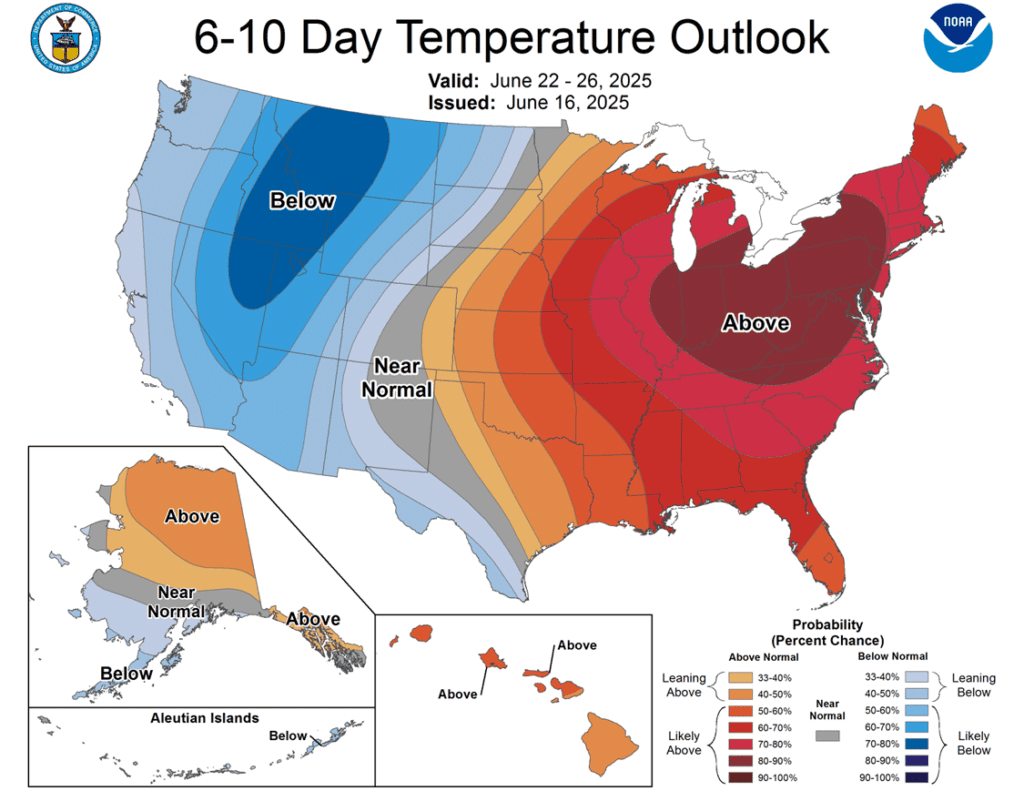

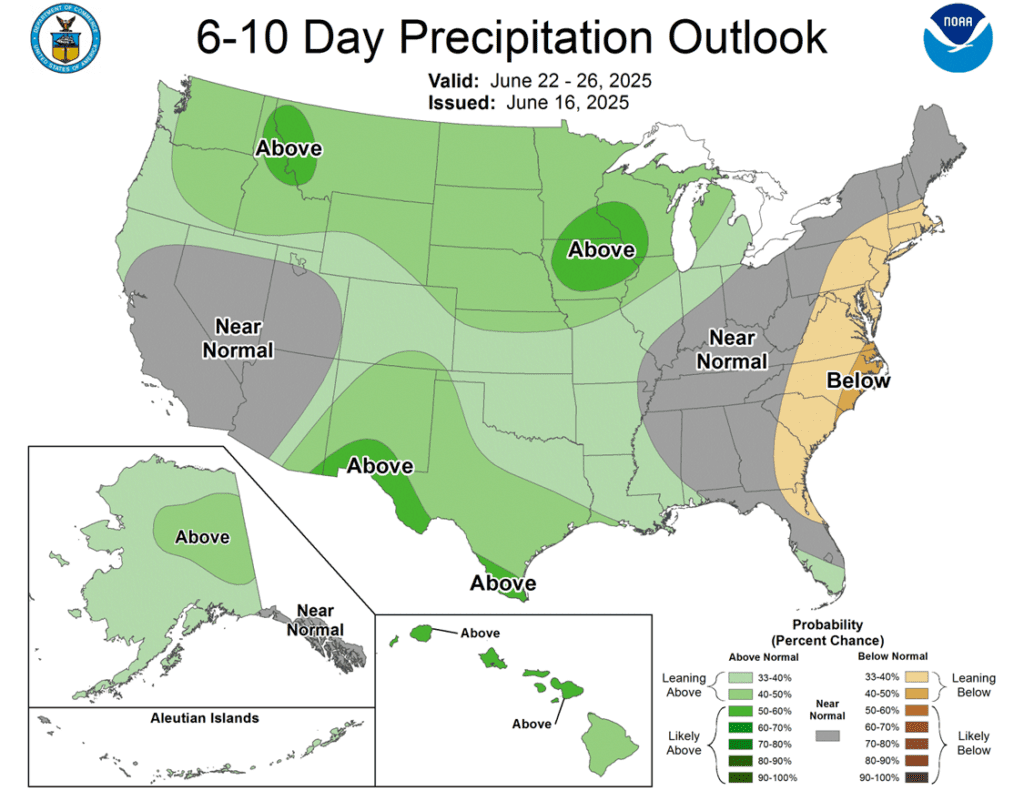

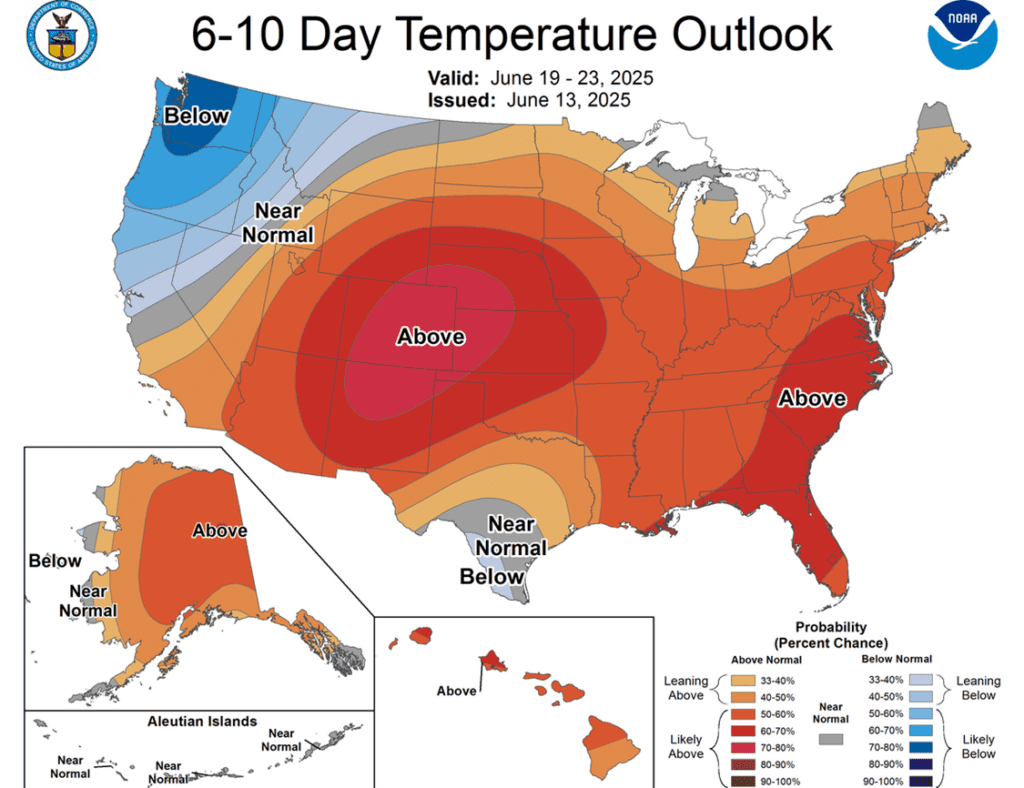

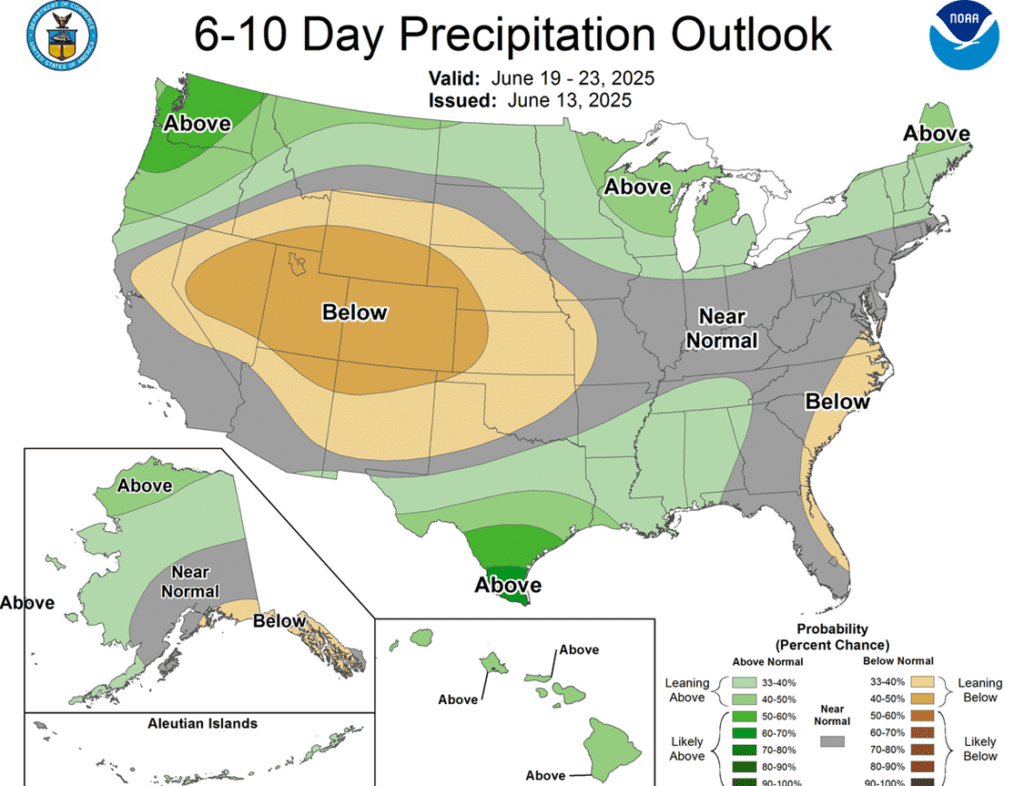

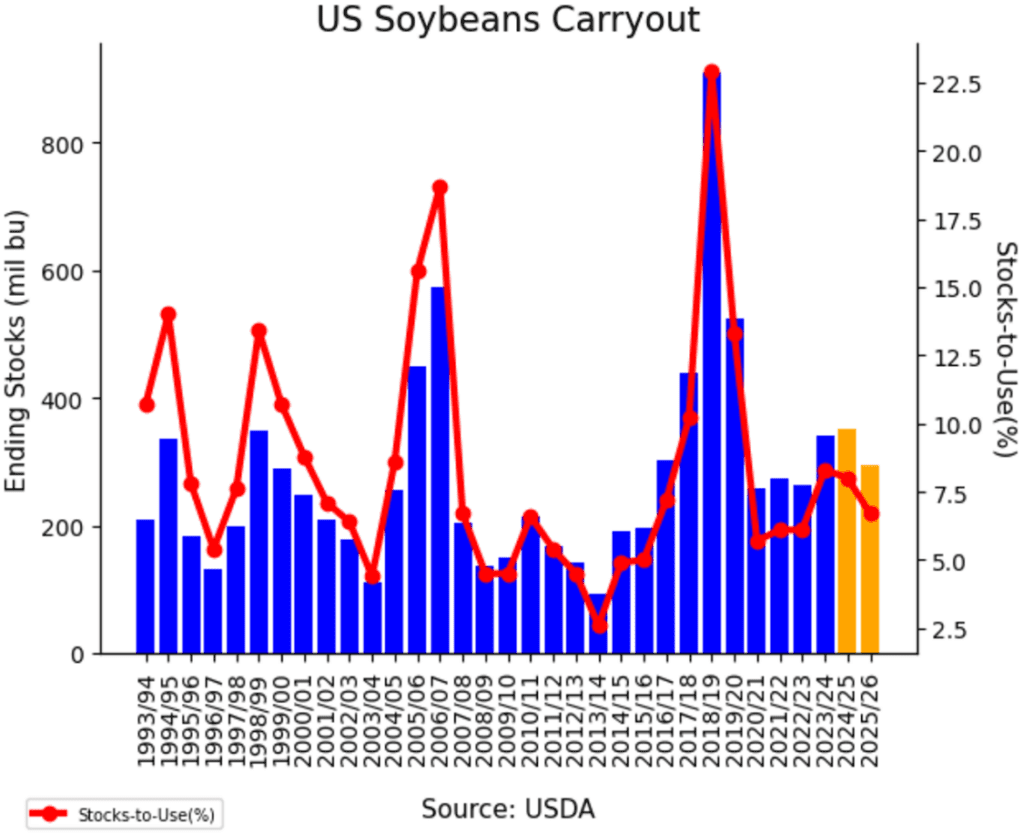

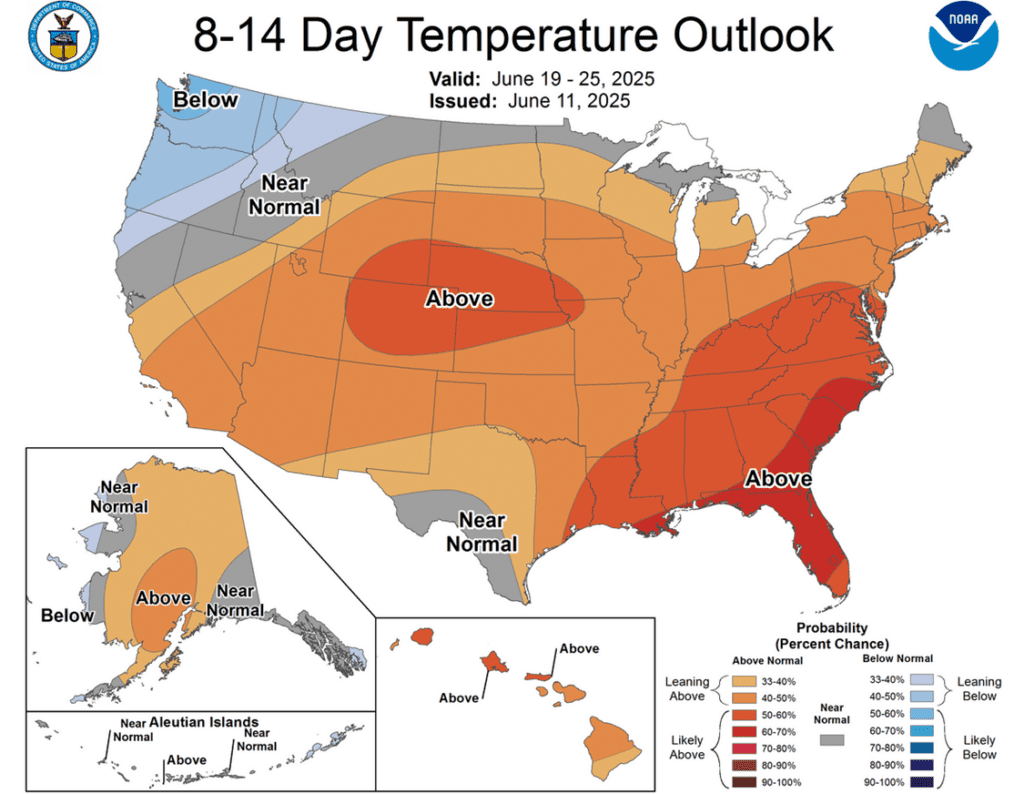

- 🌱 Soybeans: Soybeans closed higher for a third straight session, supported by a drop in crop ratings and a drier extended forecast. Soybean oil snapped its sharp rally with a modest loss, while meal finished higher. Normal trading limits will resume tomorrow across the complex.

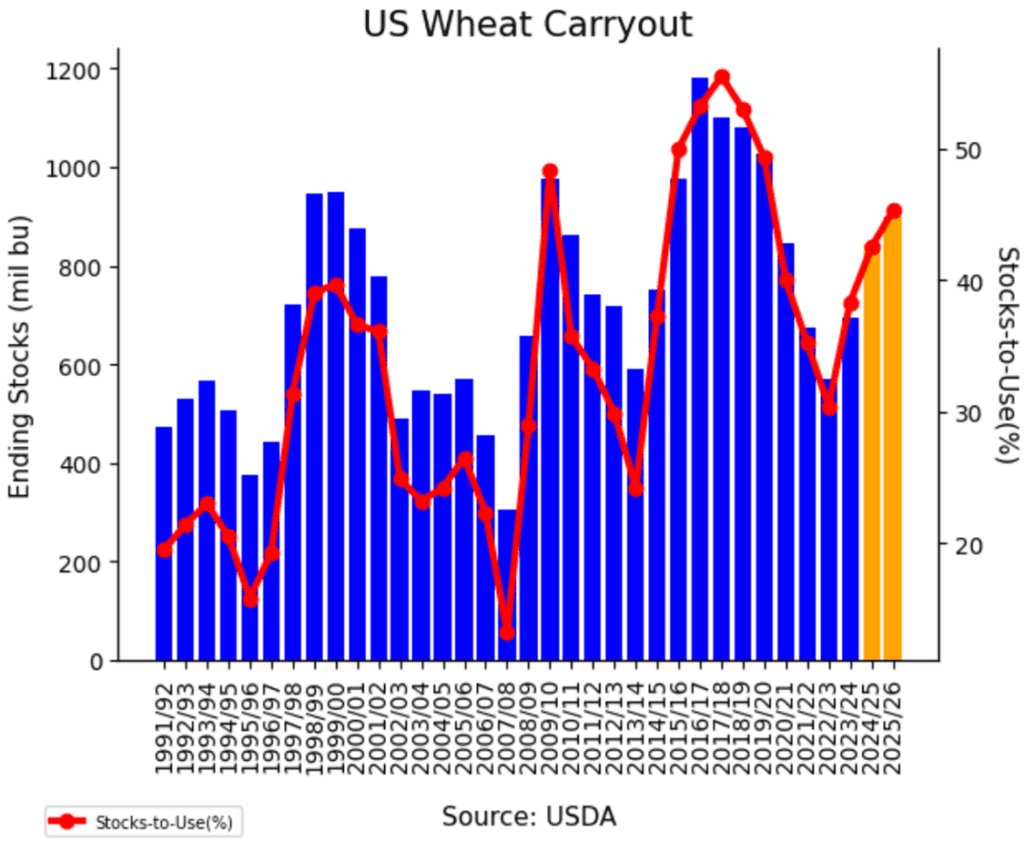

- 🌾 Wheat: Wheat futures closed with strong gains across all classes, despite a firmer U.S. dollar. Support came from higher Matif wheat, weaker U.S. crop ratings, and likely technical buying as momentum indicators like stochastics and RSI trend higher.

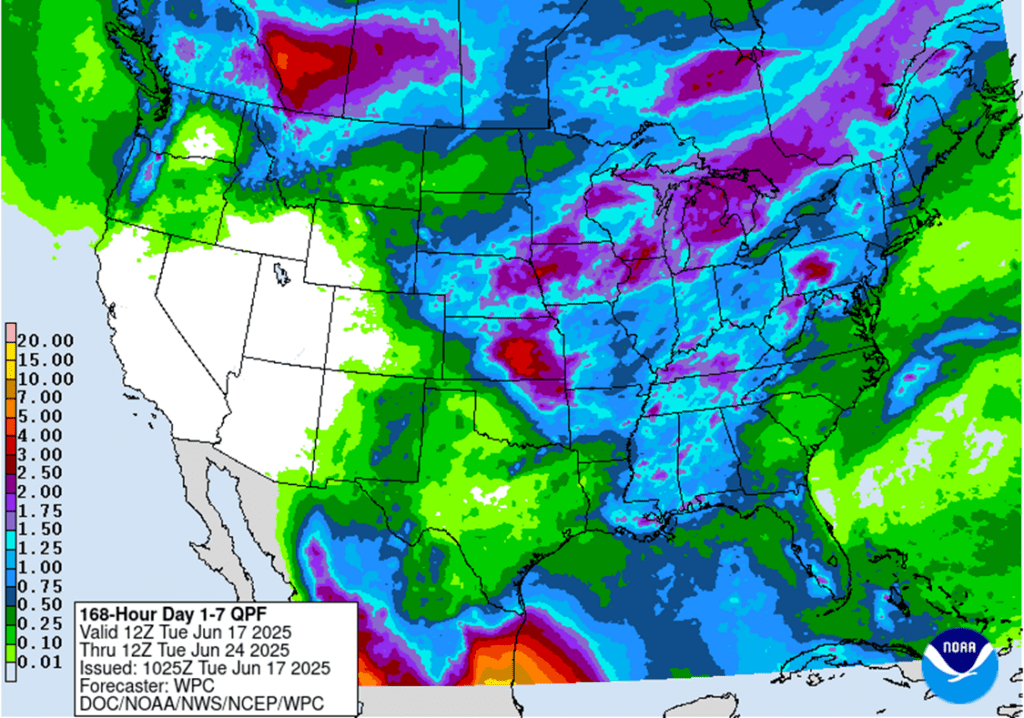

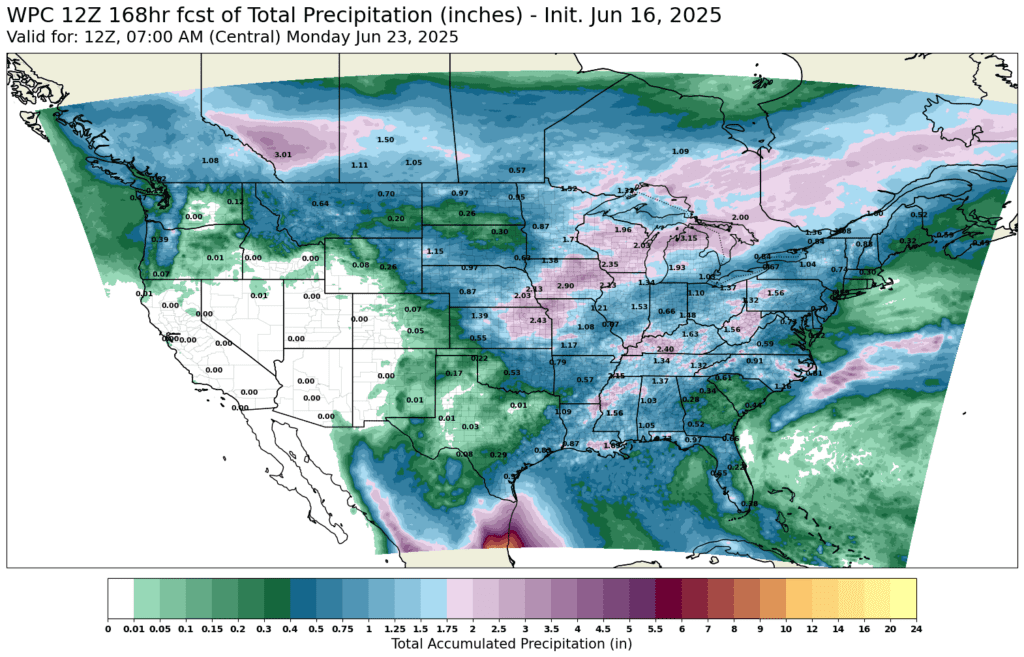

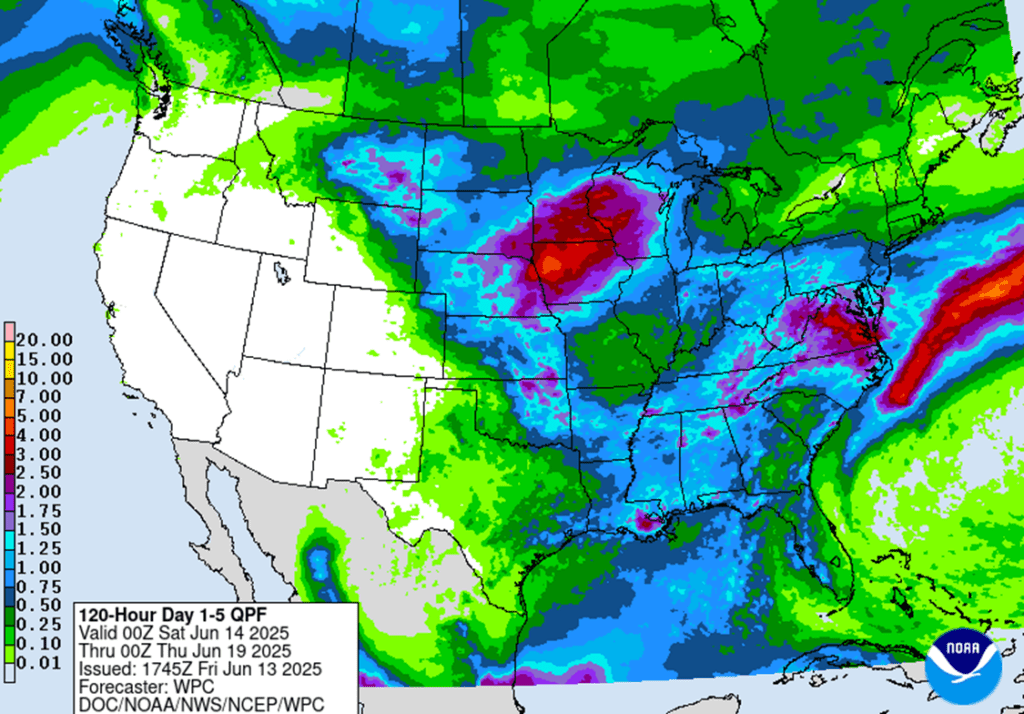

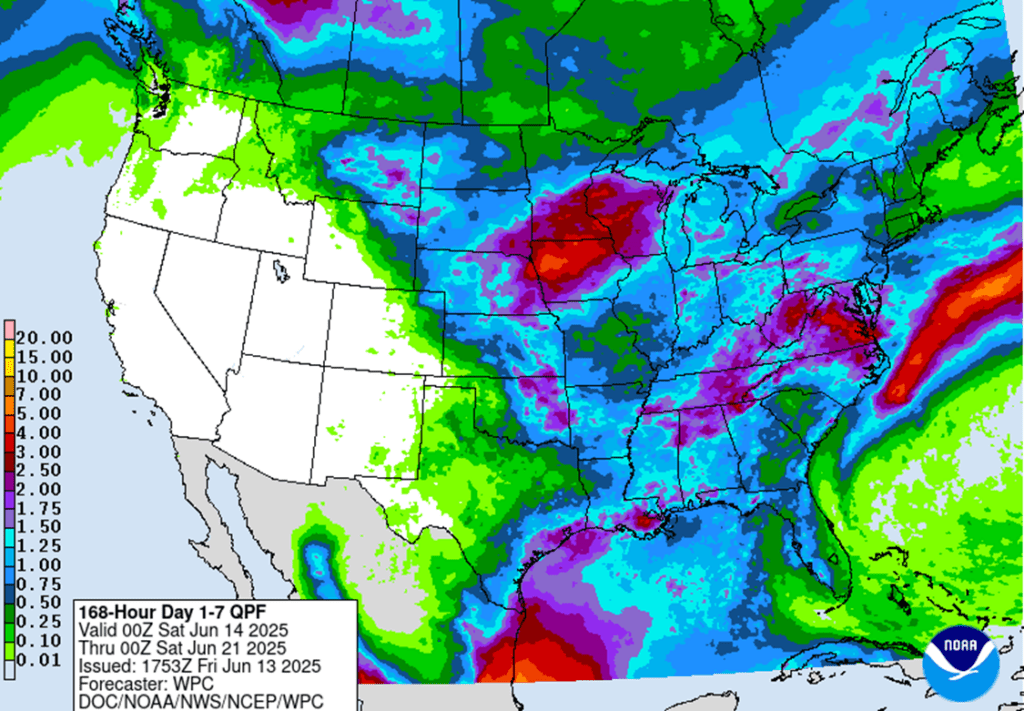

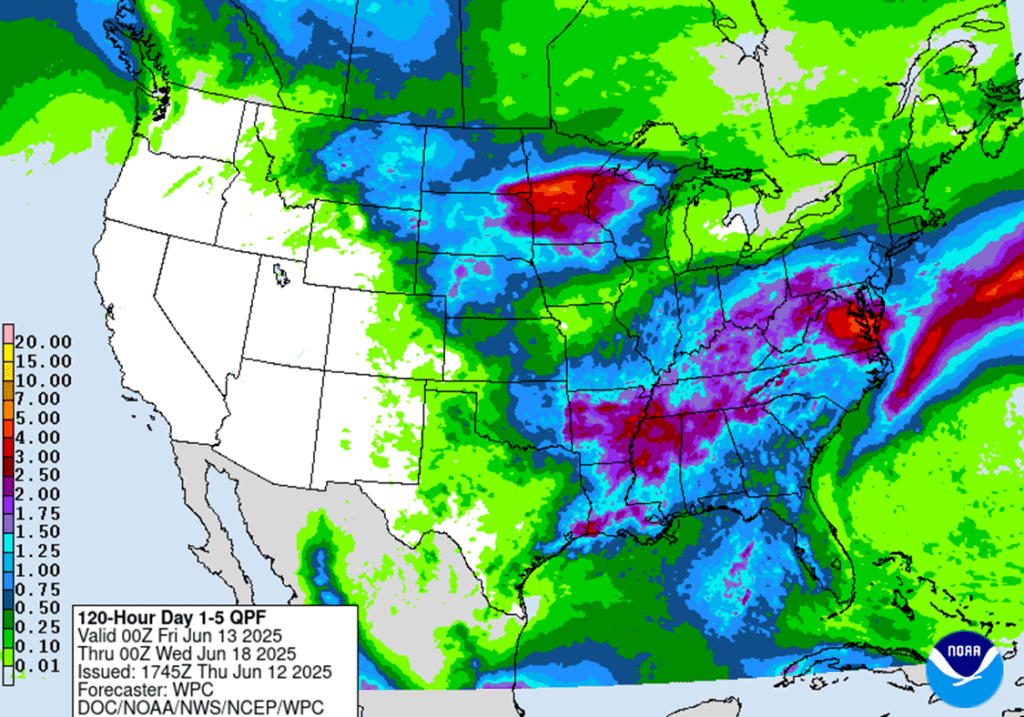

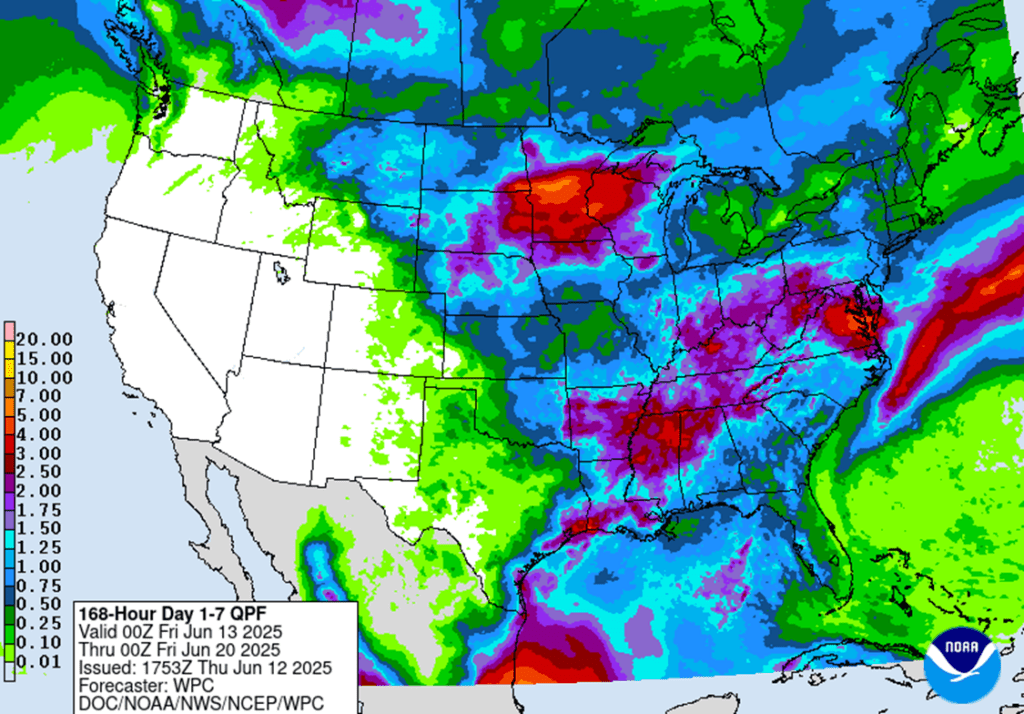

- To see updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

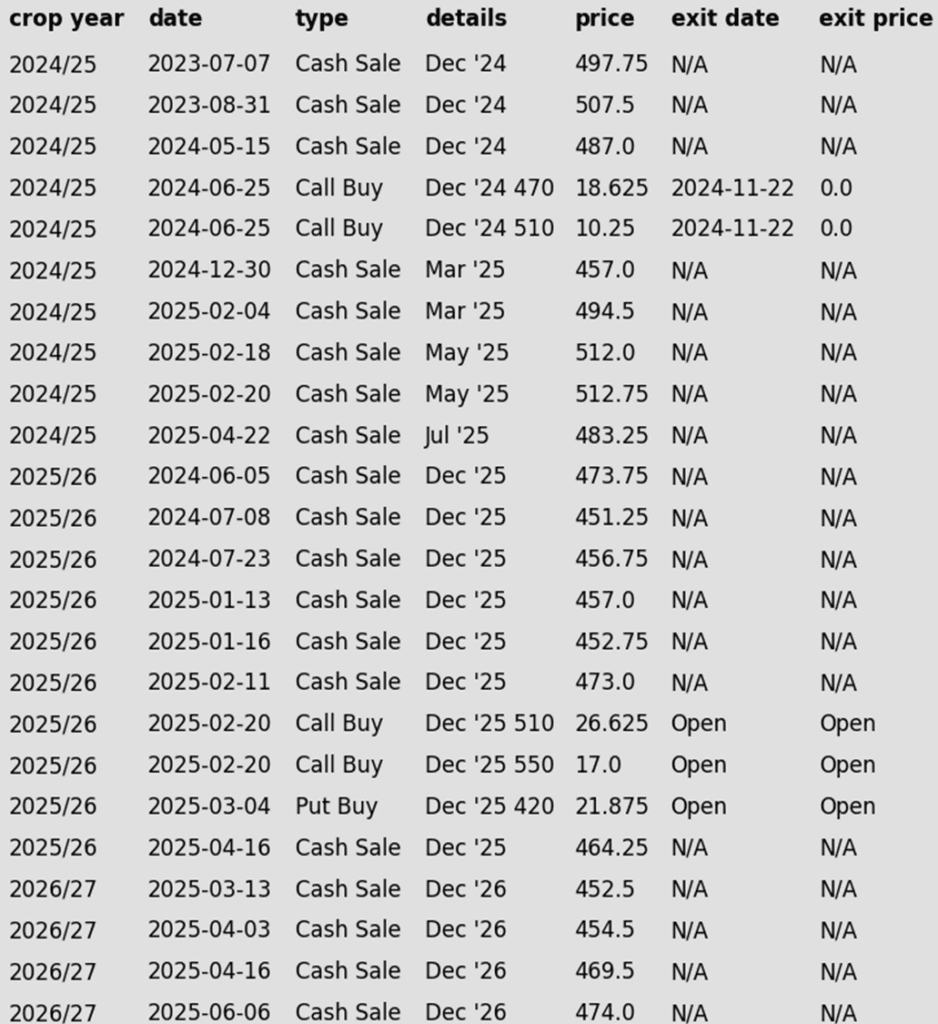

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

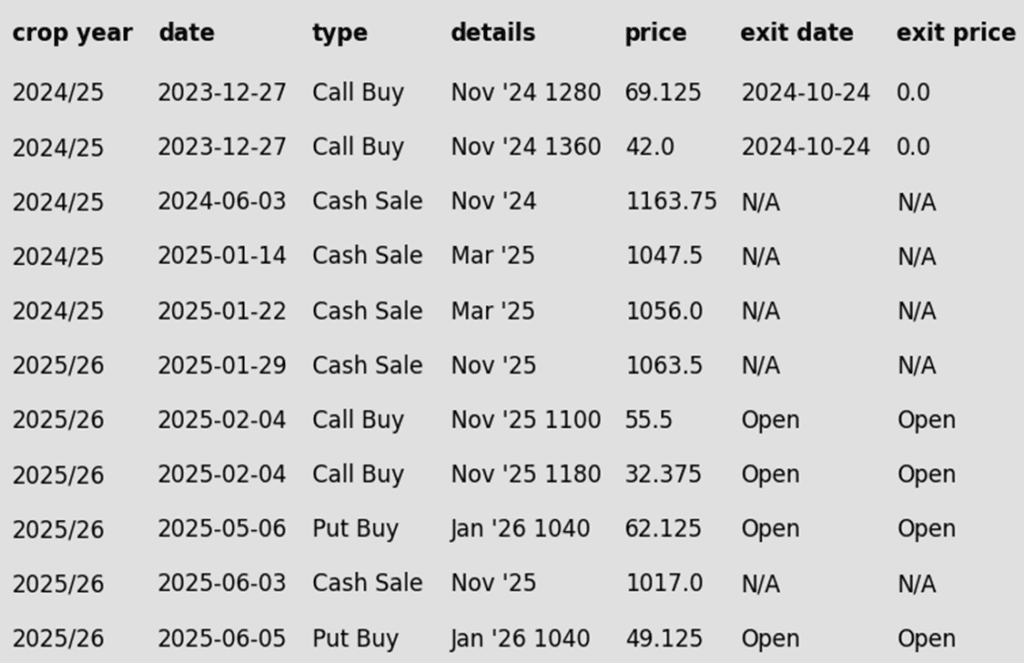

To date, Grain Market Insider has issued the following corn recommendations:

- Corn was higher to end Tuesday’s session, lifted by the wheat market strengthening today. The July contract was the only loser, down 4 cents, to close at $4.3150.

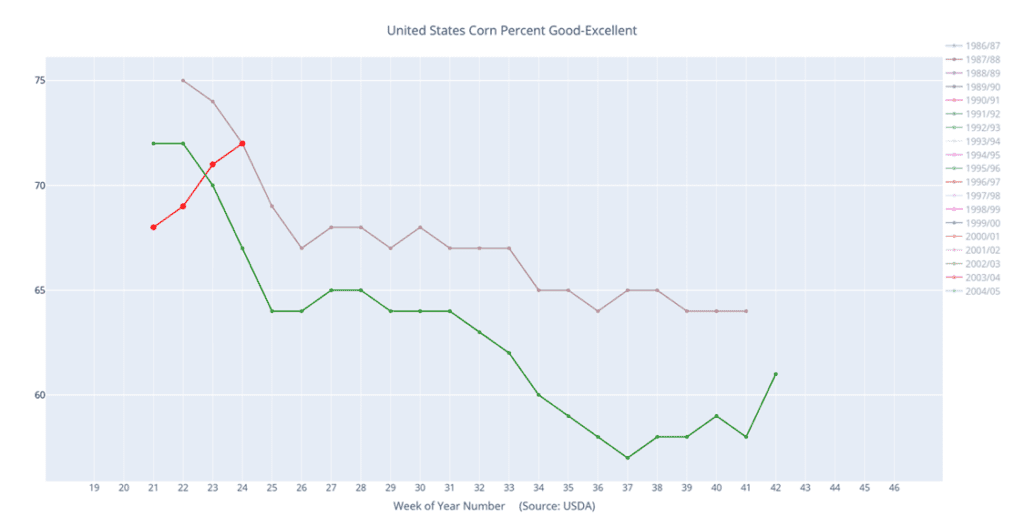

- Monday’s Crop Progress report confirmed U.S. corn planting is complete, with crop conditions improving 1 point to 72% good-to-excellent — matching last year’s rating.

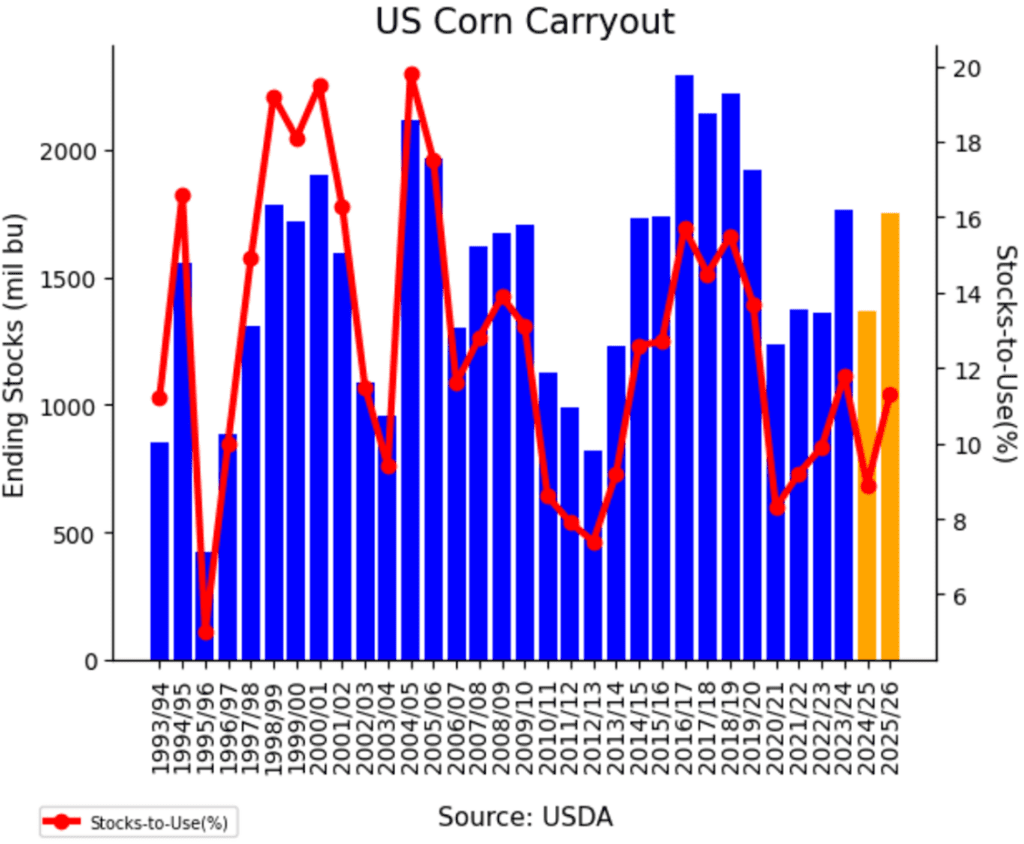

- Global corn supplies for 2025/26 are projected to rise on improved yields, though the overall balance remains tight due to lower beginning stocks and stronger demand.

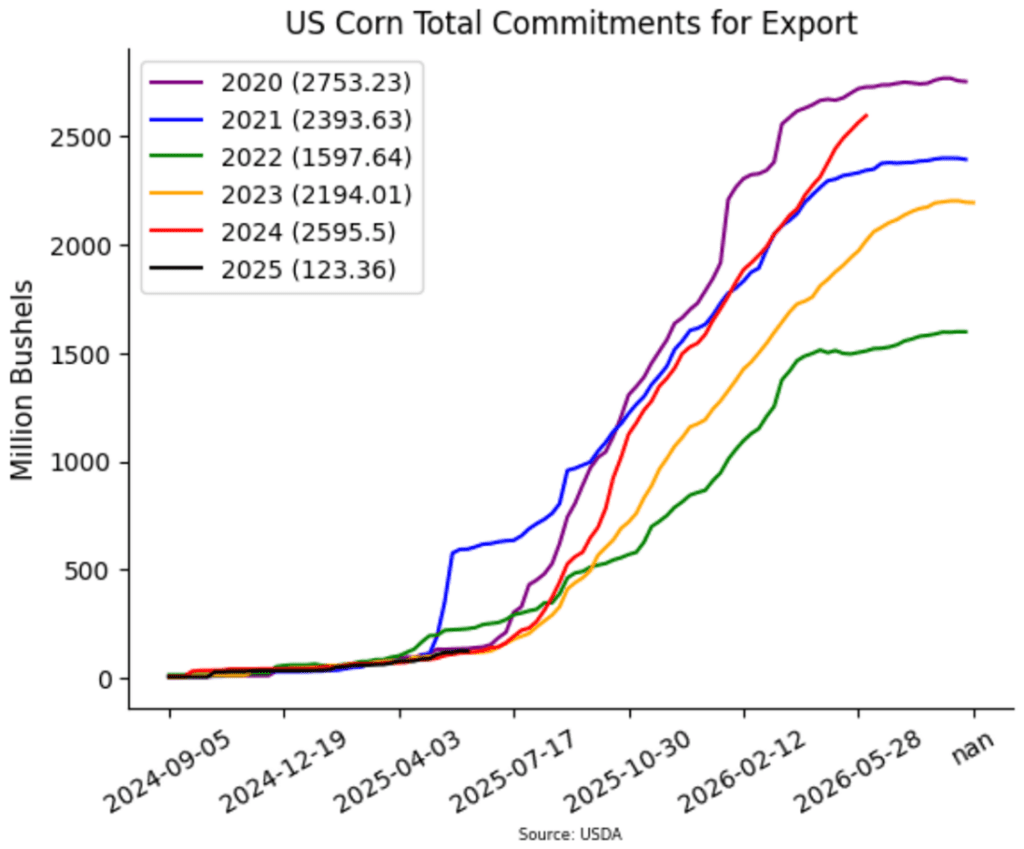

- Corn export inspections totaled 1.673 mmt, down from 1.728 mmt last week, but up from 1.380 mmt last year. Top destinations were Japan and Mexico.

- AgRural reported that, as of June 12, Brazil’s corn harvest is 5.2% complete, up from 1.9% the week prior but down from 21% finished at this time last year.eek last year.

Corn Futures Continue to Trade Within Recent Range

The front-month July contract continues to trade within a tight range, mostly between 434 and 446. A close above 446 would open the door to the next upside opportunity at 465. On the downside, support sits at the June 10 bullish reversal low of 429.25. A close below that level would make 408 the next downside risk to watch.

Above: Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A new cash sale target of 1114 has posted.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

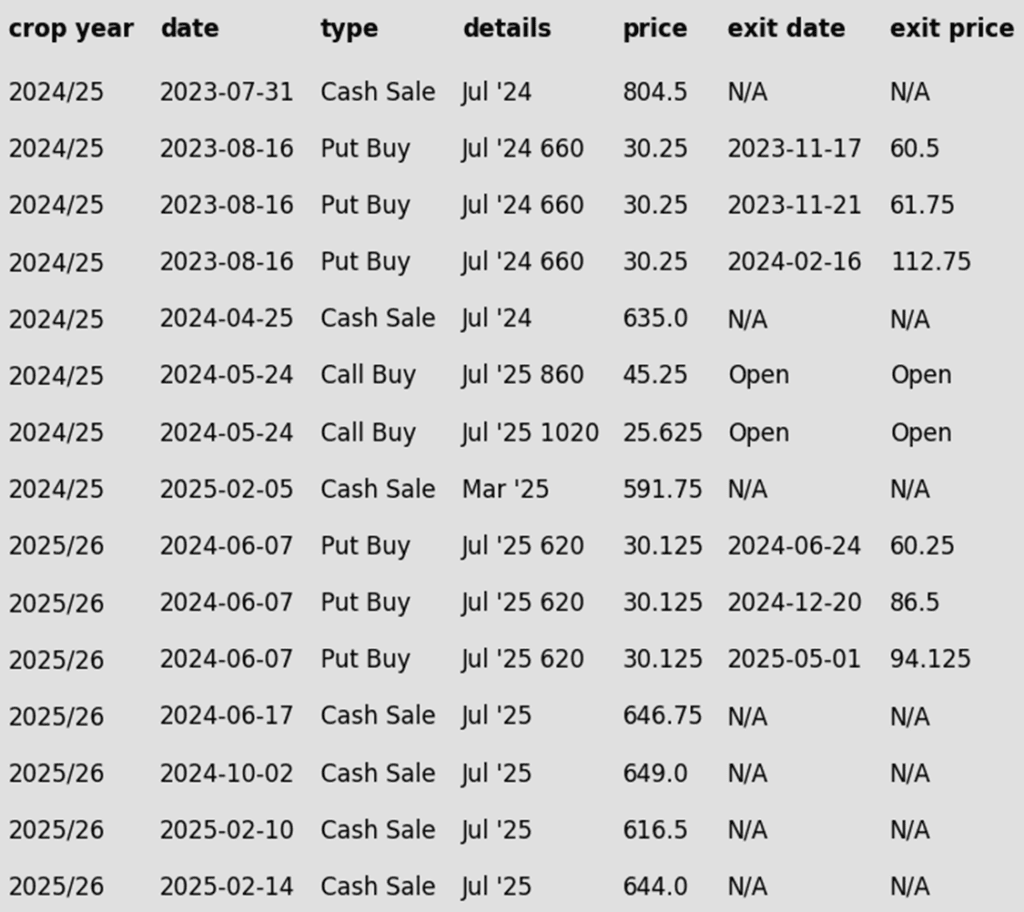

To date, Grain Market Insider has issued the following soybean recommendations:

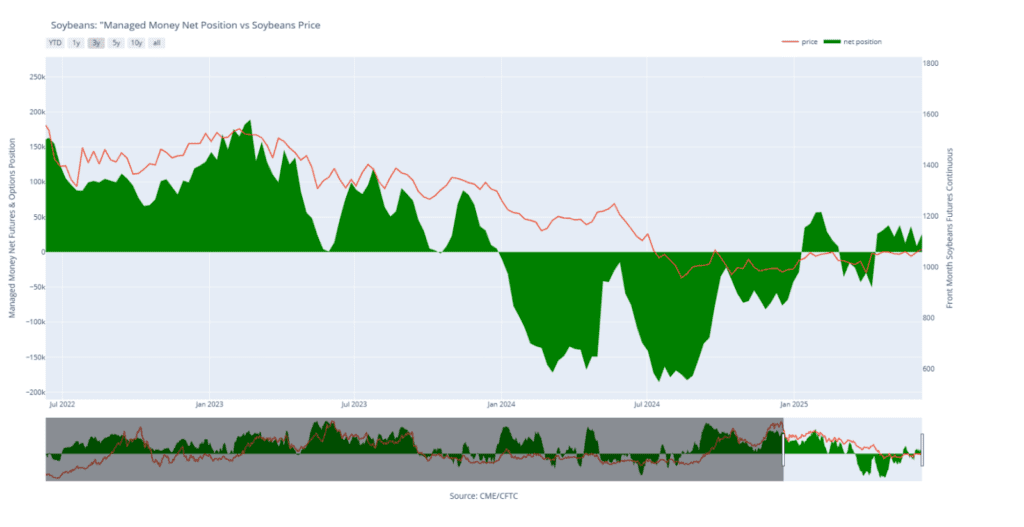

- Soybeans closed higher for the third consecutive day following a decline in crop ratings and drier weather in the extended forecast. Soybean oil ended its massive run today with a small loss, while soybean meal closed higher. The soy complex will go back to normal limits tomorrow.

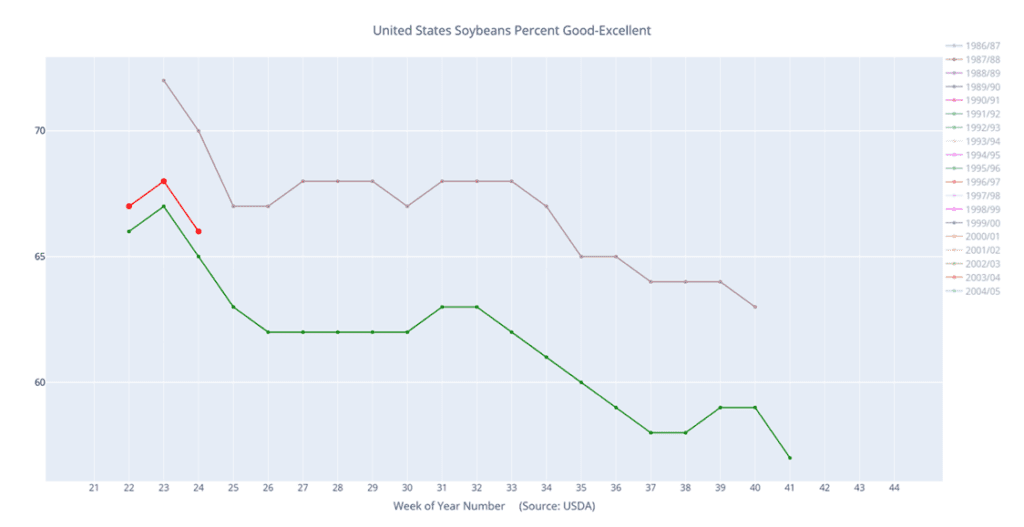

- Monday’s Crop Progress report showed soybean conditions down 2 points to 66% good-to-excellent — below both last week and the average trade estimate. Planting is 93% complete, with 84% emerged, slightly ahead of the 5-year average of 83%.

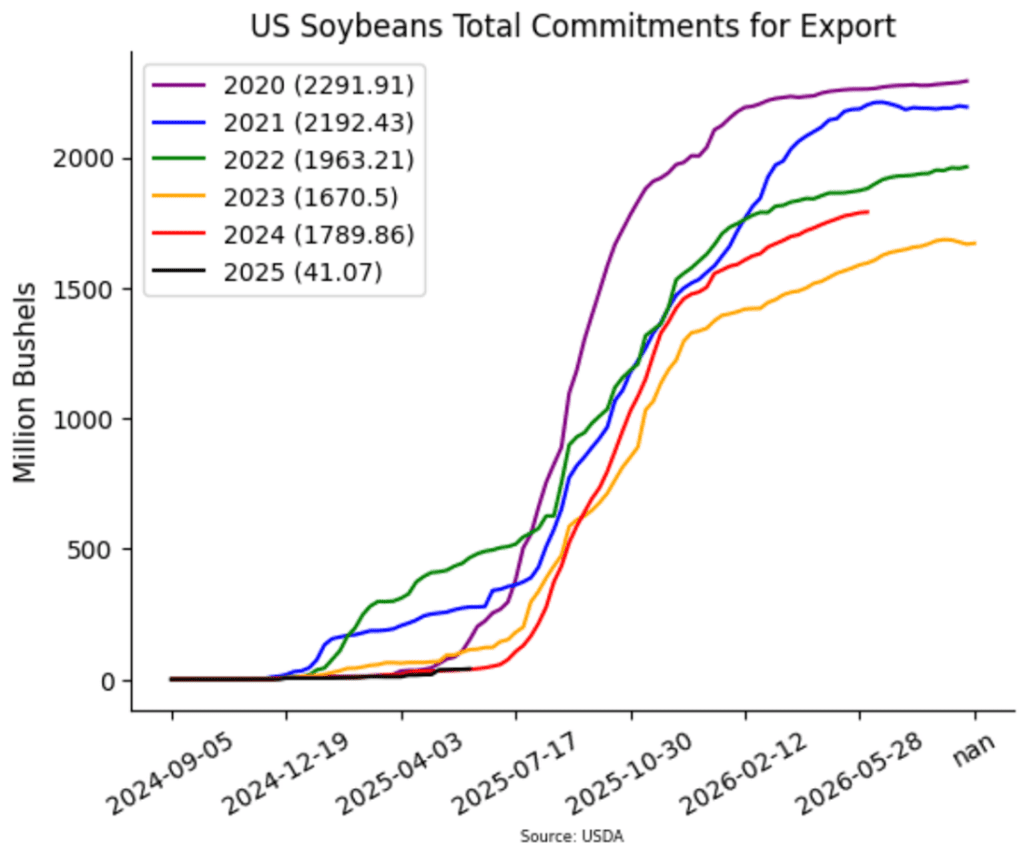

- USDA reported a sale of 120,000 metric tons of soybean meal to unknown destinations for 2025/26. Export sales remain slow, as the U.S. is currently outside its prime soybean export window.

- Yesterday’s export inspections report saw soybean inspections at 216k tons as of June 12, which compared to 559k the previous week and 341k tons a year ago at this time. Primary destinations were to Germany, Japan, and Mexico.

July Soybeans Pause Near Upper End of Recent Range

July still has major resistance to clear before broader upside opportunities can become more immediate possibilities. Macro trend remains sideways with resistance at the May high of 1082. A close over that resistance and the first upside objective could be the open gap on the front month continuous chart from last June. The gap starts at 1161 and ends at 1177. If July cannot clear 1082 then rangebound to lower trade remains the risk. First support is now at 1032.50. A close below that support and the April low of 970.25 would be the next risk.

Above: Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

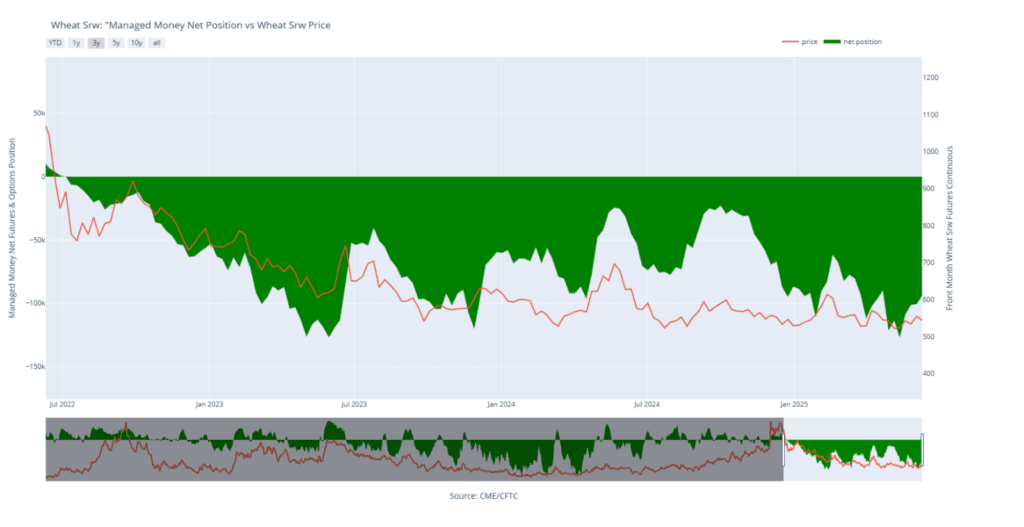

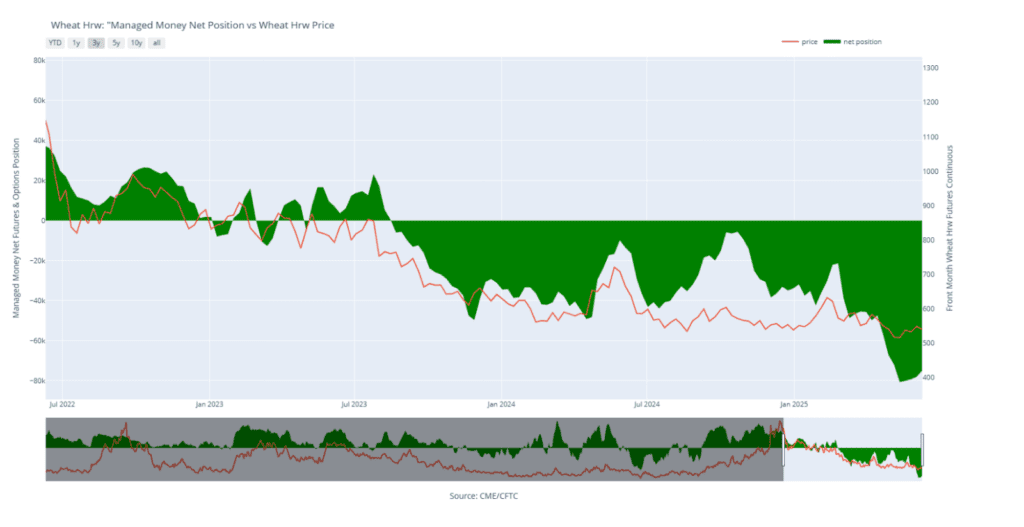

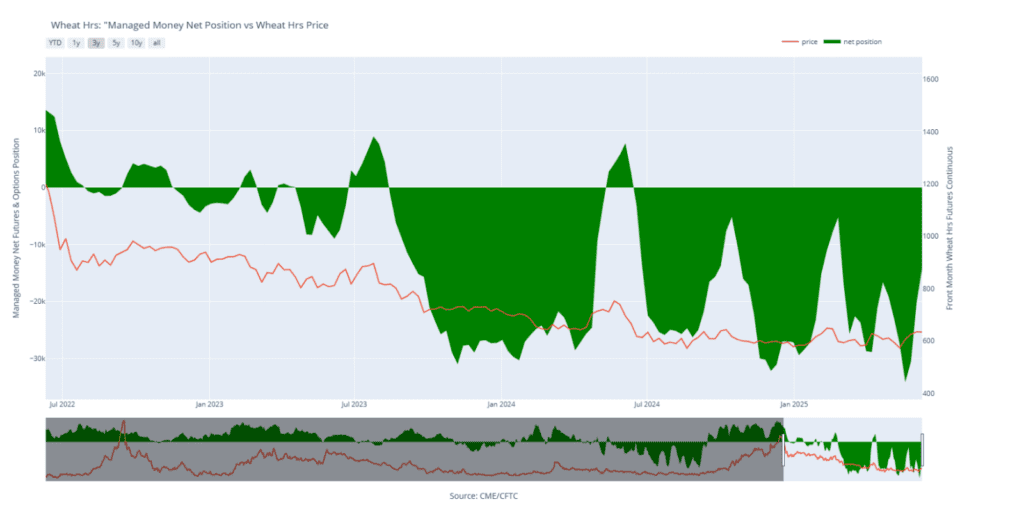

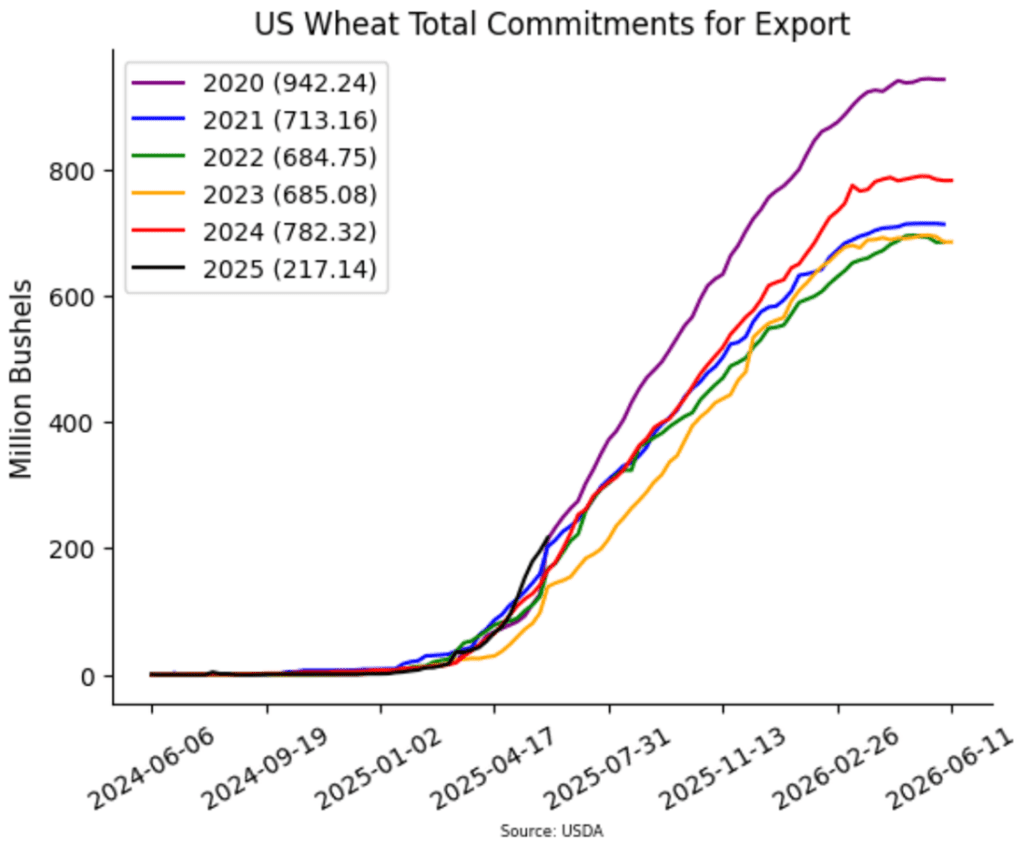

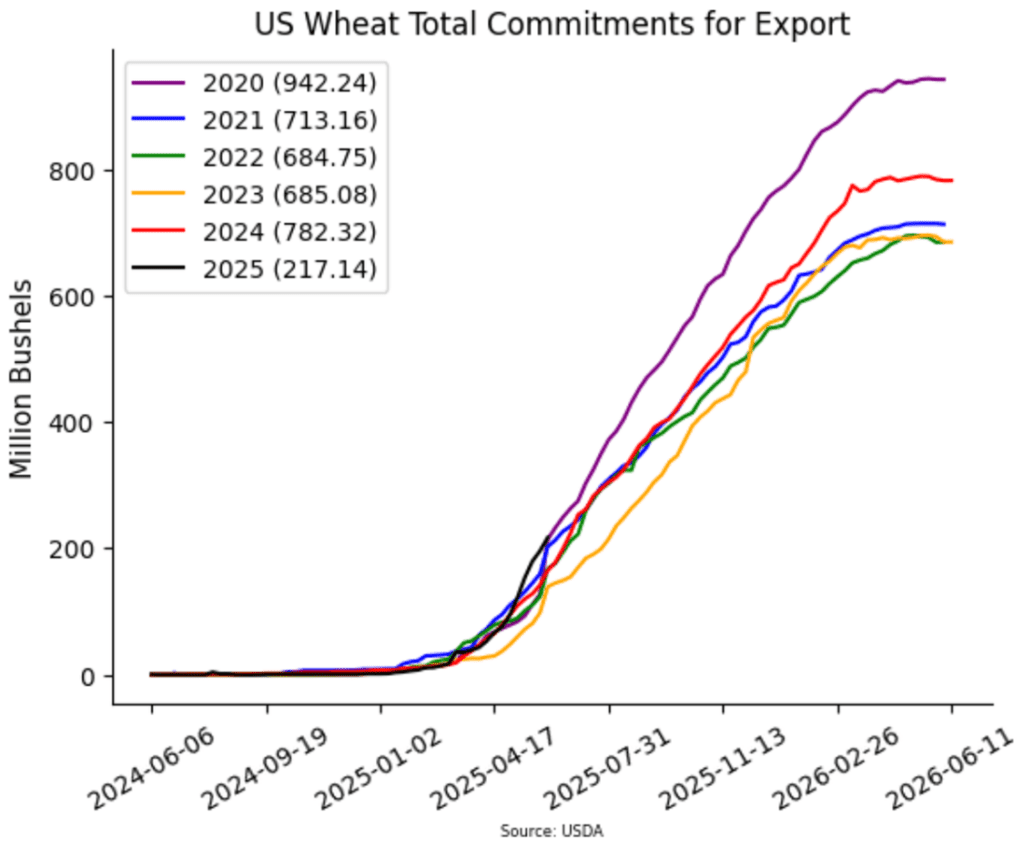

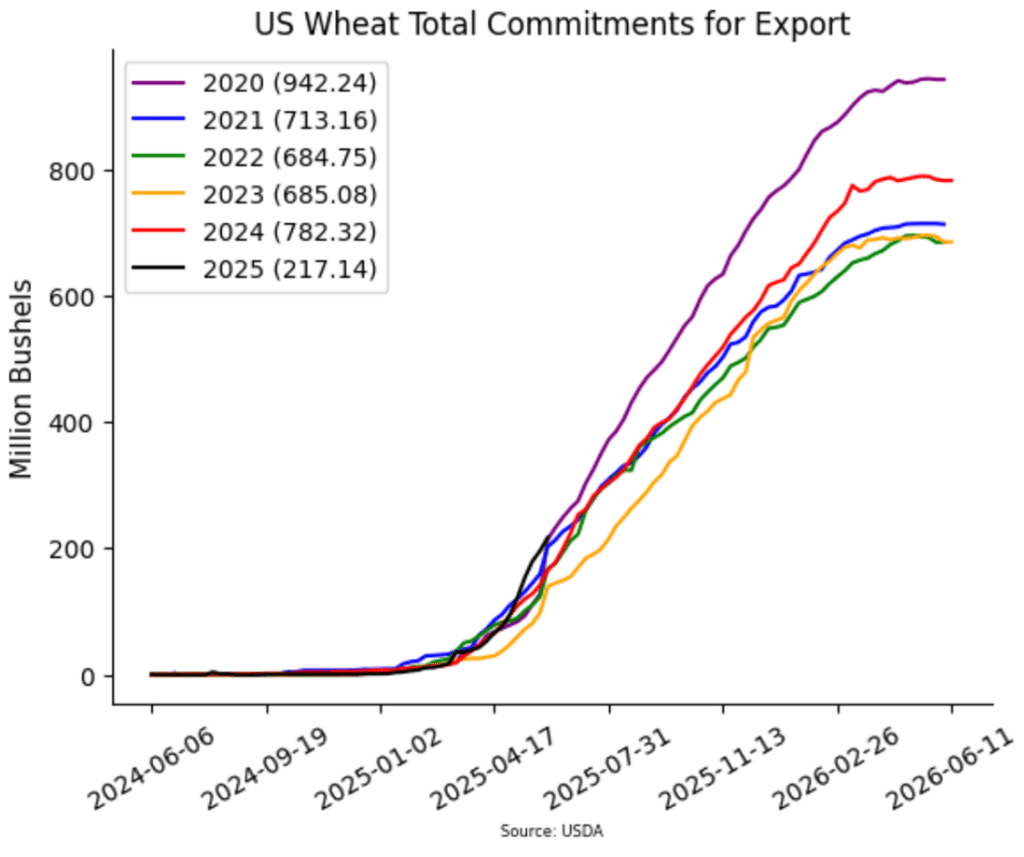

- Wheat futures closed with strong gains across all classes, despite a firmer U.S. dollar. Support came from higher Matif wheat, weaker U.S. crop ratings, and likely technical buying as momentum indicators, like stochastics and RSI, trend higher.

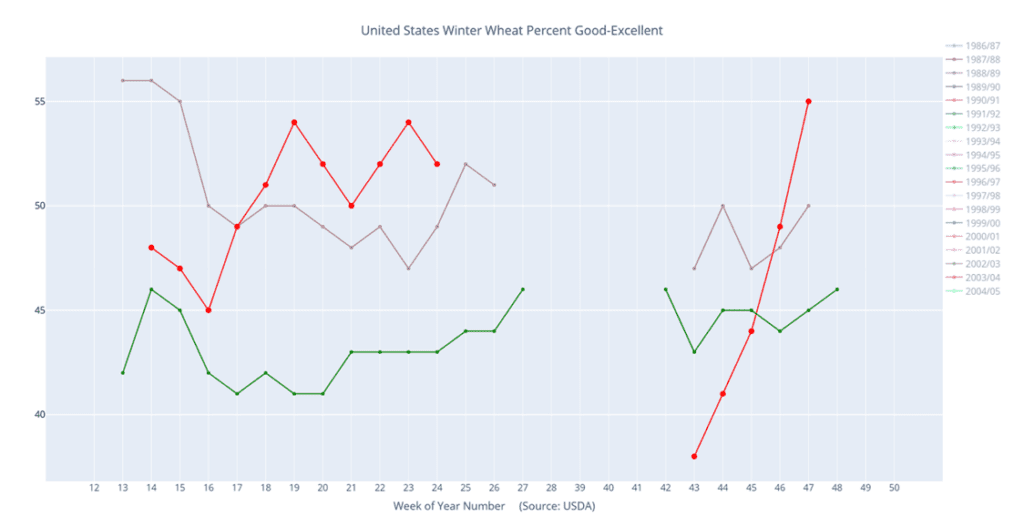

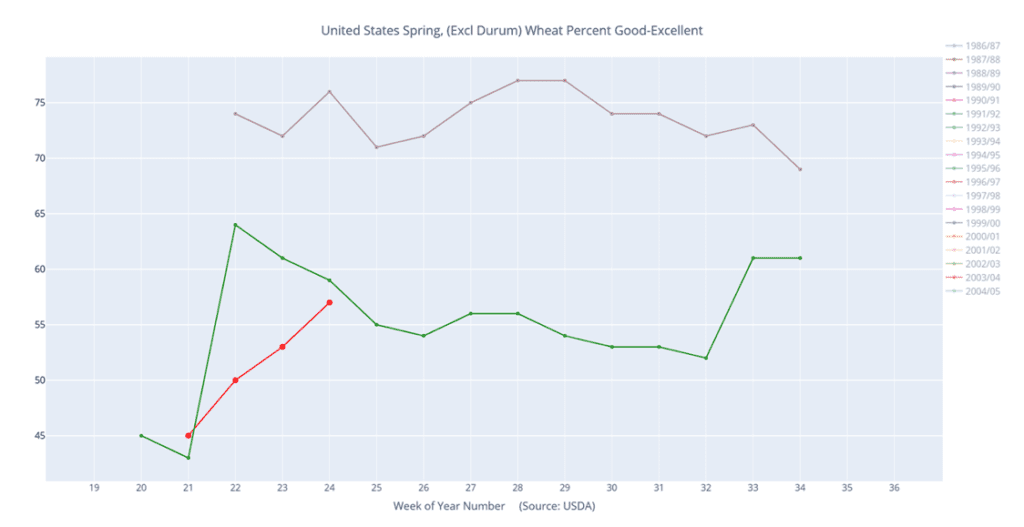

- USDA’s Crop Progress report showed winter wheat 93% headed, with conditions slipping 2 points to 52% good-to-excellent. Harvest is 10% complete — well behind last year’s 25% and the 5-year average of 16%. Spring wheat is 89% emerged and 4% headed, with conditions improving 4 points to 57% good-to-excellent.

- LSEG commodity research has estimated global 25/26 wheat production at 796.44 mmt, which compares with the 24/25 estimate of 798 mmt. Additionally, they are projecting world wheat ending stocks will decline 5.1% to 248.7 mmt.

- Russian wheat export values are reported by IKAR to have declined last week, due to improving harvest estimates. Through July delivery, new crop Russian wheat ended last week at $222 per mt FOB, down $3 from the week before. However, SovEcon estimated new crop offers at $225 to $229 per mt, which would be steady to down $1 from the prior week.

- Romania may harvest 12.2 MMT of wheat in 2025/26, according to Argus — the largest since 1997 — up from 10.2 MMT this season on higher yields and expanded acreage.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

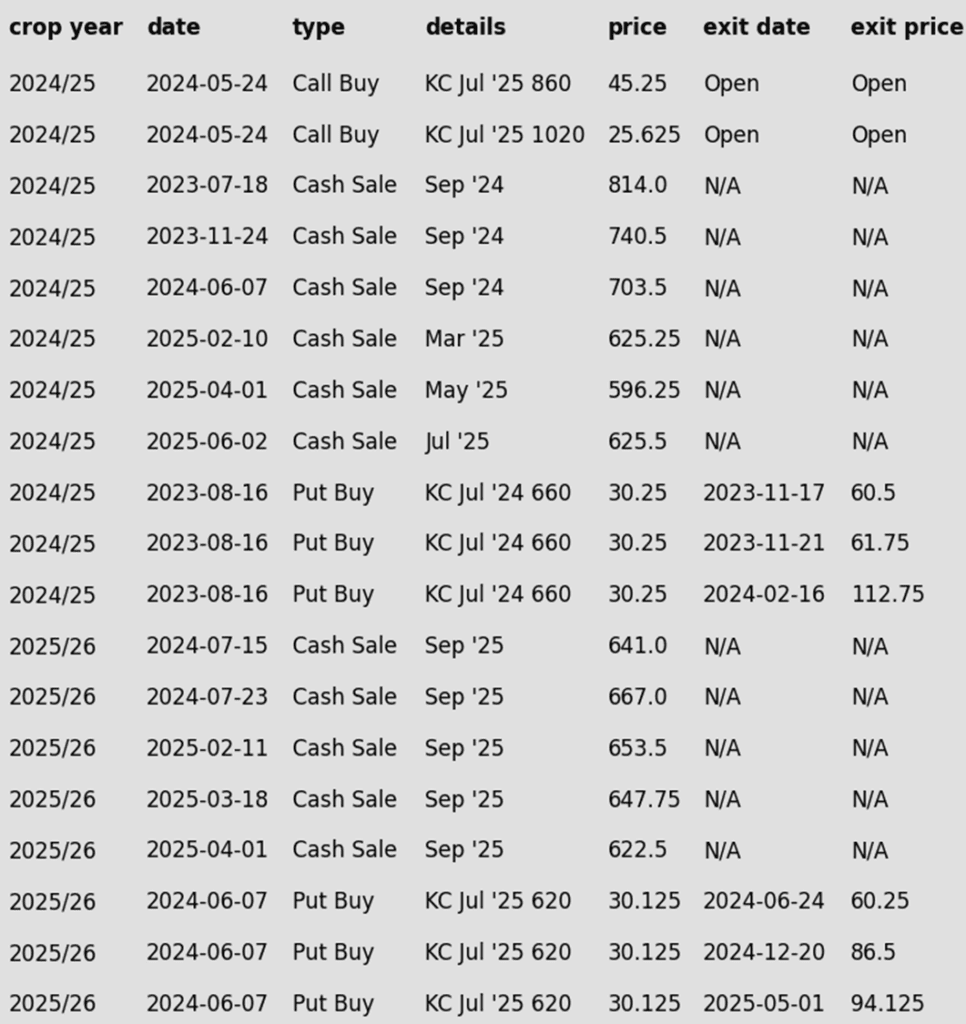

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Remains Rangebound

First downside support should appear at last week’s low of 522.25. A close below that support and the next downside risk would be 506.25. A lot of resistance remains above the market, yet with the recent high and 200-day at 558. A close over 558 and that could provide fuel for a bigger move towards the winter high of 621.75.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 535.75 support vs September and sell more cash.

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- Plan B downside stop added at 535.75 support. As long as the September contract continues to hold above this support will remain patient for better opportunities. If this support breaks then another cash sale will be recommended as further downside could follow

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- Plan B downside stop added at 549 support. As long as the July ’26 contract continues to hold above this support will remain patient for better opportunities. If this support breaks then another cash sale will be recommended as further downside could follow.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Resistance at the 50-Day

July closed right at the 50-day moving average today following a strong bullish reversal off today’s low. Closing over today’s high would make the 200-day at 567 the next immediate target.

Above: Winter wheat condition percentage good-excellent (red) versus the 5-year average (green) and last year (purple).

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Retests Recent Highs

uly spring wheat futures closed last week just below the previous Friday’s close of 635.25. A close over that resistance would make 660 the next first upside target. Downside support is at this week’s low and the 200-day in the 607 area. A close below that support and the May low of 572.50 would be the first downside risk.

Above: Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather